Europe Orthopedic Surgical Robots Market Analysis and Insight

The orthopedic surgical robots market is largely influenced by the surging focus of key players towards technological advances in molecular diagnostics and indulging towards collaboration and partnerships with other organizations. The first documented use of orthopedic surgery had started during the 15th century. Modern orthopedic surgery and musculoskeletal research makes surgery less invasive and to make implanted components better and more durable. The orthopedic surgical robots are used to correct the bone deformities and to restore the function of the human skeletal system. During the last few years, new innovative orthopedic surgical robots products have been developed for increasing the growth of orthopedic surgical robots market, and the market players are enhancing their product portfolio. Many market players are involved in the manufacturing of orthopedic surgical robots with innovations that pave the way for market growth.

Europe orthopedic surgical robots market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an analyst brief, our team will help you create a revenue impact solution to achieve your desired goal.

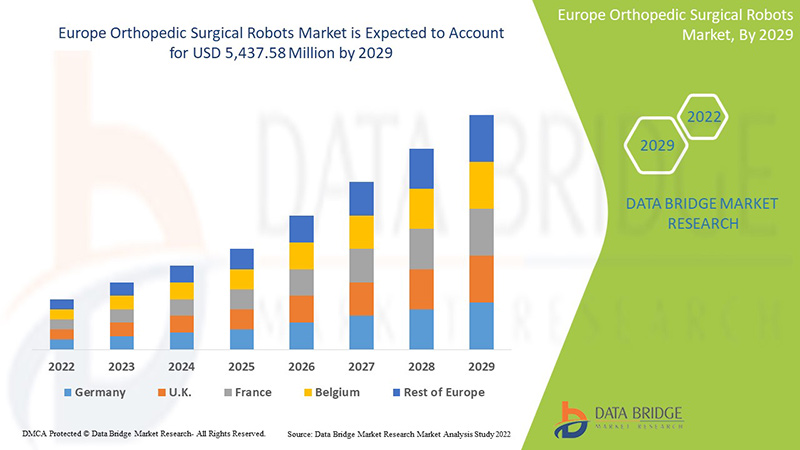

Data Bridge Market Research analyses that the orthopedic surgical robots market is expected to reach the value of USD 5,437.58 million by 2029, at a CAGR of 24.8% during the forecast period 2022-2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Product Type (Robotic System, Robotic Accessories, and Software and Services), End User (Hospital and Ambulatory Surgery Centers (ASCS)), Distribution Channel (Direct Tenders and Third Party Distributors) |

|

Countries Covered |

U.K., Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Belgium, Turkey, Rest of Europe in Europe. |

|

Market Players Covered |

Johnson & Johnson Services, Inc., Stryker, Zimmer Biomet, Smith & Nephew, Corin Group, NuVasive, Inc., Brainlab AG, Integrity Implants Inc. d/b/a/ Accelus, Beijing Tinavi Medical Technologies Co., Ltd, Medtronic, Globus Medical, Inc., Accuray Incorporated, THINK Surgical, Inc., CUREXO, INC. are among others. |

Market Definition

The orthopedic surgical robots are used to correct the bone deformities and to restore the function of the human skeletal system. It uses energy such as radiation, radio frequency, and ultrasound to seal the skin and bone tissue. The orthopedic surgical robots require an energy source, such as an electro surgery generator (ESU), and an instrument to transfer the energy to the patient. The important types include radio frequency (RF), modified electrical current, and ultrasound, which converts electrical current into mechanical motion. More specialized technologies include those that use argon gas, plasma, or a combination of technologies. The technological advancements used in the orthopedic surgical robots are ultrasound, radiofrequency, and radiation. The diagnostic technology used in the orthopedic surgical robots have permitted orthopedic surgeons to achieve new levels of precision and safety. It provides a surgeon to diagnose, plan, and expedite the orthopedic surgery for outstanding results.

