Europe Medical Gases Market

Market Size in USD Billion

CAGR :

%

USD

1.44 Billion

USD

2.80 Billion

2024

2032

USD

1.44 Billion

USD

2.80 Billion

2024

2032

| 2025 –2032 | |

| USD 1.44 Billion | |

| USD 2.80 Billion | |

|

|

|

|

Medical Gas Market Size

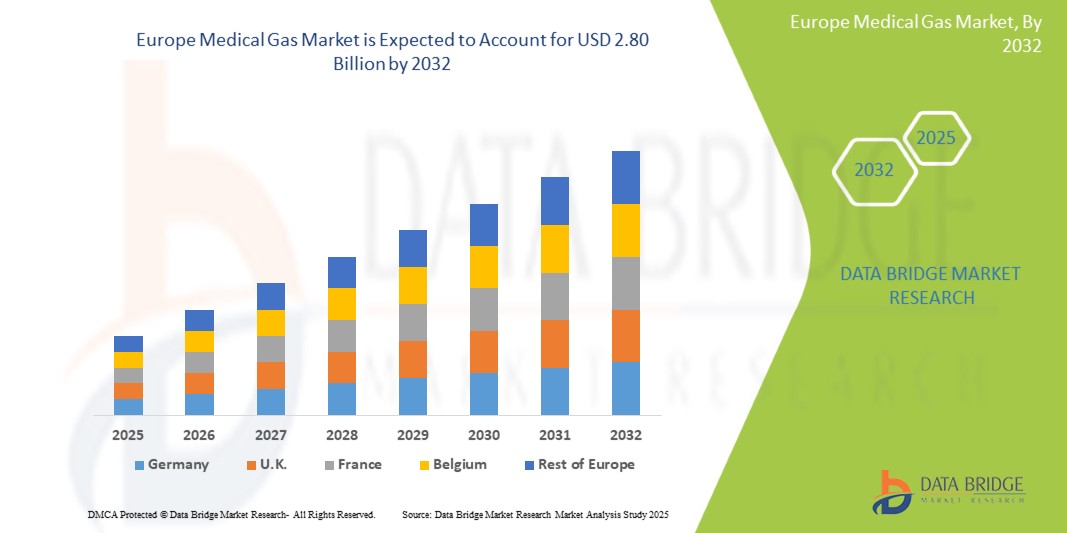

- The Europe Medical Gas market size was valued at USD 1.44 billion in 2024 and is expected to reach USD 2.80 billion by 2032, at a CAGR of 8.7% during the forecast period

- This growth is driven by the hike in ageing population, rise in home healthcare facilities, emerging Europeization and economy, increase in the cases of COPD.

Medical Gas Market Analysis

- Medical gases such as oxygen, nitrous oxide, medical air, and carbon dioxide are essential in patient care for anesthesia, ventilation, diagnostics, and therapy. These gases are administered through high-pressure cylinders or centralized systems and supported by gas equipment like flowmeters, regulators, vacuum systems, and manifolds.

- The growing burden of chronic diseases, increasing number of surgeries, and rising demand for emergency and home-based care are primary drivers. Rapidly aging populations and high pollution levels in urban centers have further pushed oxygen therapy adoption.

- Germany leads the Europe medical gas market, driven by its sophisticated hospital systems and pharmaceutical sector.

- The UK and France are also key contributors due to investments in emergency services and home-based respiratory care.

- Medical oxygen segment is expected to dominate the Europe medical gas market with the largest market share of 53.2% due to its critical application in surgical procedures, respiratory illnesses, and emergency care. Increased investment in PSA oxygen plants and oxygen therapy awareness post-COVID further supports its leadership.

Report Scope and Medical Gas Market Segmentation

|

Attributes |

Medical Gas Key Market Insights |

|

Segments Covered |

By Product: Medical Gases (Oxygen, Nitrous Oxide, Carbon Dioxide, Medical Air, Nitrogen, Others), Medical Gas Equipment (Manifolds, Hose Assemblies, Flowmeters, Vacuum Systems, Regulators, Outlets, Alarm Systems) By Modality: Standalone, and Integrated By Form of Delivery: High Pressure Cylinders, Liquid Cylinders, and Bulk Delivery By Application: Therapeutic, Diagnostic, Pharmaceutical Manufacturing and Research, and Others By End User: Hospitals, Home Healthcare, Academic & Research Institutions, Emergency Services, Pharmaceutical & Biotechnology Companies, Diagnostic & Imaging Centers, and Others |

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Gas Market Trends

“Expansion of Immuno-Oncology and Cell-Based Therapies”

A major trend in the Medical Gas market is the expansion of immuno-oncology and cell-based therapies such as CAR-T, which are transforming cancer treatment protocols

Rising investments by biotech companies in immune checkpoint inhibitors and genetically engineered T-cell therapies are driving long-term growth

For example, the growing number of clinical trials in CAR-T cell therapies across North America and Europe signifies sustained innovation in personalized cancer treatment

Medical Gas Market Dynamics

Driver

“Rising Chronic Diseases and Aging Demographics”

- Europe’s aging population is projected to exceed 30% over the age of 65 by 2030, significantly increasing demand for long-term and critical care services that require medical gases.

