Europe Medical Device Reprocessing Market

Market Size in USD Billion

CAGR :

%

USD

1.19 Billion

USD

4.38 Billion

2025

2033

USD

1.19 Billion

USD

4.38 Billion

2025

2033

| 2026 –2033 | |

| USD 1.19 Billion | |

| USD 4.38 Billion | |

|

|

|

|

Europe Medical Device Reprocessing Market Size

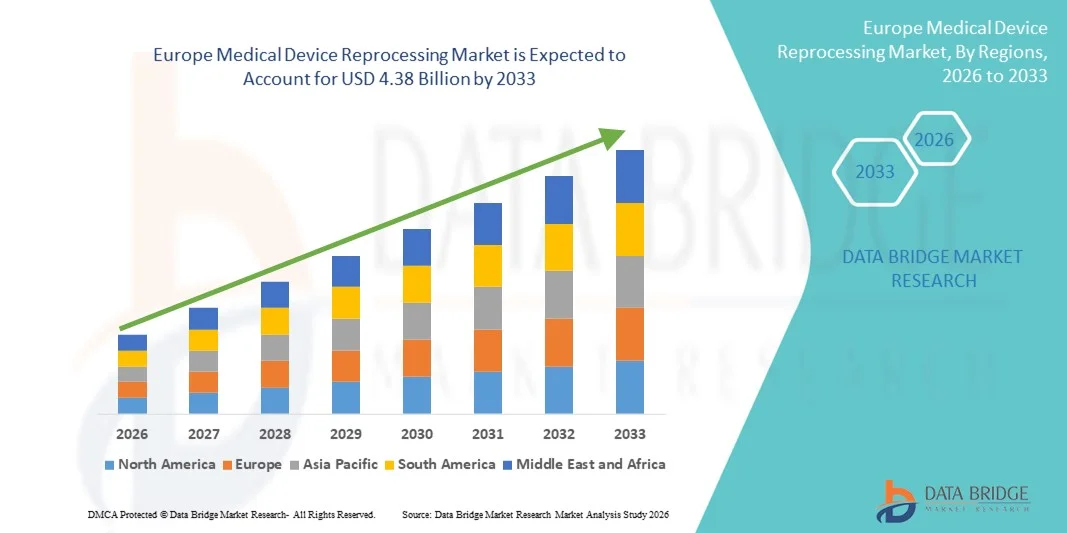

- The Europe medical device reprocessing market size was valued at USD 1.19 billion in 2025 and is expected to reach USD 4.38 billion by 2033, at a CAGR of 17.7% during the forecast period

- The market growth is largely fueled by the increasing adoption of reprocessed medical devices across hospitals and surgical centers, driven by cost reduction imperatives, sustainability mandates, and strong regulatory compliance frameworks in major European countries such as Germany, France, and the United Kingdom

- Furthermore, rising healthcare provider demand for secure, cost‑effective, and environmentally responsible solutions along with technological advancements in sterilization, cleaning, and tracking systems is positioning reprocessing as an integral part of healthcare strategies in Europe. These converging factors are accelerating uptake of medical device reprocessing solutions, thereby significantly boosting the industry’s growth

Europe Medical Device Reprocessing Market Analysis

- Medical device reprocessing, which includes the cleaning, sterilization, and refurbishment of medical instruments using enzymatic and non‑enzymatic detergents, as well as reprocessing support services, is becoming increasingly vital across hospitals, clinics, and surgical centers in Europe due to its cost-effectiveness, safety compliance, and environmental sustainability

- The escalating demand for medical device reprocessing is primarily fueled by rising healthcare cost pressures, stringent EU regulations for safe device reuse, and growing emphasis on sustainable practices in hospitals and ambulatory surgical centers

- Germany dominated the Europe medical device reprocessing market with the largest revenue share of 28.5% in 2025, driven by its advanced healthcare infrastructure, high procedural volumes, and widespread adoption of reprocessed devices in hospitals and clinics

