Europe Pharmaceutical Vials Market

Market Size in USD Billion

CAGR :

%

USD

4.18 Billion

USD

6.92 Billion

2025

2033

USD

4.18 Billion

USD

6.92 Billion

2025

2033

| 2026 –2033 | |

| USD 4.18 Billion | |

| USD 6.92 Billion | |

|

|

|

|

Europe Pharmaceutical Vials Market Size

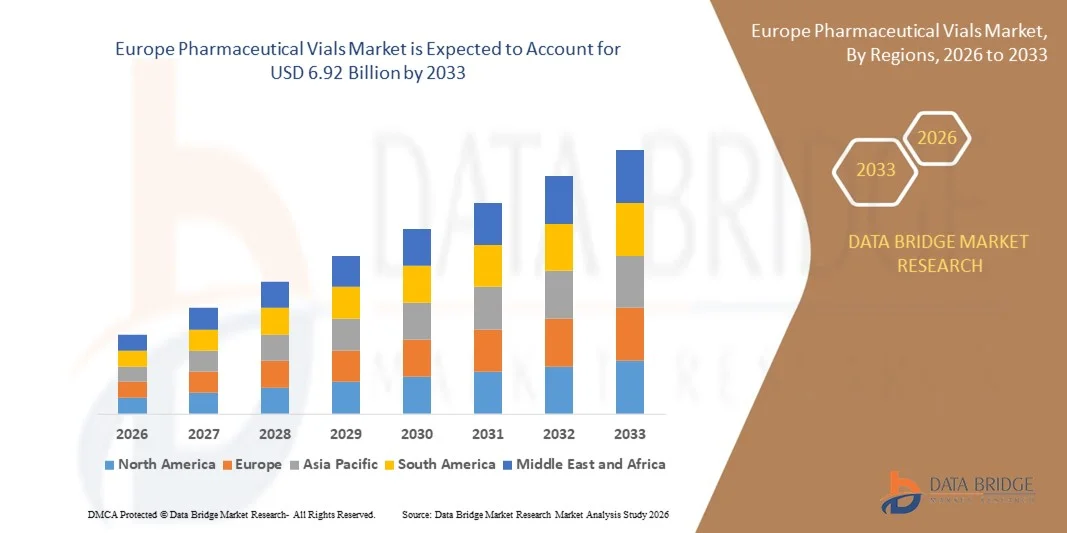

- The Europe Pharmaceutical Vials Market size was valued at USD 4.18 billion in 2025 and is expected to reach USD 6.92 billion by 2033, at a CAGR of 6.50% during the forecast period.

- The market growth is largely driven by the increasing demand for injectable drugs, rising biopharmaceutical production, and technological advancements in vial manufacturing and packaging processes, enhancing safety and efficiency.

- Furthermore, growing investments in healthcare infrastructure, stringent regulatory standards for drug storage, and rising prevalence of chronic diseases are driving the adoption of high-quality pharmaceutical vials, thereby significantly propelling the market’s expansion.

Europe Pharmaceutical Vials Market Analysis

- Pharmaceutical vials, used for storing injectable drugs and vaccines, are increasingly vital components of modern healthcare and biopharmaceutical supply chains due to their role in ensuring drug stability, sterility, and safe delivery.

- The escalating demand for pharmaceutical vials is primarily fueled by the growing prevalence of chronic diseases, increasing production of biologics and vaccines, and rising focus on drug safety and quality standards.

- Germany dominated the Europe Pharmaceutical Vials Market with the largest revenue share of 34% in 2025, characterized by advanced healthcare infrastructure, strong regulatory frameworks, and a high concentration of key industry players, with countries like Germany, France, and the U.K. experiencing substantial growth in vial production and utilization, driven by innovations in glass and polymer vial technologies.

- U.K. is expected to be the fastest-growing region in the Europe Pharmaceutical Vials Market during the forecast period due to increasing pharmaceutical manufacturing capacity, rising healthcare expenditure, and growing demand for vaccines and injectable drugs.

- The glass segment dominated the market with a revenue share of 61.5% in 2025, driven by its superior chemical resistance, thermal stability, and compatibility with injectable drugs and vaccines.

