Europe Propionic Acid And Derivatives Market

Market Size in USD Million

CAGR :

%

USD

609.56 Million

USD

921.39 Million

2024

2032

USD

609.56 Million

USD

921.39 Million

2024

2032

| 2025 –2032 | |

| USD 609.56 Million | |

| USD 921.39 Million | |

|

|

|

|

Europe Propionic Acid and Derivatives Market Size

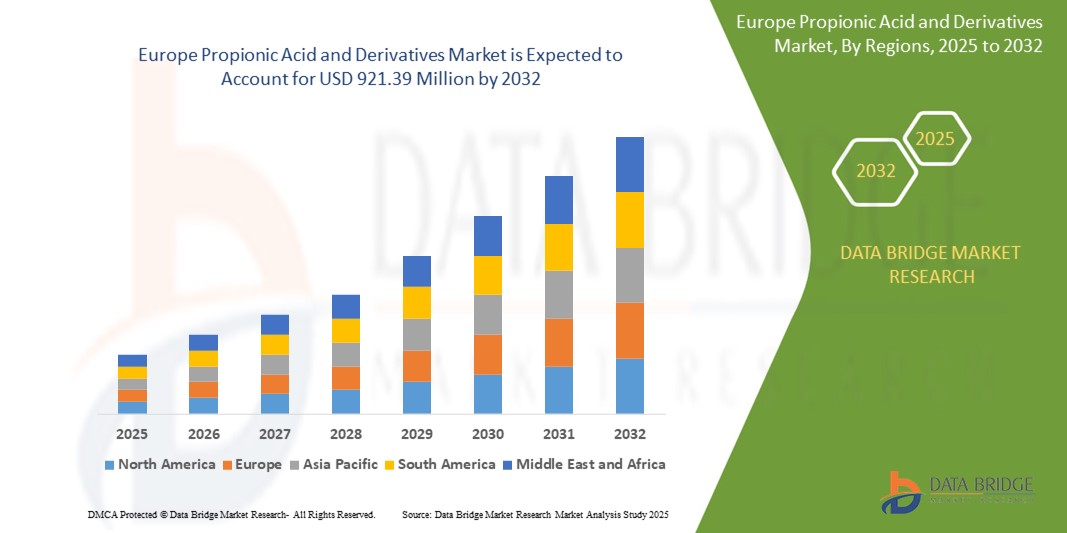

- The Europe propionic acid and derivatives market size was valued at USD 609.56 million in 2024 and is expected to reach USD 921.39 million by 2032, at a CAGR of 5.30% during the forecast period

- The market growth is largely fuelled by the expanding food and feed industries, growing demand for preservatives due to rising food exports, and increasing use of propionic acid as a fungicide and antibacterial agent in agricultural applications

- Rising awareness about livestock health and the role of feed preservatives in improving feed shelf-life and reducing microbial contamination is further driving regional demand

Europe Propionic Acid and Derivatives Market Analysis

- The growing focus on improving livestock health and feed efficiency, particularly in commercial poultry and dairy farming, is boosting the adoption of propionic acid derivatives such as calcium and sodium propionate across the region

- Expanding industrial applications, including use in herbicides, cellulose-based plastics, and pharmaceutical formulations, are further contributing to the market's steady growth in the region

- Germany dominated the Europe propionic acid and derivatives market, driven by its advanced food and feed manufacturing industries, strict regulatory compliance with EU food safety standards, and high adoption of preservatives in bakery, dairy, and animal nutrition sectors

- U.K. is expected to witness the highest compound annual growth rate (CAGR) in the Europe propionic acid and derivatives market due to rising demand for processed and ready-to-eat foods, increasing consumer preference for extended shelf-life products, and growing investments in domestic food security and animal health

- The propionic acid segment held the largest market revenue share in 2024, driven by its extensive use as a preservative in food and feed applications across the region. The increasing demand for shelf-life enhancement, especially in bakery and dairy products, has significantly contributed to the segment’s growth. In the feed sector, propionic acid is widely adopted to prevent mold growth and maintain nutritional value

Report Scope and Europe Propionic Acid and Derivatives Market Segmentation

|

Attributes |

Europe Propionic Acid and Derivatives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Propionic Acid and Derivatives Market Trends

“Rising Adoption of Propionic Acid in Livestock Feed to Improve Animal Health and Productivity”

- Increased demand for high-quality animal protein in Europe has led to growing use of propionic acid in animal feed to prevent microbial spoilage and maintain nutritional integrity

