Europe Lymphedema Treatment Market

Market Size in USD Million

CAGR :

%

USD

307.74 Million

USD

608.27 Million

2024

2032

USD

307.74 Million

USD

608.27 Million

2024

2032

| 2025 –2032 | |

| USD 307.74 Million | |

| USD 608.27 Million | |

|

|

|

|

Europe Lymphedema Treatment Market Size

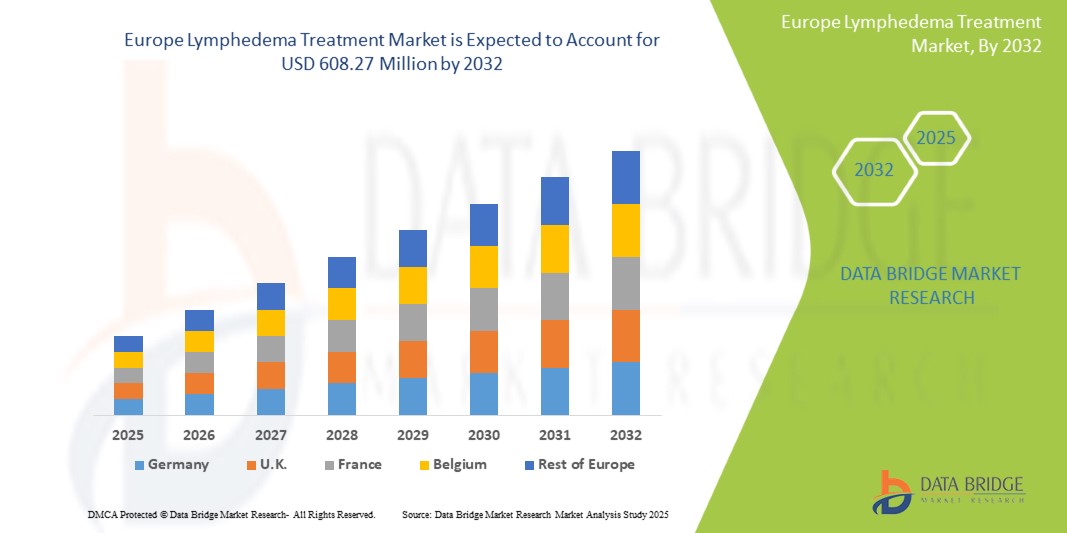

- The Europe lymphedema treatment market size was valued at USD 307.74 million in 2024 and is expected to reach USD 608.27 million by 2032, at a CAGR of 9.1% during the forecast period

- The market growth in Europe is largely fueled by the rising regional prevalence of lymphedema and cancer-related lymphedema, coupled with significant technological advancements in diagnostic imaging modalities and innovative treatment approaches, leading to improved identification and management of the condition.

- Furthermore, increasing patient and clinician demand across the region for more effective, accessible, and integrated solutions for managing chronic swelling and enhancing quality of life is establishing advanced compression therapies, lymphatic drainage techniques, and microsurgical interventions as the modern standard of lymphedema care. These converging factors are accelerating the uptake of lymphedema management solutions in Europe, thereby significantly boosting the industry's regional growth.

Europe Lymphedema Treatment Market Analysis

- Lymphedema, characterized by chronic swelling caused by impaired lymphatic system function, is an increasingly vital area of focus in modern healthcare due to its significant impact on patient quality of life, often arising as a complication of cancer treatment or genetic predispositions

- The escalating demand for lymphedema treatments is primarily fueled by the rising global prevalence of lymphedema and cancer-related lymphedema, increasing awareness among healthcare professionals and patients, and continuous technological advancements in diagnostic and therapeutic modalities

- Germany dominated the lymphedema market in 2024, driven by a high prevalence of lymphedema cases (particularly cancer-related lymphedema), advanced healthcare infrastructure, and strong consumer awareness and early adoption of innovative therapies

- The compression therapy segment dominated the lymphedema treatment market in 2024, driven by its established reputation as the first-line and most common treatment for managing swelling, its non-invasive nature, and ongoing innovations in compression garments and devices offering improved comfort and efficacy

Report Scope and Europe Lymphedema Treatment Market Segmentation

|

Attributes |

Europe Lymphedema Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Lymphedema Treatment Market Trends

Enhanced Patient Care Through AI and Digital Integration

- A significant and accelerating trend in the lymphedema market is the deepening integration with artificial intelligence (AI) and digital health platforms, encompassing remote monitoring, personalized treatment algorithms, and telehealth solutions. This fusion of technologies is significantly enhancing patient convenience, treatment adherence, and overall management of their chronic condition. For instance, the region's increasing burden of cancer incidence and other chronic conditions contributing to lymphedema highlights a critical patient segment driving demand for long-term lymphedema management solutions

- AI integration in lymphedema care enables features such as analyzing vast patient data to predict potential flare-ups, optimizing compression garment pressure levels based on individual responses, and providing more intelligent alerts for early intervention. For instance, some emerging AI-driven solutions are being explored to improve the accuracy of early lymphedema detection by analyzing imaging data, and to guide patients through personalized rehabilitation exercises. Furthermore, digital platforms with integrated communication capabilities offer patients the ease of virtual consultations, allowing them to discuss symptoms and receive guidance remotely

