Europe Network Packet Broker Market

Market Size in USD Million

CAGR :

%

USD

565.14 Million

USD

935.31 Million

2024

2032

USD

565.14 Million

USD

935.31 Million

2024

2032

| 2025 –2032 | |

| USD 565.14 Million | |

| USD 935.31 Million | |

|

|

|

|

Europe Network Packet Broker Market Size

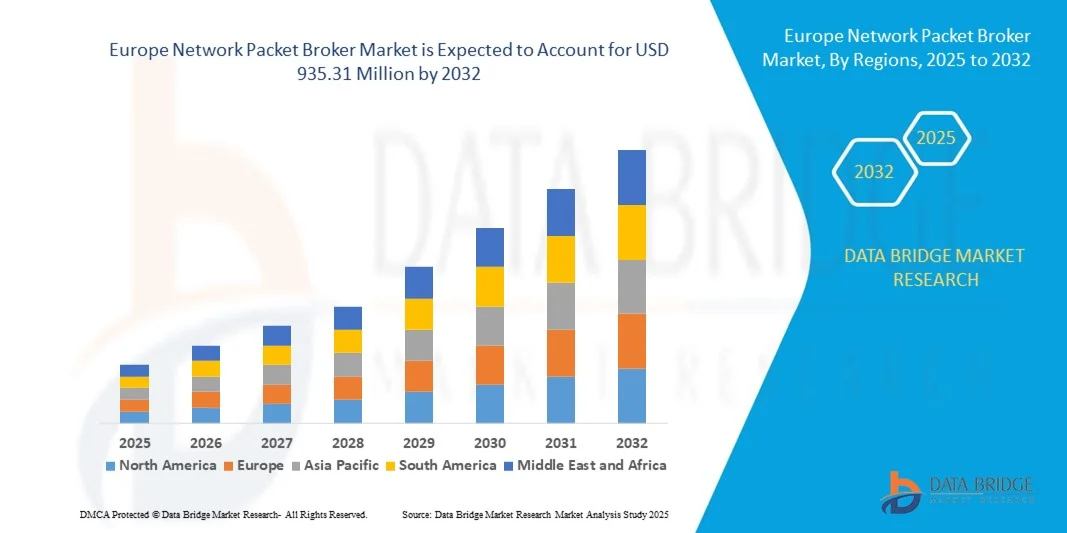

- The Europe Network Packet Broker Market size was valued at USD 565.14 million in 2024 and is projected to reach USD 935.31 million by 2032, growing at a CAGR of 6.50% during the forecast period.

- The regional market expansion is driven by increasing network complexity, rising cybersecurity threats, and the widespread adoption of cloud-based services across various industries.

- Additionally, growing demand for optimized network performance, real-time data monitoring, and regulatory compliance is pushing enterprises to invest in advanced network visibility tools, fueling the adoption of network packet brokers and supporting sustained market growth.

Europe Network Packet Broker Market Analysis

- Network Packet Brokers (NPBs), which aggregate, filter, and optimize network traffic for monitoring and security tools, are becoming critical infrastructure components in European enterprises due to the rising need for network visibility, cybersecurity, and performance optimization across complex IT environments.

- The surging demand for NPBs in Europe is primarily driven by increasing adoption of cloud computing, rapid digital transformation, and heightened awareness of data privacy and regulatory compliance such as GDPR.

- Germany dominated the Europe network packet broker market with the largest revenue share of 44.7% in 2024, supported by strong IT infrastructure, early implementation of advanced networking solutions, and high investments in cybersecurity, particularly in countries like Germany, the UK, and France.

- U.K. is expected to be the fastest growing region in the Europe NPB market during the forecast period due to ongoing digitalization efforts, expanding telecom networks, and growing demand for real-time network monitoring in emerging economies.

- The Passive segment dominated the market in 2024 with a revenue share of 58.4%, as it supports non-intrusive network monitoring, traffic analysis, and performance diagnostics.

Report Scope and Europe Network Packet Broker Market Segmentation

|

Attributes |

Network Packet Broker Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Network Packet Broker Market Trends

Enhanced Network Intelligence Through AI and Automation Integration

- A significant and rapidly evolving trend in the Europe Network Packet Broker Market is the integration of artificial intelligence (AI), machine learning (ML), and automation technologies to deliver smarter, more adaptive network traffic management and security capabilities. This shift is enhancing operational efficiency, reducing manual intervention, and enabling more dynamic and responsive network environments across industries.

