Europe Pet Food Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

35.81 Billion

USD

63.72 Billion

2021

2029

USD

35.81 Billion

USD

63.72 Billion

2021

2029

| 2022 –2029 | |

| USD 35.81 Billion | |

| USD 63.72 Billion | |

|

|

|

|

Europe Pet Food Ingredients Market Analysis and Size

The increased rates of domestication by households and food manufacturers will propel the growth of the market. According to the European Pet Food Federation (FEDIAF), there are approximately 110 million cats and 90 million dogs domesticated by the households in 2020. The rapid pace of changes in societal trends and lifestyle can be linked to the rising number of pet ownerships. The rising food safety initiatives have also led to an increase in demands for the initiation of safe ingredients in pet meals.

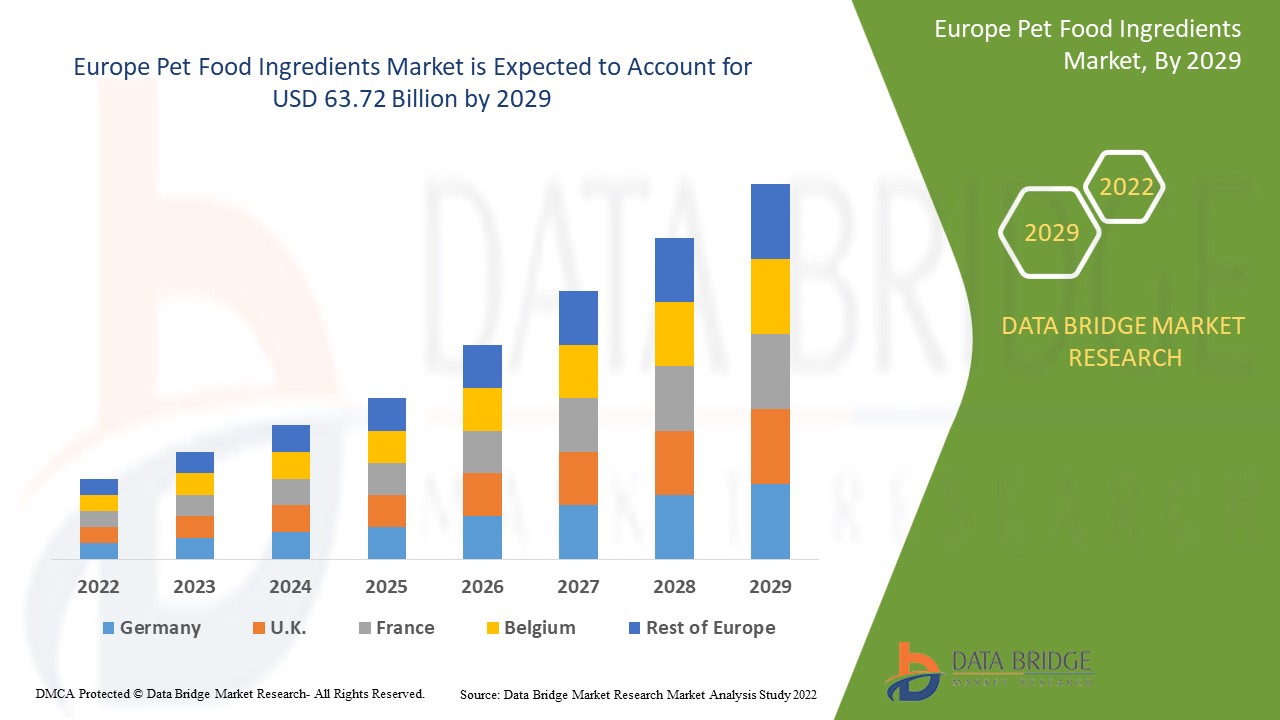

Data Bridge Market Research analyses that the pet food ingredients market was valued at USD 35.81 billion in 2021 and is expected to reach USD 63.72 billion by 2029, registering a CAGR of 7.47% during the forecast period of 2022 to 2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Europe Pet Food Ingredients Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 - 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Ingredient Type (Meat and Meat Products, Cereals, Vegetable and Fruits, Fats, Additives), Form (Dry, Liquid), Product Type (Original, Blended), Animal (Dog, Cat, Fish, Bird, Rabbit, Others), Source (Animal Based, Plant-Derivatives, Synthetic), Nature (Organic, Inorganic) |

