Europe Obsessive Compulsive Disorder Ocd Drugs Market

Market Size in USD Billion

CAGR :

%

USD

1.55 Billion

USD

3.13 Billion

2025

2033

USD

1.55 Billion

USD

3.13 Billion

2025

2033

| 2026 –2033 | |

| USD 1.55 Billion | |

| USD 3.13 Billion | |

|

|

|

|

Europe Obsessive-Compulsive Disorder (OCD) Drugs Market Size

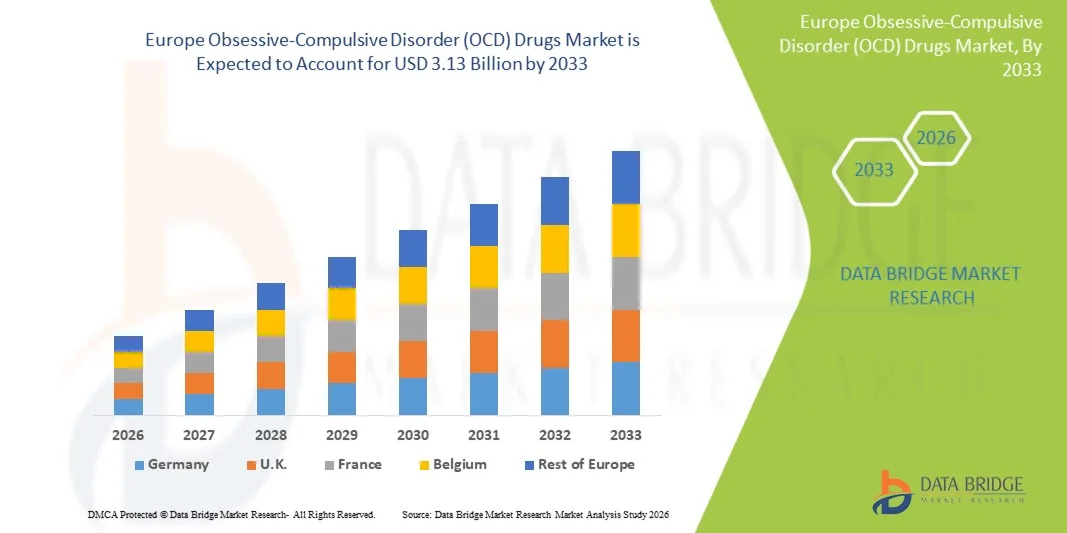

- The Europe Obsessive-Compulsive Disorder (OCD) Drugs Market size was valued at USD 1.55 billion in 2025 and is expected to reach USD 3.13 billion by 2033, at a CAGR of 9.20% during the forecast period

- The market growth is largely fueled by the rising prevalence of obsessive-compulsive disorder worldwide, increasing mental health awareness, and ongoing advancements in psychiatric drug development, leading to greater adoption of pharmacological treatments across both clinical and outpatient settings

- Furthermore, growing patient demand for effective, fast-acting, and better-tolerated therapeutic options is encouraging pharmaceutical companies to develop innovative SSRIs, SNris, and novel drug classes, thereby accelerating the uptake of obsessive-compulsive disorder (OCD) Drugs solutions and significantly boosting the industry's growth

Europe Obsessive-Compulsive Disorder (OCD) Drugs Market Analysis

- Obsessive-Compulsive Disorder (OCD) drugs, including SSRIs, SNRIs, tricyclic antidepressants, and emerging novel therapeutics, are becoming increasingly vital components of modern psychiatric treatment due to their proven clinical efficacy, improved safety profiles, and expanding use across hospitals, specialty mental health clinics, and home-care settings

- The escalating demand for OCD drugs is primarily fueled by the rising global prevalence of anxiety and OCD-related disorders, increasing awareness of mental health conditions, and growing patient preference for pharmacological therapies that offer long-term symptom control and improved quality of life

