Europe Medical Automation Market

Market Size in USD Billion

CAGR :

%

USD

13.93 Billion

USD

27.96 Billion

2025

2033

USD

13.93 Billion

USD

27.96 Billion

2025

2033

| 2026 –2033 | |

| USD 13.93 Billion | |

| USD 27.96 Billion | |

|

|

|

|

Europe Medical Automation Market Size

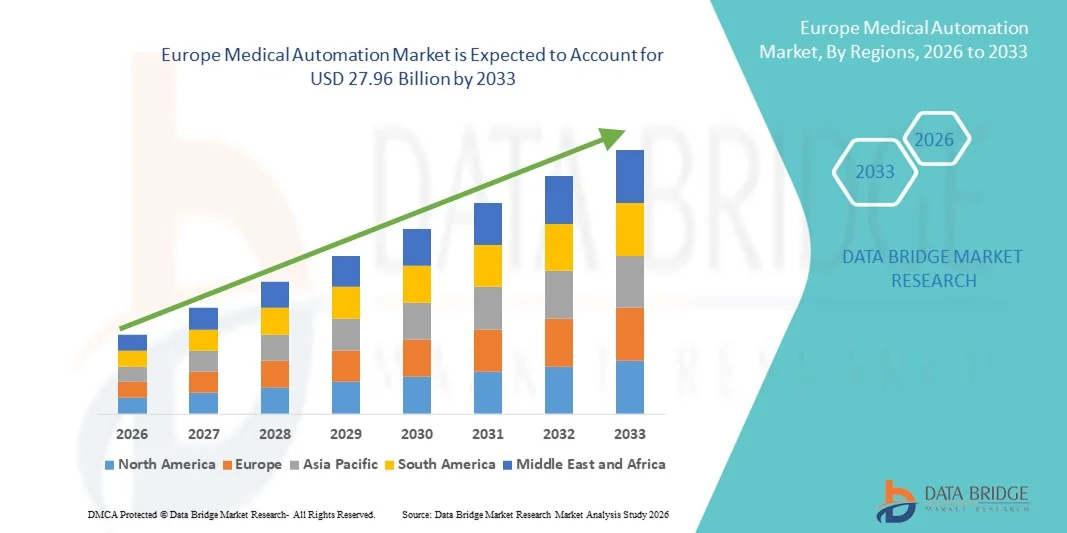

- The Europe medical automation market size was valued at USD 13.93 billion in 2025 and is expected to reach USD 27.96 billion by 2033, at a CAGR of 9.10% during the forecast period

- The market growth is largely fueled by the rapid adoption of advanced healthcare IT systems, robotics, and artificial intelligence across hospitals and diagnostic laboratories, leading to increased automation of clinical, administrative, and operational workflows in both inpatient and outpatient settings

- Furthermore, rising demand for improved operational efficiency, reduced human error, cost containment, and enhanced patient safety is establishing medical automation as a critical component of modern healthcare delivery. These converging factors are accelerating the uptake of Medical Automation solutions, thereby significantly boosting the industry’s growth

Europe Medical Automation Market Analysis

- Medical automation, encompassing robotics, AI-driven software, automated diagnostics, and digital workflow solutions, is becoming increasingly essential across hospitals, laboratories, and outpatient facilities as healthcare providers seek to improve operational efficiency, clinical accuracy, and patient safety

- The rising demand for medical automation is primarily driven by increasing patient volumes, growing pressure to reduce operational costs, shortages of skilled healthcare professionals, and the rapid adoption of digital health, AI, and robotic technologies across clinical and administrative processes

- The U.K. dominated the medical automation market in Europe with the largest revenue share of approximately 32.4% in 2025, supported by a well-established healthcare system, strong NHS-led digital transformation initiatives, early adoption of healthcare automation solutions, and increasing investments in AI-enabled diagnostics, robotic surgery, and hospital automation

- Germany is expected to be the fastest growing country in the medical automation market during the forecast period, with a robust CAGR, driven by rapid modernization of hospital infrastructure, strong government support for healthcare digitization, rising adoption of medical robotics, and significant investments by domestic and international medical technology companies