Orthopedic Surgical Robots Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

DRIVERS

-

RISING PREVALENCE OF OSTEOPOROSIS

Osteoporosis is a chronic disease that suppresses the bones. If an individual has osteoporosis, he will be at a greater risk for sudden and unexpected bone fractures. In 2021, the World Health Organization (WHO) data stated that about 200 million people are predicted to have osteoporosis.

Though osteoporosis affects males and females, females are likely to develop more osteoporosis than men. For the treatment of osteoporosis, hip fractures and knee replacements are there, and it is important to understand the previous physical health conditions of elderly patients, such as reduced bone mass and bone fragility. The regularity of osteoporosis is increasing, so the surgical approach for osteoporosis is rising. The reamer-irrigator aspirator is a type of hand piece which are used among orthopedic surgeons. For example, the high torq power tool is a reamer used to treat osteoporosis.

With the rising prevalence of osteoporosis globally, the demand for early diagnosis of the disease is also increasing, with which the demand for care, services, and technologies is rising to treat chronic conditions in old age.

-

INCREASE IN NUMBER OF ORTHOPEDIC SURGERIES

The increase in the geriatric population and orthopedic disorders such as osteoporosis. Due to the increase in orthopedic disorders, the number of orthopedic-related surgeries is also increasing. The increased number of orthopedic surgeries would increase the number of orthopedic surgeons. This would increase the use of orthopedic surgical robots. It would increase the production and supply of orthopedic surgical robots.

Surgical robots are already transforming the healthcare market. As they capture a growing volume of surgical procedures, outpatient centers will force down prices on medtech devices and trigger changes for payers and providers. Hence, an increase in the number of orthopedic surgeries is expected to drive the growth of the orthopedic surgical robots market.

RESTRAINTS

- LACK OF AWARENESS ABOUT ORTHOPEDIC SURGERIES

Although orthopedic surgical energy devices have positioned themselves as a platform in the market of non-invasive devices, the non-existence of orthopedic surgeries is present in developing countries. This would result in delay and diagnosis of the orthopedic disease and the orthopedic surgical robots having a lower market position. The lack of awareness and self-efficacy also adds to the potential barriers and imperfect implementation.

-

RISKS OBSERVED IN ORTHOPEDIC SURGERIES

Orthopedic surgical are performed by orthopedics to cure orthopedic disorders, blood vessels, cut tissue, and stop bleeding. They are hand-held devices, so they must be operated as part of the doctor's instrument. Although they do not offer a diagnosis, they deliver medications that enable better treatment. However, there are certain risks observed while using orthopedic surgeries.

However, the variety of risks and health complications associated with orthopedic surgery and the need for further surgical intervention to fix some of them are expected to hamper its demand in the market. Thus, the health complications associated with orthopedic surgeries are expected to restrain the orthopedic surgical robots market.

OPPORTUNITIES

-

INCREASE IN GERIATRIC POPULATIONS

Knee disorders are common in the elderly population globally. Adults aged 60 years and above, particularly those living in long-term care facilities, are likely to suffer from chronic knee symptoms. As aging increases, the burden of knee disorders in the geriatric population may increase, which paves the way for the development of medications and implants in diagnostic and prevention strategies critical for improving the knee disorders of older adults.

As age increases, the susceptibility to knee disorders and other risk factors also increases. For some individuals, it may be hereditary, while for others, knee osteoarthritis can result from injury, infection, or even from being overweight. The increase in the geriatric population is expected to propel the market growth as it leads to greater use of robots in numerous surgeries. These robots were introduced to address the needs of geriatric people, including physical and medical care. Additionally, the senior population is greatly affected by chronic diseases can be a factor in the growth of the orthopedic surgical robots market.