- The U.K. dominated the Europe Obsessive-Compulsive Disorder (OCD) Drugs Market with the largest revenue share of 38.6% in 2025, driven by its well-established mental healthcare infrastructure, high diagnosis and treatment rates, strong clinical adoption of next-generation antidepressants, and increasing access to psychiatric services through both public (NHS) and private healthcare systems. The country’s growing awareness campaigns, rising prescription volumes for SSRIs and antipsychotics, and expanding availability of specialized OCD treatment centers significantly contributed to its leading market position

- Germany is expected to be the fastest-growing country in the Europe Obsessive-Compulsive Disorder (OCD) Drugs Market during the forecast period, projected to expand at a notable CAGR of 17.2% from 2026 to 2033, fueled by increasing recognition of mental health disorders, expansion of advanced psychiatric treatment facilities, rising investments in pharmaceutical R&D, and a growing patient population seeking evidence-based pharmacological therapies. The country’s strong healthcare reimbursement structure and accelerating adoption of novel OCD medications further support its rapid market growth

- The oral segment dominated the largest market revenue share of 71.8% in 2025, as SSRIs, SNRIs, and antipsychotics—the mainstay of OCD treatment—are primarily administered orally

Report Scope and Europe Obsessive-Compulsive Disorder (OCD) Drugs Market Segmentation

|

Attributes |

Obsessive-Compulsive Disorder (OCD) Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Obsessive-Compulsive Disorder (OCD) Drugs Market Trends

“Shift Toward Novel Mechanisms, Personalized Treatment, and Digital-Therapeutic Integration”

- A significant and accelerating trend in the global Europe Obsessive-Compulsive Disorder (OCD) Drugs Market is the growing shift toward therapies with novel mechanisms of action beyond traditional SSRIs and SNRIs, driven by limitations in response rates and frequent side effects

- For instance, in February 2024, multiple pharmaceutical companies announced expanded research efforts into glutamate-modulating agents and neuromodulators, which show promising results in reducing treatment-resistant OCD symptoms

- Another key trend is the rising adoption of personalized medicine, where genetic markers and patient-specific biological profiles are increasingly used to predict drug response and reduce trial-and-error prescribing

- Digital health platforms and telepsychiatry integration are also reshaping treatment patterns, allowing clinicians to closely monitor medication adherence, symptom progression, and patient feedback in real time

- For instance, during 2023–2024, several leading mental health providers incorporated AI-based symptom tracking tools that help optimize medication dosing and identify early relapse signs

- In addition, pharmaceutical companies are focusing on developing extended-release formulations, combination therapies, and drugs with enhanced tolerability to improve long-term treatment adherence

- This collective shift toward innovative drug development, data-driven treatment personalization, and digital-therapeutic augmentation is creating a more advanced, responsive, and patient-centered approach to OCD pharmacotherapy

Europe Obsessive-Compulsive Disorder (OCD) Drugs Market Dynamics

Driver

“Rising OCD Prevalence and Growing Adoption of Advanced Pharmacological Therapies”

- The increasing global prevalence of obsessive-compulsive disorder, along with rising diagnosis rates driven by improved mental health awareness, is a major factor propelling the demand for OCD drugs

- For instance, in May 2023, several European mental health bodies reported a significant rise in clinical consultations for OCD symptoms post-pandemic, prompting stronger emphasis on pharmaceutical interventions

- As more patients seek structured and evidence-based treatment, there is growing reliance on SSRIs, SNRIs, and adjunct therapies, which offer clinically validated efficacy in symptom reduction

- Moreover, advancements in precision medicine, improved drug formulations, and better-tolerated therapeutic options are enhancing patient adherence and driving market expansion

- The adoption of long-term maintenance treatment for chronic OCD cases further supports consistent demand for pharmacological solutions

- In addition, increasing investments by pharmaceutical companies to develop novel mechanisms of action—such as glutamate modulators and neuromodulatory agents—are expected to accelerate the availability of next-generation OCD drugs

