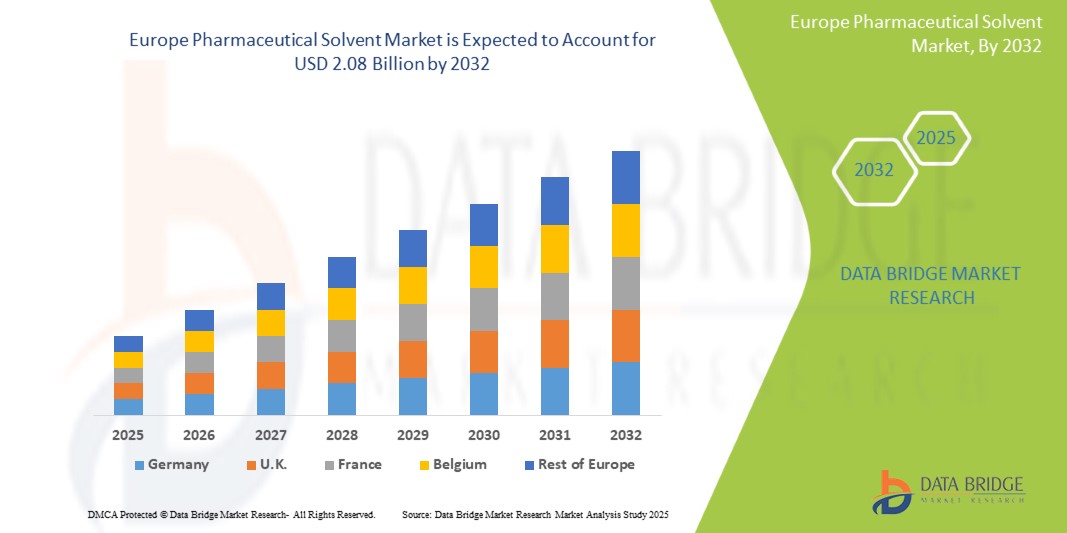

Europe Pharmaceutical Solvent Market

Market Size in USD Billion

CAGR :

%

USD

1.38 Billion

USD

2.08 Billion

2024

2032

USD

1.38 Billion

USD

2.08 Billion

2024

2032

| 2025 –2032 | |

| USD 1.38 Billion | |

| USD 2.08 Billion | |

|

|

|

|

Pharmaceutical Solvent Market Size

- The Europe pharmaceutical solvent market size was valued at USD 1.38 billion in 2024 and is expected to reach USD 2.08 billion by 2032, at a CAGR of 5.3% during the forecast period

- This growth is driven by factors such as the aging population, increasing prevalence of eye diseases, and advancements in ophthalmic technology

Pharmaceutical Solvent Market Analysis

- Pharmaceutical solvents are critical components used in drug formulation and manufacturing, playing a vital role in dissolving active ingredients and facilitating chemical reactions during the production of various medications.

- The demand for pharmaceutical solvents is significantly driven by the increasing prevalence of chronic diseases, rising pharmaceutical production, and advancements in drug development technologies.

- Switzerland is expected to dominate the Pharmaceutical Solvent Market due to its advanced healthcare infrastructure, strong pharmaceutical manufacturing base, and increasing demand for high-quality drug formulations.

- Switzerland is also projected to be the fastest-growing region in the Pharmaceutical Solvent Market during the forecast period, driven by rising awareness about healthcare quality and continuous investments in research and development.

- The alcohol segment is expected to dominate the market with a share of 29.59%, owing to its widespread use in drug synthesis, extraction, and purification processes. Its high solvency power, compatibility with various active pharmaceutical ingredients (APIs), and regulatory acceptance make it the preferred choice across the pharmaceutical industry.

Report Scope and Pharmaceutical Solvent Market Segmentation

|

Attributes |

Pharmaceutical Solvent Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pharmaceutical Solvent Market Trends

“Growing Emphasis on Green and Sustainable Solvents in the European Pharmaceutical Sector”

- A key trend shaping the Europe pharmaceutical solvent market is the rising demand for environmentally friendly and sustainable solvents driven by stricter environmental regulations and corporate sustainability goals.

- This shift encourages the use of bio-based and low-toxicity solvents that reduce hazardous waste and enhance worker safety during drug formulation and manufacturing

- For instance, green solvents like ethyl lactate and supercritical CO₂ are increasingly being adopted as safer alternatives to conventional petrochemical-based solvents in pharmaceutical synthesis and extraction processes.

