Europe Nutraceutical Excipients Market

Market Size in USD Million

CAGR :

%

USD

507.68 Million

USD

892.06 Million

2024

2032

USD

507.68 Million

USD

892.06 Million

2024

2032

| 2025 –2032 | |

| USD 507.68 Million | |

| USD 892.06 Million | |

|

|

|

|

Europe Nutraceutical Excipients Market Size

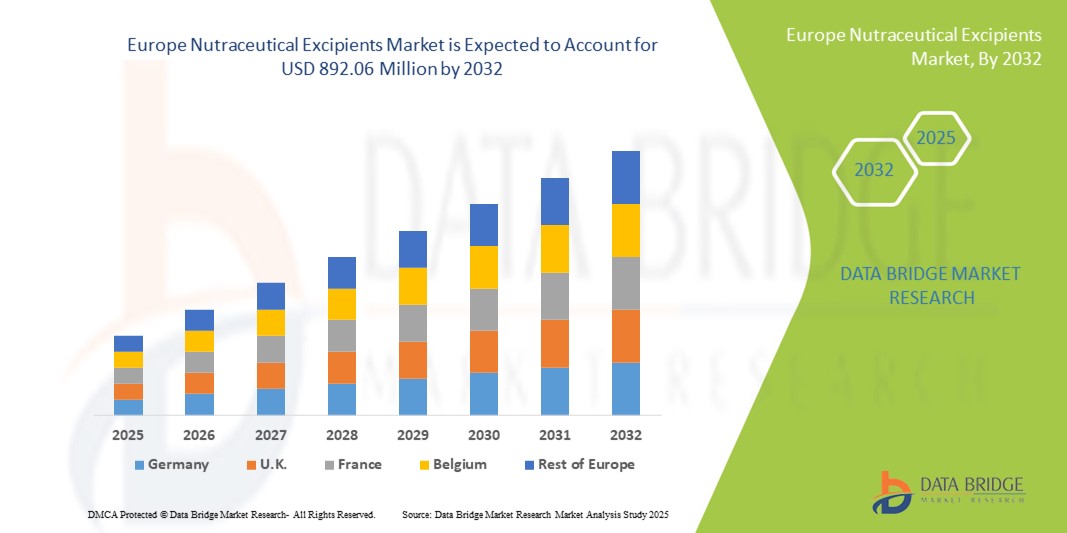

- The Europe nutraceutical excipients market size was valued at USD 507.68 million in 2024 and is expected to reach USD 892.06 million by 2032, at a CAGR of 7.30% during the forecast period

- The market growth is largely fueled by the rising demand for functional foods, dietary supplements, and fortified beverages, supported by increasing consumer focus on preventive healthcare and wellness. Growing awareness about lifestyle-related disorders such as obesity, diabetes, and cardiovascular diseases has further driven the need for nutraceutical products, thereby boosting the uptake of nutraceutical excipients globally

- Furthermore, advancements in formulation technologies and the rising demand for clean-label, natural, and multifunctional excipients are propelling innovation in the market. These converging factors are accelerating the adoption of nutraceutical excipient solutions across product formulations, significantly enhancing stability, bioavailability, and consumer acceptance, thereby strengthening overall industry growth

Europe Nutraceutical Excipients Market Analysis

- Nutraceutical excipients, essential for the formulation of dietary supplements and functional foods, are increasingly in demand due to their critical role in improving stability, bioavailability, taste-masking, and overall product quality in nutraceutical formulations. They provide the necessary support to ensure consistent performance of active ingredients, enabling wider consumer acceptance and regulatory compliance

- The escalating demand for nutraceutical excipients is primarily fueled by rising consumer preference for health and wellness products, increasing prevalence of chronic diseases, and a surge in the consumption of dietary supplements, fortified foods, and beverages. In addition, regulatory emphasis on clean-label ingredients is pushing manufacturers to innovate with natural and multifunctional excipients

- Germany dominated the nutraceutical excipients market in Europe with the largest revenue share of 34.5% in 2024, supported by its advanced pharmaceutical and food processing industries, strong consumer base for dietary supplements, and growing adoption of clean-label, plant-based excipients. The country also benefits from well-established manufacturing infrastructure, strong R&D investments, and collaborations between universities, biotech firms, and nutraceutical companies that continue to drive innovation and ensure market leadership

- France is expected to be the fastest-growing country in the European nutraceutical excipients market during the forecast period, registering the highest CAGR, driven by increasing consumer awareness toward preventive healthcare, rising investments in nutraceutical research, and supportive government programs encouraging the use of fortified foods

- The Dry form segment dominated the Europe nutraceutical excipients market with a market share of 65.4% in 2024, owing to its stability, longer shelf-life, and ease of use in tablets, capsules, and powdered formulations

