Europe Lipid Poct Market

Market Size in USD Million

CAGR :

%

USD

214.92 Million

USD

305.63 Million

2025

2033

USD

214.92 Million

USD

305.63 Million

2025

2033

| 2026 –2033 | |

| USD 214.92 Million | |

| USD 305.63 Million | |

|

|

|

|

Europe Lipid POCT Market Size

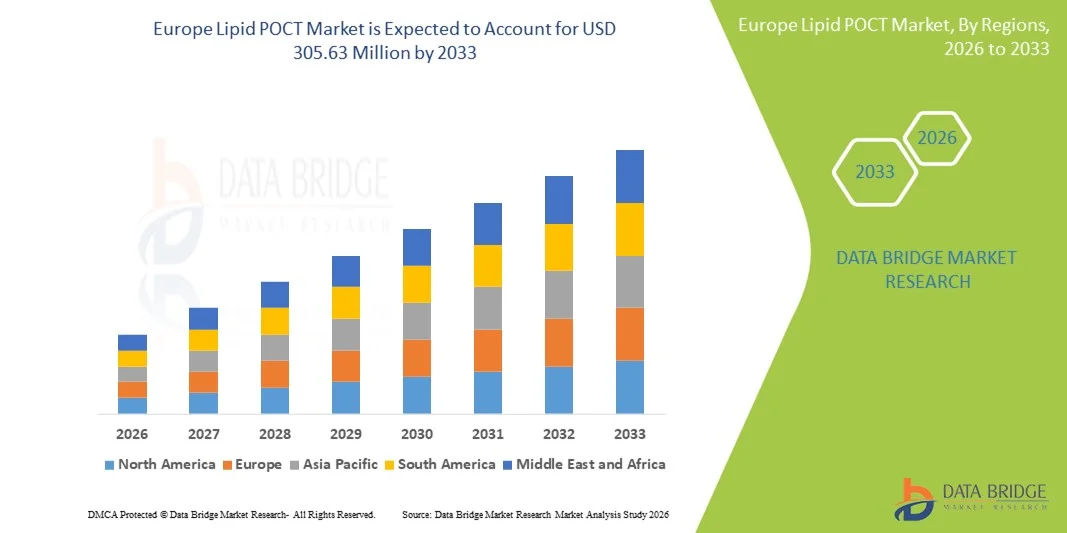

- The Europe lipid POCT market size was valued at USD 214.92 million in 2025 and is expected to reach USD 305.63 million by 2033, at a CAGR of 4.5% during the forecast period

- The market growth is largely driven by the rising prevalence of cardiovascular diseases, increasing emphasis on early diagnosis, and the growing adoption of rapid, decentralized diagnostic solutions across hospitals, clinics, and primary care settings

- Furthermore, strong demand for fast, accurate, and user-friendly lipid testing devices, along with supportive healthcare infrastructure and preventive screening initiatives, is positioning lipid POCT as a preferred diagnostic approach. These converging factors are accelerating market adoption across Europe, thereby significantly boosting overall industry growth

Europe Lipid POCT Market Analysis

- Lipid point-of-care testing (POCT) solutions, enabling rapid and on-site measurement of cholesterol and lipid parameters, are increasingly critical components of Europe’s diagnostic landscape due to their role in early cardiovascular risk assessment and timely clinical decision-making across hospitals, clinics, and home care settings

- The escalating demand for lipid POCT is primarily driven by the high prevalence of cardiovascular diseases, increasing focus on preventive healthcare, and growing preference for fast, accurate, and decentralized diagnostic solutions that reduce reliance on centralized laboratories

- Germany dominated the Europe lipid POCT market with the largest revenue share of 28.6% in 2025, supported by a robust healthcare system, high screening coverage for hyperlipidemia, and strong adoption of prescription-based lipid POCT devices across hospitals and professional diagnostic centers

- Poland is expected to be the fastest growing country during the forecast period, driven by improving healthcare infrastructure, rising awareness of lipid disorders, and increasing availability of cost-effective and OTC-based lipid POCT solutions

- Hyperlipidemia segment dominated the market with the largest market share of 46.3% in 2025, driven by routine lipid screening and long-term disease management needs

