Europe Mycotoxin Binders Market

Market Size in USD Million

CAGR :

%

USD

78.96 Million

USD

147.24 Million

2024

2032

USD

78.96 Million

USD

147.24 Million

2024

2032

| 2025 –2032 | |

| USD 78.96 Million | |

| USD 147.24 Million | |

|

|

|

|

Mycotoxin Binders Market Size

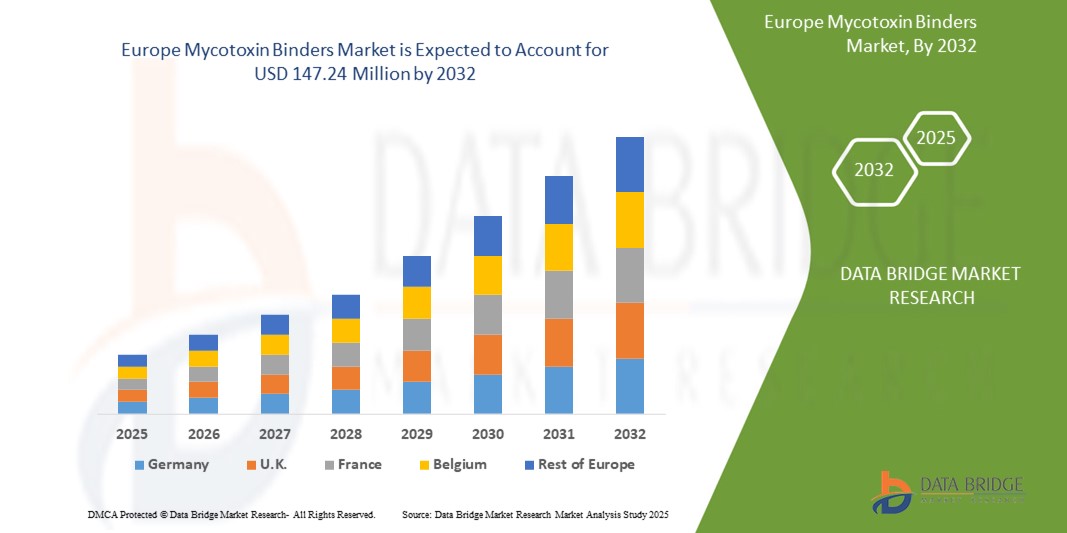

- The Europe mycotoxin binders market size was valued at USD 78.96 million in 2024 and is expected to reach USD 147.24 million by 2032, at a CAGR of 8.1% during the forecast period

- The market growth is largely fueled by the increasing incidence of mycotoxin contamination in animal feed and the resulting economic and health impact on livestock, prompting greater adoption of toxin management strategies across the global feed industry

- Furthermore, rising awareness of feed safety, tightening regulatory standards, and growing demand for high-performance livestock production are accelerating the integration of mycotoxin binders into commercial feed formulations, thereby significantly boosting the industry's growth

Mycotoxin Binders Market Analysis

- Mycotoxin binders, used to reduce the bioavailability of harmful mycotoxins in animal feed, are increasingly vital components in livestock nutrition strategies due to their role in maintaining animal health, improving feed efficiency, and minimizing economic losses associated with mycotoxicosis

- The escalating demand for mycotoxin binders is primarily fueled by the rising prevalence of mycotoxin contamination in animal feed, increasing global livestock production, and heightened regulatory pressure to ensure feed safety and quality standards across developed and developing markets

- Germany dominated the mycotoxin binders market in 2024, due to its advanced livestock sector, especially in swine and dairy production, where feed safety is strictly regulated

- France is expected to be the fastest growing region in the mycotoxin binders market with a share of during the forecast period due to the country’s expanding poultry and aquaculture sectors and the increased risk of mycotoxin exposure due to variable climatic conditions

- Cataract surgery segment dominated the market with a market share of 56.22% in 2024, due to

Report Scope and Mycotoxin Binders Market Segmentation

|

Attributes |

Mycotoxin Binders Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mycotoxin Binders Market Trends

“Advancement in Multifunctional Binder Technologies”

- A significant and growing trend in the mycotoxin binders market is the advancement in multifunctional binder technologies that go beyond simple adsorption, incorporating mechanisms such as biotransformation and colonization to neutralize a broader spectrum of mycotoxins

- For instance, TriSorb by Avitech Nutrition applies the ABC principle—Adsorption, Biotransformation, and Colonisation—to tackle multiple toxin types through physical binding, enzymatic degradation, and beneficial gut microflora support

- These innovations are driving demand among livestock producers seeking more comprehensive and efficient feed safety solutions, especially in regions with high multi-toxin prevalence. Products offering extended adsorption profiles and stability across varying pH levels are gaining preference for consistent performance

