Europe Playing Cards And Board Games Market

Market Size in USD Billion

CAGR :

%

USD

4.85 Billion

USD

7.75 Billion

2025

2033

USD

4.85 Billion

USD

7.75 Billion

2025

2033

| 2026 –2033 | |

| USD 4.85 Billion | |

| USD 7.75 Billion | |

|

|

|

|

Europe Playing Cards and Board Games Market Size

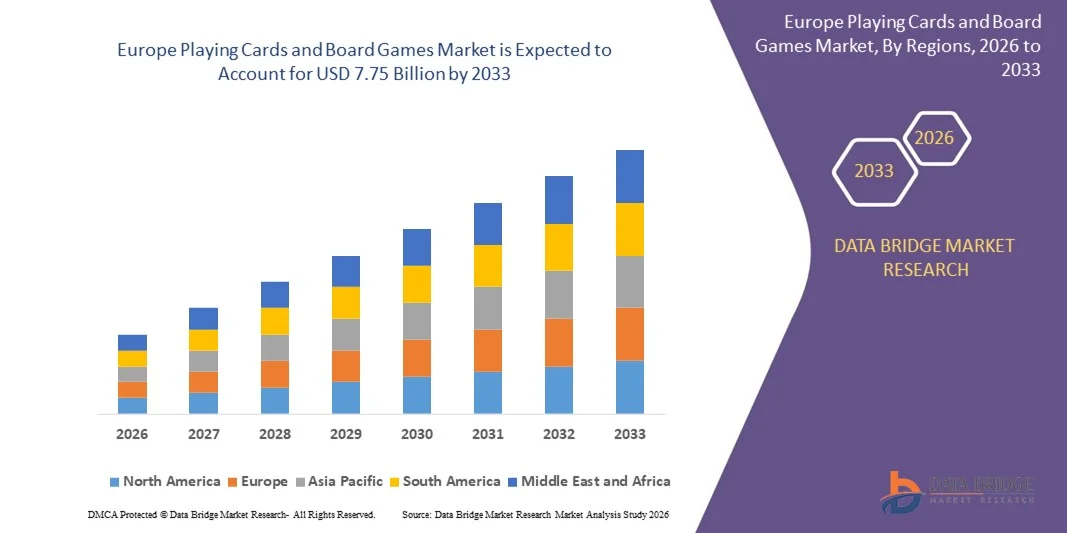

- The Europe playing cards and board games market was valued at USD 4.85 billion in 2025 and is expected to reach USD 7.75 billion by 2033

- During the forecast period of 2026 to 2033 the market is likely to grow at a CAGR of 6.1%, primarily due to rising consumer interest in tabletop entertainment, fueled by nostalgia, social gaming trends, and increasing demand for family-friendly activities. The popularity of strategy and collectible games, combined with growth in online communities and retail expansion, also drives market growth. Additionally, innovation in game design and licensing collaborations with popular media franchises further boost sales.

Europe Playing Cards and Board Games Market Analysis

- The playing cards and board games market represents a rapidly evolving segment within the broader toys, entertainment, and experiential gaming industry, accounting for a critical share of the global tabletop entertainment and social recreational segments. The market is increasingly shaped by rising consumer preference for immersive, narrative-rich gameplay, growing demand for social and family-oriented recreational activities, and the emergence of hybrid physical–digital formats that integrate mobile apps, AR/VR tools, and digital extensions.

- Growth is further driven by the proliferation of e-commerce platforms, the rise of crowdfunding models (Kickstarter, Gamefound) for indie game development, and the expansion of board game cafés, hobbyist communities, and social gaming clubs worldwide. The increasing adoption of educational & STEM-based board games, along with cognitive development-based gameplay formats, is reshaping demand particularly among parents, schools, and learning institutions.

- Innovation in modular gameplay mechanics, storyline-driven experiences, expansion packs, miniature strategy games, and collectible card formats (TCGs & CCGs) is supporting long-term engagement and repeat purchases. Additionally, digital extensions of physical games, including mobile companion apps, cloud-based multiplayer formats, and augmented/virtual reality-based mechanics, are fueling demand for interactive and hybrid gaming ecosystems.

