Europe Ldl Test Market

Market Size in USD Million

CAGR :

%

USD

638.64 Million

USD

1,226.58 Million

2025

2033

USD

638.64 Million

USD

1,226.58 Million

2025

2033

| 2026 –2033 | |

| USD 638.64 Million | |

| USD 1,226.58 Million | |

|

|

|

|

Europe Low Density Lipoprotein (LDL) Test Market Size

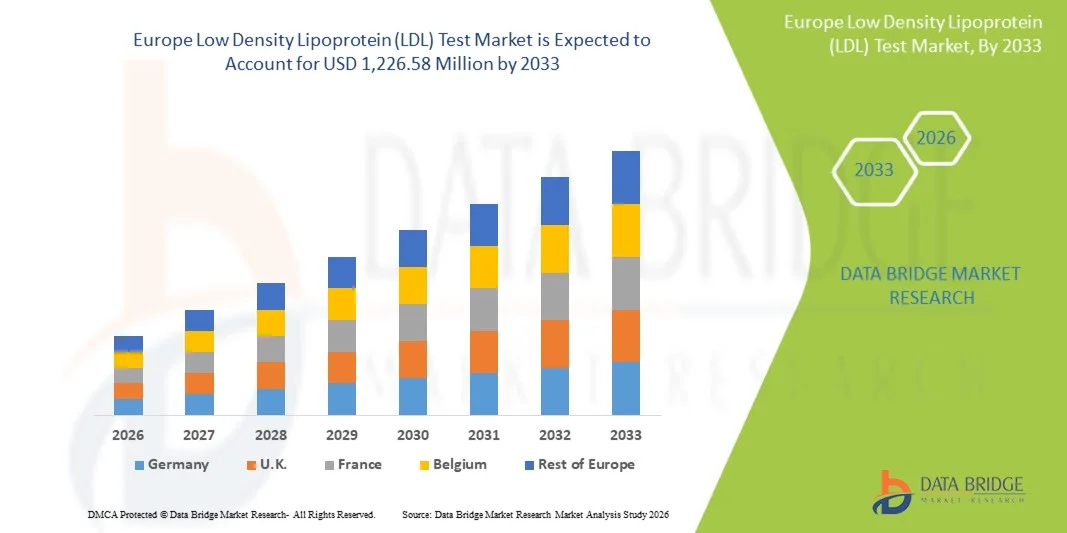

- The Europe Low Density Lipoprotein (LDL) test market size was valued at USD 638.64 million in 2025 and is expected to reach USD 1,226.58 million by 2033, at a CAGR of 8.50% during the forecast period

- The market growth is largely driven by the increasing prevalence of cardiovascular diseases, rising awareness about preventive healthcare, and the growing emphasis on early diagnosis of lipid disorders across Europe

- Furthermore, advancements in lipid testing technologies, along with the integration of automated analyzers and digital diagnostics, are enhancing the accuracy and efficiency of LDL testing. These combined factors are strengthening the region’s clinical diagnostic capabilities and significantly propelling market expansion

Europe Low Density Lipoprotein (LDL) Test Market Analysis

- Low Density Lipoprotein (LDL) tests, vital for evaluating cholesterol levels and identifying cardiovascular risk, are increasingly integrated into preventive healthcare frameworks across hospitals, clinics, and diagnostic laboratories in Europe due to their accuracy, reliability, and importance in managing lifestyle-related diseases

- The growing demand for LDL testing is primarily driven by the rising prevalence of cardiovascular disorders, diabetes, and obesity, alongside increasing awareness about early detection and preventive healthcare supported by favorable public health initiatives across European nations

- Germany dominated the LDL test market with the largest revenue share of 27.9% in 2025, owing to its robust healthcare infrastructure, high diagnostic testing rates, and strong presence of leading clinical laboratories and diagnostic device manufacturers

- The U.K. is expected to be the fastest-growing country in the LDL test market during the forecast period, driven by increasing adoption of advanced lipid profiling in primary care, digital diagnostic integration, and government-backed cardiovascular screening programs