- New product development is also focused on combining inorganic and organic components, such as clay minerals with yeast cell wall extracts, to enhance efficacy without compromising gut health or nutrient absorption. Such hybrid solutions are being adopted in high-value sectors such as poultry, swine, and aquaculture

- As producers shift toward performance-based feed formulations, binder technologies that contribute to better immunity, improved gut integrity, and feed conversion ratios are becoming integral to animal nutrition strategies

- The growing preference for precision toxin management in response to stricter food safety regulations and residue monitoring is pushing companies to invest in research-driven, multifunctional binder innovations that ensure both safety and performance

Mycotoxin Binders Market Dynamics

Driver

“Rising Awareness of Mycotoxin Contamination”

- The increasing awareness among livestock producers, integrators, and feed manufacturers regarding the economic losses and health risks caused by mycotoxin contamination is a primary driver of market growth

- For instance, the widespread occurrence of aflatoxins and Fusarium toxins in feed crops across regions such as Asia-Pacific and Latin America has triggered preventive actions by commercial farms, accelerating binder demand

- Regulatory agencies such as the European Food Safety Authority (EFSA) and the U.S. FDA have set strict maximum permissible levels for mycotoxins, prompting proactive feed safety strategies through the use of binders

- Producers are recognizing the importance of consistent toxin control for optimal animal performance, especially in high-stress periods such as weaning and seasonal feed changes, where toxin presence can suppress immunity and productivity

- The integration of mycotoxin management as a routine part of feed formulation in commercial livestock operations is expected to sustain the growth momentum of the market across both developed and emerging economies

Restraint/Challenge

“Variability in Mycotoxin Types and Binder Efficacy”

- Concerns over the inconsistent efficacy of binders against different mycotoxin types and environmental conditions remain a critical challenge for the market. No single binder effectively neutralizes all mycotoxins under varying gut conditions

- For instance, while clay-based binders show high affinity for aflatoxins, their performance against less polar toxins such as zearalenone or fumonisins is often limited, necessitating the use of complex or multiple binder systems

- Variability in contamination levels due to regional climate shifts, crop storage issues, and raw material sourcing increases the unpredictability of toxin presence in feed, complicating binder selection. Performance is also affected by factors such as dosage, feed composition, and animal species, making it difficult for producers to adopt a one-size-fits-all approach

- These limitations raise the cost and complexity of formulation, as feed producers must balance efficacy, nutritional value, and economic viability while ensuring compliance with safety standards

- To overcome these challenges, companies are focusing on extensive in-vivo trials, development of multi-modal binders, and precision tools such as rapid diagnostic kits that help tailor binder use based on real-time toxin profiles in feed batches

Mycotoxin Binders Market Scope

The market is segmented on the basis of product type, nature, type of animal, and form.

• By Product Type

On the basis of product type, the mycotoxin binders market is segmented into adsorbents and denaturants. The adsorbents segment dominated the largest market revenue share in 2024, primarily due to their widespread use in livestock feed formulations for binding and removing mycotoxins from the gastrointestinal tract. These binders, particularly clay-based variants such as bentonite and zeolite, are cost-effective, easy to blend into feed, and exhibit high binding affinities for commonly occurring mycotoxins such as aflatoxins. Their non-nutritive and inert properties also make them safe for long-term consumption by animals, enhancing their adoption across regions with high contamination risks.

The denaturants segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for biological solutions that bind and also degrade or transform mycotoxins into non-toxic compounds. Denaturants, often enzyme-based or microbial, are gaining traction due to their ability to address a broader spectrum of mycotoxins and ensure more comprehensive detoxification. Their growth is further supported by increasing regulatory emphasis on animal health and the reduction of chemical residues in feed.

• By Nature

On the basis of nature, the mycotoxin binders market is categorized into organic and inorganic. The inorganic segment accounted for the largest revenue share in 2024, largely driven by the established use of mineral-based binders such as aluminosilicates and activated carbon, which are known for their high efficacy in binding polar mycotoxins. These compounds are favored in mass feed production due to their stability, availability, and lower cost, especially in regions with well-developed livestock industries.

The organic segment is expected to register the fastest CAGR from 2025 to 2032, supported by the growing preference for natural and environmentally friendly solutions in animal nutrition. Organic binders, which include yeast cell wall extracts and herbal additives, are increasingly accepted due to their multifunctional properties such as immune modulation and gut health improvement. This shift aligns with the trend toward sustainable and residue-free animal feed practices, especially in premium livestock farming.

• By Type of Animal

On the basis of animal type, the market is segmented into companion animals, livestock, and aquatic animals. The livestock segment held the largest market share of 71.9% in 2024, owing to the vast scale of feed consumption by poultry, cattle, and swine, which are particularly vulnerable to the effects of mycotoxins. High economic losses associated with livestock health degradation and productivity decline continue to drive significant demand for binders in this segment. Furthermore, regulatory mandates regarding mycotoxin levels in feed are stricter in livestock production, intensifying binder usage.