- Key players in the playing cards and board games market are focusing on continuous innovation in game design, premium materials, and franchise-based titles to attract diverse age groups. Strategic collaborations with entertainment brands, digital influencers, and crowdfunding platforms are reshaping product development and marketing approaches. With growing consumer demand for social, family-oriented, and hobby-focused games, companies are expanding distribution across retail and e-commerce channels. As preferences shift toward immersive, thematic, and collectible formats, sustained growth will depend on creativity, strong licensing partnerships, and adapting to evolving consumer engagement trends.

- Germany is expected to dominate the playing cards and board games market with the largest revenue share of 22.32% in 2026, supported by strong consumer demand for premium board games, a well-established gaming culture, and the presence of major industry players. The country hosts significant board game events such as Spiel Essen, which drives innovation, product launches, and market visibility. High household spending on recreational activities, along with strong retail and e-commerce penetration, further positions Germany as a key leader in the European market.

Report Scope and Playing Cards and Board Games Market Segmentation

|

Attributes |

Playing Cards and Board Games Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Playing Cards and Board Games Market Trends

Subscription-Model Expansion

- The subscription-based model offers a compelling growth avenue for the global playing cards and board games market. By transitioning from traditional one-time purchases to recurring delivery of curated game experiences, manufacturers and retailers can benefit from improved customer lifetime value, predictability of demand, and deeper engagement. Subscription services facilitate discovery of new titles, reduce the risk of consumer choice overload, and allow brands to bundle exclusive or limited-edition content.

- Additionally, the model supports incremental monetisation through tiered memberships, themed boxes, and community-driven features. As e-commerce logistics and digital payments mature, subscription frameworks become more feasible across geographies and consumer segments, creating a scalable channel for the tabletop games industry to diversify revenue streams and foster brand loyalty.

- In May 2022, Gibsons (company announcement) launched a monthly jigsaw-puzzle subscription offering, demonstrating publisher-level adoption of recurring-revenue product formats in adjacent tabletop/puzzle categories.

- In October 2024, Build Game Box published a company press release announcing the launch of a monthly subscription box for game design and desktop game kits, indicating new entrant activity in curated game-box subscriptions.

- The Europe playing cards and board games market is increasingly positioned to benefit from the expansion of subscription-based models. Publisher acquisitions of digital platforms, integration of premium membership services, and the emergence of curated game-box offerings all indicate growing institutional commitment to recurring-revenue formats. These developments are reinforced by maturing digital-commerce infrastructure, rising consumer interest in curated physical experiences, and the steady adoption of hybrid physical-digital engagement models.

- As subscription ecosystems scale, they strengthen pathways for product discovery, customer retention, and portfolio monetisation. Collectively, these factors point toward a market environment that supports sustained subscription adoption, enabling industry participants to diversify revenue, stabilize demand, and enhance long-term strategic positioning within the tabletop entertainment landscape.

Europe Playing Cards and Board Games Market Dynamics

Driver

Rise in Demand for Thematic and Strategy-Based Board Games

- Demand for thematic and strategy-based board games has been observed to increase significantly, providing a substantial growth driver for the global playing cards and board games market. Consumers are increasingly seeking games that go beyond simple mechanics and offer deeper narrative engagement, strategic decision-making, and immersive thematic settings.

- These preferences reflect broader shifts in leisure-time allocation: players seek social interaction, intellectual stimulation and replay value rather than just casual or party-style formats. The growth in immersive themes (fantasy, historical, scientific), complex strategy mechanics (resource management, area control, legacy elements) and community-driven play (clubs, cafés, competitive frameworks) has broadened the addressable market and allowed game-publishers to launch premium variants and expansions with higher price-points. As a result, thematic and strategy-based titles are enhancing product differentiation, supporting longer shelf-life, and strengthening consumer loyalty in the tabletop segment.

- In April 2025, The Times reported that the board game Wingspan had seen UK sales increase by 166 % since its introduction to major retail in 2022; the article noted that its bird-watching theme and strategic gameplay had attracted adult players and younger demographics alike

- In March 2023, Yahoo Finance reported that strategy-based board games were witnessing higher demand, noting that while preschool children preferred chance-based tabletop games, adults were moving toward more strategic titles.