-

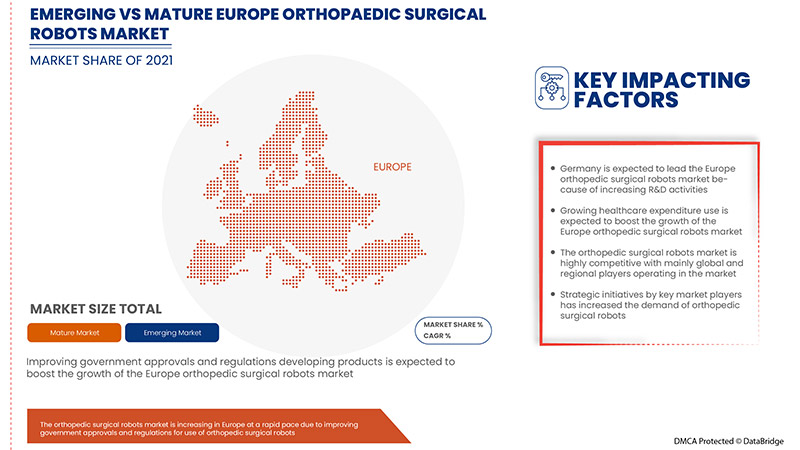

RISING HEALTHCARE EXPENDITURE

The expense of money used by a country on its healthcare and its growth rate over time is inclined by a wide variety of economic and social factors, including the financing arrangements and structure of the organization for the health system. In particular, there is a strong association between the whole income level of a country and how much the country's population spends on health care.

Healthcare expenditure has increased across developed, and emerging countries as the disposable income of people are growing. The more money is spent on healthcare the healthier a country's population is. Moreover, to accomplish the population requirements, government bodies and healthcare organizations in different regions are taking the initiative to accelerate healthcare expenditure. Therefore, the rise in healthcare expenditure simultaneously helps healthcare organizations and government bodies to increase healthcare management services in various aspects.

CHALLENGES

-

LACK OF SKILLED PROFESSIONALS

The lack or shortage of skilled expertise would challenge the pace of recovery and growth in one place. Often, the unemployed people in one place have skills in short supply elsewhere. Moreover, rapid technological advancement in this field also leads to a lack of expertise. Despite the call to increase, the number of podiatrists and some residency training programs remains unknown.

Even as the revalidation process for orthopedic surgeons began in Switzerland, the United Kingdom, and other countries, some orthopedic and medical professionals elsewhere in Europe have not started to address the issue of CME and related requirements. As skill demands are too high, retaining and managing skill-specified professionals has become a challenge. Moreover, technological advancement is another aspect that leads to the increased demand for skilled professionals. Podiatrists report significant unmet supportive care needs and barriers in their centers, with only a small minority rating themselves as competently providing supportive care. There is an urgent need for the requirement of podiatrists and professionals to treat chronic knee disorders and procure available supportive care resources. Lack of trained and experienced professionals and persistent skill gaps limit the employability prospects and access to quality jobs. Therefore, this signifies that the lack of skilled professionals is a challenge to the growth of the orthopedic surgical robots market.

-

STRICT REGULATORY FRAMEWORKS

Regulation of medical devices plays a significant role in healthcare. Achieving the requisite approval for legal selling medical devices in such jurisdictions can entail significant financial expenditure, which could take months or years to complete. If these constraints are not understood or considered, delays can seriously jeopardize the likelihood of success in a highly competitive market. Medical robots are increasingly used in minimally invasive surgeries; assistive surgeries are important for treating various diseases. But their approval and marketing in various regions across different regions require a meeting of stringent regulatory standards and approvals by various regulatory bodies.

Post COVID-19 Impact on Orthopedic Surgical Robots Market

COVID-19 created a major impact on the orthopedic surgical robots market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the Europe orthopedic surgical robots market is increasing prevalence of osteoporosis this sector has increased the demand because it targets patient who has the bone related disease. Other reasons driving the demand for these procedures are increasing aging people and rising requirement of healthcare facilities which can further result in decrease in burden on healthcare facilities. Hence, rise in demand for surgical robots procedure is estimated over the forecast period. However, factors such as inadequate availability of raw material to meet orthopedic surgical robots product production demand are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Recent Developments

- In February 2022, Stryker completes the acquisition of Vocera Communications. This acquisition provides significant opportunities to advance innovations and accelerate our digital aspirations. Vocera brings a highly complementary and innovative portfolio to Stryker’s Medical division that will enhance the company’s Advanced Digital Healthcare offerings and further advance Stryker’s focus on preventing adverse events throughout the continuum of care.