The aquatic animals segment is projected to grow at the fastest pace from 2025 to 2032 due to the increasing expansion of aquaculture and heightened awareness of feed safety in fish farming. Aquatic species are especially sensitive to mycotoxins, even at lower concentrations, making toxin mitigation critical. The development of water-stable binder formulations suitable for aquatic feed pellets is also accelerating product adoption in this segment.

• By Form

On the basis of form, the mycotoxin binders market is segmented into dry and liquid. The dry form segment commanded the largest share of the market in 2024, supported by its ease of handling, cost-effectiveness, and compatibility with bulk feed manufacturing processes. Dry binders such as powders and granules can be easily stored, transported, and uniformly mixed with a variety of feed types, making them a preferred choice across industrial-scale operations.

The liquid segment is projected to register the highest growth rate between 2025 and 2032, propelled by the demand for precise dosing and enhanced dispersion in specialized feed applications. Liquid binders are especially suitable for high-moisture feeds or liquid-based delivery systems in intensive farming environments. Their rising usage in companion animal feed and aqua nutrition, where consistency and bioavailability are critical, further contributes to segment expansion.

Mycotoxin Binders Market Regional Analysis

- Germany dominated the mycotoxin binders market with the largest revenue share in 2024, driven by its advanced livestock sector, especially in swine and dairy production, where feed safety is strictly regulated

- The country’s strong feed manufacturing infrastructure and adherence to EU mycotoxin thresholds have driven high adoption of both inorganic and organic binders among large-scale producers

- Ongoing investments in precision livestock farming and a well-established framework for animal health monitoring are further encouraging the consistent use of mycotoxin mitigation solutions in commercial feed

U.K. Mycotoxin Binders Market Insight

The U.K. mycotoxin binders market is expected to see stable growth from 2025 to 2032, driven by its emphasis on premium livestock products and increasing awareness of toxin-related risks in feed. The country’s dairy and poultry sectors are adopting integrated feed safety practices, including regular testing and binder supplementation, to comply with domestic and export quality standards. Growth is also supported by the rising demand for sustainable and residue-free animal nutrition solutions, especially among medium-sized farms and contract feed producers.

France Mycotoxin Binders Market Insight

France is projected to register the fastest CAGR in the Europe mycotoxin binders market during the forecast period of 2025 to 2032. This growth is fueled by the country’s expanding poultry and aquaculture sectors and the increased risk of mycotoxin exposure due to variable climatic conditions. French feed producers are actively investing in multi-functional binder solutions to meet strict EU safety regulations and maintain high levels of productivity. Government-backed initiatives to enhance feed traceability and support innovation in animal health are also contributing to accelerated market adoption.

Mycotoxin Binders Market Share

The mycotoxin binders industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- Zoetis (U.S.)

- Phibro Animal Health Corporation (U.S.)

- Bayer AG (Germany)

- BASF (Germany)

- Perstorp (Sweden)

- ADM (U.S.)

- Adisseo (France)

- Alltech (U.S.)

- Amlan International (U.S.)

- Anpario plc (U.K.)

- Brenntag Nordic Oy (Finland)

- Impextraco N.V. (Belgium)

- Kemin Industries, Inc. (U.S.)

- NOVUS INTERNATIONAL (U.S.)

- Olmix Group (France)

- Trouw Nutrition USA LLC (U.S.)

Latest Developments in Europe Mycotoxin Binders Market

- In April 2025, Clariant inaugurated a new feed additive production line at its Cileungsi facility in West Java, Indonesia. This expansion is set to strengthen the company’s presence in the mycotoxin binders market by enabling faster regional distribution, meeting rising demand from the livestock sector, and enhancing service responsiveness across Southeast Asia

- In April 2022, Clariant initially invested in its Cileungsi production facility, marking a strategic move to localize feed additive manufacturing. This investment laid the foundation for future capacity expansion and supported the company’s long-term goal of improving accessibility to mycotoxin management solutions within the growing regional animal nutrition industry

- In November 2021, Avitech Nutrition launched TriSorb, a premium mycotoxin binder formulated using the ABC principles of Adsorption, Biotransformation, and Colonisation. This innovative product introduced a comprehensive mechanism to neutralize a wide spectrum of mycotoxins, setting a new benchmark in the industry and driving demand for multifunctional binder technologies

- In January 2020, Biochem expanded its mycotoxin management portfolio with the launch of B.I.O.Tox Activ8. Engineered with activated substances and natural detoxifiers, the product improved Fusarium toxin control—particularly Deoxynivalenol (DON)—and reinforced the market trend toward advanced, health-oriented solutions that enhance animal performance and organ protection

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Mycotoxin Binders Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Mycotoxin Binders Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Mycotoxin Binders Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.