Report Scope and Europe Lipid POCT Market Segmentation

|

Attributes |

Europe Lipid POCT Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Lipid POCT Market Trends

Shift Toward Rapid, Decentralized Cardiovascular Screening

- A significant and accelerating trend in the Europe lipid POCT market is the growing shift toward rapid, decentralized lipid testing across primary care clinics, pharmacies, and community healthcare settings, enabling faster cardiovascular risk assessment and timely clinical decisions

- For instance, lipid POCT systems such as Roche Cobas B 101 and Alere Cholestech LDX are increasingly used in outpatient clinics and physician offices across Europe to deliver cholesterol results within minutes without the need for centralized laboratories

- Technological advancements in lipid POCT devices are enabling improved analytical accuracy, reduced sample volumes, and simplified workflows. For instance, microfluidics-based platforms are enhancing test reliability while maintaining portability and ease of use for non-laboratory personnel

- The growing emphasis on preventive healthcare and early disease detection is driving the integration of lipid POCT into routine health checkups and screening programs, particularly for populations at risk of hyperlipidemia and cardiovascular diseases

- This trend toward faster, more accessible lipid testing is reshaping diagnostic pathways across Europe. Consequently, companies such as Abbott and Roche are focusing on compact, user-friendly POCT analyzers that can be deployed in diverse care environments

- The demand for lipid POCT solutions offering rapid turnaround time and operational simplicity is rising steadily across hospitals, diagnostic centers, and home care settings, as healthcare providers prioritize efficiency and patient-centric care models

- The integration of digital connectivity features, such as data transfer to electronic health records and mobile health platforms, is gaining traction, supporting remote monitoring and continuity of cardiovascular care

Europe Lipid POCT Market Dynamics

Driver

Rising Cardiovascular Disease Burden and Preventive Screening Focus

- The increasing prevalence of cardiovascular diseases across Europe, combined with a strong focus on preventive healthcare and early diagnosis, is a major driver supporting the adoption of lipid POCT solutions

- For instance, several European national health systems are strengthening routine cholesterol screening initiatives to identify high-risk individuals early, which is encouraging the use of rapid lipid POCT devices in primary care settings

- As healthcare providers seek faster diagnostic tools to support immediate clinical decisions, lipid POCT offers advantages such as reduced turnaround time, immediate patient counseling, and improved treatment adherence

- Furthermore, aging populations and rising incidence of lifestyle-related disorders such as obesity and diabetes are increasing the demand for frequent lipid monitoring, further driving POCT adoption

- The ability of lipid POCT devices to operate outside traditional laboratory environments aligns well with Europe’s growing emphasis on decentralized and value-based healthcare delivery models

- The expanding availability of prescription-based and OTC-based lipid POCT solutions, combined with increasing clinician acceptance, is significantly propelling market growth across both institutional and non-institutional care settings

- Government-backed cardiovascular prevention programs and public health initiatives are further accelerating demand for accessible lipid testing solutions across multiple care levels

- Growing pressure on centralized laboratories to reduce turnaround times and operational costs is prompting healthcare providers to increasingly adopt lipid POCT as a complementary diagnostic approach

Restraint/Challenge

Accuracy Concerns and Regulatory Compliance Complexity

- Concerns regarding the analytical accuracy and consistency of lipid POCT results compared to centralized laboratory testing pose a key challenge to broader market adoption, particularly for clinical decision-making in high-risk patients

- For instance, variability in test performance across different POCT platforms has led some clinicians to rely on laboratory confirmation for critical lipid measurements, limiting full-scale POCT utilization

- Stringent regulatory requirements and compliance standards across European countries add complexity to product approvals, increasing time-to-market for new lipid POCT technologies

- In addition, the cost of POCT instruments and recurring consumables can be a barrier for smaller clinics and primary care practices operating under budget constraints

- Overcoming these challenges through continuous device validation, regulatory harmonization, and improved clinician education will be essential to ensure sustained growth of the Europe lipid POCT market

- Limited reimbursement coverage for POCT-based lipid testing in certain European countries may restrict adoption despite clinical benefits

- Concerns related to operator dependency and the need for adequate training among non-laboratory personnel can impact result reliability and slow broader market penetration

Europe Lipid POCT Market Scope

The market is segmented on the basis of type, application, mode, brand, platform, end user, and distribution channel.

