Europe Orthopedic Implants Including Dental Implants Market

Market Size in USD Billion

CAGR :

%

USD

17.79 Billion

USD

47.64 Billion

2024

2032

USD

17.79 Billion

USD

47.64 Billion

2024

2032

| 2025 –2032 | |

| USD 17.79 Billion | |

| USD 47.64 Billion | |

|

|

|

|

Europe Orthopedic Implants (Including Dental Implants) Market Size

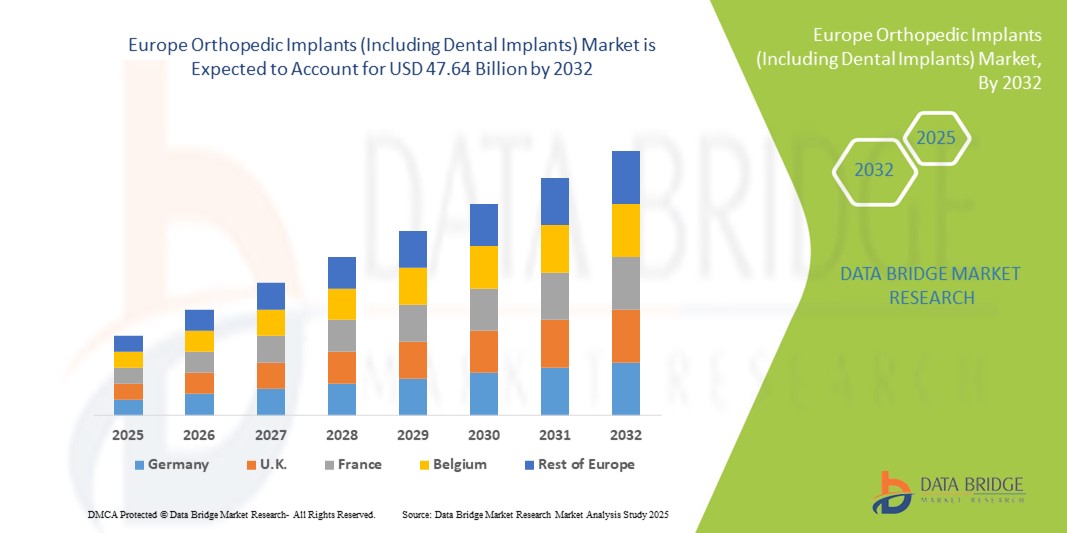

- The Europe orthopedic implants (including dental implants) market size was valued at USD 17.79 billion in 2024 and is expected to reach USD 47.64 billion by 2032, at a CAGR of 13.10% during the forecast period

- The market growth is largely fueled by the rising prevalence of orthopedic disorders, musculoskeletal injuries, and age-related conditions such as osteoarthritis and osteoporosis, which are driving the demand for advanced implant solutions. Increasing incidences of fractures and joint replacement procedures, along with the rising global elderly population, are accelerating the adoption of orthopedic and dental implants across diverse healthcare settings

- Furthermore, growing patient preference for minimally invasive surgical techniques, coupled with continuous advancements in biomaterials, 3D printing, and computer-assisted implant design, is establishing orthopedic and dental implants as the preferred solutions for restoring mobility and improving quality of life. These converging factors are significantly boosting the uptake of Orthopedic Implants (Including Dental Implants) solutions, thereby strengthening overall market growth

Europe Orthopedic Implants (Including Dental Implants) Market Analysis

- Orthopedic implants, including dental implants, play a vital role in modern healthcare by restoring mobility, function, and aesthetics for patients requiring joint replacement, trauma fixation, spinal procedures, or dental rehabilitation. Their adoption has expanded significantly across Europe due to advancements in biomaterials, minimally invasive surgical techniques, and increasing awareness of early treatment options

- The escalating demand for orthopedic implants (including dental implants) in Europe is primarily fueled by the rising prevalence of musculoskeletal disorders, aging populations, and the growing number of patients seeking restorative dental procedures. In addition, government initiatives to improve access to advanced surgical care and increasing healthcare expenditure are further propelling market growth across the region

- Germany dominated the orthopedic implants (including dental implants) market in Europe with the largest revenue share of 24.74% in 2024, supported by its well-established healthcare infrastructure, presence of leading medical device manufacturers, and high adoption of advanced orthopedic and dental implant technologies. The country also benefits from strong reimbursement frameworks and early uptake of innovative solutions, making it a leader in the regional market