- In March 2022, Corin Group has announced that the company is partnering with Efferent Health, LLC, a leader in medical operations automation technology, delivering innovative solutions that streamline key processes. This results in strengthening the portfolio of interoperability data services as well as expanding the company’s credibility in the market.

Europe Orthopedic Surgical Robots Market Scope

Europe orthopedic surgical robots market is segmented on the basis of product type, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Product Type

- Robotic System

- Robotic Accessories

- Software and Services

On the basis of product type, the Europe orthopedic surgical robots market is segmented into robotic system, robotic accessories, and software and services.

By End User

- Hospitals

- Ambulatory Surgical Centers

On the basis of by end user, the Europe orthopedic surgical robots market has been segmented into hospitals, and ambulatory surgical centers.

By Distribution Channel

- Direct Tender

- Third Party Distributors

On the basis of by distribution channel, the Europe orthopedic surgical robots market has been segmented into direct tender, and third party distributors.

Orthopedic Surgical Robots Market Regional Analysis/Insights

The orthopedic surgical robots market is analyzed and market size insights and trends are provided by country, product type, end user, and distribution channel as referenced above.

The countries covered in the Europe orthopedic surgical robots market report are U.K., Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Belgium, Turkey, Rest of Europe in Europe.

Germany dominates the Europe orthopedic surgical robots market due to increasing technology and reliability of orthopedic surgical robots.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Orthopedic Surgical Robots Market Share Analysis

The orthopedic surgical robots market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus on the orthopedic surgical robots market.

Some of the major players operating in the orthopedic surgical robots market are Johnson & Johnson Services, Inc., Stryker, Zimmer Biomet, Smith & Nephew, Corin Group, NuVasive, Inc., Brainlab AG, Integrity Implants Inc. d/b/a/ Accelus, Beijing Tinavi Medical Technologies Co., Ltd, Medtronic, Globus Medical, Inc., Accuray Incorporated, THINK Surgical, Inc., CUREXO, INC. are among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES

4.3 CLINICAL TRIALS ON ORTHOPEDIC SURGICAL ROBOTS EUROPELY

4.4 STRATEGIC INITIATIVES

4.4.1 DEMOGRAPHIC TRENDS

4.4.2 KEY PATENT ENROLLMENT STRATEGIES

4.5 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET, REGULATORY FRAMEWORK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING PREVALENCE OF OSTEOPOROSIS

