Europe Optical Fiber Components Market

Market Size in USD Billion

CAGR :

%

USD

5.40 Billion

USD

10.20 Billion

2024

2032

USD

5.40 Billion

USD

10.20 Billion

2024

2032

| 2025 –2032 | |

| USD 5.40 Billion | |

| USD 10.20 Billion | |

|

|

|

|

Europe Optical Fiber Components Market Size

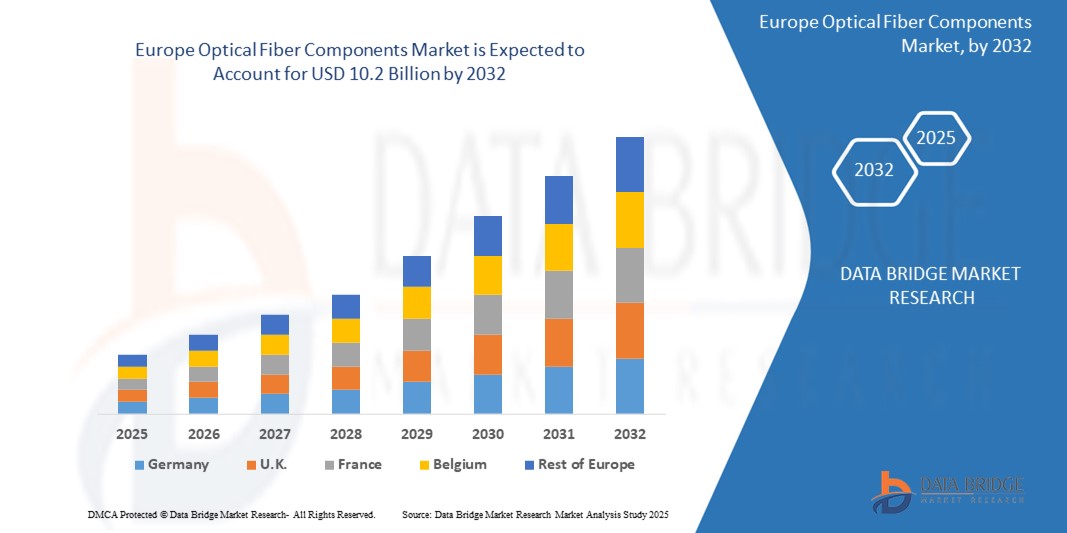

- The Europe Optical Fiber Components Market is projected to reach USD 5.4 billion by 2024 and is expected to hit USD 10.2 billion by 2032, growing at a CAGR of 9.51% during the forecast period...

- This strong growth reflects rising demand for high-speed connectivity, the rollout of 5G networks, and the growing importance of seamless communication across industries. As the digital economy expands, wireless infrastructure is becoming the backbone of everything from smart cities and connected homes to industrial automation and remote healthcare.

Europe Optical Fiber Components Market Analysis

- Optical fiber is redefining how Europe communicates powering everything from everyday internet use to critical industrial operations. As demand for faster, more secure, and reliable connectivity rises, countries across the region are accelerating fiber deployments to support next-gen digital infrastructure. Whether it's high-speed broadband for homes or robust fiber backhaul for mobile networks, optical fiber components are at the core of Europe’s digital transformation.

- What’s driving this momentum is the surge in 5G rollout, cloud computing, and smart city initiatives. Fiber doesn’t just carry data it enables the speed and scale needed for technologies like AI, IoT, and autonomous systems to thrive. To make that possible, networks must be more dense, responsive, and future-ready. That’s where components like transceivers, amplifiers, and connectors become vital ensuring low-loss, high-bandwidth performance across expanding networks.

- In response, telecom operators, governments, and enterprise sectors are ramping up investments in fiber infrastructure. In Western Europe, the focus is on replacing legacy copper with full-fiber networks and strengthening digital resilience. In Eastern and Southern Europe, efforts are aimed at extending broadband coverage and bridging rural connectivity gaps. Across the board, the Europe optical fiber components market is evolving to meet both high-performance and inclusive connectivity needs—delivering on speed, scalability, and sustainability.

Report Scope and Europe Optical Fiber Components Market Segmentation

|

Attributes |

Europe Optical Fiber Components Market Key Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

Massive investments in 5G infrastructure across countries like Germany, France, the U.K., and the Nordics are creating significant demand for optical fiber components. To achieve ultra-low latency and high-speed mobile networks, operators are deploying dense fiber backhaul and fronthaul networks, especially in urban areas and industrial zones.