- By Type

On the basis of type, the Europe lipid POCT market is segmented into instruments, consumables, and kits. The instruments segment dominated the market in 2025, driven by their widespread installation across hospitals and professional diagnostic centers for routine lipid profiling. These instruments play a critical role in delivering rapid and reliable cholesterol results at the point of care, supporting immediate clinical decision-making. Healthcare providers prioritize POCT analyzers to manage cardiovascular risk and chronic lipid disorders efficiently. Continuous technological advancements, including improved analytical accuracy and digital connectivity, further strengthen adoption. The longer operational lifespan of instruments ensures a stable installed base across healthcare facilities. Strong institutional procurement and reimbursement support further reinforce the dominance of this segment.

The consumables and kits segment is expected to witness the fastest growth during the forecast period, fueled by the recurring nature of demand associated with every lipid POCT test performed. Each test requires single-use strips, cartridges, or reagents, ensuring consistent consumption across care settings. Rising preventive screening initiatives across Europe are significantly increasing test volumes. Expansion of OTC-based lipid testing and home care monitoring is accelerating consumable usage. Growing awareness of routine cholesterol monitoring is driving repeat testing frequency. These factors collectively position consumables and kits as the fastest-growing type segment.

- By Application

On the basis of application, the market is segmented into hyperlipidemia, hypertriglyceridemia, hyperlipoproteinemia, familial hypercholesterolemia, Tangier disease, and others. The hyperlipidemia segment dominated the market in 2025 with a market share of 46.3%, owing to its high prevalence across European populations and its strong association with cardiovascular disease risk. Routine cholesterol screening is widely recommended for adults, driving frequent lipid testing across primary care settings. Lipid POCT devices are extensively used for ongoing disease monitoring and therapy adjustment. Strong physician awareness and well-established clinical guidelines support sustained testing demand. Preventive healthcare programs further reinforce the importance of early lipid detection. As a result, hyperlipidemia remains the largest application segment in the market.

The familial hypercholesterolemia segment is anticipated to grow at the fastest rate during the forecast period, supported by improving diagnosis rates and expanding genetic screening initiatives across Europe. Increased awareness of inherited lipid disorders is encouraging early identification and regular monitoring. POCT solutions enable rapid follow-up testing in specialized lipid clinics. National cardiovascular prevention strategies emphasize early detection of genetically high-risk individuals. Advancements in POCT accuracy support confidence in decentralized testing. These drivers collectively fuel accelerated growth in this segment.

- By Mode

On the basis of mode, the market is segmented into prescription-based testing and OTC-based testing. The prescription-based testing segment dominated the market in 2025, driven by strong physician involvement and integration into formal healthcare pathways. Most lipid POCT testing is conducted in hospitals, clinics, and diagnostic centers under medical supervision. Reimbursement frameworks across Europe favor prescription-based lipid testing. Clinicians rely on these tests for managing high-risk and chronic cardiovascular patients. Regulatory confidence further supports institutional adoption. These factors collectively sustain segment dominance.

The OTC-based testing segment is expected to witness the fastest growth during the forecast period, fueled by rising consumer awareness of cardiovascular health. Preventive care trends are encouraging individuals to proactively monitor cholesterol levels. User-friendly POCT devices enable testing outside traditional clinical environments. Expanding retail pharmacy availability improves accessibility across Europe. Digital result interpretation tools enhance consumer confidence. This shift toward self-care is driving rapid adoption of OTC testing.

- By Brand

On the basis of brand, the market includes Roche Reflotron, Roche Cobas B 101, Alere Cholestech LDX, Alere Afinion, Samsung Labgeo, PTS Cardiochek, and others. The Roche Reflotron and Roche Cobas B 101 brands dominated the market in 2025, supported by strong clinical credibility and extensive European distribution networks. These systems are widely trusted for analytical accuracy and consistent performance. Hospitals and diagnostic centers prefer Roche platforms due to regulatory compliance and proven reliability. Long-standing brand presence enhances clinician confidence. Comprehensive service and technical support further strengthen adoption. These advantages sustain Roche’s leadership position in the market.

