Europe Metabolic Testing Market

Market Size in USD Million

CAGR :

%

USD

345.80 Million

USD

654.40 Million

2024

2032

USD

345.80 Million

USD

654.40 Million

2024

2032

| 2025 –2032 | |

| USD 345.80 Million | |

| USD 654.40 Million | |

|

|

|

|

Metabolic Testing Market Size

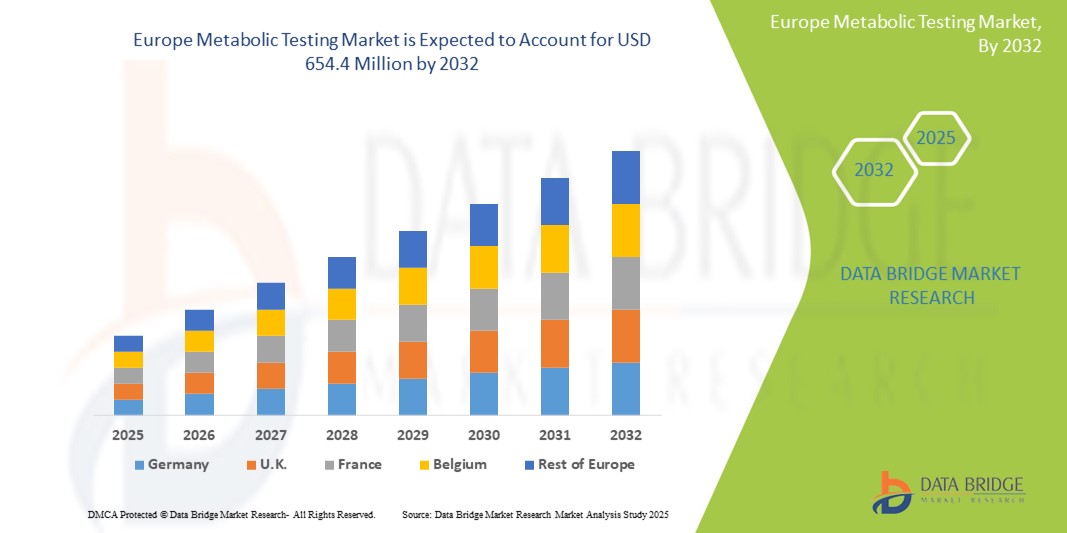

- The Europe Metabolic Testing market size was valued at USD 345.8 million in 2024 and is expected to reach USD 654.4 million by 2032, at a CAGR of 8.3% during the forecast period

- The market growth is largely fueled by the increasing awareness of metabolic health, the rising prevalence of lifestyle-related diseases such as obesity, diabetes, and cardiovascular disorders across Europe, and the growing adoption of personalized nutrition and fitness programs.

- Furthermore, continuous technological advancements, including portable metabolic analyzers, non-invasive testing methods, and digital health platform integration, are driving market expansion. These converging factors are accelerating the adoption of metabolic testing solutions, thereby significantly boosting the industry's growth.

Metabolic Testing Market Analysis

- Metabolic Testing market encompasses a range of diagnostic tools and systems used to measure an individual's metabolic rate and analyze various metabolic parameters. These tests assess how the body converts food into energy, burns calories, and utilizes oxygen. Products in this market include CPET systems, metabolic carts, body composition analyzers, ECG/EKG systems, and specialized software. Metabolic testing is crucial for understanding energy expenditure, optimizing fitness, managing weight, and diagnosing conditions like obesity, diabetes, and cardiovascular diseases.

- The escalating demand for metabolic testing is primarily fueled by the increasing focus on preventive healthcare, the growing popularity of sports and fitness activities, and the rising need for effective monitoring of metabolic changes for health management and disease prevention.