|

Countries Covered |

Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe |

|

Market Players Covered |

ADM (U.S.), DuPont (U.S.), Barentz (Netherlands), The Peterson Company (U.S.), BASF SE (Germany), DSM (Netherlands), Ingredion. (U.S.), Cargill, Incorporated. (U.S.), Kerry Group plc. (Ireland), The Scoular Company (U.S.), Balchem Inc. (U.S.), Roquette Frères (France), Darling Ingredients (U.S.), Omega Protein (U.S.), Tate & Lyle (U.K.), Chr. Hansen Holding A/S (Denmark), American Dehydrated Foods (ADF®) (U.S.), APS Phoenix LLC (U.S.), BIORIGIN APS (U.S.), LaBudde Group Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

The pet food ingredients are included in pet meals to enhance the nutritional content and enable pets to meet their daily dietary requirements. They support the growth of the animals, provide a rich source of vitamins and minerals and enhance the safety parameters to ensure safe quality content.

Pet Food Ingredients Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Rising pet population and expenditure

The increasing pet population and expenditure within the region. The growth has been registered by increasing expenditure by pet owners. For instance, according to APPA, pet expenditures raised form USD 53.3 billion in 2012 to USD 123.6 billion. Thus, the rise in pet food expenditure and the rising domestication of animals within the region and across the globe are the factors driving the growth of the market over the forecasted period.

- Shifting lifestyle and trends

The rising urbanization and increasing disposable income will drive the market's growth. Also, increasing infrastructure investments and growing use of enhanced contents to deliver rich quality content of the pet meals enhanced the growth rate of pet food ingredients market. Moreover, the growing health consciousness for pets among the owners is also a factor boosting the market’s growth. Additionally, the rising innovations in the direct choices within Europe is also the factor driving the growth of the market over the forecasted period.

Opportunities

- Increase in regulations and standardisations

The surging number of regulations and standardizations will boost new market opportunities for the market’s growth rate. For instance, the Federal Food, Drug and Cosmetic Act of 1938 states that (FFDCA), animal food needs to be safe and effective with enhanced vitamin and mineral-rich quality content and also to be manufactured in sanitary conditions. The Food Safety Modernisation Act (FSMA) introduced guidelines related to the certification, sterilization and labeling of the food products. Moreover, rise in strategic collaborations and emerging new markets will act as drivers and further boost beneficial opportunities for the market’s growth rate.

Restraints/ Challenges

- Lack of standardized procedures

Regulations related to safe delivery of nutritional content to animals like these could greatly impact the long-term supply, cost, and sales of pet meals. The lack of a standardized structure can affect product sales in a particular region. These factors are projected to represent a threat to market growth throughout the forecast period.

- High capital costs and investments

Increased capital investments for production and manufacturing will hinder the market’s growth rate. The high cost of equipment indulged in production and manufacturing is also a most significant factor that will act as market restraint and further challenge the market growth rate.

This pet food ingredients market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the pet food ingredients market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

COVID-19 Impact on Pet Food Ingredients Market

The COVID-19 pandemic severely impacted the pet food supply chain in Europe. The pandemic affected the region due to disruption in production, processing and supply chains. The decreased investment rate also affected the market. However, the rising demands of pet food were observed amongst European pet food consumers. For instance, in 2020, Zooplus, Germany, the sales reported a percentage of 21% rise compared to 2019, due to increased demands from existing customers and stable inflow of new customers. The market will expand, due to the upliftment of the restrictions and rise in the demands of pet food within the region ad across the globe.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent developments

- In 2022, BASF SE announced plans to expand its vitamin A formulation plant for enhancing animal nutrition. With this expansion, the firm intends to increase its market position among leading players.

- In 2022, Cargill launched a new range of by-product meals that specifically caters to domestic animals with animal treats such as wind pipes, bones, ribs, jerkies and others.

