Europe Needles Market

Market Size in USD Million

CAGR :

%

USD

2,421.86 Million

USD

4,319.33 Million

2022

2030

USD

2,421.86 Million

USD

4,319.33 Million

2022

2030

| 2023 –2030 | |

| USD 2,421.86 Million | |

| USD 4,319.33 Million | |

|

|

|

Europe Needles Market Analysis and Size

The growing incidence rate of cancer is making way for the market's growth as immense surgeries, and treatment processes use different needles. Also, due to the incidence of diabetes, insulin requirement is on the rise, enhancing the market's growth rapidly. The use of needle-free injection technology is increasing by physicians and healthcare providers which is letting to more adoptuion of the same and in a way growing the market growth.

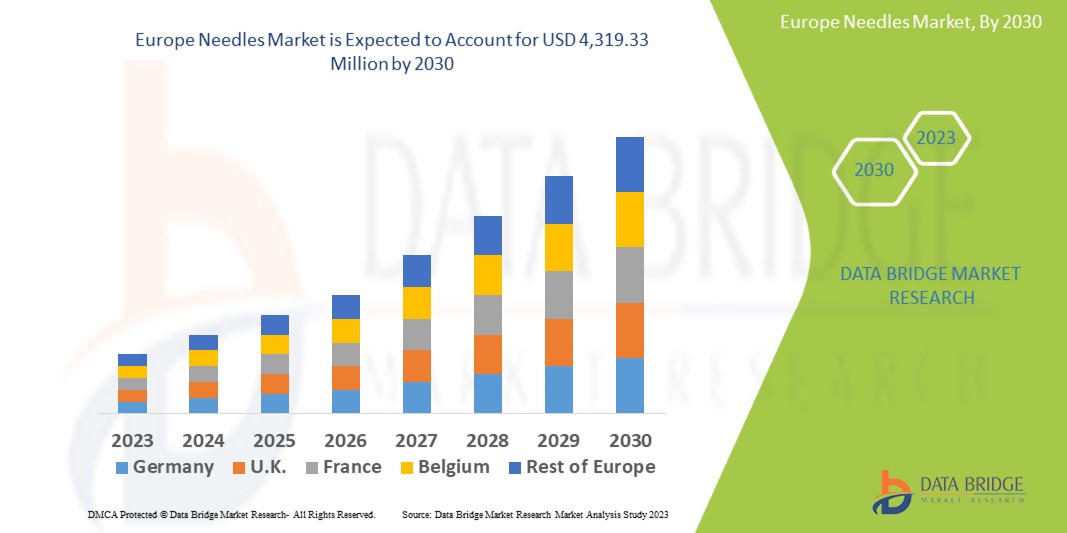

Data Bridge Market Research analyses a growth rate in the needles market in the forecast period 2023-2030. The expected CAGR of the needles market tends to be around 7.50% in the mentioned forecast period. The market is valued at USD 2,421.86 million in 2022 and will grow to USD 4,319.33 million by 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Europe Needles Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Conventional Needles and Safety Needles), Product Type (Suture Needles, Blood Collection Needles, Ophthalmic Needles, Dental Needles, Insufflation Needles, Pen Needles and Others), Material (Stainless Steel, Plastic Needles, Glass Needles and Peek Needles), Delivery Mode (Hypodermic Needles, Intravenous Needles, Intramuscular Needles and Intraperitoneal Needles), End User (Hospitals, Diagnostic Centers, Home Care and Others), Distribution Channel (Direct Tender and Retail Sales) |

|

Countries Covered |

Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe |

|

Market Players Covered |

Medtronic (Ireland), Ethicon U.S., LLC. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Novo Nordisk A/S (Denmark), B.D. (U.S.), Stryker (U.S.), Boston Scientific Corporation (U.S.), Luminex Corporation (U.S.), Illumina, Inc (U.S.), Bio-Rad Laboratories, Inc. (U.S.), QIAGEN (Netherlands), Abcam plc (U.K.), Merck KGaA (Germany), Promega Corporation (U.S.), Siemens (Germany), PerkinElmer, Inc. (U.S.) and Shimadzu Corporation (Japan) |

|

Market Opportunities |

|

Market Definition

Needles are the kind of injectable devices widely used with injections to offer medications to the body. They are also widely used to collect samples, inject numerous pharmaceutical drugs into the body, and are adjusted in syringes. The needles are of several types and sizes used widely for samples, injections, and sutures. They are used through two major routes hypodermic and intravenous. Some major types include safety needles, intravenous needles, and winged needles.