- The Kits and Reagents segment dominated the LDL test market with a market share of 39.4% in 2025, attributed to their recurring use in testing procedures, growing preference for high-sensitivity assay kits, and continuous advancements in reagent formulations enhancing diagnostic accuracy

Report Scope and Europe Low Density Lipoprotein (LDL) Test Market Segmentation

|

Attributes |

Europe Low Density Lipoprotein (LDL) Test Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Low Density Lipoprotein (LDL) Test Market Trends

“Integration of Advanced Automation and Digital Diagnostics”

- A key and accelerating trend in the Europe Low Density Lipoprotein (LDL) Test market is the growing integration of automated analyzers and digital diagnostic platforms, significantly improving testing accuracy, efficiency, and workflow management across healthcare facilities

- For instance, Roche Diagnostics introduced fully automated lipid profiling systems that streamline LDL testing by combining high throughput analysis with digital data connectivity, reducing manual intervention and turnaround time

- Automation in LDL testing enables continuous, error-free processing and enhanced reproducibility of results, while digital diagnostic systems allow for real-time data sharing and result interpretation, facilitating more personalized cardiovascular care

- Furthermore, several diagnostic providers are integrating LDL testing with electronic health records (EHRs) and cloud-based platforms, enabling physicians to monitor patient lipid profiles remotely and identify cardiovascular risk trends with precision

- This trend toward connected and automated testing is transforming clinical diagnostics by supporting preventive healthcare approaches and optimizing patient management pathways across hospitals and laboratories in Europe

- Consequently, major players such as Abbott and Siemens Healthineers are developing next-generation automated LDL testing systems that incorporate digital connectivity and analytical intelligence to strengthen diagnostic reliability and operational efficiency

- The rising preference for automated, digitalized LDL diagnostic solutions is expanding rapidly across both public and private healthcare sectors, as laboratories increasingly prioritize accuracy, operational speed, and interoperability with broader digital health infrastructures

Europe Low Density Lipoprotein (LDL) Test Market Dynamics

Driver

“Growing Prevalence of Cardiovascular Diseases and Focus on Preventive Diagnostics”

- The increasing burden of cardiovascular diseases and metabolic disorders such as diabetes and obesity across Europe is a major driver fueling demand for LDL testing as a critical component of preventive healthcare

- For instance, in March 2025, Abbott Laboratories expanded its lipid testing portfolio in Europe with improved reagent sensitivity for LDL-C and HDL-C differentiation, aiming to enhance early cardiovascular risk detection

- As public health programs emphasize early diagnosis and monitoring of lipid abnormalities, routine LDL testing has become central to cardiovascular disease prevention and management strategies

- Furthermore, rising healthcare awareness and the growing availability of advanced diagnostic technologies are driving the adoption of automated and accurate LDL testing in both hospital and outpatient settings

- The increasing focus on personalized medicine, along with national screening initiatives and reimbursement support for cholesterol testing, is significantly strengthening market growth across the region

- The incorporation of advanced analyzers and digital diagnostic platforms enhances efficiency and clinical decision-making, encouraging more healthcare facilities to integrate LDL testing into preventive health programs

Restraint/Challenge

“Cost Sensitivity and Lack of Standardization in Testing Procedures”

- The high costs associated with advanced LDL testing kits and automated analyzers pose a major challenge, particularly for smaller diagnostic centers and healthcare providers with limited budget

- For instance, variations in LDL measurement methodologies such as direct assays versus calculated LDL-C—create inconsistencies in results across laboratories, affecting diagnostic reliability and physician confidence

- Addressing this challenge requires harmonization of testing standards, validated reference ranges, and adoption of quality control protocols across European laboratories

- Furthermore, limited awareness of the benefits of advanced LDL profiling in rural and underdeveloped areas continues to hinder market penetration despite broader healthcare improvements

- The absence of uniform reimbursement policies in certain European countries also restricts access to advanced diagnostic testing, particularly for patients outside urban centers

- Overcoming these barriers through cost-effective test development, laboratory accreditation programs, and policy-level standardization will be essential for achieving sustained market expansion in Europe

Europe Low Density Lipoprotein (LDL) Test Market Scope

The market is segmented on the basis of type, component, disease, end user, and distribution channel.