- Germany dominates the Metabolic Testing market in Europe, holding the largest revenue share of 27.9% in 2025, supported by its advanced healthcare and diagnostic infrastructure, strong government focus on preventive health, and increasing prevalence of metabolic and lifestyle-related disorders. The country’s commitment to managing conditions like obesity, diabetes, and cardiovascular diseases has led to a significant rise in the use of metabolic testing systems across hospitals, specialized clinics, and sports medicine centers.

- Germany is also expected to be the fastest-growing country in the Europe Metabolic Testing market during the forecast period, driven by expanding health check-up programs, integration of metabolic analyzers into routine clinical workflows, and rising consumer interest in fitness and personalized health tracking. Collaborations between academic institutions, medical device manufacturers, and fitness technology companies are accelerating innovation and increasing access to portable and digital metabolic analyzers in both urban and rural areas.

- VO2 Max Analyzers are expected to dominate the Europe Metabolic Testing market with a market share of 30.6% in 2025, owing to their critical role in evaluating cardiorespiratory fitness, athletic performance, and overall metabolic efficiency. These devices are widely used by healthcare professionals, sports scientists, and fitness coaches to assess oxygen consumption, endurance, and energy expenditure. The growing adoption of VO2 Max testing in preventive cardiology, corporate wellness programs, and elite training environments is further boosting this segment. Technological advancements such as wireless connectivity, wearable sensors, and cloud-based data interpretation are enhancing usability and expanding the market for both clinical and consumer-focused applications.

Report Scope and Metabolic Testing Market Segmentation

|

Attributes |

Metabolic Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Metabolic Testing Market Trends

“Seamless connectivity with smartphones and health apps”

- Integration with Digital Health Platforms and Wearable Technologies: A significant and accelerating trend in the Europe Metabolic Testing Market is the growing integration of metabolic testing devices with digital health platforms and wearable technologies. This evolution is significantly enhancing accessibility, convenience, and continuous monitoring capabilities for users and healthcare professionals.

- For instance, modern metabolic analyzers often connect seamlessly with smartphones, fitness trackers, and health management software, allowing individuals to track their metabolic rate, calorie expenditure, and other key parameters in real-time. This connectivity provides personalized insights, trend analysis, and actionable data for optimizing fitness regimens and nutrition plans.

- The development of portable and user-friendly devices, such as breath analyzers and smart scales with metabolic assessment features, is making metabolic testing more accessible for home users and for on-site consultations in fitness centers.

- The adoption of AI and machine learning algorithms is improving the accuracy and efficiency of data interpretation, providing more precise recommendations for weight management and performance optimization.

- This trend towards more intelligent, connected, and user-friendly metabolic testing solutions is fundamentally reshaping how individuals and professionals approach health monitoring and personalized wellness in Europe

Metabolic Testing Market Dynamics

Driver

“Increasing incidence of obesity, diabetes, and cardiovascular diseases”

- Rising Prevalence of Lifestyle Diseases and Increasing Health Awareness: The increasing incidence of lifestyle-related diseases such as obesity, diabetes, and cardiovascular disorders across Europe, coupled with a heightened awareness regarding health and wellness among the population, is a major driver for the growth of the metabolic testing market

- For instance, the World Health Organization estimates that chronic illnesses cause a significant percentage of all deaths worldwide, highlighting an increasing health burden. The need for better diagnostic and monitoring tools like metabolic testing is rising as these diseases become more prevalent

- The growing focus on preventive healthcare and better living standards is encouraging individuals to seek metabolic assessments for early detection and management of health risks.

- European countries have high healthcare expenditure with a strong emphasis on preventive care, leading to increased adoption of metabolic testing by healthcare providers.

- The burgeoning fitness industry and increasing membership in health clubs and wellness centers across Europe are also propelling market growth, as these facilities increasingly offer metabolic analysis services.

- The continuous technological advancement in metabolic testing devices, such as digital metabolic rate testing devices, further influences the market

Restraint/Challenge

“High capital investment for metabolic testing equipment”

- High Cost of Equipment and Limited Reimbursement: The substantial costs associated with advanced metabolic testing equipment and software, coupled with limited reimbursement policies in certain regions, present significant challenges to widespread market adoption.

