Europe Orthopedic Implants Market

Market Size in USD Billion

CAGR :

%

USD

19.54 Billion

USD

52.32 Billion

2024

2032

USD

19.54 Billion

USD

52.32 Billion

2024

2032

| 2025 –2032 | |

| USD 19.54 Billion | |

| USD 52.32 Billion | |

|

|

|

|

Europe Orthopedic Implants Market Size

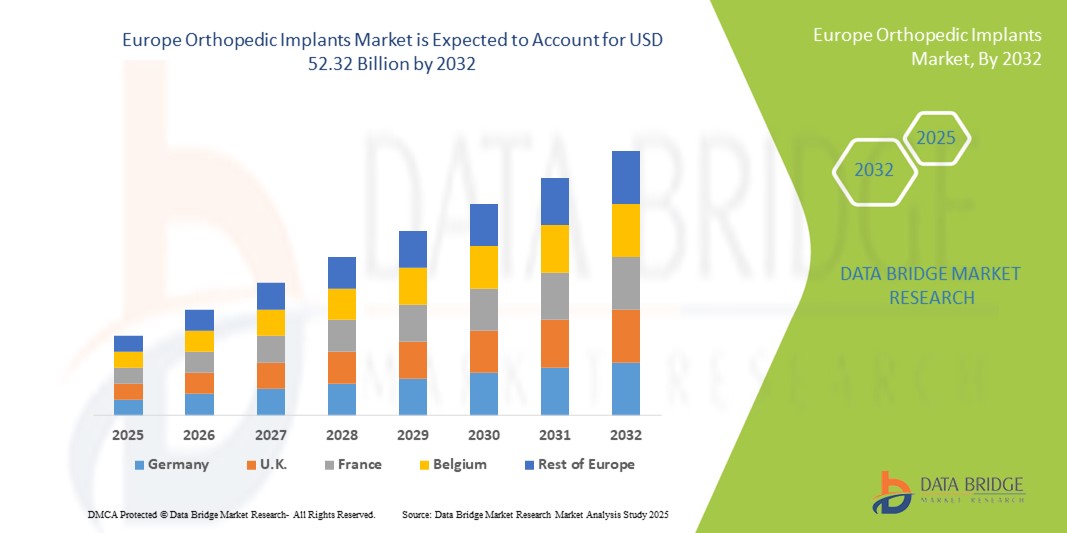

- The Europe orthopedic implants market size was valued at USD 19.54 billion in 2024 and is expected to reach USD 52.32 billion by 2032, at a CAGR of 13.10% during the forecast period

- The market growth is largely fueled by the rising prevalence of musculoskeletal disorders, an aging global population, and increasing incidences of orthopedic injuries and trauma, driving the demand for advanced orthopedic implant solutions

- Furthermore, technological advancements in implant materials, surgical techniques, and minimally invasive procedures are enhancing patient outcomes and boosting the adoption of orthopedic implants across hospitals and specialty clinics

Europe Orthopedic Implants Market Analysis

- The Orthopedic Implants market is witnessing significant growth in Europe, driven by the rising prevalence of musculoskeletal disorders, an aging population, and increasing demand for joint replacement and trauma fixation procedures. Advanced healthcare infrastructure and rising awareness of minimally invasive surgeries are also contributing to market expansion

- The escalating demand for orthopedic implants is primarily fueled by the rising prevalence of musculoskeletal disorders, increasing geriatric population, and growing adoption of minimally invasive and technologically advanced surgical procedures across Europe

- Germany dominated the orthopedic implants market in Europe with the largest revenue share of 34.55% in 2024, supported by its advanced healthcare infrastructure, widespread adoption of joint replacement procedures, and strong research ecosystem fostering innovative implant development. The country’s well-established hospitals and specialized orthopedic centers further strengthen market leadership

- France is expected to be the fastest-growing country in the Europe orthopedic implants market during the forecast period, registering the highest CAGR due to rising investments in orthopedic surgery innovations, increasing number of elective procedures, and expanding adoption of advanced implant materials and robotic-assisted surgeries. The focus on improving patient outcomes and enhanced surgical precision is driving this rapid growth trajectory

- The internal fixation devices segment dominated the Europe orthopedic implants market with the largest market revenue share of 50.2% in 2024, owing to their critical role in stabilizing fractures and supporting healing. Devices such as plates, screws, and intramedullary nails are extensively used due to their proven ability to provide stability and accelerate bone healing