- This trend is transforming solvent selection strategies, promoting cleaner production practices, and boosting the demand for sustainable solvent technologies across the European pharmaceutical industry

Pharmaceutical Solvent Market Dynamics

Driver

“Increase in Demand for Alcohol Solvents for Manufacturing of Various Drugs”

- The European pharmaceutical solvent market is experiencing notable growth, driven by the escalating demand for alcohol-based solvents such as ethanol and isopropanol.

- These solvents are integral in drug formulation, synthesis, and purification processes. Factors contributing to this surge include the rise in chronic diseases, an aging population, and advancements in pharmaceutical research and development.

- Additionally, the industry's shift towards green chemistry and sustainable practices is influencing solvent selection, with a growing preference for bio-based alcohol solvents. This trend underscores the critical role of alcohol solvents in ensuring the efficacy and safety of pharmaceutical product.

For instance,

- In February, 2025 findings from Drugs.com indicate that alcohol is widely used in pharmaceutical preparations as a solvent, preservative, and disinfectant. Its versatility allows it to dissolve a variety of active ingredients, aiding in drug formulation. Due to its antimicrobial properties and effectiveness in drug stability, alcohol plays a vital role in manufacturing various oral and topical medications

- In August, 2024, as per article published in Springer Nature, the role of alcohol solvents, particularly methanol and ethanol, in efficiently removing residual solvents like dichloromethane from pharmaceutical formulations, such as PLGA microparticles. This reflects the growing demand for alcohol-based solvents in drug manufacturing, driven by regulatory requirements and the need for safe, effective drug delivery systems

- The increasing reliance on alcohol solvents in Europe's pharmaceutical sector highlights their essential role in drug development and manufacturing. As the industry progresses towards sustainable practices, the demand for high-quality, bio-based alcohol solvents is expected to rise, ensuring compliance with environmental regulations and enhancing product safety

Opportunity

“Expansion of Biosimilars and High-Potency Drugs”

- The increasing development and production of biosimilars and High-Potency Active Pharmaceutical Ingredients (HPAPIs) across Europe significantly elevate the demand for high-purity, precision-grade solvents.

- These solvents are essential for ensuring product safety, maintaining chemical stability, and meeting rigorous containment and regulatory requirements associated with handling sensitive drug substances.

- Europe’s leadership in biosimilar approvals, supported by a strong regulatory framework and advanced biomanufacturing infrastructure, drives substantial growth in this segment. As pharmaceutical companies scale up production of complex biologics and potent compounds, the need for specialized solvents intensifies. This trend opens a lucrative and sustainable opportunity for the Europe pharmaceutical solvent market, especially in the high-value niche of solvent innovation and customization.

For instance,

- In February 2025, according to the article published by Dolphin Pharmaceuticals, the increasing demand for targeted cancer therapies and advanced biologics is accelerating the production of high-potency active pharmaceutical ingredients (HPAPIs), which require stringent manufacturing conditions. Solvents and catalysts play a critical role in enabling precise chemical reactions and purifications essential for these complex drugs. This drives demand for high-quality solvents, creating a significant growth opportunity for the Europe pharmaceutical solvent market

- In August 2022, as per the article published by GaBi, Europe remains at the forefront of biosimilar development, with the European Medicines Agency (EMA) approving 88 biosimilars to date under a centralized regulatory framework. This leadership fosters a surge in biosimilar manufacturing, requiring high-purity solvents for synthesis and purification. The region’s dominance in biosimilars drives solvent demand, offering a substantial opportunity for the market

- In July 2022, based on the article published by Rapid Life Sciences Ltd, the growing demand for drug products with high potency active pharmaceutical ingredients (HPAPIs) is boosting the role of Contract Development and Manufacturing Organizations (CDMOs) that offer end-to-end solutions. These processes require precision-grade solvents for synthesis and formulation. As CDMO activity expands across Europe, it significantly increases the need for high-quality solvents, presenting a strong opportunity for the pharmaceutical solvent market

- The expanding landscape of biosimilars and high-potency drug development in Europe is driving a sustained need for high-purity, specialized solvents. With strong regulatory support, advanced manufacturing infrastructure, and growing CDMO involvement, Europe is well-positioned to lead this segment. These factors collectively present a robust and long-term growth opportunity for the Europe pharmaceutical solvent market

Restraint/Challenge

“Health and Safety Concerns Regarding Pharmaceutical Solvents”

- Pharmaceutical solvents, especially petrochemical-based ones such as benzene, toluene, methylene chloride, and acetone, pose significant health and safety risks to workers and the environment.