- The seamless integration of lymphedema monitoring devices and self-management tools with broader digital health ecosystems facilitates centralized control over various aspects of a patient's care. Through a single interface, users can manage their limb measurements, therapy adherence, and communicate with their care team, creating a unified and more proactive health management experience

- This trend towards more intelligent, intuitive, and interconnected lymphedema management systems is fundamentally reshaping patient expectations for chronic disease care. Consequently, companies are developing AI-enabled diagnostic tools and digital platforms with features such as automated data analysis, personalized alerts, and remote therapy adjustments

- The demand for lymphedema solutions that offer seamless AI and digital integration is growing rapidly across healthcare settings and patient demographics, as both clinicians and patients increasingly prioritize effective, convenient, and comprehensive management of this lifelong condition

Europe Lymphedema Treatment Market Dynamics

Driver

Growing Need Due to Rising Disease Prevalence and Enhanced Diagnostic Capabilities

- The increasing prevalence of lymphedema, particularly secondary lymphedema resulting from cancer treatments, coupled with accelerating advancements in diagnostic technologies and growing awareness, is a significant driver for the heightened demand for lymphedema management solutions

- For instance, the large and aging patient population across Europe, combined with a rising incidence of chronic diseases and improving healthcare access, significantly contributes to the growing need for effective lymphedema management

- As healthcare professionals and patients become more aware of the long-term implications of untreated lymphedema and seek earlier intervention, advanced diagnostic tools such as bioimpedance spectroscopy (BIS) and sophisticated imaging (e.g., ICG lymphography) offer precise measurement and early detection, providing a compelling advantage over traditional tape measurements

- Furthermore, the growing focus on patient-centric care and the desire for improved quality of life for those living with chronic conditions are making comprehensive lymphedema management an integral component of post-cancer care and chronic disease management, offering seamless integration with rehabilitation programs and supportive therapies

- The convenience of early diagnosis, personalized treatment plans facilitated by digital health tools, and the ability to self-manage symptoms through advanced compression and exercise regimens are key factors propelling the adoption of lymphedema solutions in both clinical and home care settings. The trend towards proactive screening and the increasing availability of user-friendly self-management products further contributes to market growth

Restraint/Challenge

Concerns Regarding Underdiagnosis and High Treatment Costs

- Concerns surrounding the widespread underdiagnosis and misdiagnosis of lymphedema, coupled with the significant financial burden of ongoing treatment, pose a significant challenge to broader market penetration and effective patient care. As lymphedema often presents subtly in early stages and is frequently overlooked by healthcare providers, it leads to delayed intervention and progression of the disease, raising anxieties among patients about their long-term health outcomes

- For instance, in many parts of Europe, the substantial out-of-pocket expenses for ongoing lymphedema care, including specialized garments and therapies, can create a significant financial burden for patients, particularly where public health coverage or insurance schemes are limited

- Addressing these underdiagnosis concerns through enhanced medical education, standardized screening protocols, and public awareness campaigns is crucial for improving patient outcomes. Regional and local health organizations often emphasize advocacy and educational initiatives to improve early detection and care. Additionally, the relatively high and ongoing cost of specialized compression garments, pneumatic pumps, and manual lymphatic drainage therapy can be a significant barrier to consistent treatment for price-sensitive consumers, particularly in Europe regions with limited insurance coverage or for patients facing financial strain. Out-of-pocket expenses for lifelong management remain substantial across the region

- While awareness is gradually increasing, the perceived lack of a "cure" and the chronic nature of the condition can still hinder proactive management, especially for those who do not have adequate insurance coverage or access to specialized care

- Overcoming these challenges through enhanced educational initiatives for healthcare providers and the public, improving insurance reimbursement policies, and the development of more affordable and accessible lymphedema management options will be vital for sustained market growth and improving the quality of life for millions affected by lymphedema

Europe Lymphedema Treatment Market Scope

The market is segmented on the basis of treatment type, type, affected area, age group, route of administration, end user, and distribution channel.

By Treatment Type

On the basis of treatment type, the lymphedema market is segmented into compression therapy, surgery, drug therapy, laser therapy and others. The compression therapy segment is expected to dominate the largest market revenue share with 66.87% in 2025, driven by its established reputation as the gold standard for lymphedema management and its non-invasive nature, making it accessible for a wide range of patients. Patients often prioritize compression therapy for its effectiveness in reducing swelling and improving comfort. The market also sees strong demand for compression garments and pumps due to ongoing advancements in materials and designs, enhancing comfort and adherence.

The surgery segment is anticipated to witness the fastest growth rate during the forecast period in the Europe region, fueled by increasing advancements in microsurgical techniques like lymphovenous anastomosis (LVA) and vascularized lymph node transfer (VLNT, and rising patient awareness of these potentially curative options in severe cases. Surgical interventions offer the prospect of significant long-term limb volume reduction, making them suitable for patients unresponsive to conservative treatments. The growing number of specialized lymphedema surgical centers and the increasing recognition of surgical efficacy also contribute to their rising popularity.