European industries—including automotive, aerospace, pharmaceuticals, and energy—are increasingly adopting private 5G and fiber-based networks. These networks enhance control, cybersecurity, and real-time data flow, particularly in high-precision environments like factories and smart campuses.

As edge data centers multiply across Europe to handle growing IoT workloads, the need for fast, secure, and low-latency optical fiber links is rising. Fiber components play a critical role in connecting edge sites to cloud infrastructure and ensuring seamless machine-to-machine communication.

European municipalities are investing in smart infrastructure—such as smart poles, intelligent traffic systems, and city-wide public Wi-Fi. These initiatives depend on high-capacity fiber optic networks to handle data transmission from connected sensors, cameras, and control systems

Public funding under programs like the Connecting Europe Facility (CEF) and Digital Europe Programme is accelerating fiber deployments, especially in rural and underserved regions. These initiatives are opening new markets for fiber component suppliers as countries aim to meet EU-wide gigabit connectivity goals. |

|

Value Added Data Infosets |

|

Europe Optical Fiber Components Market Trends

“Fiber at the Core of Europe’s Digital Future”

- Fiber is becoming the silent backbone of Europe’s digital revolution. As demand for high-speed internet surges across homes, businesses, and public infrastructure, countries are doubling down on full-fiber networks. From Germany’s ambitious gigabit targets to France’s rural FTTH expansion, optical fiber components like transceivers, amplifiers, and splitters are at the center of every rollout. The push isn't just about speed it's about building scalable, future-ready infrastructure that can handle everything from 5G backhaul to ultra-HD streaming and smart city platforms.

- A major trend reshaping the market is the growing role of fiber in supporting edge computing and data center interconnects. As European tech hubs like Frankfurt, Amsterdam, and Dublin grow more connected, the need for low-latency fiber links is skyrocketing. Optical components are no longer just about telecom—they're now critical for enabling cloud services, AI-driven workloads, and enterprise-grade cybersecurity across the continent. Fiber’s reliability and capacity make it the go-to medium for Europe’s expanding digital economy.

- At the same time, sustainability is becoming a defining priority. European network operators are under pressure to reduce energy consumption and carbon emissions. That’s fueling demand for more efficient optical components, compact designs, and recyclable cabling systems. Suppliers are responding with innovations that not only boost performance but align with the EU’s Green Deal and ESG standards. In this new era, fiber isn’t just faster—it’s smarter, greener, and more essential than ever.

Europe Optical Fiber Components Market Dynamics

Driver

“Accelerated 5G Rollouts and Rising Fiber-First Strategies”

- Europe is witnessing a rapid expansion of 5G networks, and with that comes an urgent demand for robust fiber infrastructure. As mobile operators race to offer high-speed, low-latency services, fiber-optic components are at the heart of enabling seamless backhaul and fronthaul connectivity.

- Countries like Germany, the U.K., and France are prioritizing fiber-first strategies—where optical fiber becomes the baseline for all broadband and mobile services. National programs such as the U.K.’s Project Gigabit and Germany’s Digital Infrastructure Plan are fueling this push with billions in public funding.

- This shift is creating massive opportunities for fiber component manufacturers and system integrators. Transceivers, optical amplifiers, connectors, and fiber cables are being deployed at scale to support not just telecom networks, but also smart cities, data centers, and edge computing hubs across the continent.

- As consumers and businesses demand more bandwidth—for streaming, cloud services, telemedicine, and AI workloads—fiber components are becoming essential to meet these expectations reliably and efficiently.

Restraint/Challenge

“High Deployment Costs and Uneven Rollout in Rural Regions”

Rolling out fiber infrastructure in Europe is capital-intensive, particularly in less densely populated rural and remote areas. While urban centers benefit from existing ductwork and infrastructure, rural deployments often require new trenching, which can drive costs significantly higher.

Operators and local authorities also face logistical challenges like terrain complexity, labor shortages, and long permitting processes. In countries like Poland, Romania, and parts of Southern Europe, bureaucratic red tape can delay project timelines by months.