Report Scope and Nutraceutical Excipients Market Segmentation

|

Attributes |

Nutraceutical Excipients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Nutraceutical Excipients Market Trends

Growing Demand Driven by Health Awareness and Product Innovation

- A significant and accelerating trend in the Europe nutraceutical excipients market is the rising demand for functional ingredients that improve formulation stability, bioavailability, and product efficacy. Manufacturers are increasingly prioritizing excipients that support clean-label claims, plant-based formulations, and enhanced nutrient delivery

- For instance, advanced binder and filler excipients are being widely adopted in Europe to optimize tablet and capsule formulations, ensuring consistent performance of active ingredients in dietary supplements. Similarly, natural emulsifiers and stabilizers are gaining traction in fortified beverages and functional foods

- Excipients that improve solubility, taste masking, and shelf-life are driving innovation across nutraceutical products, enabling companies to offer more consumer-friendly, effective, and safe dietary supplements

- The seamless integration of these excipients into various nutraceutical formats—capsules, tablets, powders, and liquids—facilitates product differentiation and helps manufacturers meet regulatory and consumer expectations simultaneously

- This trend towards multifunctional, high-quality excipients is reshaping formulation strategies across Europe, particularly for companies focusing on preventive healthcare, wellness, and personalized nutrition

- Leading market players are investing in R&D to develop advanced excipients that enhance nutrient absorption, improve product stability, and align with sustainability goals

- The growing demand for fortified foods, sports nutrition, and dietary supplements continues to drive adoption, as consumers increasingly prioritize health and wellness in their daily diet

- Overall, the Europe Nutraceutical Excipients market is witnessing steady growth as manufacturers innovate formulations, adopt advanced excipients, and cater to a health-conscious and quality-focused consumer base

Europe Nutraceutical Excipients Market Dynamics

Driver

Growing Demand for Health and Wellness Products

- The increasing consumer focus on health, wellness, and preventive care is a significant driver for the growing demand for nutraceutical products, which, in turn, boosts the adoption of advanced nutraceutical excipients

- For instance, in April 2024, BASF SE expanded its portfolio of functional excipients aimed at improving the bioavailability and stability of protein supplements and vitamins, reflecting the rising emphasis on innovative ingredient solutions. Such strategies by key companies are expected to propel the Nutraceutical Excipients market during the forecast period

- Consumers are increasingly seeking dietary supplements that offer enhanced efficacy, improved taste, and extended shelf-life, all of which are enabled by high-quality excipients

- Furthermore, the rise in preventive healthcare trends, coupled with growing awareness of chronic conditions like cardiovascular and metabolic disorders, is fueling the demand for nutraceutical products fortified with functional excipients

- Excipients that enhance solubility, flavor masking, and product stability are becoming critical for manufacturers to meet consumer expectations for high-performance supplements

- The global expansion of dietary supplement markets, particularly in Europe and North America, presents additional growth opportunities for excipient suppliers who can innovate in line with regulatory compliance and clean-label trends

Restraint/Challenge

Stringent Regulatory Requirements and Cost Pressures

- Compliance with stringent regulatory frameworks for dietary supplements and nutraceutical ingredients poses a major challenge for excipient manufacturers. Ensuring that excipients meet safety, quality, and labeling standards is critical for market acceptance

- For instance, high-quality excipients must comply with EFSA and FDA guidelines, which can require extensive testing and documentation, potentially delaying product launches and increasing operational costs

- In addition, price pressures in the highly competitive nutraceutical sector can limit the adoption of premium excipients, as manufacturers seek to optimize formulations while keeping final product costs affordable

- Smaller companies and new entrants may face barriers to market entry due to high R&D costs and regulatory hurdles associated with innovative excipient development

- Addressing these challenges through robust quality assurance, scalable production processes, and strategic partnerships with regulatory bodies will be crucial to sustaining growth in the Nutraceutical Excipients market

- Companies focusing on cost-effective, natural, and clean-label excipients that maintain performance while meeting consumer expectations are likely to achieve a competitive advantage

Europe Nutraceutical Excipients Market Scope

The market is segmented on the basis of type, end product, form, excipient source, and distribution channel.

- By Type

On the basis of type, the Europe nutraceutical excipients market is segmented into flavoring agents, coloring agents, sweeteners, coating agents, buffers, solvents, carriers, antifoams, gliding agents, wetting agents, thickeners/gelling agents, preservatives, binders, disintegrants, lubricants, fillers and diluents, and others. The Sweeteners segment dominated the market with a revenue share of 28.6% in 2024, owing to the rising consumer demand for low-calorie and sugar-free products. Sweeteners are widely used across functional foods, beverages, and dietary supplements due to their ability to enhance taste without affecting caloric content. European manufacturers are increasingly incorporating high-purity and natural sweeteners to meet regulatory standards and consumer preferences. In addition, sweeteners contribute to improved product compliance, extended shelf-life, and better consumer acceptance, making them the leading choice in nutraceutical formulations. Their versatility in both powder and liquid applications further strengthens their market dominance.

