Europe Molded Fibreglass Reinforced Plastic (FRP) Grating Market Analysis and Insights

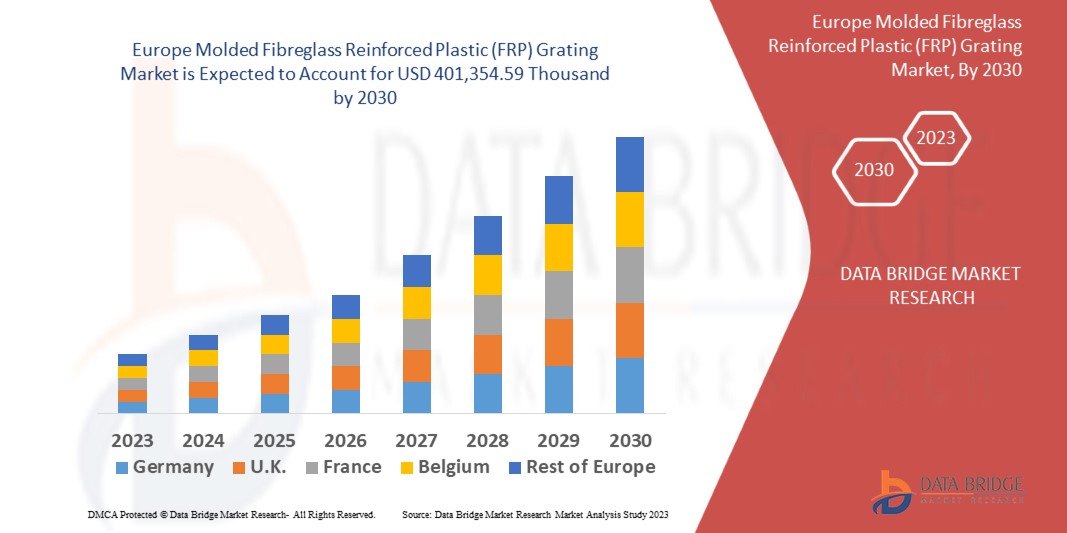

Europe molded fibreglass reinforced plastic (FRP) grating market is expected to gain significant growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 5.2% in the forecast period of 2023 to 2030 and is expected to reach USD 401,354.59 thousand by 2030. The major factor driving the growth of the molded FRP grating market is rising demand of the fiber-reinforced plastic (FRP) grating due to increasing the investments in the infrastructure sector and FRP gratings are high corrosion resistant and fire retardant in nature.

Fiberglass reinforced plastic (FRP) grating is a composite material manufactured by combining a resin and fiberglass matrix. Fiberglass reinforced plastic (FRP) grating offers properties such as corrosion resistance, high strength to weight ratio. UV resistance, minimal thermal expansion, low electrical and thermal conductivity and anti-skid surface. FRP grating are considered as highly durable in the harshest environment, high load-bearing capacity, easy to install and low cost maintenance. The driving factors growth of the market is providing safer alternative to steel.

Europe molded fibreglass reinforced plastic (FRP) grating market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Type (Polyester, Vinyl Ester, Epoxy, Phenolic, Polyurethanes, and Others), Product Type (Trench Covers, Angles, Squares, Flat Strips, I Beams, U Channel, Round Tube, Wide Flange Beams, Solid Rods, Fluted/Ladder Ring, Kick Plate/Toe Plate, and Others), Graftings (31-50MM, 10-30MM and Above 50MM), Applications (Platforms, Walkaways, Docks, Stair Trends, Hand Rails, Walls, and Others), End-Users (Petrochemicals, Pulp and Paper, Food and Beverages, Oil and Gas, Mining, Pharmaceutical, Electrical and Electronics, Water Management, Building and Construction, Marine, Defense, Sports and Leisure, and Others) |

|

Countries Covered |

Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, Denmark, Sweden, Poland, Norway, Finland and Rest of Europe |

|

Market Players Covered |

Fibergrate Composite Structures, TECHNO COMPOSITES, Fibrolux GmbH, Lionweld Kennedy, Eurograte, Locker Group Ltd, Exel Composites |

Market Definition

Fiberglass reinforced plastic (FRP) grating is a composite material manufactured by combining a matrix of resin and fibreglass. Fiberglass reinforced plastic (FRP) grating offers properties such as corrosion resistance, high strength to weight ratio. UV resistance, Minimal thermal expansion, low electrical and thermal conductivity and anti-skid surface. FRP grating are considered as highly durable in the harshest environment, high load-bearing capacity, easy to install and low cost maintenance. The driving factors behind growth of the market is providing safer alternative to steel.