By Type

On the basis of type, the lymphedema treatment market in the Europe region is segmented into primary lymphedema and secondary lymphedema. The secondary lymphedema segment is expected to dominate the largest market revenue share with 79.05% in 2025, driven by its significantly higher prevalence across the region, largely attributed to cancer treatments such as lymph node dissection and radiation therapy. Healthcare providers and patients often prioritize secondary lymphedema management due to its association with life-saving cancer interventions and its more identifiable onset. The market also sees strong demand for solutions targeting secondary lymphedema due to increasing cancer survival rates and enhanced awareness of its post-treatment complications.

The primary lymphedema segment is anticipated to witness a fastest growth rate during the forecast period, fueled by increasing awareness and diagnostic capabilities for this often hereditary and early-onset condition, alongside advancements in genetic testing and specialized pediatric lymphedema care. Greater understanding of genetic mutations linked to primary lymphedema is leading to earlier diagnosis

By Affected Area

On the basis of affected area, the Europe lymphedema treatment market is segmented into lower extremity, upper extremity and genitalia. The lower extremity segment is anticipated to continue dominating the largest market revenue share with 53.95% in the Europe region, reflecting global trends. This is primarily driven by the high prevalence of filarial lymphedema in certain parts of Europe, as well as increasing instances of lymphedema linked to chronic venous insufficiency and a rising burden of gynecological and prostate cancers. Patients in the Europe region experiencing lower extremity lymphedema often seek treatment due to significant functional impairments, mobility issues, and discomfort, leading to sustained demand for therapeutic solutions.

The upper extremity segment is expected to witness fastest growth rate during the forecast period in Europe, fueled by the increasing number of breast cancer survivors in the region. Breast cancer treatment, particularly axillary lymph node dissection and radiation therapy, remains a major risk factor for upper extremity lymphedema. Rising awareness among oncology patients and healthcare providers in Europe about screening, early diagnosis, and intervention for arm lymphedema is driving demand for tailored solutions. The continuous development and expanding accessibility of specialized arm sleeves and pneumatic compression devices designed for the upper limb further contribute to its growing market presence.

By Age Group

On the basis of age group, the Europe lymphedema treatment market is segmented into Adult, Geriatric and Pediatric. The adult segment is expected to continue dominating the largest market revenue share in the Europe region. This is primarily driven by the high incidence of secondary lymphedema linked to cancer treatments, such as those for breast, gynecological, and prostate cancers, which are increasingly prevalent in the adult population across Europe due to changing lifestyles, environmental factors, and improving cancer diagnostics. In addition, various acquired causes, including trauma, infections (like filariasis in certain endemic areas), and other medical conditions, contribute to lymphatic dysfunction in adults. Adult patients in Europe form the largest demographic seeking lymphedema treatment due to the sheer size of this population segment and the growing awareness of available treatment options. The market also benefits from a broad range of products and solutions specifically tailored for adult lymphedema management.

The geriatric segment is anticipated to witness the fastest growth rate in the Europe region during the forecast perod. This accelerated growth is fueled by the significant increase in the aging population across Europe, which is inherently more susceptible to age-related lymphatic decline, leading to reduced lymphatic function. The rising prevalence of co-morbidities such as chronic venous insufficiency, obesity, and other age-related chronic conditions also contributes to the higher incidence of lymphedema in older adults. As life expectancy continues to rise in many Europe countries, so does the burden of chronic conditions, including lymphedema, in the elderly.

By Route Of Administration

On the basis of route of administration, the Europe lymphedema treatment market is segmented into oral, injectable and topical. The oral segment is expected to hold a largest market share with 51.84% in the Europe region in 2025. This is driven by the convenience of at-home use for supportive medications, such as diuretics for managing swelling symptoms, antibiotics for preventing or treating recurrent cellulitis (a common complication of lymphedema), and various anti-inflammatory drugs. There's also growing interest in and investigation of emerging oral therapies aimed at improving lymphatic function. Patients in Europe often prefer oral medications due to their ease of self-administration, which promotes better adherence to treatment plans outside of clinical settings.

The injectable segment is anticipated to witness the fastest growth rate in the Europe region during the forecast perod. This rapid expansion is fueled by the ongoing research and development efforts in novel biological therapies, growth factors (such as VEGF-C, which stimulates lymphatic regeneration), and gene therapies. These advanced treatments often require parenteral (injectable) administration to effectively stimulate lymphatic regeneration, reduce inflammation, or modulate disease progression.

By End User

On the basis of end user, the global lymphedema treatment market is segmented into hospitals, specialty clinics, ambulatory surgical centers (ASCs), and others. The hospital segment is expected to hold the largest market share. This dominance is attributed to the hospital's ability to offer a full spectrum of lymphedema treatment options—from early-stage conservative therapies like manual lymphatic drainage and compression therapy to advanced surgical procedures such as lymphovenous anastomosis and vascularized lymph node transfer. Hospitals also serve as the primary referral point for complicated or advanced-stage cases, which require multidisciplinary care, including imaging, diagnostics, and surgical intervention.