- Poland is expected to be the fastest-growing country in the market during the forecast period, driven by expanding hospital networks, rising healthcare expenditure, and growing awareness of cost-effective and sustainable device reprocessing solutions

- Non-critical devices segment dominated the market in 2025 with a market share of 42.9%, driven by its high usage in routine medical procedures, lower risk compared to critical devices, frequent need for cleaning and reprocessing, and strong adoption across hospitals and clinics for cost-effective patient care

Report Scope and Europe Medical Device Reprocessing Market Segmentation

|

Attributes |

Europe Medical Device Reprocessing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Medical Device Reprocessing Market Trends

Automation and Digital Monitoring for Enhanced Efficiency

- A significant and accelerating trend in the Europe medical device reprocessing market is the increasing adoption of automated cleaning, disinfection, and sterilization systems, coupled with digital monitoring tools that enhance workflow efficiency and compliance tracking

- For instance, hospitals in Germany are using automated washer-disinfectors with integrated RFID tracking to monitor device usage, sterilization cycles, and maintenance schedules, reducing human error and ensuring adherence to EU medical regulations

- Digital monitoring enables real-time alerts for process deviations, ensures traceability of reprocessed instruments, and helps maintain consistent sterilization quality, minimizing the risk of infections and operational delays

- The integration of automated systems with hospital management software allows centralized tracking of devices, enabling staff to manage multiple instruments, sterilization schedules, and reprocessing tasks efficiently across departments

- The use of AI-assisted predictive maintenance in reprocessing equipment is gaining traction, helping hospitals anticipate equipment failures, reduce downtime, and optimize sterilization schedules

- Vendors such as Steris and Getinge are developing intelligent reprocessing systems with real-time compliance reporting and centralized management capabilities, enhancing operational efficiency and staff productivity

- The demand for digitally monitored and automated reprocessing solutions is increasing across hospitals, clinics, and surgical centers, as healthcare providers prioritize efficiency, traceability, and compliance with strict EU regulations.

Europe Medical Device Reprocessing Market Dynamics

Driver

Rising Need for Cost Savings and Regulatory Compliance

- The growing pressure on healthcare providers to reduce operational costs, combined with strict EU regulations on device reuse, is a key driver for the adoption of reprocessed medical devices

- For instance, in April 2025, a hospital network in France implemented automated washer-disinfectors and reprocessed endoscopes, achieving substantial cost reductions while meeting regulatory sterilization standards

- Reprocessing provides hospitals with a safe, cost-effective alternative to single-use instruments, reducing procurement and waste disposal expenses without compromising patient safety

- Furthermore, increasing awareness of environmentally sustainable practices in hospitals and clinics is driving adoption of reprocessing programs that minimize medical waste while maintaining compliance with hygiene standards

- The availability of user-friendly reprocessing services and automated systems facilitates integration into hospital workflows, allowing staff to efficiently manage device sterilization, tracking, and documentation across multiple departments

- Rising patient safety awareness is prompting hospitals to adopt reprocessing solutions that ensure consistent sterilization and reduce hospital-acquired infection risks, reinforcing trust in reprocessed devices

- Government incentives and EU funding programs for sustainable healthcare practices are encouraging hospitals to invest in reprocessing technology and services, supporting market growth

- The adoption of standardized reprocessing protocols across multiple facilities is helping large hospital networks reduce operational complexity while ensuring compliance and safety, further driving market expansion

Restraint/Challenge

Regulatory Complexity and Infection Risk Concerns

- Stringent regulatory frameworks across different European countries, along with concerns about patient safety and infection risks, pose significant challenges for the medical device reprocessing market

- For instance, variations in sterilization guidelines between Germany, the U.K., and France require hospitals to adapt processes for compliance, creating additional operational complexity and staff training needs