- Spain is expected to be the fastest growing country in the orthopedic implants (including dental implants) market in Europe during the forecast period, driven by rising investments in healthcare modernization, expanding access to dental and orthopedic procedures, and increasing demand for cost-effective yet advanced implants. Growing medical tourism and awareness about minimally invasive surgeries are further supporting its rapid market expansion

- The Open Surgery segment dominated the orthopedic implants (including dental implants) market with a market with a revenue share of 58.9% in 2024, supported by its continued role as the standard approach for complex orthopedic interventions, including major joint replacements and trauma management

Report Scope and Orthopedic Implants (Including Dental Implants) Market Segmentation

|

Attributes |

Orthopedic Implants (Including Dental Implants) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Orthopedic Implants (Including Dental Implants) Market Trends

Growing Adoption of Advanced Implant Technologies and Minimally Invasive Surgery

- A significant and accelerating trend in the Europe orthopedic implants (including dental implants) market is the growing adoption of advanced implant materials, minimally invasive surgical techniques, and patient-specific solutions. This transformation is significantly enhancing surgical precision, reducing recovery times, and improving long-term patient outcomes

- For instance, modern orthopedic and dental implants are increasingly developed using biocompatible and durable materials such as titanium alloys, ceramics, and advanced polymers. These innovations allow for improved integration with the human body, reduced risk of rejection, and enhanced durability for joint and dental restorations. Similarly, modular implant systems are being introduced to enable surgeons to tailor implants more closely to patient-specific anatomical needs

- The use of robotic-assisted surgical platforms and navigation technologies is becoming more widespread across Europe, supporting accurate implant placement and lowering the chances of revision surgeries. Preoperative imaging and simulation tools further allow surgeons to plan procedures with greater precision, ensuring optimal outcomes and improved patient satisfaction

- Integration of advanced coatings and surface modifications on implants—such as antimicrobial layers and bioactive coatings—enhances osseointegration, reduces infection risks, and accelerates healing. This is particularly important in high-demand procedures like hip, knee, and dental implant surgeries

- This trend toward innovative, durable, and patient-centered implants is fundamentally reshaping expectations in orthopedic and dental surgery. As a result, leading companies such as Stryker, Zimmer Biomet, Straumann, and DePuy Synthes are heavily investing in next-generation implants that combine enhanced biomechanical performance with higher adaptability to complex surgical needs

- The demand for orthopedic and dental implants is rising rapidly across both hospitals and specialty clinics in Europe, as patients increasingly seek faster recovery, reduced complication risks, and longer-lasting solutions. This surge reflects growing healthcare investment, an aging population, and rising preference for advanced surgical options across the region

Europe Orthopedic Implants (Including Dental Implants) Market Dynamics

Driver

Growing Need Due to Rising Orthopedic and Dental Disorders

- The increasing prevalence of musculoskeletal disorders, including osteoporosis, arthritis, hip fractures, and spinal deformities, along with the growing incidence of tooth loss and dental diseases, is a significant driver for the heightened demand for orthopedic and dental implants

- For instance, in April 2024, Zimmer Biomet announced advancements in its orthopedic implant portfolio, introducing innovative personalized solutions for joint replacements. Similarly, Straumann expanded its dental implant systems to enhance treatment precision and patient comfort. Such strategies by key companies are expected to drive the Orthopedic Implants (Including Dental Implants) industry growth during the forecast period

- As patients become more aware of treatment options for mobility restoration and oral rehabilitation, orthopedic and dental implants offer advanced solutions such as minimally invasive procedures, faster recovery times, and long-term durability, providing a compelling alternative to traditional corrective approaches

- Furthermore, the rising demand for aesthetic dental procedures, coupled with the aging population requiring joint and bone replacements, is making implants an essential part of modern healthcare solutions. These factors, along with innovations in biomaterials and 3D printing, are accelerating adoption across hospitals, clinics, and surgical centers

- The convenience of advanced implant designs, improved surgical techniques, and the ability to restore functionality and quality of life are key factors propelling the adoption of orthopedic and dental implants across multiple applications. The trend toward patient-specific implants and the increasing availability of user-friendly implant systems further contribute to market growth

Restraint/Challenge

Concerns Regarding High Costs and Risk of Post-Surgical Complications

- Concerns surrounding the high costs of orthopedic and dental implant procedures, as well as risks associated with post-surgical complications, pose significant challenges to broader market penetration. Since these implants often involve advanced biomaterials and surgical expertise, affordability remains a barrier in price-sensitive markets, limiting widespread adoption