Report Scope and Orthopedic Implants Market Segmentation

|

Attributes |

Orthopedic Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Orthopedic Implants Market Trends

Advancements in Implant Technology and Minimally Invasive Procedures

- A significant and accelerating trend in the Europe orthopedic implants market is the growing adoption of advanced implant technologies and minimally invasive surgical techniques. This trend is significantly enhancing surgical precision, reducing recovery times, and improving patient outcomes

- For instance, modern orthopedic implant systems now incorporate biocompatible materials and modular designs, allowing surgeons to customize implants to patient-specific anatomy. Similarly, navigation-assisted and robotic-assisted surgical tools are being increasingly adopted for complex procedures

- Integration of imaging and preoperative planning software enables surgeons to simulate procedures and optimize implant positioning, thereby reducing complications and improving long-term functionality. Advanced implant coatings and materials also contribute to faster healing and reduced risk of infection

- The availability of technologically advanced orthopedic implants facilitates better outcomes for joint replacement, trauma, and spinal surgeries, allowing healthcare providers to offer higher standards of care

- This trend towards more innovative, durable, and patient-specific implants is fundamentally reshaping expectations in orthopedic surgery. Consequently, companies such as Stryker, Zimmer Biomet, and DePuy Synthes are developing next-generation implants with enhanced biomechanical performance and surgical adaptability

- The demand for advanced orthopedic implants is growing rapidly across both hospital and specialty clinic settings, as patients and surgeons increasingly prioritize improved outcomes, shorter recovery times, and reduced postoperative complications

Europe Orthopedic Implants Market Dynamics

Driver

Rising Demand Driven by Aging Population and Orthopedic Condition

- The increasing prevalence of orthopedic disorders, such as osteoarthritis, osteoporosis, and sports-related injuries, is a significant driver for the heightened demand for orthopedic implants across Europe

- For instance, in 2024, several leading orthopedic device manufacturers introduced advanced implant technologies aimed at improving patient outcomes, minimally invasive procedures, and faster recovery times. Such innovations are expected to drive market growth in the forecast period

- As the aging population continues to rise, the need for joint replacement surgeries and spinal correction procedures is increasing, contributing to strong adoption of hip, knee, and spinal implants

- Furthermore, growing awareness among patients and healthcare providers regarding the benefits of advanced implant designs, such as biocompatible materials and improved load distribution, is boosting demand for innovative orthopedic solutions

- The expansion of healthcare infrastructure, increasing number of specialty orthopedic centers, and government support for surgical interventions are key factors propelling market growth

- Rising investments in research and development, coupled with collaborations between hospitals and medical device companies, are driving continuous improvements in implant quality, durability, and customization

Restraint/Challenge

High Costs and Regulatory Hurdles

- The high cost of advanced orthopedic implants remains a major barrier to market growth in Europe. Premium implants, including hip, knee, and spinal devices, often require significant investment in both the device itself and the associated surgical procedure, limiting accessibility for patients in price-sensitive segments

- Reimbursement challenges across different European countries further complicate market adoption, as varying insurance coverage and healthcare funding policies can delay or restrict access to cutting-edge implant technologies

- Stringent regulatory requirements, including CE marking and compliance with the European Medical Device Regulation (MDR), impose lengthy approval timelines, extensive documentation, and rigorous clinical testing. This slows the introduction of new implant innovations to the market

- Manufacturers also face challenges related to maintaining quality, safety, and biocompatibility standards, which are critical to avoid post-operative complications and ensure long-term implant performance

- The presence of lower-cost generic implants and competitive pricing pressures from emerging local manufacturers may hinder the adoption of technologically advanced, premium implants in some regions

- Even with ongoing efforts to reduce production costs, the perceived high investment required for advanced orthopedic devices can deter smaller hospitals and clinics from adopting the latest implant technologies

- Addressing these barriers through enhanced reimbursement policies, regulatory support, and cost-effective manufacturing strategies will be essential for sustained growth in the European orthopedic implants market

Europe Orthopedic Implants Market Scope

The market is segmented on the basis of product type, biomaterial, procedure, device type, application, and end-user.