Moreover, while EU funds are available, smaller municipalities and local ISPs often struggle with upfront financing or co-investment requirements. This limits the pace at which fiber can reach the “last mile” in underserved communities

Although government subsidies and public-private partnerships are helping bridge the gap, many regions still lag behind, creating a digital divide that component providers and policymakers alike are working hard to close

• By Infrastructure Type

Access Network (FTTH/FTTB): The largest deployment area across Europe, especially in France, Spain, and the U.K., where governments and telecoms are accelerating fiber-to-the-home/building coverage. Key components used include optical splitters, connectors, and termination boxes..

Metro Network: Supports connectivity between local exchanges and data aggregation points. Countries like Germany and the Netherlands are investing in metro fiber networks for enterprise and 5G support. Common components include optical amplifiers, WDM systems, and enclosures.

Core/Long-Haul Network: Used to connect major cities, countries, and internet exchanges. Deployed across pan-European routes, especially in central and northern Europe. High-capacity transceivers, DWDM modules, and optical switches dominate in this segment

Backhaul and Fronthaul (5G Mobile Transport): Growing significantly with 5G rollouts across the EU. Fiber is critical for connecting cell sites to core networks, particularly in urban areas. Fiber cables, ruggedized connectors, and mux/demux units are widely deployed.

Data Center Interconnect (DCI): With the expansion of hyperscale and colocation data centers in cities like Frankfurt, Paris, and Amsterdam, demand for high-density fiber links is rising. Optical transceivers, patch panels, and cable assemblies are key components in this space.

• By Component

Hardware leads the segment, driven by strong demand for optical cables, transceivers, amplifiers, and splitters. As FTTH and 5G rollouts intensify, hardware components form the foundation of Europe’s next-gen connectivity landscape.

Software adoption is picking up across the region as telecom operators increasingly deploy SDN (Software Defined Networking) and AI-driven network management. Countries like Germany and the Netherlands are pioneering the shift to intelligent fiber networks.

Services are essential for supporting deployment and maintenance. With multiple EU-backed programs in motion, service providers offering installation, project management, and post-deployment support are seeing high demand across Europe’s fiber expansion projects..

• By Network Technology

4G LTE remains significant in Eastern and parts of Southern Europe, where it still forms the primary connectivity layer. However, operators are steadily transitioning toward 5G-ready infrastructure.

5G is growing fastest, particularly in the U.K., France, and Nordic countries, where full-scale rollouts are underway. The fiber components market is benefiting directly from the high backhaul capacity required for 5G.

Wi-Fi 6/6E adoption is accelerating in enterprise, education, and healthcare sectors across Europe, particularly in Germany, the Netherlands, and Finland.

2G/3G networks are being phased out in much of Western Europe, though they remain active in parts of Central and Eastern Europe for legacy services.

Future Technologies (6G, LEO Satellites) are in early trial phases, with the EU investing in research to ensure Europe’s leadership in ultra-high-speed and low-orbit satellite connectivity by the next decade..

• By Ownership Type

Mobile Network Operators (MNOs) like Orange, Deutsche Telekom, and Vodafone are the primary owners of core optical infrastructure across Europe, especially for nationwide 5G backbones.

Tower Companies such as Cellnex and Vantage Towers are expanding fiber-linked passive infrastructure, enabling cost-efficient shared use by multiple telecom providers.

Private Network Providers are emerging across sectors like automotive (Germany), manufacturing (Italy), and logistics (Belgium), deploying closed-loop fiber networks for greater control and security.

Government Agencies are actively involved in deploying fiber in underserved areas, particularly through EU funding programs and rural broadband initiatives in countries like Ireland, Portugal, and Greece

By End User

Telecom remains the dominant end user, with operators scaling up infrastructure to meet growing bandwidth demand across mobile, broadband, and data center networks.

Enterprises across Europe, especially in sectors like finance, healthcare, and advanced manufacturing, are integrating high-speed fiber for low-latency operations and private 5G use cases.

Government & Public Safety rely on fiber-enabled networks for surveillance, emergency communications, and digital public services, especially in urban modernization projects.

Transportation & Logistics sectors are deploying fiber-backed connectivity across rail, port, and road networks to enable real-time tracking, automated systems, and smart infrastructure.

Residential demand is booming as FTTH programs expand across the EU. With remote work, smart homes, and online learning on the rise, fiber-optic connections have become essential for European households.

Europe Optical Fiber Components Market – Regional Development Analysis

- Western Europe:

Countries such as Germany, France, and the United Kingdom are leading the optical fiber components market in Western Europe. These nations benefit from well-established telecom infrastructure, high urbanization rates, and aggressive 5G rollout plans. The demand for optical transceivers, splitters, and WDM systems is growing rapidly, especially in metro and core network deployments. Government initiatives like the U.K.’s Project Gigabit and Germany’s Gigabit Strategy 2025 are accelerating FTTH adoption, driving the need for high-performance fiber components.