The specialty clinics segment is anticipated to witness the fastest growth rate during the forecast period. This growth is driven by the increasing number of lymphedema-focused rehabilitation and outpatient care centers that provide non-invasive therapies and chronic condition management. These clinics cater especially to patients with mild to moderate lymphedema who require regular therapy sessions, making them cost-effective and convenient alternatives to hospital visits. Their rise is further supported by growing awareness campaigns and government-led initiatives for chronic edema management, particularly in urban settings.

By Distribution Channel:

On the basis of distribution channel, the global lymphedema treatment market is segmented into pharmacy, stores, direct tender, and others. The direct tender segment is projected to dominate the market. This is primarily due to bulk procurement of medical devices such as compression pumps, garments, and surgical kits by public hospitals, rehabilitation centers, and government health agencies. Direct tender channels ensure streamlined procurement processes, compliance with regulatory standards, and preferential pricing, making them the preferred option for large-scale institutional buyers.

The stores segment—which includes both retail and online channels—is expected to be the fastest growing segment during the forecast period. This rapid expansion is attributed to a shift in patient behavior toward home-based lymphedema management, especially post-COVID-19. The convenience of online purchasing, growing e-commerce penetration, and availability of self-management devices such as compression sleeves and wraps have accelerated the segment’s growth. Additionally, the rise of telehealth services has empowered patients to manage early-stage lymphedema at home, increasing reliance on over-the-counter and e-commerce-based treatment tools.

Europe Lymphedema Treatment Market Regional Analysis

- Europe held a market share of 29.28% In the lymphedema treatment in 2024, driven by a high prevalence of lymphedema cases (particularly cancer-related lymphedema), robust healthcare infrastructure, and significant investments in medical research and development

- Healthcare providers and patients in the region highly value the readily available advanced diagnostic tools, comprehensive treatment options, and increasing awareness campaigns offered by specialized clinics and hospitals

- This widespread adoption is further supported by high disposable incomes, strong health insurance penetration, and a proactive approach to chronic disease management, establishing lymphedema care as an integrated part of patient pathways for both cancer survivors and those with other lymphatic disorders

Germany Lymphedema Treatment Market Insight

The Germany lymphedema market captured a significant revenue share within Europe, often representing over 17.45% in 2024, fueled by the swift uptake of advanced diagnostic tools and the expanding trend of integrated lymphedema care. Healthcare professionals and patients are increasingly prioritizing the early detection and effective management of lymphedema through comprehensive treatment protocols. The growing recognition of the condition among clinicians, combined with robust demand for specialized compression therapies, pneumatic pumps, and digital health monitoring, further propels the lymphedema industry. Moreover, the increasing integration of supportive policies like comprehensive national healthcare coverage for lymphedema, alongside technological advancements in bioimpedance spectroscopy (BIS) and remote patient monitoring platforms, is significantly contributing to the market's expansion, enhancing patient access and adherence to long-term care.

UK Lymphedema Treatment Market Insight

The UK lymphedema market captured a notable revenue share of 15.30 within Europe, contributing significantly to regional growth in 2025, driven by the gradual uptake of advanced diagnostic tools and the increasing emphasis on integrated lymphedema care within the National Health Service (NHS). Healthcare professionals and patients across the UK are increasingly prioritizing early detection and comprehensive management of lymphedema through coordinated treatment protocols and multidisciplinary care approaches. The rising awareness of the condition among clinicians, coupled with growing demand for specialized compression garments, pneumatic compression devices, and emerging digital health tools, is steadily propelling the lymphedema market in the country. Moreover, the supportive role of national advocacy organizations such as the Lymphoedema Support Network and NHS initiatives promoting education and patient access, along with technological advancements in diagnostic modalities like bioimpedance spectroscopy (BIS) and remote patient management platforms, is contributing to the market's expansion. These efforts are enhancing access to timely diagnosis and promoting adherence to long-term care strategies, ultimately improving outcomes for UK patients living with lymphedema.

Europe Lymphedema Treatment Market Share

The Lymphedema Treatment industry is primarily led by well-established companies, including:

- Tactile Medical (U.S.)

- Essity Aktiebolag (publ) (Sweden)

- 3M (U.S.)

- Cardinal Health (U.S.)

- Lohmann & Rauscher GmbH & Co. KG (Germany)

- PAUL HARTMANN AG (Germany)

- medi GmbH & Co. KG (Germany)

- ConvaTec Inc. (U.K.)

- Juzo (Germany)

- Smith + Nephew (U.K.)

- SIGVARIS GROUP (Switzerland)

- Sanyleg Srl (Italy)

- Avet Pharmaceuticals Inc. (U.S.)

- ThermoTek Inc. (U.S.)

- Huntleigh Healthcare Limited (U.K.)

- KOYA MEDICAL (U.S.)

- AIROS Medical, Inc. (U.S.)

- BIOCOMPRESSION SYSTEMS (U.S.)

