Europe Polypropylene Market

Market Size in USD Billion

CAGR :

%

USD

33.46 Billion

USD

52.00 Billion

2024

2032

USD

33.46 Billion

USD

52.00 Billion

2024

2032

| 2025 –2032 | |

| USD 33.46 Billion | |

| USD 52.00 Billion | |

|

|

|

|

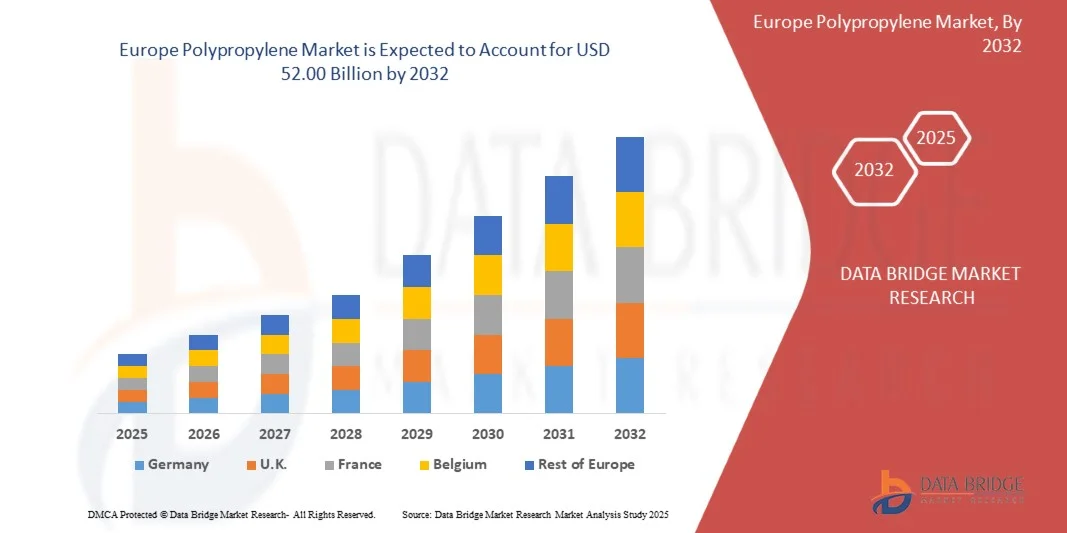

What is the Europe Polypropylene Market Size and Growth Rate?

- The Europe Polypropylene Market size was valued at USD 33.46 Billion in 2024 and is expected to reach USD 52.00 Billion by 2032, at a CAGR of 6.5% during the forecast period

- Major factors driving the market studied area unit increasing usage of plastics to scale back vehicle weight and enhance fuel economy, growing demand for versatile packaging

- The rise within the aging population, growing demand for convenient packaging, growth of the e-commerce business, the growing on-line food delivery market, and therefore the packaging of merchandise in numerous sizes and quantities area unit a number of the market conditions that have boosted the expansion of versatile packaging trade

What are the Major Takeaways of Europe Polypropylene Market?

- Development of bioplastics in conjunction with increasing use of product in automotive trade which can in addition contribute by generating huge opportunities which will result in the expansion of the polypropene market within the on top of mentioned projected timeframe

- Availability of different substitutes, terminate of single use plastics in conjunction with declining demand for automotive within the developing countries which can doubtless to act as market restraints issue for the expansion of the polypropene within the on top of mentioned projected timeframe

- Germany dominated the Europe Polypropylene Market with the largest revenue share of 54.2% in 2024, driven by the growing demand for sustainable and recyclable polypropylene across packaging, automotive, and construction applications

- The France Europe Polypropylene Market is witnessing one of the fastest growth rates of 9.8%, fueled by increasing adoption of polypropylene in packaging, medical devices, and automotive interiors. Investments in R&D, coupled with rising awareness of recyclable materials, are accelerating adoption

- The Homopolymer segment dominated the market with a revenue share of 62.4% in 2024, owing to its superior tensile strength, stiffness, and cost-effectiveness, making it highly suitable for packaging, textiles, and automotive components

Report Scope and Europe Polypropylene Market Segmentation

|

Attributes |

Polypropylene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Europe Polypropylene Market?

