Europe Mass Spectroscopy Market

Market Size in USD Billion

CAGR :

%

USD

1.73 Billion

USD

3.08 Billion

2024

2032

USD

1.73 Billion

USD

3.08 Billion

2024

2032

| 2025 –2032 | |

| USD 1.73 Billion | |

| USD 3.08 Billion | |

|

|

|

|

Europe Mass Spectroscopy Market Size

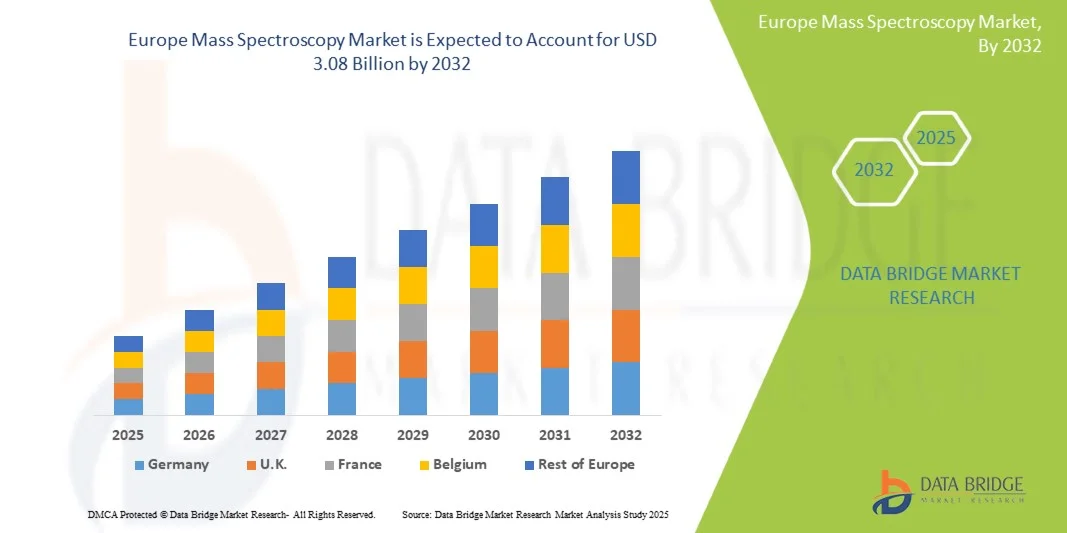

- The Europe Mass Spectroscopy Market size was valued at USD 1.73 billion in 2024 and is expected to reach USD 3.08 billion by 2032, at a CAGR of 7.50% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in analytical and life sciences research, leading to increased utilization of mass spectrometry solutions in pharmaceutical, biotechnology, environmental, and food safety applications

- Furthermore, rising demand for high-precision, automated, and integrated analytical solutions is establishing mass spectrometry as a critical tool for research, diagnostics, and quality control. These converging factors are accelerating the uptake of mass spectrometry technologies, thereby significantly boosting the industry's growth

Europe Mass Spectroscopy Market Analysis

- Europe Mass Spectroscopy Market is witnessing significant growth in Europe, driven by the increasing adoption of advanced analytical techniques across pharmaceutical, chemical, and research laboratories. Rising demand for accurate and rapid detection of chemical and biological compounds is propelling the market

- Technological advancements in spectroscopic instrumentation, coupled with government regulations supporting high-quality research and safety testing, are further contributing to market expansion. European laboratories are increasingly investing in automated and high-throughput mass spectrometry systems to improve productivity and reliability

- Germany dominated the Europe Mass Spectroscopy Market with the largest revenue share of 36.5% in 2024, supported by its strong pharmaceutical and biotechnology sectors, extensive research infrastructure, and widespread adoption of high-performance mass spectrometry instruments in both industrial and academic applications

- France is expected to be the fastest-growing country in the European Europe Mass Spectroscopy Market during the forecast period, driven by increasing investments in analytical laboratories, rising demand for environmental and food safety testing, and rapid adoption of advanced mass spectrometry solutions in research and clinical settings

