Europe Operating Room Equipment Supplies Market

Market Size in USD Billion

CAGR :

%

USD

9.72 Billion

USD

13.04 Billion

2025

2033

USD

9.72 Billion

USD

13.04 Billion

2025

2033

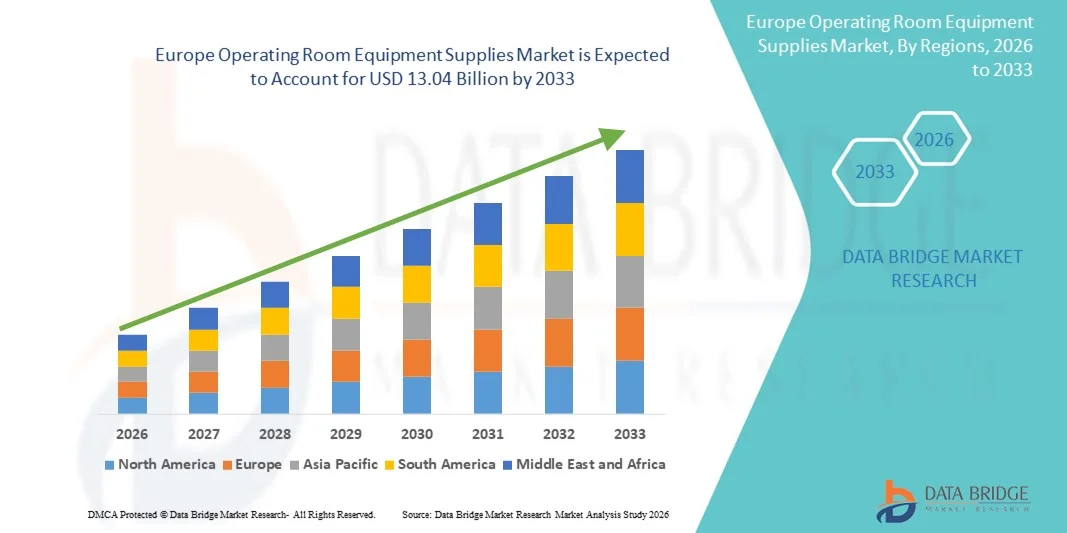

| 2026 –2033 | |

| USD 9.72 Billion | |

| USD 13.04 Billion | |

|

|

|

|

Europe Operating Room Equipment Supplies Market Size

- The Europe operating room equipment supplies market size was valued at USD 9.72 billion in 2025 and is expected to reach USD 13.04 billion by 2033, at a CAGR of 3.75% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in hospital infrastructure and surgical procedures, leading to increased automation and efficiency in operating rooms across both public and private healthcare facilities

- Furthermore, rising demand for advanced, sterile, and user-friendly surgical equipment and instruments is driving the adoption of Operating Room Equipment Supplies solutions, thereby significantly boosting the industry's growth

Europe Operating Room Equipment Supplies Market Analysis

- Operating room equipment supplies, including surgical instruments, diagnostic devices, and support systems, are increasingly vital components of modern healthcare infrastructure in both hospitals and surgical centers due to their critical role in patient safety, procedural efficiency, and surgical outcomes

- The escalating demand for operating room equipment supplies is primarily fueled by the growing number of surgical procedures, rising awareness of advanced surgical technologies, and an increasing focus on patient safety and hospital efficiency

- U.K. dominated the operating room equipment supplies market with the largest revenue share of 37.5% in 2025, supported by advanced healthcare infrastructure, high adoption of modern surgical equipment, strong presence of leading medical device manufacturers, and robust government initiatives for healthcare modernization across hospitals, surgical centers, and specialty clinics

- Germany is expected to be the fastest-growing region in the operating room equipment supplies market during the forecast period, projected to record a CAGR of 12.1% from 2026 to 2033, driven by expanding hospital infrastructure, increasing number of surgical procedures, growing healthcare investments, and a rising focus on patient safety and technologically advanced operating room solutions

