Medical Device Packaging Market Size

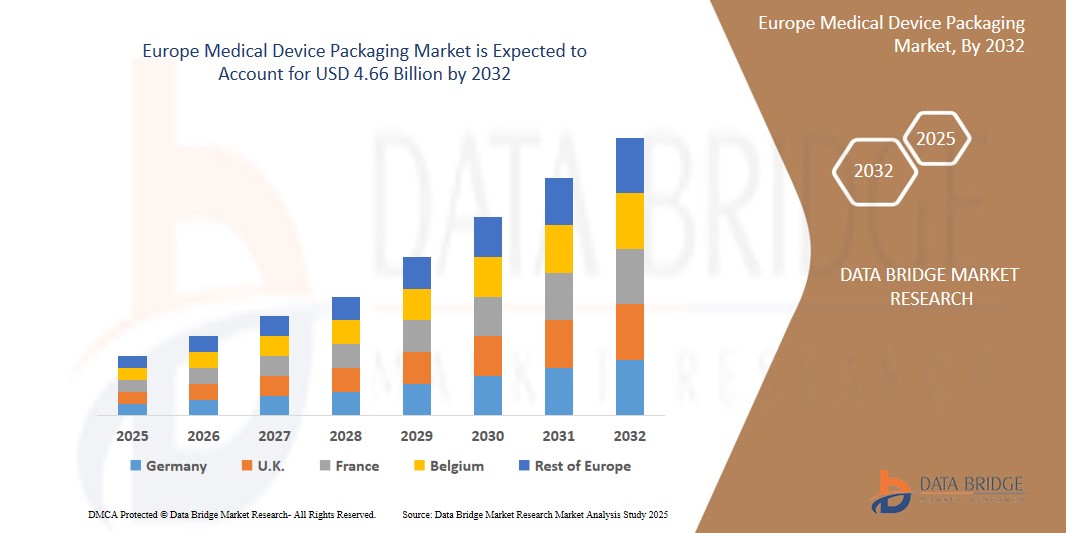

- The Europe Medical Device Packaging Market was valued at USD 2.67 billion in 2024 and is expected to reach USD 4.66 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.2%, primarily driven by the rise in the trend of sterile devices across the region

- The growing preference for single-use medical devices, such as syringes and catheters, drives demand for reliable sterile packaging to prevent cross-contamination.

Medical Device Packaging Market Analysis

- Europe's aging demographic is driving demand for medical devices, particularly in orthopaedics and prosthetics.

- This trend necessitates specialized packaging solutions to maintain sterility and protect complex components.

- Germany’s robust healthcare expenditure and stringent regulatory standards drive continuous advancement in packaging solutions.

Report Scope and Medical Device Packaging Market Segmentation

|

Attributes |

Medical Device Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Device Packaging Market Trends

“Shift Towards Sustainable Packaging Solutions”

- There's a growing emphasis on developing sustainable packaging materials, including biodegradable plastics and paper-based alternatives, to meet both environmental standards and functional requirements.

- The increasing awareness among consumers and healthcare providers about environmental sustainability is driving the demand for eco-friendly packaging solutions in the medical device sector.

- Leading companies like Amcor Plc have introduced products such as AmLite, an ultra-recyclable and high-barrier flexible packaging solution, aiming to reduce carbon footprints significantly.

- For instance, expanding its sustainable offerings, Amcor launched High Shield laminates—recycle-ready materials suitable for sachets, stickpacks, and strippacks. These laminates meet the stringent barrier requirements of pharmaceutical packaging while supporting recyclability initiatives across Europe.

- The focus on sustainability is contributing to the robust growth of the European medical device packaging market, with projections indicating significant expansion driven by eco-friendly practices.

Medical Device Packaging Market Dynamics

Driver

“Rise in the Trend of Sterile Devices Across the Region”

- European regulations mandate that medical devices maintain sterility throughout their lifecycle, necessitating advanced packaging solutions.

- The growing preference for single-use medical devices, such as syringes and catheters, drives demand for reliable sterile packaging to prevent cross-contamination.

- Ensuring the sterility of medical devices is crucial for patient safety, leading healthcare providers to prioritize packaging solutions that guarantee contamination-free products.

