Europe Non Hodgkin Lymphoma Diagnostics Market

Market Size in USD Million

CAGR :

%

USD

213.40 Million

USD

400.87 Million

2024

2032

USD

213.40 Million

USD

400.87 Million

2024

2032

| 2025 –2032 | |

| USD 213.40 Million | |

| USD 400.87 Million | |

|

|

|

|

Europe Non-Hodgkin Lymphoma Diagnostics Market Size

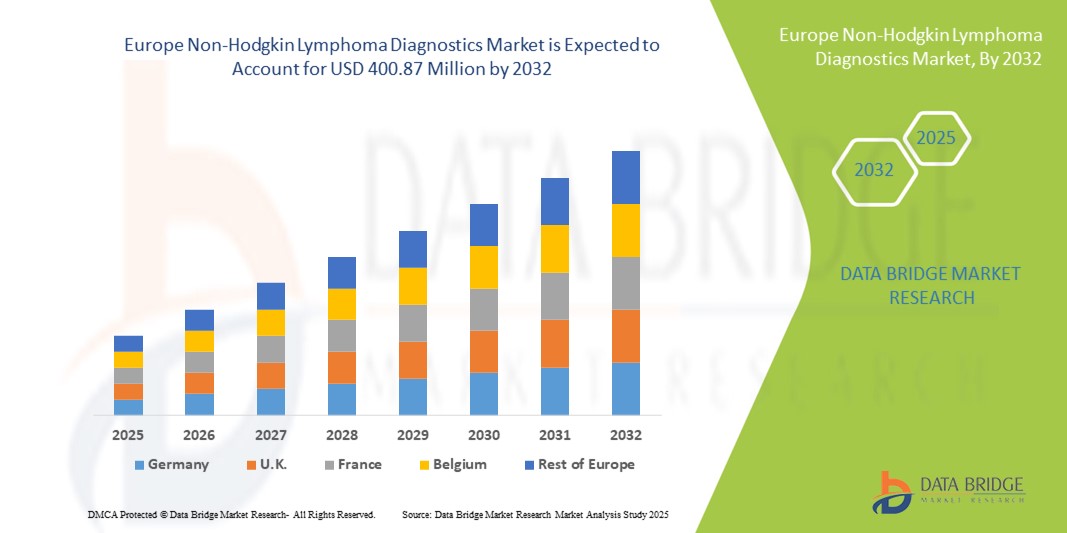

- The Europe non-Hodgkin lymphoma diagnostics market size was valued at USD 213.4 million in 2024 and is expected to reach USD 400.87 million by 2032, at a CAGR of 8.20% during the forecast period

- The market growth is largely fueled by the increasing prevalence of Non-Hodgkin Lymphoma (NHL) worldwide and the growing need for early and accurate diagnostic solutions, supported by technological advancements in molecular diagnostics, flow cytometry, and imaging techniques

- Furthermore, rising demand for personalized medicine, along with greater awareness of cancer screening and the integration of advanced diagnostic platforms in healthcare facilities, is establishing Non-Hodgkin Lymphoma diagnostics as a critical component of oncology care. These converging factors are accelerating the uptake of Non-Hodgkin Lymphoma Diagnostics solutions, thereby significantly boosting the industry's growth

Europe Non-Hodgkin Lymphoma Diagnostics Market Analysis

- Non-Hodgkin lymphoma diagnostics, encompassing advanced imaging, biomarker testing, biopsy technologies, and molecular diagnostics, are increasingly vital in improving early detection, staging, and treatment personalization for patients across Europe. Growing adoption of precision medicine and advanced diagnostic platforms is significantly enhancing clinical outcomes

- The rising demand for non-Hodgkin lymphoma diagnostics is primarily driven by an aging population, increasing prevalence of hematologic cancers, advancements in next-generation sequencing (NGS), and strong government support for cancer screening and early detection programs across the region

- Germany dominated the non-Hodgkin lymphoma diagnostics market in Europe with the largest revenue share of 34.5% in 2024, supported by its advanced healthcare infrastructure, widespread availability of PET-CT and molecular imaging systems, and robust adoption of companion diagnostics in oncology. The country’s strong research ecosystem and collaborations between academic institutions and biotech companies further strengthen market leadership

