Europe Ophthalmology Devices Market

Market Size in USD Billion

CAGR :

%

USD

10.38 Billion

USD

16.17 Billion

2024

2032

USD

10.38 Billion

USD

16.17 Billion

2024

2032

| 2025 –2032 | |

| USD 10.38 Billion | |

| USD 16.17 Billion | |

|

|

|

|

Europe Ophthalmology Devices Market Size

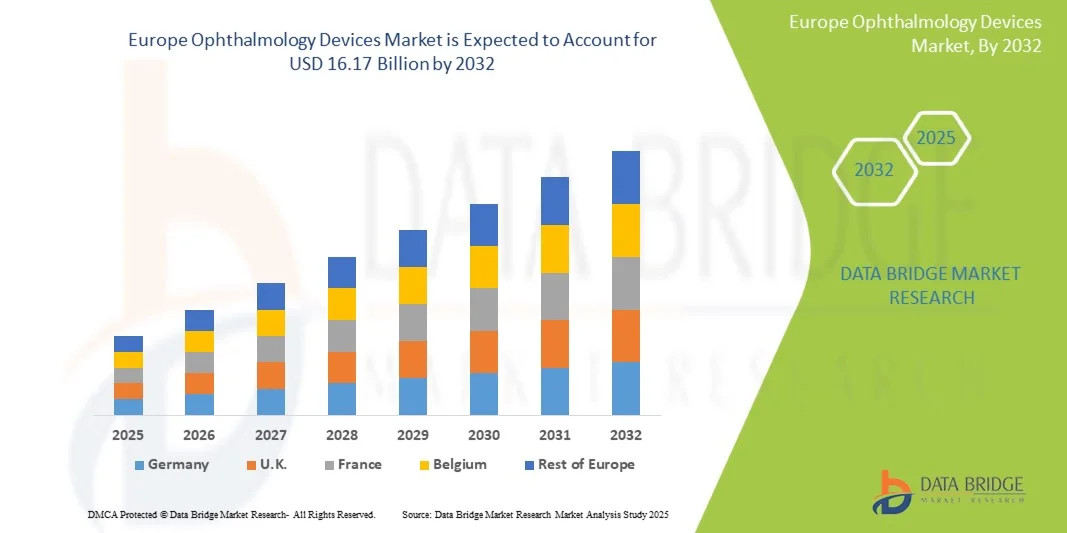

- The Europe Ophthalmology Devices Market size was valued at USD 10.38 billion in 2024 and is expected to reach USD 16.17 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is largely fueled by the increasing prevalence of eye disorders such as cataracts, glaucoma, and age-related macular degeneration, coupled with rising awareness regarding early diagnosis and treatment. In addition, continuous technological advancements, including the integration of artificial intelligence (AI) and advanced imaging techniques, are enhancing diagnostic accuracy and treatment outcomes, driving the demand for ophthalmology devices globally

- Furthermore, the growing adoption of minimally invasive surgical procedures and the rising preference for advanced ophthalmic equipment in hospitals and specialty clinics are establishing ophthalmology devices as essential components in modern eye care. These converging factors are accelerating the uptake of ophthalmology devices solutions, thereby significantly boosting the industry's growth

Europe Ophthalmology Devices Market Analysis

- Ophthalmology devices, encompassing diagnostic, monitoring, and surgical instruments, are essential components in modern eye care and vision correction practices, both in hospitals and specialty clinics. Their adoption is driven by rising incidences of cataracts, glaucoma, diabetic retinopathy, and age-related macular degeneration (AMD), coupled with the growing demand for minimally invasive procedures and precision-based diagnostics

- The escalating demand for ophthalmology devices is primarily fueled by an aging global population, increasing prevalence of chronic eye diseases, rapid technological advancements such as AI-enabled diagnostics, and a strong shift toward outpatient and home-based ophthalmic monitoring solutions