Europe Needles Market Dynamics

Drivers

- Increasing Prevalence of Diabetes

Around 60 million people have diabetes in the European Region; about 10.3% are men, and 9.6% are women aged 25 years and above. Approximately 1 in 11 adults has diabetes. Around 36% of people living with diabetes are undiagnosed. The diabetic population requires insulin for lowering and controlling blood sugar levels, which is generally administered with the help of a syringe. Therefore, the growing incidence of diabetes will likely increase the market's growth.

- Growing Rate of Product Approvals from Organizations

There has been an increasing rate of product approvals from authorized organizations that boost market growth. For instance, Takeda received the United States Food and Drug Administration (U.S. FDA) approval for the TAKHZYRO injection single-dose prefilled syringe (PFS) in 2022 to prevent attacks of hereditary angioedema (HAE). Thus, these kinds of product approvals enhance the demand for needles and are expected to help the market growth in the region.

Opportunities

- Growing Number of Immunization Programs

The increasing number of immunization programs, especially after the pandemic, the rising adoption of COVID-19 vaccination, and the wide availability of needles are estimated to play a main role in the market's growth. For instance, with the current large-scale vaccination programs in this region, needles are being used on a large scale in delivering vaccines. Thus, the production of syringes has increased rapidly. Thus, this factor boosts the growth of the market.

- Increasing Demand for Hypothermic Needles

The growing demand for hypothermic needles is accelerating market growth. A hypodermic needle is utilized for the quick delivery of liquids. It is also beneficial to deliver some medications that cannot be delivered orally because of vomiting. Hypodermic needles can be effective with a smaller diameter; hence, many patients prefer that as they have less vein damage and, consequently, lower amounts of pain. Thus, this factor increases the market growth.

Restraints/Challenges

- Complications Associated with Needle Stick Injuries

There have been rising complications associated with needle stick injuries that impede market growth. These injuries transmit infectious diseases, particularly blood-borne viruses. The different types include the Human Immunodeficiency Virus (HIV), which can cause AIDS (Acquired Immune Deficiency Syndrome), hepatitis B, and hepatitis C. Thus, this factor hinders the market growth.

This needles market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the needles market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In 2022, Roche diabetes care introduced ACCU-FINE pen needles for painless insulin delivery. The product assists in easier insulin delivery, thus leading to better diabetes management for people suffering from this disease

Europe Needles Market Scope

The needles market is segmented on the basis of type, product type, material, delivery mode, end users and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Conventional

- Safety

Product Type

- Suture

- Blood Collection

- Ophthalmic

- Dental

- Insufflation

- Pen

- Others

Material

- Stainless Steel

- Plastic Needles

- Glass Needles

- Peek Needles

Delivery Mode

- Hypodermic Needles

- Intravenous Needles

- Intramuscular Needles

- Intraperitoneal Needles

End User

- Hospitals

- Diagnostic Centers

- Home Care

- Others

Distribution Channel

- Direct Tender

- Retail Sales

Needles Market Regional Analysis/Insights

The needles market is analyzed and market size insights and trends are provided by type, product type, material, delivery mode, end users and distribution channel as referenced above.

The major countries covered in the needles market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe.

Germany is anticipated to grow with the highest CAGR in the forecast period because of growing cases of chronic diseases and various research activities. The growing sedentary lifestyle of people, and requirement of many injection medications, presence of the highest number of elderly and vulnerable populations are all leading to the growth of the market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Needles Market Share Analysis

The needles market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to needles market

Key players operating in the needles market include:

- Medtronic (Ireland)

- Ethicon U.S., LLC. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Novo Nordisk A/S (Denmark)

- B.D. (U.S.)

- Stryker (U.S.)

- Boston Scientific Corporation (U.S.)

- Luminex Corporation (U.S.)

- Illumina, Inc (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- QIAGEN (Netherlands)

- Abcam plc (U.K.)