- For Instance, AI-powered network packet brokers can automatically detect anomalies in traffic patterns, optimize data flow to monitoring tools, and prioritize critical network packets based on real-time analytics. Solutions such as Gigamon’s GigaSMART and Keysight’s Vision series increasingly leverage AI and ML to intelligently filter, deduplicate, and distribute packets for better network visibility.

- AI integration allows NPBs to identify potential threats earlier by analyzing behavioral patterns, improving intrusion detection systems, and enabling predictive threat intelligence. Automation features further allow for dynamic rule updates, traffic path adjustments, and policy enforcement without human intervention, reducing response time and operational overhead.

- Moreover, these intelligent NPBs integrate seamlessly with SIEM (Security Information and Event Management) platforms, cloud monitoring tools, and security orchestration platforms, ensuring centralized control and a unified view of hybrid and multi-cloud environments. This allows enterprises to streamline network operations and better comply with regulations like GDPR.

- This trend toward AI-driven, context-aware packet brokering is transforming how European organizations approach network performance and security. Vendors like Netscout, Arista, and Cisco are now offering AI-enhanced features that deliver real-time traffic insights, automated threat mitigation, and adaptive network traffic management across both traditional and virtual infrastructures.

- The rising demand for intelligent, automated, and scalable NPB solutions is especially strong in sectors such as finance, healthcare, and telecom, where high data throughput and zero-downtime are critical, driving continuous innovation and adoption across the European market.

Europe Network Packet Broker Market Dynamics

Driver

Growing Need Due to Rising Security Threats and Network Complexity

-

The increasing frequency and sophistication of cyberattacks, combined with the rising complexity of modern enterprise networks, is a major driver of demand for advanced network visibility solutions like Network Packet Brokers (NPBs) across Europe.

- For instance, in June 2024, Keysight Technologies expanded its Vision NPB product line to address the evolving security monitoring needs of hybrid IT environments in the European market, offering enhanced packet-level visibility and threat detection capabilities. Such strategic developments from key players are expected to propel market growth over the forecast period.

- As organizations across sectors like finance, healthcare, telecom, and government face heightened regulatory pressure and increased risk of data breaches, NPBs provide critical functionality, such as traffic filtering, decryption, and load balancing for security tools—enabling better protection against cyber threats.

- Additionally, the widespread shift toward cloud computing, virtual environments, and software-defined networking (SDN) is creating new blind spots in network monitoring, making it essential for enterprises to deploy intelligent NPBs that can bridge visibility gaps and ensure compliance with stringent data protection laws like GDPR.

- The need for centralized traffic management, high-performance threat detection, and optimized use of monitoring and security tools is pushing organizations to integrate NPBs into their infrastructure. Their ability to deliver real-time, actionable insights across distributed and complex environments is making them indispensable in modern network architectures.

Restraint/Challenge

High Implementation Costs and Limited Awareness in Emerging Markets

- The Europe Network Packet Broker Market faces key challenges related to the high deployment and operational costs associated with advanced packet brokering solutions. These costs include not only the hardware and software investment but also the need for skilled IT personnel to configure, maintain, and integrate NPBs into increasingly complex network environments.

- For instance, large-scale enterprises may benefit from high-end, feature-rich NPB solutions from vendors like Gigamon or Arista, but small and mid-sized organizations often struggle to justify the expense, limiting broader market adoption—particularly in cost-sensitive regions such as parts of Eastern and Southern Europe.

- Furthermore, concerns around data privacy and compliance with strict regulations like the General Data Protection Regulation (GDPR) present an additional challenge. Since NPBs handle sensitive network traffic and can potentially access personal or confidential data, there is heightened scrutiny over how data is processed, stored, and shared. Improper handling or lack of transparency can raise legal and ethical concerns among European enterprises.

- To overcome these issues, vendors must focus on developing cost-effective, modular solutions that allow organizations to scale their packet brokering capabilities incrementally. In addition, providing clear compliance features, such as data anonymization, logging, and policy-based filtering, will help address privacy concerns and build trust.

- Enhanced customer education around the ROI benefits of NPBs—such as improved threat detection, optimized tool performance, and reduced network downtime—alongside flexible pricing and managed service options, will be critical to overcoming adoption barriers and driving sustainable growth across the European market.