- France is expected to be the fastest growing country in the European non-Hodgkin lymphoma diagnostics market during the forecast period, registering the highest CAGR due to increasing investments in cancer diagnostic innovation, expanding molecular pathology labs, and national healthcare programs prioritizing early hematological cancer detection. Rising adoption of liquid biopsy technologies and biomarker-driven personalized therapy also support this rapid growth trajectory

- The aggressive lymphoma segment dominated the non-Hodgkin lymphoma diagnostics market with the largest revenue share of 61.4% in 2024, driven by the higher clinical burden of fast-progressing lymphoma subtypes

Report Scope and Non-Hodgkin Lymphoma Diagnostics Market Segmentation

|

Attributes |

Non-Hodgkin Lymphoma Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Non-Hodgkin Lymphoma Diagnostics Market Trends

Enhanced Accuracy Through AI and Digital Integration

- A significant and accelerating trend in the Europe Non-Hodgkin Lymphoma Diagnostics market is the integration of artificial intelligence (AI), digital pathology, and advanced data analytics into diagnostic processes. This technological fusion is substantially improving the accuracy, speed, and efficiency of lymphoma diagnosis, enabling earlier detection and more personalized treatment strategies

- For instance, AI-powered imaging platforms are now capable of assisting pathologists in identifying malignant cells and subtypes of Non-Hodgkin Lymphoma with higher precision, reducing human error and supporting more reliable clinical decisions. Digital pathology systems integrated with AI tools also allow for real-time image sharing and remote consultations, improving diagnostic access across regions

- AI applications in immunohistochemistry and genetic testing are further enhancing the ability to detect biomarkers and mutations associated with Non-Hodgkin Lymphoma. These innovations not only improve diagnostic accuracy but also support oncologists in selecting targeted therapies, advancing the shift toward precision medicine

- Cloud-based diagnostic platforms, combined with AI algorithms, are also streamlining workflows by enabling centralized data management and analysis. Hospitals and research centers in Europe are increasingly adopting such systems to facilitate collaboration, reduce turnaround times, and optimize resource allocation in cancer diagnostics

- The growing reliance on AI-enhanced diagnostic technologies is fundamentally transforming the market by setting higher standards for accuracy and personalization in oncology. Consequently, leading companies such as F. Hoffmann-La Roche, Siemens Healthcare, and Philips are actively investing in AI-enabled diagnostic tools, genetic sequencing platforms, and digital pathology systems tailored for hematological malignancies

- The demand for AI-driven diagnostic solutions is expanding rapidly across hospitals, diagnostic centers, and research institutes, as healthcare providers seek to address rising Non-Hodgkin Lymphoma incidence rates and improve patient outcomes through earlier, more accurate, and more personalized interventions

Europe Non-Hodgkin Lymphoma Diagnostics Market Dynamics

Driver

Growing Need Due to Rising Cancer Burden and Precision Medicine Adoption

- The rising incidence of non-Hodgkin lymphoma across Europe, coupled with increasing awareness about the importance of early detection, is a major driver for the growth of the Non-Hodgkin Lymphoma Diagnostics market

- For instance, in March 2024, Roche Diagnostics received CE approval for its next-generation digital pathology platform to enhance lymphoma subtyping and biomarker testing, marking a critical advancement for European laboratories. Such developments are expected to accelerate industry growth during the forecast period

- As oncologists and healthcare providers increasingly prioritize precision medicine, diagnostic tools such as immunohistochemistry (IHC), flow cytometry, and next-generation sequencing (NGS) are being integrated into clinical practice to enable accurate disease characterization and treatment planning

- Furthermore, strong support from government-backed cancer screening programs and rising investments in oncology-focused diagnostic infrastructure are expanding access to advanced diagnostic services across hospitals and laboratories in the region

- The growing adoption of companion diagnostics, which link biomarker testing with targeted therapies, is further fueling the demand for advanced Non-Hodgkin Lymphoma diagnostic solutions, positioning them as indispensable tools in both academic research and routine clinical settings

Restraint/Challenge

High Diagnostic Costs and Limited Access in Developing Regions

- Despite technological advancements, the relatively high costs of advanced non-Hodgkin lymphoma diagnostic procedures, including NGS-based testing and molecular imaging, pose challenges for widespread adoption, particularly in low- and middle-income countries within Europe and surrounding regions