- The Anaesthesia Machines segment dominated the largest market revenue share of 55.1% in 2025, owing to its critical role in patient safety during surgeries

Report Scope and Operating Room Equipment Supplies Market Segmentation

|

Attributes |

Operating Room Equipment Supplies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

• Stryker (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Operating Room Equipment Supplies Market Trends

Expansion in Emerging Markets and Technological Advancements

- The adoption of technologically advanced operating room equipment offers opportunities for manufacturers to expand into emerging markets such as India, Southeast Asia, and Latin America, where increasing healthcare expenditure and surgical volumes are fueling demand

- For instance, in 2024, several manufacturers introduced modular and portable operating room systems designed for low-resource hospitals, highlighting potential for market growth in underserved regions

- Continuous innovation in surgical instruments, energy-efficient lighting, smart sterilization, and ergonomic designs presents opportunities for companies to differentiate products and meet evolving clinical needs

- Rising awareness among healthcare providers about patient safety, infection control, and surgical efficiency is expected to create sustained demand for reliable and advanced operating room equipment supplies over the forecast period

Europe Operating Room Equipment Supplies Market Dynamics

Driver

Growing Demand Due to Rising Surgical Procedures and Healthcare Investments

- The increasing prevalence of surgeries, including minimally invasive procedures, coupled with rising investments in healthcare infrastructure, is a significant driver for the growing demand for operating room equipment supplies

- For instance, in April 2025, announced an advancement in IoT-based self-storage security, looking forward to integrating state-of-the-art sensors into the Passport locking solution. Such strategies by key companies are expected to drive the Operating Room Equipment Supplies industry growth in the forecast period

- Hospitals and surgical centers are increasingly focusing on upgrading their operating rooms with advanced equipment such as surgical tables, lighting systems, sterilization tools, and anesthesia devices to enhance efficiency, safety, and patient outcomes

- Government initiatives and private funding promoting modern surgical facilities in developing regions are further driving the adoption of high-quality operating room equipment supplies

- The growing number of outpatient surgical centers and ambulatory care facilities is also boosting demand, as these facilities require reliable and cost-effective operating room equipment to perform various procedures efficiently

Restraint/Challenge

High Initial Costs and Maintenance Complexities

- The high upfront cost of advanced operating room equipment and the associated maintenance requirements pose a significant challenge to market growth, particularly for small and mid-sized hospitals in developing countries

- For instance, high-profile reports of operational inefficiencies due to complex equipment handling have caused some healthcare providers to delay investment in new operating room technologies

- Addressing these challenges requires robust training programs, preventive maintenance schedules, and service support to build trust and ensure proper utilization of the equipment

- While prices for some basic surgical tools and consumables have gradually decreased, premium surgical devices such as robotic-assisted instruments or multi-functional OR tables still carry high costs, limiting adoption in budget-constrained facilities

- Furthermore, logistical challenges related to supply chain disruptions, equipment sterilization, and storage constraints can hinder widespread deployment of operating room supplies, particularly in remote or resource-limited areas

Europe Operating Room Equipment Supplies Market Scope

The market is segmented on the basis of product, applications, equipment, supplies, and end users.

- By Product

On the basis of product, the Europe Operating Room Equipment Supplies market is segmented into Instruments and Accessories. The Instruments segment dominated the largest market revenue share of 54.6% in 2025, driven by the high demand for precision surgical instruments in a variety of procedures, including orthopaedic, cardiovascular, and general surgeries. Hospitals and ambulatory surgical centers increasingly prefer high-quality instruments for accuracy, safety, and patient outcomes. Adoption is supported by growing surgical volumes and expansion of hospital infrastructure across Europe countries such as China, India, and Japan. Technological advancements in minimally invasive and robotic-assisted surgeries drive instrument adoption. Integration with sterilization protocols and hospital workflows enhances utilization. OEM partnerships and consistent supply of instruments improve procurement efficiency. Surgeons’ preference for durable, reliable, and ergonomic instruments supports segment dominance. The availability of both reusable and modular instruments encourages wide-scale adoption. Regulatory approvals and standardized quality certifications ensure clinical compliance. Training programs and workshops for surgical staff further support usage. Increasing focus on reducing surgical complications and improving efficiency reinforces the segment’s market leadership.