- U.K. dominated the Europe Ophthalmology Devices Market with the largest revenue share of 41.7% in 2024, driven by its advanced healthcare infrastructure, high adoption of digital ophthalmic technologies, and a strong presence of key industry players. The country has witnessed substantial growth in ophthalmology device installations across hospitals, clinics, and franchise optical stores

- Germany is expected to be the fastest-growing country in the Europe Ophthalmology Devices Market during the forecast period, with a CAGR of 8.9% from 2025 to 2032, fueled by increasing healthcare modernization, rising investments in ophthalmic research, and growing adoption of advanced diagnostic and surgical devices

- The Diagnostic and Monitoring Devices segment dominated the largest market revenue share of 46.7% in 2024, driven by the growing prevalence of eye disorders such as glaucoma, cataract, and diabetic retinopathy which require continuous monitoring and early-stage detection

Report Scope and Europe Ophthalmology Devices Market Segmentation

|

Attributes |

Europe Ophthalmology Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Ophthalmology Devices Market Trends

“Enhanced Convenience Through Technological Advancements”

- A significant and accelerating trend in the global Europe Ophthalmology Devices Market is the continuous development of advanced imaging systems, diagnostic technologies, and minimally invasive surgical solutions, which are significantly improving clinical efficiency, patient outcomes, and accessibility to care

- For instance, advanced optical coherence tomography (OCT) and high-resolution fundus imaging devices allow clinicians to detect ocular diseases at early stages, including glaucoma, macular degeneration, and diabetic retinopathy. Similarly, femtosecond lasers and micro-incision surgical platforms enhance procedural precision while reducing recovery times, offering a discreet and highly effective ophthalmic solution

- Integration of portable and point-of-care ophthalmic devices enables clinicians to provide reliable screening and monitoring in remote and underserved areas, supporting faster diagnosis and follow-ups without compromising quality

- The adoption of clinician-friendly, ergonomically designed devices with multi-functional capabilities is facilitating workflow efficiency, reducing examination times, and enhancing patient experiences

- This focus on technological innovation, improved usability, and enhanced clinical outcomes is fundamentally reshaping expectations for ophthalmic care. Consequently, companies such as Topcon, Carl Zeiss Meditec, and Alcon are developing solutions that combine precision, reliability, and ease of use for both diagnostic and surgical applications

- The demand for advanced ophthalmology devices is growing rapidly across hospitals, clinics, and specialty centers worldwide, as healthcare providers increasingly prioritize diagnostic accuracy, patient safety, and procedural efficiency

Europe Ophthalmology Devices Market Dynamics

Driver

“Growing Demand for Advanced Diagnostics and Minimally Invasive Surgeries”

- The increasing prevalence of ocular disorders, including cataract, glaucoma, diabetic retinopathy, and macular degeneration, is driving the adoption of high-precision diagnostic and surgical ophthalmology devices

- For instance, in April 2024, Topcon Medical Systems launched an advanced OCT platform with enhanced imaging speed and improved retinal layer visualization, enabling earlier diagnosis and optimized treatment planning. Such initiatives by leading companies are expected to propel market growth in the forecast period

- Healthcare providers are actively adopting minimally invasive surgical technologies and high-resolution imaging devices to improve procedural accuracy, reduce complications, and enhance patient outcomes

- Furthermore, the growing emphasis on point-of-care diagnostics and portable devices is expanding access to ophthalmic care, particularly in emerging markets and remote regions, contributing to overall market expansion

- The combination of advanced technology, improved workflow, and patient-centric design is a key factor driving the adoption of ophthalmology devices across hospitals, clinics, and specialty care centers

Restraint/Challenge

“High Costs and Limited Accessibility in Emerging Markets”

- The high capital investment required for advanced ophthalmology devices, including imaging systems and surgical platforms, remains a major barrier to adoption, particularly for smaller clinics and healthcare facilities in developing regions

- For instance, premium devices from companies such as Carl Zeiss Meditec and Alcon may be cost-prohibitive for resource-limited hospitals or clinics

- In addition, limited availability of trained personnel to operate sophisticated equipment and provide follow-up care can hinder broader market penetration

- Addressing these challenges through cost-effective, multi-functional, and portable device solutions, as well as investing in clinician training programs, is essential to drive adoption and expand market reach

- Although prices for mid-range and portable ophthalmology devices are gradually decreasing, perceived high costs and accessibility limitations continue to restrict widespread utilization, particularly in underdeveloped and rural regions

Europe Ophthalmology Devices Market Scope

The market is segmented on the basis of product type, application, and end user.