Europe Pet Food Ingredients Market Scope

The pet food ingredients market is segmented on the basis of ingredient type, form, product type, animal, source and nature. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Ingredient Type

- Meat and Meat Products

- Deboned Meat

- Meat Meal

- By-Product Meal

- Animal Digest

- Cereals

- Corn and Corn Meal

- Wheat and Wheat Meal

- Barley

- Rice

- Vegetable and Fruits

- Fruits

- Potato

- Carrots

- Soy and Soymeal

- Pea

- Fats

- Fish Oil

- Lard

- Tallow

- Vegetable Oil

- Poultry Fat

- Additives

- Vitamins and Minerals

- Enzymes

- Other Additives

Form

- Dry

- Liquid

Product Type

- Original

- Blended

Animal

- Dog

- Cat

- Fish

- Bird

- Rabbit

- Others

Source

- Animal Based

- Plant-Derivatives

- Synthetic

Nature

- Organic

- Inorganic

Pet Food Ingredients Market Regional Analysis/Insights

The pet food ingredients market is analyzed and market size insights and trends are provided by ingredient type, form, product type, animal, source and nature as referenced above.

The countries covered in the pet food ingredients market report are Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe.

France dominates the pet food ingredients market due to the rising adoption of pets along with the rising demands of the pet food/meals within the region.

Germany is expected to grow from 2022 to 2029 due to the rising prevalence of the regions' manufacturers.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Pet Food Ingredients Market Share Analysis

The pet food ingredients market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to pet food ingredients market.

Some of the major players operating in the pet food ingredients market are:

- ADM (U.S.)

- DuPont (U.S.)

- Barentz (Netherlands)

- The Peterson Company (U.S.)

- BASF SE (Germany)

- DSM (Netherlands)

- Ingredion. (U.S.)

- Cargill, Incorporated. (U.S.)

- Kerry Group plc. (Ireland)

- The Scoular Company (U.S.)

- Balchem Inc. (U.S.)

- Roquette Frères (France)

- Darling Ingredients (U.S.)

- Omega Protein (U.S.)

- Tate & Lyle (U.K.)

- Chr. Hansen Holding A/S (Denmark)

- American Dehydrated Foods (ADF®) (U.S.)

- APS Phoenix LLC (U.S.)

- BIORIGIN APS (U.S.)

- LaBudde Group Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE PET FOOD INGREDIENTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE EUROPE PET FOOD INGREDIENTS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 EUROPE PET FOOD INGREDIENTS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 EUROPE PET FOOD INGREDIENTS MARKET, BY INGREDIENT TYPE, 2018-2032 (USD MILLION) (KILO TONS)

