Europe Optical Imaging Market

Market Size in USD Billion

CAGR :

%

USD

1.45 Billion

USD

3.20 Billion

2024

2032

USD

1.45 Billion

USD

3.20 Billion

2024

2032

| 2025 –2032 | |

| USD 1.45 Billion | |

| USD 3.20 Billion | |

|

|

|

|

Optical imaging Market Size

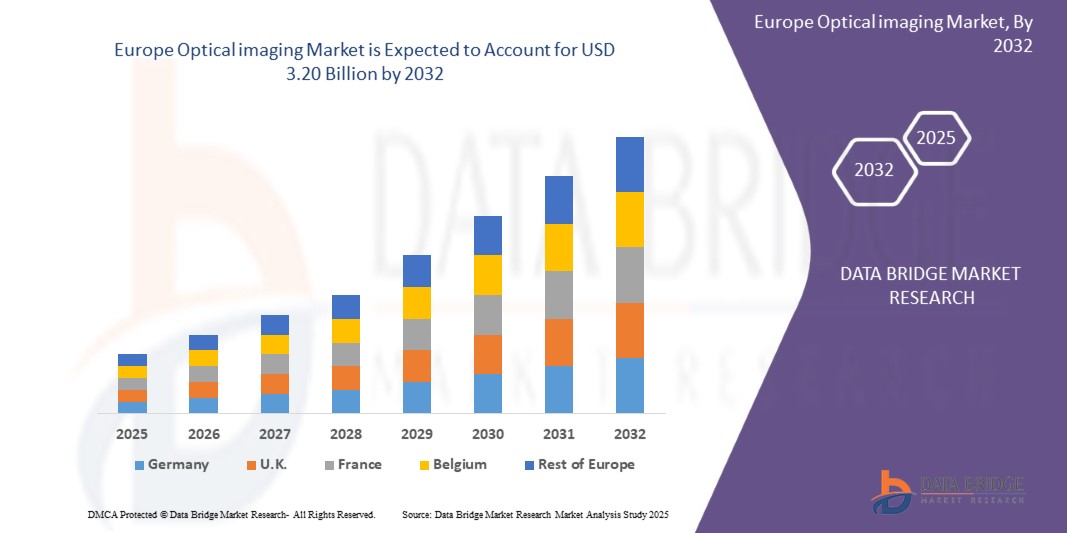

- The Europe optical imaging systems market size was valued at USD US$ 1.45 Billion in 2024 and is expected to reach USD 3.20 Billion by 2032, at a CAGR of 10.4% during the forecast period

- The market growth is significantly driven by the Growing Prevalence of Chronic Diseases, alongside continuous Aging Population in Europe and Rising Demand for Non-Invasive Diagnostics.

- Furthermore, growing preference for radiation-free imaging methods and rising investments in healthcare infrastructure and research initiatives across Europe are accelerating the adoption of optical imaging solutions in various clinical and research settings, thereby substantially boosting the industry's growth

Optical imaging Market Analysis

- Optical imaging technologies, which utilize light to generate detailed, high-resolution images of biological tissues, are becoming increasingly vital components of modern medical diagnostics and research in both clinical and academic settings due to their non-invasive nature, real-time visualization capabilities, and growing integration with advanced analytics

- The escalating demand for Optical imaging is primarily fueled by the increasing prevalence of chronic diseases like cancer and eye disorders, alongside continuous technological advancements in imaging systems

- Germany dominated the optical imaging market with the largest revenue share of 28% in 2024, characterized by Rising Demand for Non-Invasive Diagnostics, and Aging Population in Europein imaging systems.

- France is expected to be the fastest growing country in the imaging systems market during the forecast period due Growing Prevalence of Chronic Diseases.

- Optical Coherence Tomography segment dominated the imaging systems market with a market share of 52.4% in 2024, driven by Rising Demand for Non-Invasive Diagnostics.

Report Scope and Optical imaging Market Segmentation

|

Attributes |

Optical imaging Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Optical imaging Market Trends

“The Rise of AI and System Integration in Europe’s Optical Imaging Industry”

A significant and accelerating trend in the Europe optical imaging market is the deepening integration with artificial intelligence (AI) and advanced image processing ecosystems such as deep learning algorithms for real-time diagnostics, automated image enhancement, and pattern recognition. This fusion of technologies is significantly enhancing clinical precision and diagnostic efficiency across applications such as ophthalmology, oncology, and neurology.

- For instance, Optical Coherence Tomography (OCT) platforms developed by European manufacturers increasingly feature AI-driven analysis modules that assist clinicians in identifying retinal pathologies with high accuracy. Similarly, Photoacoustic imaging systems are being enhanced with AI algorithms to detect early-stage tumors and vascular abnormalities, providing clinicians with more actionable insights.