- The reviewed instances collectively indicate a clear and sustained shift toward deeper thematic engagement and strategic gameplay within the global board-games market. Across multiple regions and sources, rising consumer interest in narrative-rich mechanics, cooperative formats, intellectually stimulating play structures and immersive social environments has been consistently documented. This trend reflects changing leisure preferences, where players increasingly prioritize depth, replay value and meaningful interaction.

- The convergence of retail demand patterns, evolving design approaches and growing social-play ecosystems reinforces the view that thematic and strategy-based titles are becoming central to market expansion, strengthening long-term growth prospects and shaping future product-development priorities across the value chain.

Restraint/Challenge

Competitive Displacement from the Larger Digital/Video Games

- The growth of digital and video game platforms is exerting competitive pressure on the physical playing cards and board games market. As consumers allocate more leisure time and spending towards immersive digital entertainment, including mobile games, consoles, and online multiplayer experiences—the analog tabletop segment faces a displacement risk. Digital formats offer convenience, frequent content updates, subscription models, and social connectivity, which heighten competitive intensity. Consequently, manufacturers and retailers of board games and playing cards must contend with not only traditional leisure alternatives, but also a rapidly expanding digital ecosystem that weakens analog market share, increases consumer-acquisition costs, and heightens the need for differentiated positioning and hybridization of physical-digital blends.

- In August 2025, PC Gamer reported that 90 % of European gaming revenue in 2024 was generated via digital purchases, with only 10 % derived from physical boxed game sales, illustrating the dominance of digital formats in the broader gaming-entertainment ecosystem

- In January 2025, The Guardian published data showing that UK boxed-video-game sales fell by 35 % in 2024 while digital and subscription revenues grew, underscoring the migration of entertainment spend away from physical formats.

- In March 2023, a peer-reviewed study in PLOS ONE observed that video-game play time was a significant predictor of cognitive-function metrics whereas board-game play was not, suggesting higher engagement levels and longer sessions in digital formats.

- It is concluded that displacement risk from the larger digital/video game sector constitutes a significant challenge for the playing cards and board games market. The evidence demonstrates that digital gaming has achieved dominant revenue share, sustained consumer engagement and rapid innovation, thereby reducing the available leisure time and spend for physical tabletop formats. For analogue-game producers, this means increased urgency to enhance value through hybrid digital integration, augment social-play propositions, and strengthen marketing differentiation. Without such strategic adaptation, the analog segment may face slower growth, thinner margins and diminished competitive standing within an entertainment landscape increasingly dominated by digital experiences

Europe Playing Cards and Board Games Market Scope

The market is segmented on the basis of product type, age group, distribution channel, and end user.

- By Product Type

On the basis of product type, the Europe playing cards and board games market is segmented into board games, playing cards. In 2026, the board games segment is expected to dominate the market with a 72.35% market share, driven by growing consumer preference for strategy-based and cooperative gameplay, increasing popularity of family-oriented and educational board games, strong uptake of licensed and themed game titles, and the rise of board-game cafés and community gaming events that continue to boost engagement and sales regionally.

The playing cards segment is the fastest-growing in the Europe playing cards and board games market, with a CAGR of 6.3%, driven by rising popularity of collectible and themed card decks, increasing interest in casual and social card games, growing adoption of playing cards in family entertainment and travel-friendly gaming, and the expansion of online retail channels that offer wider variety and easier accessibility.

- By Age Group

On the basis of age group, the Europe playing cards and board games market is segmented into 5–12 years, above 12 years, 2–5 years, 0–2 years. In 2026, the 5–12 years segment is expected to dominate with a 45.17% market share, driven by strong demand for educational, skill-building, and interactive games; increasing parental focus on cognitive development; widespread adoption of board and card games in schools and learning centers; and the popularity of character-based and themed gaming products among children in this age group.

The above 12 years segment is the fastest-growing segment in the Europe playing cards and board games market, with a CAGR of 6.5%, driven by the increasing interest in strategy-based and complex tabletop games, rising engagement among teenagers and young adults, the growing popularity of hobby gaming communities, and the strong influence of social media, gaming events, and pop-culture trends that encourage participation in advanced board and card games.