- Chronic respiratory diseases, including COPD, affect over 35 million people in Europe (European Lung Foundation, 2023), necessitating a reliable supply of oxygen and air gas systems.

- For instance, Germany recorded a 25% increase in long-term oxygen therapy prescriptions between 2021 and 2024, reflecting the aging population’s medical gas dependence.

- The prevalence of cardiovascular diseases, responsible for 45% of all deaths in Europe, continues to require consistent usage of nitrous oxide and medical air during surgeries.

Opportunity

“Government Healthcare Modernization Initiatives”

- The European Union’s Recovery and Resilience Facility has allocated over EUR 9 billion specifically for health infrastructure upgrades across member countries.

- For instance, France launched a nationwide medical modernization program in 2024, upgrading over 150 public hospitals with advanced gas delivery systems and digital monitoring platforms. • The UK’s NHS Improvement Plan (2023–2026) includes a budget for mobile and AI-enabled oxygen concentrators to support elderly patients in home settings.

- Italy has initiated regional pilot programs to integrate gas delivery systems with telehealth platforms, ensuring real-time support and monitoring.

Restraint/Challenge

“Logistics and Certification Hurdles Across Countries”

- Differing certification and approval protocols across EU countries complicate product launches; dual compliance is required in Germany and Italy, extending go-to-market timelines by 4–6 months.

- Brexit has significantly disrupted the supply of aluminum cylinders and valves from the EU to the UK, causing temporary shortages in nearly 80 NHS-affiliated hospitals during Q1 2023.

- Transportation costs for cryogenic gas cylinders have increased by 18% year-on-year due to new customs checks, especially impacting deliveries to Eastern European countries.

- Regulatory misalignment between EU MDR (Medical Device Regulation) and national standards continues to create bottlenecks for small and mid-sized gas equipment manufacturers.

Medical Gas Market Scope

The market is segmented on the basis application, product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Modality |

|

|

By Form of Delivery |

|

|

By Application |

|

|

By End User |

|

In 2025, the medical oxygen segment is projected to dominate the market with the largest share in product segment

In 2025, the medical oxygen segment is expected to dominate the Europe medical gas market with the largest market share of 53.2% due to its critical application in surgical procedures, respiratory illnesses, and emergency care. Increased investment in PSA oxygen plants and oxygen therapy awareness post-COVID further supports its leadership.

The hospital segment is expected to account for the largest share during the forecast period in end user segment

In 2025, the hospital segment is expected to dominate the market with the largest market share of 60.1% owing to high patient footfall, surgical volume, and emergency care reliance. Government-backed infrastructure investments and smart hospital integrations further consolidate hospital leadership.

Medical Gas Market Regional Analysis

“Germany Holds the Largest Share in the Europe Medical Gas Market”

Germany leads due to its robust hospital infrastructure, strong pharmaceutical manufacturing base, and early adoption of gas management systems.

- Government R&D support further enhances market maturity.

“United Kingdom is Projected to Register the Highest CAGR in the Europe Medical Gas Market”

- UK growth is driven by rising investment in community care, telehealth, and portable respiratory solutions.

NHS funding initiatives and partnerships with medical gas suppliers improve service penetration. Medical Gas Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Air Liquide (France)

- Linde plc (Ireland)

- Praxair Technology Inc. (U.S.)

- Messer Group GmbH (Germany)

- SOL Group (Italy)

- Atlas Copco AB (Sweden)

- GCE Group AB (Sweden)

- Taiyo Nippon Sanso Corporation (Japan)

- Air Water Inc. (Japan)

Latest Developments in Europe Medical Gas Market

- In March 2024, Linde India announced a $60 million investment in new medical oxygen and nitrogen plants across Maharashtra and Gujarat

- In November 2023, Air Liquide expanded its bulk medical gas delivery system network to over 150 hospitals in Southeast Asia

- In July 2023, Taiyo Nippon Sanso Corporation introduced a next-gen oxygen flow monitoring system for smart hospitals in Japan

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.