- Mego Afek ltd. (Israel)

- SIGVARIS GROUP (Switzerland)

- Sanyleg Srl (Italy)

- Thusane (France)

Latest Developments in Europe Lymphedema Treatment Market

- In March 2025, BSN Medical (an Essity company) announced a new initiative to enhance wound care education across Europe, aiming to equip more healthcare professionals with advanced knowledge in chronic wound management, including aspects relevant to lymphedema. This program focuses on evidence-based practices and product innovations to improve patient outcomes

- In April 2025, Lohmann & Rauscher (L&R) Group acquired a leading medical device distributor in France, significantly strengthening L&R’s presence and market access in the French hospital and homecare sectors for lymphedema products. This strategic move aims to leverage L&R's extensive product portfolio and expand its European footprint

- In February 2025, medi GmbH & Co. KG introduced an updated line of compression garments specifically designed for lower extremity lymphedema, featuring enhanced material breathability and anatomical fit for improved patient comfort and compliance. This launch caters to the growing demand for discreet and comfortable long-term management solutions.

- In October 2024, Juzo GmbH launched its new "JuzoFlex" compression hosiery line for upper extremity lymphedema, offering a lighter fabric and innovative sizing options. Designed for daily wear and ease of application, these garments aim to increase patient adherence and improve quality of life

- In July 2024, SIGVARIS AG announced a partnership with a prominent European telehealth platform to integrate remote patient monitoring capabilities for lymphedema management. This collaboration enables patients to track their limb measurements and therapy adherence, facilitating virtual consultations with their care teams

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE LYMPHEDEMA TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDUSTRY INSIGHTS –

4.3.1 MICRO AND MACROECONOMIC FACTORS

4.3.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3.3 KEY PRICING STRATEGIES

4.3.4 ANALYSIS AND RECOMMENDATION

4.4 INNOVATION TRACKER & STRATEGIC ANALYSIS

4.4.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.4.1.1 MERGERS & ACQUISITIONS

4.4.1.2 TECHNOLOGY COLLABORATIONS

4.4.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.4.3 STAGE OF DEVELOPMENT

