Europe Nuts And Snacks Bars Market

Market Size in USD Billion

CAGR :

%

USD

3.90 Billion

USD

6.16 Billion

2025

2033

USD

3.90 Billion

USD

6.16 Billion

2025

2033

| 2026 –2033 | |

| USD 3.90 Billion | |

| USD 6.16 Billion | |

|

|

|

|

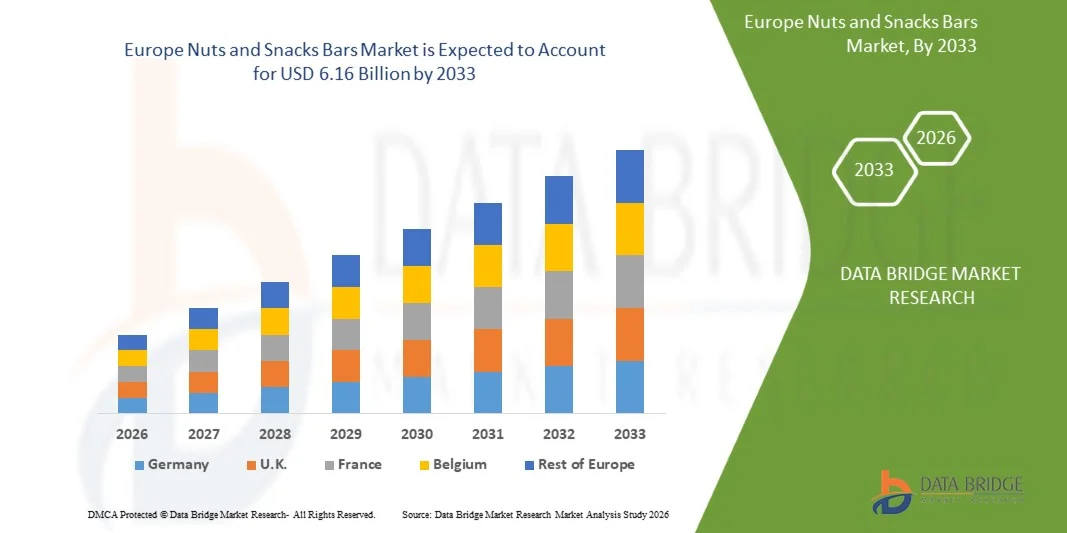

What is the Europe Nuts and Snacks Bars Market Size and Growth Rate?

- The Europe Nuts and Snacks Bars market size was valued at USD 3.90 billion in 2025 and is expected to reach USD 6.16 billion by 2033, at a CAGR of5.2% during the forecast period

- The increasing fast and busy lifestyle has led to many health issues among consumers in the past years. Thus, people opt for a healthier lifestyle and maintain their control of nutrient intakes such as sugar, carbohydrates, and others

- The nut and snack manufacturers have come up with new sugar-free products, which decrease the sugar uptake from the body. Many companies are coming up with new launches of nut and snack bars with many diverse compositions

What are the Major Takeaways of Nuts and Snacks Bars Market?

- The increasing health awareness and changing lifestyle among European consumers are the leading factors driving the market's growth

- Various countries across Europe are opting for healthy food and snacking trends. Consumers in the U.K. are more focused on convenience snack bars that offer several health benefits, while Germany is the vast market for organic snacks. In Germany, the food culture is turning more vegan. As consumers' awareness of nutrition increases, the food industries adapt to produce healthy snacks

- Germany dominated the Europe nuts and cereal snacks bar market with a 34.5% revenue share in 2025, supported by rising consumer demand for healthy snacking, clean-label ingredients, and convenience-focused products

- France is projected to witness the fastest CAGR of 8.2% from 2026 to 2033, driven by rising demand in fitness centers, offices, supermarkets, and households. Consumers increasingly prefer organic, gluten-free, and low-calorie snack bars, while clean-label and plant-based options continue to gain traction

- The Nut Bars segment dominated the market with a revenue share of 54.2% in 2025, driven by rising demand for protein-rich, low-sugar, and clean-label snacks made from almonds, cashews, peanuts, and mixed nuts

Report Scope and Nuts and Snacks Bars Market Segmentation

|

Attributes |

Nuts and Snacks Bars Key Market Insights |

|

Segments Covered |

|

|

Country Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Nuts and Snacks Bars Market?