- For instance, reports of implant failures, revision surgeries, and infection risks in orthopedic and dental procedures have made some patients hesitant to undergo these treatments, particularly in regions with limited healthcare reimbursement

- Addressing these challenges through cost-effective solutions, improved biomaterials, and advanced surgical planning tools is crucial for building patient and physician confidence. Companies such as Stryker and DePuy Synthes focus on introducing durable implants and investing in clinical studies to demonstrate safety and efficacy, thereby reassuring patients and healthcare providers. In addition, the relatively high price of advanced implants compared to conventional treatment options can deter adoption, especially in developing countries

- While prices are gradually becoming more competitive with the introduction of locally manufactured implants, the perceived premium for high-quality implants can still hinder widespread adoption, particularly among patients without comprehensive insurance coverage

- Overcoming these challenges through innovative financing models, expanding insurance coverage, patient education on long-term benefits, and continuous product innovation will be vital for sustained growth of the Orthopedic Implants (Including Dental Implants) Market

Europe Orthopedic Implants (Including Dental Implants) Market Scope

The market is segmented on the basis of product type, biomaterial, procedure, fixation type, end user, and distribution channel.

- By Product Type

On the basis of product type, the orthopedic implants (including dental implants) market is segmented into reconstructive joint replacements, spinal implants, motion preservation devices/non-fusion devices, dental implants, trauma implants, orthobiologics, and others. The Reconstructive Joint Replacements segment dominated the market with a revenue share of 35.6% in 2024, primarily due to the high prevalence of osteoarthritis and degenerative joint conditions among Europe’s aging population. Hip and knee replacements are among the most common surgeries, supported by strong reimbursement frameworks across Germany, the U.K., and France. Continuous innovation in modular implant designs, biocompatible coatings, and navigation-assisted surgeries has strengthened adoption. The growing demand for improved mobility and reduced post-surgical complications has also made reconstructive implants the gold standard in advanced orthopedic care across the region.

The dental implants segment is anticipated to witness the fastest growth, with a CAGR of 7.9% from 2025 to 2032, driven by rising cases of tooth loss and the increasing popularity of cosmetic and restorative dental procedures. Growing dental tourism in Hungary, Spain, and Poland further accelerates demand. Technological advances such as 3D printing, patient-specific implants, and minimally invasive surgeries have improved outcomes and broadened accessibility. Rising disposable incomes, coupled with aesthetic awareness among younger and older populations, ensure strong growth momentum for this segment in the coming years.

- By Biomaterial

On the basis of biomaterial, the Europe orthopedic implants (including dental implants) market is segmented into metallic biomaterials, ceramic biomaterials, polymeric biomaterials, natural biomaterials, and others. The Metallic Biomaterials segment dominated the market with a revenue share of 47.8% in 2024, owing to their unmatched durability, strength, and long clinical history of use in orthopedic surgeries. Titanium and its alloys remain the preferred choice for hip, knee, and spinal implants, ensuring stability and longevity. Surgeons across Europe continue to favor metallic implants due to their proven biocompatibility and success in load-bearing applications. Ongoing innovations in porous surface coatings have improved bone integration, further reinforcing dominance in this category.

The ceramic biomaterials segment is expected to grow at the fastest CAGR of 8.5% from 2025 to 2032, as ceramics offer superior wear resistance, reduced risk of allergic reactions, and natural aesthetics, especially for dental implants. Their growing use in joint replacements, particularly among younger patients, is driving adoption due to their longevity and reduced risk of implant-related complications. With continued innovation in ceramic composites to improve fracture resistance, the demand for ceramics in both dental and orthopedic applications is accelerating significantly. In addition, increasing clinician preference for biocompatible and durable materials is further propelling the adoption of ceramic biomaterials across Europe.

- By Procedure

On the basis of procedure, the Europe orthopedic implants (including dental implants) market is segmented into open surgery, minimally invasive surgery (MIS), and others. The open surgery segment dominated the market with a revenue share of 58.9% in 2024, supported by its continued role as the standard approach for complex orthopedic interventions, including major joint replacements and trauma management. Despite the rise of newer technologies, open surgery provides surgeons with greater visibility and control, ensuring precision in complicated cases. Its strong acceptance across Europe’s hospitals, coupled with experienced surgeon preference and well-established protocols, reinforces its leading market share.