10.1 OVERVIEW

10.2 AMINO ACID

10.2.1 AMINO ACID, BY TYPE

10.2.1.1. LYSINE

10.2.1.2. METHIONINE

10.2.1.3. THREONINE

10.2.1.4. TRYPTOPHAN

10.2.1.5. OTHERS

10.3 PROTEIN

10.4 VITAMINS

10.4.1 VITAMINS, BY TYPE

10.4.1.1. FAT-SOLUBLE

10.4.1.1.1. FAT-SOLUBLE, BY TYPE

10.4.1.1.1.1 VITAMIN A

10.4.1.1.1.2 VITAMIN E

10.4.1.1.1.3 VITAMIN D

10.4.1.1.1.4 VITAMIN K

10.4.1.2. WATER-SOLUBLE

10.4.1.2.1. WATER-SOLUBLE, BY TYPE

10.4.1.2.1.1 VITAMIN C

10.4.1.2.1.2 VITAMIN B COMPLEX

10.5 MINERALS

10.5.1 MINERALS, BY TYPE

10.5.1.1. CALCIUM

10.5.1.2. ZINC

10.5.1.3. GLYCINATES

10.5.1.4. IRON

10.5.1.5. COPPER

10.5.1.6. MANGANESE

10.5.1.7. IODINE

10.5.1.8. SELENIUM

10.5.1.9. OTHERS

10.6 FEED ACIDIFIERS

10.6.1 FEED ACIDIFIERS, BY TYPE

10.6.1.1. FORMALDIHYDE

10.6.1.2. PROPIONIC ACID

10.6.1.3. CITRIC ACID

10.6.1.4. MALIC ACID

10.6.1.5. LACTIC ACID

10.6.1.6. SORBIC ACID

10.6.1.7. OTHERS

10.7 ENZYMES

10.7.1 ENZYMES, BY TYPE

10.7.1.1. PHYTASE

10.7.1.2. PROTEASE

10.7.1.3. AMYLASE

10.7.1.4. CELLULASE

10.7.1.5. MANNASE

10.7.1.6. GLUCANASE

10.7.1.7. XYLANASE

10.7.1.8. OTHERS

10.8 LIPIDS/OMEGA

10.9 MYCOTOXIN DETOXIFIERS

10.9.1 MYCOTOXIN DETOXIFIERS, BY TYPE

10.9.1.1. BINDERS

10.9.1.2. MODIFIERS

10.1 PROBIOTICS

10.10.1 PROBIOTICS, BY TYPE

10.10.1.1. LACTOBACILLI

10.10.1.2. STRETOCOCCUS THERMOPHILUS

10.10.1.3. BIFIDOBACTERIA

10.10.1.4. YEAST

10.10.1.5. OTHERS

10.11 PHYTOGENIC

10.11.1 PHYTOGENIC, BY TYPE

10.11.1.1. ESSENTIAL OILS

10.11.1.2. HERBS & SPICES

10.11.1.3. OLEORESIN

10.11.1.4. OTHERS

10.12 CAROTENOIDS

10.12.1 CAROTENOIDS, BY TYPE

10.12.1.1. ASTAXANTHIN

10.12.1.2. CANTHAXANTHIN

10.12.1.3. LUTEIN

10.12.1.4. BETA-CAROTENE

10.13 PRESERVATIVES

10.13.1 PRESERVATIVES, BY TYPE

10.13.1.1. SYNTHETIC

10.13.1.1.1. SYNTHETIC, BY TYPE

10.13.1.1.1.1 THOXYQUIN

10.13.1.1.1.2 BUTYLATED HYDROXYANISOLE (BHA)

10.13.1.1.1.3 BUTYLATED HYDROXYTOLUENE (BHT)

10.13.1.1.1.4 PROPYLENE GLYCOL

10.13.1.1.1.5 PROPYL GALLATE

10.13.1.1.1.6 OTHERS

10.13.1.2. NATURAL

10.13.1.2.1. NATURAL, BY TYPE

10.13.1.2.1.1 TOCOPHEROL

10.13.1.2.1.2 ASCORBATE

10.13.1.2.1.3 OTHERS

10.14 OTHERS

11 EUROPE PET FOOD INGREDIENTS MARKET, BY PET TYPE, 2018-2032 (USD MILLION)

11.1 OVERVIEW

11.2 DOGS

11.3 CAT

11.4 BIRDS

11.5 AQUA

11.6 RABBIT

11.7 OTHERS

12 EUROPE PET FOOD INGREDIENTS MARKET, BY SOURCE, 2018-2032 (USD MILLION)

12.1 OVERVIEW

12.2 ANIMAL BASED

12.2.1 ANIMAL BASED , BY TYPE

12.2.1.1. MEAT MEAL

12.2.1.2. ANIMAL DIGEST

12.2.1.3. MILK BASED

12.2.1.4. OTHERS

12.3 PLANT BASED

12.3.1 PLANT BASED, BY TYPE

12.3.1.1. CEREAL GRAINS

12.3.1.1.1. CEREAL GRAINS, BY TYPE

12.3.1.1.1.1 WHEAT

12.3.1.1.1.2 RICE

12.3.1.1.1.3 PEAS

12.3.1.1.1.4 LENTILS