- By Product Type

On the basis of product type, the orthopedic implants market is segmented into reconstructive joint replacements, spinal implants, orthobiologics, trauma & craniomaxillofacial, and others. The reconstructive joint replacements segment dominated the largest market revenue share of 41.5% in 2024, largely due to the increasing demand for hip and knee replacement procedures across Europe. Rising cases of osteoarthritis and rheumatoid arthritis, combined with an aging population, have significantly boosted the adoption of these implants. The availability of advanced designs, including modular and patient-specific implants, has further strengthened clinical outcomes and reduced revision surgeries. In addition, continuous innovation in implant coatings to improve osseointegration and lower infection risks has supported long-term success rates.

The spinal implants segment is projected to witness the fastest CAGR of 10.8% from 2025 to 2032, driven by the rising prevalence of spinal disorders such as degenerative disc disease, scoliosis, and spinal stenosis. Increasing adoption of spinal fixation systems and interbody fusion devices is a major growth driver, especially as minimally invasive spinal surgeries gain traction. Surgeons are increasingly favoring spinal implants due to advancements in navigation-assisted and robotic systems that ensure greater precision and shorter recovery times. Moreover, Europe has witnessed a surge in specialized spine centers, creating higher demand for advanced implants. The growing elderly population, who are more prone to spinal conditions, further accelerates this segment’s expansion. Collectively, these factors make spinal implants the fastest-growing segment in the product type category.

- By Biomaterial

On the basis of biomaterial, the orthopedic implants market is segmented into ceramics biomaterials, metallic biomaterials, polymeric biomaterials, and natural biomaterials. The metallic biomaterials segment dominated the largest market revenue share of 45.3% in 2024, supported by their widespread application in joint replacements, trauma fixation, and spinal implants. Materials such as titanium and stainless steel are highly valued for their strength, durability, and biocompatibility, ensuring excellent long-term outcomes in orthopedic surgeries. Their ability to withstand mechanical stress makes them the gold standard for load-bearing implants. In addition, technological improvements in metal surface modifications, like porous coatings, have enhanced bone integration, reducing implant failure rates. The wide clinical acceptance and availability of metallic implants also contribute to their dominance, particularly in large-scale surgeries performed in hospitals across Europe.

The polymeric biomaterials segment is expected to witness the fastest CAGR of 11.2% from 2025 to 2032, driven by rising demand for lightweight, flexible, and bioresorbable materials. These polymers are increasingly being adopted in trauma fixation and minimally invasive surgeries, as they reduce complications linked to long-term implantation. Innovations in advanced polymers, such as composite materials and biodegradable scaffolds, are enabling patient-specific solutions and regenerative capabilities. Furthermore, polymeric biomaterials are gaining traction in pediatric orthopedics, where temporary implants that naturally degrade are preferred. Their adaptability, reduced patient discomfort, and growing R&D investments in polymer-based implants are propelling strong growth in this segment across Europe.

- By Procedure

On the basis of procedure, the orthopedic implants market is segmented into open surgery, minimally invasive surgery (MIS), and others. The open surgery segment dominated the largest market revenue share of 48.7% in 2024, owing to its extensive use in complex fracture repairs, joint replacements, and spinal surgeries. Open procedures are often preferred by surgeons for their visibility and control, especially in challenging cases where precision is critical. They are widely regarded as the gold standard in orthopedic interventions due to their reliability and established clinical success rates. The strong infrastructure of European hospitals and their reliance on tried-and-tested techniques further reinforce the preference for open surgeries. Moreover, insurance coverage and standardized guidelines make open procedures more accessible and common across the region.

The Minimally Invasive Surgery (MIS) segment is expected to witness the fastest CAGR of 12.0% from 2025 to 2032, fueled by patient demand for quicker recovery times, smaller incisions, and reduced postoperative complications. MIS has gained popularity due to its ability to minimize hospital stays and improve patient satisfaction. Technological advancements, such as robotic-assisted systems and advanced imaging for navigation, have made these procedures safer and more precise. Surgeons are increasingly adopting MIS techniques for joint replacements and spinal surgeries, as they deliver similar outcomes to open surgery but with fewer risks. As healthcare providers in Europe invest heavily in MIS infrastructure and training, this segment is expected to expand rapidly.