“Growing Shift Toward Eco-Friendly, Plant-Based, and Clean-Label Nuts and Snacks Bars”

- The nuts and snacks bars market is witnessing a strong transition toward plant-based ingredients, biodegradable packaging, and clean-label formulations, driven by rising consumer awareness of health, sustainability, and environmental impact

- For instance, in 2024, Kind LLC (U.S.) and Clif Bar & Company (U.S.) expanded their product portfolios with plant-based, low-sugar, and compostable-packaged snack bars to attract eco-conscious consumers

- Increasing demand for plastic-free wrappers, organic nut ingredients, and sustainably sourced grains is accelerating the adoption of greener product innovations

- Manufacturers are incorporating biodegradable film packaging, natural sweeteners, and responsibly sourced nuts to meet consumer expectations for healthier and planet-friendly snacks

- Rising regulatory pressure on sustainable packaging, sugar reduction, and cleaner ingredient labels is influencing product development across global brands

- As sustainability and health-driven snacking gain momentum, eco-friendly and plant-based Nuts and Snacks Bars will continue to define future market evolution and competitive positioning

What are the Key Drivers of Nuts and Snacks Bars Market?

- Increasing focus on healthy snacking, protein-rich diets, and natural ingredients across households, fitness centers, and on-the-go consumers remains a primary growth driver for the nuts and snacks bars market

- For instance, in 2025, General Mills (U.S.) and Nestlé S.A. (Europe) expanded their snack bar lines with high-protein, gluten-free, and functional nutrition bars to meet evolving health demands

- Rising preference for convenient, portable, and energy-boosting snacks is boosting market penetration across both urban and semi-urban regions

- Technological advancements in nut roasting, natural flavor extraction, and texture enhancement are enabling better product quality and wider consumer adoption.

- Growth in sectors such as sports nutrition, travel retail, corporate wellness programs, and online grocery is increasing the consumption of Nuts and Snacks Bar

- As health-conscious lifestyles expand across global markets, the Nuts and Snacks Bars industry is expected to grow steadily, fueled by clean-label trends and continuous product innovation

Which Factor is Challenging the Growth of the Nuts and Snacks Bars Market?

- High production costs, fluctuating prices of nuts, seeds, and natural sweeteners, and strict food safety regulations pose key challenges to market growth

- For instance, during 2024–2025, several regional manufacturers faced cost pressures due to rising prices of almonds, peanuts, cocoa, and sustainable packaging materials

- Growing concerns over sugar content, allergens (such as peanuts), and calorie density are limiting large-scale consumption among certain consumer groups

- Competition from low-cost cereal bars, baked snacks, and conventional confectionery puts pricing pressure on premium snack bar manufacturers

- Limited availability of recycling facilities for multilayer packaging and challenges in maintaining clean-label compliance present operational hurdles

- To overcome these constraints, companies are focusing on cost-efficient production, diversified ingredient sourcing, and biodegradable packaging solutions to improve market accessibility and consumer trust

How is the Nuts and Snacks Bars Market Segmented?

The market is segmented on the basis of product type, claim, category, nature, flavor, pack type, packaging, brand and distribution channel.

• By Product Type

The Nuts and Snacks Bars market is segmented into Cereal Bars and Nut Bars. The Nut Bars segment dominated the market with a revenue share of 54.2% in 2025, driven by rising demand for protein-rich, low-sugar, and clean-label snacks made from almonds, cashews, peanuts, and mixed nuts. Their strong nutritional profile, satiety value, and suitability for keto, low-carb, and high-protein diets make Nut Bars highly preferred among health-conscious consumers.

The Cereal Bars segment is projected to grow at the fastest CAGR during 2026–2033, supported by increasing consumption of convenient, fiber-enriched, and whole-grain breakfast alternatives. The rising adoption of oats, multigrain flakes, granola, and ancient grains in bar formulations is appealing to consumers seeking digestive health benefits. Growing availability of flavored cereal bars in travel retail, schools, and offices further boosts category expansion across global markets.

• By Claim

The market is segmented into Regular, Gluten Free, Vegan, Lactose Free, Artificial Color & Preservative Free, and Others. The Regular segment dominated the market with a 41.7% revenue share in 2025, attributed to its wide availability, affordable pricing, and strong acceptance across mainstream retail. Regular bars remain the preferred choice for general snacking, sports activities, and on-the-go consumption.

The Gluten-Free segment is expected to grow at the fastest CAGR during 2026–2033, driven by increasing prevalence of gluten intolerance, lifestyle-driven gluten-free diets, and rising demand for clean-label formulations based on nuts, seeds, millet, quinoa, and rice crisps. The Vegan and Preservative-Free categories are also expanding steadily as consumers seek plant-based, allergen-free, and chemical-free snack options aligned with sustainable and transparent ingredient sourcing.