- For instance, reimbursement gaps and limited insurance coverage in Eastern European countries restrict patient access to cutting-edge molecular diagnostics, which can delay or complicate timely treatment decisions

- Addressing these challenges requires coordinated efforts, including healthcare policy reforms, government subsidies, and wider inclusion of advanced diagnostics under reimbursement frameworks. Leading companies such as Qiagen and Agilent emphasize cost-efficient diagnostic kits and automated systems to expand accessibility

- Another major restraint is the uneven availability of trained pathologists and advanced diagnostic laboratories, especially outside major urban hubs, which limits the accurate and timely diagnosis of lymphoma cases

- Overcoming these barriers will require investments in healthcare infrastructure, professional training programs, and the introduction of more affordable diagnostic technologies, ensuring equitable access to Non-Hodgkin Lymphoma testing across all patient populations

Europe Non-Hodgkin Lymphoma Diagnostics Market Scope

The market is segmented on the basis of test type, cancer stage, tumor type, product, technology, application, end user, and distribution channel

- By Test Type

On the basis of test type, the Europe non-Hodgkin lymphoma diagnostics market is segmented into imaging, biopsy, immunohistochemistry, biomarker, genetic test, cytogenetics, lumbar puncture, blood test, cytochemistry, and others. The biopsy segment dominated the market with the largest revenue share of 40.1% in 2024, owing to its role as the most definitive diagnostic method for lymphoma. Biopsies provide direct access to tissue samples, which allows clinicians to conduct histopathological, molecular, and cytogenetic assessments. This process enables accurate classification of lymphoma subtypes, disease staging, and treatment planning, making biopsy indispensable across European healthcare systems. Its widespread clinical acceptance, high diagnostic accuracy, and mandatory role in clinical guidelines further consolidate its position as the dominant diagnostic method. The constant reliance on biopsy for both initial diagnosis and relapse confirmation ensures it maintains a leading revenue share in the European market.

The genetic test segment is anticipated to grow at the fastest CAGR of 19.3% from 2025 to 2032, fueled by the rapid integration of genomics into clinical practice. Genetic testing provides actionable insights into gene mutations, chromosomal translocations, and molecular drivers of non-Hodgkin lymphoma, which guide personalized treatment approaches. The adoption of next-generation sequencing (NGS) platforms in European cancer centers is expanding the scope of genetic testing, making it a cornerstone of precision oncology. Increasing demand for targeted therapies and immunotherapies is directly driving the uptake of genetic diagnostics. Government-funded genomic initiatives, particularly in Western Europe, are accelerating adoption rates. With growing emphasis on early detection and treatment optimization, genetic tests are emerging as the fastest-growing sub-segment.

- By Cancer Stage

On the basis of cancer stage, the Europe non-Hodgkin lymphoma diagnostics market is segmented into Stage IV, Stage III, Stage II, Stage I, and Stage 0. The Stage IV segment dominated the market with the largest revenue share of 47.0% in 2024, largely because most patients are diagnosed at advanced stages due to delayed symptom recognition. Stage IV lymphoma typically requires a comprehensive diagnostic approach including imaging, biopsy, immunohistochemistry, and molecular tests, which significantly boosts demand for diagnostic solutions. Advanced-stage patients often undergo repeated testing to assess treatment response and disease progression. The high prevalence of late-stage diagnosis across Europe, especially in older populations, reinforces Stage IV as the largest revenue-generating category. Its dominance is also linked to the growing availability of advanced diagnostic tools for late-stage disease management.

The Stage I segment is projected to expand at the fastest CAGR of 16.8% from 2025 to 2032, supported by increased focus on early detection programs across Europe. Rising awareness campaigns and improvements in primary healthcare screening are helping identify lymphoma cases earlier than before. Advances in imaging technologies and biomarker-based screening tools are enabling more precise and earlier detection. Healthcare systems in Europe are also investing in preventive oncology initiatives, which is expected to increase Stage I diagnosis rates. Early diagnosis significantly improves treatment outcomes, which is incentivizing physicians to adopt advanced diagnostic tools for this group. As more patients are detected at the initial stages, Stage I is set to experience the fastest growth during the forecast period.

