Europe Nut Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

23.59 Billion

USD

37.04 Billion

2024

2032

USD

23.59 Billion

USD

37.04 Billion

2024

2032

| 2025 –2032 | |

| USD 23.59 Billion | |

| USD 37.04 Billion | |

|

|

|

|

Nut Ingredients Market Size

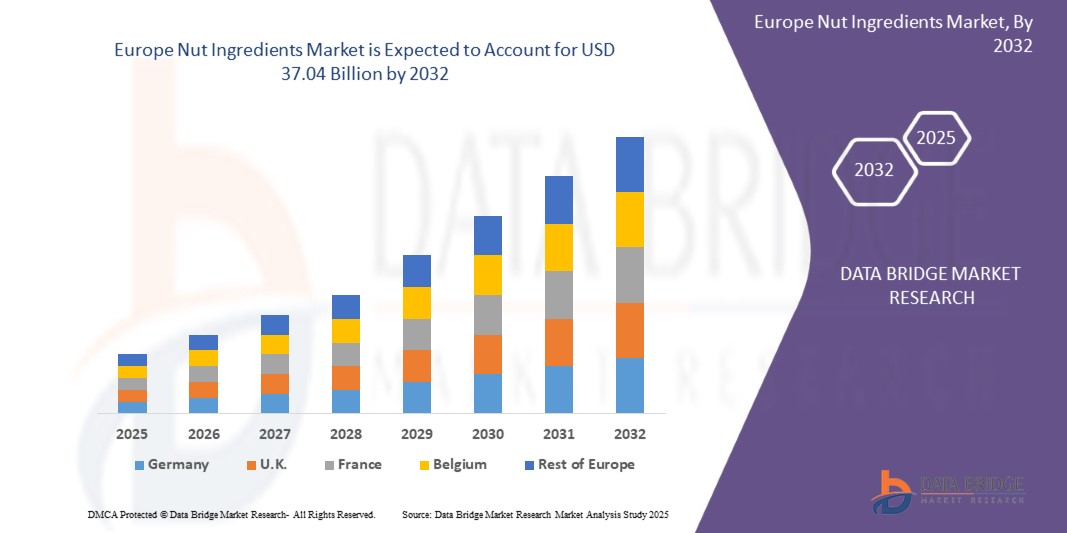

- The Europe Nut Ingredients market size was valued at USD 23.59 billion in 2024 and is expected to reach USD 37.04 billion by 2032, at a CAGR of 6.1% during the forecast period

- The market growth is largely fueled by rising consumer awareness of health and wellness, increasing demand for plant-based and protein-rich food products, expanding vegan population, and the growing popularity of convenient, nutritious snack options. Additionally, innovations in flavor and product variety further boost the appeal of nut ingredients.

- Furthermore, advancements in processing technologies and sustainable sourcing practices are enhancing product quality and availability. Increasing investments by key players in product development and marketing, along with expanding distribution channels, are also driving the widespread adoption of nut ingredients across various food and beverage sectors.

Nut Ingredients Market Analysis

- Advancements in processing technologies and sustainable sourcing practices are improving the quality, safety, and consistency of nut ingredients, making them more appealing to manufacturers and consumers, while also supporting environmental and ethical standards within the supply chain.

- Increased investments by key players in product innovation, marketing strategies, and expanding distribution networks are accelerating the penetration of nut ingredients in diverse food and beverage categories, enhancing consumer accessibility and driving overall market growth.

- Germany dominates the Nut Ingredients market with a 35.45% revenue share in 2025, driven by its leading cashew production and export, strong domestic demand, cultural integration of nuts in cuisine, expanding processing capacity, and rising global health-conscious consumption trends.

- Additionally, India’s robust supply chain, government support for nut farming, increasing investments in processing technology, and growing international trade partnerships further strengthen its leadership in the Nut Ingredients market, boosting revenue growth and solidifying its position through 2025 and beyond.

- The conventional segment is expected to dominate the Nut Ingredients market with a significant share of around 63.45% in 2025, driven by widespread consumer preference, established production methods, cost-effectiveness, and strong supply chain networks supporting traditional nut processing and distribution.

Report Scope and Nut Ingredients Market Segmentation

|

Attributes |

Nut Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Nut Ingredients Market Trends

“Increasing use of nut ingredients in plant-based products”

- Nut ingredients like almonds, cashews, and walnuts are increasingly used as creamy bases in plant-based dairy alternatives such as milk, yogurt, and cheese, offering a rich texture and nutritional benefits, meeting consumer demand for lactose-free, vegan-friendly options.

- Plant-based meat alternatives are incorporating nut proteins and oils to improve texture, flavor, and nutritional profile, providing healthier fats and essential nutrients while catering to flexitarians and vegans seeking sustainable protein sources

- The rise in allergen-friendly formulations is driving innovation in nut blends, allowing manufacturers to create diverse plant-based snacks and protein bars that are free from common allergens like soy and gluten, while leveraging nuts’ natural richness and health benefits.