Europe Molded Fibreglass Reinforced Plastic (FRP) Grating Market Dynamics

Drivers

- Increasing the investments in the infrastructure sector

FRP grating offers corrosion resistance, high strength to weight ratio, UV resistance, Minimal thermal expansion, low electrical and thermal conductivity, and anti-skid surface. These properties are expected to fuel the demand for the FRP grating across various end-use, including infrastructure sectors such as building and construction.

Demand for FRP grating is rising across the infrastructure sector is due to FRP gratings' low life cycle cost. Growing awareness regarding the advantages of FRP grating over conventional gratings. FRP offers an optimal strength to weight ratio alongside superior durability and affordability. FRP is composed of a protective polymer reinforced with high strength fibreglass. These materials together create a premium composite with many potential construction applications. FRP outperforms wood and concrete for bridges, pedestrian pathways, and other structures, while holding up the decades of wear and tear. Moreover, extremely versatile by nature, FRP is easily available, easy to install, and maintenance–free fabrications, making them ideal for infrastructure sector. All the aforementioned characteristics and advantages make FRP gratings the smartest choice for infrastructure projects adding to the growth of the molded fibreglass reinforced plastic (FRP) grating market.

- Providing a safer alternative to steel

FRP (Fibreglass Reinforced Plastic) is considered 70% lighter than steel with exceptional strength – to weight ratio. FRP is non-conductive and slip resistant, considered a safer alternative to steel. The glass fibre provides strength and stiffness, and the resin provides shape and protects the fibres. FRP composites have greater flexural strength, and pound – for pound is often stronger than steel and aluminum in the lengthwise direction. FRP reinforcement can have more than double the tensile strength of steel. FRP products are non-conductive and have a higher friction factor than steel, reducing the risk of electrical shocks and injuries caused by slips. Therefore becoming the clear choice for safer structural products. Moreover, stiffness and strength to weight ratio are important parameters when selecting the right material for building and infrastructure work. FRP strength to weight ratio is superior to steel, making it the right and smart choice. This can drive the market to growth in the forecasting period.

Opportunities

- Increase in application and advancement in aerospace, automotive, construction, rail and container transport