- Ensuring consistent sterilization efficacy, maintaining traceability of instruments, and addressing staff apprehension about infection risks are critical to gaining trust and wider adoption of reprocessing programs

- In addition, the high upfront cost of advanced automated cleaning and monitoring systems can deter smaller clinics or budget-constrained hospitals from implementing full-scale reprocessing operations

- Overcoming these challenges through standardized protocols, robust staff training, and cost-effective automated solutions is essential to sustain market growth and expand reprocessing adoption across diverse healthcare facilities

- The complexity of cross-country regulatory approvals for reprocessed devices can delay market entry and limit adoption of innovative solutions, creating barriers for vendors

- Limited awareness and skepticism among some healthcare staff regarding the safety of reprocessed devices may slow adoption, requiring additional training and awareness programs

- Integration of new technologies, such as AI monitoring and cloud-based tracking, may face resistance due to workflow disruption concerns and the need for IT infrastructure upgrades in hospitals

Europe Medical Device Reprocessing Market Scope

The market is segmented on the basis of type, product & service, process, devices type, application, and end user.

- By Type

On the basis of type, the Europe medical device reprocessing market is segmented into enzymatic detergent and non-enzymatic detergent. Enzymatic Detergent segment dominated the market with the largest market share in 2025, driven by its superior ability to break down complex biological residues such as proteins and blood from critical and semi-critical medical devices. Hospitals and surgical centers prioritize enzymatic detergents for their proven efficacy in maintaining high hygiene standards and minimizing infection risks. The segment also benefits from established adoption in European healthcare facilities due to stringent regulatory guidelines for device sterilization. Enzymatic detergents are compatible with a wide range of reprocessing equipment, including automatic washer-disinfectors, enhancing workflow efficiency. In addition, their use reduces the such likely hood of device damage during cleaning compared to harsh chemical alternatives. Hospitals in Germany and France, in particular, rely heavily on enzymatic detergents for high-volume reprocessing.

Non-Enzymatic Detergent segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption in smaller clinics, diagnostic centers, and ambulatory surgical centers that require cost-effective, versatile cleaning solutions. Non-enzymatic detergents are preferred where routine cleaning of non-critical and semi-critical devices is needed, offering effective sterilization at lower cost and simplified handling. Growing awareness of sustainable and eco-friendly cleaning chemicals is also boosting adoption, as non-enzymatic formulas often have reduced chemical impact. Market players are innovating with concentrated and ready-to-use non-enzymatic solutions to improve convenience and reduce preparation time. Their compatibility with a wide variety of surfaces and instruments enhances their appeal across multiple healthcare settings. The segment is particularly gaining traction in Eastern European countries with expanding outpatient services.

- By Product & Service

On the basis of product & service, the market is segmented into reprocessing support & services and reprocessed medical devices. Reprocessing Support & Services segment dominated the market in 2025, accounting for the largest revenue share, driven by the need for hospitals to outsource complex sterilization and device tracking processes. Healthcare providers increasingly rely on specialized service providers for end-to-end reprocessing, including device collection, cleaning, sterilization, testing, and return logistics. Outsourcing reduces the burden on hospital staff while ensuring compliance with EU regulations and traceability requirements. The segment also benefits from technological integration, such as digital tracking, real-time reporting, and automated quality checks, improving operational efficiency. Hospitals in Germany, France, and the U.K. are the primary adopters due to high procedural volumes and stringent regulatory requirements. Strong partnerships between service providers and device manufacturers further support market dominance.

Reprocessed Medical Devices segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising cost-containment initiatives and increased awareness of environmental sustainability in healthcare. Hospitals, clinics, and diagnostic centers are increasingly adopting reprocessed devices such as endoscopes, surgical instruments, and non-critical devices to reduce procurement costs while maintaining quality standards. Technological advancements in reprocessing methods have enhanced safety and reliability, encouraging greater adoption. The trend is also supported by government initiatives and regulatory incentives promoting safe reuse of medical devices. Hospitals in Poland and the Czech Republic are emerging as high-growth adopters, driven by expanding healthcare infrastructure. Growing partnerships between hospitals and certified reprocessing vendors further accelerate uptake of this segment.

