Europe Probe Card Market

Market Size in USD Million

CAGR :

%

USD

324.59 Million

USD

711.11 Million

2024

2032

USD

324.59 Million

USD

711.11 Million

2024

2032

| 2025 –2032 | |

| USD 324.59 Million | |

| USD 711.11 Million | |

|

|

|

|

Europe Probe Card Market Size

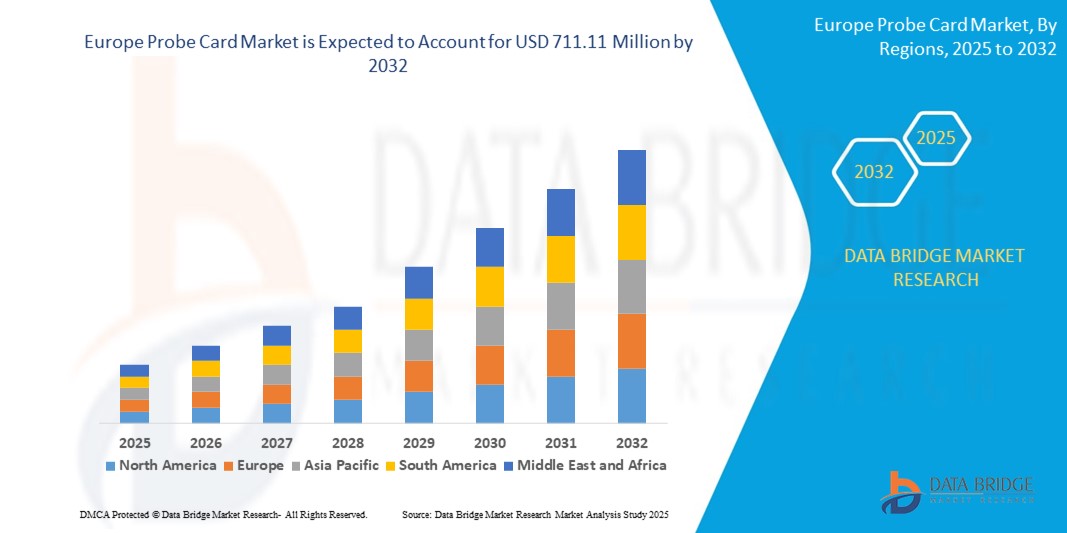

- The Europe probe card market size was valued at USD 324.59 million in 2024 and is expected to reach USD 711.11 million by 2032, at a CAGR of 10.30% during the forecast period

- The market growth is largely fueled by the rising demand for semiconductor miniaturization and the growing adoption of advanced packaging technologies across Europe. As electronic devices become smaller and more complex, manufacturers increasingly rely on high-precision testing tools such as probe cards to ensure chip quality and functionality during wafer testing. This technological trend is driving consistent demand from integrated device manufacturers (IDMs) and outsourced semiconductor assembly and test (OSAT) service providers across the region

- Furthermore, the increasing focus on electric vehicles (EVs), 5G infrastructure, and AI-based devices is establishing probe cards as a critical component in ensuring performance reliability of next-generation semiconductors. These converging factors—alongside expanding chip fabrication activities in countries such as Germany, the Netherlands, and France—are accelerating the uptake of Europe Probe Card solutions, thereby significantly boosting the industry's growth

Europe Probe Card Market Analysis

- Probe cards, crucial components in semiconductor testing, are witnessing increased adoption across Europe due to rising demand for advanced electronics, 5G technology expansion, and the growing complexity of integrated circuits (ICs). As chip geometries shrink and packaging densities increase, the need for highly precise, durable, and efficient probe cards is accelerating

- The growing demand for advanced probe card technologies in Europe is driven by increasing investments in semiconductor R&D, rising consumer electronics penetration, and the region’s push toward digital transformation and electric mobility. Leading foundries and integrated device manufacturers (IDMs) in the region are adopting MEMS and vertical probe cards to support high-volume wafer-level testing