The Accessories segment is expected to witness the fastest CAGR of 13.8% from 2026 to 2033, driven by rising demand for supplementary products that enhance surgical precision and efficiency. Accessories, including holders, connectors, sterilization trays, and specialized adapters, are increasingly procured by hospitals and ambulatory centers to support complex surgeries. Growing adoption of minimally invasive procedures and multi-specialty surgical suites fuels accessory demand. Technological innovation, such as smart integration with surgical devices, further drives growth. Emerging markets in Europe show high growth potential due to rapid hospital expansion. Disposable accessories for infection control and safety compliance are widely adopted. Partnerships between accessory manufacturers and medical device companies accelerate distribution. Rising awareness among surgical staff about optimizing operative workflows supports adoption. Customizable and modular accessory designs appeal to multi-specialty hospitals. Expansion in private healthcare infrastructure increases the requirement for advanced accessories.

- By Applications

On the basis of applications, the market is segmented into Orthopaedic and Trauma Surgeries, Cardiovascular Surgeries, Gastrointestinal Surgeries, Nephrology, Neurosurgeries, Oncosurgery, General Surgery, and Others. The Orthopaedic and Trauma Surgeries segment dominated the largest market revenue share of 49.3% in 2025, driven by increasing incidences of fractures, degenerative bone diseases, and sports-related injuries in Asia-Pacific. Hospitals prioritize advanced instruments and supplies for precision and improved patient recovery. Rising geriatric populations and increased road traffic accidents boost procedural volumes. Technological advancements, including navigation-assisted and robotic surgery, strengthen adoption. High volumes of elective and emergency orthopaedic surgeries in countries like India, China, and Japan drive sustained demand. OEM-backed surgical kits and disposables ensure supply consistency. Surgeons’ preference for minimally invasive instruments enhances segment dominance. Government initiatives to improve trauma care infrastructure further support growth. Hospital investments in orthopedic departments and training programs for staff encourage adoption. Collaboration between device manufacturers and healthcare providers ensures timely deployment. Increased awareness of post-operative outcomes reinforces reliance on advanced OR equipment.

The Cardiovascular Surgeries segment is expected to witness the fastest CAGR of 14.5% from 2026 to 2033, driven by rising prevalence of heart diseases and growing demand for minimally invasive cardiac procedures. Hospitals and specialty centers increasingly procure advanced operating room equipment and monitoring systems. Technological advancements in robotic-assisted cardiac surgeries and multi-parameter patient monitoring support adoption. Training programs for surgeons enhance utilization of high-precision tools. Expansion of cardiovascular departments in emerging Europe countries fuels market growth. Disposable and accessory requirements for cardiac procedures further boost revenue. Integration with digital operating rooms improves workflow efficiency. OEM partnerships for cardiac-specific instruments encourage adoption. Government healthcare initiatives targeting cardiovascular disease prevention drive procedural volumes. The rise of outpatient cardiovascular procedures in specialized centers accelerates adoption.

- By Equipment

On the basis of equipment, the market is segmented into Anaesthesia Machines, Operating Tables, Electrosurgical Units, Multi-parameter Patient Monitors, Surgical Imaging Devices, and Operating Room Lights. The Anaesthesia Machines segment dominated the largest market revenue share of 55.1% in 2025, owing to its critical role in patient safety during surgeries. Hospitals and ambulatory centers prioritize high-quality anesthesia systems for accurate monitoring, efficient gas delivery, and integration with patient monitoring systems. Increasing number of surgeries and complex procedures drives adoption. Technological advancements, including low-flow anesthesia and automated ventilation, strengthen segment dominance. OEM-backed service contracts ensure equipment reliability. Training programs for anesthesiologists and operating room staff support adoption. Rapid hospital expansions in Europe countries further drive growth. Integration with multi-parameter monitors enhances patient safety. Regulatory standards for anesthesia monitoring boost equipment procurement. Preference for modern, compact, and ergonomic designs reinforces segment leadership.