- By Distribution Channel

On the basis of distribution channel, the Europe playing cards and board games market is segmented into offline, online. In 2026, the offline segment is expected to dominate the market with 63.58% market share, driven by the strong presence of specialty game stores, toy retailers, supermarkets, and hobby shops; consumers’ preference for in-store product evaluation; the rise of board-game cafés and experiential retail formats; and the continued popularity of physical shopping environments that allow hands-on engagement and immediate product availability.

Online is the fastest-growing segment with a CAGR of 6.5% in the Europe playing cards and board games market driven by rapid expansion of e-commerce platforms, increasing consumer preference for convenient home delivery, wider product availability compared to offline channels, frequent online discounts and promotions, and the growing influence of digital marketing and social media in shaping purchasing decisions for gaming products.

- By End User

On the basis of end user, the Europe playing cards and board games market is segmented into children's and adult. In 2026, the children’s segment is expected to dominate the market with 59.74% market share, driven by rising demand for educational and skill-enhancing games, increasing adoption of play-based learning in schools and homes, strong popularity of character-themed and licensed game titles, and the growing influence of online and offline toy retailers that actively promote children-focused board and card games.

Children's is the fastest-growing segment with CAGR of 6.2% in the Europe playing cards and board games market driven by increasing parental focus on educational and skill-building games, rising popularity of character-themed and licensed products, expanding online retail accessibility, and the growing adoption of board games as a tool for cognitive development and social interaction among young players.

Europe Playing Cards and Board Games Market – Regional Analysis

- Germany is expected to dominate the Europe playing cards and board games market with the largest revenue share of 22.11% in 2025, driven by strong consumer interest in board gaming culture, high disposable incomes, and the presence of well-established game manufacturers and retailers.

- European markets are seeing frequent launches of themed and educational board games and playing cards, attracting diverse age groups and boosting market growth.

- Countries such as Germany, the U.K., and France are leading due to high consumer adoption of board games and playing cards, strong retail and e-commerce infrastructure, and a growing culture of social and family gaming.

- The popularity of gaming conventions, tournaments, and community events in countries like Germany and France is increasing consumer engagement and driving sales across the region.

Germany Playing Cards and Board Games Market Insight

Germany holds a substantial 22.11% share in the European playing cards and board games market in 2025, reflecting its strong consumer base and long-standing gaming culture. The country’s well-established retail networks, combined with the popularity of both traditional and modern board games, contribute significantly to this market dominance. Additionally, a growing interest in family-oriented and social gaming experiences has fueled consistent demand.

Innovation in game design and localization also plays a key role in Germany’s market strength. Local game developers and international companies cater to German consumers with diverse and high-quality offerings, ranging from classic card games to strategy board games. Furthermore, participation in gaming events, conventions, and online communities helps sustain engagement and reinforces Germany’s leadership position within the European market.

U.K. Playing Cards and Board Games Market Insight

The U.K. accounted for the second-largest share of the Europe playing cards and board games market at 18.05% in 2025, supported by a strong culture of tabletop gaming and widespread consumer engagement. The popularity of family-friendly games, strategy board games, and collectible card games has driven consistent demand across the country. Retail availability through both physical stores and online platforms further strengthens market penetration.

Additionally, the U.K. benefits from active participation in gaming communities, tournaments, and conventions, which helps sustain interest and introduce new products to consumers. Local game developers and international brands alike cater to British preferences with innovative game designs and licensed content, reinforcing the U.K.’s prominent position in the European market.

France Playing Cards and Board Games Market Insight

France is emerging as one of the fastest-growing markets for playing cards and board games in Europe, fueled by increasing consumer interest in social and family-oriented entertainment. A rise in board game cafés, gaming events, and community gatherings has helped popularize both traditional and modern games, driving steady market growth.

The expansion of e-commerce platforms and the availability of diverse game offerings—from strategy and educational games to collectible card games, also contribute to France’s market momentum. Additionally, collaborations between local designers and international publishers are introducing innovative and culturally relevant games, further boosting consumer engagement and solidifying France’s position as a dynamic growth market.

The Major Market Leaders Operating in the Market Are:

- Mattel, Inc. (U.S.)

- Hasbro, Inc. (U.S.)