- The Single Mass Spectrometry segment dominated the Europe Mass Spectroscopy Market with a revenue share of 41.6% in 2024, driven by its extensive use in routine analytical and industrial laboratories. Its reliability, cost-effectiveness, and ease of use make it ideal for pharmaceutical quality control, environmental monitoring, and food safety testing

Report Scope and Europe Mass Spectroscopy Market Segmentation

|

Attributes |

Mass Spectroscopy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Mass Spectroscopy Market Trends

Enhanced Convenience Through Technological Advancements

- A significant and accelerating trend in the Europe Mass Spectroscopy Market is the continuous development and integration of advanced mass spectrometry technologies, enhancing analytical precision, efficiency, and reliability across research and industrial applications

- For instance, hybrid mass spectrometry systems are increasingly adopted in European pharmaceutical and biotechnology laboratories, enabling more comprehensive molecular analysis and faster sample processing

- Technological improvements in instrumentation, including miniaturization, automation, and high-resolution capabilities, are providing researchers and quality control teams with more accurate data and streamlined workflows

- The adoption of mass spectrometry solutions in food and beverage testing, environmental monitoring, and industrial chemistry is helping laboratories comply with regulatory standards while optimizing operational efficiency

- The increasing demand for precise, high-throughput analytical solutions is reshaping user expectations, driving vendors to offer more user-friendly, integrated, and multifunctional mass spectrometry platforms

- Companies such as Bruker, Thermo Fisher Scientific, and Agilent Technologies are leading innovation in the European market by launching cutting-edge instruments and expanding their service networks, further boosting adoption across research institutions and industrial facilities

- The growing focus on regulatory compliance, environmental safety, and rapid analysis in sectors such as pharmaceuticals, biotechnology, and food safety is expected to continue driving market growth across Europe during the forecast period.

Europe Mass Spectroscopy Market Dynamics

Driver

Growing Demand Due to Expanding Applications in Life Sciences, Pharma, and Industrial Testing

- The increasing need for precise, high-throughput analytical tools across pharmaceutical research, biotechnology, environmental monitoring, and food safety is a significant driver for the Mass Spectrometry market

- For instance, in April 2024, Thermo Fisher Scientific launched an advanced Orbitrap mass spectrometer with enhanced sensitivity and throughput for proteomics and metabolomics applications. Such strategic product innovations by key companies are expected to drive Mass Spectrometry industry growth during the forecast period

- As research and industrial testing requirements become more complex, mass spectrometers provide high-resolution data, faster analysis, and robust detection capabilities, offering a compelling upgrade over traditional analytical methods

- Furthermore, the growing emphasis on regulatory compliance, precision medicine, and quality control in laboratories worldwide is making mass spectrometry an integral tool for modern scientific workflows, enabling seamless integration with other laboratory instrumentation and software platforms

- The versatility of MS systems—covering applications from small molecule analysis to protein characterization—and their ability to support high-throughput automated workflows are key factors propelling adoption across life sciences, clinical, and industrial sectors. Continuous technological improvements, along with more user-friendly and automated MS solutions, further contribute to market growth

Restraint/Challenge

High Costs and Technical Complexity

- The relatively high initial cost of advanced mass spectrometry systems, along with the need for specialized technical expertise to operate and maintain them, poses a significant challenge to broader market adoption

- For instance, premium systems such as hybrid LC-MS/MS or high-resolution Orbitrap instruments may be financially prohibitive for smaller research labs or industrial facilities, limiting access to cutting-edge technology

- Operational complexity, including sample preparation, calibration, and data interpretation, can be a barrier for labs lacking trained personnel

- Maintenance and service costs, as well as the need for frequent software and hardware updates, add to the total cost of ownership, discouraging potential buyers

- Limited awareness or knowledge about the full capabilities of mass spectrometry in emerging markets can reduce adoption, despite growing demand in pharmaceutical and environmental applications

- Compatibility issues with existing laboratory workflows or instruments may hinder seamless integration, requiring additional investment in infrastructure and training

- Addressing these challenges through the development of more affordable, compact, and automated mass spectrometry solutions is crucial for expanding market penetration. Companies such as Agilent and Bruker are emphasizing modular, user-friendly designs with automated workflows to lower the barrier to adoption