- By Process

On the basis of process, the market is segmented into presoak, manual cleaning, automatic cleaning, and disinfection. Automatic Cleaning segment dominated the market in 2025, driven by its ability to ensure standardized, high-quality cleaning and sterilization of devices while reducing human error. Large hospitals and surgical centers prefer automatic washer-disinfectors for critical and semi-critical instruments, as they comply with stringent EU regulatory standards. Automation reduces staff workload, improves turnaround time, and enhances traceability via integrated digital monitoring systems. Hospitals in Germany, France, and the U.K. heavily invest in these systems to manage high procedural volumes efficiently. Automatic cleaning is also compatible with a wide range of device types, making it highly versatile. Integration with sterilization and tracking software further increases operational efficiency and compliance.

Manual Cleaning segment is expected to witness the fastest growth from 2026 to 2033, driven by adoption in smaller clinics, diagnostic centers, and ambulatory surgical centers where automated equipment may be cost-prohibitive. Manual cleaning remains critical for instruments with intricate designs or delicate materials that require careful handling. Training programs and standardized protocols are improving manual cleaning efficacy, increasing trust in this method. The segment benefits from rising awareness of device hygiene standards and simple infrastructure requirements. Countries such as Poland and the Czech Republic are adopting manual cleaning processes in expanding healthcare networks. Growing demand for hybrid cleaning approaches combining manual pre-cleaning with automation further fuels segment growth.

- By Devices Type

On the basis of devices type, the market is segmented into critical devices, semi-critical devices, and non-critical devices. Non-Critical Devices segment dominated the market in 2025 with a market share of 42.9%, driven by the high volume and routine usage of instruments such as stethoscopes, blood pressure cuffs, and bedside equipment across hospitals and clinics. These devices require frequent reprocessing, making them a primary focus for workflow optimization and cost management. Hospitals in Germany and France are leading adopters due to high procedural volumes and regulatory requirements for traceable cleaning. Non-critical devices are also compatible with automated and manual cleaning systems, allowing flexibility in reprocessing protocols. Adoption is supported by the need to minimize cross-contamination risks and maintain hygiene standards in high-traffic areas. The widespread availability of specialized cleaning solutions and staff training programs further reinforces this segment’s dominance.

Critical Devices segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing adoption of endoscopes, surgical instruments, and other high-risk medical devices that require meticulous cleaning and sterilization. Technological advancements in automated disinfection and sterilization systems have improved the safety and reliability of reprocessing critical devices. Hospitals in the U.K., Poland, and the Czech Republic are investing in high-end automated systems to ensure compliance with EU standards. Critical devices’ high replacement costs also drive healthcare providers to adopt reprocessing strategies. Growing awareness of infection control and patient safety enhances the segment’s adoption across surgical centers. Partnerships between hospitals and certified reprocessing vendors further accelerate market growth in this category.

- By Application

On the basis of application, the market is segmented into devices and accessories. Devices segment dominated the market in 2025, driven by high demand for reprocessing of core medical instruments such as endoscopes, surgical tools, and diagnostic devices. These instruments are critical to hospital operations and require stringent sterilization protocols to ensure patient safety. Hospitals in Germany, France, and the U.K. lead adoption due to high procedural volumes and regulatory compliance requirements. The segment benefits from advanced automated cleaning, digital monitoring, and quality control systems, which improve efficiency and traceability. Frequent usage and high costs of these devices further encourage reprocessing instead of disposal. Integration with hospital management software and device tracking systems enhances operational workflow and reduces human error.