- By Type

On the basis of type, the Europe LDL Test Market is segmented into LDL-C, LDL-B, LDL-P, and Others. The LDL-C segment dominated the market with the largest revenue share of 46.8% in 2025, driven by its routine use in cholesterol screening and cardiovascular disease risk assessment. LDL-C tests are widely accepted as the standard clinical measure of “bad cholesterol,” making them essential for early diagnosis and monitoring of heart disease and atherosclerosis. The segment benefits from extensive availability across both public and private healthcare facilities in Europe, supported by favorable reimbursement policies. Moreover, the development of high-precision enzymatic assays and automated analyzers has further strengthened LDL-C’s dominance. Continuous integration of LDL-C testing into national cardiovascular health programs across Germany, France, and the U.K. also contributes to its strong market position.

The LDL-P segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by its growing clinical relevance in assessing particle number rather than cholesterol content, which provides deeper insights into cardiovascular risk. Physicians increasingly prefer LDL-P testing for patients with metabolic syndrome or diabetes, where traditional LDL-C may underestimate risk. Technological advancements in nuclear magnetic resonance (NMR) and ion mobility analysis have made LDL-P measurement more accessible and accurate. The segment’s adoption is also supported by the shift toward precision medicine and personalized lipid management strategies. Growing research emphasizing LDL particle count as a superior risk predictor is expected to further accelerate its adoption in advanced diagnostic laboratories across Europe.

- By Component

On the basis of component, the market is segmented into kits and reagents, devices, and services. The Kits and Reagents segment dominated the market with the largest revenue share of 39.4% in 2025, attributed to their continuous demand in diagnostic laboratories for routine lipid profiling and follow-up testing. High-volume testing environments rely on consumable kits and reagents to ensure consistent and reliable results. The segment’s dominance is also supported by frequent product innovations offering greater sensitivity, faster turnaround time, and longer shelf life. Manufacturers such as Roche Diagnostics and Abbott are continuously expanding their reagent portfolios tailored for automated lipid analyzers. In addition, the recurring revenue model associated with reagent use provides sustained growth potential, particularly in centralized and hospital-based laboratories.

The Devices segment is expected to record the fastest CAGR from 2026 to 2033, driven by increasing adoption of automated lipid analyzers and point-of-care testing (POCT) devices. The rising demand for compact, portable analyzers in primary care settings and outpatient clinics is expanding this segment’s reach. Technological advancements, including integration with digital health platforms and cloud-based result reporting, are making devices more user-friendly and efficient. In addition, collaborations between diagnostic equipment manufacturers and healthcare providers are boosting the installation of advanced analyzers across Europe. Growing preference for rapid, accurate, and digitally connected devices will continue to drive this segment’s expansion.

- By Disease

On the basis of disease, the Europe LDL Test Market is segmented into diabetes, stroke, atherosclerosis, obesity, dyslipidaemia, carotid artery disease, peripheral arterial disease, angina, and others. The Atherosclerosis segment dominated the market with the largest revenue share of 28.6% in 2025, as LDL testing is a key diagnostic tool for identifying and managing plaque buildup in arteries. Regular LDL monitoring helps in assessing treatment effectiveness and disease progression, making it indispensable in cardiology practices. The segment benefits from the growing prevalence of atherosclerosis among aging populations and patients with sedentary lifestyles. Widespread clinical awareness and guidelines recommending LDL testing for cardiovascular disease prevention further strengthen its position. The expansion of cardiovascular health programs across major European countries supports the high test volume within this segment.