The Flavoring Agents segment is expected to witness the fastest CAGR of 12.4% from 2025 to 2032, driven by growing consumer focus on taste and product palatability in protein supplements, prebiotics, and vitamin formulations. Flavoring agents are essential for masking the unpleasant taste of active ingredients while enhancing the overall product experience. Rising demand for clean-label and natural flavors, along with innovations in functional beverages and snack formats, supports rapid growth. Manufacturers are leveraging advanced flavor encapsulation technologies to maintain stability, freshness, and consistency across a wide range of nutraceutical products.

- By End Product

On the basis of end product, the Europe nutraceutical excipients market is segmented into prebiotics, probiotics, protein and amino acid supplements, mineral supplements, vitamin supplements, Omega-3 supplements, and other supplements. The vitamin Supplements segment dominated the market with a share of 31.2% in 2024, supported by strong awareness of immunity, preventive health, and wellness among European consumers. Vitamins remain a core part of daily supplementation routines, and manufacturers are offering advanced formulations with improved bioavailability. Regulatory compliance and the growing trend of personalized nutrition also contribute to the segment’s dominance. The high penetration of multivitamin and combination formulations further strengthens market share. The segment benefits from established distribution channels across pharmacies, e-commerce, and retail outlets, driving widespread accessibility and adoption.

The protein and amino acid supplements segment is expected to witness the fastest CAGR of 11.8% from 2025 to 2032, fueled by the rise of fitness culture, sports nutrition, and health-conscious lifestyles. Increasing adoption of plant-based and functional proteins, combined with advanced amino acid formulations, drives demand. The segment also benefits from innovations in solubility, stability, and taste-masking, making protein products more appealing to consumers. Growth is further supported by new product launches, collaborations with sports nutrition brands, and expanding applications in functional beverages and bars.

- By Form

On the basis of form, the Europe nutraceutical excipients market is segmented into dry and liquid. The dry form segment dominated with a market share of 65.4% in 2024, owing to its stability, longer shelf-life, and ease of use in tablets, capsules, and powdered formulations. Dry excipients are preferred for large-scale production due to better handling, storage, and compatibility with various active ingredients. Manufacturers favor dry formulations for their cost efficiency, reduced degradation, and flexibility in dosage design. The segment is widely adopted in vitamins, minerals, protein powders, and prebiotic supplements across Europe. Dry excipients also facilitate precise control over texture, flow properties, and compressibility, further enhancing product quality and consistency.

The liquid form segment is expected to witness the fastest CAGR of 10.9% from 2025 to 2032, driven by the rising demand for ready-to-consume functional beverages, liquid nutraceuticals, and enhanced bioavailability formulations. Liquid excipients enable faster absorption, improved solubility, and convenient consumption, particularly in pediatric, geriatric, and active adult populations. Growth is also supported by increasing investments in liquid supplement production facilities and innovative packaging solutions. The rising preference for flavored liquid supplements and enhanced palatability further accelerates market adoption.

- By Excipient Source

On the basis of excipient source, the Europe nutraceutical excipients market is segmented into natural and synthetic. The natural excipients segment dominated with a market share of 57.1% in 2024, owing to the growing consumer preference for plant-based, organic, and clean-label formulations. Natural excipients align with European trends for sustainable, health-conscious, and environmentally friendly products. They are widely used in vitamins, protein supplements, probiotics, and prebiotics, providing functionality while maintaining natural product appeal. Manufacturers leverage natural excipients for better regulatory compliance, reduced chemical additives, and improved consumer trust. The segment’s versatility across dry and liquid formulations supports its sustained dominance.

The synthetic excipients segment is expected to witness the fastest CAGR of 12.2% from 2025 to 2032, driven by the growing demand for enhanced stability, controlled release, and improved solubility in complex nutraceutical formulations. Synthetic excipients play a crucial role in highly specialized products where consistency, precise dosing, and long-term shelf-life are essential. Their engineered properties allow manufacturers to achieve uniformity in texture, flow, and performance across diverse supplement formats, ensuring product reliability and efficacy. In addition, synthetic excipients are increasingly adopted in innovative formulations such as advanced protein powders, liquid nutraceuticals, and combination supplements where natural excipients may not provide sufficient functional support.

- By Distribution Channel

On the basis of distribution channel, the Europe nutraceutical excipients market is segmented into Direct tender, retail sales, and others. The retail sales segment dominated with a revenue share of 54.3% in 2024, benefiting from widespread availability of nutraceutical products across pharmacies, supermarkets, and e-commerce platforms in Europe. Retail provides immediate consumer access, convenience, and a high degree of visibility for new product launches. It also supports brand loyalty and awareness, making it the preferred choice for both traditional and specialty nutraceutical products. Retail channels cater to urban, semi-urban, and rural markets, ensuring penetration across diverse consumer segments.