Report Scope and Europe Pharmaceutical Vials Market Segmentation

|

Attributes |

Pharmaceutical Vials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

• Gerresheimer AG (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Pharmaceutical Vials Market Trends

Enhanced Efficiency Through Advanced Manufacturing and Automation

- A significant and accelerating trend in the Europe Pharmaceutical Vials Market is the deepening adoption of advanced manufacturing technologies, automation, and digital monitoring systems. These innovations are significantly enhancing production efficiency, quality control, and traceability throughout the vial manufacturing process.

- For instance, automated vial filling and inspection systems from companies such as Gerresheimer and SCHOTT enable high-speed, precise production with minimal human intervention, reducing contamination risk and ensuring consistent product quality. Similarly, integrated track-and-trace solutions allow real-time monitoring of vials throughout the supply chain.

- Automation and digitalization in vial production enable features such as predictive maintenance, real-time quality alerts, and process optimization. For example, some modern filling lines can detect deviations in vial weight or seal integrity, automatically adjusting machinery to maintain strict regulatory compliance. Furthermore, these technologies reduce human error, improve batch consistency, and allow manufacturers to scale production efficiently.

- The seamless integration of automated production systems with digital supply chain management platforms facilitates centralized oversight over multiple stages of pharmaceutical manufacturing. Through a single interface, manufacturers can monitor vial production, inspection, packaging, and distribution, ensuring high safety standards and regulatory compliance.

- This trend toward more intelligent, efficient, and interconnected manufacturing systems is fundamentally reshaping expectations for pharmaceutical vial production. Consequently, companies such as SCHOTT, Stevanato Group, and Gerresheimer are developing fully automated, AI-assisted production lines with capabilities such as real-time quality monitoring, predictive maintenance, and end-to-end supply chain visibility.

- The demand for high-quality, precision-manufactured pharmaceutical vials is growing rapidly across both biopharmaceutical and generic drug sectors, as manufacturers increasingly prioritize efficiency, safety, and regulatory compliance.

Europe Pharmaceutical Vials Market Dynamics

Driver

Growing Need Due to Rising Biologics Production and Healthcare Demand

- The increasing prevalence of chronic diseases, rising demand for vaccines, and rapid growth of biologics production are significant drivers for the heightened demand for pharmaceutical vials.

- For instance, in 2025, Gerresheimer expanded its production capacity for Type I glass vials to meet increasing demand from global vaccine manufacturers. Such strategic expansions by key companies are expected to drive the pharmaceutical vials market growth during the forecast period.

- As healthcare providers and pharmaceutical companies focus on safe and sterile drug delivery, vials offer advanced features such as high chemical resistance, precise dosing, and compatibility with automated filling systems, providing a compelling advantage over alternative packaging.

- Furthermore, the growing adoption of injectable therapies and the increasing preference for prefilled and ready-to-use solutions are making vials an essential component of modern drug administration, ensuring drug stability and regulatory compliance.

- The convenience of standardized vial formats, compatibility with automated filling and inspection systems, and the ability to ensure patient safety are key factors propelling the adoption of pharmaceutical vials across both biopharmaceutical and generic drug sectors. The trend toward scalable, automated manufacturing and regulatory-compliant solutions further contributes to market growth.

Restraint/Challenge

Concerns Regarding Regulatory Compliance and Production Costs

- Stringent regulatory requirements for sterile manufacturing, quality control, and material safety pose a significant challenge to broader market expansion. Vial production must comply with multiple international standards, increasing operational complexity and costs.

- For instance, high-profile recalls due to contamination or defective vials have made some manufacturers cautious, necessitating additional investments in quality assurance and validation processes.

- Addressing these regulatory and quality challenges through robust process controls, advanced sterilization techniques, and continuous monitoring is crucial for maintaining compliance and trust. Companies such as SCHOTT and Stevanato Group emphasize their GMP-compliant facilities and rigorous quality protocols to reassure customers. Additionally, the relatively high cost of specialized glass or polymer vials compared to simpler packaging can be a barrier for price-sensitive manufacturers or regions. While prices for standard vials are gradually stabilizing, premium features such as coated vials or advanced stopper systems often come at a higher cost.

- Overcoming these challenges through process optimization, innovation in cost-effective materials, and consistent regulatory compliance will be vital for sustained market growth.

Europe Pharmaceutical Vials Market Scope

The pharmaceutical vials market is segmented on the basis of the material, neck type, cap size, distribution channel, capacity, drug type, application, end-user and market.