- Merck KGaA (Germany)

- Promega Corporation (U.S.)

- Siemens (Germany)

- PerkinElmer, Inc. (U.S.)

- Shimadzu Corporation (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of EUROPE NEEDLES MARKET

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- MULTIVARIATE MODELLING

- TYPE LIFELINE CURVE

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- market END USER coverage grid

- vendor share analysis

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- Regional Summary, Europe Needles Market

- Europe

- EUROPE needles market: regulations

- REGULATION IN EUROPE FOR NEEDLES:

- MARKET OVERVIEW

- DRIVERS

- INCREASE IN THE INCIDENCE OF CHRONIC DISEASES, ESPECIALLY CANCER

- RISE IN GERIATRIC POPULATION

- GROWTH IN DEMAND FOR VACCINES

- UPSURGE IN THE NUMBER OF OPHTHALMIC DISORDERS

- RESTRAINTS

- USAGE OF NEEDLE-FREE INJECTION TECHNOLOGY

- COMPLICATIONS ASSOCIATED WITH NEEDLE STICK INJURIES

- OPPORTUNITIES

- RisE IN healthcare expenditure

- Strategic Initiatives by Key market players

- INCREASE IN RESEARCH AND DEVELOPMENT

- CHALLENGEs

- AVAILABILITY OF ALTERNATIVE DRUG DELIVERY METHODS

- stringent regulatory framework

- IMPACT OF COVID-19 ON THE EUROPE NEEDLES MARKET

- IMPACT ON PRICE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- STRATEGIC DECISIONS BY MANUFACTURERS

- CONCLUSION

- Europe needles market, By type

- overview

- conventional needles

- bevel needles

- blunt fill needles

- filter needles

- vented needles

- safety needles

- active needles

- passive needles

- Europe needles market, By PRODUCT type

- overview

- suture needles

- blood collection needles

- pen needles

- ophthalmic needles

- dental needles

- insufflation needles

- others

- Europe needles market, By MATERIAL

- overview

- stainless steel

- plastic NEEDLES

- glass needles

- peek needles

- Europe needles market, By delivery mode

- overview

- hypodermic needles

- intravenous needles

- intramuscular needles

- intraperitoneal needles

- Europe needles market, By end user

- overview

- hospitals

- BY TYPE

- PUBLIC

- PRIVATE

- BY SIZE

- LARGE

- MEDIUM

- SMALL

- diagnostic centers

- HOME CARE

- others

- Europe needles market, By distribution channel

- overview

- DIRECT TENDER

- retail sales

- EUROPE NEEDLES MARKET, BY COUNTRY

- Germany

- FRANCE

- U.K.

- italy

- spain

- Russia

- turkey

- Netherlands

- Belgium

- Switzerland

- REST of europe

- Europe NEEDLES MARKET, COMPANY landscape

- company share analysis: Europe

- Swot analysis

- company profiles

- BD.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Acquisition

- B. Braun Melsungen AG

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Thermo Fisher Scientific Inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Acquisition

- JOHNSON & JOHNSON SERVICES, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Acquisition

- MEDTRONIC

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- HTL-STREFA S.A.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- ALLISON MEDICAL, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- ARGON MEDICAL

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Acquisition

- boston scientific corporation

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Acquisition

- BPB medica – biopsybell

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- CONMED CORPORATION

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- HAMILTON COMPANY

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Expansion

- Novo Nordisk A/S

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Owen Mumford Limited

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Product Approval

- retractable technologies, inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- SMITHS MEDICAL

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Acquisition

- Smith+Nephew

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- PRODUCT LAUNCH

- sterylab s.r.l.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- TERUMO CORPORATION

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- PRODUCT UPDATE

- YPSOMED

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Expansion

- ZAMAR CARE.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- questionnaire

- related reports

List of Table

TABLE 1 Europe needles market, By type, 2019-2028 (USD million)

TABLE 2 Europe Conventional Needles in Needles Market, By TYPE, 2019-2028 (USD Million)

TABLE 3 Europe Safety Needles in Needles Market, By Type, 2019-2028 (USD Million)

TABLE 4 Europe needles market, By product type, 2019-2028 (USD million)