Europe Network Packet Broker Market Scope

The market is segmented on the basis of bandwidth, network set-up, security tools, and end user.

- By Bandwidth

On the basis of bandwidth, the Europe Network Packet Broker Market is segmented into 1 Gbps and 10 Gbps, 40 Gbps, and 100 Gbps. The 1 Gbps and 10 Gbps segment dominated the market with the largest revenue share of 47.6% in 2024, primarily due to its widespread adoption in enterprise networks and data centers that handle moderate to high traffic volumes. These bandwidth levels offer a balance of performance and cost-efficiency, making them ideal for businesses seeking reliable visibility without overprovisioning.

The 100 Gbps segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by the rising volume of data generated through cloud computing, IoT devices, and AI-driven applications. With large enterprises and service providers upgrading infrastructure to support high-speed connectivity, demand for high-bandwidth packet brokers is accelerating. Growth in data-intensive sectors such as telecom and finance further contributes to this trend.

- By Network Set-Up

On the basis of network set-up, the Europe Network Packet Broker Market is segmented into On-Premise, Cloud, and Virtual. The On-Premise segment held the largest market revenue share of 52.1% in 2024, driven by its widespread use in traditional enterprise data centers where organizations maintain full control over hardware and data. This setup is particularly favored in sectors with stringent security and compliance requirements, such as government and finance.

The Cloud segment is expected to witness the fastest CAGR from 2025 to 2032, supported by rapid cloud adoption across industries and the growing shift toward SaaS and IaaS platforms. Cloud-based NPBs offer scalability, cost efficiency, and ease of deployment, which appeal to organizations pursuing digital transformation. As multi-cloud and hybrid network environments become more prevalent, demand for cloud-integrated network visibility solutions continues to grow rapidly across the region.

- By Security Tools

On the basis of security tools, the Europe Network Packet Broker Market is segmented into Passive and Active tools. The Passive segment dominated the market in 2024 with a revenue share of 58.4%, as it supports non-intrusive network monitoring, traffic analysis, and performance diagnostics. These tools are especially preferred in environments where monitoring without impacting live traffic is critical, such as healthcare, education, and public sector networks.

The Active segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by the increasing demand for proactive security measures that not only monitor but also respond to threats in real-time. Active NPBs enable advanced features such as inline threat prevention, policy enforcement, and traffic redirection, which are becoming essential in modern security architectures. Rising cyber threats and the growing need for automated incident response are key drivers accelerating the adoption of active NPB tools.

- By End User

On the basis of end user, the Europe Network Packet Broker Market is segmented into Enterprise, Service Providers, and Government Organizations. The Enterprise segment accounted for the largest market revenue share of 49.3% in 2024, owing to increasing investments in network security, visibility, and data compliance. Enterprises across finance, healthcare, and retail are adopting NPBs to manage growing traffic complexity and to ensure efficient delivery of security and monitoring tools.

The Service Providers segment is expected to register the fastest CAGR from 2025 to 2032, driven by the exponential growth in data traffic, 5G deployments, and edge computing. Telecom operators and ISPs require high-performance NPBs to ensure seamless service delivery and real-time analytics. Additionally, the scalability and reliability of NPBs help service providers optimize infrastructure performance and improve customer experience while supporting massive amounts of concurrent connections.

Europe Network Packet Broker Market Regional Analysis

- Germany dominated the Europe Network Packet Broker Market with the largest revenue share of 44.7% in 2024, driven by robust demand for advanced network visibility and security solutions amid growing concerns around cyber threats and regulatory compliance. Countries such as Germany, the UK, and France are at the forefront of adopting high-performance packet brokering technologies across enterprise and government sectors.

- Organizations in the region prioritize secure, real-time network monitoring and data traffic optimization, fueled by digital transformation, cloud migration, and increasingly complex hybrid IT environments.

- This widespread adoption is further supported by strong IT infrastructure, stringent data protection laws such as GDPR, and a mature base of technologically advanced enterprises. The region’s emphasis on operational efficiency, compliance, and proactive threat management is solidifying network packet brokers as a critical component of modern cybersecurity and network architecture strategies.