- Prolonged exposure to these solvents results in severe health issues including neurotoxicity, respiratory complications, skin disorders, and organ damage, particularly affecting the liver and kidneys. Inhalation of vapors during manufacturing, coupled with the flammable and volatile nature of these chemicals, increases the risk of workplace accidents and environmental contamination.

- This presents a substantial challenge for the Europe pharmaceutical solvent market, as it restricts formulation flexibility and adds financial and procedural burdens to manufacturers.

For instance,

- In October 2024, according to the information published by SCAT Europe, solvent vapors pose serious hazards, including respiratory illnesses, skin and eye irritation, organ damage, fire or explosion risks, and environmental contamination. Poorly managed solvent use in workplaces can lead to occupational accidents and regulatory violations. These risks necessitate stringent safety protocols and increase operational costs, making health and safety concerns a major challenge for the market

- In August 2020, as per the data published by Veeprho Pharmaceuticals s.r.o, residual solvents are toxic volatile compounds that remain in drug substances after manufacturing. Even in trace amounts, they can compromise drug safety, efficacy, and stability, with risks including organ toxicity and carcinogenicity. Strict regulations like ICH Q3C (R8) require rigorous testing and removal, increasing compliance costs and complexity—posing a significant challenge for the market

- In 2022, in accordance with the article published by ScienceDirect, chronic occupational exposure to organic solvents leads to cognitive decline, mood disturbances, memory loss, vision and hearing impairments, and peripheral neuropathy. Developmental neurotoxicity and worsened hearing due to noise co-exposure further heighten risks. These serious health effects necessitate enhanced safety protocols and regulatory compliance, increasing costs and posing a major challenge for the market

- The health and safety concerns associated with pharmaceutical solvents, particularly petrochemical-based ones, present significant challenges for the Europe pharmaceutical solvent market. The risks of occupational exposure, residual solvent toxicity, and long-term health effects require stringent safety measures, regulatory compliance, and continuous monitoring. These factors not only increase operational costs but also limit formulation flexibility, ultimately impacting the overall efficiency and competitiveness of the market.

Pharmaceutical Solvent Market Scope

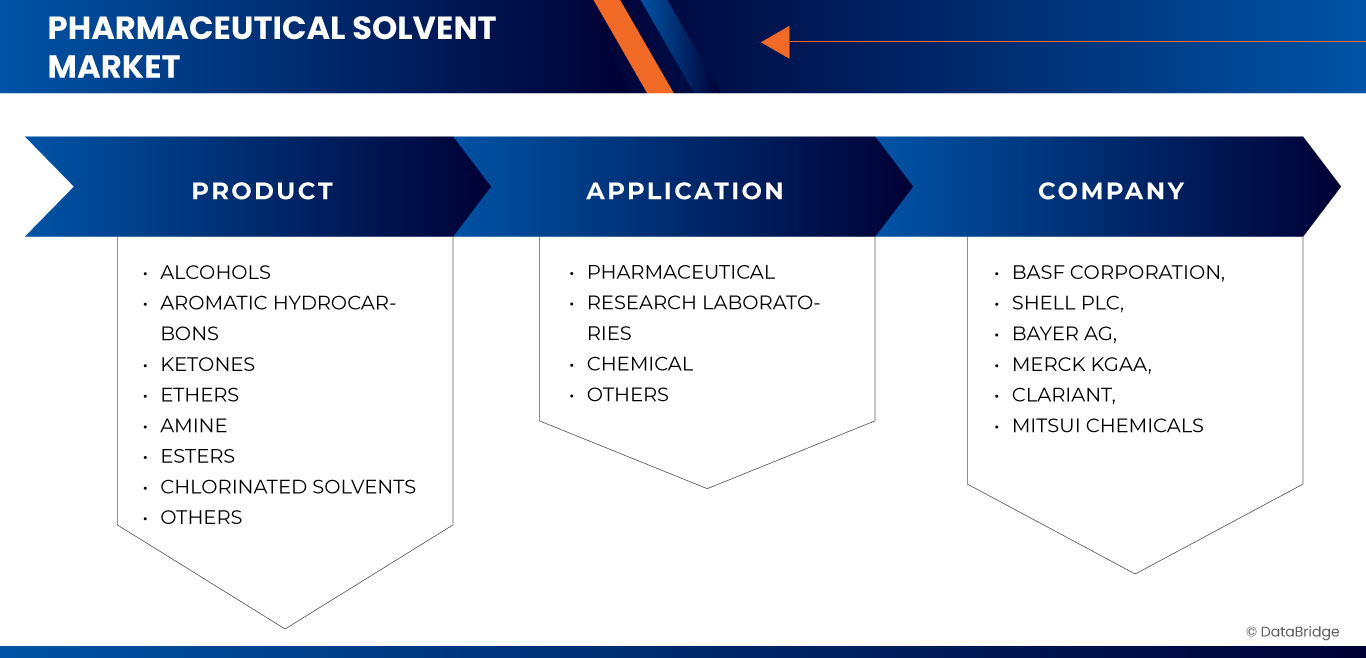

The market is segmented on the basis product, and application.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