TABLE 5 Europe needles market, By material, 2019-2028 (USD million)

TABLE 6 Europe needles market, By delivery mode, 2019-2028 (USD million)

TABLE 7 Europe needles market, By end user, 2019-2028 (USD million)

TABLE 8 Europe HOSPITALs in needles market, By end user, 2019-2028 (USD million)

TABLE 9 Europe hospitals in needles market, By end user, 2019-2028 (USD million)

TABLE 10 Europe needles market, By distribution channel, 2019-2028 (USD million)

TABLE 11 EUROPE NEEDLES MARKET, By country, 2019-2028 (USD Million)

TABLE 12 Germany NEEDLES MARKET, BY Type, 2019-2028 (USD MILLION)

TABLE 13 Germany Conventional Needles in Needles Market, By Material, 2019-2028 (USD Million)

TABLE 14 Germany Safety Needles in Needles Market, By Type, 2019-2028 (USD Million)

TABLE 15 Germany Needles Market, By Product Type, 2019-2028 (USD Million)

TABLE 16 Germany Needles Market, By Material, 2019-2028 (USD Million)

TABLE 17 Germany Needles Market, By Delivery Mode, 2019-2028 (USD Million)

TABLE 18 Germany Needles Market, By End User, 2019-2028 (USD Million)

TABLE 19 Germany Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 20 Germany Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 21 Germany Needles Market, By Distribution CHannel, 2019-2028 (USD Million)

TABLE 22 France NEEDLES MARKET, BY Type, 2019-2028 (USD MILLION)

TABLE 23 France Conventional Needles in Needles Market, By Material, 2019-2028 (USD Million)

TABLE 24 France Safety Needles in Needles Market, By Type, 2019-2028 (USD Million)

TABLE 25 France Needles Market, By Product Type, 2019-2028 (USD Million)

TABLE 26 France Needles Market, By Material, 2019-2028 (USD Million)

TABLE 27 France Needles Market, By Delivery Mode, 2019-2028 (USD Million)

TABLE 28 France Needles Market, By End User, 2019-2028 (USD Million)

TABLE 29 France Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 30 France Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 31 France Needles Market, By Distribution CHannel, 2019-2028 (USD Million)

TABLE 32 U.K. NEEDLES MARKET, BY Type, 2019-2028 (USD MILLION)

TABLE 33 U.K. Conventional Needles in Needles Market, By Material, 2019-2028 (USD Million)

TABLE 34 U.K. Safety Needles in Needles Market, By Type, 2019-2028 (USD Million)

TABLE 35 U.K. Needles Market, By Product Type, 2019-2028 (USD Million)

TABLE 36 U.K. Needles Market, By Material, 2019-2028 (USD Million)

TABLE 37 U.K. Needles Market, By Delivery Mode, 2019-2028 (USD Million)

TABLE 38 U.K. Needles Market, By End User, 2019-2028 (USD Million)

TABLE 39 U.K. Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 40 U.K. Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 41 U.K. Needles Market, By Distribution CHannel, 2019-2028 (USD Million)

TABLE 42 Italy NEEDLES MARKET, BY Type, 2019-2028 (USD MILLION)

TABLE 43 Italy Conventional Needles in Needles Market, By Material, 2019-2028 (USD Million)

TABLE 44 Italy Safety Needles in Needles Market, By Type, 2019-2028 (USD Million)

TABLE 45 Italy Needles Market, By Product Type, 2019-2028 (USD Million)

TABLE 46 Italy Needles Market, By Material, 2019-2028 (USD Million)

TABLE 47 Italy Needles Market, By Delivery Mode, 2019-2028 (USD Million)

TABLE 48 Italy Needles Market, By End User, 2019-2028 (USD Million)

TABLE 49 Italy Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 50 Italy Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 51 Italy Needles Market, By Distribution CHannel, 2019-2028 (USD Million)

TABLE 52 Spain NEEDLES MARKET, BY Type, 2019-2028 (USD MILLION)

TABLE 53 Spain Conventional Needles in Needles Market, By Material, 2019-2028 (USD Million)

TABLE 54 Spain Safety Needles in Needles Market, By Type, 2019-2028 (USD Million)