12.3.1.1.1.5 CORN

12.3.1.1.1.6 SORGHUM

12.3.1.1.1.7 BARLEY

12.3.1.1.1.8 RYE

12.3.1.1.1.9 TRITICALE

12.3.1.1.1.10 OATS

12.3.1.1.1.11 OTHERS

12.3.1.2. OILSEEDS

12.3.1.2.1. OILSEEDS, BY TYPE

12.3.1.2.1.1 SUNFLOERS

12.3.1.2.1.2 FLAXSEED OIL

12.3.1.2.1.3 SOY

12.3.1.2.1.4 OTHERS

12.3.1.3. VEGETABLES

12.3.1.3.1. VEGETABLES, BY TYPE

12.3.1.3.1.1 SPINACH

12.3.1.3.1.2 BROCCOLI

12.3.1.3.1.3 SWEETPOTATOS

12.3.1.3.1.4 POTATOS

12.3.1.3.1.5 OTHERS

12.3.1.4. FRUITS & NUTS

12.3.1.5. OTHERS

12.4 YEAST

12.5 OTHERS

13 EUROPE PET FOOD INGREDIENTS MARKET, BY PET FOOD TYPE , 2018-2032 (USD MILLION)

13.1 OVERVIEW

13.2 POWDER/DRY FOOD

13.2.1 POWDER/DRY FOOD, BY TYPE

13.2.1.1. CUBES

13.2.1.2. POWDER

13.2.1.3. FLAKES

13.2.1.4. KIBBLE

13.2.1.5. PELLET

13.2.1.6. OTHERS

13.3 LIQUID FOOD

13.3.1 LIQUID FOOD, BY TYPE

13.3.1.1. WET FOOD

13.3.1.2. OTHERS

14 EUROPE PET FOOD INGREDIENTS MARKET, BY MODE OF DELIVERY, 2018-2032 (USD MILLION)

14.1 OVERVIEW

14.2 REGULAR PRODUCTS

14.3 PREMIXES

14.4 ORAL POWDERS

14.5 ORAL SOLUTIONS

14.6 INJECTIONS

14.7 OTHERS

15 EUROPE PET FOOD INGREDIENTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

15.1 OVERVIEW

15.2 BLENDED

15.3 ORIGINAL

16 EUROPE PET FOOD INGREDIENTS MARKET , BY CATEGORY, 2018-2032 (USD MILLION)

16.1 OVERVIEW

16.2 ORGANIC

16.3 INORGANIC/CONVENTIONAL

17 EUROPE PET FOOD INGREDIENTS MARKET, BY PACKAGING, 2018-2032 (USD MILLION)

17.1 OVERVIEW

17.2 CAN

17.3 BOXES AND CARTONS

17.4 SACHES

17.5 BOTTLES

17.6 TUBES

18 EUROPE PET FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

18.1 OVERVIEW

18.2 B2B

18.2.1 B2B, BY TYPE

18.2.1.1. ONLINE

18.2.1.2. WHOLESALE TRADERS

18.2.1.3. OTHERS

18.3 B2C

18.3.1 B2C, BY TYPE

18.3.1.1. ONLINE/E-COMMERCE

18.3.1.2. HYPERMARKETS/SUPERMARKETS

18.3.1.3. CONVEINIENCE STORES

18.3.1.4. GROCERY STORES

18.3.1.5. SPECIALTY STORES

18.3.1.6. OTHERS

19 EUROPE PET FOOD INGREDIENTS MARKET, BY END USER, 2018-2032 (USD MILLION)

19.1 OVERVIEW

19.2 HOUSEHOLD

19.3 PETSTORES

20 EUROPE PET FOOD INGREDIENTS MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

EUROPE PET FOOD INGREDIENTS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

20.1 EUROPE

20.1.1 GERMANY

20.1.2 U.K.

20.1.3 ITALY

20.1.4 FRANCE

20.1.5 SPAIN

20.1.6 SWITZERLAND

20.1.7 RUSSIA

20.1.8 TURKEY

20.1.9 BELGIUM

20.1.10 NETHERLANDS

20.1.11 SWITZERLAND

20.1.12 DENMARK

20.1.13 NORWAY

20.1.14 FINLAND

20.1.15 SWEDEN

20.1.16 REST OF EUROPE

21 EUROPE PET FOOD INGREDIENTS MARKET, COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: EUROPE

21.2 MERGERS & ACQUISITIONS

21.3 NEW PRODUCT DEVELOPMENT & APPROVALS

21.4 EXPANSIONS & PARTNERSHIP

21.5 REGULATORY CHANGES