- Asmodee Group (France/Sweden)

- Spin Master Corp. (Canada)

- Cartamundi Group (Belgium)

- Buffalo Games, Inc. (U.S.)

- CMON Limited (Singapore)

- Czech Games Edition (CGE) (Czech Republic)

- Goliath Games — (Netherlands)

- HABA USA — (U.S.)

- Hicreate Games (China)

Latest Developments in Europe Playing Cards and Board Games Market

- In September, 2025, Hasbro and Disney Consumer Products announced an expanded collaboration bringing PLAY-DOH together with iconic Disney storytelling through new sensory-focused, compound-led playsets. The debut collection features Disney Jr.’s Mickey Mouse Clubhouse with multiple on-the-go playsets now available on Amazon and broader retail availability coming in January 2026. This collaboration is expected to strengthen Hasbro’s preschool portfolio and drive long-term brand growth through expanded licensing opportunities and broader consumer reach.

- In July 2025, Hasbro announced new multi-year licensing partnerships with Aristocrat Technologies, Evolution, Galaxy Gaming, and Bally’s to expand its popular brands, including MONOPOLY, YAHTZEE, and BATTLESHIP, into the casino gaming sector. These partnerships aim to bring Hasbro’s iconic IP to land-based slots, online slots, table games, and online casinos for adult audiences. The new titles are set to launch in January 2026, reflecting Hasbro’s “Playing to Win” strategy of innovation and brand expansion. This move is expected to generate new revenue streams and strengthen Hasbro’s presence in the growing adult gaming market.

- In January 2025, Addo Play signed a multi-year global licensing agreement with Spin Master to revitalize the iconic Meccano brand, designing and manufacturing a new range of playsets, junior products, and STEM-focused collaborations. The partnership aims to reposition Meccano in global markets and reintroduce it in the UK through over 1,200 retail outlets, strengthening the brand’s presence and growth potential.

- In September 2024, Spin Master announced new consumer product licensing agreements for Unicorn Academy following the greenlight for Season Two on Netflix, including deals with Sony Music, Panini, Make it Real, Ravensburger, and VTech, along with new international licensing agents to expand the franchise globally. These initiatives are expected to strengthen the brand’s market presence and drive revenue growth for the company.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE PLAYING CARDS AND BOARD GAMES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPETITIVE INSIGHTS

4.1.1 MARKET STRUCTURE AND ROLES

4.1.2 MANUFACTURING CAPACITY AND SCALE ADVANTAGES

4.1.3 PRODUCT, IP, AND LICENSING STRATEGIES

4.1.4 DIGITAL, HYBRID, AND TECHNOLOGY COMPETITION

4.1.5 HOBBY PUBLISHERS, MINIATURES AND COMMUNITY ECONOMICS

4.1.6 REGIONAL MANUFACTURERS, CHINA OEMS AND SUPPLY OPTIONS

4.1.7 DISTRIBUTION CHANNELS AND GO-TO-MARKET COMPETITION

4.1.8 QUALITY, PROVENANCE, AND ANTI-COUNTERFEIT POSITIONING

4.1.9 SUSTAINABILITY, COMPLIANCE AND REGULATORY PRESSURES

4.1.10 CONSOLIDATION, FINANCING AND STRATEGIC MOVES

4.2 CONSUMERS BUYING BEHAVIOUR

4.2.1 PRICE SENSITIVITY AND VALUE CONSIDERATION

4.2.2 ROLE OF SOCIAL INFLUENCE, FAMILY ENGAGEMENT, AND GROUP

4.2.3 IMPACT OF CLIMATE AND REGIONAL CONDITIONS

4.2.4 IMPORTANCE OF BRAND TRUST AND PRODUCT RELIABILITY

4.2.5 SHIFT TOWARD THEMATIC DEPTH, AESTHETICS AND COLLECTIBILITY

4.3 SUPPLY CHAIN ANALYSIS

4.3.1 OVERVIEW

4.3.2 RAW MATERIALS

4.3.3 MANUFACTURING AND PACKAGING

4.3.4 DISTRIBUTION

4.3.5 END USERS

4.4 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.4.1 AUTOMATION, ROBOTICS & INDUSTRY 4.0 IN PRINTING, CUTTING & PACKAGING