5.1.2 GROWING TECHNOLOGICAL ADVANCEMENTS IN ROBOTIC SYSTEMS

5.1.3 INCREASE IN NUMBER OF ORTHOPEDIC SURGERIES

5.1.4 RISE IN INCIDENCE OF SPORTS AND TRAUMA INJURIES

5.2 RESTRAINTS

5.2.1 LACK OF AWARENESS ABOUT ORTHOPEDIC SURGERIES

5.2.2 RISKS OBSERVED IN ORTHOPEDIC SURGERIES

5.2.3 HIGH COST ASSOCIATED WITH THE ORTHOPEDIC SURGERY

5.3 OPPORTUNITIES

5.3.1 INCREASE IN GERIATRIC POPULATIONS

5.3.2 RISING HEALTHCARE EXPENDITURE

5.3.3 RISE IN FRACTURE INCIDENCE

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS

5.4.2 STRICT REGULATORY FRAMEWORKS

6 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 ROBOTIC SYSTEMS

6.2.1 KNEE

6.2.1.1 SURGERY TYPE

6.2.1.1.1 TOTAL KNEE ARTHROPLASTY

6.2.1.1.2 UNICOMPARTMENTAL KNEE ARTHROPLASTY

6.2.1.1.3 ANTERIOR CRUCIATE LIGAMENT RECONSTRUCTION

6.2.1.1.4 OTHERS

6.2.1.1.5 ROBOT TYPE

6.2.1.1.6 MAKO

6.2.1.1.7 CORI

6.2.1.1.8 NAVIO

6.2.1.1.9 TIROBOT

6.2.1.1.10 TSOLUTION ONE

6.2.1.1.11 OTHERS

6.2.2 HIP

6.2.2.1 SURGERY TYPE

6.2.2.1.1 TOTAL HIP ARTHROPLASTY

6.2.2.1.2 OTHERS

6.2.2.1.3 ROBOT TYPE

6.2.2.1.4 MAKO

6.2.2.1.5 TSOLUTION ONE

6.2.2.1.6 OTHERS

6.2.3 SPINE

6.2.3.1 SURGERY TYPE

6.2.3.1.1 PEDICLE SCREW IMPLANTATION

6.2.3.1.2 VERTEBRAL AUGMENTATION

6.2.3.1.3 LAPAROSCOPIC ANTERIOR LUMBAR INTERBODY FUSION

6.2.3.1.4 SPINE TUMOR RESECTION SURGERY

6.2.3.1.5 INTRAOPERATIVE LOCALIZATION

6.2.3.1.6 ANTERIOR LUMBER INTERBODY FUSION

6.2.3.1.7 OTHERS

6.2.3.1.8 ROBOT TYPE

6.2.3.1.9 MAZOR

6.2.3.1.9.1 RENAISSANCE

6.2.3.1.9.2 MAZOR X

6.2.3.1.9.3 SPINE ASSIST

6.2.3.1.10 ROSA

6.2.3.1.11 CIRQ

6.2.3.1.12 EXCELSIUSGPS

6.2.3.1.13 OTHERS

6.2.4 FEMUR

6.2.4.1 SURGERY TYPE

6.2.4.1.1 FEMUR NECK CANNULATED SCREW PLACEMENT

6.2.4.1.2 INTRAMEDULLARY NAIL FIXATION

6.2.4.1.3 CORE DECOMPRESSION OF THE FEMORAL HEAD

6.2.4.1.4 OTHERS

6.2.4.1.5 ROBOT TYPE

6.2.4.1.6 TIROBOT

6.2.4.1.7 OTHERS

6.2.5 PELVIS

6.2.5.1 SURGERY TYPE

6.2.5.1.1 FEMUR NECK CANNULATED SCREW PLACEMENT

6.2.5.1.2 INTRAMEDULLARY NAIL FIXATION

6.2.5.1.3 CORE DECOMPRESSION OF THE FEMORAL HEAD

6.2.5.1.4 OTHERS

6.2.5.1.5 ROBOT TYPE

6.2.5.1.6 TIROBOT

6.2.5.1.7 OTHERS

6.2.6 HAND

6.2.6.1 SURGERY TYPE

6.2.6.1.1 FEMUR NECK CANNULATED SCREW PLACEMENT

6.2.6.1.2 INTRAMEDULLARY NAIL FIXATION

6.2.6.1.3 CORE DECOMPRESSION OF THE FEMORAL HEAD

6.2.6.1.4 OTHERS

6.2.6.1.5 ROBOT TYPE

6.2.6.1.6 TIROBOT

6.2.6.1.7 OTHERS

6.2.7 ELBOW

6.2.7.1 SURGERY TYPE

6.2.7.1.1 FEMUR NECK CANNULATED SCREW PLACEMENT

6.2.7.1.2 INTRAMEDULLARY NAIL FIXATION

6.2.7.1.3 CORE DECOMPRESSION OF THE FEMORAL HEAD

6.2.7.1.4 OTHERS

6.2.7.1.5 ROBOT TYPE

6.2.7.1.6 TIROBOT

6.2.7.1.7 OTHERS

6.2.8 OTHERS

6.3 ROBOTIC ACCESSORIES

6.4 SOFTWARE AND SERVICES

7 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER

7.1 OVERVIEW

7.2 HOSPITALS

7.2.1 ACTUE CARE HOSPITALS

7.2.2 LONG-TERM CARE HOSPITALS

7.2.3 NURSING FACILITIES

7.2.4 REHABILITATION CENTERS

7.3 AMBULATORY SURGICAL CENTERS

8 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 DIRECT TENDER

8.3 THIRD PARTY DISTRIBUTORS

9 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION

9.1 EUROPE

9.1.1 GERMANY

9.1.2 FRANCE

9.1.3 U.K.

9.1.4 ITALY

9.1.5 SPAIN

9.1.6 RUSSIA

9.1.7 NETHERLANDS

9.1.8 SWITZERLAND

9.1.9 TURKEY

9.1.10 BELGIUM

9.1.11 REST OF EUROPE

10 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: EUROPE

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 STRYKER

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 SMITH & NEPHEW

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 JOHNSON & JOHNSON SERVICES, INC.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 MEDTRONIC

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 ZIMMER BIOMET

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 ACCURAY INCORPORATED

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 BEIJING TINAVI MEDICAL TECHNOLOGIES CO., LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 BRAINLAB AG

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 CORIN GROUP

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 CUREXO, INC.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 GLOBUS MEDICAL, INC.

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 INTEGRITY IMPLANTS INC. D/B/A/ ACCELUS

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 NUVASIVE, INC.

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 THINK SURGICAL, INC.

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2021-2029 (USD MILLION)

TABLE 2 EUROPE ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2021-2029 (USD MILLION)

TABLE 3 EUROPE ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 4 EUROPE KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 5 EUROPE KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 6 EUROPE KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020- 2029 (UNITS)

TABLE 7 EUROPE HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 8 EUROPE HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 9 EUROPE HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020- 2029 (UNITS)

TABLE 10 EUROPE SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 11 EUROPE SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 12 EUROPE SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 VOLUME, (UNITS)

TABLE 13 EUROPE MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 14 EUROPE MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 15 EUROPE FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 16 EUROPE FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 17 EUROPE FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 18 EUROPE PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 19 EUROPE PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 20 EUROPE PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 21 EUROPE HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 22 EUROPE HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 23 EUROPE HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 24 EUROPE ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020- 2029 (USD MILLION)

TABLE 25 EUROPE ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020- 2029 (USD MILLION)

TABLE 26 EUROPE ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME,2020- 2029 (UNITS)

TABLE 27 EUROPE ROBOTIC ACCESSORIES IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2021-2029 (USD MILLION)

TABLE 28 EUROPE SOFTWARE AND DEVICES IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2021-2029 (USD MILLION)