- By Tumor Type

On the basis of tumor type, the Europe non-Hodgkin lymphoma diagnostics market is segmented into aggressive lymphomas and indolent lymphomas. The aggressive lymphoma segment accounted for the largest revenue share of 61.4% in 2024, driven by the higher clinical burden of fast-progressing lymphoma subtypes. Aggressive lymphomas such as diffuse large B-cell lymphoma (DLBCL) require extensive diagnostic evaluations at the time of presentation. Patients in this category undergo intensive testing including imaging, biopsy, immunohistochemistry, and genetic assays, which drives higher diagnostic revenues. The urgent nature of aggressive lymphoma cases leads to greater diagnostic demand per patient compared to indolent types. Rising incidence of DLBCL in Europe further ensures aggressive lymphomas remain the dominant revenue generator in diagnostics. Clinical urgency and treatment-critical testing solidify this segment’s leading position.

The indolent lymphoma segment is anticipated to grow at the fastest CAGR of 13.5% from 2025 to 2032, reflecting rising awareness and management of slow-progressing forms such as follicular lymphoma. Unlike aggressive types, indolent lymphomas often require continuous monitoring and frequent diagnostic evaluations over long disease durations. Biomarker testing, blood work, and imaging play central roles in tracking disease progression and therapeutic needs. Improved survival rates of patients with indolent lymphomas extend diagnostic demand across multiple years. Advances in molecular and biomarker-based tools are further boosting diagnostic applications for indolent subtypes. With healthcare shifting towards personalized disease management, this segment is forecasted to grow strongly over the forecast period.

- By Product

On the basis of product, the Europe non-Hodgkin lymphoma diagnostics market is segmented into instrument-based products, platform-based products, kits and reagents, and other consumables. The kits and reagents segment held the largest revenue share of 44.7% in 2024, as they form the backbone of most diagnostic procedures in non-Hodgkin lymphoma testing. They are essential for assays in immunohistochemistry, genetic testing, biomarker detection, and cytogenetics. Their recurring demand across hospitals, cancer centers, and diagnostic laboratories ensures stable and consistent revenues. Moreover, continuous development of new reagent kits tailored for lymphoma-specific applications strengthens their importance. High utilization rates, cost-effectiveness, and wide accessibility position kits and reagents as the dominant sub-segment.

The platform-based products segment is expected to witness the fastest CAGR of 18.1% from 2025 to 2032, driven by the rapid adoption of advanced diagnostic platforms such as NGS and high-resolution imaging systems. These platforms are transforming diagnostic workflows by enabling high-throughput, precise, and automated testing. European cancer centers are increasingly investing in platform technologies to support personalized treatment approaches. Integration with digital pathology and AI-driven analytics is further enhancing the capabilities of these platforms. With healthcare providers seeking efficiency and accuracy, platform-based products are emerging as the most dynamic growth segment in the region.

- By Technology

On the basis of technology, the Europe non-Hodgkin lymphoma diagnostics market is segmented into fluorescent in situ hybridization (FISH), next-generation sequencing (NGS), fluorimmunoassay, comparative genomic hybridization, immunohistochemical, and others. The immunohistochemical segment dominated the market with the largest revenue share of 39.8% in 2024, owing to its established role in routine lymphoma diagnosis. Immunohistochemistry (IHC) is widely used to identify protein markers and differentiate between lymphoma subtypes. Its reliability, cost-effectiveness, and integration into pathology lab workflows make it indispensable across Europe. Clinical guidelines strongly recommend IHC, reinforcing its importance as a primary diagnostic tool. Widespread use in both initial diagnosis and prognostic evaluation ensures IHC maintains dominance.

The next-generation sequencing (NGS) segment is expected to expand at the fastest CAGR of 20.4% from 2025 to 2032, reflecting the growing importance of molecular profiling. NGS provides detailed genomic insights, helping clinicians design highly personalized treatment plans. European oncology centers are rapidly deploying NGS platforms as part of precision oncology initiatives. Demand for advanced therapeutics such as CAR-T therapy is also driving the adoption of NGS, as these require genomic testing for eligibility. The combination of high clinical utility, ongoing technological innovation, and rising healthcare investments in genomics ensures NGS grows at the fastest pace.