4.4.2 ADVANCED MATERIALS & SURFACE ENGINEERING

4.4.3 DIGITAL–PHYSICAL HYBRIDIZATION (NFC, BLUETOOTH, APP INTEGRATION)

4.4.4 AUGMENTED REALITY (AR) & ARTIFICIAL INTELLIGENCE (AI) INTEGRATION

4.4.5 RAPID PROTOTYPING & SHORT-RUN CUSTOMIZATION

4.4.6 SUSTAINABILITY TECHNOLOGIES & ECO-FRIENDLY MATERIALS

4.4.7 QUALITY ASSURANCE & ANTI-COUNTERFEIT TECHNOLOGIES

4.5 VENDOR SELECTION CRITERIA

4.5.1 QUALITY AND CONSISTENCY

4.5.2 TECHNICAL EXPERTISE AND R&D SUPPORT

4.5.3 SUPPLY-CHAIN RELIABILITY AND LOGISTICS COVERAGE

4.5.4 COMPLIANCE, SAFETY, AND REGULATORY DOCUMENTATION

4.5.5 SUSTAINABILITY AND ENVIRONMENTAL CREDENTIALS

4.5.6 COST STRUCTURE, PRICING TRANSPARENCY AND TOTAL COST OF OWNERSHIP

4.5.7 FINANCIAL STABILITY AND BUSINESS CONTINUITY CAPACITY

4.5.8 FLEXIBILITY, CUSTOMIZATION, AND COLLABORATION CAPABILITIES

4.5.9 RISK MANAGEMENT, CONTINGENCY PLANNING AND TRACEABILITY

5 MARKET OVERVIEW

5.1 DRIVERS-

5.1.1 RISE IN DEMAND FOR THEMATIC AND STRATEGY-BASED BOARD GAMES

5.1.2 ONLINE COMMERCE AND DIGITAL RETAIL CHANNELS

5.1.3 GROWING INTEREST IN OFFLINE SOCIAL ENTERTAINMENT

5.1.4 HIGH-PROFILE INTELLECTUAL-PROPERTY TIE-UPS AND LICENSED PROJECTS

5.2 RESTRAINTS

5.2.1 COMPETITIVE DISPLACEMENT FROM THE LARGER DIGITAL/VIDEO GAMES

5.2.2 PRONOUNCED SEASONAL DEMAND PATTERNS, PARTICULARLY AROUND HOLIDAY PERIODS, RESULTING IN UNEVEN REVENUE CYCLES AND COMPLEX INVENTORY MANAGEMENT REQUIREMENTS