Accessories segment is expected to witness the fastest growth from 2026 to 2033, fueled by the increasing need to reprocess high-use supporting items such as tubing, connectors, and sensor attachments. Smaller clinics, diagnostic centers, and ambulatory surgical centers adopt accessory reprocessing as a cost-effective approach to reduce procurement expenses. Technological innovations in cleaning and sterilization methods improve safety and efficiency of accessory reprocessing. Countries such as Poland and the Czech Republic are experiencing high growth due to expanding healthcare infrastructure and adoption of outpatient services. Standardized cleaning protocols and reusable accessory designs further accelerate this segment’s adoption. Growing environmental awareness is also motivating hospitals to minimize disposable accessory usage.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, home healthcare, diagnostic centers, manufacturers, ambulatory surgical centers, and others. Hospitals segment dominated the market in 2025 with the largest revenue share, driven by high procedural volumes, stringent EU sterilization regulations, and large-scale adoption of automated cleaning and monitoring systems. Hospitals require frequent reprocessing of critical, semi-critical, and non-critical devices to maintain patient safety and operational efficiency. Germany, France, and the U.K. are the leading countries driving this segment due to well-established healthcare infrastructure. Integration of digital tracking and reporting enhances workflow efficiency and compliance. Partnerships with certified reprocessing vendors further strengthen hospitals’ reliance on professional services. The segment also benefits from ongoing investment in staff training and standardized reprocessing protocols.

Clinics segment is expected to witness the fastest growth from 2026 to 2033, fueled by expanding outpatient services, rising adoption of automated and manual cleaning solutions, and increasing awareness of device safety and infection prevention. Smaller clinics in Poland and the Czech Republic are implementing cost-effective reprocessing solutions to reduce procurement and waste management expenses. Clinics handle non-critical and semi-critical devices extensively, which drives demand for efficient, flexible reprocessing services. Technological innovations and simplified protocols enhance adoption in these facilities. Increasing government support and incentives for sustainable healthcare practices further contribute to rapid growth in the clinic segment.

Europe Medical Device Reprocessing Market Regional Analysis

- Germany dominated the Europe medical device reprocessing market with the largest revenue share of 28.5% in 2025, driven by its advanced healthcare infrastructure, high procedural volumes, and widespread adoption of reprocessed devices in hospitals and clinics

- Healthcare providers in the country highly value the efficiency, traceability, and compliance offered by automated and digitally monitored reprocessing solutions, ensuring consistent sterilization and patient safety

- This widespread adoption is further supported by strict EU regulatory standards, strong investment in hospital technology, and a focus on sustainable practices, establishing medical device reprocessing as a preferred solution for hospitals, clinics, and diagnostic centers

The Germany Medical Device Reprocessing Market Insight

The Germany medical device reprocessing market captured the largest revenue share of 28.5% in 2025, driven by its advanced healthcare infrastructure, high procedural volumes, and widespread adoption of automated and digitally monitored reprocessing systems. Hospitals and surgical centers prioritize patient safety, efficiency, and compliance with EU sterilization standards, fueling market growth. The demand is further supported by strong regulatory frameworks, investment in staff training, and initiatives promoting sustainable healthcare practices. Germany’s focus on innovation encourages adoption of AI-assisted cleaning and sterilization technologies. The integration of digital tracking systems ensures traceability and operational efficiency, solidifying Germany’s leading position.

France Medical Device Reprocessing Market Insight

The France medical device reprocessing market held the second-largest share of 18.3% in 2025, fueled by hospitals and clinics seeking cost-effective and sustainable sterilization solutions. National initiatives promoting medical waste reduction, coupled with growing awareness of reprocessed device safety, support market expansion. French healthcare facilities increasingly adopt automated washer-disinfectors and digital monitoring tools to ensure compliance and improve operational efficiency. Reprocessing programs also help reduce procurement costs while maintaining high standards of patient safety. The market is growing across hospitals, diagnostic centers, and ambulatory surgical centers due to strong government support. France’s emphasis on eco-friendly and traceable sterilization processes further boosts adoption of advanced reprocessing technologies.