- Germany dominated the Europe probe card market with the largest revenue share of 28.7% in 2024, supported by its strong semiconductor manufacturing base, robust automotive electronics industry, and advanced infrastructure for testing and metrology. Germany’s strategic focus on microelectronics through initiatives such as IPCEI (Important Project of Common European Interest) further strengthens its leadership in the probe card sector

- France is projected to witness the highest CAGR in the Europe Probe Card market during the forecast period. This growth is fueled by increasing government support for chip fabrication and research activities, growing start-up ecosystem in electronics, and strategic collaborations with international semiconductor players. France’s investments in domestic chip manufacturing under the European Chips Act are also a key growth catalyst

- The more than 12 inches segment dominated the Europe probe card market with a share of 68.1% in 2024, reflecting the industry shift toward larger wafers such as 300 mm

Report Scope and Europe Probe Card Market Segmentation

|

Attributes |

Europe Probe Card Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Probe Card Market Trends

Advancing Semiconductor Testing for AI and 5G Applications

- A major trend in the Europe probe card market is the increasing integration of probe card technologies with high-performance semiconductor testing for AI, 5G, and advanced computing. As European industries prioritize digital sovereignty and advanced electronics production, the demand for high-density, fine-pitch probe cards is accelerating

- Manufacturers are shifting focus toward MEMS-based probe cards, which offer higher precision, repeatability, and performance in testing chips with complex architectures. This trend aligns with the European Union’s emphasis on developing an independent and resilient semiconductor ecosystem

- For instance, growing investment in fabs and test facilities across Germany and France is encouraging partnerships with probe card companies for logic, memory, and advanced packaging testing

- Technological innovation is also driving automation-compatible probe cards, designed for integration with wafer-level test platforms, enabling faster throughput and reduced error margins during testing

- Sustainability is emerging as a differentiator, with probe card companies exploring recyclable materials and low-power solutions to align with EU Green Deal objectives

- The continued miniaturization of devices and demand for below 5nm chip testing is pushing suppliers to adopt advanced head configurations, finer beam sizes, and hybrid materials in probe card design, supporting future-ready semiconductor testing infrastructure in Europe

Europe Probe Card Market Dynamics

Driver

Growing Demand Due to Expansion of Semiconductor and Electronics Industry in Europe

- The increasing reliance on consumer electronics, automotive chips, and high-performance computing in Europe is fueling the demand for advanced probe cards used in semiconductor wafer testing

- For instance, the European Chips Act and recent investments by global semiconductor manufacturers in Germany and France are accelerating the need for high-precision probe card solutions to support chip manufacturing, logic testing, and memory validation

- As electronic components become smaller and more complex, industries are seeking high-density, fine-pitch probe cards for accurate testing and minimal signal loss during wafer probing

- In addition, the growing use of WLCSP (wafer-level chip-scale packaging) in European electronics manufacturing is increasing the need for probe cards with enhanced accuracy, contact durability, and performance in high-throughput testing environments

- Continuous advancements in 5G, AI, IoT, and automotive semiconductors are also creating new opportunities for probe card vendors specializing in customized or MEMS-based designs, catering to the evolving complexity of integrated circuits

Restraint/Challenge

High Customization Costs and Limited Local Manufacturing Infrastructure

- The Europe Probe Card Market faces challenges related to the high cost of custom-designed probe cards, which are often required for specialized chip architectures, leading to long lead times and procurement delays

- Many European fabs still depend on imports from the U.S. and East Asia for high-end probe card components, which increases costs and can result in supply chain bottlenecks, especially during global semiconductor shortages

- Moreover, probe cards require frequent maintenance or replacement due to wear, especially in high-volume testing setups, adding to operational expenses

- The lack of regionally distributed testing service providers and manufacturing facilities further limits the availability of affordable, rapid-response probe card solutions in certain parts of Europe

- To address these issues, investments in local manufacturing hubs, public–private partnerships, and standardization of probe card technologies across test platforms will be essential for improving efficiency and cost-effectiveness in the region

Europe Probe Card Market Scope

The market is segmented on the basis of probe type, manufacturing technology type, wafer size, head size, test type, material, application, beam size, and end-use.