5.3 OPPORTUNITIES

5.3.1 AUGMENTED-REALITY (AR) AND MIXED-REALITY INTEGRATIONS

5.3.2 PREMIUM COLLECTOR AND LICENSED-IP PRODUCTS

5.3.3 SUBSCRIPTION-MODEL EXPANSION

5.4 CHALLENGES

5.4.1 COMPLIANCE BURDENS AND COST OF MEETING EVOLVING PACKAGING/WASTE LAWS

5.4.2 FRAGMENTATION OF CONSUMER ATTENTION

6 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

6.1 OVERVIEW

6.2 GAMES

6.3 PLAYING CARDS

6.4 EUROPE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.4.1 ASIA-PACIFIC

6.4.2 NORTH AMERICA

6.4.3 EUROPE

6.4.4 MIDDLE EAST AND AFRICA

6.4.5 SOUTH AMERICA

6.5 EUROPE PLAYING CARDS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.5.1 ASIA-PACIFIC

6.5.2 NORTH AMERICA

6.5.3 EUROPE

6.5.4 MIDDLE EAST AND AFRICA

6.5.5 SOUTH AMERICA

7 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

7.1 OVERVIEW

7.2 5–12 YEARS

7.3 ABOVE 12 YEARS

7.4 2–5 YEARS

7.4.1 0–2 YEARS

7.5 EUROPE 5–12 YEARS IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.5.1 ASIA-PACIFIC

7.5.2 NORTH AMERICA

7.5.3 EUROPE

7.5.4 MIDDLE EAST AND AFRICA

7.5.5 SOUTH AMERICA

7.6 EUROPE ABOVE 12 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.6.1 ASIA-PACIFIC

7.6.2 NORTH AMERICA

7.6.3 EUROPE

7.6.4 MIDDLE EAST AND AFRICA

7.6.5 SOUTH AMERICA

7.7 EUROPE 2–5 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.7.1 ASIA-PACIFIC

7.7.2 NORTH AMERICA

7.7.3 EUROPE

7.7.4 MIDDLE EAST AND AFRICA

7.7.5 SOUTH AMERICA

7.8 EUROPE 0–2 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.8.1 ASIA-PACIFIC

7.8.2 NORTH AMERICA

7.8.3 EUROPE

7.8.4 MIDDLE EAST AND AFRICA

7.8.5 SOUTH AMERICA

8 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 OFFLINE

8.2.1 SUPERMARKETS AND HYPERMARKETS

8.2.2 SPECIALTY STORES

8.2.3 OTHERS

8.3 ONLINE

8.3.1 3RD PARTY DISTRIBUTOR

8.3.2 COMPANY OWN WEBSITE

9 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY END USER

9.1 OVERVIEW

9.2 CHILDREN'S

9.2.1 BOY

9.2.2 GIRL

9.3 ADULT

10 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY REGION

10.1 EUROPE

10.1.1 GERMANY

10.1.2 U.K.

10.1.3 FRANCE

10.1.4 ITALY

10.1.5 SPAIN

10.1.6 RUSSIA

10.1.7 NETHERLANDS

10.1.8 BELGIUM

10.1.9 SWITZERLAND

10.1.10 TURKEY

10.1.11 LUXEMBOURG

10.1.12 REST OF EUROPE

11 EUROPE PLAYING CARDS AND BOARD GAMES MARKET: COMPANY LANDSCAPE

11.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

12 COMPANY PROFILES

12.1 MATTEL

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 HASBRO

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 ASMODEE NORDICS

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 SPIN MASTER

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 CARTAMUNDI

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 BUFFALO GAMES

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 CMON

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 CZECH GAMES EDITION (CGE)

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 GOLIATH GAMES

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 HABA USA

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 HICREATE GAMES

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 LONGPACK GAMES

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 NECA/WIZKIDS LLC (WIZKIDS)

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 NINGBO THREE A GROUP CO., LTD.

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENT

12.15 PIATNIK

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 R&R GAMES

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 THE RAVENSBURGER GROUP

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 UNIVERSITY GAMES CORPORATION