TABLE 55 Spain Needles Market, By Product Type, 2019-2028 (USD Million)

TABLE 56 Spain Needles Market, By Material, 2019-2028 (USD Million)

TABLE 57 Spain Needles Market, By Delivery Mode, 2019-2028 (USD Million)

TABLE 58 Spain Needles Market, By End User, 2019-2028 (USD Million)

TABLE 59 Spain Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 60 Spain Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 61 Spain Needles Market, By Distribution CHannel, 2019-2028 (USD Million)

TABLE 62 Russia NEEDLES MARKET, BY Type, 2019-2028 (USD MILLION)

TABLE 63 Russia Conventional Needles in Needles Market, By Material, 2019-2028 (USD Million)

TABLE 64 Russia Safety Needles in Needles Market, By Type, 2019-2028 (USD Million)

TABLE 65 Russia Needles Market, By Product Type, 2019-2028 (USD Million)

TABLE 66 Russia Needles Market, By Material, 2019-2028 (USD Million)

TABLE 67 Russia Needles Market, By Delivery Mode, 2019-2028 (USD Million)

TABLE 68 Russia Needles Market, By End User, 2019-2028 (USD Million)

TABLE 69 Russia Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 70 Russia Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 71 Russia Needles Market, By Distribution CHannel, 2019-2028 (USD Million)

TABLE 72 Turkey NEEDLES MARKET, BY Type, 2019-2028 (USD MILLION)

TABLE 73 Turkey Conventional Needles in Needles Market, By Material, 2019-2028 (USD Million)

TABLE 74 Turkey Safety Needles in Needles Market, By Type, 2019-2028 (USD Million)

TABLE 75 Turkey Needles Market, By Product Type, 2019-2028 (USD Million)

TABLE 76 Turkey Needles Market, By Material, 2019-2028 (USD Million)

TABLE 77 Turkey Needles Market, By Delivery Mode, 2019-2028 (USD Million)

TABLE 78 Turkey Needles Market, By End User, 2019-2028 (USD Million)

TABLE 79 Turkey Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 80 Turkey Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 81 Turkey Needles Market, By Distribution CHannel, 2019-2028 (USD Million)

TABLE 82 Netherlands NEEDLES MARKET, BY Type, 2019-2028 (USD MILLION)

TABLE 83 Netherlands Conventional Needles in Needles Market, By Material, 2019-2028 (USD Million)

TABLE 84 Netherlands Safety Needles in Needles Market, By Type, 2019-2028 (USD Million)

TABLE 85 Netherlands Needles Market, By Product Type, 2019-2028 (USD Million)

TABLE 86 Netherlands Needles Market, By Material, 2019-2028 (USD Million)

TABLE 87 Netherlands Needles Market, By Delivery Mode, 2019-2028 (USD Million)

TABLE 88 Netherlands Needles Market, By End User, 2019-2028 (USD Million)

TABLE 89 Netherlands Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 90 Netherlands Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 91 Netherlands Needles Market, By Distribution CHannel, 2019-2028 (USD Million)

TABLE 92 Belgium NEEDLES MARKET, BY Type, 2019-2028 (USD MILLION)

TABLE 93 Belgium Conventional Needles in Needles Market, By Material, 2019-2028 (USD Million)

TABLE 94 Belgium Safety Needles in Needles Market, By Type, 2019-2028 (USD Million)

TABLE 95 Belgium Needles Market, By Product Type, 2019-2028 (USD Million)

TABLE 96 Belgium Needles Market, By Material, 2019-2028 (USD Million)

TABLE 97 Belgium Needles Market, By Delivery Mode, 2019-2028 (USD Million)

TABLE 98 Belgium Needles Market, By End User, 2019-2028 (USD Million)

TABLE 99 Belgium Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 100 Belgium Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 101 Belgium Needles Market, By Distribution CHannel, 2019-2028 (USD Million)

TABLE 102 Switzerland NEEDLES MARKET, BY Type, 2019-2028 (USD MILLION)

TABLE 103 Switzerland Conventional Needles in Needles Market, By Material, 2019-2028 (USD Million)

TABLE 104 Switzerland Safety Needles in Needles Market, By Type, 2019-2028 (USD Million)