4.4.4 TIMELINES & MILESTONES

4.4.5 INNOVATION STRATEGIES & METHODOLOGIES

4.4.6 RISK ASSESSMENT & MITIGATION

4.4.7 FUTURE OUTLOOK

4.5 PIPELINE ANALYSIS – EUROPE LYMPHEDEMA TREATMENT MARKET

4.5.1 CLINICAL TRIALS AND PHASE ANALYSIS

4.5.2 DRUG THERAPY PIPELINE

4.5.3 PHASE III CANDIDATES

4.5.4 PHASE II CANDIDATES

4.5.5 PHASE I CANDIDATES

4.5.6 OTHERS (PRE-CLINICAL AND RESEARCH)

4.5.7 CONCLUSION

4.6 EPIDEMIOLOGY–

4.6.1 INCIDENCE OF LYMPHEDEMA (EUROPE & BY GENDER)

4.6.2 INCIDENCE OF LYMPHEDEMA BY GENDER

4.6.3 TREATMENT RATE

4.6.4 MORTALITY RATE

4.6.5 DRUG ADHERENCE AND THERAPY SWITCH MODEL

4.6.6 PATIENT TREATMENT SUCCESS RATES

4.7 TARIFF

4.7.1 OVERVIEW

4.7.2 TARIFF STRUCTURES

4.7.2.1 Europe vs. Regional Tariff Structures

4.7.2.2 United States: Medicare/Medicaid Tariff Policies, CMS Pricing Models

4.7.2.3 European Union: Cross-border Tariff Regulations and Reimbursement Policies

4.7.2.4 Asia-Pacific: Government-imposed Tariffs on Imported Medical Products

4.7.2.5 Emerging Markets: Challenges in Tariff Implementation

4.7.3 PHARMACEUTICAL TARIFFS AND TRADE BARRIERS

4.7.3.1 Import Duties on Prescription Drugs vs. Generics

4.7.3.2 Impact on Drug Affordability and Access

4.7.3.3 Key Trade Agreements Affecting Pharmaceutical Tariffs

4.7.4 IMPACT OF HEALTHCARE TARIFFS ON PROVIDERS AND PATIENTS

4.7.4.1 Cost Burden on Hospitals and Healthcare Facilities

4.7.4.2 Effect on Patient Affordability and Insurance Coverage

4.7.4.3 Tariffs and Their Role in Medical Tourism

4.7.5 TRADE AGREEMENTS AND HEALTHCARE TARIFFS

4.7.5.1 WTO Regulations on Healthcare Tariffs

4.7.5.2 Impact of Trade Wars on the Healthcare Supply Chain

4.7.5.3 Role of Free Trade Agreements (FTAs) in Reducing Tariffs

4.7.6 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

4.7.7 IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

5 REGULATORY FRAMEWORK–

5.1 NORTH AMERICA

5.2 SOUTH AMERICA

5.3 EUROPE

5.4 ASIA-PACIFIC

5.5 MIDDLE EAST & AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN THE NUMBER OF LYMPHEDEMA CASES GLOBALLY

6.1.2 INCREASE IN THE PREVALENCE OF CANCERS

6.1.3 INCREASING NUMBER OF HEALTHCARE FACILITIES

6.1.4 AVAILABILITY AND ADVANCEMENT OF MULTIPLE THERAPEUTIC OPTIONS

6.2 RESTRAINTS

6.2.1 SIGNIFICANT COST BURDEN ASSOCIATED WITH LYMPHEDEMA MANAGEMENT

6.2.2 LACK OF AWARENESS ABOUT THE DISEASE

6.3 OPPORTUNITIES

6.3.1 EXPANDING OPPORTUNITIES FOR DRUG DEVELOPMENT AND REGULATORY APPROVALS

6.3.2 STRATEGIC COLLABORATIONS AND ALLIANCES AMONG INDUSTRY STAKEHOLDERS

6.4 CHALLENGES

6.4.1 ABSENCE OF A DEFINITIVE CURATIVE TREATMENT

6.4.2 RESTRICTIVE AND INCONSISTENT REIMBURSEMENT POLICIES

7 EUROPE LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE

7.1 OVERVIEW

7.2 COMPRESSION THERAPY

7.3 SURGERY

7.4 DRUG THERAPY

7.5 LASER THERAPY

7.6 OTHERS

8 EUROPE LYMPHEDEMA TREATMENT MARKET, BY TYPE

8.1 OVERVIEW

8.2 SECONDARY LYMPHEDEMA

8.3 PRIMARY LYMPHEDEMA

9 EUROPE LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA

9.1 OVERVIEW

9.2 LOWER EXTREMITY

9.3 UPPER EXTREMITY

9.4 GENITALIA

10 EUROPE LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP

10.1 OVERVIEW

10.2 ADULT

10.3 GERIATRIC

10.4 PEDIATRIC

11 EUROPE LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION

11.1 OVERVIEW

11.2 ORAL

11.3 INJECTABLE

11.4 TOPICAL

12 EUROPE LYMPHEDEMA TREATMENT MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL

12.3 SPECIALTY CLINICS

12.4 AMBULATORY SURGICAL CENTERS

12.5 OTHERS

13 EUROPE LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 PHARMACY STORES

13.3 DIRECT TENDER

13.4 OTHERS

14 EUROPE LYMPHEDEMA TREATMENT MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 FRANCE

14.1.3 UNITED KINGDOM

14.1.4 ITALY

14.1.5 RUSSIA

14.1.6 SPAIN

14.1.7 TURKEY

14.1.8 NETHERLANDS

14.1.9 SWITZERLAND

14.1.10 BELGIUM

14.1.11 POLAND

14.1.12 AUSTRIA

14.1.13 HUNGARY

14.1.14 NORWAY

14.1.15 IRELAND

14.1.16 LITHUANIA

14.1.17 REST OF EUROPE

15 EUROPE LYMPHEDEMA TREATMENT MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 TACTILE MEDICAL

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 ESSITY AKTIEBOLAG (PUBL)

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 3M

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CARDINAL HEALTH

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 LOHMANN & RAUSCHER GMBH & CO. KG

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 AIROS MEDICAL, INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ARJO

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 AVET PHARMACEUTICALS INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 BAUERFEIND

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BIOCOMPRESSION SYSTEMS

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 CONVATEC INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 ENOVIS CORPORATION

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 HUNTLEIGH HEALTHCARE LIMITED

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 IMPEDIMED LIMITED

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT/NEWS

17.15 JODAS EXPOIM PVT. LTD.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 JUZO

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 KOYA MEDICAL

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 LLC BINNOPHARM GROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 MCKESSON MEDICAL-SURGICAL INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 MEDI GMBH & CO. KG

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 MEDTRONIC

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 MEGO AFEK LTD

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 PAUL HARTMANN AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 PERFORMANCE HEALTH

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 PURETECH HEALTH INC

17.25.1 COMPANY SNAPSHOT

17.25.2 PIPELINE PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 SANYLEG SRL A SOCIO UNICO

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 SIGVARIS GROUP

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 SMITH+NEPHEW

17.28.1 COMPANY SNAPSHOT

17.28.2 REVENUE ANALYSIS

17.28.3 PRODUCT PORTFOLIO

17.28.4 RECENT DEVELOPMENT

17.29 THERMOTEK

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 THUASNE

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENT

17.31 VIATRIS INC.

17.31.1 COMPANY SNAPSHOT

17.31.2 REVENUE ANALYSIS

17.31.3 PRODUCT PORTFOLIO

17.31.4 RECENT DEVELOPMENT

17.32 WHITE SWAN PHARMACEUTICAL

17.32.1 COMPANY SNAPSHOT

17.32.2 PRODUCT PORTFOLIO

17.32.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 PRODUCTS AND THEIR STAGES IN DEVELOPMENT.