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENT

12.19 THE OP GAMES

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENT

12.2 Z-MAN GAMES

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 2 EUROPE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 3 EUROPE PLAYING CARDS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 4 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 5 EUROPE 5–12 YEARS IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 6 EUROPE ABOVE 12 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 EUROPE 2–5 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 8 EUROPE 0–2 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 9 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 10 EUROPE OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 11 EUROPE OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 12 EUROPE ONLINE IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 EUROPE ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 14 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 15 EUROPE ONLINE IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 EUROPE CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 17 EUROPE ADULT IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 18 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 19 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 EUROPE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 EUROPE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 22 EUROPE PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 EUROPE PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 24 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 25 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 26 EUROPE OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 27 EUROPE ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 28 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 29 EUROPE CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 30 GERMANY PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 GERMANY BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 GERMANY BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 33 GERMANY PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 GERMANY PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 35 GERMANY PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 36 GERMANY PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 37 GERMANY OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 38 GERMANY ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 39 GERMANY PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 40 GERMANY CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 41 U.K. PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 U.K. BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 U.K. BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 44 U.K. PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 U.K. PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 46 U.K. PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 47 U.K. PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 48 U.K. OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 49 U.K. ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 50 U.K. PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 51 U.K. CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 52 FRANCE PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 FRANCE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 FRANCE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 55 FRANCE PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 56 FRANCE PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 57 FRANCE PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 58 FRANCE PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 59 FRANCE OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 60 FRANCE ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 61 FRANCE PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 62 FRANCE CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 63 ITALY PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 ITALY BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 ITALY BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 66 ITALY PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 ITALY PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 68 ITALY PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 69 ITALY PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 70 ITALY OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 71 ITALY ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 72 ITALY PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 73 ITALY CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 74 SPAIN PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 SPAIN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 SPAIN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 77 SPAIN PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 SPAIN PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 79 SPAIN PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 80 SPAIN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 81 SPAIN OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 82 SPAIN ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 83 SPAIN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 84 SPAIN CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 85 RUSSIA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 RUSSIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 87 RUSSIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 88 RUSSIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 RUSSIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 90 RUSSIA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 91 RUSSIA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 92 RUSSIA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 93 RUSSIA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 94 RUSSIA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 95 RUSSIA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 96 NETHERLANDS PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 NETHERLANDS BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 NETHERLANDS BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 99 NETHERLANDS PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 NETHERLANDS PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 101 NETHERLANDS PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 102 NETHERLANDS PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 103 NETHERLANDS OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 104 NETHERLANDS ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 105 NETHERLANDS PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 106 NETHERLANDS CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 107 BELGIUM PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 BELGIUM BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 BELGIUM BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 110 BELGIUM PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 BELGIUM PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 112 BELGIUM PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 113 BELGIUM PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 114 BELGIUM OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 115 BELGIUM ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 116 BELGIUM PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 117 BELGIUM CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 118 SWITZERLAND PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 SWITZERLAND BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 SWITZERLAND BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 121 SWITZERLAND PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 SWITZERLAND PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 123 SWITZERLAND PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 124 SWITZERLAND PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 125 SWITZERLAND OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 126 SWITZERLAND ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 127 SWITZERLAND PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 128 SWITZERLAND CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 129 TURKEY PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 TURKEY BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 TURKEY BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 132 TURKEY PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 TURKEY PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 134 TURKEY PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 135 TURKEY PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 136 TURKEY OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 137 TURKEY ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 138 TURKEY PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 139 TURKEY CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 140 LUXEMBOURG PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 LUXEMBOURG BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 LUXEMBOURG BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 143 LUXEMBOURG PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 LUXEMBOURG PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 145 LUXEMBOURG PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 146 LUXEMBOURG PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 147 LUXEMBOURG OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 148 LUXEMBOURG ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 149 LUXEMBOURG PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 150 LUXEMBOURG CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 151 REST OF EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 REST OF EUROPE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 EST OF EUROPE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 154 REST OF EUROPE PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 REST OF EUROPE PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 156 REST OF EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 157 REST OF EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 158 REST OF EUROPE OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 159 REST OF EUROPE ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 160 REST OF EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 161 REST OF EUROPE CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 EUROPE PLAYING CARDS AND BOARD GAMES MARKET: SEGMENTATION

FIGURE 2 EUROPE PLAYING CARDS AND BOARD GAMES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PLAYING CARDS AND BOARD GAMES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PLAYING CARDS AND BOARD GAMES MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE PLAYING CARDS AND BOARD GAMES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PLAYING CARDS AND BOARD GAMES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE PLAYING CARDS AND BOARD GAMES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE PLAYING CARDS AND BOARD GAMES MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 EXECUTIVE SUMMARY

FIGURE 10 STRATEGIC DECISIONS

FIGURE 11 TWO SEGMENTS COMPRISE THE EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL (2026)

FIGURE 12 EUROPE PLAYING CARDS AND BOARD GAMES MARKET: SEGMENTATION

FIGURE 14 INCREASING CONSUMER PREFERENCE FOR THEMATIC AND STRATEGY-FOCUSED TABLETOP GAMES EXPECTED TO DRIVE THE EUROPE PLAYING CARDS AND BOARD GAMES MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 15 OFFLINE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PLAYING CARDS AND BOARD GAMES MARKET IN 2026 & 2033

FIGURE 16 VENDOR SELECTION CRITERIA

FIGURE 17 DROC ANALYSIS

FIGURE 18 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

FIGURE 19 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

FIGURE 20 EUROPE PLAYING CARDS AND BOARD GAMES MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 21 EUROPE PLAYING CARDS AND BOARD GAMES MARKET: BY END USER, 2025

FIGURE 22 EUROPE PLAYING CARDS AND BOARD GAMES MARKET: SNAPSHOT (2025)

FIGURE 23 EUROPE PLAYING CARDS AND BOARD GAMES MARKET: COMPANY SHARE 2025(%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.