- For instance, European regulations, particularly the EU Medical Device Regulation (MDR), mandate that medical devices, especially those delivered sterile, maintain sterility throughout their lifecycle, including during transport and storage. This requirement necessitates the use of advanced packaging solutions that effectively act as a sterile barrier, preventing contamination and ensuring product integrity.

- The European sterile medical packaging market is projected to grow significantly, with investments in research and development focusing on enhancing packaging technologies to meet the increasing demand.

Opportunity

“Adoption of Sustainable Packaging Solutions”

- There's a growing emphasis on eco-friendly packaging materials due to heightened environmental awareness among consumers and stringent EU regulations promoting sustainability.

- Companies are investing in the development of recyclable and biodegradable packaging materials, such as bio-based polymers and advanced barrier films, to meet sustainability goals.

- Major industry players, including Amcor and Berry Global, are actively pursuing sustainability initiatives, focusing on reducing the environmental footprint of their packaging solutions.

- Sustainable packaging offers companies a competitive edge, allowing them to differentiate their products in a market increasingly driven by environmental considerations.

- For instance, Growing consumer awareness of environmental issues has led to a preference for eco-friendly packaging materials. Consumers are actively seeking products with less waste and packaging made from recycled or renewable sources

- The shift towards sustainable packaging is not only a response to current demands but also positions companies for long-term growth as sustainability becomes integral to healthcare procurement and patient preferences.

Restraint/Challenge

“Stringent Regulatory Compliance”

- The EU's Medical Device Regulation (MDR) enforces strict guidelines on packaging safety, sterility, and labeling, requiring constant updates and technical adjustments.

- Meeting rigorous requirements increases production costs, especially for small and medium-sized enterprises (SMEs).

- Regulatory approvals for new packaging materials and designs can delay time-to-market for medical devices.

- Regulations limit the use of certain plastics and chemicals, impacting material sourcing and design flexibility.

- Ongoing testing for biocompatibility, barrier performance, and shelf life is mandatory, demanding significant time and resources.

Medical Device Packaging Market Scope

The market is segmented on the basis of material, container type, packaging type, and applications.

|

Segmentation |

Sub-Segmentation |

|

By Material |

|

|

By Container Type |

|

|

By Packaging Type |

|

|

By Applications |

|

Medical Device Packaging Market Regional Analysis

“Germany is the Dominant Region in the Medical Device Packaging Market”

- Germany holds a significant share due to its advanced medical technology sector, robust healthcare infrastructure, and stringent regulatory standards.

- Germany's commitment to innovation and quality in medical device manufacturing necessitates high-quality, compliant packaging solutions, reinforcing its market dominance. .

“France is Projected to Register the Highest Growth Rate”

- France is expected to witness the highest growth rate in the Medical Device Packaging market, driven by sustained economic recovery, government initiatives, and a steady job market.

- Additionally, France's commitment to healthcare excellence and innovation fosters increased demand for advanced medical device packaging solutions.

Medical Device Packaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- DuPont (U.S.),

- Mitsubishi Electric Corporation (Japan),

- Texchem Polymer Engineering Division (Malaysia),

- Klockner Pentaplast (U.S.),

- 3M (U.S.),

- Bemis Company, Inc. (U.S.),

- Plastic Ingenuity (U.S.),

- Technipaq Inc. (U.S.),

- Amcor plc (Switzerland),

- DOW (U.S.),

- Berry Global (U.S.),

- Wihuri Group (Finland),

- Oliver (U.S.),

- Beacon Converters (U.S.)

- CONSTANTIA (Austria)

Latest Developments in Europe Medical Device Packaging Market

- In November 2023, Coveris launched Formpeel P, an innovative flexible thermoforming film designed for a wide range of medical packaging applications. This co-extruded film is distinguished by its strong puncture resistance, ensuring robust protection for medical products. It is compatible with peelable polyethylene or polyolefin substrates. At the same time, high-performance plastics (HPPs) are witnessing accelerated market growth compared to standard commodity plastics. This surge is driven by their advanced properties—such as improved durability, resistance to chemicals, and suitability for diverse sterilization techniques—which are critical in the packaging of medical devices.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Medical Device Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Medical Device Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Medical Device Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.