Europe Plant Based Eggs Market

Market Size in USD Million

CAGR :

%

USD

366.31 Million

USD

5,594.22 Million

2024

2032

USD

366.31 Million

USD

5,594.22 Million

2024

2032

| 2025 –2032 | |

| USD 366.31 Million | |

| USD 5,594.22 Million | |

|

|

|

|

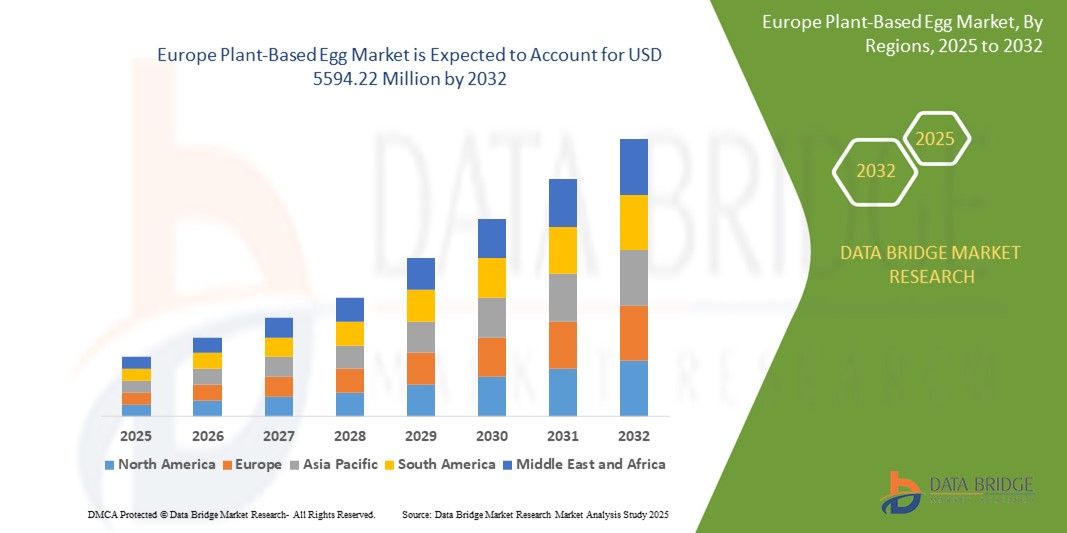

What is the Europe Plant-Based Egg Market Size and Growth Rate?

- The Europe plant-based egg market size was valued at USD 366.31 million in 2024 and is expected to reach USD 5594.22million by 2032, at a CAGR of 3.90% during the forecast period

- The plant-based egg market is growing, offering benefits such as reduced environmental impact, animal welfare, and health advantages. With versatile applications in cooking and baking, plant-based eggs cater to diverse dietary needs, appealing to vegans, vegetarians, and health-conscious consumers seeking sustainable alternatives without compromising taste or nutrition

What are the Major Takeaways of Plant-Based Egg Market?

- Government initiatives promoting sustainable food production and reducing reliance on animal agriculture can drive plant-based egg market growth. Supportive policies and regulations incentivize manufacturers to invest in alternatives, expanding their presence. This fosters innovation and accessibility, aligning with consumer preferences for sustainable, ethical, and healthier food choices

- As health consciousness rises, consumers turn to plant-based diets, seeking alternatives to animal products. Plant-based eggs, devoid of cholesterol and lower in fat, cater to this trend, appealing to individuals prioritizing health. Their nutritional profile aligns with the preferences of health-conscious consumers, driving the demand for plant-based egg market

- U.K. dominated Europe’s plant-based egg market with a 42.8% share in 2024, led by due to High consumer awareness of ethical consumption, animal welfare, and environmental sustainability is boosting demand for egg alternatives

- Germany is expected to witness the fastest growth rate in the Europe’s plant-based egg market, with a strong foundation in food technology and sustainability. A large base of vegan and environmentally conscious consumers fuels consistent demand across retail and foodservice channels

- The Full Egg segment dominated the market with the largest revenue share of 44.1% in 2024, driven by its versatility in replicating traditional eggs across various recipes including baking, cooking, and scrambling

Report Scope and Plant-Based Egg Market Segmentation

|

Attributes |

Plant-Based Egg Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Plant-Based Egg Market?