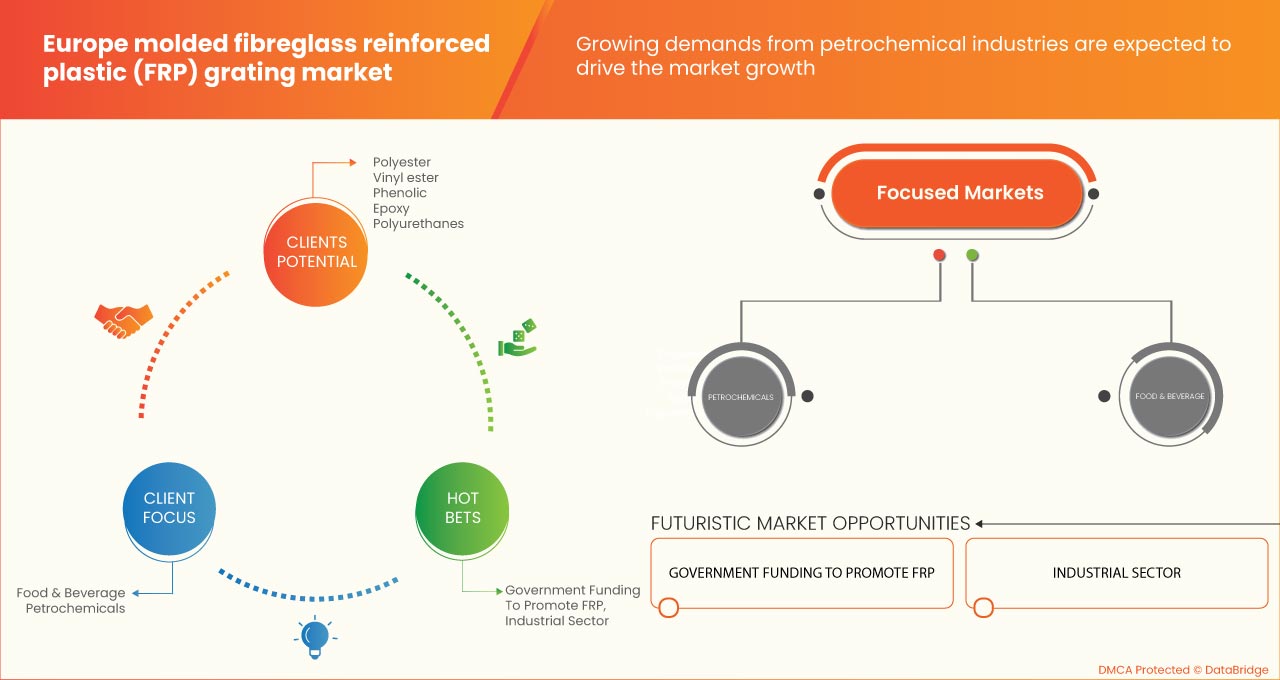

Fibreglass reinforced plastic (FRP) belongs to the category of composite materials, which comprise polymer matrix and other supporting fibrous materials. The materials are usually hard thermoset resin and resist chemical or abrasive damage. Due to these properties, FRP has huge opportunities in the following industries: aerospace, automotive, the construction field, and marine infrastructure. In the Aerospace industry, Carbon fibres in FRPs reduce the weight by 25% but ensure equal or greater strength than aluminum sheets. They also offer tensile strength and are more tolerant to harsh environments and extreme temperatures, which is crucial for aerospace industries. In the automotive industry a high strength-to-weight ratio is the Holy Grail for the automotive industry. This will help in reducing the weight and saving cost consumption of fuel, and with its lightweight properties, it will also help in increasing speed. In the construction industry, FRP is used to fortify existing structures (such as slabs, columns, or beams) to enhance their load-bearing capacity or to repair damage. This is extremely cost-effective and useful when it comes to equipping older structures. FRP is also used to manufacture highway structures like guardrails, signboards, drainage system and bridge decks, auto skyways, utility poles pipelines, oils, and gas and sewage. It is also used to build prefabricated houses, household furniture, appliances, swimming pools, and bathroom equipment. Hence, there is a huge opportunity for the company to grow in the market in the forecast period with the opportunity in various manufacturing industries like aerospace, automotive, marine, and construction industries.

Restraint/Challenge

- Difficulties in the reuse or recycling of FRP grating product

Molded fibreglass reinforced plastic grating is produced using resin, glass fibre, and other auxiliary materials as raw materials. Most FRP gratings have a long term service life of up to several years and are intended for going through many harsh conditions. Despite a wide preference and benefits of FRP grating, significant issues associated reuse or recyclability of the product is present in molded FRP grating market. Recycling means energy must be expended to convert waste into something valuable. In this scenario, molded FRP and almost all other products have no value for recycling or reusing. Existing methods for recycling these products are either too much costly or not as per the industry standards. The available process of recycling FRP grates includes three major types: physical recycling, energy recycling, and chemical recycling. All of these are very costly methods for application. Moreover, not having proper recycling methodologies available in the market makes the molded FRP grating market face challenges from regulatory bodies due to increasing awareness of sustainability goals. In addition, the non-availability of proper applications to commercialized products is expected to lead to a significant drop in sales for molded FRP grating products and acts as a bottleneck in the growth of the Europe molded fibreglass reinforced plastic (FRP) grating market.

Recent Developments

- In February 2022, Fibrolux GmbH announced about their new products. In this announcement they mentioned that all Glass reinforced plastic products and carbon rods will be available as ground rods. This will based on as per consumer requirement. This will help them to make larger product portfolio and may attract new consumer base.

- In April 2019, Eurograte celebrated ticomm and promaco forty years in business. This partnership laids down the professionalism, investments and passion as the foundation of the group and team.

