Europe Outdoor Led Lighting Market

Market Size in USD Billion

CAGR :

%

USD

2.44 Billion

USD

3.38 Billion

2024

2032

USD

2.44 Billion

USD

3.38 Billion

2024

2032

| 2025 –2032 | |

| USD 2.44 Billion | |

| USD 3.38 Billion | |

|

|

|

|

Europe Outdoor LED (Light-Emitting Diode) Lighting Market Size

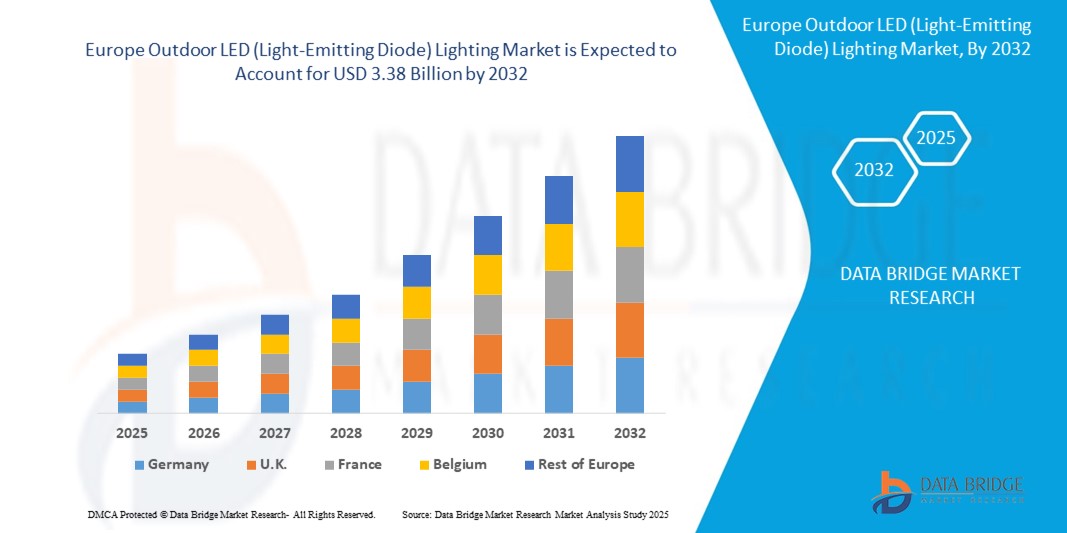

- The Europe Outdoor LED (Light-Emitting Diode) Lighting market size was valued at USD 2.44 Billion in 2024 and is expected to reach USD 3.38 Billion by 2032, at a CAGR of5.80% during the forecast period

- The increasing demand for LED lighting due to the modernization and development of infrastructures such as economic corridors and smart cities will influence the growth of the outdoor LED (light-emitting diode) lighting market.

Europe Outdoor LED (Light-Emitting Diode) Lighting Market Analysis

- Outdoor LED (light-emitting diode) lighting can be defined as light sources that illuminate or illuminate an outdoor space. Consumers or cities are deploying these lighting solutions in outdoor applications to enhance the beauty and safety of their environment.

- The requirement of improving the visibility and safety of drivers and pedestrians, decrement in the prices of LED, high demand for smart controls in street lighting systems and rising need for energy-efficient lighting systems for highways will enhance the market growth rate.

- Germany dominates the Europe Outdoor LED (Light-Emitting Diode) Lighting market with the largest revenue share of 42.01% in 2025, This significant market dominance is being driven by increasing consumer interest in electric LED light vehicles, coupled with governmental initiatives that actively support green mobility.

- France is expected to be the fastest growing region in the Europe Outdoor LED (Light-Emitting Diode) Lighting market during the forecast period due a rapid urbanization, rising disposable incomes, and the strengthening of automotive manufacturing hubs within the region. The escalating demand for fuel-efficient and environmentally sustainable light is significantly accelerating market development in France.

- The hardware segment is anticipated to hold the largest market share of 24.9% in the Europe Outdoor LED (Light-Emitting Diode) Lighting Market during the forecast period. This dominance can be primarily attributed to the enhanced performance and improved fuel efficiency offered by lightweight frames, particularly in diesel-powered commercial and utility LED light, even amidst the ongoing shift towards cleaner energy alternatives.

Report Scope and Europe Outdoor LED (Light-Emitting Diode) Lighting Market Segmentation

|

Attributes |

Europe Outdoor LED (Light-Emitting Diode) Lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Outdoor LED (Light-Emitting Diode) Lighting Market Trends

“Driving Efficiency and Sustainability in Outdoor Infrastructure”

- A key trend shaping the Europe Outdoor LED Lighting market is the growing focus on energy efficiency and carbon footprint reduction, with municipalities and commercial entities rapidly replacing traditional lighting systems with LED alternatives.