“Sustainability and Circular Economy Integration”

- A major and accelerating trend in the global polypropylene (PP) market is the growing emphasis on sustainability, recycling, and circular economy initiatives. Manufacturers are increasingly adopting advanced mechanical and chemical recycling methods to reduce plastic waste and promote resource efficiency

- Companies such as BASF SE and LyondellBasell Industries N.V. are leading efforts to integrate closed-loop recycling systems, producing recycled polypropylene (rPP) with properties comparable to virgin materials

- Technological advancements in chemical depolymerization and additive-enhanced recycling are improving material quality, durability, and recyclability, enabling broader applications in packaging, automotive, and consumer goods sectors

- Regulatory support, particularly in Europe and North America, is accelerating this shift, with initiatives aimed at achieving zero-waste and carbon-neutral production goals by 2030

- This trend is reshaping product design, pushing manufacturers to develop bio-based, low-carbon PP grades that meet both performance and environmental standards

- Growing consumer awareness and brand commitments toward sustainability are further propelling demand for recyclable polypropylene solutions across packaging, textiles, and automotive industries

What are the Key Drivers of Europe Polypropylene Market?

- The rising demand for lightweight and durable materials across automotive, packaging, and consumer goods sectors is a key driver of market growth, as PP offers excellent chemical resistance and flexibility at a competitive cost

- For instance, in 2024, ExxonMobil Chemical expanded its advanced polypropylene production line to cater to high-performance applications in electric vehicles and sustainable packaging

- Expanding construction and infrastructure development in emerging economies is driving the use of PP in pipes, insulation, and fittings due to its cost-effectiveness and high strength-to-weight ratio

- The shift toward bio-based and recyclable polymers aligns with global sustainability mandates, supporting long-term market expansion

- Technological innovations in polymer blending and catalyst systems are improving PP’s heat resistance and transparency, broadening its industrial applications and enhancing product value

Which Factor is Challenging the Growth of the Europe Polypropylene Market?

- Volatility in crude oil prices directly impacts polypropylene production costs, as PP is derived from propylene, a petroleum byproduct, causing fluctuations in profit margins

- Limited recycling infrastructure and contamination in post-consumer plastic waste pose major challenges to achieving large-scale circular economy targets

- Environmental regulations and restrictions on single-use plastics in regions such as the U.K. and European Union are pressuring manufacturers to innovate rapidly while ensuring compliance

- Competition from alternative sustainable materials such as biodegradable polymers and paper-based packaging is affecting market share in some sectors

- To overcome these challenges, the industry must invest in advanced recycling technologies, expand bio-based PP production, and strengthen global supply chain resilience, ensuring stable growth and sustainability in the long term

How is the Europe Polypropylene Market Segmented?

The market is segmented on the basis of type, process, chemical structure, end use, and application.

• By Type

On the basis of type, the Europe Polypropylene Market is segmented into Homopolymer and Copolymer. The Homopolymer segment dominated the market with a revenue share of 62.4% in 2024, owing to its superior tensile strength, stiffness, and cost-effectiveness, making it highly suitable for packaging, textiles, and automotive components. Homopolymers are widely preferred for applications requiring high rigidity and thermal stability.

The Copolymer segment is expected to witness the fastest CAGR of 6.8% during 2025–2032, driven by its enhanced impact resistance, flexibility, and durability. The growing use of copolymers in consumer goods, medical devices, and automotive interiors is fueling demand. Rising innovation in impact and random copolymer formulations is further expanding their industrial applicability. The shift toward tougher and more versatile polypropylene grades continues to enhance market opportunities across end-use sectors globally.

• By Process

On the basis of process, the Europe Polypropylene Market is segmented into Injection Molding, Blow Molding, Extrusion, and Others. The Injection Molding segment dominated the market with a 45.6% revenue share in 2024, attributed to its precision, repeatability, and cost-efficiency in mass-producing complex parts such as containers, caps, and automotive components.