- By Material

On the basis of material, the Europe Pharmaceutical Vials Market is segmented into glass, plastic, and others. The glass segment dominated the market with a revenue share of 61.5% in 2025, driven by its superior chemical resistance, thermal stability, and compatibility with injectable drugs and vaccines. Glass vials are widely preferred for sterile formulations, ensuring long-term drug stability and adherence to stringent regulatory standards. They are particularly favored in high-value biologics and parenteral applications where contamination prevention is critical.

The plastic segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the growing demand for lightweight, break-resistant, and cost-effective alternatives in prefilled and disposable drug delivery systems. Plastic vials are gaining traction in emerging markets due to easier transportation, reduced breakage risk, and adaptability for large-scale production. Increasing innovation in polymer formulations with high chemical resistance is further driving adoption.

- By Neck Type

On the basis of neck type, the Europe Pharmaceutical Vials Market is segmented into screw neck, crimp neck, double chamber, flip cap, and others. The screw neck segment dominated the market with a revenue share of 45.3% in 2025, owing to its ease of sealing, compatibility with automated filling lines, and suitability for both injectable and oral drug formulations. Screw neck vials are widely adopted in hospitals, pharmacies, and research labs for their standardized closure systems and cost-effectiveness.

The crimp neck segment is expected to witness the fastest CAGR from 2026 to 2033, driven by its enhanced sealing capabilities, suitability for lyophilized products, and preference in high-volume vaccine production. The crimp neck design ensures minimal contamination risk, reliable stopper placement, and compliance with strict GMP standards, making it a preferred choice for critical injectable drug formulations.

- By Cap Size

On the basis of cap size, the Europe Pharmaceutical Vials Market is segmented into 13-425 mm, 15-425 mm, 18-400 mm, 22-350 mm, 24-400 mm, 8-425 mm, 9 mm, and others. The 13-425 mm segment dominated the market with a revenue share of 38.7% in 2025, driven by its widespread use for injectable formulations and standardization across pharmaceutical manufacturing lines. This cap size is favored due to compatibility with automated filling and sealing machinery and its prevalence in both hospital and retail applications.

The 18-400 mm segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing adoption in vaccine packaging and high-volume biologics manufacturing. The segment’s growth is supported by innovations in sealing technology, improved compatibility with rubber stoppers, and the growing trend of multi-dose vials for mass immunization campaigns.

- By Distribution Channel

On the basis of distribution channel, the Europe Pharmaceutical Vials Market is segmented into direct sales, medical stores/pharmacies, e-commerce, and others. The direct sales segment dominated the market with a revenue share of 52.1% in 2025, driven by direct procurement by pharmaceutical and biopharmaceutical companies from manufacturers, ensuring bulk supply, customized orders, and strict quality assurance.

The e-commerce segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by rising digitalization in healthcare procurement, the convenience of online ordering, and growing acceptance among small pharmacies and research labs. E-commerce platforms facilitate quick access to standardized vial sizes, materials, and cap types, particularly for urgent or niche requirements, thereby supporting the rapid adoption of online channels in the pharmaceutical supply chain.

- By Capacity

On the basis of capacity, the Europe Pharmaceutical Vials Market is segmented into 1 ml, 2 ml, 3 ml, 4 ml, 8 ml, 10 ml, 20 ml, 30 ml, 50 ml, and others. The 10 ml segment dominated the market with a revenue share of 35.9% in 2025, owing to its versatility for vaccines, biologics, and injectable drugs commonly used in hospitals and clinics. The 10 ml vial size is compatible with automated filling, inspection, and labeling systems, offering efficiency and consistency in large-scale pharmaceutical production.

The 2 ml segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the rising demand for prefilled syringes, pediatric formulations, and laboratory-scale applications. Smaller-capacity vials provide precision dosing and reduce drug wastage, meeting the needs of personalized medicine and small-volume injectable therapies.

- By Drug Type

On the basis of drug type, the Europe Pharmaceutical Vials Market is segmented into injectable and non-injectable. The injectable segment dominated the market with a revenue share of 78.4% in 2025, driven by the growing prevalence of vaccines, biologics, and parenteral therapies requiring sterile, high-quality containment. Injectable vials ensure accurate dosing, maintain sterility, and are compatible with automated filling systems, making them essential in hospitals and pharmaceutical manufacturing.

The non-injectable segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by rising demand for oral solutions, diagnostic reagents, and specialty formulations requiring secure and standardized packaging. Advances in plastic vials and caps for non-injectable drugs are supporting faster adoption in emerging pharmaceutical sectors.