- AI integration in optical imaging enables features such as automated segmentation, anomaly detection, and predictive analytics. For instance, some next-generation OCT systems can learn from imaging databases to provide decision support and flag unusual anatomical changes. Furthermore, real-time processing capabilities offer researchers and clinicians the ease of hands-free, automated data interpretation, reducing time to diagnosis and improving workflow.

- The seamless integration of optical imaging technologies with hospital information systems (HIS) and broader digital health platforms facilitates centralized control over various aspects of diagnostic operations. Through a single interface, medical staff can manage imaging data alongside electronic medical records (EMR), patient scheduling, and AI-based clinical decision support, creating a unified and streamlined diagnostic environment.

- This trend towards more intelligent, intuitive, and interconnected imaging systems is fundamentally reshaping clinical expectations for diagnostic accuracy and workflow efficiency. Consequently, companies such as Heidelberg Engineering and iThera Medical are developing AI-enabled optical imaging systems with features such as automated image interpretation and seamless integration with hospital IT systems.

- The demand for optical imaging solutions that offer seamless AI integration and enhanced diagnostic intelligence is growing rapidly across both clinical and research sectors, as healthcare providers increasingly prioritize precision, automation, and interoperability in medical imaging technologies

Optical imaging Market

Driver

“Growing Prevalence of Chronic Diseases”

- The increasing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and age-related macular degeneration is a significant driver for the heightened demand for advanced optical imaging technologies in Europe.

- For instance, in March 2024, Heidelberg Engineering announced the launch of an enhanced OCT platform designed specifically for early detection and monitoring of diabetic retinopathy and glaucoma. Such innovations by key European players are expected to drive the optical imaging market growth during the forecast period.

- As healthcare systems face rising patient loads and seek to improve chronic disease management, optical imaging systems offer non-invasive, real-time diagnostic capabilities, allowing for earlier detection, more accurate disease monitoring, and improved patient outcomes—providing a compelling upgrade over conventional diagnostic methods.

- Furthermore, the growing demand for personalized medicine and continuous patient monitoring is making optical imaging an essential component of chronic disease care pathways. These technologies enable integration with electronic health records and AI-driven diagnostic platforms, ensuring more comprehensive and efficient disease management.

- The ability to conduct high-resolution imaging, track disease progression over time, and deliver rapid insights to clinicians through advanced software platforms are key factors propelling the adoption of optical imaging in hospitals, research institutes, and specialty clinics. The trend toward preventive healthcare, aging populations, and increased chronic illness burden across Europe further contributes to the market’s growth

Restraint/Challenge

“Limited Awareness Among Clinicians”

Limited awareness among clinicians regarding the full diagnostic potential and applications of advanced optical imaging technologies poses a significant challenge to broader market penetration. Despite the availability of cutting-edge systems such as OCT, photoacoustic imaging, and hyperspectral imaging, many healthcare professionals are still unfamiliar with their clinical utility, limiting adoption rates across Europe.

- For instance, studies and market analyses indicate that a considerable number of general practitioners and even some specialists remain unaware of how optical imaging can aid in early disease detection or real-time monitoring of chronic conditions, particularly outside of established fields like ophthalmology.

- Addressing this knowledge gap through targeted clinical education, professional training programs, and wider dissemination of case studies is crucial for building trust and confidence among healthcare providers. Companies such as Heidelberg Engineering and Carl Zeiss Meditec are increasingly focusing on clinician engagement and education to improve uptake. Additionally, the relatively high cost of some advanced optical imaging systems, combined with limited institutional budgets, especially in smaller hospitals and rural facilities, can be a barrier to widespread adoption.

- While prices of certain imaging technologies are gradually becoming more competitive, the perceived complexity and lack of familiarity with these systems can still hinder their integration into routine clinical workflows, particularly for clinicians who are not regularly exposed to advanced imaging environments.

- Overcoming these challenges through robust clinician training, improved visibility of clinical outcomes, and expanded reimbursement policies will be vital for sustained market growth and broader utilization of optical imaging technologies in the European healthcare landscape

Optical imaging Market Scope

The market is segmented on the basis of Technique, Therapeutic Area, Application, End-User, and Product.