- The integration of smart lighting technologies, such as motion sensors, adaptive brightness, and remote monitoring, is expanding, offering both energy savings and improved urban safety and security.

- Rising urbanization and smart city initiatives across Europe are accelerating the demand for intelligent outdoor lighting systems capable of real-time control and data collection.

- Architectural and landscape lighting applications are increasingly utilizing color-changing and programmable LED solutions to enhance visual appeal while minimizing energy use.

- Continuous innovation in LED chip technology is improving luminosity, durability, and efficiency, further driving adoption across streets, highways, parking areas, and public spaces.

- Government incentives and regulatory mandates for sustainable infrastructure are also influencing procurement and modernization efforts in the public lighting sector.

Europe Outdoor LED (Light-Emitting Diode) Lighting Market Dynamics

Driver

“Rising Demand for Energy-Efficient Lighting and Smart City Infrastructure”

- The transition toward energy-efficient and long-lasting lighting solutions is a major driver of market growth in Europe, where LED lights offer significant operational cost savings over traditional lighting technologies.

- Growing investments in smart city projects are increasing the deployment of connected outdoor LED lighting systems with IoT integration, enabling automated control and real-time monitoring.

- Environmental sustainability goals and EU directives targeting reductions in energy consumption and CO₂ emissions further support LED lighting adoption across public and private sectors.

- Public safety improvements through better nighttime visibility and adaptive lighting in urban areas contribute to broader acceptance and government funding of outdoor LED projects.

Restraint/Challenge

“High Initial Investment and Infrastructure Compatibility Issues”

- The substantial initial investment required for LED installations and smart lighting systems remains a major barrier, especially for smaller municipalities. Limited financial resources often prevent these communities from adopting modern lighting solutions despite the long-term benefits of energy efficiency and cost savings.

- Challenges also arise from the need to retrofit or replace existing lighting infrastructure, which can be labor-intensive and require significant capital investment.

- Integrating advanced smart lighting technologies with older infrastructure often demands tailored technical solutions. These integrations can be complex and time-consuming, increasing overall project difficulty. Legacy systems may also require significant modifications, raising implementation costs and slowing down deployment timelines.

- Additionally, ensuring cybersecurity and data privacy in connected outdoor lighting systems presents a growing concern, particularly with the expansion of IoT networks.

Europe Outdoor LED (Light-Emitting Diode) Lighting Market Scope

The market is segmented on the offering, installation type, wattage and application.

|

Segmentation |

Sub-Segmentation |

|

By Offering |

|

|

By Installation Type |

|

|

By Wattage |

|

|

By Application |

|

Europe Outdoor LED (Light-Emitting Diode) Lighting Market Scope

The market is segmented on the basis offering, installation type, wattage and application.

- By Offering

On the basis of offering, the Europe Outdoor LED (Light-Emitting Diode) Lighting market is segmented into hardware, software, and services. The hardware segment dominates the largest market revenue share of 51.1% in 2025, the increasing demand for energy-efficient and durable lighting solutions for various outdoor applications. This includes the growing adoption of LED luminaires in street lighting, public spaces, and architectural lighting due to their longevity and reduced energy consumption. Technological advancements in LED chips and materials are also enhancing performance and driving market growth.

The software segment is anticipated to witness the fastest growth rate of 20.1% from 2025 to 2032, smart city initiatives and the demand for connected lighting systems are driving the need for sophisticated software for remote monitoring, control, and energy management. Software solutions allow for dynamic lighting adjustments, predictive maintenance, and integration with other smart infrastructure, optimizing efficiency and reducing operational costs for outdoor LED installations.

- By Installation Type

On the basis of Installation type, the Europe Outdoor LED (Light-Emitting Diode) Lighting market is segmented into retrofit installation and new installation. The retrofit installation held the largest market revenue share in 2025 of, driven by the urgent need to replace outdated and energy-inefficient traditional lighting systems. Government regulations promoting energy conservation and the compelling cost savings offered by LEDs are key drivers for this segment. Municipalities and businesses are increasingly undertaking retrofit projects in street lighting, public spaces, and industrial areas to reduce energy consumption, lower maintenance costs, and improve lighting quality, contributing substantially to market volume.

The new installation segment is expected to witness the fastest CAGR from 2025 to 2032, driven by expanding infrastructure development, smart city initiatives, and the construction of new commercial and residential spaces. The inherent energy efficiency, design flexibility, and long lifespan of LED technology make it the preferred choice for modern outdoor lighting projects. Growing awareness of sustainability and the integration of smart lighting features in new developments further fuel the demand for innovative LED solutions in this segment, shaping future urban landscapes.