- By Application

On the basis of application, the Europe non-Hodgkin lymphoma diagnostics market is segmented into screening, diagnostic and predictive, prognostic, and research. The diagnostic and predictive segment held the largest revenue share of 46.5% in 2024, as accurate identification of lymphoma and prediction of disease progression are central to patient management. Hospitals and cancer centers prioritize diagnostic and predictive applications because they directly inform treatment strategies. This segment benefits from the routine need for biopsies, imaging, and biomarker testing across the majority of lymphoma patients. Growing availability of advanced diagnostic solutions in European healthcare further supports its dominance.

The prognostic segment is forecasted to grow at the fastest CAGR of 15.9% from 2025 to 2032, driven by increasing importance of survival predictions and recurrence risk assessments. Prognostic applications are gaining traction with the adoption of molecular and biomarker-based testing tools. They provide critical insights for long-term patient management, influencing both treatment planning and monitoring strategies. The push towards precision medicine in Europe emphasizes prognostic assessments as an essential step. Growing research and clinical trials that focus on personalized care are also fueling this segment’s rapid growth.

- By End User

On the basis of end user, the Europe non-Hodgkin lymphoma diagnostics market is segmented into hospitals, diagnostic centers, cancer research centers, academic institutes, ambulatory surgical centers, and others. The hospitals segment dominated the market with the largest revenue share of 51.2% in 2024, owing to their central role in comprehensive cancer diagnosis and treatment. Hospitals host multidisciplinary diagnostic services, including imaging, biopsy, and genetic testing, under one roof. Their capacity to handle large patient volumes and access to advanced technologies ensures hospitals remain the leading end user. Strong integration with treatment facilities further consolidates this segment’s dominance in Europe.

The diagnostic centers segment is projected to grow at the fastest CAGR of 17.6% from 2025 to 2032, as they increasingly specialize in advanced lymphoma diagnostics. Diagnostic centers provide cost-effective services with faster turnaround times, making them attractive to patients and physicians. Many centers are adopting cutting-edge technologies such as NGS and biomarker assays to expand their service portfolios. Rising outsourcing of diagnostic testing by hospitals is also driving this segment’s rapid expansion. Growing demand for decentralized healthcare solutions positions diagnostic centers as the fastest-growing end-user category.

- By Distribution Channel

On the basis of distribution channel, the Europe non-Hodgkin lymphoma diagnostics market is segmented into direct tender, retail sales, and others. The direct tender segment accounted for the largest revenue share of 58.3% in 2024, reflecting the purchasing behavior of large hospitals and public healthcare systems. Direct tendering allows institutions to procure diagnostic kits, reagents, and instruments in bulk at cost-effective prices. This ensures consistent availability of essential diagnostic products, especially in government-run healthcare systems across Europe. Long-term supplier contracts and cost efficiency consolidate direct tender’s dominance as the leading channel.

The retail sales segment is forecasted to grow at the fastest CAGR of 14.7% from 2025 to 2032, driven by the increasing demand from independent labs, academic research institutes, and smaller healthcare facilities. The convenience of purchasing through distributors and e-commerce platforms is accelerating retail adoption. Retail channels allow flexibility in procurement and rapid access to new diagnostic products. Rising trend of decentralized testing and expanding research activities further boost the retail segment’s growth. With greater accessibility and convenience, retail sales are expected to be the most dynamic channel during the forecast period.

Europe Non-Hodgkin Lymphoma Diagnostics Market Regional Analysis

- The Europe non-Hodgkin lymphoma diagnostics market is projected to expand at a substantial CAGR throughout the forecast period, driven by the rising incidence of lymphoma, increasing demand for early detection, and the adoption of precision medicine across healthcare systems

- Strong government initiatives supporting cancer screening programs and continuous technological advancements in imaging, molecular diagnostics, and immunohistochemistry are fueling growth

- The region also benefits from a well-established oncology infrastructure, high diagnostic awareness, and growing collaborations between research institutes and diagnostic companies, making Europe a key hub for non-Hodgkin lymphoma diagnostics adoption

Germany Non-Hodgkin Lymphoma Diagnostics Market Insight

The Germany non-Hodgkin lymphoma diagnostics market dominated the non-Hodgkin lymphoma diagnostics market in Europe with the largest revenue share of 34.5% in 2024, supported by its advanced healthcare infrastructure, widespread availability of PET-CT scanners, and increasing integration of molecular imaging technologies. The strong adoption of companion diagnostics in oncology ensures precise patient stratification and therapy planning. Germany’s research ecosystem, driven by collaborations between academic institutions, hospitals, and biotech firms, further enhances its leadership in the market. The country’s robust investment in laboratory automation and biomarker-driven diagnostic solutions positions it as the central hub for innovation and clinical adoption of advanced Non-Hodgkin Lymphoma diagnostics.