- While prices are gradually decreasing for entry-level systems, the perceived premium for advanced MS technology can still hinder adoption, particularly in developing regions or for budget-conscious laboratories

- Overcoming these challenges through technological innovation, operator training, and enhanced software for ease-of-use will be vital for sustained Mass Spectrometry market growth in the coming years

Europe Mass Spectroscopy Market Scope

The market is segmented on the basis of technology, and application

• By Technology

On the basis of technology, the Europe Mass Spectroscopy Market is segmented into single mass spectrometry, hybrid mass spectrometry, and other mass spectrometry. The single mass spectrometry segment dominated the market with a revenue share of 41.6% in 2024, driven by its extensive use in routine analytical and industrial laboratories. Its reliability, cost-effectiveness, and ease of use make it ideal for pharmaceutical quality control, environmental monitoring, and food safety testing. Laboratories prefer single mass spectrometry for standard procedures due to its simplified workflow and lower operational costs. Strong vendor support, well-established training programs, and standardized protocols enhance adoption across Europe. In addition, its integration into regulatory compliance processes further solidifies its market leadership. The segment continues to benefit from technological improvements, including automated sample handling and enhanced detection sensitivity, maintaining dominance in the region.

The hybrid mass spectrometry segment is expected to witness the fastest growth with a CAGR of 19.8% from 2025 to 2032, driven by its high sensitivity and selectivity for complex research applications. Increasing adoption in pharmaceutical development, clinical studies, and biotechnology research is propelling this segment forward. Hybrid systems support multi-dimensional analysis, improving accuracy and reliability in protein, metabolite, and genomic studies. Rising demand from research institutions and advanced laboratories across Europe, along with technological advancements such as high-resolution instruments and enhanced throughput, further accelerates growth. Growing collaborations between academic and industrial R&D centers and the need for precise, large-scale experimental data make this segment the fastest-growing in the market.

• By Application

On the basis of application, the Europe Mass Spectroscopy Market is segmented into biotechnology, pharmaceutical, environmental testing, industrial chemistry, food and beverage testing, and other applications. The pharmaceutical segment dominated the market with a revenue share of 38.7% in 2024, driven by stringent regulatory requirements, expanding drug discovery pipelines, and the critical role of mass spectrometry in impurity profiling and pharmacokinetic studies. European pharmaceutical companies rely heavily on mass spectrometry for quality control, process optimization, and clinical trial support. The segment benefits from growing investments in R&D, increasing demand for personalized medicines, and the need for accurate bioanalysis. Its leadership is reinforced by well-established laboratory infrastructure, expert personnel, and integration into standardized workflows. Rising adoption of automated systems and cloud-based data management further strengthens the segment’s position. Continuous technological upgrades, including advanced detection methods, enhance precision and productivity, maintaining its dominance across the region.

The Biotechnology segment is expected to witness the fastest growth with a CAGR of 18.9% from 2025 to 2032, fueled by its adoption in proteomics, genomics, and metabolomics research. Increasing use of hybrid and high-resolution mass spectrometry improves experimental accuracy, while expanding academic research and industrial biotechnology studies accelerate segment growth. This segment supports complex analyses such as protein characterization and biomarker discovery, which are increasingly demanded in Europe. Technological advancements enhancing reproducibility and data throughput, along with government and private funding in biotech R&D, are key factors contributing to its rapid growth. The rising demand for precision medicine applications further positions this segment as the fastest-growing in the market.

Europe Mass Spectroscopy Market Regional Analysis

- The Europe mass spectrometry market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing applications in pharmaceutical research, biotechnology, environmental monitoring, and food safety testing

- Germany dominated the European Europe Mass Spectroscopy Market with the largest revenue share of 36.5% in 2024, supported by its strong pharmaceutical and biotechnology sectors, extensive research infrastructure, and widespread adoption of high-performance mass spectrometry instruments in both industrial and academic applications

- France is expected to be the fastest-growing country in the European Europe Mass Spectroscopy Market during the forecast period, driven by increasing investments in analytical laboratories, rising demand for environmental and food safety testing, and rapid adoption of advanced mass spectrometry solutions in research and clinical settings

Germany Mass Spectrometry Market Insight

The Germany mass spectrometry market dominated the European market with the largest revenue share of 36.5% in 2024, supported by its strong pharmaceutical and biotechnology sectors, extensive research infrastructure, and widespread adoption of high-performance mass spectrometry instruments in both industrial and academic applications. The market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of advanced analytical technologies, demand for environmentally conscious solutions, and the integration of mass spectrometry into research and clinical workflows.