Europe Molded Fibreglass Reinforced Plastic (FRP) Grating Market Scope

Europe molded fibreglass reinforced plastic (FRP) grating market is categorized based on type, product type, grafting height, application and merchant. The growth amongst these segments will help you analyse major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Polyester

- Vinyl Ester

- Phenolic

- Epoxy

- Polyurethanes

- Others

Based on type, the Europe molded fibreglass reinforced plastic (FRP) grating market is classified into polyester, vinyl ester, phenolic, epoxy, polyurethanes and others.

Product Type

- Angles

- Squares

- Flat Strips

- I Beams

- U Channel

- Round Tube

- Wide Flange Beams

- Trench Covers

- Solid Rods

- Fluted/Ladder Rung

- Kick Plate/Toe Plate

- Others

Based on product type, the Europe molded fibreglass reinforced plastic (FRP) grating market is classified into angles, squares, flat strips, I beams, U channel, round tube, wide flange beams, trench covers, solid rods, fluted/ladder rung, kick plate/toe plate and others.

Grafting Height

- 10-30 Mm

- 31-50 Mm

- Above 50 Mm

Based on the grafting height, the Europe molded fibreglass reinforced plastic (FRP) grating market is classified into 10-30 mm, 31-50 mm and above 50mm.

Application

- Stair Trends

- Walkaways

- Platforms

- Docks

- Hand Rails

- Walls

- Others

Based on the application, the Europe molded fibreglass reinforced plastic (FRP) grating market is classified into stair trends, walkaways, platforms, docks, hand rails, walls and others.

End-User

- Petrochemicals

- Pulp And Paper

- Building And Construction

- Food And Beverages

- Mining

- Pharmaceutical

- Oil And Gas

- Electrical And Electronics

- Water Management

- Marine

- Defense

- Sports And Leisure

- Others

Based on the end-user, the Europe molded fibreglass reinforced plastic (FRP) grating market is classified into petrochemicals, pulp and paper, building and construction, food and beverages, mining, pharmaceutical, oil and gas, electrical and electronics, water management, marine, defense, sports and leisure and others.

Europe Molded Fibreglass Reinforced Plastic (FRP) Grating Market Regional Analysis/Insights

The Europe molded fibreglass reinforced plastic (FRP) grating market is segmented on the basis of type, product type, grafting height, application and merchant.

The countries in the Europe molded fibreglass reinforced plastic (FRP) grating market are the Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, Denmark, Sweden, Poland, Norway, Finland and Rest of Europe. Germany is dominating the Europe molded fibreglass reinforced plastic (FRP) grating market in terms of market share and market revenue because of the rising application of FRP grating market across pharmaceutical, water treatment industry in the region.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Molded Fibreglass Reinforced Plastic (FRP) Grating Market Share Analysis

Europe molded fibreglass reinforced plastic (FRP) grating market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, patents, product width and breadth, application dominance, product lifeline curve. The above data points provided are only related to the companies’ focus related to the Europe molded fibreglass reinforced plastic (FRP) grating market.

Some of the prominent participants operating in the Europe molded fibreglass reinforced plastic (FRP) grating market are Fibergrate Composite Structures, TECHNO COMPOSITES, Fibrolux GmbH, Lionweld Kennedy, Eurograte, Locker Group Ltd and Exel Composites among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE MOLDED FIBRE REINFORCED PLASTIC (FRP) GRATING MARKET

1.4 LIMITATIONS

1.5 MARKET COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET PRODUCT LIFE LINE CURVE

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 DBMR VENDOR SHARE ANALYSIS

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 OVERVIEW

4.4.2 LOGISTIC COST SCENARIO

4.4.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.6 VENDOR SELECTION CRITERIA