The minimally invasive surgery (MIS) segment is expected to grow at the fastest CAGR of 9.2% from 2025 to 2032, propelled by patient preference for faster recovery, smaller incisions, and reduced hospital stays. Innovations in robotic-assisted surgery, endoscopic tools, and navigation systems are accelerating MIS adoption in hip, spine, and dental procedures. Increasing awareness of the benefits, along with healthcare cost savings from shorter hospitalization, positions MIS as the fastest-growing segment across Europe. Furthermore, the rising number of specialized orthopedic and dental centers equipped with advanced MIS technologies is driving higher procedure volumes. Continuous training and skill development among surgeons are also contributing to the wider adoption of minimally invasive techniques across the region.

- By Fixation Type

On the basis of fixation type, the Europe orthopedic implants (including dental implants) market is segmented into cement orthopedic implants, cementless orthopedic implants, and hybrid orthopedic implants. The cementless orthopedic implants segment dominated the market with a revenue share of 52.1% in 2024, attributed to their ability to promote natural bone integration and long-term stability. These implants are especially popular among younger patients requiring durability and reduced complications in revision surgeries. Surgeons favor cementless solutions due to advanced porous coatings and 3D-printed designs that enhance osseointegration. Their clinical success and adaptability to modern surgical methods secure this segment’s dominant market position.

The hybrid orthopedic implants segment is projected to register the fastest CAGR of 7.6% from 2025 to 2032, offering a balance of immediate fixation and long-term bone integration. These implants are increasingly adopted for patients with poor bone quality, particularly elderly populations, ensuring initial stability while supporting long-term function. Growing clinical validation, coupled with surgeon acceptance of hybrid techniques in hip and knee procedures, positions this segment for rapid growth. In addition, advancements in implant materials and design are enhancing patient outcomes and reducing revision rates. Increasing awareness among orthopedic specialists about the benefits of hybrid implants is further driving their adoption across Europe.

- By End User

On the basis of end user, the Europe orthopedic implants (including dental implants) market is segmented into hospitals, clinics, ambulatory surgical centers, home care settings, academic & research institutes, and others. The hospitals segment dominated the market with a revenue share of 61.4% in 2024, as they remain the primary centers for complex orthopedic and dental procedures. Equipped with advanced surgical tools, robotic platforms, and highly skilled professionals, hospitals continue to handle the majority of high-risk interventions. Government investments in healthcare infrastructure and reimbursement support across Europe further reinforce the dominance of this segment.

The ambulatory surgical centers (ASCs) segment is expected to record the fastest CAGR of 8.7% from 2025 to 2032, fueled by rising demand for cost-effective, same-day surgeries with reduced hospital stays. ASCs are increasingly chosen for minimally invasive orthopedic and dental procedures, supported by advancements in anesthesia and pain management. Their growing role in delivering efficient outpatient care highlights a major shift in Europe’s orthopedic implants landscape. Furthermore, favorable reimbursement policies and patient preference for convenience are accelerating ASC adoption. The integration of advanced surgical technologies in ASCs is also enhancing procedural efficiency and patient outcomes, reinforcing their market growth.

- By Distribution Channel

On the basis of distribution channel, the Europe orthopedic implants (including dental implants) market is segmented into Direct tender, retail sales, and others. The direct tender segment dominated the market with a revenue share of 68.2% in 2024, as bulk procurement by hospitals and government institutions remains the preferred purchasing route across Europe. This model ensures lower costs, standardized quality, and strong partnerships between manufacturers and healthcare providers. National health systems, particularly in countries like Germany and the U.K., emphasize centralized purchasing to enhance efficiency and control prices, supporting the dominance of direct tender channels.

The retail sales segment is expected to grow at the fastest CAGR of 7.4% from 2025 to 2032, driven by the expansion of private clinics and dental practices offering direct implant sales to patients. Growing disposable incomes and increasing willingness to spend on premium healthcare services, especially for dental implants, support retail demand. Patients are also showing a preference for personalized care through smaller clinics, ensuring strong growth in this channel. In addition, the rise of online platforms for medical products and enhanced marketing strategies by manufacturers are boosting retail accessibility. The focus on patient education and customized implant solutions further strengthens the adoption of retail sales across Europe.