- Expanding access to psychiatric care services, combined with insurance support in several countries, is also enabling a larger patient population to receive timely treatment, contributing significantly to market growth

Restraint/Challenge

“Side Effects, Limited Drug Classes, and High Treatment Costs”

- A key challenge limiting the growth of the OCD drugs market is the significant side-effect profile associated with many existing medications, including weight gain, insomnia, gastrointestinal issues, and dependency concerns

- For instance, reports from various mental health clinics in 2024 noted frequent patient discontinuation due to SSRI-induced side effects, leading to treatment resistance or relapse

- The market is also constrained by the limited number of drug classes currently approved for OCD, with many patients requiring off-label combinations or augmentation therapies to achieve symptom control

- High treatment costs—particularly for long-term medication plans, psychiatric consultations, and hospital-based therapy sessions—pose further barriers, especially in low- and middle-income regions

- The slow pace of regulatory approvals for novel agents and the complex design of psychiatric clinical trials prolong product development timelines

- In addition, social stigma around seeking mental health treatment can delay diagnosis, reducing the number of patients receiving appropriate pharmacological therapy

- Overcoming these challenges will require investment in safer drugs with fewer side effects, improving access to affordable care, and increasing patient education about the benefits of continuous OCD management

Europe Obsessive-Compulsive Disorder (OCD) Drugs Market Scope

The market is segmented on the basis of severity, sub-type, drugs, route of administration, population type, end user, and distribution channel.

• By Severity

On the basis of severity, the Europe Obsessive-Compulsive Disorder (OCD) Drugs Market is segmented into mild to moderate and moderate to severe. The mild to moderate segment dominated the largest market revenue share of 56.4% in 2025, supported by the significantly larger patient pool presenting with early-stage or manageable symptoms that respond well to standard SSRI therapy. Increasing global awareness regarding mental health and improvements in primary-care screening have made early detection more common, expanding the treated population. The availability of several cost-effective medications in generic form further drives treatment uptake within this group. Patients in this category typically show higher adherence rates, strengthening long-term prescription continuity. Lifestyle stressors and growing mental-health openness among young populations also contribute to expanding diagnosis frequency. The rising influence of digital mental-health platforms and telepsychiatry facilitates timely intervention among mild to moderate patients, thereby supporting segment dominance.

The moderate to severe segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, driven by the increasing prevalence of treatment-resistant OCD requiring advanced pharmacological strategies. Patients in this category often exhibit chronic symptom patterns that are more likely to need high-dose SSRIs or combination therapy involving antipsychotics, resulting in higher prescription intensity. Expanding access to psychiatric specialists and improved evaluation protocols for severe OCD significantly increase diagnosis rates. The rising use of specialized treatment centers offering targeted drug interventions for severe symptoms further accelerates segment growth. Increased awareness of severe OCD’s impact on quality of life has prompted earlier initiation of drug therapy, including NMDA blockers in some regions. The ongoing development of novel drug mechanisms and the expansion of clinical trials focusing on severe OCD patients further strengthen the growth prospects of this segment.

• By Sub-Type

On the basis of sub-type, the Europe Obsessive-Compulsive Disorder (OCD) Drugs Market is segmented into contamination obsessions with washing/cleaning compulsion, harm obsessions with checking compulsions, obsessions without visible compulsions, symmetry/ordering/arranging/counting compulsions, hoarding, and others. The contamination with washing/cleaning compulsion segment dominated the largest market revenue share of 38.7% in 2025, driven by its high global prevalence and increased public focus on hygiene practices over the past decade. Patients with this subtype often seek treatment earlier due to the disruptive impact of repeated washing cycles, resulting in higher diagnosis rates. The segment also benefits from strong physician familiarity with therapeutic guidelines for contamination-linked OCD. The responsiveness of this subtype to high-dose SSRI treatment further enhances long-term medication demand. Rising clinical acceptance of standardized assessment tools helps improve identification accuracy, expanding the treated population. Increased patient awareness of compulsive cleaning behaviors through digital mental-health campaigns has also contributed to earlier intervention and higher treatment uptake.