TABLE 29 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 EUROPE HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 EUROPE AMBULATORY SURGICAL CENTERS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 34 EUROPE DIRECT TENDER IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE THIRD PARTY DISTRIBUTORS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 37 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 42 EUROPE HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 44 EUROPE HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 45 EUROPE SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 46 EUROPE SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 47 EUROPE SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 48 EUROPE MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 49 EUROPE MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 50 EUROPE FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 51 EUROPE FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 52 EUROPE FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 53 EUROPE PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 54 EUROPE PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 55 EUROPE PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 56 EUROPE HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 57 EUROPE HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 58 EUROPE HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 59 EUROPE ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 60 EUROPE ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 61 EUROPE ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 62 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 EUROPE HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 GERMANY ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 GERMANY ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 GERMANY KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 68 GERMANY KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 69 GERMANY KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 70 GERMANY HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 71 GERMANY HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 72 GERMANY HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 73 GERMANY SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 74 GERMANY SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 75 GERMANY SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 76 GERMANY MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 77 GERMANY MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 78 GERMANY FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 79 GERMANY FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 80 GERMANY FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 81 GERMANY PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 82 GERMANY PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 83 GERMANY PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 84 GERMANY HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 85 GERMANY HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 86 GERMANY HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 87 GERMANY ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 88 GERMANY ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 89 GERMANY ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 90 GERMANY ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 GERMANY HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 GERMANY ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 93 FRANCE ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 FRANCE ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 FRANCE KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 96 FRANCE KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 97 FRANCE KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 98 FRANCE HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 99 FRANCE HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 100 FRANCE HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 101 FRANCE SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 102 FRANCE SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 103 FRANCE SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 104 FRANCE MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 105 FRANCE MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 106 FRANCE FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 107 FRANCE FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 108 FRANCE FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 109 FRANCE PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 110 FRANCE PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 111 FRANCE PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 112 FRANCE HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 113 FRANCE HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 114 FRANCE HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 115 FRANCE ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 116 FRANCE ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 117 FRANCE ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 118 FRANCE ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 FRANCE HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 120 FRANCE ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 121 U.K. ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 122 U.K. ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 U.K. KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 124 U.K. KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 125 U.K. KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 126 U.K. HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 127 U.K. HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 128 U.K. HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 129 U.K. SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 130 U.K. SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 131 U.K. SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 132 U.K. MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 133 U.K. MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 134 U.K. FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 135 U.K. FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 136 U.K. FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 137 U.K. PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 138 U.K. PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 139 U.K. PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 140 U.K. HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 141 U.K. HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 142 U.K. HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 143 U.K. ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 144 U.K. ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 145 U.K. ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 146 U.K. ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 147 U.K. HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 148 U.K. ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 149 ITALY ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 150 ITALY ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 151 ITALY KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 152 ITALY KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 153 ITALY KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 154 ITALY HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 155 ITALY HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 156 ITALY HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 157 ITALY SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 158 ITALY SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 159 ITALY SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 160 ITALY MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 161 ITALY MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 162 ITALY FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 163 ITALY FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 164 ITALY FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 165 ITALY PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 166 ITALY PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 167 ITALY PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 168 ITALY HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 169 ITALY HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 170 ITALY HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 171 ITALY ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 172 ITALY ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 173 ITALY ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 174 ITALY ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 ITALY HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 176 ITALY ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 177 SPAIN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 178 SPAIN ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 179 SPAIN KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 180 SPAIN KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 181 SPAIN KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 182 SPAIN HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 183 SPAIN HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 184 SPAIN HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 185 SPAIN SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 186 SPAIN SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 187 SPAIN SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 188 SPAIN MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 189 SPAIN MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 190 SPAIN FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 191 SPAIN FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 192 SPAIN FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 