5 REGULATIONS

6 PRICE INDEX

7 IMPORT EXPORT SCENARIO

8 REGIONAL SUMMARY

8.1 EUROPE

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT'S ROLE

9.4 ANALYST RECOMMENDATION

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 INCREASING THE INVESTMENTS IN THE INFRASTRUCTURE SECTOR

10.1.2 PROVIDING A SAFER ALTERNATIVE TO STEEL

10.1.3 FRP GRATINGS ARE HIGHLY CORROSION RESISTANT AND FIRE RETARDANT.

10.2 RESTRAINT

10.2.1 DIFFICULTIES IN THE REUSE OR RECYCLING OF FRP GRATING PRODUCT

10.3 OPPORTUNITIES

10.3.1 INCREASE IN APPLICATION AND ADVANCEMENT IN AEROSPACE, AUTOMOTIVE, CONSTRUCTION, RAIL, AND CONTAINER TRANSPORT

10.3.2 GOVERNMENT FUNDING TO PROMOTE THE PRODUCTION AND USE OF FRP (FIBREGLASS REINFORCED PLASTIC)

10.4 CHALLENGES

10.4.1 COMPETITIVE SCENARIO WITH THE TRADITIONAL STEEL AND ALUMINIUM

10.4.2 LACK OF AWARENESS OF FIBREGLASS REINFORCED PLASTIC

11 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE

11.1 OVERVIEW

11.2 POLYESTER

11.3 VINYL ESTER

11.4 EPOXY

11.5 PHENOLIC

11.6 POLYURETHANES

11.7 OTHERS

12 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 TRENCH COVERS

12.3 ANGLES

12.4 SQUARES

12.5 FLAT STRIPS

12.6 I BEAMS

12.7 U CHANNEL

12.8 ROUND TUBE

12.9 WIDE FLANGE BEAMS

12.1 SOLID RODS

12.11 FLUTED/LADDER RING

12.12 KICK PLATE/TOE PLATE

12.13 OTHERS

13 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT

13.1 OVERVIEW

13.2 31-50 MM

13.3 10-30 MM

13.4 ABOVE 50 MM

14 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 PLATFORMS

14.3 WALKAWAYS

14.4 DOCKS

14.5 STAIR TRENDS

14.6 HAND RAILS

14.7 WALLS

14.8 OTHERS

15 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER

15.1 OVERVIEW

15.2 PETROCHEMICALS

15.3 PULP AND PAPER

15.4 FOOD AND BEVERAGES

15.5 OIL AND GAS

15.6 MINING

15.7 PHARMACEUTICAL

15.8 ELECTRICAL AND ELECTRONICS

15.9 WATER MANAGEMENT

15.1 BUILDING AND CONSTRUCTION

15.11 MARINE

15.12 DEFENSE

15.13 SPORTS AND LEISURE

15.14 OTHERS

16 EUROPE MOLDED FIBERGLASS REINFORCED PLASTIC (FRP) MARKET, BY COUNTRY

16.1 GERMANY

16.2 SPAIN

16.3 ITALY

16.4 U.K.

16.5 FRANCE

16.6 FRANCE

16.7 BELGIUM

16.8 TURKEY

16.9 DENMARK

16.1 SWITZERLAND

16.11 SWEDEN

16.12 NETHERLANDS

16.13 POLAND

16.14 NORWAY

16.15 FINLAND

16.16 REST OF EUROPE

17 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: EUROPE

17.2 ANNOUNCEMENT

17.3 EXHIBITION

17.4 NEW LAUNCHES

17.5 PARTNERSHIP

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 EXEL COMPOSITES

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 SWOT

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT UPDATES

19.2 LIONWELD KENNEDY

19.2.1 COMPANY SNAPSHOT

19.2.2 PRODUCT PORTFOLIO

19.2.3 SWOT

19.2.4 RECENT UPDATES

19.3 LOCKER GROUP LTD

19.3.1 COMPANY SNAPSHOT

19.3.2 PRODUCT PORTFOLIO

19.3.4 RECENT UPDATE

19.4 EUROGRATE

19.4.1 COMPANY SNAPSHOT

19.4.2 PRODUCT PORTFOLIO

19.4.3 SWOT

19.4.4 RECENT UPDATE

19.5 FIBROLUX GMBH

19.5.1 COMPANY SNAPSHOT

19.5.2 PRODUCT PORTFOLIO

19.5.3 SWOT

19.5.4 RECENT UPDATE

19.6 FIBERGRATE COMPOSITE STRUCTURES

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.4 RECENT UPDATES

19.7 TECHNO COMPOSITES

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 SWOT

19.7.4 RECENT UPDATE

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY COUNTRY, 2021-2030 (PRICE/SQUARE METER)