- Nut ingredients are favored in plant-based baking and confectionery for their flavor, crunch, and nutrient density, enabling producers to offer indulgent yet healthier treats that appeal to health-conscious and vegan consumers alike, enhancing product variety in the market.

- Advances in food processing technology enable extraction of nut-based oils and proteins with improved stability and shelf life, facilitating their integration into ready-to-eat plant-based meals, sauces, and dressings, aligning with the growing convenience food trend among busy consumers..

Nut Ingredients Market Dynamics

Driver

“Growing veganism fuels plant-based nut product innovation”

- Increasing vegan populations globally push food manufacturers to innovate by incorporating nut-based ingredients that mimic dairy and meat textures, providing creamy, rich, and protein-packed alternatives that meet ethical and dietary preferences without compromising taste or nutrition.

- Vegan consumers demand clean-label, allergen-friendly products, encouraging brands to use nuts like cashews, almonds, and macadamias as natural thickeners, creamers, and protein sources, leading to a surge in novel plant-based cheeses, yogurts, and desserts with improved sensory qualities.

- The ethical and environmental motivations behind veganism inspire research into sustainable nut cultivation and processing methods, enabling development of plant-based foods that not only appeal to vegans but also reduce carbon footprint and water usage compared to animal-based products.

- To satisfy diverse vegan palates, companies experiment with nut blends and innovative formulations, combining nuts with legumes and seeds, expanding the variety of plant-based meat substitutes, snacks, and protein powders available in the market with enhanced flavor and texture profiles.

- The growth of veganism stimulates investment in food technology startups focusing on nut-derived ingredients, leading to breakthroughs such as nut-based milks with extended shelf life, nut protein isolates, and fermented nut products, expanding options for consumers seeking cruelty-free nutrition.

Restraint/Challenge

“Allergies restrict consumer base for nut ingredient products”

- Nut allergies affect a significant portion of the population, causing manufacturers to face challenges in product formulation and labeling to ensure safety, which limits the widespread adoption of nut-based ingredients in mainstream food products

- Strict regulatory requirements for allergen declaration and cross-contamination prevention increase production costs and complexity for companies, discouraging some from including nut ingredients, thereby restricting availability and variety of nut-based products in the market.

- Consumer fear of allergic reactions often leads to avoidance of nut-containing foods altogether, reducing market demand and limiting growth opportunities for nut ingredient manufacturers targeting a broader audience.

- Food service and retail sectors may hesitate to offer nut ingredient products due to liability concerns and the need for dedicated handling processes, further restricting market expansion in places like schools and hospitals.

- The need for alternative hypoallergenic ingredients drives innovation but also splits consumer focus, resulting in fragmented market segments where nut ingredients struggle to gain dominance compared to allergy-friendly substitutes like seed or soy-based options..

Nut Ingredients Market Scope

The market is segmented on the basis of category, type, coating type, form and end-user and distribution channel.

- By Category

On the basis of category, the Nut Ingredients market is segmented into conventional, organic. The conventional segment dominates the largest market revenue share of approximately 63.45% in 2025, driven by established production practices, cost efficiency, widespread consumer familiarity, and well-developed supply chains supporting traditional nut cultivation and processing.

The conventional segment is anticipated to witness the fastest growth rate of around 6.4% CAGR from 2025 to 2032, fueled by increasing demand for affordable nut products, expanding processing capabilities, and rising consumption in emerging markets.

- By Type

On the basis of treatment capacity, the Nut Ingredients market is segmented in to almonds, brazil nuts, cashews, chestnuts, hazelnuts, hickory nuts, macadamia nuts, pecans, pine nuts, pistachios, walnuts, peanuts, and others. The almonds segment drives the Nut Ingredients market due to its high nutritional value, versatile use in snacks and dairy alternatives, growing consumer preference for healthy foods, strong global production, and increasing incorporation in plant-based and clean-label products.

The almonds segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising health awareness, expanding plant-based product applications, increased production, and growing demand for nutrient-rich, convenient snack options.

- By Coating Type

On the basis of coating type, the Nut Ingredients market is segmented in to coated, uncoated. The coated segment drives the Nut Ingredients market due to its enhanced flavor, texture, and shelf life, appealing to consumer preferences for tasty, convenient snacks. Innovation in coatings also supports product differentiation and growing demand in confectionery and snack industries.

The coated segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising consumer demand for flavorful, ready-to-eat snacks, innovations in coating technologies, and increasing use in confectionery, bakery, and savory product applications globally.

- By Form

On the basis of form, the Nut Ingredients market is segmented in to whole, diced/cut, roasted, granular. The whole segment drives the Nut Ingredients market due to its natural appeal, minimal processing, and versatility in culinary uses. Consumers prefer whole nuts for their texture, nutritional benefits, and clean-label attributes, boosting demand in snacks, bakery, and health food products.