193 SPAIN PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 194 SPAIN PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 195 SPAIN PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 196 SPAIN HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 197 SPAIN HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 198 SPAIN HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 199 SPAIN ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 200 SPAIN ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 201 SPAIN ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 202 SPAIN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 203 SPAIN HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 204 SPAIN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 205 RUSSIA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 206 RUSSIA ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 207 RUSSIA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 208 RUSSIA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 209 RUSSIA KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 210 RUSSIA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 211 RUSSIA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 212 RUSSIA HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 213 RUSSIA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 214 RUSSIA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 215 RUSSIA SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 216 RUSSIA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 217 RUSSIA MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 218 RUSSIA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 219 RUSSIA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 220 RUSSIA FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 221 RUSSIA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 222 RUSSIA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 223 RUSSIA PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 224 RUSSIA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 225 RUSSIA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 226 RUSSIA HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 227 RUSSIA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 228 RUSSIA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 229 RUSSIA ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 230 RUSSIA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 231 RUSSIA HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 232 RUSSIA ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 233 NETHERLANDS ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 234 NETHERLANDS ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 235 NETHERLANDS KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 236 NETHERLANDS KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 237 NETHERLANDS KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 238 NETHERLANDS HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 239 NETHERLANDS HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 240 NETHERLANDS HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 241 NETHERLANDS SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 242 NETHERLANDS SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 243 NETHERLANDS SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 244 NETHERLANDS MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 245 NETHERLANDS MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 246 NETHERLANDS FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 247 NETHERLANDS FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 248 NETHERLANDS FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 249 NETHERLANDS PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 250 NETHERLANDS PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 251 NETHERLANDS PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 252 NETHERLANDS HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 253 NETHERLANDS HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 254 NETHERLANDS HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 255 NETHERLANDS ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 256 NETHERLANDS ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 257 NETHERLANDS ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 258 NETHERLANDS ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 259 NETHERLANDS HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 260 NETHERLANDS ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 261 SWITZERLAND ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 262 SWITZERLAND ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 263 SWITZERLAND KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 264 SWITZERLAND KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 265 SWITZERLAND KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 266 SWITZERLAND HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 267 SWITZERLAND HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 268 SWITZERLAND HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 269 SWITZERLAND SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 270 SWITZERLAND SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 271 SWITZERLAND SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 272 SWITZERLAND MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 273 SWITZERLAND MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 274 SWITZERLAND FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 275 SWITZERLAND FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 276 SWITZERLAND FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 277 SWITZERLAND PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 278 SWITZERLAND PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 279 SWITZERLAND PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 280 SWITZERLAND HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 281 SWITZERLAND HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 282 SWITZERLAND HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 283 SWITZERLAND ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 284 SWITZERLAND ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 285 SWITZERLAND ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 286 SWITZERLAND ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 287 SWITZERLAND HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 288 SWITZERLAND ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 289 TURKEY ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 290 TURKEY ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 291 TURKEY KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 292 TURKEY KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 293 TURKEY KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 294 TURKEY HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 295 TURKEY HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 296 TURKEY HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 297 TURKEY SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 298 TURKEY SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 299 TURKEY SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 300 TURKEY MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 301 TURKEY MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 302 TURKEY FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 303 TURKEY FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 304 TURKEY FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 305 TURKEY PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 306 TURKEY PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 307 TURKEY PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 308 TURKEY HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 309 TURKEY HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 310 TURKEY HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 311 TURKEY ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 312 TURKEY ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 313 TURKEY ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 314 TURKEY ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 315 TURKEY HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 316 TURKEY ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 317 BELGIUM ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 318 BELGIUM ROBOTIC SYSTEMS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 319 BELGIUM KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 320 BELGIUM KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 321 BELGIUM KNEE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 322 BELGIUM HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 323 BELGIUM HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 324 BELGIUM HIP IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 325 BELGIUM SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 326 BELGIUM SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 327 BELGIUM SPINE IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 328 BELGIUM MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 329 BELGIUM MAZOR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 330 BELGIUM FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 331 BELGIUM FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 332 BELGIUM FEMUR IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 333 BELGIUM PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 334 BELGIUM PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 335 BELGIUM PELVIS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 336 BELGIUM HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 337 BELGIUM HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 338 BELGIUM HAND IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 339 BELGIUM ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 340 BELGIUM ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2029 (USD MILLION)