By Technique

- On the basis of technique, the Europe optical imaging market is segmented into Optical Coherence Tomography (OCT), Near-Infrared Spectroscopy, Hyperspectral Imaging, Photoacoustic Tomography, Diffused Optical Tomography, Super-Resolution Microscopy, and others. The Optical Coherence Tomography (OCT) segment dominated the market with the largest market revenue share of 52.4% in 2024, driven by its established role in ophthalmology and increasing adoption across cardiology and dermatology. Clinicians often prioritize OCT for its high-resolution, non-invasive imaging capabilities and its integration into standard diagnostic workflows. The market also sees strong demand for OCT systems due to their compatibility with AI-assisted image analysis and the continuous development of portable and real-time OCT platforms enhancing clinical efficiency.

- The Photoacoustic Tomography segment is anticipated to witness the fastest growth rate of 18.9% from 2025 to 2032, fueled by increasing adoption in oncology and neurology applications. Photoacoustic techniques offer the advantage of deep tissue imaging with high contrast, making them suitable for early-stage tumor detection and vascular imaging. Their integration with AI and multimodal platforms provides researchers and clinicians with enhanced diagnostic accuracy and functional imaging capabilities. The growing body of clinical research and technological innovation in photoacoustic systems also contributes to their expanding use across European research institutions and hospitals

By Therapeutic Area

- On the basis of therapeutic area, the Europe optical imaging market is segmented into Ophthalmology, Oncology, Cardiology, Dermatology, Neurology, Dentistry, and Others. The Ophthalmology segment held the largest market revenue share in 2024, driven by the high prevalence of eye disorders and the widespread adoption of optical imaging techniques such as Optical Coherence Tomography (OCT) for early diagnosis and monitoring. Ophthalmology benefits from well-established clinical workflows that integrate advanced imaging systems, contributing to its dominant market position.

- The Oncology segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing adoption of optical imaging technologies for early cancer detection, tumor margin assessment, and treatment monitoring. Techniques like photoacoustic tomography and hyperspectral imaging provide non-invasive, high-contrast visualization of tumors, which is accelerating their integration into clinical oncology practice across Europe. Increasing research investments and rising cancer incidence rates further support the rapid growth of this segment.

By Application

- On the basis of application, the Europe optical imaging market is segmented into Pre-Clinical and Clinical Research, Pathological Imaging, Intra-Operative Imaging, and Others. The Pre-Clinical and Clinical Research segment accounted for the largest market revenue share in 2024, driven by the increasing adoption of optical imaging techniques in drug discovery, disease modeling, and clinical trials. Growing investments in medical research and the development of advanced imaging platforms supporting translational research contribute significantly to this segment’s dominance.

- The Intra-Operative Imaging segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising demand for real-time imaging solutions that assist surgeons in precisely identifying anatomical structures and tumor margins during procedures. The integration of optical imaging with surgical workflows enhances accuracy, reduces complications, and improves patient outcomes, fueling rapid adoption in European hospitals and surgical centers.

By End-User

- On the basis of end-user, the Europe optical imaging market is segmented into Hospitals and Clinics, Research Laboratories, Pharmaceutical and Biotechnology Companies, and Diagnostic Imaging Centres. The Hospitals and Clinics segment accounted for the largest market revenue share in 2024, driven by the increasing adoption of optical imaging technologies for diagnostic and therapeutic applications. The growing demand for non-invasive, real-time imaging solutions in patient care, coupled with rising investments in advanced medical infrastructure across Europe, contributes significantly to this segment’s dominance.

- The Pharmaceutical and Biotechnology Companies segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the expanding use of optical imaging in drug discovery, disease modeling, and clinical trials. These companies leverage optical imaging technologies for high-resolution visualization of biological processes, accelerating research and development activities and improving the efficiency of therapeutic innovations.

By Product

- On the basis of product, the Europe optical imaging market is segmented into Imaging Systems, Cameras, Optical Imaging Software, Illumination Systems, Lenses, and Other Optical Imaging Products. The Imaging Systems segment accounted for the largest market revenue share in 2024, driven by the increasing demand for advanced, integrated imaging platforms across clinical and research settings. The growing need for high-resolution, non-invasive diagnostic tools and the continuous technological advancements in imaging hardware contribute significantly to this segment’s dominance.

- The Optical Imaging Software segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising adoption of AI-powered image analysis, real-time processing, and data management solutions. Software platforms enhance the capabilities of imaging systems by enabling automated interpretation, improved accuracy, and seamless integration with hospital IT infrastructures, accelerating the adoption of optical imaging technologies across Europe

Optical imaging Market Country Analysis

- Germany dominated the Optical imaging market with the largest revenue share of 28% in 2024, characterized by Rising Demand for Non-Invasive Diagnostics, and Aging Population in Europein imaging systems.

- Healthcare providers and researchers in the region highly value the precision, non-invasive nature, and advanced diagnostic capabilities offered by optical imaging technologies.