The Electrosurgical Units segment is expected to witness the fastest CAGR of 13.9% from 2026 to 2033, driven by the increasing demand for minimally invasive procedures and precision surgical techniques. Hospitals and outpatient centers adopt electrosurgical devices for faster surgeries, reduced blood loss, and improved patient outcomes. Expansion of private healthcare infrastructure fuels market growth. Technological advancements, including bipolar and advanced energy devices, enhance adoption. Disposable electrodes and accessories support recurring revenue. Emerging markets in Europe demonstrate strong growth potential. OEM collaborations improve product distribution and servicing. Training and awareness programs for surgeons enhance device utilization. Increasing surgical volumes and adoption of outpatient surgical centers contribute to growth. Rising focus on reducing operative complications reinforces the segment’s fast growth trajectory.

- By Supplies

On the basis of supplies, the market is segmented into Surgical Instruments, Disposable Materials, Accessories, and Others. The Surgical Instruments segment accounted for the largest market revenue share of 53.6% in 2025, supported by hospitals’ need for precision tools in high-volume surgeries. Instruments for orthopaedic, cardiovascular, neurosurgery, and oncosurgery are consistently in demand. OEM partnerships ensure quality and reliable supply. Hospitals and ambulatory centers prefer reusable instruments for cost efficiency. Integration with sterilization and maintenance protocols improves utilization. Technological enhancements such as ergonomic designs and minimally invasive instrument sets reinforce adoption. Training programs and workshops for surgeons promote consistent use. High surgical volumes in Asia-Pacific, especially in India, China, and Japan, sustain demand. Government healthcare programs supporting surgical capacity expansion boost procurement. Consistent demand from elective and emergency procedures ensures market stability.

The Disposable Materials segment is expected to witness the fastest CAGR of 14.2% from 2026 to 2033, driven by infection control regulations, rising surgical volumes, and growing outpatient procedures. Hospitals increasingly rely on disposable drapes, gloves, gowns, and suction materials. Emerging clinics and ambulatory centers adopt disposables to maintain hygiene standards. Technological innovation in single-use products improves usability and safety. Rising awareness of hospital-acquired infections supports rapid adoption. Growth in surgical interventions across cardiovascular, orthopedic, and oncosurgery domains accelerates demand. OEM-backed supply chains ensure availability of quality disposables. Government mandates and accreditation programs reinforce usage. Portability and convenience make disposable materials attractive for ambulatory surgery centers. Cost-effective production and bulk purchasing further stimulate growth.

- By End Users

On the basis of end users, the market is segmented into Hospitals, Outpatient Facilities, and Ambulatory Surgery Centres. The Hospitals segment dominated the largest market revenue share of 57.2% in 2025, driven by the high volume of surgical procedures, availability of ICU and OR facilities, and investment in advanced equipment. Hospitals prioritize durable and multi-functional instruments, electrosurgical units, and monitoring systems. Government healthcare programs, accreditation requirements, and hospital expansions reinforce adoption. Training programs for clinical staff enhance utilization. Hospitals in developed Europe economies such as Japan, Australia, and Singapore lead in procurement. OEM service contracts and recurring purchases strengthen market dominance. Rising awareness of patient safety and surgical outcomes further supports hospital adoption.