- By Probe Type

On the basis of probe type, the Europe probe card market is segmented into advanced probe card and standard probe card. The advanced probe card segment held the largest revenue share of 61.4% in 2024, owing to its precision and suitability for complex IC testing.

The standard probe card segment is projected to grow at a CAGR of 16.2% from 2025 to 2032, supported by demand for cost-effective solutions in traditional wafer testing.

- By Manufacturing Technology Type

On the basis of manufacturing technology, the Europe probe card market is segmented into MEMS, vertical, cantilever, epoxy, blade, and others. The MEMS segment accounted for the largest share of 32.7% in 2024, driven by enhanced scalability and fine-pitch capabilities.

The cantilever segment is projected to expand at a CAGR of 15.8% from 2025 to 2032, due to its robustness and affordability in low-frequency applications.

- By Wafer Size

On the basis of wafer size, the Europe probe card market is segmented into more than 12 inches and less than 12 inches. The more than 12 inches segment held the dominant share of 68.1% in 2024, reflecting the industry shift toward larger wafers such as 300 mm.

The less than 12 inches segment is expected to grow at a CAGR of 14.3% from 2025 to 2032, supported by legacy chip applications.

- By Head Size

On the basis of head size, the Europe probe card market is segmented into more than 40mm x 40mm and less than 40mm x 40mm. The more than 40mm x 40mm segment captured 57.5% of the market share in 2024, driven by high-volume, high-pin-count testing requirements.

The less than 40mm x 40mm segment is projected to grow at a CAGR of 13.7% from 2025 to 2032, fueled by increased adoption in compact device testing.

- By Test Type

On the basis of test type, the Europe probe card market is segmented into DC test, functional test, and AC test. The DC test segment led the market with 49.6% share in 2024, given its fundamental role in wafer-level defect detection.

The functional test segment is expected to register the fastest CAGR of 19.6% from 2025 to 2032, as semiconductor devices become more complex.

- By Material

On the basis of material, the Europe probe card market is segmented into tungsten, copper, clad laminated (CCL), aluminium, and others. Tungsten held the largest share of 38.2% in 2024, due to its high durability and conductivity.

Copper is projected to grow at a CAGR of 17.1% from 2025 to 2032, benefiting from cost efficiency and advancements in copper-compatible probe designs.

- By Application

On the basis of application, the Europe probe card market is segmented into WLCSP, SIP, mixed signal, flip chip, and analog. The WLCSP segment held the highest market share of 30.4% in 2024, supported by increased usage in smartphones and compact consumer electronics.

The flip chip segment is forecasted to grow at the fastest CAGR of 20.8% from 2025 to 2032, aligned with demand for high-performance computing and AI chips.

- By Beam Size

On the basis of beam size, the Europe probe card market is segmented into more than 1.5 mil and less than 1.5 mil. The more than 1.5 mil segment held 59.1% market share in 2024, primarily used for robust and standard wafer testing.

The less than 1.5 mil segment is expected to grow at a CAGR of 18.4% from 2025 to 2032, favored for miniaturized device testing and fine-pitch applications.

- By End-Use

On the basis of end-use, the Europe probe card market is segmented into foundry, parametric, logic and memory device, DRAM, CMOS image sensor (CIS), flash, and others. The foundry segment led with 34.9% market share in 2024, owing to the dominance of fabless manufacturing models and outsourced semiconductor assembly and testing (OSAT).

The logic and memory device segment is anticipated to grow at the highest CAGR of 19.2% from 2025 to 2032, driven by rapid adoption in AI, automotive, and cloud computing applications.

Europe Probe Card Market Regional Analysis

- Europe dominated the global probe card market with the largest revenue share of 31.25% in 2024, driven by strong semiconductor manufacturing capabilities, a robust presence of foundries and logic device producers, and increasing adoption of advanced IC testing technologies

- The region’s leadership is further supported by growing R&D investments, government-backed digital infrastructure projects, and expanding demand for consumer electronics and automotive semiconductors, particularly in Germany and France

- In addition, Europe’s focus on precision engineering and the integration of MEMS-based and vertical probe cards for high-frequency and high-density testing has propelled the market forward

Germany Probe Card Market Insight

The Germany probe card market accounted for the largest revenue share of 28.7% in 2024 within Europe, attributed to its highly advanced semiconductor industry, strong presence of memory and logic device manufacturers, and world-class engineering capabilities. Germany’s emphasis on automotive electronics, IoT devices, and AI-driven chips has increased the need for high-performance probe cards, especially in parametric and functional testing segments.