The PTS Cardiochek brand is expected to grow at the fastest pace during the forecast period, driven by its compact design and cost-effectiveness. The device is well suited for home care, pharmacies, and community screening programs. Growing adoption of OTC lipid testing supports brand expansion. Ease of use attracts non-laboratory professionals and consumers. Preventive health initiatives favor portable POCT solutions. These factors collectively accelerate growth for this brand. Ongoing technological improvements and digital integration are accelerating growth for this brand segment.

- By Platform

On the basis of platform, the market is segmented into lateral flow assays, molecular diagnostics, immunoassays, dipsticks, and microfluidics. The immunoassays segment dominated the market in 2025, driven by high analytical accuracy and clinical reliability for lipid profiling. Immunoassay-based platforms are widely adopted across hospitals and diagnostic centers. Clinicians trust these systems for consistent and validated results. Compatibility with established POCT analyzers supports continued usage. Strong clinical validation reinforces confidence among healthcare providers. These factors position immunoassays as the leading platform segment.

The microfluidics segment is expected to witness the fastest growth during the forecast period, fueled by advancements in miniaturization and rapid testing technologies. Microfluidic platforms require smaller sample volumes and deliver faster results. Their portability supports decentralized and home-based testing. Integration with digital health systems enhances usability. Ongoing R&D investments are improving performance and affordability. These benefits are accelerating adoption across Europe.

- By End User

On the basis of end user, the market is segmented into hospitals, professional diagnostic centers, home care, research laboratories, and other end users. The hospitals segment dominated the market in 2025, supported by high patient volumes and routine cardiovascular screening activities. Hospitals act as primary centers for diagnosis and management of lipid disorders. Availability of trained healthcare professionals supports POCT implementation. Integration into inpatient and outpatient workflows enhances efficiency. Strong procurement capabilities enable adoption of advanced POCT systems. These factors reinforce hospital dominance.

The home care segment is anticipated to grow at the fastest rate during the forecast period, driven by aging populations and rising chronic disease burden. Increasing availability of OTC lipid POCT devices supports home testing adoption. Convenience and reduced need for hospital visits encourage patient preference. Remote monitoring aligns with value-based healthcare models. Digital connectivity enables physician oversight of home test results. These trends collectively fuel rapid growth in home care settings.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail sales. The direct tender segment dominated the market in 2025, driven by bulk procurement by hospitals and public healthcare institutions. Government-backed purchasing mechanisms favor tender-based acquisition. Long-term supply contracts ensure stability and cost efficiency. Established vendor relationships support consistent demand. High-volume procurement strengthens supplier presence. These factors sustain dominance of the direct tender channel.

The retail sales segment is expected to witness the fastest growth during the forecast period, fueled by rising OTC-based lipid testing adoption. Pharmacies and medical retailers are expanding POCT product offerings. Consumer awareness of cholesterol monitoring is increasing steadily. Easy accessibility encourages uptake among individuals. Competitive pricing further supports sales growth. Retail expansion is accelerating channel penetration. The expansion of retail networks and digital result interpretation tools is accelerating market penetration in this segment.

Europe Lipid POCT Market Regional Analysis

- Germany dominated the Europe lipid POCT market with the largest revenue share of 28.6% in 2025, supported by a robust healthcare system, high screening coverage for hyperlipidemia, and strong adoption of prescription-based lipid POCT devices across hospitals and professional diagnostic centers

- Healthcare providers and consumers in the country highly value rapid and accurate cholesterol testing offered by POCT devices, which support early diagnosis and ongoing disease management

- This widespread adoption is further supported by strong reimbursement policies, advanced diagnostic networks, and growing preventive healthcare initiatives, establishing lipid POCT as a preferred solution in hospitals, clinics, and home care settings

The Germany Lipid POCT Market Insight

The Germany lipid POCT market dominated Europe in 2025, driven by advanced healthcare infrastructure and high adoption of preventive cardiovascular screening programs. German hospitals and diagnostic centers are increasingly utilizing rapid POCT devices to deliver accurate lipid profiles efficiently. Strong reimbursement frameworks and government-led health initiatives support widespread adoption of these technologies. Healthcare professionals value the reliability and speed of POCT testing for hyperlipidemia management and early detection of cardiovascular risk. The integration of lipid POCT with electronic health records is further improving patient management. Increasing awareness among patients about self-monitoring and preventive care is also contributing to sustained market growth.