TABLE 3 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 6 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 7 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 8 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 9 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY COUNTRY, 2021-2030 (THOUSAND SQUARE METER)

TABLE 10 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY COUNTRY, 2021-2030 (PRICE/SQUARE METER)

TABLE 11 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 12 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 13 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 14 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 16 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 17 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 18 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 19 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 20 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 21 GERMANY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 22 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 24 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 25 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 27 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 28 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 29 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 30 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 31 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 32 SPAIN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 33 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 35 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 36 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 38 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 39 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 40 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 41 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 42 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 43 ITALY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 44 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 46 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 47 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 49 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 50 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 51 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 52 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 53 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 54 U.K. MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 55 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 57 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 58 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 60 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 61 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 62 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 63 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 64 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 65 FRANCE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 66 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 68 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 69 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 71 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 72 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 73 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 74 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 75 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 76 RUSSIA MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 77 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 79 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 80 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 82 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 83 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 84 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 85 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 86 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 87 BELGIUM MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 88 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 90 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 91 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 93 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 94 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 95 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 96 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 97 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 98 TURKEY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 99 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 101 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 102 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 104 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 105 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 106 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 107 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 108 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 109 DENMARK MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 110 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 112 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 113 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 115 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 116 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 117 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 118 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 119 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 120 SWITZERLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 121 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 123 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 124 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 126 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 127 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 128 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 129 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 130 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 131 SWEDEN MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 132 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 133 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 134 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 135 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 137 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 138 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 139 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 140 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 141 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 142 NETHERLANDS MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 143 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 145 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 146 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 148 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 149 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 150 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 151 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 152 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 153 POLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 154 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 155 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 156 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 157 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 158 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 159 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 160 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 161 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 162 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 163 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 164 NORWAY MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 165 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 166 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 167 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

TABLE 168 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 169 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 170 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (USD THOUSAND)

TABLE 171 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY GRAFTING HEIGHT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 172 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 173 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY APPLICATION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 174 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 175 FINLAND MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY END-USER, 2021-2030 (THOUSAND SQUARE METER)

TABLE 176 REST OF EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 177 REST OF EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 178 REST OF EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET, BY TYPE, 2021-2030 (PRICE/SQUARE METER)

List of Figure

FIGURE 1 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC(FRP) GRATING MARKET-

FIGURE 2 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: THE MATERIAL LIFE LINE CURVE

FIGURE 7 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: MULTIVARIATE MODELLING

FIGURE 8 PRODUCT LIFE LINE CURVE

FIGURE 9 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: DBMR MARKET POSITION GRID

FIGURE 11 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 13 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: VENDOR SHARE ANALYSIS

FIGURE 14 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: SEGMENTATION

FIGURE 15 BEING A SAFER ALTERNATIVE TO STEEL IS EXPECTED TO DRIVE EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET IN THE FORECAST PERIOD

FIGURE 16 POLYESTER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET IN 2022 & 2030

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET

FIGURE 19 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY TYPE, 2022

FIGURE 20 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY PRODUCT TYPE, 2022

FIGURE 21 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY GRATFTSING HEIGHT, 2022

FIGURE 22 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY APPLICATION, 2022

FIGURE 23 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET : BY END-USER, 2022

FIGURE 24 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) MARKET: SNAPSHOT (2022)

FIGURE 25 EUROPE MOLDED FIBERGLASS REINFORCED PLASTIC (FRP) MARKET: BY COUNTRY (2022)

FIGURE 26 EUROPE MOLDED FIBERGLASS REINFORCED PLASTIC (FRP) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 27 EUROPE MOLDED FIBERGLASS REINFORCED PLASTIC (FRP)E MARKET: BY COUNTRY (2022 & 2030)

FIGURE 28 EUROPE MOLDED FIBERGLASS REINFORCED PLASTIC (FRP) MARKET: BY TYPE (2023-2030)

FIGURE 29 EUROPE MOLDED FIBREGLASS REINFORCED PLASTIC (FRP) GRATING MARKET: COMPANY SHARE 2022 (%)

Europe Molded Frp Grating Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Molded Frp Grating Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Molded Frp Grating Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.