United Kingdom Medical Device Reprocessing Market Insight

The U.K. medical device reprocessing market accounted for 16.7% of Europe’s market in 2025, driven by high hospital procedural volumes, growing concerns over infection control, and the increasing implementation of automated reprocessing systems. Hospitals are adopting digital tracking, real-time monitoring, and advanced disinfection protocols to ensure device safety and regulatory compliance. The market is also benefiting from awareness campaigns highlighting the safety and cost-efficiency of reprocessed devices. Expansion of hospital networks and multi-center healthcare facilities supports greater adoption of both reprocessing services and reprocessed medical devices. The U.K.’s focus on innovation, efficiency, and sustainability in healthcare further propels market growth.

Poland Medical Device Reprocessing Market Insight

The Poland medical device reprocessing market contributed 7.2% of Europe’s market in 2025 and is expected to grow at a notable CAGR, driven by expanding hospital infrastructure, rising healthcare expenditure, and adoption of cost-effective reprocessing solutions in clinics and ambulatory surgical centers. Smaller healthcare facilities are increasingly implementing automated and manual cleaning systems to improve compliance and operational efficiency. Awareness of patient safety, device traceability, and infection control is rising, prompting broader adoption of reprocessing solutions. Partnerships with certified service providers enhance access to advanced reprocessing technologies. The market growth is supported by government initiatives promoting sustainable healthcare and standardized sterilization protocols.

Europe Medical Device Reprocessing Market Share

The Europe Medical Device Reprocessing industry is primarily led by well-established companies, including:

- STERIS (Ireland)

- Stryker (U.S.)

- Medline Industries, Inc. (U.S.)

- Vanguard AG (Germany)

- Medtronic (Ireland)

- Johnson & Johnson Services, Inc. (U.S.)

- Centurion Medical Products Corporation (U.S.)

- Teleflex Incorporated (U.S.)

- Ascent Healthcare Solutions, Inc. (U.S.)

- ReNu Medical, Inc. (U.S.)

- SureTek Medical (U.S.)

- NEScientific, Inc. (U.S.)

- Innovative Health, Inc. (U.S.)

- Hygia Health Services, Inc. (U.S.)

- Soma Technology, Inc. (U.S.)

- Agiliti Health, Inc. (U.S.)

- Getinge AB (Sweden)

- Arjo (Sweden)

- Wassenburg Medical B.V. (Netherlands)

- Medisafe International (U.K.)

What are the Recent Developments in Europe Medical Device Reprocessing Market?

- In September 2025, Swissmedic updated the Swiss “Good Practices for the Reprocessing of Flexible, Thermolabile Endoscopes” (GPAE), providing clearer legal duties and modern hygiene standards under the Swiss Medical Devices Ordinance to improve patient safety and compliance in hospital and outpatient settings

- In September 2025, Swissmedic published a major update to the Swiss Good Practices for Endoscope Reprocessing (GPAE), strengthening legal and hygienic standards for reprocessing flexible thermolabile endoscopes in hospitals and outpatient facilities after inspections revealed compliance gaps, aiming to improve patient safety and documentation quality

- In February 2025, an amended Danish executive order came into force permitting the reprocessing and further reuse of single-use medical devices in Denmark, allowing hospitals to send such devices for validated reprocessing and reuse under EU Medical Device Regulation requirements, marking a key regulatory shift toward sustainable healthcare practices

- In January 2025, Denmark officially legalised the reprocessing of single‑use medical devices, allowing Danish hospitals to reuse previously single‑use equipment under regulated conditions to save costs, reduce waste, and strengthen supply chains after years of advocacy and stakeholder consultation

- In September 2021, several EU countries, including Germany, Poland, Portugal, Spain, Sweden, and others, updated or ratified national rules on the reprocessing of single‑use devices under MDR obligations, clarifying where reprocessing is permitted and where it remains restricted

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.