The Blow Molding segment is projected to register the fastest CAGR of 7.2% during 2025–2032, owing to the rising demand for hollow products such as bottles, tanks, and packaging films. Extrusion remains vital for continuous product manufacturing such as films and sheets. Technological advancements in molding automation, coupled with material optimization, are enhancing throughput and quality. The growing integration of energy-efficient and high-speed processing equipment further strengthens production capabilities across industries.

• By Application

On the basis of application, the Europe Polypropylene Market is segmented into Fiber, Film and Sheet, Raffia, Foam, Tape, and Others. The Film and Sheet segment dominated the market with a 38.9% revenue share in 2024, driven by extensive use in packaging, labeling, and lamination due to excellent clarity and barrier properties.

The Fiber segment is expected to record the fastest CAGR of 7.6% from 2025 to 2032, fueled by its applications in nonwoven fabrics, geotextiles, and carpets. The rising demand for hygienic and disposable products, such as wipes and medical fabrics, is further propelling fiber-based PP growth. Technological advancements in film extrusion and coating processes are enhancing performance and recyclability, making PP films and fibers key to sustainable material innovation.

• By Chemical Structure

On the basis of chemical structure, the Europe Polypropylene Market is categorized into Isotactic, Syndiotactic, and Atactic. The Isotactic segment dominated the market with a revenue share of 71.3% in 2024, owing to its high crystallinity, mechanical strength, and suitability for industrial applications such as automotive parts and rigid packaging.

The Syndiotactic segment is projected to witness the fastest CAGR of 6.4% during 2025–2032, driven by its superior transparency, impact resistance, and flexibility. Atactic PP, although limited in use, is gaining traction in adhesives and coatings due to its tacky nature. The continued development of stereoregular catalysts is enhancing molecular control and improving product performance across polymer processing industries.

• By End Use

On the basis of end use, the Europe Polypropylene Market is segmented into Packaging, Building and Construction, Automotive, Furniture, Electrical and Electronics, Medical, Consumer Products, and Others. The Packaging segment dominated the market with a revenue share of 38.5% in 2024, driven by the high demand for flexible and rigid packaging solutions in food, beverage, and consumer goods industries.

The Automotive segment is anticipated to witness the fastest CAGR of 8.1% from 2025 to 2032, supported by lightweighting trends and the need for fuel efficiency. Polypropylene’s versatility, cost-effectiveness, and recyclability make it ideal for bumpers, interiors, and under-the-hood components. Expanding usage across medical and electrical applications further strengthens market penetration, while the shift toward sustainable and recyclable end-use solutions underlines the evolving landscape of polypropylene demand worldwide.

Which Region Holds the Largest Share of the Europe Polypropylene Market?

- Germany dominated the Europe Polypropylene Market with the largest revenue share of 54.2% in 2024, driven by the growing demand for sustainable and recyclable polypropylene across packaging, automotive, and construction applications. The country’s strong industrial base, advanced polymer processing infrastructure, and focus on circular economy initiatives further support market leadership

- Local and international manufacturers provide high-quality homopolymer and copolymer grades, while innovations in recycled polypropylene (rPP) and bio-based PP enhance material performance and environmental compliance

- Germany’s emphasis on sustainability, industrial automation, and lightweight polymer solutions positions it as a critical market driving growth in Europe’s polypropylene sector

France Europe Polypropylene Market Insight

The France Europe Polypropylene Market is witnessing one of the fastest growth rates of 9.8%, fueled by increasing adoption of polypropylene in packaging, medical devices, and automotive interiors. Investments in R&D, coupled with rising awareness of recyclable materials, are accelerating adoption. Advanced extrusion and molding techniques for sustainable PP solutions are driving growth, positioning France as a key market in Europe.

U.K. Europe Polypropylene Market Insight

The U.K. Europe Polypropylene Market is expanding at a moderate CAGR, driven by demand for lightweight, durable, and recyclable polymer solutions in construction, automotive, and consumer products. Government regulations promoting plastic recycling and sustainability, combined with growing adoption of high-performance copolymers, encourage market growth. Integration of advanced processing technologies further strengthens polypropylene applications across industries.