France Network Packet Broker Market Insight

The France Network Packet Broker Market is expected to witness steady growth during the forecast period, driven by initiatives focused on national cybersecurity and digital sovereignty. French organizations are increasingly investing in NPBs to improve network visibility, detect anomalies, and ensure data security across distributed networks. The government’s push for secure digital infrastructure and the growth of smart city projects are fostering adoption, particularly within public services, utilities, and enterprise IT environments. France’s emphasis on digital resilience and privacy, alongside EU-wide compliance requirements, is making packet brokers a critical tool for modern network architectures.

U.K. Network Packet Broker Market Insight

The U.K. Network Packet Broker Market is anticipated to grow at a robust CAGR during the forecast period, supported by increased adoption of cloud services, rising cyber threats, and the need for resilient digital infrastructure. U.K. businesses are prioritizing investment in advanced NPB technologies to improve network observability, automate traffic management, and maintain regulatory compliance post-Brexit. With a thriving financial services sector and a mature IT ecosystem, the demand for NPBs is strong across enterprise and government segments. Additionally, growing reliance on remote work and digital services continues to drive the need for secure, high-performance network traffic management solutions.

Europe Network Packet Broker Market Share

The Network Packet Broker industry is primarily led by well-established companies, including:

- NETSCOUT (U.S.)

- VIAVI Solutions Inc. (U.S.)

- Keysight Technologies (U.S.)

- Gigamon (U.S.)

- APCON (Switzerland)

- Garland Technology (India)

- Big Switch Networks, Inc. (U.S.)

- Network Critical (U.K.)

- Corvil (Ireland)

- Microtel Innovation S.r.l (Italy)

- Juniper Networks, Inc. (U.S.)

- Arista Networks, Inc. (U.S.)

- CPACKET NETWORKS (U.S.)

- Niagara Networks (U.S.)

- Profitap HQ B.V. (Netherlands)

- CGS Tower Networks (Israel)

- Datacom Systems INC (U.S.)

- 5FeetNetworks Oy (Finland)

- Cisco (U.S.)

- ECI Telecom (Israel)

What are the Recent Developments in Europe Network Packet Broker Market?

- In May 2023, Gigamon, a global leader in deep observability solutions, expanded its footprint in Europe by launching its next-generation Network Packet Broker (NPB) platform tailored for hybrid cloud environments. The platform integrates advanced traffic intelligence and AI-driven analytics to help European enterprises manage encrypted traffic, reduce tool overload, and detect hidden threats. This strategic move reinforces Gigamon’s commitment to providing scalable and secure visibility solutions that address the evolving demands of modern enterprise networks across Europe.

- In April 2023, Keysight Technologies Inc. introduced enhancements to its Vision NPB Series in the European market, focusing on delivering greater performance and operational simplicity for large-scale network infrastructures. These upgrades include improved support for high-speed (100 Gbps) environments, automated traffic intelligence, and better integration with cybersecurity tools. The development reflects Keysight’s continued investment in innovation to support digital transformation and security resilience for telecom operators and enterprises across Europe.

- In March 2023, Arista Networks expanded its DANZ Monitoring Fabric (DMF) offering in Europe by integrating it with next-generation AI-powered NPB capabilities. The enhanced solution enables real-time telemetry, granular packet filtering, and seamless traffic decryption, making it ideal for data centers and cloud service providers. This advancement demonstrates Arista’s focus on empowering European organizations with dynamic visibility tools essential for securing increasingly complex and distributed network environments.

- In February 2023, NetScout Systems, Inc. launched a strategic initiative targeting critical infrastructure sectors in Europe, including energy, government, and financial services. The initiative promotes the deployment of its InfiniStreamNG (ISNG) platform with integrated packet broker functionality, enabling proactive threat detection and service assurance. By addressing the need for secure and reliable network visibility, NetScout strengthens its role in safeguarding Europe's digital economy and infrastructure.

- In January 2023, Profitap, a leading European manufacturer of network visibility solutions, unveiled its IOTA 10G NPB Appliance, designed for SMBs and mid-sized enterprises. Featuring compact design, advanced filtering, and ease of deployment, this new solution addresses the gap in affordable, high-performance packet brokers for smaller organizations. Profitap’s innovation highlights the growing demand for flexible and cost-efficient NPBs tailored to the needs of diverse business sizes across Europe.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Network Packet Broker Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Network Packet Broker Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Network Packet Broker Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.