- Southern Europe:

Spain, Italy, and Portugal are witnessing steady growth in fiber deployments, driven by strong FTTH penetration and support from EU digital infrastructure funding. Spain, in particular, has one of the highest FTTH coverage rates in Europe, prompting continued investment in passive optical components such as connectors and enclosures. The region is also investing in data center infrastructure, increasing demand for high-speed optical modules and interconnects..

- Northern Europe:

Nordic countries including Sweden, Finland, and Denmark are at the forefront of broadband adoption and fiber-led connectivity. These markets focus on sustainable and energy-efficient fiber infrastructure, supported by strong government incentives and tech-driven deployment models. The adoption of AI-based network monitoring and SDN is also contributing to rising demand for intelligent optical components.

- Eastern Europe:

Countries like Poland, Romania, and Hungary are catching up through accelerated rural broadband programs and public-private partnerships. While infrastructure in some areas remains underdeveloped, EU-backed initiatives and national fiber strategies are improving network reach and quality. This is resulting in increased uptake of basic fiber components such as cables, splicing kits, and ODFs (optical distribution frames), especially in access and backhaul networks

- Central Europe:

Markets including Austria, Czech Republic, and Switzerland are showing moderate growth, with ongoing fiber deployments in both urban and semi-urban areas. These countries are focused on network modernization and digital inclusion, leading to rising demand for components like optical amplifiers and high-density patch panels. Switzerland’s early adoption of 10G PON technologies is also influencing advanced component consumption.

Europe Optical Fiber Components Market Insight

The Europe optical fiber components market is undergoing rapid expansion, driven by widespread FTTH deployments, accelerating 5G rollout, and the growing digital transformation across industries. Key economies such as Germany, France, the U.K., and Spain are heavily investing in fiber infrastructure to meet the surging demand for high-speed, low-latency connectivity.

Telecom operators and broadband providers are scaling up investments in both active and passive optical components—including transceivers, optical cables, connectors, splitters, and WDM systems—to support expanding access, metro, and backbone networks. Government-backed initiatives like Germany’s Gigabit Strategy and the U.K.’s Project Gigabit are creating strong momentum in urban and rural fiber rollouts alike.

Moreover, the rise of data center interconnects, cloud computing, and smart city infrastructure is fueling demand for high-performance, scalable fiber components across enterprise and public sectors. Sustainability is also influencing purchasing decisions, with growing interest in energy-efficient and durable fiber systems.

Competition is intensifying as established players and new entrants vie for market share. Local manufacturing, cost optimization, and component innovation (such as smaller form-factor transceivers and AI-integrated monitoring systems) are becoming key differentiators. As Europe pushes toward a gigabit society, the optical fiber components market is poised for strong and sustained growth...

The following companies are recognized as major players in the Global Wireless Infrastructure market:

- Corning Incorporated

- Prysmian Group (Italy)

- Nexans S.A. (France)

- Fujikura Ltd. (via European subsidiaries)

- Huber+Suhner AG (Switzerland)

- CommScope Inc.

- Adtran (Germany/USA)

- Hexatronic Group AB (Sweden)

- Legrand (France)

- Telefonica Tech / Open Fiber (via partnerships)

Latest Developments in Europe Optical Fiber Components Market

- May 2025 – Corning Incorporated announced the expansion of its optical fiber manufacturing capacity in Poland to support rising demand for FTTH deployments across Central and Eastern Europe. The investment aims to strengthen local supply chains and reduce lead times for passive optical components..

- March 2025 – Prysmian Group unveiled its new high-density optical cable portfolio designed specifically for urban FTTH rollouts. These cables, featuring reduced diameter and enhanced flexibility, are being piloted in Italy and the Netherlands to accelerate city-wide fiber access..

- January 2025 – HUBER+SUHNER launched a range of eco-friendly fiber management systems made from recycled materials. The product line, introduced at a European telecom conference in Geneva, aligns with sustainability goals and green infrastructure trends..

- December 2024 – Adtran (formerly ADVA Optical Networking) completed the deployment of an open optical transport solution for a pan-European research network. The project spans multiple countries and aims to boost capacity and scalability for academic and scientific data exchanges.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.