In 2025, the alcohols segment is expected to dominate the market with a largest share in product segment

The alcohols segment is expected to dominate the Pharmaceutical Solvent Market with the largest share of 29.59% in 2025 due to its wide applicability in drug formulation, extraction, and purification processes. Its favorable solvent properties, cost-effectiveness, and regulatory acceptance further drive demand. Additionally, alcohols like ethanol and isopropanol are extensively used across both APIs and excipients.

The Pharmaceutical is expected to account for the largest share during the forecast period in application

In 2025, the pharmaceutical segment is expected to dominate the market with the largest share of 54.60% due to the rising demand for high-purity solvents in drug formulation and production. Increased R&D activities, expanding pharmaceutical manufacturing, and stringent quality standards further fuel the segment’s growth. These solvents are essential for ensuring product efficacy and safety.

Pharmaceutical Solvent Market Regional Analysis

“Switzerland Holds the Largest Share and Register the Highest CAGR in the Pharmaceutical Solvent Market”

- Europe's Pharmaceutical Solvent Market is witnessing steady growth, with Switzerland emerging as the dominant country due to its strong pharmaceutical manufacturing base, high-quality standards, and supportive regulatory environment.

- Switzerland holds a significant share owing to the presence of leading pharmaceutical companies, a skilled workforce, and a robust focus on innovation in drug development and production.

- The country’s emphasis on compliance with international quality norms and its well-established infrastructure for research and manufacturing contribute to market strength.

- Furthermore, the increasing adoption of high-purity solvents for advanced drug formulations and the growing trend toward sustainable and green chemistry practices are driving market growth across the region

Pharmaceutical Solvent Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BASF Corporation (Germany)

- Shell PLC (UK)

- Bayer AG (Germany)

- Merck KGaA (Germany)

- CLARIANT (Switzerland)

- Mitsui Chemicals, Inc. (Japan)

- ExxonMobil Corporation (U.S.)

- Dow (U.S.)

- Nouryon (Netherlands)

- Braskem (Brazil)

- DuPont (U.S.)

- Eastman Chemical Company (U.S.)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- ACTYLIS (U.S.)

- SK Chemicals (South Korea)

- Carl Roth GmbH + Co. KG (Germany)

- Chemco UK(UK)

- PCC Group (Germany)

- Advion Interchim Scientific (U.S.)

Latest Developments in Europe Pharmaceutical Solvent Market

- In May, Bayer AG company announced unveiled its new Solida-1 pharmaceutical production facility in Leverkusen, Germany. Set to become operational in 2024, the USD 311.69 million single-storey facility is positioned to be one of the most advanced pharmaceutical production plants in the world. Solida-1 is part of Bayer’s USD 1.13 billion investment program aimed at strengthening its global pharmaceutical manufacturing network.

- In July, Merck has completed the acquisition of EyeBio, strengthening its ophthalmology pipeline with Restoret, a novel Wnt pathway agonist for diabetic macular edema and neovascular age-related macular degeneration. The deal includes additional preclinical assets targeting retinal diseases. This strategic acquisition diversifies Merck’s late-stage portfolio and supports its vision of advancing innovative treatments for vision-related conditions.

- In November, Clariant presented its latest portfolio of healthcare solutions at the upcoming CPHI India tradeshow, taking place in Delhi NCR from November 26 to 28, 2024. This year’s exhibition will highlight Clariant Health Care’s ‘Made in India’ product range, the capabilities of its Bonthapally facility, and its deep expertise in biologics, generics, and excipient production.

- In June 2024, Carl Roth GmbH & Co. KG’s facility in Karlsruhe, Germany, has been awarded EXCiPACT GMP certification for its role as a supplier of pharmaceutical excipients.

