Europe Molded Plastics Market

Market Size in USD Million

CAGR :

%

USD

832.07 Million

USD

1,248.21 Million

2024

2032

USD

832.07 Million

USD

1,248.21 Million

2024

2032

| 2025 –2032 | |

| USD 832.07 Million | |

| USD 1,248.21 Million | |

|

|

|

|

Europe Molded Plastics Market Size

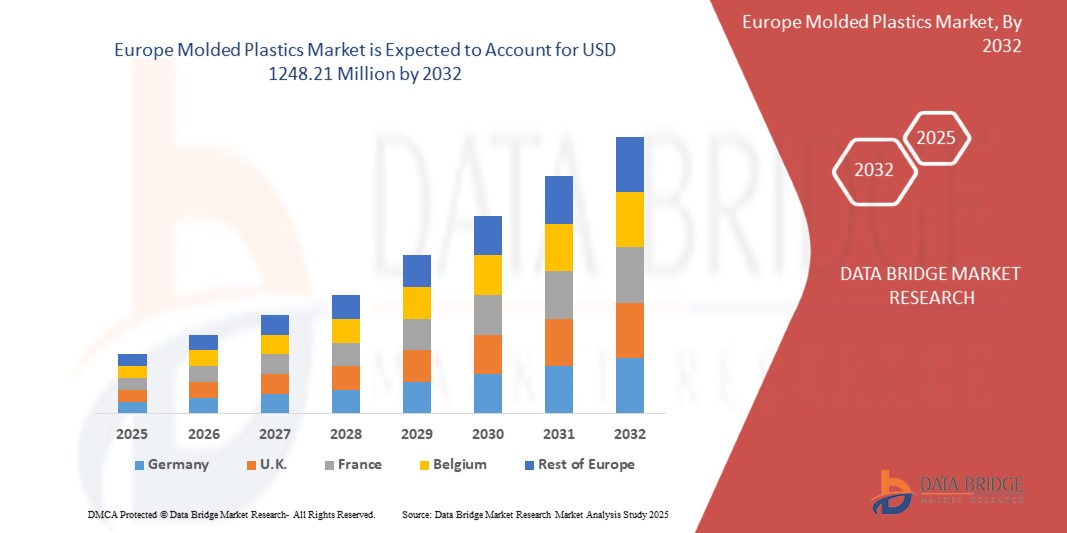

- The Europe molded plastics market size was valued at USD 832.07 million in 2024 and is expected to reach USD 1248.21 million by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fuelled by the increasing demand across industries such as automotive, packaging, construction, and healthcare, along with advancements in molding technologies and materials that enhance design flexibility and cost efficiency

- The rising adoption of bio-based and recyclable plastic materials across Europe, in response to environmental regulations and sustainability goals, is expected to further accelerate market expansion over the coming years

Europe Molded Plastics Market Analysis

- The market in Europe is witnessing steady growth due to the rising use of lightweight and durable plastic components in automotive manufacturing aimed at improving fuel efficiency and reducing emissions

- Packaging remains one of the dominant application sectors, supported by the food and beverage industry's demand for high-barrier, tamper-proof, and customizable plastic packaging

- Germany dominates the molded plastics market in Europe, driven by its strong manufacturing ecosystem, advanced technological infrastructure, and the extensive use of molded plastics across key sectors such as automotive, electricals, and construction

- U.K. is expected to witness the highest compound annual growth rate (CAGR) in the Europe molded plastics market due to rising investments in construction and renovation projects, increasing demand for lightweight materials in automotive and electronics applications, and government initiatives promoting green building materials and plastic waste reduction

- The polyethylene segment dominated the market with the largest revenue share in 2024, driven by its widespread use in packaging, construction, and consumer goods due to its flexibility, moisture resistance, and durability. PE’s ability to be molded into various shapes while maintaining strength and resilience has made it a preferred choice for manufacturers across diverse industries. The growing demand for sustainable alternatives and lightweight materials in packaging has further increased its adoption

Report Scope and Europe Molded Plastics Market Segmentation

|

Attributes |

Europe Molded Plastics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Molded Plastics Market Trends

“Growing Shift Toward Sustainable and Bio-Based Plastics”

- The molded plastics industry in Europe is undergoing a shift toward sustainable and bio-based materials due to increasing environmental awareness and regulatory pressure

- Governments across the region, particularly in Germany and France, are supporting the adoption of biodegradable molded plastics in packaging and automotive applications

- Consumers are demanding environmentally responsible products, prompting brands to invest in recyclable and compostable molded plastic components

- Innovation in green polymers and bioplastics is accelerating, with companies seeking cost-effective, eco-friendly alternatives to traditional plastic

- For instance, BASF launched a portfolio of bio-based polymers aimed at replacing petroleum-based molded plastics in consumer goods and automotive parts

Europe Molded Plastics Market Dynamics

Driver

“High Demand from Automotive and Packaging Industries”

- The automotive sector in Europe relies heavily on molded plastics due to their lightweight and fuel-efficiency benefits

- Molded plastic components are widely used in interiors, bumpers, and dashboards to reduce vehicle weight and meet emission regulations

- The packaging industry uses molded plastics to ensure product protection, improve shelf appeal, and meet hygiene standards, especially in the food and pharmaceutical sectors

- Increased e-commerce activity has intensified the need for molded plastic packaging that offers durability, customization, and cost-efficiency

- For instance, Volkswagen incorporates molded plastic modules in its electric vehicles to enhance design flexibility and reduce overall weight

Restraint/Challenge

“Environmental Concerns and Stringent Regulations”

- Regulatory bodies such as the European Commission have imposed strict restrictions on single-use and non-recyclable molded plastics to reduce environmental impact

- Adhering to evolving sustainability standards increases operational and compliance costs for manufacturers, especially small- and mid-sized enterprises

- Consumer backlash against plastic waste is influencing retailers and product manufacturers to shift toward biodegradable alternatives

- Transitioning to circular economy practices requires substantial investments in R&D, infrastructure, and raw material sourcing

- For instance, the EU’s Single-Use Plastics Directive, enforced since 2021, has reduced the use of conventional molded plastic products in disposable consumer goods across Europe

Europe Molded Plastics Market Scope

The market is segmented on the basis of product type, technology, distribution channel, and end-user.