- For instance, sophisticated CPET systems and metabolic carts require significant capital investment, which can be a deterrent for smaller healthcare facilities, gyms, or individuals with budget constraints. This high initial cost can limit the widespread adoption of advanced metabolic testing devices.

- The lack of comprehensive reimbursement for all metabolic testing procedures across various European countries can create financial barriers for patients and healthcare providers, impacting the volume of tests performed.

- Additionally, the presence of stringent regulations and a lack of widespread awareness about the importance of metabolic testing in certain areas can further hinder market growth.

- Inconsistency in readings across different metabolic analyzers and the need for experienced professionals to interpret complex data also pose challenges

Metabolic Testing Market Scope

The market is segmented on the basis product, technology, application and end user.

- By Product

On the basis of Product, the Metabolic Testing Market is into CPET Systems, Metabolic Carts, Body Composition Analyzers, ECGs & EKGs Systems, and Software. The CPET Systems (Cardiopulmonary Exercise Testing Systems) segment is expected to dominate the market with the largest revenue share of 39.2% 2025, due to its comprehensive assessment capabilities in evaluating cardiovascular, respiratory, and muscular responses to exercise. These systems are widely used in hospitals and sports performance labs for detecting underlying heart and lung conditions as well as in pre-operative assessments.

The Software segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the growing need for real-time data visualization, cloud integration, and AI-powered analysis in both clinical and fitness settings. The demand for advanced reporting tools and remote monitoring capabilities is fueling adoption across Europe’s digital health ecosystem.

- By Technology

On the basis of Technology, the Metabolic Testing Market is into VO2 Max Analysis, RMR (Resting Metabolic Rate) Analysis[AJ1] [PK2] , and Body Composition Analysis. The VO2 Max Analysis segment is expected to dominate the market with the largest revenue share, driven by its critical role in assessing aerobic endurance and cardiovascular fitness. Used extensively by sports scientists, cardiologists, and fitness professionals, VO2 max testing is now increasingly integrated into preventive health and wellness screening programs across Germany, the U.K., and France.

The RMR Analysis segment is projected to witness the fastest CAGR from 2025 to 2032, as the demand for personalized nutrition and weight management programs rises. RMR testing helps determine calorie needs at rest and supports tailored diet planning—making it a valuable tool in combating obesity and metabolic syndrome.

- By Application

On the basis of application, the Metabolic Testing market is segmented into Lifestyle Diseases, Critical Care, Human Performance Testing, Dysmetabolic Syndrome X, Metabolic Disorders, and Others. The Lifestyle Diseases held the largest market revenue share in 2025 owing to the increasing prevalence of conditions such as obesity, diabetes, and hypertension. Metabolic testing is widely used for early detection, treatment monitoring, and personalized intervention strategies in clinical and wellness settings.

The Human Performance Testing is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising demand for metabolic assessments among athletes, fitness enthusiasts, and military personnel. Institutions across Europe are adopting metabolic analyzers for performance optimization, recovery planning, and training customization.

- By End users

On the basis of end users, the Metabolic Testing market is segmented into Hospitals, Laboratories, Sports Training Centers, Gyms, and Others. The Hospitals segment accounted for the largest market revenue share in 2024, attributed to the increasing use of metabolic testing for patient risk assessment, disease diagnosis, and therapy optimization in clinical settings. The growing focus on preventive care and the integration of metabolic evaluations into chronic disease management protocols are strengthening this segment.

The Gyms and Sports Training Centers segment is expected to witness the fastest CAGR from 2025 to 2032, during the forecast period, fueled by the expanding trend of personalized fitness and digital wellness solutions. Gyms across the U.K., Spain, and Nordic countries are incorporating metabolic testing to deliver advanced fitness assessments, VO2 max tracking, and fat-burning efficiency insights.