The Diabetes segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by the strong link between lipid abnormalities and diabetic cardiovascular complications. Patients with type 2 diabetes are frequently screened for LDL levels to prevent long-term vascular issues. Increased integration of LDL testing in diabetes management protocols across hospitals and clinics enhances the segment’s growth potential. Advancements in test automation and improved point-of-care access also facilitate regular monitoring among diabetic patients. Growing diabetic populations across Europe, particularly in the U.K. and Italy, and ongoing public health initiatives promoting metabolic health screening further accelerate segment expansion.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, ambulatory care, and research laboratories. The Hospitals segment dominated the market with the largest revenue share of 42.1% in 2025, owing to their high testing capacity, comprehensive diagnostic infrastructure, and integration of advanced analyzers for routine lipid profiling. Hospitals frequently conduct LDL testing as part of general health checkups, cardiovascular monitoring, and pre-surgical evaluations. The availability of in-house laboratories, trained personnel, and automated equipment supports efficient testing operations. Moreover, hospitals in Western Europe benefit from strong reimbursement frameworks and digital connectivity between departments, further streamlining test processes. Continuous hospital investments in automation and centralized laboratory expansion are key factors maintaining this segment’s dominance.

The Ambulatory Care segment is expected to witness the fastest growth rate from 2026 to 2033, propelled by the increasing shift toward outpatient diagnostics and decentralized healthcare delivery. The adoption of compact analyzers and point-of-care testing solutions in ambulatory centers is improving accessibility and convenience for patients. Ambulatory care settings are becoming preferred locations for preventive lipid screening due to shorter waiting times and cost-effective testing options. The trend toward chronic disease management in outpatient settings further supports growth. In addition, government incentives promoting early cardiovascular risk detection are driving LDL testing adoption in community-based care centers.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders and retail. The Direct Tenders segment dominated the market with the largest revenue share of 58.7% in 2025, driven by bulk procurement of diagnostic kits, reagents, and analyzers by public hospitals, laboratories, and government healthcare institutions. Direct tendering ensures supply stability, cost efficiency, and compliance with national healthcare procurement frameworks. The segment benefits from strong participation by major diagnostic companies offering long-term service contracts and maintenance support. In countries such as Germany and France, centralized purchasing systems under government health agencies further reinforce the dominance of this channel. In addition, the growing emphasis on standardized quality assurance in public healthcare facilities sustains demand through tender-based supply chains.

The Retail segment is anticipated to witness the fastest CAGR from 2026 to 2033, supported by the increasing availability of LDL testing kits and devices through pharmacies, online platforms, and diagnostic retailers. The rise of self-testing and home-based cholesterol monitoring kits is empowering consumers to take proactive steps in managing their cardiovascular health. Growing e-commerce penetration and digital health marketplaces across Europe are improving accessibility and affordability of test products. Moreover, strategic partnerships between diagnostic manufacturers and retail distributors are expanding product visibility. This consumer-driven trend toward personalized healthcare and preventive monitoring is expected to propel retail segment growth significantly during the forecast period.

Europe Low Density Lipoprotein (LDL) Test Market Regional Analysis

- Germany dominated the LDL test market with the largest revenue share of 27.9% in 2025, owing to its robust healthcare infrastructure, high diagnostic testing rates, and strong presence of leading clinical laboratories and diagnostic device manufacturers

- Healthcare providers in Germany emphasize regular lipid and cholesterol testing as part of routine health checkups, with widespread adoption of automated analyzers and digital diagnostic systems across hospitals and laboratories ensuring high testing accuracy and efficiency

- This market leadership is further supported by well-established reimbursement policies, strong government initiatives promoting preventive healthcare, and continuous technological advancements by domestic and global diagnostic manufacturers operating within the country

The Germany Low Density Lipoprotein (LDL) Test Market Insight

The Germany LDL Test market captured the largest revenue share in Europe in 2025, driven by its advanced healthcare system, high diagnostic spending, and strong focus on early cardiovascular risk detection. The widespread availability of automated lipid testing systems and integration of AI-driven diagnostic solutions strengthen Germany’s leadership position. Hospitals and laboratories are increasingly implementing LDL tests as part of routine preventive care programs. Furthermore, supportive reimbursement policies and collaboration between healthcare providers and diagnostic manufacturers are boosting test accessibility. The country’s emphasis on innovation and quality control continues to propel its market growth.