TABLE 341 BELGIUM ELBOW IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY ROBOT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 342 BELGIUM ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 343 BELGIUM HOSPITALS IN ORTHOPEDIC SURGICAL ROBOTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 344 BELGIUM ORTHOPEDIC SURGICAL ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 345 REST OF EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: SEGMENTATION

FIGURE 2 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: MARKET END USER GRID

FIGURE 9 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVELANCE OF OESTOPOROSIS AND INCREASE INCIDENCE OF SPORTS AND TRAUMA INJURY IS EXPECTED TO DRIVE THE EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 PRODUCT TYPE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET

FIGURE 14 CURRENT HEALTHCARE EXPENDITURE (% OF GDP) 2018-2019-

FIGURE 15 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET : BY PRODUCT TYPE, 2021

FIGURE 16 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET : BY PRODUCT TYPE, 2021-2029 (USD MILLION)

FIGURE 17 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET : BY PRODUCT TYPE, CAGR (2021-2029)

FIGURE 18 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: BY END USER, 2021

FIGURE 20 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 21 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 22 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 23 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 25 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 26 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 27 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: SNAPSHOT (2021)

FIGURE 28 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: BY COUNTRY (2021)

FIGURE 29 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 32 EUROPE ORTHOPEDIC SURGICAL ROBOTS MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.