TABLE 2 PHASE-WISE DISTRIBUTION: CLINICAL TRIALS

TABLE 3 PHASE 2 CANDIDATES

TABLE 4 EUROPE LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 EUROPE LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 6 EUROPE COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY REGION 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE LASER THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE OTHERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE SECONDARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE LOWER EXTREMITY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE UPPER EXTREMITY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE GENITALIA IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE ADULT IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE GERIATRIC IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE PEDIATRIC IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE ORAL IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE INJECTABLE IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE TOPICAL IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE HOSPITAL IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE SPECIALITY CLINICS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE AMBULATORY SURGICAL CENTERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE OTHERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE PHARMACY STORES IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE DIRECT TENDER IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE OTHERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE LYMPHEDEMA TREATMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 44 EUROPE LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 45 EUROPE COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 EUROPE LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 53 EUROPE LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 54 EUROPE LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 55 EUROPE LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 56 EUROPE LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 57 GERMANY LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 GERMANY LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 59 GERMANY LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 60 GERMANY COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 61 GERMANY COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 62 GERMANY COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 63 GERMANY SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 GERMANY DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 GERMANY LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 GERMANY PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 GERMANY LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 68 GERMANY LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 69 GERMANY LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 70 GERMANY LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 71 GERMANY LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 72 FRANCE LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 FRANCE LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 74 FRANCE LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 75 FRANCE COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 76 FRANCE COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 77 FRANCE COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 78 FRANCE SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 FRANCE DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 FRANCE LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 FRANCE PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 FRANCE LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 83 FRANCE LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 84 FRANCE LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 85 FRANCE LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 86 FRANCE LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 87 UNITED KINGDOM LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 UNITED KINGDOM LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 89 UNITED KINGDOM LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 90 UNITED KINGDOM COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 91 UNITED KINGDOM COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 92 UNITED KINGDOM COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 93 UNITED KINGDOM SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 UNITED KINGDOM DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 UNITED KINGDOM LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 UNITED KINGDOM PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 UNITED KINGDOM LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 98 UNITED KINGDOM LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 99 UNITED KINGDOM LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 100 UNITED KINGDOM LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 101 UNITED KINGDOM LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 102 ITALY LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 ITALY LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 104 ITALY LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 105 ITALY COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 106 ITALY COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 107 ITALY COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 108 ITALY SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 ITALY DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 ITALY LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 ITALY PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 ITALY LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 113 ITALY LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 114 ITALY LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 115 ITALY LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 116 ITALY LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 117 RUSSIA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 RUSSIA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 119 RUSSIA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 120 RUSSIA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 121 RUSSIA COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 122 RUSSIA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 123 RUSSIA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 RUSSIA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 RUSSIA LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 RUSSIA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 RUSSIA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 128 RUSSIA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 129 RUSSIA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 130 RUSSIA LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 131 RUSSIA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 132 SPAIN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SPAIN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 134 SPAIN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 135 SPAIN COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 136 SPAIN COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 137 SPAIN COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 138 SPAIN SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 SPAIN DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 SPAIN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SPAIN PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 SPAIN LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 143 SPAIN LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 144 SPAIN LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 145 SPAIN LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 146 SPAIN LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 147 TURKEY LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 TURKEY LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 149 TURKEY LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 150 TURKEY COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 151 TURKEY COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 152 TURKEY COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 153 TURKEY SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 TURKEY DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 TURKEY LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 TURKEY PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 TURKEY LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 158 TURKEY LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 159 TURKEY LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 160 TURKEY LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 161 TURKEY LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 162 NETHERLANDS LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 NETHERLANDS LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 164 NETHERLANDS LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 165 NETHERLANDS COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 166 NETHERLANDS COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 167 NETHERLANDS COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 168 NETHERLANDS SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 NETHERLANDS DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 NETHERLANDS LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 NETHERLANDS PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 NETHERLANDS LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 173 NETHERLANDS LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 174 NETHERLANDS LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 175 NETHERLANDS LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 176 NETHERLANDS LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 177 SWITZERLAND LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 SWITZERLAND LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 179 SWITZERLAND LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 180 SWITZERLAND COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 181 SWITZERLAND COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 182 SWITZERLAND COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 183 SWITZERLAND SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 SWITZERLAND DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 SWITZERLAND LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 SWITZERLAND PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 SWITZERLAND LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 188 SWITZERLAND LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 189 SWITZERLAND LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 190 SWITZERLAND LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 191 SWITZERLAND LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 192 BELGIUM LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 BELGIUM LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 194 BELGIUM LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 195 BELGIUM COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 196 BELGIUM COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 197 BELGIUM COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 198 BELGIUM SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 BELGIUM DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 BELGIUM LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 BELGIUM PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 BELGIUM LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 203 BELGIUM LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 204 BELGIUM LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 205 BELGIUM LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 206 BELGIUM LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 207 POLAND LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 POLAND LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 209 POLAND LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 210 POLAND COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 211 POLAND COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 212 POLAND COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 213 POLAND SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 POLAND DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 POLAND LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 POLAND PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 POLAND LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 218 POLAND LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 219 POLAND LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 220 POLAND LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 221 POLAND LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 222 AUSTRIA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 AUSTRIA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 224 AUSTRIA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 225 AUSTRIA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 226 AUSTRIA COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 227 AUSTRIA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 228 AUSTRIA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 AUSTRIA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 AUSTRIA LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 AUSTRIA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 AUSTRIA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 233 AUSTRIA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 234 AUSTRIA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 235 AUSTRIA LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 236 AUSTRIA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 237 HUNGARY LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 HUNGARY LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 239 HUNGARY LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 240 HUNGARY COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 241 HUNGARY COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 242 HUNGARY COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 243 HUNGARY SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 HUNGARY DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 HUNGARY LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 HUNGARY PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 HUNGARY LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 248 HUNGARY LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 249 HUNGARY LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 250 HUNGARY LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 251 HUNGARY LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 252 NORWAY LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 NORWAY LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 254 NORWAY LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 255 NORWAY COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 256 NORWAY COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 257 NORWAY COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 258 NORWAY SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 NORWAY DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 NORWAY LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 NORWAY PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 NORWAY LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 263 NORWAY LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 264 NORWAY LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 265 NORWAY LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 266 NORWAY LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 267 IRELAND LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 IRELAND LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 269 IRELAND LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 270 IRELAND COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 271 IRELAND COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 272 IRELAND COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 273 IRELAND SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 IRELAND DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 IRELAND LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 IRELAND PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 IRELAND LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 278 IRELAND LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 279 IRELAND LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 280 IRELAND LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 281 IRELAND LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 282 LITHUANIA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 LITHUANIA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 284 LITHUANIA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 285 LITHUANIA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 286 LITHUANIA COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 287 LITHUANIA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 288 LITHUANIA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 LITHUANIA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 LITHUANIA LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 LITHUANIA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 LITHUANIA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 293 LITHUANIA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 294 LITHUANIA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 295 LITHUANIA LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 296 LITHUANIA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 297 REST OF EUROPE LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 REST OF EUROPE LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 299 REST OF EUROPE LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