France Probe Card Market Insight

The France probe card market captured a 14.3% revenue share in 2024, driven by growing investments in semiconductor testing infrastructure and academic-industry collaborations. France is focusing on scaling up its domestic semiconductor ecosystem under the EU Chips Act, further boosting the demand for MEMS and cantilever probe cards in research and industrial production environments.

U.K. Probe Card Market Insight

The U.K. probe card market held a revenue share of 13.7% in 2024 and is projected to grow at a notable CAGR through 2032. The growth is primarily supported by expanding applications in telecommunications, aerospace, and AI technologies. The U.K.’s emerging fabless design sector and increasing reliance on wafer-level chip-scale packaging (WLCSP) are driving the need for advanced vertical and blade probe cards.

Netherlands Probe Card Market Insight

The Netherlands probe card market accounted for a 6.1% share of the European market in 2024, owing to its strategic importance in the global semiconductor supply chain. The country’s leadership in photolithography and partnerships with major players such as ASML and NXP Semiconductors support robust growth in demand for high-density testing solutions, particularly in analog and mixed-signal IC applications.

Europe Probe Card Market Share

The Europe probe card industry is primarily led by well-established companies, including:

- FormFactor (U.S.)

- FEINMETALL GmbH (Germany)

- TSE Co, Ltd. (South Korea)

- STAr Technologies Inc. (Taiwan)

- MICRONICS JAPAN CO., LTD. (Japan)

- Translarity (U.S.)

- Korea Instrument Co., Ltd. (South Korea)

- MPI Corporation (Taiwan)

- Onto Innovation (U.S.)

- JAPAN ELECTRONIC MATERIALS CORPORATION (Japan)

- WinWay Tech. Co., Ltd. (Taiwan)

- Technoprobe S.p.A. (Italy)

- WILLTECHNOLOGY (Alabama)

- Wentworth Labs (U.S.)

- htt high tech trade GmbH (Germany)

- SV Probe (U.S.)

Latest Developments in Europe Probe Card Market

- In May 2025, researchers published a landmark clinical study in Nature showing that gamified, closed-loop probe card testing (a miniaturized implant) significantly improved arm and hand recovery in individuals with chronic cervical spinal cord injury (SCI). After 12 weeks of therapy combining motion-sensor feedback and vagus nerve probe card stimulation, patients showed meaningful functional gains compared to sham controls, marking a major advance in rehabilitation tech

- In September 2024, Synergia Medical reported successful implantation of its NAO.VNS system in the first two patients of the AURORA study, enabling stimulation therapy and full MRI compatibility shortly after implanting. These early cases paved the way for larger studies across Europe, positioning the technology at the forefront of next-gen probe card platforms

- In March 2024, a closed-loop, EMG-triggered taVNS protocol integrated with motion rehabilitation for stroke patients was proposed in a randomized clinical trial design. While not yet published with outcomes, this protocol signifies increasing interest in real-time physiological sync with probe card–based stimulation in rehabilitation contexts across Europe and China

- In December 2021, FormFactor inaugurated a California-based manufacturing facility, aimed at enhancing production capacity for semiconductor wafer probe cards. This strategic move addresses the growing demand from customers, enabling FormFactor to meet requirements effectively. The expansion contributes to a diversified market offering, with a broader range of products incorporating significant features

- In April 2021, FEINMETALL GmbH introduced a novel wafer probe card featuring a spring contact probe as its contact element. Responding to market demands, the product boasts unique characteristics, including independently spring-loaded chips and probes, coupled with a specialized tip style. This innovation met market requirements and enriched the industry with advanced probe card options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Probe Card Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Probe Card Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Probe Card Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.