The Ambulatory Surgery Centres segment is expected to witness the fastest CAGR of 14.6% from 2026 to 2033, fueled by the growing trend of outpatient surgeries, minimally invasive procedures, and cost-efficient care delivery. These centers increasingly adopt compact OR equipment, disposable supplies, and multi-parameter monitoring systems. Expansion in tier-2 and tier-3 cities in Europe provides growth opportunities. Training programs and OEM partnerships improve operational efficiency. Integration with digital health and telemedicine platforms enhances patient monitoring. The rise of short-stay surgeries and specialty surgical centers accelerates adoption. Emerging centers prefer advanced yet portable devices to optimize workflow. Continuous technological innovation in instruments and disposables supports rapid growth.

Europe Operating Room Equipment Supplies Market Regional Analysis

- The Europe operating room equipment supplies market is poised to grow at a fastest CAGR of 12.1% during the forecast period of 2026 to 2033

- Driven by expanding hospital infrastructure

- Rising number of surgical procedures, growing healthcare investments, and increased focus on patient safety

U.K. Operating Room Equipment Supplies Market Insight

The U.K. operating room equipment supplies market dominated the Europe market with the largest revenue share of 37.5% in 2025, supported by advanced healthcare infrastructure, high adoption of modern surgical equipment, strong presence of leading medical device manufacturers, and robust government initiatives for healthcare modernization across hospitals, surgical centers, and specialty clinics. In addition, the demand for technologically advanced surgical instruments, imaging devices, and anesthesia equipment is driving market growth across hospitals and specialty surgical centers. The aging population is further fueling the need for efficient and safer operating room solutions in both public and private healthcare facilities.

Germany Operating Room Equipment Supplies Market Insight

The Germany operating room equipment supplies market is expected to be the fastest-growing country in Europe, projected to record a CAGR of 12.1% from 2026 to 2033. This growth is driven by expanding hospital infrastructure, increasing number of surgical procedures, growing healthcare investments, and a rising focus on patient safety and technologically advanced operating room solutions. Strong government initiatives to modernize healthcare facilities, coupled with the growing presence of domestic and international medical device manufacturers, are supporting the rapid adoption of advanced operating room equipment across Germany.

Europe Operating Room Equipment Supplies Market Share

The Operating Room Equipment Supplies industry is primarily led by well-established companies, including:

• Stryker (U.S.)

• Medtronic (Ireland)

• Johnson & Johnson (U.S.)

• GE Healthcare (U.S.)

• Siemens Healthineers (Germany)

• Philips Healthcare (Netherlands)

• B. Braun Melsungen AG (Germany)

• Hill-Rom (U.S.)

• Olympus Corporation (Japan)

• Smith & Nephew (U.K.)

• Drägerwerk AG & Co. KGaA (Germany)

• Baxter International Inc. (U.S.)

• Zimmer Biomet Holdings, Inc. (U.S.)

• Conmed Corporation (U.S.)

• NuVasive, Inc. (U.S.)

• Terumo Corporation (Japan)

• Edwards Lifesciences (U.S.)

• Intuitive Surgical, Inc. (U.S.)

• Masimo Corporation (U.S.)

Latest Developments in Europe Operating Room Equipment Supplies Market

- In June 2023, Getinge AB inaugurated a new regional service and training hub in Singapore to support hospitals across Southeast Asia with technical maintenance, staff training, and remote diagnostics for its Maquet surgical tables — strengthening after‑sales support and adoption in the region

- In January 2024, market research reports highlighted the Asia‑Pacific region as the fastest‑growing segment of the global OR equipment market, with strong demand for anesthesia machines, endoscopy devices, imaging tools, and patient‑monitoring equipment — reflecting increased surgical volumes and hospital upgrades across countries like China, India, and Southeast Asia

- In August 2024, Olympus Corporation announced a strategic collaboration with Proximie to digitize operating room workflows in the Asia‑Pacific region — aiming to improve integration of imaging, remote collaboration, and OR device interoperability across hospitals

- In May 2025, a comprehensive industry‑wide report projected that continued expansion of healthcare infrastructure, rising surgical procedure volumes, and increasing investments by private and public hospitals will sustain robust growth in the Asia‑Pacific operating room equipment market, particularly for surgical tables, lights, anesthesia machines and patient monitoring system

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.