• By Product Type

On the basis of product type, the Europe molded plastics market is segmented into polypropylene (PP), polyvinyl chloride (PVC), polyethylene (PE), polyurethane (PU), polyamide (nylon), polystyrene (PS), polyethylene terephthalate (PET), polycarbonate (PC), and others. The polyethylene segment dominated the market with the largest revenue share in 2024, driven by its widespread use in packaging, construction, and consumer goods due to its flexibility, moisture resistance, and durability. PE’s ability to be molded into various shapes while maintaining strength and resilience has made it a preferred choice for manufacturers across diverse industries. The growing demand for sustainable alternatives and lightweight materials in packaging has further increased its adoption.

The polypropylene segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by its superior chemical resistance and excellent versatility. Its increasing utilization in automotive parts, textiles, and reusable containers is supporting segment growth. In addition, PP’s ability to withstand high temperatures and mechanical stress makes it a material of choice in both industrial and household applications.

• By Technology

On the basis of technology, the market is segmented into injection molding, extrusion molding, blow molding, rotational molding, thermoforming, and others. The injection molding segment held the largest market revenue share in 2024, attributed to its high production efficiency and precision in mass manufacturing. It is widely used in producing complex plastic components for automotive, electronics, and medical applications due to its ability to deliver consistent quality with minimal waste.

The blow molding segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand in the packaging industry, particularly for bottles and containers. Its cost-effectiveness in producing hollow parts and ability to meet customized volume requirements make it increasingly attractive for food, beverage, and personal care manufacturers.

• By Distribution Channel

On the basis of distribution channel, the Europe molded plastics market is segmented into direct sales/B2B, distributor/third party distribution, and others. The direct sales/B2B segment led the market in 2024, driven by long-term contracts between molded plastic manufacturers and end-use industries such as automotive and packaging. This channel allows for better control over pricing, logistics, and customer relationships, which is vital for businesses operating in regulated sectors.

The distributor/third party distribution segment is expected to witness the fastest growth rate from 2025 to 2032, due to its ability to cater to small and medium-scale buyers across different industries. These distributors offer warehousing, quick delivery, and regional market access, supporting the penetration of molded plastic components in remote and decentralized markets.

• By End-User

On the basis of end-user, the market is segmented into packaging, building construction, automotive and transportation, electronics and electricals, agriculture, sports equipment, medical, and others. The packaging segment held the largest revenue share in 2024, supported by the booming e-commerce and retail sectors, along with increasing demand for lightweight and cost-effective materials for product protection. Molded plastics offer a hygienic, tamper-resistant, and customizable solution for food and beverage, personal care, and pharmaceutical packaging.

The automotive and transportation segment is expected to witness the fastest growth rate from 2025 to 2032, owing to increasing adoption of lightweight plastic components to improve fuel efficiency and reduce carbon emissions. Molded plastics are being increasingly used for dashboards, bumpers, door panels, and interior trims, contributing to both design flexibility and overall vehicle performance.

Europe Molded Plastics Market Regional Analysis

- Germany dominates the molded plastics market in Europe, driven by its strong manufacturing ecosystem, advanced technological infrastructure, and the extensive use of molded plastics across key sectors such as automotive, electricals, and construction

- The country’s focus on high-performance, durable, and lightweight plastic materials supports innovation in end-use industries

- In addition, government initiatives promoting sustainable and recyclable plastic usage contribute significantly to market leadership

- With a well-established network of manufacturers and research institutions, Germany continues to lead in both production capacity and material innovation across the region

U.K. Molded Plastics Market Insight

The U.K. is projected to be the fastest-growing market for molded plastics in Europe during the forecast period, fuelled by rising investments in packaging, healthcare, and building materials. The shift toward sustainable packaging solutions, along with the growing demand for plastic components in electric vehicles and green construction, is accelerating growth. The U.K.’s commitment to recycling and circular economy practices, combined with advancements in plastic processing technologies, is further driving the rapid expansion of the molded plastics industry.

Europe Molded Plastics Market Share

The Europe Molded Plastics industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- INEOS (U.K.)

- Solvay (Belgium)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- LANXESS (Germany)

- Versalis S.p.A. (Italy)

- Indorama Ventures Europe B.V. (Netherlands)

- Repsol S.A. (Spain)

- Borealis AG (Austria)

- TotalEnergies SE (France)

Latest Developments in Europe Molded Plastics Market

- In March 2020, BASF SE announces the advancement of its extended polypropylene foam (EPP) Neopolen product line. The new Neopolen P 9235 + content provides improved surface characteristics, 20% deepening of color printing and an enhanced fabrication filling efficiency relative to existing grades. The new grade has chemicals and oil resistant, thermally insulated and with a low intake of water. The fragments of foam are accessible as packaging or loose stock

- In February 2020, SABIC introduces at MD&M West 2020 New LNP ELCRES CRX Pc copolymers that can withstand stress cracking in systems subjected to intense healthcare disinfectants our latest LNP ELCRES CRX copolymers give product manufacturers a simpler, drop-in solution to traditional resins that encounter difficulties in the face of constant cleaning with incredibly harsh disinfectants. With this launch, the company increases its market share and company revenue

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Molded Plastics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Molded Plastics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Molded Plastics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.