• By Product Type

On the basis of product type, the Europe Ophthalmology Devices Market is segmented into Vision Care Devices, Surgery Devices, and Diagnostic and Monitoring Devices. The Diagnostic and Monitoring Devices segment dominated the largest market revenue share of 46.7% in 2024, driven by the growing prevalence of eye disorders such as glaucoma, cataract, and diabetic retinopathy which require continuous monitoring and early-stage detection. Increasing utilization of advanced imaging technologies including optical coherence tomography (OCT), fundus cameras, and wavefront aberrometers has further enhanced diagnostic precision. The integration of artificial intelligence (AI) in ophthalmic diagnostics has enabled faster image analysis, reducing diagnostic errors and improving clinical outcomes. Furthermore, the adoption of teleophthalmology platforms in hospitals and clinics has expanded access to remote eye diagnostics, particularly across rural and underserved areas. The presence of well-established healthcare infrastructure and favorable reimbursement policies in the U.S. and Europe continues to support high product demand. In addition, the rising focus on early detection programs and preventive eye health awareness initiatives has significantly bolstered device installations. The growing aging population and lifestyle-induced vision impairments are further expected to propel the diagnostic device segment’s growth trajectory. Increasing R&D investments by global players for innovation in portable and AI-assisted devices are enhancing global accessibility and affordability. Overall, the diagnostic and monitoring devices segment remains the key contributor to market expansion due to its essential role in accurate disease identification and management.

The Surgery Devices segment is anticipated to witness the fastest growth rate of 10.8% from 2025 to 2032, driven by the increasing number of ophthalmic surgeries, especially cataract, glaucoma, and refractive procedures. The introduction of robotic-assisted systems, femtosecond laser technologies, and disposable microsurgical instruments has transformed ophthalmic surgical efficiency and safety. Surgeons are increasingly adopting minimally invasive and laser-assisted techniques that provide faster recovery times and superior visual outcomes for patients. Growing access to healthcare and medical tourism in emerging economies such as India, Singapore, and the UAE is also boosting ophthalmic surgical volumes. The shift from traditional manual surgery to digital and image-guided procedures is enhancing precision and reducing surgical risks. In addition, the availability of premium intraocular lenses (IOLs) and micro-incision phacoemulsification systems is expanding adoption in high-income and middle-income regions alike. Strong collaborations between medical device companies and hospitals for technology transfer and skill development are further supporting rapid growth. Rising patient awareness of elective vision correction surgeries, such as LASIK and SMILE, is another factor driving the expansion of this segment. Continuous innovations focused on cost-effectiveness and automation are making advanced surgical technologies more accessible. Hence, the surgery devices segment is expected to record substantial growth momentum throughout the forecast period.

• By Application

On the basis of application, the Europe Ophthalmology Devices Market is segmented into Vision Care, Ophthalmic Woundcare, Cataract Surgery, Oculoplastics, and Others. The Vision Care segment held the largest market revenue share of 42.1% in 2024, primarily attributed to the high global prevalence of refractive errors such as myopia, hyperopia, and astigmatism. Increasing digital screen exposure, aging populations, and growing demand for contact lenses and prescription spectacles have driven continuous demand. The segment benefits from product innovations like smart contact lenses, anti-fatigue coatings, and blue light filtering lenses designed to reduce eye strain from electronic devices. Furthermore, the expansion of e-commerce platforms and retail optical chains has increased the accessibility and affordability of vision care products. Major players are focusing on eco-friendly materials and extended-wear contact lenses to enhance comfort and sustainability. Regular eye check-up campaigns by public health organizations and the World Health Organization’s (WHO) initiatives for vision correction have boosted awareness. Technological integration in optometry, including digital lens fitting and AI-powered eye exams, has improved accuracy and customization for patients. The rising use of daily disposable contact lenses and customized frames among youth further supports segment dominance. Partnerships between optical manufacturers and healthcare providers are enhancing product penetration globally. Thus, the vision care segment continues to be the backbone of the ophthalmology devices industry, sustaining consistent revenue streams.