- In December, Dow has partnered with Macquarie Asset Management to establish Diamond Infrastructure Solutions, a new infrastructure provider focusing on operational efficiency and customer acquisition. Macquarie will acquire a 40% stake in select U.S. Gulf Coast assets, with an option to increase to 49%. The deal is expected to generate up to $3 billion in proceeds for Dow

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE PHARMACEUTICAL SOLVENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MARKET APPLICATION COVERAGE GRID

2.7 MULTIVARIATE MODELLING

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTLE ANALYSIS

4.3 CLIMATE CHANGE SCENARIO – EUROPE PHARMACEUTICAL SOLVENT MARKET

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.4 PRICING ANALYSIS – EUROPE PHARMACEUTICAL SOLVENT MARKET

4.4.1 RAW MATERIAL COSTS

4.4.2 PURITY AND GRADE

4.4.3 REGULATORY COMPLIANCE COSTS

4.4.4 REGIONAL PRICING VARIABILITY

4.4.5 SUPPLY CHAIN & LOGISTICS

4.4.6 COMPETITIVE LANDSCAPE

4.4.7 FORECASTED PRICING TRENDS (2025–2032)

4.5 PRODUCTION CAPACITY OVERVIEW – EUROPE PHARMACEUTICAL SOLVENT MARKET

4.5.1 KEY PRODUCTION HUBS

4.5.2 CAPACITY UTILIZATION TRENDS

4.5.3 IMPACT OF GREEN CHEMISTRY INITIATIVES

4.5.4 CAPACITY CONSTRAINTS & CHALLENGES

4.6 RAW MATERIAL COVERAGE

4.6.1 IMPORT-EXPORT ANALYSIS

4.6.2 PRODUCTION–CONSUMPTION ANALYSIS

4.7 SUPPLY CHAIN ANALYSIS – EUROPE PHARMACEUTICAL SOLVENT MARKET

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 TARIFFS AND ITS IMPACT ON THE MARKET – EUROPE PHARMACEUTICAL SOLVENT MARKET