U.K. Low Density Lipoprotein (LDL) Test Market Insight

The U.K. LDL Test market is expected to grow at a notable CAGR during the forecast period, fueled by a rising incidence of lifestyle-related diseases and the government’s commitment to preventive cardiovascular screening. The expansion of primary care testing and the adoption of advanced diagnostic analyzers in hospitals and clinics are supporting strong market performance. Increasing collaboration between public health agencies and diagnostic companies enhances the reach of cholesterol testing programs. In addition, growing consumer awareness of lipid management and the integration of LDL testing in digital health platforms are driving adoption.

France Low Density Lipoprotein (LDL) Test Market Insight

The France LDL Test market is projected to witness steady growth through the forecast period, driven by a high prevalence of heart disease and strong government initiatives for preventive diagnostics. France’s universal healthcare system supports regular lipid screening, promoting widespread access to LDL testing services. Increasing demand for advanced automated analyzers and cost-efficient reagent kits across hospitals and laboratories is further fueling growth. The country’s focus on early detection and personalized healthcare approaches enhances LDL testing adoption. In addition, technological collaborations between diagnostic manufacturers and healthcare institutions are improving test accuracy and patient outcomes.

Italy Low Density Lipoprotein (LDL) Test Market Insight

The Italy LDL Test market is anticipated to expand at a considerable CAGR over the forecast period, supported by rising awareness of cardiovascular health and the increasing burden of dyslipidemia among the aging population. The growing presence of diagnostic laboratories equipped with automated lipid analyzers is enhancing testing accessibility across urban and regional healthcare centers. Furthermore, Italy’s emphasis on preventive care and chronic disease monitoring is promoting regular LDL testing in both public and private sectors. Strategic initiatives by diagnostic firms to introduce cost-effective testing solutions are expected to further accelerate market expansion.

Europe Low Density Lipoprotein (LDL) Test Market Share

The Europe Low Density Lipoprotein (LDL) Test industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Beckman Coulter, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Abbott (U.S.)

- Siemens Healthineers AG (Germany)

- Hitachi High-Tech Corporation (Japan)

- DiaSorin S.p.A. (Italy)

- BD (U.S.)

- Randox Laboratories Ltd. (U.K.)

- Eurofins Scientific (Luxembourg)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd (China)

- PerkinElmer. (U.S.)

- Tosoh Corporation (Japan)

- HORIBA Ltd. (Japan)

- Werfen (Spain)

- Nipro Corporation (Japan)

- Sekisui Chemical Co., Ltd. (Japan)

- Tecan Group Ltd. (Switzerland)

What are the Recent Developments in Europe Low Density Lipoprotein (LDL) Test Market?

- In May 2025, Roche Diagnostics, in its Diagnostics Day presentation, listed plans for upcoming lipid assays including LDL (low-density lipoprotein cholesterol) testing capabilities in Europe. This indicates a strategic move by a major diagnostics company to expand LDL test availability and accessibility in Europe

- In April 2025, the European Society of Cardiology/European Atherosclerosis Society (ESC/EAS) published the cholesterol guidelines, reaffirming very aggressive LDL-C goals and emphasising that further lowering is beneficial indirectly boosting demand for improved LDL testing in Europe

- In September 2024, an article titled “The new lipid panel playbook” reported rising clinical emphasis in Europe on measuring apo B (apolipoprotein B) alongside LDL-C, due to limitations of traditional LDL-C tests. MyADLM. The article explained that LDL-C calculation methods are less accurate at very low LDL-C levels or with high triglycerides

- In August 2023, research published in the U.S. but relevant to Europe noted that combining measurements of LDL-C, lipoprotein(a) [Lp(a)] and CRP produced much higher predictive value for 30-year cardiovascular risk reinforcing the importance of comprehensive lipid testing including LDL in Europe

- In June 2022, a real-world observational study in Germany found that only about 6% of patients with recurrent vascular events achieved the target LDL-C level of <1.0 mmol/L, highlighting major gaps in LDL testing and control in Europe. It underlines the need for improved LDL-C testing and management systems, especially in high-risk populations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.