The Cataract Surgery segment is projected to witness the fastest CAGR of 11.3% from 2025 to 2032, driven by the growing incidence of cataracts among the elderly population and the increasing availability of advanced intraocular lens technologies. The shift toward femtosecond laser-assisted cataract surgery has significantly improved precision and safety in surgical procedures. Technological advancements such as toric and multifocal intraocular lenses (IOLs) provide enhanced visual outcomes and patient satisfaction, reducing the dependency on spectacles post-surgery. Moreover, the rising affordability of cataract procedures in developing economies due to government-led health initiatives is boosting surgery volumes. For instance, national vision restoration programs in India and Africa are facilitating free or subsidized cataract operations, improving accessibility. The growing geriatric population in both developed and emerging countries is another major growth driver. Increasing collaborations between research institutes and device manufacturers have led to continuous product innovation and customization in lens materials. In addition, robotic-assisted cataract surgeries are being increasingly adopted across major hospitals in North America and Europe. The strong focus on reducing surgery time, minimizing complications, and enhancing patient recovery continues to push technological integration in this segment. Consequently, the cataract surgery application is set to lead future market expansion with strong innovation and volume growth.

• By End User

On the basis of end user, the Europe Ophthalmology Devices Market is segmented into Hospitals, Diagnosis Clinics, Franchise Optical Stores, Eye Research Institutes, and Government Agencies and Academics. The Hospitals segment accounted for the largest market revenue share of 48.5% in 2024, as hospitals serve as the central hubs for both ophthalmic diagnostics and surgical interventions. The high patient inflow for cataract, refractive, and glaucoma treatments drives significant device utilization across hospital settings. Advanced imaging systems, operating microscopes, and surgical platforms are increasingly being adopted in multispecialty and specialty eye hospitals. Hospitals benefit from established infrastructure, multidisciplinary expertise, and the integration of electronic health records (EHRs) that streamline patient management and follow-up. The segment also gains from high investment capacity for technologically advanced diagnostic tools and surgical equipment. Rising healthcare expenditure and hospital accreditation initiatives in developing economies have further supported modern ophthalmology infrastructure. The increasing trend of day-care ophthalmic surgeries in hospital-affiliated centers is boosting equipment demand. In addition, collaborations between hospitals and major manufacturers for device trials and innovation programs continue to drive product availability and adoption. Hospitals also lead in clinical research and training programs that promote the latest ophthalmic technologies, cementing their dominant market position.

The Diagnosis Clinics segment is projected to record the fastest CAGR of 9.9% from 2025 to 2032, driven by the growing number of standalone ophthalmic and optometric centers specializing in diagnostic services. The emergence of miniaturized diagnostic devices has enabled clinics to provide high-quality care with compact, cost-effective setups. Rising patient preference for personalized, quick, and localized diagnostic services is fueling demand for independent clinics. These clinics offer shorter waiting times, specialized consultations, and advanced testing such as OCT, retinal imaging, and corneal topography. Increased awareness regarding early detection of vision disorders and the rising prevalence of diabetic eye diseases have expanded clinic visits. Integration of teleophthalmology and AI-based platforms allows remote diagnosis and consultation, improving accessibility in suburban and rural areas.