The symmetry/ordering/arranging/counting compulsions segment is expected to witness the fastest CAGR of 20.3% from 2026 to 2033, driven by growing clinical recognition of its complex symptom patterns and rising detection rates among adolescents and young adults. Patients with this subtype often require long-term and intensive treatment due to the chronic and rigid nature of symmetry-driven compulsions, boosting sustained medication usage. Increased research linking symmetry compulsions to specific neurobiological dysfunctions has encouraged targeted pharmacological development. The segment also benefits from growing adoption of combination drug therapy within specialized OCD clinics where such compulsions are more frequently identified. Expanded training programs for psychiatrists and psychologists now include enhanced diagnostic criteria for symmetry-related symptoms, improving recognition. In addition, rising cases of academic stress and perfection-driven behaviors in younger populations fuel increased diagnosis of this subtype.

• By Drugs

On the basis of drugs, the Europe Obsessive-Compulsive Disorder (OCD) Drugs Market is segmented into antidepressants, antipsychotics, NMDA blockers, and others. The antidepressants segment dominated the largest market revenue share of 62.5% in 2025, driven by SSRIs being globally accepted as the first-line pharmacological treatment for all major OCD subtypes. Widespread physician preference, high clinical efficacy, and strong safety profiles ensure consistent long-term use. Generic availability of commonly prescribed SSRIs supports affordability and accessibility across developing regions. Patients on antidepressants typically require extended treatment durations, maintaining prescription demand. The segment is further supported by solid reimbursement coverage for antidepressant therapy in most health systems. Increased awareness of mental health and early help-seeking behaviors reinforce treatment initiation rates. Growth in online mental-health consultations has also increased the frequency of antidepressant prescribing.

The NMDA blocker segment is expected to witness the fastest CAGR of 22.4% from 2026 to 2033, driven by rising global acceptance of glutamate-modulating treatments for severe and treatment-resistant OCD. Positive clinical outcomes associated with ketamine-based therapies have increased their adoption in specialized psychiatric facilities. Pharmaceutical companies are expanding research in next-generation NMDA-modulating molecules, supporting strong pipeline activity. The rapid-acting nature of NMDA blockers has generated significant clinical interest in cases where SSRIs fail to provide adequate relief. Growth in infusion centers offering ketamine therapy has improved patient access. Increasing real-world evidence supporting shorter-term symptom reduction in severe OCD further boosts adoption. Enhanced regulatory support for research in glutamate-targeting psychiatric drugs strengthens long-term market expansion.

• By Route of Administration

On the basis of route of administration, the market is segmented into oral and parenteral. The oral segment dominated the largest market revenue share of 71.8% in 2025, as SSRIs, SNRIs, and antipsychotics—the mainstay of OCD treatment—are primarily administered orally. Oral formulations offer high convenience, aiding patient adherence in long-term treatment plans. Widespread availability of affordable generics supports accessibility in emerging markets. Physicians prefer oral dosing due to lower administration complexity and ease of titration. Chronic disease management patterns in OCD, often requiring months or years of therapy, further reinforce reliance on oral drugs. Improved formulation technologies, including extended-release tablets, enhance treatment tolerability. Millions of patients accessing treatment through home-based teleconsultations also favor oral medications.

The parenteral segment is expected to witness the fastest CAGR of 19.1% from 2026 to 2033, driven by the rising adoption of IV ketamine and other infusion-based psychiatric therapies for severe OCD cases. Parenteral administration allows rapid drug delivery, making it suitable for treatment-resistant patients who require fast-acting interventions. Growing expansion of psychiatric infusion centers and hospital-based ketamine programs increases access to parenteral OCD therapies. Advancements in NMDA-modulating drug research also support increased demand for injectable formulations. The segment benefits from improved clinical acceptance and expanding reimbursement for infusion-based mental-health treatments in some markets. Increasing use of parenteral medications in high-risk or inpatient OCD cases further accelerates growth.