U.K. Lipid POCT Market Insight

The U.K. lipid POCT market is expected to grow at a notable CAGR during the forecast period, driven by growing awareness of cardiovascular diseases and preventive healthcare. Hospitals, clinics, and diagnostic centers are adopting POCT devices to provide rapid and convenient lipid testing. Consumers are increasingly focused on early detection of hyperlipidemia and managing cholesterol levels at home. The availability of OTC-based POCT devices in pharmacies is expanding the market reach. Integration of POCT systems with digital platforms allows for efficient data management and remote patient monitoring. Strong healthcare policies promoting preventive screening further support market expansion.

France Lipid POCT Market Insight

The France lipid POCT market is witnessing significant growth due to rising awareness of lipid disorders and preventive cardiovascular care. Healthcare providers in France are adopting rapid lipid testing devices to deliver timely diagnostics and improve patient outcomes. Hospitals and professional diagnostic centers prioritize accuracy, reliability, and speed for routine lipid monitoring. The expansion of home-based and self-testing solutions is contributing to market growth. Government health initiatives promoting early detection of cardiovascular risk factors are encouraging adoption. In addition, integration with digital healthcare systems enhances result management and accessibility, driving market demand.

Poland Lipid POCT Market Insight

The Poland lipid POCT market is expected to grow at a notable CAGR during the forecast period, driven by increasing awareness of cardiovascular diseases and preventive health screening programs. Hospitals, clinics, and diagnostic centers are adopting rapid lipid testing devices to provide timely and accurate results for hyperlipidemia management. Consumers are also showing growing interest in home-based lipid monitoring, supported by the availability of user-friendly POCT devices. Retail pharmacy distribution of OTC lipid testing kits is expanding the market reach. Integration with digital healthcare systems allows for efficient tracking and management of patient lipid profiles. Government initiatives promoting early detection of cardiovascular risk factors and the rising prevalence of lipid disorders are further propelling market growth.

Europe Lipid POCT Market Share

The Europe Lipid POCT industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- PTS Diagnostics (U.S.)

- PRIMA Lab SA (Switzerland)

- F. Hoffmann La Roche Ltd (Switzerland)

- SD Biosensor, INC (South Korea)

- EuroMedix (Belgium)

- Trinity Biotech (Ireland)

- Nova Biomedical (U.S.)

- Calligari Srl (Italy)

- MICO BIOMED (South Korea)

- General Life Biotechnology Co., Ltd. (Taiwan)

- TASCOm (South Korea)

- Jant Pharmacal Corporation (U.S.)

- ACON Laboratories, Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- Beckman Coulter, Inc. (U.S.)

- BD (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

What are the Recent Developments in Europe Lipid POCT Market?

- In May 2025, NOUL launched the miLab™ BCM, an AI‑powered point‑of‑care blood testing system designed to enhance rapid diagnostics in Europe, including lipid and other metabolic assessments, marking a significant step toward more integrated, automated POC solutions in European healthcare settings

- In March 2025, researchers in the UK published findings highlighting that only two out of six cholesterol point‑of‑care tests meet required accuracy standards for use in the NHS Health Check programme, revealing significant concerns about the performance of widely available lipid POCT devices and prompting renewed focus on improving test quality and regulatory oversight in European preventive care settings

- In September 2024, a study on the diagnostic accuracy of the CardioChek® PA point‑of‑care lipid analyser was published, demonstrating acceptable accuracy for key lipid markers (total cholesterol, HDL, LDL, triglycerides) and reinforcing clinical confidence in POCT devices for screening and epidemiological use

- In May 2023, PocDoc launched the world‑first smartphone‑powered 5‑marker lipid test that enables cardiovascular lipid profiling in under six minutes using an app and lateral flow test, expanding accessibility of lipid POCT beyond traditional clinical settings

- In May 2023, LabMedica International reported on the PocDoc smartphone lipid panel test’s practical impact on early detection of cardiovascular risk and expanding diagnostic accessibility, highlighting tech progress toward decentralized lipid POCT

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.