Europe Ophthalmology Devices Market Regional Analysis

- The Europe Ophthalmology Devices Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by advanced healthcare infrastructure, increasing adoption of digital ophthalmic technologies, and the growing demand for modern vision care solutions

- The rise in healthcare modernization, coupled with technological advancements in diagnostic and surgical devices, is fostering the adoption of ophthalmology devices across hospitals, clinics, and franchise optical stores

- European consumers and healthcare providers are increasingly emphasizing early diagnosis, effective treatment, and patient-centric care, contributing to steady market growth across the region

U.K. Europe Ophthalmology Devices Market Insight

The U.K. Europe Ophthalmology Devices Market dominated Europe with the largest revenue share of 41.7% in 2024, fueled by its advanced healthcare infrastructure, high adoption of digital ophthalmic technologies, and the strong presence of key market players. The country has witnessed substantial growth in ophthalmology device installations across hospitals, clinics, and franchise optical stores. The increasing focus on early diagnosis, preventive care, and patient management continues to drive market expansion.

Germany Europe Ophthalmology Devices Market Insight

The Germany Europe Ophthalmology Devices Market is expected to be the fastest-growing country in Europe, with a CAGR of 8.9% from 2025 to 2032. This growth is driven by increasing healthcare modernization, rising investments in ophthalmic research, and growing adoption of advanced diagnostic and surgical devices. Germany’s emphasis on innovative healthcare solutions and the integration of modern ophthalmology technologies in clinical practice is significantly propelling market growth.

Europe Ophthalmology Devices Market Share

The Ophthalmology Devices industry is primarily led by well-established companies, including:

- Alcon Inc. (Switzerland)

- Bausch + Lomb (U.S.)

- Johnson & Johnson and its affiliates. (U.S.)

- Carl Zeiss Meditec AG (Germany)

- EssilorLuxottica (France)

- Hoya Corporation (Japan)

- Topcon Corporation (Japan)

- Nidek Co., Ltd. (Japan)

- Canon Medical Systems Corporation (Japan)

- Ziemer Ophthalmic Systems AG (Switzerland)

- STAAR Surgical Company (U.S.)

- Glaukos Corporation (U.S.)

- IRIDEX Corporation (U.S.)

- Ellex Medical Lasers Ltd. (Australia)

- OCULUS Optikgeräte GmbH (Germany)

Latest Developments in Europe Ophthalmology Devices Market

- In April 2023, Bausch + Lomb, a leading provider of eye care products, announced the acquisition of a portfolio of eye care products from Novartis for USD 1.75 billion. This acquisition includes the anti-inflammation eye drop, Xiidra, and the rights to AccuStream, a device for delivering treatments for dry eye disease. The deal is expected to expand Bausch + Lomb's range of offerings for eye conditions and be financially advantageous immediately. The transaction is set to be completed by the end of 2023

- In May 2024, Merck announced its acquisition of Eyebiotech, a biotechnology company specializing in ophthalmology, for up to USD 3 billion. The deal entails an initial payment of USD 1.3 billion, with potential additional payments if developmental, regulatory, and commercial milestones are achieved. Eyebiotech is developing a drug called Restoret to treat vision loss. This acquisition aims to diversify Merck's product pipeline, particularly as it anticipates a decline in revenue from its current leading cancer drug, Keytruda, when its patent expires in 2028

- In August 2025, EssilorLuxottica, the Franco-Italian maker of Ray-Ban, announced plans to acquire Optegra, an AI-focused ophthalmology platform, from MidEuropa. This acquisition enhances EssilorLuxottica’s portfolio, which already includes frames, lenses, wearables, AI-powered technologies, and medical instruments. Optegra operates more than 70 eye hospitals and diagnostic centers across the UK, Czech Republic, Poland, Slovakia, and the Netherlands, offering ophthalmic treatments and vision correction procedures that integrate AI in pre- and post-operative care. The acquisition is expected to close later in 2025, pending regulatory approval

- In September 2025, Carl Zeiss Meditec issued a profit warning, causing its shares to fall by 13%. The company cited weak sales and earnings amid a drop in orders, particularly in North America, and a slow start to the peak season for refractive surgeries in China. Despite these challenges, Carl Zeiss expects renewed growth in fiscal 2025 and maintains its target of achieving an EBIT margin above 20%

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.