Italy Europe Polypropylene Market Insight

The Italy Europe Polypropylene Market is expected to grow steadily, fueled by rising usage in packaging, automotive, and consumer goods segments. Local production of high-quality PP grades and the growing emphasis on energy-efficient processing technologies enhance competitiveness. Increasing demand for eco-friendly and bio-based polypropylene solutions, along with investments in extrusion and molding technologies, drives adoption across both industrial and commercial applications in Italy.

Spain Europe Polypropylene Market Insight

The Spain Europe Polypropylene Market is projected to witness consistent growth, driven by expanding construction, packaging, and automotive sectors. Adoption of sustainable polypropylene solutions, including recycled and additive-enhanced grades, is increasing due to regulatory support and growing consumer demand for environmentally friendly products. Advanced polymer processing infrastructure and investments in high-performance PP products are further strengthening market presence in Spain.

Which are the Top Companies in Europe Polypropylene Market?

The polypropylene industry is primarily led by well-established companies, including:

- Harima Chemicals Group, Inc. (Japan)

- BASF SE (Germany)

- Resinall Corp (U.S.)

- Ingevity (U.S.)

- OMNOVA Solutions Inc (U.S.)

- Arakawa Chemical Industries Ltd. (Japan)

- KRATON CORPORATION (U.S.)

- Arkema (France)

- Evonik Industries AG (Germany)

- Gellner Industrial LLC (U.S.)

- Shenghong Chemical (China)

- Meilida Pigment Industry Co., Ltd. (China)

- MHM Holding Beteiligungs GmbH (Germany)

- Advanced Micro Polymers Inc. (U.S.)

- Mitsubishi Chemical Corporation (Japan)

- Eastman Chemical Company (U.S.)

- DSM (Netherlands)

- Specialty Polymers, Inc (U.S.)

- The Lubrizol Corporation (U.S.)

- Indulor (Germany)

- DIC CORPORATION (Japan)

- Flint Group (Switzerland)

What are the Recent Developments in Europe Polypropylene Market?

- In March 2025, LyondellBasell launched Pro-fax EP649U, a polypropylene impact copolymer specifically developed for rigid packaging applications. Engineered for thin-walled injection molding, it features high flow, rapid crystallization, and enhanced organoleptic properties. The product is available under the CirculenRenew and CirculenRevive portfolios, supporting sustainability objectives. This launch underscores the growing focus on eco-friendly, high-performance polypropylene solutions in packaging industries

- In February 2025, Polyvel introduced a novel additive for nonwoven polypropylene products, designed to improve cost-efficiency. By enabling the use of widely available PP resins, the additive reduces dependence on specialized meltblown grades, lowers production costs, and increases supply chain flexibility. This innovation highlights the industry's push toward more economical and scalable polypropylene manufacturing processes

- In November 2024, Copper Standard expanded its portfolio with the FlexiCore Thermoplastic Body Seal, a lightweight, fully recyclable alternative to conventional metal carrier doorframe seals for vehicles. The product maintains performance while reducing material weight and enhancing sustainability. This development reflects the automotive sector’s shift toward eco-friendly polymer-based components

- In September 2024, Dangote Refinery announced plans to commence propylene production by October 2024, significantly reducing Nigeria’s reliance on imported polypropylene. The initiative is expected to enhance domestic supply and support local polymer-based industries. This marks a strategic step toward strengthening Nigeria’s polypropylene self-sufficiency

- In March 2024, GEKA introduced the first formulation-compliant post-consumer recycled polypropylene (PCR-PP) for primary cosmetic packaging, containing at least 95% recycled content. The material delivers virgin-such as color brilliance, reduces CO₂ emissions by 75%, is odorless, and compatible with existing manufacturing processes. This launch highlights the growing adoption of sustainable, high-quality recycled polypropylene in consumer goods packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Polypropylene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Polypropylene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Polypropylene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.