• By Category

The Nuts and Snacks Bars market is divided into Regular, Meal Replacement Bars, Pre-Workout Bars, Post-Workout Bars, Yoga Bars, and Others. The Regular segment dominated the market with a revenue share of 48.5% in 2025, supported by its extensive consumption among working professionals, students, and families for convenient snacking.

The Meal Replacement Bars segment is projected to grow at the fastest CAGR during 2026–2033, driven by increased interest in weight management, controlled-calorie diets, and high-protein formulations that offer balanced nutrition. Pre- and Post-Workout Bars are also gaining strong traction due to the rapid rise of gym culture, marathon participation, and sports nutrition trends. The Yoga Bars and functional wellness bars category continues to expand as consumers look for clean, minimally processed snacks designed for holistic wellness and sustained energy.

• By Nature

The market based on nature is segmented into Conventional and Organic snack bars. The Conventional segment dominated the market with a 67.9% revenue share in 2025, owing to its affordable pricing, mass availability, and broader flavor options across retail, e-commerce, and convenience stores.

The Organic segment is expected to grow at the fastest CAGR from 2026–2033, fueled by rising consumer interest in chemical-free ingredients, non-GMO nuts, organically grown cereals, and transparent supply chains. Growing health consciousness, concerns about pesticide exposure, and regulatory push toward sustainable agriculture are boosting demand for organic bars. Premium brands are expanding their organic ranges using responsibly sourced nuts, plant proteins, and natural sweeteners such as honey, dates, and maple syrup, further enhancing category growth across global markets.

• By Flavor

Based on flavor, the Nuts and Snacks Bars market is segmented into Regular and Flavored bars. The Flavored segment dominated the market with a 62.3% revenue share in 2025, driven by growing consumer preference for indulgent tastes such as chocolate, berry, caramel, coconut, citrus, peanut butter, and exotic combinations. Flavor innovation remains a key branding strategy for market leaders.

The Regular segment is projected to grow at the fastest CAGR during 2026–2033, supported by rising adoption of clean-label, unsweetened, and natural-taste bars made from whole nuts, seeds, and grains. Growing interest in low-sugar and naturally flavored bars using spices, fruits, and botanicals continues to shape demand across fitness, lifestyle, and wellness categories.

• By Pack Type

The market is segmented into Single Pack, Family Pack/Multipack, and Others. The Single Pack segment dominated the market with a 58.4% revenue share in 2025, driven by strong demand for on-the-go convenience, portion-controlled snacking, and impulse purchases at retail counters.

The Family Pack/Multipack segment is expected to grow at the fastest CAGR during 2026–2033, fueled by rising household consumption, bulk purchasing trends, and demand from office pantries, schools, and gyms. The growing popularity of value packs, promotional bundles, and subscription-based multipacks in e-commerce channels further supports market expansion.

• By Packaging

The Nuts and Snacks Bars market is segmented into Wrap-In, Pouches, Card Box, and Others. The Wrap-In segment dominated the market with a 64.1% revenue share in 2025, due to its cost-effectiveness, portability, and suitability for moisture retention and product freshness.

The Card Box segment is projected to grow at the fastest CAGR from 2026–2033, supported by rising demand for eco-friendly, recyclable, and premium-looking packaging for multipacks and gift boxes. Manufacturers are increasingly adopting compostable films, paper-based laminates, and biodegradable wrappers to align with sustainability trends and reduce plastic usage

• By Brand

The market is segmented into Branded and Private Label products. The Branded segment dominated the market with a 69.3% revenue share in 2025, supported by strong consumer trust, product consistency, advanced R&D, and wide availability across supermarkets, hypermarkets, and specialty nutrition stores.

The Private Label segment is expected to grow at the fastest CAGR during 2026–2033, driven by price-sensitive consumers and rapid retail expansion of store-owned brands offering competitive quality at lower prices. Growing acceptance of private label protein bars, granola bars, and nut bars in Europe, the U.S., and Asia continues to strengthen this segment.

• By Distribution Channel

The market is divided into Store-Based Retailers and Non-Store Retailers. The Store-Based Retailers segment dominated the market with a 72.8% revenue share in 2025, due to high product visibility, impulse buying, and strong penetration across supermarkets, convenience stores, specialty stores, and pharmacies.

The Non-Store Retailers segment is projected to grow at the fastest CAGR during 2026–2033, fueled by rapid expansion of e-commerce, subscription services, and direct-to-consumer (D2C) nutrition brands. Online platforms offer wider product variety, customizable packs, and targeted promotions, driving strong adoption among millennials and urban consumers.

Which Region Holds the Largest Share of the Nuts and Snacks Bars Market?