• By Population Type

On the basis of population type, the market is segmented into pediatrics and adults. The adult segment dominated the largest market revenue share of 68.9% in 2025, supported by higher diagnosis rates among adults due to greater awareness of OCD symptoms and more frequent help-seeking behavior. Adults are more likely to undergo long-term pharmacological management, sustaining prescription volume. Elevated stress levels, workplace pressures, and rising mental-health literacy contribute to increasing OCD detection among adults. Strong reimbursement support for adult psychiatric treatment in many regions further drives adoption. Adults also exhibit higher adherence to structured treatment plans, enhancing drug utilization. Increased integration of mental-health services within corporate wellness programs improves diagnostic outreach.

The pediatric segment is expected to witness the fastest CAGR of 18.6% from 2026 to 2033, driven by rising parental awareness of childhood mental health and increased school-based psychological screening. Pediatric OCD is being identified earlier due to improved clinician training and growing availability of child psychiatry services. More parents are seeking medical treatment for persistent compulsive behaviors, increasing the use of pharmacotherapy in moderate and severe pediatric cases. Expanding digital mental-health tools for children enhance early detection. New clinical guidelines have standardized treatment approaches for pediatric OCD, supporting physician confidence in initiating pharmacotherapy. Growing research on early-onset OCD pathophysiology also accelerates therapeutic advancement in this segment.

• By End User

On the basis of end user, the market is segmented into hospitals, specialty clinics, home healthcare, and others. The hospital segment dominated the largest market revenue share of 47.3% in 2025, driven by the availability of psychiatric specialists, advanced diagnostic tools, and comprehensive care pathways required for moderate to severe OCD management. Hospitals frequently handle high-risk, treatment-resistant cases needing intensive pharmacotherapy, increasing drug utilization. Collaboration between psychiatry, neurology, and behavioral therapy departments supports holistic treatment approaches. Access to emergency and inpatient mental-health services further strengthens segment dominance.

Specialty clinics are expected to witness the fastest CAGR of 20.9% from 2026 to 2033, driven by rising demand for focused OCD treatment centers offering targeted medication management and personalized therapeutic plans. Increasing availability of psychiatrists trained in complex OCD subtypes enhances treatment precision. These clinics often adopt advanced pharmacological combinations earlier, accelerating prescription volume. Patient preference for specialized care with shorter waiting times also supports growth. Expansion of private psychiatric practices and specialty mental-health chains contributes to stronger market penetration.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The retail pharmacy segment accounted for the largest market revenue share of 42.1% in 2025, supported by easy accessibility, widespread geographic reach, and greater patient reliance on local pharmacies for monthly psychiatric medication refills. Retail pharmacies stock a broad range of generics, supporting affordability. Regular physician follow-up schedules also align with retail dispensing frequencies, maintaining strong prescription turnover.

The online pharmacy segment is expected to witness the fastest CAGR of 21.4% from 2026 to 2033, driven by the rapid adoption of digital prescriptions and increasing use of home-delivery services for chronic psychiatric medications. Online platforms enhance privacy and convenience, encouraging medication adherence. Growth in telemedicine-driven prescribing directly boosts online pharmacy transactions.