22 EUROPE PET FOOD INGREDIENTS MARKET, SWOT & DBMR ANALYSIS

23 EUROPE PET FOOD INGREDIENTS MARKET, COMPANY PROFILE

23.1 INGREDION INCORPORATED

23.1.1 COMPANY OVERVIEW

23.1.2 REVENUE ANALYSIS

23.1.3 PRODUCT PORTFOLIO

23.1.4 GEOGRAPHIC PRESENCE

23.1.5 RECENT DEVELOPMENTS

23.2 ADM

23.2.1 COMPANY OVERVIEW

23.2.2 REVENUE ANALYSIS

23.2.3 PRODUCT PORTFOLIO

23.2.4 GEOGRAPHIC PRESENCE

23.2.5 RECENT DEVELOPMENTS

23.3 CARGILL, INCORPORATED

23.3.1 COMPANY OVERVIEW

23.3.2 REVENUE ANALYSIS

23.3.3 PRODUCT PORTFOLIO

23.3.4 GEOGRAPHIC PRESENCE

23.3.5 RECENT DEVELOPMENTS

23.4 DSM

23.4.1 COMPANY OVERVIEW

23.4.2 REVENUE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 GEOGRAPHIC PRESENCE

23.4.5 RECENT DEVELOPMENTS

23.5 DUPONT

23.5.1 COMPANY OVERVIEW

23.5.2 REVENUE ANALYSIS

23.5.3 PRODUCT PORTFOLIO

23.5.4 GEOGRAPHIC PRESENCE

23.5.5 RECENT DEVELOPMENTS

23.6 BASF SE

23.6.1 COMPANY OVERVIEW

23.6.2 REVENUE ANALYSIS

23.6.3 PRODUCT PORTFOLIO

23.6.4 GEOGRAPHIC PRESENCE

23.6.5 RECENT DEVELOPMENTS

23.7 BALCHEM INC

23.7.1 COMPANY OVERVIEW

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 GEOGRAPHIC PRESENCE

23.7.5 RECENT DEVELOPMENTS

23.8 BARENTZ

23.8.1 COMPANY OVERVIEW

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 GEOGRAPHIC PRESENCE

23.8.5 RECENT DEVELOPMENTS

23.9 DARLING INGREDIENTS INC

23.9.1 COMPANY OVERVIEW

23.9.2 REVENUE ANALYSIS

23.9.3 PRODUCT PORTFOLIO

23.9.4 GEOGRAPHIC PRESENCE

23.9.5 RECENT DEVELOPMENTS

23.1 KERRY GROUP PLC

23.10.1 COMPANY OVERVIEW

23.10.2 REVENUE ANALYSIS

23.10.3 PRODUCT PORTFOLIO

23.10.4 GEOGRAPHIC PRESENCE

23.10.5 RECENT DEVELOPMENTS

23.11 OMEGA PROTEIN CORPORATION

23.11.1 COMPANY OVERVIEW

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 GEOGRAPHIC PRESENCE

23.11.5 RECENT DEVELOPMENTS

23.12 ROQUETTE FRÈRES

23.12.1 COMPANY OVERVIEW

23.12.2 REVENUE ANALYSIS

23.12.3 PRODUCT PORTFOLIO

23.12.4 GEOGRAPHIC PRESENCE

23.12.5 RECENT DEVELOPMENTS

23.13 TATE & LYLE

23.13.1 COMPANY OVERVIEW

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 GEOGRAPHIC PRESENCE

23.13.5 RECENT DEVELOPMENTS

23.14 THE PETERSON COMPANY

23.14.1 COMPANY OVERVIEW

23.14.2 REVENUE ANALYSIS

23.14.3 PRODUCT PORTFOLIO

23.14.4 GEOGRAPHIC PRESENCE

23.14.5 RECENT DEVELOPMENTS

23.15 THE SCOULAR COMPANY

23.15.1 COMPANY OVERVIEW

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 GEOGRAPHIC PRESENCE

23.15.5 RECENT DEVELOPMENTS

23.16 KEMIN INDUSTRIES, INC

23.16.1 COMPANY OVERVIEW

23.16.2 REVENUE ANALYSIS

23.16.3 PRODUCT PORTFOLIO

23.16.4 GEOGRAPHIC PRESENCE

23.16.5 RECENT DEVELOPMENTS

24 RELATED REPORTS

25 CONCLUSION

26 QUESTIONNAIRE

27 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.