- By Application: Oral, Nasal, Injectable, and Others

On the basis of application, the Europe Pharmaceutical Vials Market is segmented into oral, nasal, injectable, and others. The injectable segment dominated the market with a revenue share of 80.2% in 2025, driven by the rapid adoption of vaccines, biologics, and other parenteral therapies requiring sterile containment. Injectable vials provide critical features such as drug stability, sterility, and compatibility with automated filling systems.

The oral segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by growing demand for liquid oral medications, pediatric solutions, and ready-to-use formulations. Standardized oral vial designs enhance convenience for dispensing, ensure accurate dosing, and improve patient compliance, especially in hospital and home care settings.

- By End-User

On the basis of end-user, the Europe Pharmaceutical Vials Market is segmented into pharmaceutical companies, biopharmaceutical companies, contract development and manufacturing organizations (CDMOs), compound pharmacies, and others. The pharmaceutical companies segment dominated the market with a revenue share of 54.6% in 2025, driven by high-volume production of injectable drugs, vaccines, and oral formulations for global distribution.

The biopharmaceutical companies segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing investments in biologics, monoclonal antibodies, and gene therapies. Biopharmaceutical firms require specialized vials with stringent quality standards, compatible with advanced filling and inspection technologies.

- By Market

On the basis of market, the Europe Pharmaceutical Vials Market is segmented into parenteral, gastro, ENT, and others. The parenteral segment dominated the market with a revenue share of 72.8% in 2025, driven by the growing production of vaccines, injectable biologics, and therapeutic drugs requiring sterile packaging. Parenteral vials provide critical features such as stability, precise dosing, and compliance with GMP standards, making them indispensable in hospitals and pharmaceutical manufacturing.

The ENT segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by rising demand for specialized nasal and ear formulations and targeted drug delivery systems. Innovations in vial design, closures, and materials are supporting growth in this niche segment.

Europe Pharmaceutical Vials Market Regional Analysis

- Germany dominated the Europe Pharmaceutical Vials Market with the largest revenue share of 34% in 2025, driven by the presence of advanced healthcare infrastructure, high pharmaceutical manufacturing capacity, and stringent regulatory standards.

- Manufacturers and healthcare providers in the region highly value the safety, chemical stability, and compliance offered by high-quality glass and polymer vials, ensuring secure storage and delivery of injectable drugs, vaccines, and biologics.

- This widespread adoption is further supported by strong investments in pharmaceutical R&D, the concentration of key market players, and the rising demand for sterile and prefilled vial solutions, establishing pharmaceutical vials as an essential component of drug formulation, packaging, and distribution across hospitals, pharmacies, and research institutions in Europe.

Germany Pharmaceutical Vials Market Insight

The Germany pharmaceutical vials market captured a significant revenue share in 2025, driven by the country’s robust pharmaceutical and biotech industries, advanced healthcare infrastructure, and stringent regulatory standards. Manufacturers and healthcare providers highly prioritize vial safety, chemical stability, and regulatory compliance for injectable drugs, vaccines, and biologics. The adoption of automated filling, inspection, and packaging systems is fostering efficiency and high-quality production. Furthermore, rising investments in R&D and the demand for sterile, prefilled vial solutions in hospitals, clinics, and research facilities continue to propel market growth.

France Pharmaceutical Vials Market Insight

The France pharmaceutical vials market is projected to expand at a strong CAGR during the forecast period, primarily driven by the growing biopharmaceutical sector and the increasing production of injectable drugs and vaccines. French manufacturers emphasize regulatory-compliant vial quality, chemical resistance, and sterility, ensuring safe drug delivery. Increasing government initiatives supporting vaccine production and growing adoption of prefilled and multi-dose vials in healthcare and clinical research applications are further fueling market growth.

U.K. Pharmaceutical Vials Market Insight

The U.K. pharmaceutical vials market is expected to grow at a notable CAGR during the forecast period, fueled by the country’s strong pharmaceutical manufacturing ecosystem, increasing demand for injectable therapies, and rising healthcare expenditure. The adoption of innovative vial designs and advanced materials such as Type I glass ensures drug stability and compliance with GMP standards. Hospitals, clinics, and research institutions are increasingly using prefilled and sterile vials, boosting market expansion across both residential and commercial pharmaceutical sectors.