- The Wired segment dominated the market with a revenue share of nearly 58.2% in 2025, primarily due to its superior reliability, stable data transmission, and low-latency performance in critical healthcare environments

Report Scope and Medical Automation Market Segmentation

|

Attributes |

Medical Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

• Siemens Healthineers (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Medical Automation Market Trends

Rising Adoption of Automated Clinical and Laboratory Workflows

- A significant and accelerating trend in the global medical automation market is the widespread adoption of automated systems across hospitals, diagnostic laboratories, pharmaceutical manufacturing facilities, and outpatient care centers to improve efficiency, accuracy, and patient safety

- For instance, in 2024, Siemens Healthineers expanded the deployment of its laboratory automation platforms across North America, Europe, and Asia-Pacific, supporting high-throughput diagnostics and standardized testing workflows on a global scale

- Medical automation solutions are increasingly utilized to streamline repetitive clinical and administrative tasks such as sample preparation, medication dispensing, patient monitoring, and data management, significantly reducing manual intervention and error rates

- The rising global demand for faster diagnostics, consistent clinical outcomes, and high-volume testing is accelerating automation adoption across both developed and emerging healthcare markets

- Advancements in robotics, integrated software platforms, and sensor-enabled systems are enabling seamless coordination between different healthcare functions, improving workflow continuity across complex care environments

- This shift toward automated, scalable, and interoperable healthcare systems is fundamentally transforming global healthcare delivery models and strengthening the role of medical automation worldwide

Europe Medical Automation Market Dynamics

Driver

Growing Global Healthcare Demand and Operational Efficiency Requirements

- The increasing global burden of chronic diseases, aging populations, and rising patient volumes are key drivers supporting the growth of the global Medical Automation market

- For instance, in April 2025, Fresenius Medical Care announced the global rollout of automated treatment management and monitoring solutions across its dialysis clinics in multiple regions, aimed at improving care consistency and operational efficiency

- Healthcare providers worldwide are increasingly adopting automation technologies to address workforce shortages, reduce operational costs, and enhance consistency in clinical processes

- The expansion of centralized laboratories, pharmaceutical manufacturing hubs, and outpatient care facilities across regions such as Asia-Pacific, Latin America, and the Middle East is further fueling demand for automated medical systems

- In addition, global healthcare modernization initiatives and investments in digital and automated infrastructure are accelerating the integration of automation solutions across public and private healthcare settings

- These factors collectively create strong momentum for sustained growth in the global Medical Automation market over the forecast period

Restraint/Challenge

High Capital Costs and Implementation Complexity

- The high upfront investment required for advanced medical automation systems remains a major challenge for healthcare providers, particularly in cost-sensitive and resource-constrained regions

- For instance, in 2024, several hospitals in emerging markets across Asia and Latin America postponed large-scale laboratory automation projects due to funding limitations and infrastructure readiness challenges, highlighting cost-related adoption barriers

- System integration complexity, including compatibility with existing legacy infrastructure and hospital information systems, can extend implementation timelines and increase total ownership costs

- In addition, challenges such as staff training requirements, workflow redesign, and temporary operational disruptions during deployment can further slow adoption

- Regulatory variability across countries and regions can complicate the deployment of standardized automation solutions, increasing compliance-related costs

- Overcoming these restraints through scalable system design, flexible financing models, and vendor-supported implementation strategies will be essential for the long-term growth of the global Medical Automation market

Europe Medical Automation Market Scope

The market is segmented on the basis of component, type, application, connectivity, end user, and distribution channel.

- By Component

On the basis of component, the Medical Automation market is segmented into Equipment, Software, and Services. The Equipment segment dominated the largest market revenue share of around 46.1% in 2025, driven by extensive deployment of automated hardware systems across hospitals, diagnostic laboratories, and specialty clinics. Equipment such as automated imaging systems, robotic surgical platforms, automated dispensing units, and laboratory robots form the backbone of medical automation infrastructure. Hospitals continue to prioritize capital investment in automation equipment to reduce clinical errors, enhance procedural precision, and manage rising patient volumes. Strong demand from tertiary hospitals and academic medical centers supports dominance. Equipment solutions also benefit from longer replacement cycles and high upfront procurement value. Integration of AI-enabled sensors, robotics, and smart controllers further increases adoption. Developed markets such as the U.S., Germany, Japan, and France lead equipment deployment. Continuous upgrades and expansion of automation-enabled facilities sustain revenue leadership.