- Germany dominated the Europe nuts and cereal snacks bar market with a 34.5% revenue share in 2025, supported by rising consumer demand for healthy snacking, clean-label ingredients, and convenience-focused products

- Strong retail presence, expanding organic product lines, and investments in plant-based, high-protein, and low-sugar snack bars drive Germany’s regional leadership, while online grocery platforms further accelerate market penetration

France Nuts and Cereal Snacks Bar Market Insight

France is projected to witness the fastest CAGR of 8.2% from 2026 to 2033, driven by rising demand in fitness centers, offices, supermarkets, and households. Consumers increasingly prefer organic, gluten-free, and low-calorie snack bars, while clean-label and plant-based options continue to gain traction. Enhanced retail expansion, strong e-commerce adoption, and growing interest in healthy breakfast replacements further support France’s rising contribution to the European market.

U.K. Nuts and Cereal Snacks Bar Market Insight

The U.K. contributes steadily to regional growth, fueled by rising adoption of protein bars, vegan bars, and functional cereal snacks across households, workplaces, and gyms. Consumers show strong preference for fiber-rich, low-sugar, and eco-friendly packaged snack bars, while brands invest in premium formulations, natural ingredients, and innovative flavor profiles. Urban lifestyle changes, on-the-go snacking trends, and expanding retail shelves strengthen the U.K.’s position in Europe’s Nuts and Cereal Snacks Bar market.

Italy Nuts and Cereal Snacks Bar Market Insight

Italy is growing steadily, supported by increasing consumption of nut-based, artisanal, and naturally flavored snack bars across residential and commercial segments. Demand for biodegradable packaging, sugar-conscious formulations, and plant-based cereals is rising among health-focused consumers. Manufacturers are introducing fruit-infused, organic, and high-fiber variants, while retail modernization and e-commerce penetration continue to support sustained market growth.

Spain Nuts and Cereal Snacks Bar Market Insight

Spain is emerging as a key market in Europe, driven by rising consumer preference for healthy, convenient, and protein-rich snack bars. Growing awareness of balanced snacking, sports nutrition, and natural ingredients is strengthening demand across households, gyms, and offices. Retail network expansion, private-label innovation, and strong online distribution channels further elevate Spain’s contribution to the Europe Nuts and Cereal Snacks Bar market.

Which are the Top Companies in Nuts and Snacks Bars Market?

The nuts and snacks bars industry is primarily led by well-established companies, including:

- Mondelez International (U.S.)

- General Mills (U.S.)

- Kellogg’s (U.S.)

- The Simply Good Foods Company (U.S.)

- Associated British Foods plc (U.K.)

- Nestlé (Switzerland)

- The Quaker Oats Company (U.S.)

- Clif Bar and Company (U.S.)

- Cerealto Siro Foods (Spain)

- Danone (France)

- Bühler (Switzerland)

- Mars, Incorporated (U.S.)

- Eat Naturals (U.K.)

- Hero Group (Switzerland)

What are the Recent Developments in Europe Nuts and Snacks Bars Market?

- In August 2024, Mars, Incorporated announced an agreement to acquire Kellanova, a major producer of snacking and cereal products, aiming to strengthen its snacking portfolio and expand its global presence. This acquisition is expected to significantly enhance Mars’ competitive positioning in the worldwide snacks category

- In May 2023, Nature Valley, a brand under General Mills, introduced its Savory Nut Crunch Bars in three flavors—White Cheddar, Smoky BBQ, and Everything Bagel—using a proprietary binding method that removes the need for sugar binders. This launch marks Nature Valley’s strategic move into savory snacking while enhancing product innovation

- In May 2023, Nature Valley expanded its offerings with the introduction of its first savory snack line under the Savory Nut Crunch Bars range, introducing a new flavor dimension to its product portfolio. This initiative reinforces the brand’s commitment to diversifying flavors and meeting evolving consumer preferences

- In April 2023, Ferrero acquired a snack bar manufacturing facility in Germany to support its long-term growth in the better-for-you snacks segment. This acquisition strengthens Ferrero’s production capabilities and accelerates its presence in the health-focused snack bar market

- In November 2022, Mars Incorporated debuted repackaged snack bars using plastic sourced through advanced recycling, developed in collaboration with SABIC, Landbell, Plastic Energy, Taghleef, and SIT, enabling a fully recyclable mono-material propylene wrapper. This sustainable packaging initiative highlights Mars’ commitment to circularity and eco-friendly materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Nuts And Snacks Bars Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Nuts And Snacks Bars Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Nuts And Snacks Bars Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.