Netherlands Pharmaceutical Vials Market Insight

The Netherlands pharmaceutical vials market is anticipated to grow steadily, supported by the country’s strategic location, advanced logistics infrastructure, and growing pharmaceutical manufacturing capabilities. Manufacturers and healthcare providers prioritize high-quality vials for sterility, chemical stability, and compliance, particularly in vaccine and biologics production. Increasing adoption of automated vial filling, inspection, and packaging systems, combined with R&D collaborations between local and international companies, continues to drive market growth.

Switzerland Pharmaceutical Vials Market Insight

The Switzerland pharmaceutical vials market holds a significant position in Europe, supported by the country’s globally recognized pharmaceutical and biotech industry, advanced healthcare systems, and high-quality manufacturing standards. Swiss pharmaceutical companies and hospitals prioritize chemically stable, sterile, and GMP-compliant vials for high-value injectable drugs, vaccines, and biologics. Strong investments in research and development, technological innovation in vial production, and strategic partnerships with global market players are key factors fueling market growth in Switzerland.

Europe Pharmaceutical Vials Market Share

The Pharmaceutical Vials industry is primarily led by well-established companies, including:

• Gerresheimer AG (Germany)

• SCHOTT AG (Germany)

• Stevanato Group (Italy)

• Vetter Pharma-Fertigung GmbH & Co. KG (Germany)

• BD (Becton, Dickinson and Company) (U.S.)

• Nipro Corporation (Japan)

• Catalent, Inc. (U.S.)

• AptarGroup, Inc. (U.S.)

• Pfizer Packaging Solutions (U.S.)

• Sartorius AG (Germany)

• Ompi (SGD Pharma) (France)

• Rexam (now part of Ball Corporation) (U.K.)

• Aseptic Technologies (France)

• Alpha Pro Tech (Canada)

• Rommelag Group (Germany)

• Gerresheimer Regensburg GmbH (Germany)

• Thermo Fisher Scientific (U.S.)

• SCHOTT Kaisha Ltd. (Japan)

• Pfizer Glass & Vial Solutions (U.S.)

• Spartek Group (U.K.)

What are the Recent Developments in Europe Pharmaceutical Vials Market?

- In April 2024, Gerresheimer AG, a global leader in pharmaceutical packaging solutions, expanded its production capacity in Germany to meet the rising demand for injectable drugs and vaccines. This strategic initiative emphasizes the company’s commitment to delivering high-quality, GMP-compliant vials while supporting Europe’s growing biologics and vaccine manufacturing sector. By leveraging advanced glass and polymer vial technologies, Gerresheimer is addressing regional pharmaceutical needs and reinforcing its position in the rapidly growing Europe Pharmaceutical Vials Market.

- In March 2024, SCHOTT AG, a pioneer in specialty glass solutions, launched its new line of prefilled Type I glass vials designed for high-volume vaccine and biologics production. These vials offer enhanced chemical resistance, sterility, and compatibility with automated filling systems. The launch highlights SCHOTT’s dedication to innovation and its role in ensuring safe and efficient drug delivery in hospitals, clinics, and research facilities across Europe.

- In March 2024, Stevanato Group successfully commissioned a state-of-the-art automated vial filling and inspection line at its Italian facility. The project aims to enhance production efficiency, maintain high-quality standards, and meet the increasing demand for sterile injectable vials. This development underscores Stevanato’s commitment to technological advancement in pharmaceutical packaging, contributing to the expansion of safe and reliable drug supply chains in Europe.

- In February 2024, Vetter Pharma-Fertigung GmbH & Co. KG announced a strategic collaboration with a leading European biopharmaceutical company to supply custom-designed prefilled vials for new injectable therapies. This partnership is intended to improve operational efficiency, ensure regulatory compliance, and accelerate drug availability in the market. The initiative highlights Vetter’s dedication to innovation, quality, and meeting the evolving needs of pharmaceutical manufacturers.

- In January 2024, BD (Becton, Dickinson and Company) unveiled its new portfolio of advanced polymer and glass vials for high-value biologics and vaccines at the European Pharma Packaging Expo 2024. Equipped with improved chemical stability, sterilization compatibility, and enhanced closure systems, these vials allow safer and more efficient drug storage and delivery. The launch demonstrates BD’s commitment to integrating cutting-edge technology into pharmaceutical packaging, offering manufacturers and healthcare providers enhanced reliability and performance.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Pharmaceutical Vials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Pharmaceutical Vials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Pharmaceutical Vials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.