The Software segment is expected to witness the fastest CAGR of 22.4% from 2026 to 2033, owing to rapid digitalization of healthcare workflows and increasing reliance on data-driven automation. Software platforms enable centralized control, real-time monitoring, predictive maintenance, and AI-based decision support across automated systems. Rising adoption of cloud-based solutions, AI algorithms, and interoperable software integrated with electronic health records accelerates growth. Healthcare providers increasingly deploy automation software to optimize equipment utilization and reduce operational costs. Subscription-based and SaaS models further boost adoption. Expansion of telehealth and remote diagnostics also fuels demand. Emerging economies are investing heavily in automation software due to lower upfront costs compared to hardware. Regulatory emphasis on traceability and compliance additionally supports software growth.

- By Type

On the basis of type, the market is segmented into Automated Prescription Formulation & Dispensing, Automated Health Assessment & Monitoring, Automated Imaging & Image Analysis, Automated Healthcare Logistics, Resource & Personnel Tracking, Medical Robotics & Computer-Assisted Surgical Devices, Automated Therapeutic (Nonsurgical) Procedures, and Automated Laboratory Testing & Analysis. The Automated Imaging & Image Analysis segment dominated the largest market revenue share of approximately 35.6% in 2025, driven by rising demand for fast, accurate, and high-volume diagnostic imaging. Automation improves workflow efficiency in radiology departments and minimizes diagnostic variability. AI-powered imaging tools assist clinicians in early disease detection and clinical decision-making. High utilization in oncology, cardiology, and neurology strengthens adoption. Large diagnostic chains and hospitals rely heavily on automated imaging to manage increasing scan volumes. Regulatory approvals of AI-based imaging solutions further support dominance. Integration with PACS and hospital IT systems enhances value. Developed regions dominate adoption due to advanced infrastructure.

The Medical Robotics & Computer-Assisted Surgical Devices segment is expected to witness the fastest CAGR of 24.1% from 2026 to 2033, driven by increasing preference for minimally invasive and precision-based surgeries. Robotic systems improve surgical accuracy, reduce blood loss, and shorten hospital stays. Growing surgeon training programs and expanding indications across orthopedics, urology, gynecology, and neurosurgery support adoption. Technological advancements such as AI-assisted navigation and autonomous functions accelerate growth. Hospitals invest in robotics to differentiate services and improve outcomes. Expansion in Asia-Pacific and Middle East markets further fuels CAGR. Favorable reimbursement trends and patient demand for advanced care reinforce growth momentum.

- By Application

On the basis of application, the market is segmented into Diagnostics & Monitoring, Therapeutics, Lab & Pharmacy Automation, Medical Logistics & Training, and Others. The Diagnostics & Monitoring segment accounted for the largest market revenue share of about 41.3% in 2025, driven by rising chronic disease prevalence and the need for continuous patient monitoring. Automated diagnostic systems enhance accuracy and reduce turnaround times. Remote monitoring solutions gained strong adoption post-pandemic. Hospitals increasingly deploy automated diagnostics to manage high patient throughput. Integration with wearable devices and IoT platforms further strengthens dominance. Government initiatives supporting digital diagnostics also contribute. Diagnostic automation remains central to preventive healthcare strategies.

The Lab & Pharmacy Automation segment is projected to register the fastest CAGR of 23.0% from 2026 to 2033, driven by rising test volumes and demand for error-free medication dispensing. Automation improves laboratory throughput, reduces contamination risks, and ensures regulatory compliance. Pharmacy automation minimizes medication errors and improves inventory control. High adoption in hospital pharmacies and centralized labs supports growth. Expansion of ambulatory and outpatient facilities increases demand. Growing emphasis on personalized medicine further accelerates adoption.