The whole segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing consumer preference for natural, minimally processed foods, increasing use in healthy snacking, and rising demand in bakery, confectionery, and plant-based product applications.

- By End - User

On the basis of end-user, the Nut Ingredients market is segmented in to household/retail, food service sector, café, catering, bakery, others. The household/retail segment drives the Nut Ingredients market due to increasing consumer preference for home cooking, growing awareness of health benefits, rising demand for convenient packaging, and expanding availability of diverse nut products in supermarkets and online retail channels globally.

The household/retail segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing health consciousness, rising online grocery sales, and increased demand for convenient, ready-to-use nut ingredient products at home.

- By Distribution Channel

On the basis of distribution channel, the Nut Ingredients market is segmented in to store based retailers, non-store retailers. The store based retailers drives the Nut Ingredients market due to consumers valuing product freshness, ease of access, and the ability to inspect quality before purchase, alongside strong retailer networks offering diverse nut varieties and attractive promotions boosting sales.

The store based retailers segment is expected to witness the fastest CAGR from 2025 to 2032, driven by expanding retail chains, increased consumer trust in physical stores, growing demand for fresh and premium nut products, and enhanced in-store shopping experiences.

Nut Ingredients Market Regional Analysis

- Germany dominates the Nut Ingredients market with a 35.45% revenue share in 2025, driven by its leading cashew production and export, strong domestic demand, cultural integration of nuts in cuisine, expanding processing capacity, and rising global health-conscious consumption trends.

- Strong domestic consumption driven by cultural culinary practices and increasing health awareness boosts India’s nut market. Rising preference for nutritious snacks and expanding infrastructure for nut processing and export further strengthen India’s leadership in the global nut ingredients industry.

- Additionally, India’s government initiatives promoting nut cultivation, combined with favorable climate conditions and a skilled workforce, enhance production efficiency and quality, enabling the country to maintain its competitive edge and meet rising global demand in the Nut Ingredients market by 2025.

U.K. Nut Ingredients Market Insight

The U.K. Nut Ingredients market captured the largest revenue share of approximately 25.67% within Europe (APAC) in 2025, driven by its vast domestic consumption, expanding food processing industry, strong export capabilities, and growing demand for healthy snack and plant-based products.

France Nut Ingredients Market Insight

The France market is driven by rapid growth in cashew and walnut production, increasing domestic consumption, expanding export opportunities, government support for nut farming, and rising demand for nutritious snacks and plant-based products both locally and internationally.

Nut Ingredients Market Share

The Nut Ingredients industry is primarily led by well-established companies, including:

- Olam International (Singapore)

- Archer Daniels Midland Company (USA)

- Bunge Limited (USA)

- Blue Diamond Growers (USA)

- Mariani Packing Co., Inc. (USA)

- Hormel Foods Corporation (USA)

- Barry Callebaut AG (Switzerland)

- J. M. Smucker Company (USA)

- Golden Peanut and Tree Nuts (USA)

- Olam Agro India Pvt. Ltd. (India)

- NutraFood Ingredients (India)

- Shandong Jianyuan Foodstuff Co., Ltd. (China)

- PT. Indofood Sukses Makmur Tbk (Indonesia)

- Almunecar S.A. (Spain)

- Wilmar International Limited (Singapore)

Latest Developments in Europe Nut Ingredients Market

- In January 2024, ProV Foods introduced ProV Minis, a line of snack packs tailored for the Indian market. These packs contain flavored dry fruits, nuts, and seeds, catering to on-the-go nutrition needs. Flavors include Cashew Roasted & Salted, Nut & Seed Mix, Cashew Creamy Cheese, Cashew Cracked Pepper, Almonds Roasted & Salted, and Almonds Piri Piri.

- In June 2024, Archer Daniels Midland Company (ADM) acquired the nut and seed processing operations and assets of California Gold Almonds in Modesto, California. This acquisition adds critical processing capacity to ADM's West Coast tree nut operations in Lodi and Stockton, California.

- In May 2024, Olam International agreed to acquire California almond processor and ingredient maker Hughson Nut from APB Partners for $54 million. This acquisition aims to expand Olam's existing portfolio and meet the growing demand for almond-based products.

- In February 2024, Following the acquisition of Diamond Foods by Snyder-Lance, Blue Road Capital agreed to acquire the Diamond of California brand of nuts. The brand produces walnuts, almonds, cashews, and pistachios, and the acquisition aims to enhance Blue Road Capital's presence in the nut products market.

- In March 2024, Barry Callebaut, the world's leading manufacturer of high-quality cocoa and chocolate products, signed an agreement to acquire 100% of the private Spanish manufacturer of nuts, La Morella Nuts SA. La Morella Nuts is known as a specialist in premium quality ingredients in dried fruit base for the food industry in Europe.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.