4.8.1 DEFINITION AND IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

4.8.2 GLOBAL VS. REGIONAL TARIFF STRUCTURES

4.8.3 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

4.8.4 TARIFF REGULATIONS IN KEY MARKETS

4.8.4.1 MEDICARE/MEDICAID TARIFF POLICIES

4.8.4.2 CMS PRICING MODELS

4.8.4.3 OTHER COUNTRY-SPECIFIC SYSTEMS

4.8.4.4 TARIFFS ON MEDICAL DEVICES & EQUIPMENT

4.8.4.5 IMPORT/EXPORT DUTIES ON MEDICAL EQUIPMENT

4.8.4.6 IMPACT ON PRICING AND AVAILABILITY OF HIGH-END MEDICAL TECHNOLOGY

4.8.5 COST BURDEN ON HOSPITALS AND HEALTHCARE FACILITIES

4.8.6 TARIFF EXEMPTIONS AND INCENTIVES

4.8.7 DUTY-FREE IMPORTS FOR ESSENTIAL MEDICINES AND VACCINES

4.8.8 IMPACT OF TRADE WARS ON THE HEALTHCARE SUPPLY CHAIN

4.8.9 ROLE OF FREE TRADE AGREEMENTS (FTAS) IN REDUCING TARIFFS

4.9 VENDOR SELECTION CRITERIA:

5 REGULATION COVERAGE – EUROPE PHARMACEUTICAL SOLVENT MARKET

5.1 PRODUCT CODES

5.2 CERTIFIED STANDARDS

5.3 SAFETY STANDARDS

5.3.1 MATERIAL HANDLING & STORAGE

5.3.2 TRANSPORT & PRECAUTIONS

5.3.3 HAZARD IDENTIFICATION

6 MARKET OVERVIEW

6.1 DRIVER

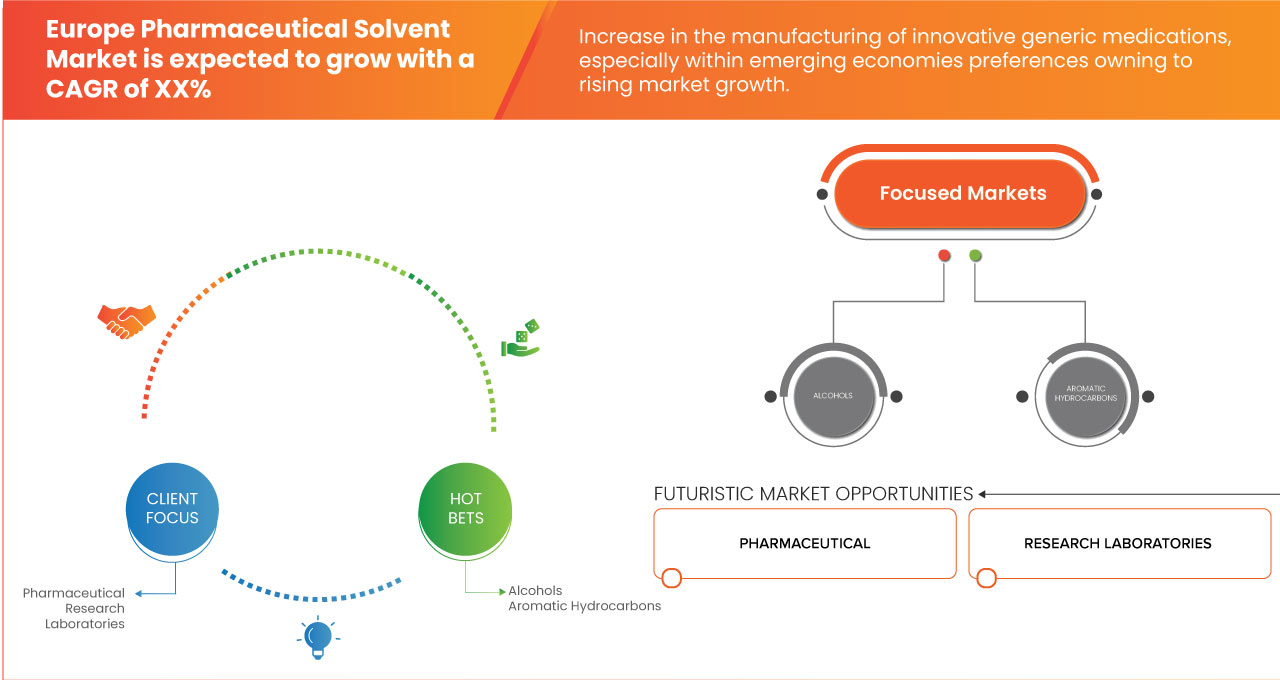

6.1.1 INCREASE IN THE MANUFACTURING OF INNOVATIVE GENERIC MEDICATIONS, ESPECIALLY WITHIN EMERGING ECONOMIES

6.1.2 INCREASE IN DEMAND FOR ALCOHOL SOLVENTS FOR MANUFACTURING OF VARIOUS DRUGS.

6.1.3 GROWTH IN PHARMACEUTICAL, AND HEALTHCARE SECTOR ACROSS THE EUROPE

6.1.4 RISE IN ADOPTION OF GREEN MATERIALS AND CHEMICALS FOR DRUG

6.2 RESTRAINT

6.2.1 ADOPTION OF GREEN SOLVENTS POSES OPERATIONAL AND TECHNICAL CHALLENGES

6.2.2 SHORTAGE OF SPECIALIZED WORKFORCE HINDERING SOLVENT PRODUCTION EFFICIENCY

6.3 OPPORTUNITY

6.3.1 EXPANSION OF BIOSIMILARS AND HIGH-POTENCY DRUGS

6.3.2 RISE IN CLINICAL TRIALS AND R&D INVESTMENTS

6.3.3 INCREASING FOCUS ON PERSONALIZED MEDICINE AND ORPHAN DRUGS.

6.4 CHALLENGES

6.4.1 COMPETITION FROM ALTERNATIVE FORMULATION TECHNOLOGIES

6.4.2 HEALTH AND SAFETY CONCERNS REGARDING PHARMACEUTICAL SOLVENTS

7 EUROPE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 ALCOHOLS

7.2.1 METHANOL

7.2.2 ETHANOL

7.2.3 1-BUTANOL

7.2.4 2-BUTANOL

7.2.5 2-METHOXYETHANOL

7.2.6 3-METHYL-1-PROPANOL

7.2.7 2-METHYL-1-PROPANOL

7.2.8 1-PENTANOL

7.2.9 1-PROPANOL

7.2.10 2-PROPANOL (ISOPROPYL ALCOHOL)