TABLE 105 Switzerland Needles Market, By Product Type, 2019-2028 (USD Million)

TABLE 106 Switzerland Needles Market, By Material, 2019-2028 (USD Million)

TABLE 107 Switzerland Needles Market, By Delivery Mode, 2019-2028 (USD Million)

TABLE 108 Switzerland Needles Market, By End User, 2019-2028 (USD Million)

TABLE 109 Switzerland Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 110 Switzerland Hospitals in Needles Market, By End User, 2019-2028 (USD Million)

TABLE 111 Switzerland Needles Market, By Distribution CHannel, 2019-2028 (USD Million)

TABLE 112 rest of europe NEEDLES MARKET, BY Type, 2019-2028 (USD MILLION)

List of Figure

FIGURE 1 EUROPE needles MARKET: segmentation

FIGURE 2 EUROPE NEEDLES MARKET: data triangulation

FIGURE 3 EUROPE NEEDLES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE NEEDLES MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE NEEDLES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE NEEDLES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE NEEDLES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE NEEDLES MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 EUROPE NEEDLES MARKET: vendor share analysis

FIGURE 10 EUROPE NEEDLES MARKET: SEGMENTATION

FIGURE 11 THE rising incidence of chronic diseases especially cancer is expected to drive THE EUROPE NEEDLES MARKET IN THE FORECAST PERIOD of 2021 to 2028

FIGURE 12 conventional needles segment is expected to account for the largest share of the EUROPE NEEDLES MARKET in 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE NEEDLES MARKET

FIGURE 14 Number of new cancer cases for all age groups in 2018 (in %)

FIGURE 15 rate of deaths in European region (in %)

FIGURE 16 EUROPE AGEING POPULATION, BY COUNTRY (IN MILLION) (2017 & 2050)

FIGURE 17 Europe needles market: By type, 2020

FIGURE 18 Europe needles market: By type, 2021-2028 (USD million)

FIGURE 19 Europe needles market: By type, CAGR (2021-2028)

FIGURE 20 Europe needles market: By type, LIFELINE CURVE

FIGURE 21 Europe needles market: By PRODUCT TYPE, 2020

FIGURE 22 Europe needles market: By PRODUCT TYPE, 2021-2028 (USD million)

FIGURE 23 Europe needles market: By PRODUCT TYPE, CAGR (2021-2028)

FIGURE 24 Europe needles market: By PRODUCT TYPE, LIFELINE CURVE

FIGURE 25 Europe needles market: By material, 2020

FIGURE 26 Europe needles market: By material, 2021-2028 (USD million)

FIGURE 27 Europe needles market: By material, CAGR (2021-2028)

FIGURE 28 Europe needles market: By material, LIFELINE CURVE

FIGURE 29 Europe needles market: By delivery mode, 2020

FIGURE 30 Europe needles market: By delivery mode, 2021-2028 (USD million)

FIGURE 31 Europe needles market: By delivery mode, CAGR (2021-2028)

FIGURE 32 Europe needles market: By delivery mode, LIFELINE CURVE

FIGURE 33 Europe needles market: By end user, 2020

FIGURE 34 Europe needles market: By end user, 2021-2028 (USD million)

FIGURE 35 Europe needles market: By end user, CAGR (2021-2028)

FIGURE 36 Europe needles market: By end user, LIFELINE CURVE

FIGURE 37 Europe needles market: By distribution channel, 2020

FIGURE 38 Europe needles market: By distribution channel, 2021-2028 (USD million)

FIGURE 39 Europe needles market: By distribution channel, CAGR (2021-2028)

FIGURE 40 Europe needles market: By distribution channel, LIFELINE CURVE

FIGURE 41 EUROPE NEEDLES MARKET: SNAPSHOT (2020)

FIGURE 42 EUROPE NEEDLES MARKET: BY COUNTRY (2020)

FIGURE 43 EUROPE NEEDLES MARKET: BY COUNTRY (2021 & 2028)

FIGURE 44 EUROPE NEEDLES MARKET: BY COUNTRY (2020 & 2028)

FIGURE 45 EUROPE NEEDLES MARKET: BY type (2021-2028)

FIGURE 46 Europe NEEDLES MARKET: company share 2020 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.