- By Connectivity

On the basis of connectivity, the market is segmented into Wired and Wireless. The Wired segment dominated the market with a revenue share of nearly 58.2% in 2025, primarily due to its superior reliability, stable data transmission, and low-latency performance in critical healthcare environments. Wired connectivity is widely preferred for automation systems used in operating rooms, intensive care units (ICUs), diagnostic imaging, and laboratory automation, where uninterrupted performance is essential. Hospitals rely on wired networks to ensure consistent system uptime and minimize cybersecurity risks associated with wireless data transfer. Existing hospital infrastructure is largely designed around wired connectivity, reducing additional investment costs. Wired systems also support high data loads generated by imaging and robotic systems. Regulatory compliance and data protection requirements further favor wired solutions. Large healthcare facilities prioritize wired automation for mission-critical applications. Long-term durability and predictable performance contribute to continued dominance.

The Wireless segment is expected to grow at the fastest CAGR of 21.2% from 2026 to 2033, driven by the rapid expansion of IoT-enabled medical devices and remote patient monitoring solutions. Wireless connectivity enables greater flexibility and mobility for healthcare professionals and patients alike. Increasing adoption of telehealth and home-based care strongly supports wireless automation deployment. Wireless systems reduce installation complexity and enable scalable expansion across facilities. Growth in ambulatory surgical centers and outpatient clinics further accelerates adoption. Advancements in 5G technology significantly improve bandwidth, speed, and reliability. Wireless connectivity is also critical for wearable devices and smart sensors. Emerging economies increasingly adopt wireless systems due to lower infrastructure requirements. Continuous innovation strengthens long-term growth prospects.

- By End User

On the basis of end user, the market is segmented into Hospitals, Diagnostic Centers, Pharmacies, Research Labs & Institutes, Homecare, Specialty Clinics, Ambulatory Surgical Centers (ASCs), and Others. The Hospitals segment dominated the market with a revenue share of approximately 49.4% in 2025, driven by extensive deployment of automation across multiple departments. Hospitals invest heavily in automated diagnostics, robotic-assisted surgery, pharmacy automation, and patient monitoring systems to improve efficiency and patient outcomes. Large patient volumes necessitate streamlined workflows and reduced human error. Hospitals also benefit from higher capital budgets and access to government or private funding. Integration of automation with hospital information systems further strengthens adoption. Teaching and tertiary hospitals are early adopters of advanced automation technologies. Regulatory pressure to improve quality of care supports continued investment. Hospitals also prioritize automation to address workforce shortages. Long-term infrastructure planning sustains market leadership.

The Homecare segment is anticipated to witness the fastest CAGR of 22.6% from 2026 to 2033, fueled by the growing shift toward decentralized and patient-centric healthcare delivery. Rising aging populations and increasing prevalence of chronic diseases significantly drive demand for home-based automation solutions. Automated monitoring devices enable continuous tracking of patient health conditions. Remote diagnostics and telehealth integration enhance care accessibility. Homecare automation reduces hospital readmissions and overall healthcare costs. Technological advancements have led to compact, user-friendly, and portable automation devices. Increasing patient preference for in-home treatment further supports growth. Expansion of wireless connectivity enhances feasibility. Favorable reimbursement policies in developed regions accelerate adoption. Emerging markets also show strong potential for homecare automation growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct Tender, Retail Sales, Online Sales, and Others. The Direct Tender segment held the largest revenue share of about 53.7% in 2025, supported by large-scale procurement contracts from hospitals, government healthcare systems, and public institutions. Direct tenders enable bulk purchasing of high-value automation equipment and systems. This channel ensures standardized deployment and compliance with regulatory requirements. Governments and large hospital networks prefer direct tenders for transparency and cost efficiency. Long-term service and maintenance agreements further strengthen this channel. Direct tendering also supports customization and system integration. It remains dominant for capital-intensive automation solutions. Public healthcare investments strongly sustain demand.

The Online Sales segment is expected to register the fastest CAGR of 21.8% from 2026 to 2033, driven by increasing digitalization of procurement processes. Small clinics, pharmacies, and homecare providers increasingly prefer online platforms for purchasing automation devices. Online sales offer greater price transparency and wider product availability. Ease of ordering and faster delivery timelines enhance adoption. Growth of e-commerce platforms specializing in medical devices supports expansion. Subscription-based software and modular automation tools are well-suited for online distribution. Rising internet penetration in emerging markets further accelerates growth. Online channels also enable direct manufacturer-to-customer engagement. Continuous platform innovation supports long-term scalability.