7.2.11 ISOPROPANOL

7.2.12 PROPYLENE GLYCOL

7.2.13 OTHERS

7.3 AROMATIC HYDROCARBONS

7.3.1 TOLUENE

7.3.2 XYLENE

7.3.3 ETHYLBENZENE

7.3.4 OTHERS

7.4 KETONES

7.4.1 ACETONE

7.4.2 CYCLOHEXANONE

7.4.3 METHYL ETHER KETONE

7.4.4 METHYL ETHYL KETONE

7.4.5 METHYL ISOBUTYL KETONE

7.4.6 OTHERS

7.5 ETHERS

7.5.1 DIETHYL ETHER

7.5.2 TETRAHYDROFURAN

7.5.3 METHOXYMETHANE

7.5.4 METHYL TERT-BUTYL ETHER

7.5.5 POLYETHYLENE GLYCOL

7.5.6 ANISOLE

7.5.7 DI-N-PROPYL ETHER

7.5.8 OTHERS

7.6 AMINE

7.6.1 MONOETHANOLAMIDE (MEA)

7.6.2 ANILINE

7.6.3 DIETHANOLAMINE (DEA)

7.6.4 METHYL DIETHANOLAMINE (MDEA)

7.6.5 TRIMETHYLAMINE

7.6.6 OTHERS

7.7 ESTERS

7.7.1 ACETYL ACETATE

7.7.2 ETHYL ACETATE

7.7.3 BUTYL ACETATE

7.7.4 OTHERS

7.8 CHLORINATED SOLVENTS

7.8.1 TRICHLOROETHYLENE (TCE)

7.8.2 DICHLOROMETHANE

7.8.3 PERCHLOROETHYLENE (PCE)

7.8.4 TRICHLOROETHANE (TCA)

7.8.5 CARBON TETRACHLORIDE

7.8.6 OTHERS

7.9 OTHERS

8 EUROPE PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 PHARMACEUTICAL

8.3 RESEARCH LABORATORIES

8.4 CHEMICAL

8.5 OTHERS

9 EUROPE PHARMACEUTICAL SOLVENT MARKET BY COUNTRIES

9.1 EUROPE

9.1.1 SWITZERLAND

9.1.2 ITALY

9.1.3 GERMANY

9.1.4 FRANCE

9.1.5 U.K.

9.1.6 SPAIN

9.1.7 BELGIUM

9.1.8 NETHERLANDS

9.1.9 RUSSIA

9.1.10 TURKEY

9.1.11 LUXEMBURG

9.1.12 REST OF EUROPE

10 EUROPE PHARMACEUTICAL SOLVENT MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: EUROPE

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 BASF CORPORATION

12.1.1 COMPANY SNAPSHOT

12.1.2 PRODUCT PORTFOLIO

12.1.3 RECENT UPDATES

12.2 SHELL PLC

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 BAYER AG

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 MERCK KGAA

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT UPDATES

12.5 CLARIANT

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 ACTYLIS

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT UPDATES

12.7 ADVION INTERCHIM SCIENTIFIC

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 BRASKEM

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 CARL ROTH GMBH + CO. KG

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT/NEWS

12.1 CHEMCO UK

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 DOW

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENT

12.12 DUPONT

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENT

12.13 EASTMAN CHEMICAL COMPANY

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 EXXON MOBIL CORPORATION

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

12.15 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENT

12.16 MITSUI CHEMICALS, INC.

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT DEVELOPMENT

12.17 NOURYON

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT UPDATES

12.18 PCC GROUP

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT UPDATES

12.19 SEQENS

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENT

12.2 SK CHEMICALS

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 EUROPE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 2 EUROPE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 3 EUROPE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 4 EUROPE ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 EUROPE AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 EUROPE KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE PHARMACEUTICAL SOLVENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 13 SWITZERLAND PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 14 SWITZERLAND PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 15 SWITZERLAND PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 16 SWITZERLAND ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 SWITZERLAND AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 SWITZERLAND KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 SWITZERLAND ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 SWITZERLAND AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 21 SWITZERLAND ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 SWITZERLAND CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 SWITZERLAND PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 ITALY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 25 ITALY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 26 ITALY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 27 ITALY ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 ITALY AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 ITALY KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 ITALY ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 ITALY AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 32 ITALY ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 ITALY CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 ITALY PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 35 GERMANY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 36 GERMANY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 37 GERMANY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 38 GERMANY ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 GERMANY AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 GERMANY KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 GERMANY ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 GERMANY AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 43 GERMANY ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 GERMANY CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 GERMANY PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 46 FRANCE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 47 FRANCE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 48 FRANCE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 49 FRANCE ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 FRANCE AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 FRANCE KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 FRANCE ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 FRANCE AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 54 FRANCE ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 FRANCE CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 FRANCE PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 U.K. PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 58 U.K. PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 59 U.K. PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 60 U.K. ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 U.K. AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 U.K. KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 U.K. ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 U.K. AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 65 U.K. ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 U.K. CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 U.K. PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 SPAIN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 69 SPAIN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 70 SPAIN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 71 SPAIN ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 SPAIN AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 SPAIN KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 SPAIN ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 SPAIN AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 76 SPAIN ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 SPAIN CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 SPAIN PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 79 BELGIUM PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 80 BELGIUM PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 81 BELGIUM PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 82 BELGIUM ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 BELGIUM AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 BELGIUM KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 BELGIUM ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 BELGIUM AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 87 BELGIUM ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 BELGIUM CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 BELGIUM PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 90 NETHERLANDS PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 91 NETHERLANDS PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 92 NETHERLANDS PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 93 NETHERLANDS ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 NETHERLANDS AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 NETHERLANDS KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 NETHERLANDS ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 NETHERLANDS AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 98 NETHERLANDS ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 NETHERLANDS CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NETHERLANDS PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 RUSSIA PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 102 RUSSIA PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 103 RUSSIA PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 104 RUSSIA ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 RUSSIA AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 RUSSIA KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 RUSSIA ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 RUSSIA AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 109 RUSSIA ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 RUSSIA CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 RUSSIA PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 TURKEY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 113 TURKEY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 114 TURKEY PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 115 TURKEY ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 TURKEY AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 TURKEY KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 TURKEY ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 TURKEY AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 120 TURKEY ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 TURKEY CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 TURKEY PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 123 LUXEMBURG PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 124 LUXEMBURG PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 125 LUXEMBURG PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/ METRIC TONS)

TABLE 126 LUXEMBURG ALCOHOLS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 LUXEMBURG AROMATIC HYDROCARBONS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 LUXEMBURG KETONES IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 LUXEMBURG ETHERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 LUXEMBURG AMINE IN PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 131 LUXEMBURG ESTERS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 LUXEMBURG CHLORINATED SOLVENTS IN PHARMACEUTICAL SOLVENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 LUXEMBURG PHARMACEUTICAL SOLVENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 134 REST OF EUROPE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 135 REST OF EUROPE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 136 REST EUROPE PHARMACEUTICAL SOLVENT MARKET, BY PRODUCT, 2018-2032 (USD/METRIC TONS)

List of Figure

FIGURE 1 EUROPE PHARMACEUTICAL SOLVENT MARKET: SEGMENTATION

FIGURE 2 EUROPE PHARMACEUTICAL SOLVENT MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PHARMACEUTICAL SOLVENT MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PHARMACEUTICAL SOLVENT MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE PHARMACEUTICAL SOLVENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PHARMACEUTICAL SOLVENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE PHARMACEUTICAL SOLVENT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 EUROPE PHARMACEUTICAL SOLVENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE PHARMACEUTICAL SOLVENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE PHARMACEUTICAL SOLVENT MARKET: SEGMENTATION

FIGURE 11 INCREASE IN THE MANUFACTURING OF INNOVATIVE GENERIC MEDICATIONS, ESPECIALLY WITHIN EMERGING ECONOMIES IS DRIVING THE GROWTH OF THE EUROPE PHARMACEUTICAL SOLVENT MARKET FROM 2025 TO 2032

FIGURE 12 THE ALCOHOLS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PHARMACEUTICAL SOLVENT MARKET IN 2025 AND 2032

FIGURE 13 EUROPE PHARMACEUTICAL SOLVENT MARKET EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 DROC ANALYSIS

FIGURE 16 EUROPE PHARMACEUTICAL SOLVENT MARKET: BY PRODUCT, 2024

FIGURE 17 EUROPE PHARMACEUTICAL SOLVENT MARKET: BY PRODUCT, 2025 TO 2032 (USD THOUSAND)

FIGURE 18 EUROPE PHARMACEUTICAL SOLVENT MARKET: BY PRODUCT, CAGR (2025- 2032)

FIGURE 19 EUROPE PHARMACEUTICAL SOLVENT MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 EUROPE PHARMACEUTICAL SOLVENT MARKET: BY APPLICATION, 2024

FIGURE 21 EUROPE PHARMACEUTICAL SOLVENT MARKET: BY APPLICATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 22 EUROPE PHARMACEUTICAL SOLVENT MARKET: BY APPLICATION, CAGR (2025- 2032)

FIGURE 23 EUROPE PHARMACEUTICAL SOLVENT MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 24 EUROPE PHARMACEUTICAL SOLVENT MARKET SNAPSHOT

FIGURE 25 EUROPE PHARMACEUTICAL SOLVENT MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.