Europe Obsessive-Compulsive Disorder (OCD) Drugs Market Regional Analysis

- The Europe Obsessive-Compulsive Disorder (OCD) Drugs Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising awareness of mental health conditions, increasing diagnosis rates, and the growing availability of specialized psychiatric care across the region

- The surge in demand for evidence-based pharmacological therapy, including SSRIs, antipsychotics, and emerging NMDA-modulating agents, is further contributing to market growth

- Europe is also witnessing expanding clinical research activities, greater healthcare spending, and improved access to both public and private mental health services, supporting the rising adoption of OCD treatment drugs across adult and pediatric populations

U.K. Europe Obsessive-Compulsive Disorder (OCD) Drugs Market Insight

The U.K. Europe Obsessive-Compulsive Disorder (OCD) Drugs Market dominated the Europe Obsessive-Compulsive Disorder (OCD) Drugs Market with the largest revenue share of 38.6% in 2025, driven by its well-established mental healthcare infrastructure, high diagnosis and treatment rates, and strong clinical adoption of next-generation antidepressants. The National Health Service (NHS) plays a key role by providing broad access to psychiatric consultations, cognitive-behavioural therapy with ERP, and prescription medications. Growing awareness campaigns, rising prescription volumes for SSRIs and antipsychotics, and an increasing number of specialized OCD treatment centers significantly contributed to the U.K.’s leading market position.

Germany Europe Obsessive-Compulsive Disorder (OCD) Drugs Market Insight

The Germany Europe Obsessive-Compulsive Disorder (OCD) Drugs Market is expected to be the fastest-growing during the forecast period, projected to expand at a notable CAGR of 17.2% from 2026 to 2033, propelled by increasing recognition of mental health disorders and rising acceptance of pharmacological treatment for OCD. The country’s expanding network of advanced psychiatric care facilities, strong investments in pharmaceutical R&D, and growing patient demand for innovative therapies such as novel serotonergic agents and glutamatergic modulators are accelerating market growth. In addition, Germany’s robust healthcare reimbursement system and emphasis on evidence-based psychiatric care support the rapid adoption of new OCD drugs.

Europe Obsessive-Compulsive Disorder (OCD) Drugs Market Share

The Obsessive-Compulsive Disorder (OCD) Drugs industry is primarily led by well-established companies, including:

- AbbVie (U.S.)

- Pfizer (U.S.)

- Eli Lilly and Company (U.S.)

- GSK (U.K.)

- Novartis (Switzerland)

- Takeda Pharmaceutical (Japan)

- Otsuka Pharmaceutical (Japan)

- AstraZeneca (U.K.)

- Bristol-Myers Squibb (U.S.)

- Roche (Switzerland)

- Sanofi (France)

- Teva Pharmaceutical (Israel)

- Lundbeck (Denmark)

- Sun Pharma (India)

- Dr. Reddy’s Laboratories (India)

- Johnson & Johnson (U.S.)

- Merck & Co. (U.S.)

- Aurobindo Pharma (India)

- Zydus Lifesciences (India)

Latest Developments in Europe Obsessive-Compulsive Disorder (OCD) Drugs Market

- In October 2022, the Medical University of Vienna launched a randomized, double-blind clinical study (NCT05577585) to test low-dose ketamine for OCD (aim: measure anti-OCD effects, stress and cognition after infusion), marking a notable move in European investigator-led trials of glutamatergic agents for treatment-resistant OCD

- In August 2024, a peer-reviewed review titled “Psilocybin in pharmacotherapy of obsessive-compulsive disorder” was published in Pharmacological Reports (open-access), summarizing emerging clinical and experimental evidence and noting multiple ongoing European trials — highlighting psychedelic agents (psilocybin) as an actively investigated novel pharmacotherapy pathway for OCD

- In July 2024, NICE (UK) recorded a formal review of its OCD guideline (CG31 — “Obsessive-compulsive disorder and body dysmorphic disorder: treatment”) and indicated an update was in progress, signalling likely guideline/standards changes that will affect prescribing pathways, service provision and uptake of new pharmacological options in the UK market

- In December 2024, the European Medicines Agency (EMA) CHMP meeting highlighted strong regulatory activity across human medicines in 2024 (CHMP recommended 17 new medicines at its Dec 9–12 meeting and EMA reported 114 recommended medicines in 2024 overall), demonstrating an active European regulatory environment for novel CNS and other therapies that can accelerate availability and market dynamics for new psychiatric treatments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.