- This widespread adoption is further supported by increasing healthcare investments, a strong focus on innovation and research, and the growing preference for real-time imaging and data-driven clinical decision-making, establishing optical imaging as a preferred solution across hospitals, research institutes, and diagnostic centers in Europe

Europe Optical imaging Market Insight

The Europe optical imaging market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing healthcare regulations promoting early diagnosis and the escalating need for advanced, non-invasive imaging technologies in hospitals and research centers. The rise in chronic disease prevalence, coupled with growing investments in healthcare infrastructure and digital health solutions, is fostering the adoption of optical imaging systems. European healthcare providers and researchers are also drawn to the precision, efficiency, and real-time capabilities these technologies offer. The region is experiencing significant growth across clinical diagnostics, research laboratories, and pharmaceutical applications, with optical imaging being increasingly integrated into both new medical facilities and existing healthcare setups

Germany Optical imaging Market Insight

The Germany optical imaging market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of advanced diagnostic techniques and the demand for precision medicine. Germany’s well-established healthcare infrastructure and strong emphasis on innovation and sustainability promote the integration of optical imaging systems in hospitals, research laboratories, and pharmaceutical companies. The growing trend of incorporating optical imaging with AI-powered analytics and its application in oncology and neurology further supports robust market growth in the region

France Optical Imaging Market Insight

The France optical imaging market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising investments in healthcare modernization and the adoption of cutting-edge imaging technologies for early disease detection. France’s expanding focus on personalized healthcare, along with government initiatives supporting medical research and technological innovation, is accelerating the use of optical imaging across clinical and research environments. The increasing prevalence of chronic diseases also fuels demand for advanced, non-invasive diagnostic imaging solutions.

Optical imaging Market Share

The Optical imaging industry is primarily led by well-established companies, including:

- Hitachi Ltd (Japan)

- Siemens Healthcare GmbH (Germany)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- GENERAL ELECTRIC COMPANY (United States)

- Koninklijke Philips N.V. (Netherlands)

- TOSHIBA CORPORATION (Japan)

- Raytheon Technologies Corporation (United States)

- Abbott (United States)

- Carl Zeiss AG (Germany)

- Leica Microsystems (Germany)

- TOPCON CORPORATION (Japan)

- Heidelberg Engineering GmbH (Germany)

- Headwall Photonics (United States)

- Optovue Incorporated (United States)

- PerkinElmer (United States)

- Agfa-Gevaert Group (Belgium)

- Medtronic (Ireland - operational headquarters in the United States)

- ASE OPTICS (Spain)

- Aetos Technologies (India)

- Michelson Diagnostics Deutschland GmbH (United Kingdom)

- Optical Imaging Ltd (Israel)

What are the Recent Developments in Optical imaging Market Market?

- In April 2023, Siemens Healthineers, a global leader in medical imaging technologies, announced the launch of an advanced optical coherence tomography (OCT) platform in Germany aimed at improving early diagnosis and treatment monitoring for ophthalmic and cardiovascular diseases. This initiative highlights Siemens’ commitment to delivering cutting-edge, precise imaging solutions tailored to the clinical needs of European healthcare providers, reinforcing its position in the rapidly growing optical imaging market.

- In March 2023, PerkinElmer, a prominent provider of imaging and analytical technologies, introduced a new hyperspectral imaging system designed specifically for pharmaceutical research and pathology labs across Europe. The system enhances disease modeling and drug discovery through high-resolution, non-invasive imaging, underscoring PerkinElmer’s dedication to advancing research capabilities and accelerating innovation in life sciences.

- In March 2023, Philips Healthcare successfully deployed an integrated intra-operative imaging solution in several leading hospitals across France, aimed at enhancing surgical precision and patient outcomes. This initiative leverages state-of-the-art optical imaging technologies combined with real-time data analytics, demonstrating Philips’ focus on improving clinical workflows and driving smarter healthcare across Europe.

- In February 2023, Oxford Instruments, a key player in scientific imaging equipment, announced a strategic collaboration with leading European research institutions to develop next-generation super-resolution microscopy systems. This partnership aims to support cutting-edge biomedical research by providing researchers with enhanced imaging capabilities, facilitating breakthroughs in cellular and molecular biology.

- In January 2023, ZEISS Group, a global leader in optical and optoelectronic technologies, unveiled its latest optical imaging software suite at the European Society for Medical Imaging (ESMI) conference. The software, equipped with AI-powered analytics and real-time processing, enables seamless integration with existing imaging platforms and improves diagnostic accuracy, reflecting ZEISS’s commitment to delivering innovative digital solutions to healthcare professionals.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.