The Direct Tender segment is expected to witness the fastest CAGR of 11.6% from 2025 to 2032, driven by the growing trend of bulk procurement by large manufacturers, contract manufacturers, and institutional buyers. This channel facilitates long-term partnerships, ensuring consistent supply and cost efficiency for large-scale production requirements. The segment’s growth is further supported by rising demand from industrial manufacturers and pharmaceutical-grade nutraceutical producers who require specialized excipients for advanced and complex formulations. Direct tender procurement also allows buyers to secure customized specifications, maintain quality standards, and streamline logistics for high-volume orders.

Europe Nutraceutical Excipients Market Regional Analysis

- The Europe nutraceutical excipients market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing consumer awareness regarding health and nutrition, rising demand for dietary supplements, and the growing adoption of clean-label and plant-based excipients

- The market growth is further supported by strong pharmaceutical and food processing industries across the region, as well as increased R&D investments and collaborations between universities, nutraceutical companies, and biotech firms

- Europe is witnessing significant expansion across functional foods, beverages, and dietary supplements, with excipients playing a crucial role in enhancing product stability, taste, and bioavailability

Germany Nutraceutical Excipients Market Insight

The Germany nutraceutical excipients market dominated the nutraceutical excipients market in Europe with the largest revenue share of 34.5% in 2024, supported by its advanced pharmaceutical and food processing industries, strong consumer base for dietary supplements, and growing adoption of clean-label, plant-based excipients. The country also benefits from well-established manufacturing infrastructure, robust R&D investments, and collaborations between universities, biotech firms, and nutraceutical companies that continue to drive innovation and ensure market leadership. Increasing consumer preference for natural, safe, and functional ingredients further reinforces Germany’s dominance in the market.

France Nutraceutical Excipients Market Insight

The France nutraceutical excipients market is expected to be the fastest-growing country in the European nutraceutical excipients market during the forecast period, registering the highest CAGR. This growth is driven by increasing consumer awareness toward preventive healthcare, rising investments in nutraceutical research, and supportive government programs encouraging the use of fortified foods. Expanding adoption of probiotics, personalized nutrition, and liquid formulations in France is further accelerating the demand for advanced excipients. The French market is evolving as a key growth hub in Europe, with manufacturers focusing on innovation, clean-label solutions, and high-quality excipient products to meet rising consumer expectations.

Europe Nutraceutical Excipients Market Share

The nutraceutical excipients industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- DuPont (U.S.)

- Ingredion (U.S.)

- W.R. Grace and Co (U.S.)

- Kerry Group plc (Ireland)

- Sensient Technologies Corporation (U.S.)

- Roquette Frères (France)

- Cargill, Incorporated (U.S.)

- Ashland (U.S.)

- SEPPIC (France)

- Gatefosse (France)

- Pioma Chemicals (India)

- Omya International AG (Switzerland)

- Gangwal Chemicals Private Limited (India)

- Grain Processing Corporation (U.S.)

- IMCD (Netherlands)

- JRS PHARMA (Germany)

- Azelis (Belgium)

- Jigs Chemical (India)

- Sigaichi Industries (Japan)

- Beneo (Germany)

- ABITEC (U.S.)

Latest Developments in Europe Nutraceutical Excipients Market

- In May 2025, Lubrizol announced its participation in CPHI Frankfurt, scheduled for October 28–30, 2025. The company plans to showcase the benefits of its polymer-based excipients for enhancing the solubility, bioavailability, and palatability of active pharmaceutical ingredients (APIs) and nutraceuticals. This initiative highlights Lubrizol's commitment to advancing the functionality and performance of excipients in the nutraceutical sector

- In February 2022, Kerry Group Plc., the world’s leading taste and Nutrition Company, announced that it had made two significant biotechnology acquisitions that have expanded its expertise, technology portfolio and manufacturing capabilities. The company has announced that it has acquired the leading biotechnology Innovation Company, c-LEcta and Mexican-based enzyme manufacturer, Enmex. c-LEcta is a leading biotechnology innovation company specializing in precision fermentation, optimized bio-processing and bio-transformation. Also, Enmex is a well-established enzyme manufacturer based in Mexico, supplying multiple bio-process solutions for food, beverage and animal nutrition markets. This has helped the company to increase its revenue

- In September 2022, DFE Pharma, a Europe leader in pharma- and nutraceutical excipient solutions, opened its new “Closer to the Formulator” (C2F), a Center of Excellence, in Hyderabad, India. C2F helped pharmaceutical companies to shorten the time from concept to finished commercial product through its expertise in all phases of pharmaceutical development. This has helped the company to showcase its progress

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.