France Non-Hodgkin Lymphoma Diagnostics Market Insight

The France non-Hodgkin lymphoma diagnostics market is expected to be the fastest-growing country in the Europe Non-Hodgkin Lymphoma Diagnostics market during the forecast period, registering the highest CAGR. Growth is fueled by significant national healthcare initiatives aimed at early cancer detection and rising investments in expanding molecular pathology and hematology-focused laboratories. Increasing adoption of liquid biopsy platforms, next-generation sequencing, and biomarker-driven personalized therapy solutions is strengthening France’s diagnostic capabilities. In addition, government-backed funding for oncology innovation and the establishment of specialized cancer centers are accelerating patient access to advanced diagnostic technologies, supporting the country’s rapid growth trajectory in the NHL diagnostics landscape.

Europe Non-Hodgkin Lymphoma Diagnostics Market Share

The non-Hodgkin lymphoma diagnostics industry is primarily led by well-established companies, including:

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Siemens Healthineers AG (Germany)

- Danaher Corporation ( U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- General Electric Company (U.S.)

- Sysmex Corporation (Japan)

- GRAIL, Inc. (U.S.)

- F. Hoffmann-La Roche (Switzerland)

- Neusoft Corporation (China)

- Agilent Technologies, Inc. (U.S.)

- NeoGenomics Laboratories (U.S.)

- Hologic, Inc. (U.S.)

- CENTOGENE N.V. (Germany)

- Merit Medical Systems (U.S.)

- Invitae Corporation (U.S.)

- PerkinElmer (U.S.)

- QIAGEN (Germany)

- GeneDx, LLC (U.S.)

Latest Developments in Europe Non-Hodgkin Lymphoma Diagnostics Market

- In January 2021, Guardant Health entered into a strategic collaboration with the Vall d’Hebron Institute of Oncology (VHIO), Spain, to launch the first Guardant-based liquid biopsy testing service in Europe. This initiative introduced comprehensive genomic profiling (CGP) for cancer patients using blood samples, allowing oncologists to detect tumor mutations non-invasively and guide personalized treatment decisions more efficiently

- In May 2022, the European Union’s In Vitro Diagnostic Regulation (IVDR) officially came into effect on 26 May 2022, replacing the previous In Vitro Diagnostic Directive (IVDD). This new regulation established more stringent requirements for diagnostic tests, including companion diagnostics used in oncology, by tightening clinical evidence, safety, and performance evaluation standards across Europe. The IVDR marked a major step toward harmonizing diagnostic regulations and ensuring higher reliability and quality of tests for cancer detection, including Non-Hodgkin Lymphoma

- In May 2022, Guardant Health and VHIO (Barcelona) further advanced their collaboration as the first European facility for blood-based cancer testing using Guardant’s digital sequencing platform became fully operational. This development enabled real-time precision oncology diagnostics across Europe, giving clinicians access to advanced liquid biopsy technology that could detect actionable mutations, track tumor evolution, and guide therapy decisions without the need for invasive tissue biopsies

- In April 2023, Roche launched its Navify Algorithm Suite, a cloud-based digital library of medical algorithms designed to support healthcare professionals in disease detection and treatment optimization. By integrating multiple diagnostic algorithms into a single platform, the suite provided tools to facilitate earlier diagnosis, improved risk stratification, and personalized patient management across cancer care and other disease areas, strengthening Roche’s presence in digital oncology diagnostics in Europe

- In May 2025, Guardant Health announced the addition of multiomic enhancements to its Guardant360 liquid biopsy test, significantly expanding its clinical utility. The upgraded version incorporated tumor phenotyping, methylation analysis, and biomarker detection with the support of AI-driven analytics, allowing oncologists to obtain deeper insights into tumor biology. This advancement marked a breakthrough in next-generation precision oncology, providing European healthcare providers with an even broader range of actionable information to support diagnosis, prognosis, and treatment selection for cancers such as Non-Hodgkin Lymphoma

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.