List of Figure

FIGURE 1 EUROPE LYMPHEDEMA TREATMENT MARKET: SEGMENTATION

FIGURE 2 EUROPE LYMPHEDEMA TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE LYMPHEDEMA TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 EUROPE LYMPHEDEMA TREATMENT MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE LYMPHEDEMA TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE LYMPHEDEMA TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE LYMPHEDEMA TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE LYMPHEDEMA TREATMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 EUROPE LYMPHEDEMA TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 FIVE SEGMENTS COMPRISE THE EUROPE LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE (2024)

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 EUROPE LYMPHEDEMA TREATMENT MARKET: SEGMENTATION

FIGURE 14 INCREASE IN THE PREVALENCE OF CANCERS IS EXPECTED TO DRIVE THE EUROPE LYMPHEDEMA TREATMENT MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 THE COMPRESSION THERAPY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE LYMPHEDEMA TREATMENT MARKET IN 2025 AND 2032

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF INDONESIA ZEOLITE MARKET

FIGURE 17 EUROPE LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, 2024

FIGURE 18 EUROPE LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 19 EUROPE LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, CAGR (2025-2032)

FIGURE 20 EUROPE LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 21 EUROPE LYMPHEDEMA TREATMENT MARKET: BY TYPE, 2024

FIGURE 22 EUROPE LYMPHEDEMA TREATMENT MARKET: BY TYPE, 2025-2032 (USD THOUSAND)

FIGURE 23 EUROPE LYMPHEDEMA TREATMENT MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 24 EUROPE LYMPHEDEMA TREATMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 25 EUROPE LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, 2024

FIGURE 26 EUROPE LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, 2025-2032 (USD THOUSAND)

FIGURE 27 EUROPE LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, CAGR (2025-2032)

FIGURE 28 EUROPE LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, LIFELINE CURVE

FIGURE 29 EUROPE LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, 2024

FIGURE 30 EUROPE LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, 2025-2032 (USD THOUSAND)

FIGURE 31 EUROPE LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, CAGR (2025-2032)

FIGURE 32 EUROPE LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 33 EUROPE LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, 2024

FIGURE 34 EUROPE LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, 2025-2032 (USD THOUSAND)

FIGURE 35 EUROPE LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2025-2032)

FIGURE 36 EUROPE LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 37 EUROPE LYMPHEDEMA TREATMENT MARKET: BY END USER, 2024

FIGURE 38 EUROPE LYMPHEDEMA TREATMENT MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 39 EUROPE LYMPHEDEMA TREATMENT MARKET: BY END USER, CAGR (2025-2032)

FIGURE 40 EUROPE LYMPHEDEMA TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 41 EUROPE LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 42 EUROPE LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 43 EUROPE LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 44 EUROPE LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 45 EUROPE LYMPHEDEMA TREATMENT MARKET: SNAPSHOT (2024)

FIGURE 46 EUROPE LYMPHEDEMA TREATMENT MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.