Metabolic Testing Market Regional Analysis

- Germany dominates the Europe Metabolic Testing Market, accounting for the largest revenue share of 27.9% in 2025, owing to its advanced diagnostic infrastructure, strong national focus on preventive healthcare, and increasing prevalence of lifestyle-related conditions such as obesity, diabetes, and cardiovascular diseases. The widespread integration of metabolic testing in hospitals, cardiopulmonary clinics, and sports performance centers has been pivotal to market growth.

- Germany's leadership is further supported by government-backed health screening initiatives and proactive adoption of cardiopulmonary exercise testing (CPET), VO₂ max testing, and resting metabolic rate (RMR) analyzers in both clinical and wellness settings. Academic and research institutions across Berlin, Munich, and Heidelberg are actively involved in validating new metabolic technologies and personalized nutrition plans based on individual metabolic profiles.

- Additionally, collaborations between health insurers, tech firms, and fitness centers are driving the deployment of connected metabolic testing devices, especially portable metabolic carts and wearable metabolic sensors. The country’s emphasis on early disease detection, corporate wellness, and athletic performance optimization continues to strengthen its market dominance.

France Metabolic Testing Market Insight

The France Metabolic Testing Market is projected to grow at a notable CAGR during the forecast period, supported by government-led efforts to reduce obesity rates and chronic diseases through national health initiatives like the Programme National Nutrition Santé (PNNS). These efforts have emphasized the importance of metabolic health monitoring in preventive care and lifestyle management. Hospitals and rehabilitation centers across France are increasingly adopting CPET systems and RMR analyzers for cardiometabolic risk screening and patient-specific treatment planning, particularly among elderly and obese populations. In parallel, wellness clinics and dietitians are leveraging metabolic carts and software-based interpretation tools to deliver customized dietary and exercise plans.

U.K. Metabolic Testing Market Insight

The U.K. Metabolic Testing Market is poised for strong growth over the forecast period, driven by NHS-supported initiatives to improve management of lifestyle diseases and reduce pressure on the healthcare system. The increasing burden of diabetes, obesity, and cardiovascular conditions has led to the wider use of VO₂ max analysis, metabolic carts, and RMR testing in primary care, specialty clinics, and community health programs. Despite regulatory adjustments post-Brexit, the U.K. maintains strong access to advanced diagnostic equipment and continues to invest in digital health technologies. Private clinics and fitness centers across London, Manchester, and Birmingham are adopting metabolic testing to offer personalized health assessments, while national academic institutions such as the University of Oxford and King’s College London are conducting cutting-edge research on metabolic efficiency and human performance.

Metabolic Testing Market Share

The Metabolic Testing industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- BD (U.S.)

- GENERAL ELECTRIC (U.S.)

- MGC Diagnostics Corporation (U.S.)

- Merck KGaA (Germany)

- Geratherm Medical AG (Germany)

- CORTEX Biophysik GmbH (Germany)

- COSMED Srl (Italy)

- OSI Systems, Inc. (U.S.)

- Microlife Corporation (Switzerland)

- AEI Technologies Inc. (U.S.)

- KORR Medical Technologies Inc. (U.S.)

- Parvo Medics Inc. (U.S.)

- Inbody Co. Ltd. (South Korea)

- Koninklijke Philips NV (Netherlands)

Latest Developments in Europe Metabolic Testing Market

- In May 2025, Sable Systems and Sable Systems Europe announced expansion of European capabilities to better serve international science.

- In March 2024, InBody introduced the InBody 380, an advanced body composition analyzer designed for fitness and wellness professionals, which is relevant for metabolic testing applications.

- In March 2023, Bauerfeind AG launched smart ankle braces in Europe, highlighting a broader healthcare trend toward wearable, integrated health monitoring technologies.[AJ3] [PK4]

- In July 2021, AEI Technologies partnered with Kimberly Gandler to shed light on the practical use of VO2 Max testing equipment, specifically AEI Technologies MAX-II Metabolic Cart.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.