Europe Medical Automation Market Regional Analysis

- The Europe medical automation market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing pressure to improve healthcare efficiency, reduce operational costs, and address workforce shortages across hospitals and diagnostic centers

- The region’s strong regulatory framework supporting digital health adoption, coupled with rising investments in automated laboratory systems, robotic-assisted surgery, and AI-enabled clinical workflows, is accelerating market growth

- European healthcare providers are increasingly adopting medical automation solutions to enhance patient safety, improve accuracy in diagnostics, and streamline hospital operations. Growth is being observed across public and private healthcare facilities, with automation technologies being integrated into both newly built hospitals and existing healthcare infrastructure modernization initiatives

U.K. Medical Automation Market Insight

The U.K. medical automation market dominated Europe with the largest revenue share of approximately 32.4% in 2025, supported by a well-established healthcare system and strong NHS-led digital transformation initiatives. Early adoption of healthcare automation solutions, including automated diagnostics, electronic health record integration, and robotic-assisted procedures, is a key growth driver. Increasing investments in AI-enabled diagnostics, robotic surgery platforms, and hospital automation systems are further strengthening market expansion. Additionally, government-backed funding programs and collaborations with technology providers are accelerating the deployment of advanced medical automation solutions across hospitals, clinics, and research institutions.

Germany Medical Automation Market Insight

The Germany medical automation market is expected to be the fastest growing in Europe during the forecast period, registering a robust CAGR driven by rapid modernization of hospital infrastructure and strong government support for healthcare digitization. Germany’s focus on precision medicine, medical robotics, and automated clinical workflows is fostering widespread adoption of automation technologies across healthcare settings. Rising investments by both domestic and international medical technology companies, along with increasing demand for robotics-assisted surgery and automated diagnostic systems, are further propelling market growth. The country’s emphasis on innovation, data security, and high-quality patient care aligns strongly with the adoption of advanced, reliable, and scalable medical automation solutions.

Europe Medical Automation Market Share

The Medical Automation industry is primarily led by well-established companies, including:

• Siemens Healthineers (Germany)

• GE Healthcare (U.S.)

• Philips Healthcare (Netherlands)

• Abbott (U.S.)

• Roche Diagnostics (Switzerland)

• Medtronic (Ireland)

• BD (U.S.)

• Stryker Corporation (U.S.)

• Boston Scientific (U.S.)

• Olympus Corporation (Japan)

• Intuitive Surgical (U.S.)

• Danaher Corporation (U.S.)

• Thermo Fisher Scientific (U.S.)

• Agilent Technologies (U.S.)

• Johnson & Johnson (U.S.)

• Fresenius Medical Care (Germany)

• Smith & Nephew (U.K.)

• Getinge AB (Sweden)

• Zimmer Biomet (U.S.)

• Omnicell (U.S.)

Latest Developments in Europe Medical Automation Market

- In March 2025, Prashanth Hospitals in India launched the Institute of Robotic Surgery along with a dedicated surgical robotic system to perform minimally invasive surgeries, marking a significant expansion of medical automation into clinical practice in South Asia. The hospital highlighted the robot’s benefits in reducing recovery time, blood loss, and procedural invasiveness while supporting general surgery, urology, and gynecology procedures — a milestone for regional automation adoption

- In April 2025, IMA Automation announced the launch of its IMA Med-Tech division focused on automated assembly and packaging lines specifically for medical devices, such as injectors, inhalers, diagnostics platforms, and wearable healthcare products. This initiative reflects the broader push for automation in device manufacturing and assembly processes across the healthcare supply chain

- In March 2025, UiPath announced a global consulting agreement with a major electronic medical records (EMR) provider to accelerate automation services for healthcare organizations across 16 countries, facilitating smoother integration between EMRs and automation workflows and expanding the footprint of automation tools in clinical and administrative processes

- In October 2024, Microsoft launched a suite of new healthcare AI and automation tools focused on medical imaging models, automated clinical documentation, and nurse workflow assistance, aiming to reduce administrative burden and improve care delivery through intelligent automation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.