- By Wattage

On the basis of Wattage, the Europe Outdoor LED (Light-Emitting Diode) Lighting market is segmented into Less than 50 watt, 50-150 Watt, More than 150 Watt). The Less than 50 watt in white held the largest market revenue share in 2025, driven by applications requiring lower illumination levels and energy consumption, such as pathway lighting, landscape lighting, and bollards. The increasing focus on aesthetic appeal and energy efficiency in residential and commercial outdoor spaces fuels demand for these lower-wattage LEDs. Advancements in LED technology allow for compact and stylish designs with sufficient light output, making them ideal for decorative and ambient lighting while minimizing energy usage and light pollution in urban and suburban environments.

The 50-150 Watt segment held a significant market share in 2025. This power range offers a balance between adequate illumination and energy efficiency for larger outdoor spaces. Government initiatives promoting energy-efficient public infrastructure and the long-term cost benefits of LEDs are key factors propelling the adoption of these mid-power LED fixtures for enhanced visibility, safety, and reduced operational expenses in urban and industrial settings across Europe.

- By Application

On the basis of application, the Europe Outdoor LED (Light-Emitting Diode) Lighting market is segmented into highway and roadway, architectural and public places, Others. The highway and roadway segment accounted for the largest market revenue share in 2024 and it is expected to witness the fastest CAGR from 2025 to 2032. The highway and roadway segment is a major driving force in the Europe Outdoor LED Lighting market. The critical need for enhanced visibility and safety on roadways, coupled with the substantial energy savings and reduced maintenance offered by LEDs, is fueling widespread adoption. Government mandates and initiatives focused on improving road infrastructure and reducing energy consumption are accelerating the replacement of traditional lighting with energy-efficient LED luminaires. This transition not only improves driving conditions but also contributes significantly to lowering carbon emissions and operational costs for transportation authorities across Europe.

Germany Europe Outdoor LED (Light-Emitting Diode) Lighting Market Insight

The Germany Europe Outdoor LED (Light-Emitting Diode) Lighting market captured the largest revenue share of 42.01% within Germany in 2025, fueled by the strong government support for energy efficiency and smart city initiatives. A high adoption rate of outdoor led (light-emitting diode) lighting further drives demand for advanced lighting solutions. Robust infrastructure development and stringent energy regulations favor the deployment of long-lasting, energy-saving LED technologies in public spaces, roadways, and industrial areas, solidifying Germany's leading position.

France Europe Outdoor LED (Light-Emitting Diode) Lighting Market Insight

The France Europe Outdoor LED (Light-Emitting Diode) Lighting market is poised to grow at the fastest CAGR of over 24.1% in 2025, driven by increasing investments in smart city infrastructure and a strong commitment to energy efficiency, France is actively upgrading its public lighting systems with LED technology. Furthermore, the preparation for major international sporting events like the Paris 2024 Olympics spurred significant investments in modernizing stadiums and public spaces with advanced LED lighting solutions, contributing to market expansion..

Europe Outdoor LED (Light-Emitting Diode) Lighting Market Share

The Europe Outdoor LED (Light-Emitting Diode) Lighting industry is primarily led by well-established companies, including:

- GENERAL ELECTRIC

- CREE WOLFSPEED

- Zumtobel Group

- Signify Holding

- OSRAM Gmbh

- Hubbell

- Astute Lighting Ltd

- NEPTUN LIGHT, INC.

- SYSKA

- Dialight

- Eaton

- Evluma

- OSRAM

Latest Developments in Europe Outdoor LED (Light-Emitting Diode) Lighting Market

- In 2025, Building on their smart city solutions, Signify likely announced or continued the rollout of their Interact City system in several cities within the Benelux region. These initiatives, potentially highlighted in press releases in early to mid-2025, would emphasize energy savings and remote management capabilities for municipal lighting.

- May 2025, ams-OSRAM likely launched new high-efficiency and high-luminance LED solutions for exterior vehicle lighting, such as headlights and taillights. These product announcements, potentially made in early 2025, would target automakers looking to enhance the safety and energy efficiency of their new vehicle models.

- August 2024 Schréder is introduced a new range of modular outdoor LED luminaires designed for ease of maintenance, repair, and future upgrades. This launch, potentially occurring in Spring 2025, would emphasize the circular economy aspects and long-term cost-effectiveness of their lighting solutions for public spaces and roadways..

- January 2025, Thorn Lighting completed several high-profile stadium lighting upgrades across Europe in the first half of 2025. These projects would showcase their advanced LED sports lighting technology, including dynamic color control and flicker-free operation for broadcast quality.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Outdoor Led Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Outdoor Led Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Outdoor Led Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.