- By Device Type

On the basis of device type, the orthopedic implants market is segmented into Internal fixation devices and external fixation devices. The internal fixation devices segment dominated the largest market revenue share of 50.2% in 2024, owing to their critical role in stabilizing fractures and supporting healing. Devices such as plates, screws, and intramedullary nails are extensively used due to their proven ability to provide stability and accelerate bone healing. Their effectiveness in managing both trauma and reconstructive surgeries has ensured widespread adoption. Furthermore, advancements in internal fixation technology, including bioactive coatings and modular designs, have improved patient outcomes and reduced revision rates. The high success rate and versatility of internal fixation devices continue to make them the backbone of orthopedic surgical practice across Europe.

The external fixation devices segment is expected to witness the fastest CAGR of 10.5% from 2025 to 2032, driven by their growing application in trauma care, corrective procedures, and complex fracture cases. These devices offer flexibility, as they can be adjusted post-surgery to aid in bone healing and alignment. Their lightweight and modular designs have improved patient comfort and compliance. In addition, external fixators are increasingly being adopted in cases where internal fixation is not feasible, such as severe open fractures or infections. As trauma cases continue to rise across Europe, external fixation devices are becoming an essential tool for orthopedic surgeons, driving their growth.

- By Application

On the basis of application, the orthopedic implants market is segmented into neck fracture, spine fracture, hip replacement, shoulder replacement, and others. The hip replacement segment dominated the largest market revenue share of 43.8% in 2024, owing to the rising incidence of hip osteoarthritis and fracture cases, particularly among the elderly population. Hip replacement procedures are widely performed due to their ability to restore mobility, reduce pain, and improve quality of life. Advancements in prosthetic designs, including cementless implants and hybrid fixation methods, have significantly improved implant longevity and success rates. Increasing government support and reimbursement for hip replacement surgeries further strengthen this segment’s dominance. In addition, the growing emphasis on early mobility post-surgery and the availability of specialized orthopedic centers in Europe make hip replacement the leading application.

The spine fracture segment is projected to witness the fastest CAGR of 11.0% from 2025 to 2032, driven by the rising burden of spinal injuries and conditions like osteoporosis. The demand for spinal implants is increasing as patients and surgeons opt for advanced solutions such as vertebral fixation and kyphoplasty. Minimally invasive techniques are playing a crucial role in the adoption of spine-related procedures, reducing recovery times and hospital stays. Furthermore, the growing prevalence of sports injuries and accidents in Europe is adding to the demand for spinal fracture treatments. The presence of specialized spine centers and increased research into advanced implant technologies further contribute to this segment’s strong growth trajectory.

- By End-User

On the basis of end-user, the orthopedic implants market is segmented into hospital, orthopedic clinics, home cares, and others. The Hospital segment dominated the largest market revenue share of 52.1% in 2024, driven by the availability of advanced infrastructure, skilled surgeons, and comprehensive patient care facilities. Hospitals are the primary providers of complex orthopedic surgeries such as joint replacements, spinal procedures, and trauma management. Their ability to offer multidisciplinary care, combined with advanced diagnostic and surgical technologies, ensures high patient preference. Favorable reimbursement policies and continuous government investments in healthcare infrastructure also support the hospital segment’s dominance in Europe.

The orthopedic clinics segment is expected to witness the fastest CAGR of 10.7% from 2025 to 2032, driven by the growing preference for specialized outpatient centers. Orthopedic clinics provide focused care, shorter waiting times, and personalized treatment plans, which make them attractive to patients. The increasing number of independent and chain-based clinics in urban regions of Europe has improved accessibility to advanced orthopedic treatments. Moreover, as minimally invasive procedures gain popularity, many of these can now be effectively performed in clinics, reducing the burden on hospitals. Rising awareness of early intervention and preventive orthopedic care also contributes to the segment’s rapid growth.