Europe Orthopedic Implants (Including Dental Implants) Market Regional Analysis

- The Europe orthopedic implants (including dental implants) market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising prevalence of musculoskeletal disorders, an increasing geriatric population, and the growing demand for dental restoration procedures

- The region benefits from advanced healthcare infrastructure, strong research capabilities, and a high adoption rate of innovative implant technologies

- Furthermore, the integration of 3D printing, biomaterials, and minimally invasive surgical techniques is accelerating the uptake of orthopedic and dental implants across Europe. Rising healthcare expenditure and supportive government initiatives for advanced surgical solutions further contribute to the market’s growth

Germany Orthopedic Implants (Including Dental Implants) Market Insight

The Germany orthopedic implants (including dental implants) market dominated the European region with the largest revenue share of 24.74% in 2024, supported by its well-established healthcare infrastructure, presence of leading medical device manufacturers, and high adoption of advanced orthopedic and dental implant technologies. The country also benefits from strong reimbursement frameworks, an aging population with high demand for joint replacements, and early uptake of innovative implant solutions. Germany’s emphasis on precision medicine, strong clinical research ecosystem, and collaborations with international implant developers further reinforce its leadership position in the European market.

Spain Orthopedic Implants (Including Dental Implants) Market Insight

The Spain orthopedic implants (including dental implants) market is expected to be the fastest-growing country in the European market during the forecast period, driven by rising investments in healthcare modernization, expanding access to orthopedic and dental procedures, and increasing adoption of cost-effective yet technologically advanced implants. Growing medical tourism, especially for dental care and joint replacement surgeries, is further enhancing market growth. In addition, increasing awareness about minimally invasive procedures and improved patient outcomes is boosting the adoption of implants across hospitals and specialized clinics. Spain’s focus on enhancing healthcare access and affordability positions it as one of the most dynamic markets in the region.

Europe Orthopedic Implants (Including Dental Implants) Market Share

The Orthopedic Implants (Including Dental Implants) industry is primarily led by well-established companies, including:

- Zimmer Biomet (U.S.)

- Smith + Nephew (U.K.)

- Medtronic (Ireland)

- Stryker (U.S.)

- B. Braun SE (Germany)

- Waston Medical Corporation (China)

- Integra LifeSciences Corporation (U.S.)

- Arthrex, Inc. (U.S.)

- Enovis Corporation (U.S.)

- Samay Surgical Pvt. Ltd. (India)

- BioHorizons (U.S.)

- Envista (U.S.)

- Institut Straumann AG (Switzerland)

- Canwell Medical Co., Ltd. (China)

- Corin Group (U.K.)

- Globus Medical (U.S.)

- CONMED Corporation (U.S.)

Latest Developments in Europe Orthopedic Implants (Including Dental Implants) Market

- In May 2022, Straumann Group announced the acquisition of PlusDental, a Europe-focused, doctor-led clear aligner and orthodontic digital-treatment provider, to broaden Straumann’s consumer-facing digital and clinic network capabilities in Europe and accelerate its move into integrated digital care pathways for dental restorative and implant solutions

- In March 2023, Zimmer Biomet unveiled major enhancements to its ZBEdge Dynamic Intelligence platform — upgrades that further connect Zimmer Biomet’s digital tools, robotic systems, and implant portfolios to collect objective episode-of-care data and help surgeons plan and assess joint replacement outcomes

- In May 2023, Zimmer Biomet launched the Persona OsseoTi Keel Tibia for cementless knee replacement, extending the company’s cementless knee portfolio with a design aimed at improving primary fixation and offering an option for cementless total knee arthroplasty in European markets

- In May 2023, Straumann Group completed the acquisition of GalvoSurge, a Swiss dental-care device specialist whose peri-implant maintenance technology complemented Straumann’s clinical solutions and expanded its portfolio for managing implant site health

- In October 2023, DePuy Synthes (Johnson & Johnson MedTech) officially launched the VELYS Robotic-Assisted Solution on the European market, marking a major rollout of its robotic knee system to hospitals in Germany, Belgium and Switzerland and underscoring the company’s push into digital and robotic orthopaedics in Europe

- In December 2023 (announced) and completed in March 2024, Stryker executed and then closed its acquisition of SERF SAS, a France-based joint-replacement company — a strategic move to strengthen Stryker’s joint replacement offerings and European manufacturing and clinical footprint

- In August 2024, DePuy Synthes announced the commercial launch plans for VELYS SPINE — its first active spine robotics and navigation platform — signalling DePuy’s expansion of robotic assistance from knees into spine procedures with anticipated commercial availability in 2025

- In November 2024, Zimmer Biomet received regulatory approval for its Oxford Cementless Partial Knee (noted in company filings/announcements), representing a notable product authorization that expanded Zimmer Biomet’s knee implant options and supported its growth in joint reconstruction markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.