U.K. Mass Spectrometry Market Insight

The U.K. mass spectrometry market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising adoption of advanced analytical instruments in life sciences, clinical diagnostics, and industrial research. Increasing investments in laboratory infrastructure and the need for precise, high-throughput analytical solutions are encouraging both academic and industrial laboratories to upgrade to state-of-the-art mass spectrometry systems.

France Mass Spectrometry Market Insight

The France mass spectrometry market is expected to be the fastest-growing country in the European market during the forecast period, driven by increasing investments in analytical laboratories, rising demand for environmental and food safety testing, and rapid adoption of advanced mass spectrometry solutions in research and clinical settings.

Europe Mass Spectroscopy Market Share

The mass spectroscopy industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Waters Corporation (U.S.)

- Danaher Corporation (U.S.)

- Bruker (Germany)

- Shimadzu Corporation (Japan)

- PerkinElmer (U.S.)

- JEOL Ltd. (Japan)

- Rigaku Corporation (Japan)

- LECO Corporation (U.S.)

- MKS Instruments (U.S.)

- Hitachi High-Tech Corporation (Japan)

- Teledyne Technologies (U.S.)

- Analytik Jena AG (Germany)

- Spectroswiss (Switzerland)

Latest Developments in Europe Mass Spectroscopy Market

- In November 2021, Thermo Fisher Scientific launched new mass spectrometry and chromatography solutions at the American Society for Mass Spectrometry (ASMS) 2021 conference. These advanced systems aimed to enhance analytical workflows and support a wide range of applications, including proteomics, metabolomics, and biopharmaceutical research

- In September 2021, Thermo Fisher introduced the world's first net-zero mass spectrometer, the Thermo Scientific Delta Q Isotope Ratio Mass Spectrometer. This innovation marked a significant step towards sustainability in analytical instrumentation

- In June 2022, Agilent Technologies announced new revolutionary quadrupole mass spectrometers at the ASMS 2022 conference. These instruments were designed to deliver high sensitivity and robustness for routine quantitative analysis in various applications

- In June 2022, Agilent also released the 6475 Triple Quadrupole LC/MS system and the 5977C GC/MSD at Analytica 2022. These systems were highlighted for their sensitivity and versatility in analytical applications.

- In October 2024, Waters Corporation launched a new suite of enzymes, reagents, and software designed to accelerate RNA therapeutic development. These tools aimed to simplify RNA analysis, enhancing precision and speed for applications such as mRNA vaccines and CRISPR therapies

- In November 2024, Waters Corporation opened a new 45,000 square foot manufacturing facility in Longbridge, UK. This facility aimed to enhance the company's machining capacity to produce critical components for mass spectrometry products developed in the UK and Ireland

- In June 2024, Waters Corporation launched the Xevo MRT mass spectrometer at the ASMS 2024 conference. This instrument was designed to provide high-resolution, accurate-mass measurements for complex analytical challenges

- In May 2025, Bruker launched the timsMetabo mass spectrometer, featuring advanced 4D LC-TIMS-MS/MS separations and CCS measurements. This system aimed to provide unprecedented specificity and annotation confidence in metabolomics and lipidomics research

- In June 2025, Agilent introduced the InfinityLab Pro iQ Series at the ASMS 2025 conference. This next-generation LC-mass detection system offered enhanced sensitivity and analytical performance for oligonucleotides, therapeutic peptides, and proteins

- In May 2025, Bruker announced the acquisition of biocrates, a leader in mass spectrometry-based quantitative metabolomics. This acquisition aimed to strengthen Bruker's position in the field of targeted quantitative metabolomics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.