Europe Orthopedic Implants Market Regional Analysis

- The Europe orthopedic implants market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising demand for joint replacement procedures, growing prevalence of musculoskeletal disorders, and continuous technological advancements in implant materials and designs

- Increasing awareness of minimally invasive and robotic-assisted orthopedic surgeries is further boosting adoption across hospitals and specialty clinics

- The region is experiencing significant growth across hip, knee, spine, and trauma implant segments, with innovative biomaterials and patient-specific solutions being increasingly integrated into surgical procedures

Germany Orthopedic Implants Market Insight

The Germany orthopedic implants market dominated the market in Europe with the largest revenue share of 34.55% in 2024, supported by its advanced healthcare infrastructure, widespread adoption of joint replacement procedures, and strong research ecosystem fostering innovative implant development. The country’s well-established hospitals and specialized orthopedic centers further strengthen market leadership. Additionally, Germany’s focus on precision surgery, minimally invasive techniques, and collaboration between medical device companies and research institutions is fueling market expansion, making it a hub for orthopedic innovation.

France Orthopedic Implants Market Insight

The France orthopedic implants market is expected to be the fastest-growing country in the European market during the forecast period, registering the highest CAGR. This growth is driven by rising investments in orthopedic surgery innovations, an increasing number of elective procedures, and the expanding adoption of advanced implant materials and robotic-assisted surgeries. French healthcare providers are focusing on improving patient outcomes and surgical precision, while government initiatives supporting modern healthcare infrastructure and research further accelerate market growth.

Europe Orthopedic Implants Market Share

The orthopedic implants industry is primarily led by well-established companies, including:

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Smith+Nephew (U.K.)

- B. Braun SE (Germany)

- Medtronic (Ireland)

- DJO Global (U.S.)

- Arthrex, Inc. (U.S.)

- NuVasive, Inc. (U.S.)

- Globus Medical (U.S.)

- Corin Group (U.K.)

- Medacta International (Switzerland)

- Exactech, Inc. (U.S.)

- Conformis (U.S.)

- United Orthopedic Corporation (Taiwan)

- Enovis Corporation (Italy)

- Meril Life Sciences Pvt. Ltd. (India)

- Biotek (India)

- Auxein (India)

- Lepu Medical Technology (Beijing) Co. Ltd. (China)

- Amplitude Surgical (France)

- Zydus Lifesciences (India)

Latest Developments in Europe Orthopedic Implants Market

- In January 2021, Smith+Nephew completed the acquisition of the Extremity Orthopaedics business, expanding its portfolio in shoulder and extremities solutions. This transaction strengthened Smith+Nephew’s product pipeline with new shoulder and extremity systems and gave the company a more focused sales channel to accelerate growth in higher-margin reconstruction segments across Europe

- In September 2023, Enovis announced an agreement to acquire Italy-based LimaCorporate for approximately EUR 800 million, a deal intended to scale Enovis’ reconstruction capabilities and add Lima’s trabecular titanium and 3D-printed implant technologies to its repertoire. The move signaled consolidation in the European reconstruction market and positioned Enovis to offer a broader set of orthopedic reconstruction options—particularly appealing to hospitals seeking advanced implant technologies and regional manufacturing presence

- In October 2023, DePuy Synthes (Johnson & Johnson MedTech) officially launched the VELYS Robotic-Assisted Solution on the European market, bringing a robotic system designed to work with the ATTUNE Knee System to hospitals in Germany, Belgium, Switzerland and other countries. The European launch underscored the accelerating rollout of image-guided/robotic platforms across Europe, enabling surgeons to adopt more personalized knee arthroplasty workflows and helping hospitals differentiate on digital-orthopaedics capabilities

- In November 2023, Smith+Nephew announced the acquisition of CartiHeal (a company focused on cartilage repair technology) for an initial cash consideration, expanding Smith+Nephew’s sports-medicine and cartilage regeneration offerings and reinforcing its strategy to diversify into high-growth orthobiologics and joint-preserving solutions across Europe. This deal enhanced Smith+Nephew’s ability to offer integrated surgical solutions for knee preservation and sports-medicine clinics

- In March 2024, Stryker completed the acquisition of SERF SAS, a France-based joint-replacement company known for hip implant technology (including dual-mobility cups). The acquisition bolstered Stryker’s European joint replacement portfolio and manufacturing footprint, enabling faster local supply and expanded implant choice for surgeons treating hip pathologies across Europe

- In January 2024, Enovis completed the acquisition of LimaCorporate, integrating Lima’s product lines and manufacturing footprint into Enovis’ recon segment and creating a combined business expected to drive mid-to-long-term growth in Europe. Completion of the deal allowed Enovis to accelerate commercialization of Lima’s technologies across European markets and to leverage combined R&D and distribution to serve reconstruction demand

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.