“Clean Label and AI-Driven Personalization in Plant-Based Egg Products”

- A leading trend in the plant-based egg market is the fusion of clean-label formulations with AI-based personalization, helping brands cater to health-conscious and diverse consumer needs

- For instance, Eat Just, Inc. and Simply Eggless are investing in AI and data analytics to develop products that closely mimic the texture, flavor, and cooking performance of real eggs for various dietary profiles

- Brands are using AI to predict consumer preferences based on regional dietary habits, enabling customized product recommendations and targeted marketing

- AI-driven platforms are also being explored to streamline supply chain forecasting, reduce waste, and enhance product development cycles

- Plant-based egg companies are now incorporating natural ingredients, such as mung beans, chickpea protein, and algae, while eliminating allergens and synthetic additives

- As demand for healthier and more transparent food grows, the integration of AI and clean-label standards is reshaping product innovation and consumer trust in the category

What are the Key Drivers of Plant-Based Egg Market?

- Growing awareness around animal welfare, climate change, and health risks linked to animal-based products is propelling the shift toward egg alternatives

- For instance, Follow Your Heart and Vegg are expanding their retail presence across Europe and Europe to meet demand for ethical and sustainable protein sources

- An increase in vegan, flexitarian, and allergen-free diets is supporting category growth across foodservice, retail, and online channels

- Governments in regions such as Europe and India are actively promoting plant-based nutrition through subsidies, guidelines, and innovation funds

- Food manufacturers are partnering with egg-alternative brands to formulate egg-free bakery, mayo, and pasta products, widening the commercial application of plant-based eggs

- The rise of e-commerce platforms has made it easier for niche brands to reach health-conscious consumers directly, accelerating market penetration

Which Factor is challenging the Growth of the Plant-Based Egg Market?

- High formulation and processing costs, combined with limited consumer familiarity in some regions, remain major growth obstacles

- According to FAIRR Initiative, plant-based egg production can cost 20%–40% more than conventional eggs due to R&D, scaling challenges, and premium ingredients

- Taste and texture inconsistencies across brands reduce repeat purchases and limit acceptance among traditional egg consumers

- For instance, several users on platforms such as Amazon and Reddit have shared mixed feedback about product performance in baking and frying applications

- Regulatory uncertainty over labeling (e.g., using the term "egg") also creates legal barriers in markets such as the U.S., France, and Australia

- To overcome these hurdles, companies must focus on consumer education, cost optimization, and clearer regulatory compliance to scale effectively and sustainably

How is the Plant-Based Egg Market Segmented?

The market is segmented on the basis of offerings, product type, deployment mode, and end use.

- By Type

On the basis of type, the plant-based egg market is segmented into Full Egg, White Egg, and Egg Yolk. The Full Egg segment dominated the market with the largest revenue share of 44.1% in 2024, driven by its versatility in replicating traditional eggs across various recipes including baking, cooking, and scrambling. Its widespread acceptance among vegan consumers and increasing commercial foodservice applications further reinforce its market dominance.

The White Egg segment is expected to witness the fastest CAGR during the forecast period due to its growing use in meringues, desserts, and protein-specific applications.

- By Form

On the basis of form, the market is segmented into Powder, Liquid, and Others. The Powder segment held the largest market share of 51.7% in 2024, owing to its longer shelf life, ease of storage and transportation, and high compatibility with bakery and packaged food industries.

The Liquid segment is projected to grow at the highest rate from 2025 to 2032, fueled by rising demand for ready-to-cook formats and convenience in home and commercial cooking environments.

- By Base Ingredient

On the basis of base ingredient, the market is segmented into Algal Flour, Wheat Flour, Soy Flour, Chia Seeds, Garbanzo Beans, Starch, Mung Beans, Pea, and Others. The Mung Beans segment dominated the market with a market share of 27.9% in 2024, attributed to its superior emulsification, binding, and protein content that closely mimics real egg functionality.

The Pea-based segment is expected to grow rapidly due to its hypoallergenic profile and clean-label appeal among health-conscious consumers.

- By Function

On the basis of function, the market is segmented into Partial Egg Replacement, Full Egg Replacement, Egg Wash Substitute, and Others. The Full Egg Replacement segment led the market with a dominant share of 59.6% in 2024, driven by growing veganism, environmental sustainability concerns, and the shift toward cholesterol-free alternatives.

The Egg Wash Substitute segment is projected to gain traction due to rising bakery and confectionery applications needing glossy finishes and binding agents.

- By Application

On the basis of application, the plant-based egg market is categorized into Breakfast Application, Homemade Bakery Applications, and Others. The Homemade Bakery Applications segment dominated the market with the largest revenue share of 46.3% in 2024, supported by the surge in at-home baking trends and demand for clean-label baking ingredients.

The Breakfast Application segment is projected to grow fastest, driven by product innovations in scramble mixes, omelets, and quiches replicating traditional breakfast offerings.

- By Packaging Type

On the basis of packaging type, the market is segmented into Bottles, Pouches, Tetra Packs, and Others. The Pouches segment held the largest market share of 39.5% in 2024, as they offer lightweight, eco-friendly, and cost-effective solutions ideal for both retail and institutional use.

The Tetra Packs segment is expected to witness significant growth due to their extended shelf life and easy pour functionality for liquid egg substitutes.

- By Distribution Channel

On the basis of distribution channel, the market is divided into Store-Based Retailer and Non-Store Based Retailer. The Store-Based Retailer segment dominated the market with a revenue share of 63.8% in 2024, attributed to strong consumer preference for in-person grocery shopping and the wide availability of plant-based eggs across supermarkets, hypermarkets, and health food stores.

The Non-Store Based Retailer segment (e-commerce) is anticipated to grow fastest, driven by expanding digital grocery platforms, subscription meal kits, and rising online vegan product searches.

Which Region Holds the Largest Share of the Plant-Based Egg Market?

- U.K. dominated Europe’s plant-based egg market with a 42.8% share in 2024, led by due to High consumer awareness of ethical consumption, animal welfare, and environmental sustainability is boosting demand for egg alternatives

- Retail and foodservice collaborations, including major supermarket chains and fast-food outlets, are accelerating product accessibility and adoption

- A growing number of startups and food tech incubators are investing in innovative plant-based egg products tailored for local taste preferences and baking applications

Germany Plant-Based Egg Market Insight

Germany is expected to witness the fastest growth rate in the Europe’s plant-based egg market, with a strong foundation in food technology and sustainability. A large base of vegan and environmentally conscious consumers fuels consistent demand across retail and foodservice channels. The country hosts a high concentration of plant-based food manufacturers and R&D centers, making it a hotspot for product development and launches. Government support for plant-forward food systems, climate-friendly diets, and public procurement policies is accelerating market penetration. Germany’s blend of progressive consumers, cutting-edge innovation, and proactive policy landscape positions it as a core market for plant-based egg growth in Europe.

France Plant-Based Egg Market Insight

France’s plant-based egg market is gaining steady traction, driven by culinary innovation, clean eating trends, and policy support. Rising interest in egg-free baking, natural ingredients, and flexitarian diets is fueling demand for plant-based alternatives, especially in urban centers like Paris and Lyon. Food startups are experimenting with culinary-grade egg substitutes that cater to French cuisine, especially pastries, quiches, and sauces. National strategies promoting sustainable agriculture, food innovation, and plant-based school meals are contributing to broader consumer adoption France’s emphasis on food quality and tradition is intersecting with modern dietary shifts, creating a niche but fast-evolving market for plant-based egg solutions.

Which are the Top Companies in Plant-Based Egg Market?

The plant-based egg industry is primarily led by well-established companies, including:

- Simply Eggless Inc. (U.S.)

- Follow Your Heart (U.S.)

- Nabati (Canada)

- Vegg (U.S.)

- Eat Just, Inc. (U.S.)

- Eggcitables (Canada)

- Peggs (U.S.)

- EVO Foods (India)

- ORGRAN (Australia)

- Terra Vegane (Germany)

- Vezlay Foods Private Limited (India)

- Now Foods (U.S.)

- Glanbia PLC (Ireland)

- Noblegen Inc. (Canada)

- Grupo Mantiqueira (Brazil)

- Le Papondu (France)

What are the Recent Developments in Europe Plant-Based Egg Market?

- In May 2022, Evo Foods partnered with Ginkgo Bioworks to launch animal-free egg products, aiming to meet the growing demand for plant-based alternatives. This collaboration seeks to launch protein replacements that cater to consumer tastes, aligning with the rising interest in animal-free food options

- In April 2022, Eat Just gained approval from the European Commission to launch its plant-based egg product line in Europe, bolstering the plant-based egg market's growth. Through offering versatile options such as folded, scramble, and sous egg bites, Eat Just aims to capitalize on the rising demand for plant-based alternatives in the region

- In October 2021, EVO Foods launched its plant-based liquid egg derived from legumes, with plans to expand into the U.S. market by year-end. This initiative bolstered the company's customer base and contributed to its growth trajectory

- In October 2021, Nestlé expanded its plant-based food portfolio by introducing plant-based egg alternatives, elevating the competition in the plant-based egg market. Branded as Garden Gourmet vEGGie, these products offer a nutritious and sustainable option

- In June 2020, The Veggletto Company Pty Ltd launched the Veggletto system, revolutionizing egg-alternative cooking. This breakthrough innovation propelled sales for the company, offering consumers a novel solution for incorporating egg substitutes into their culinary endeavors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Plant Based Eggs Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Plant Based Eggs Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Plant Based Eggs Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.