- Propionic acid derivatives such as calcium and sodium propionate are widely used to inhibit mold and bacterial growth, thereby enhancing feed safety and storage life

- In Germany, large commercial poultry and cattle operations are incorporating feed preservatives to ensure consistent growth performance and improve feed conversion ratios

- France is experiencing increased investments in livestock nutrition, with feed manufacturers adopting propionate-based additives to comply with EU safety regulations and improve productivity

- This trend aligns with broader EU goals aimed at strengthening sustainable meat production, improving animal health, and reducing reliance on antibiotics in feed

- For instance, in France, integrated livestock operations are using calcium propionate extensively to preserve feed quality during storage and distribution in humid environments

Europe Propionic Acid and Derivatives Market Dynamics

Driver

“Growing Processed Food Industry Fueling the Use of Propionic Acid as a Preservative”

- Rising consumption of packaged and convenience foods in Europe is significantly increasing demand for propionic acid-based preservatives, especially in bakery, dairy, and ready-to-eat meals

- Propionic acid is widely used to inhibit microbial growth and extend shelf-life in high-moisture food products such as bread, cheese, and snack items

- Europe has a well-established food manufacturing sector, where food-grade propionic acid and its derivatives play a vital role in meeting stringent safety and export standards

- Clean-label awareness is growing across the region; however, propionic acid continues to be preferred due to its low toxicity, effectiveness at minimal concentrations, and compliance with European Food Safety Authority (EFSA) guidelines

- Major food manufacturers are placing increased emphasis on reducing food waste, with shelf-life extension becoming a strategic priority for both domestic and international supply chains

- For instance, leading European bakery brands continue to use calcium and sodium propionate to preserve bread and pastry products distributed through large supermarket and export networks across the EU

Restraint/Challenge

“Regulatory Constraints and Health Concerns Regarding Synthetic Preservatives”

- Consumer demand for natural and clean-label products is rising in Europe, leading to scrutiny over the use of synthetic preservatives, including propionic acid derivatives

- Growing health awareness has prompted food producers to explore alternative natural preservatives, challenging the long-term market growth of synthetic propionates

- Regulatory bodies such as the European Food Safety Authority (EFSA) enforce strict labeling, usage limits, and safety evaluations for chemical preservatives, which can limit flexibility for food formulators

- Public perception linking synthetic preservatives with potential health risks is influencing reformulation strategies, particularly among organic and premium food producers

- Small and mid-sized European food companies are at the forefront of the shift toward clean-label and additive-free product lines, reducing dependency on synthetic preservatives in niche categories

- For instance, several organic food manufacturers in countries such as Germany and the Netherlands have begun replacing synthetic propionates with natural mold inhibitors such as vinegar and fermented plant extracts to meet rising consumer demand for natural ingredients

Europe Propionic Acid and Derivatives Market Scope

The market is segmented on the basis of product, grade, formulation type, form, type, source, application, production method, and distribution channel.

• By Product

On the basis of product, the Europe propionic acid and derivatives market is segmented into propionic acid and derivatives. The propionic acid segment held the largest market revenue share in 2024, driven by its extensive use as a preservative in food and feed applications across the region. The increasing demand for shelf-life enhancement, especially in bakery and dairy products, has significantly contributed to the segment’s growth. In the feed sector, propionic acid is widely adopted to prevent mold growth and maintain nutritional value.

The derivatives segment is expected to witness the fastest growth rate from 2025 to 2032. This growth is fueled by rising demand in the animal feed industry due to increased livestock production. The segment also benefits from broad utility in food processing and pharmaceuticals, where regulatory approval and versatility in formulations enhance adoption.

• By Grade

On the basis of grade, the Europe propionic acid and derivatives market is segmented into industrial grade/technical grade, food grade, feed grade, and pharma grade. The food grade segment dominated the market in 2024 owing to the rising consumption of packaged foods and the demand for effective preservatives in bakery, dairy, and ready-to-eat products. Its compliance with food safety regulations and effectiveness at low concentrations makes it the preferred option across food manufacturers in the region.

The feed grade segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increased livestock farming and the push for feed quality improvements. Propionic acid-based feed preservatives are increasingly used by commercial farms to improve feed shelf-life, reduce spoilage, and ensure animal health.

• By Formulation Type

On the basis of formulation type, the Europe propionic acid and derivatives market is segmented into sodium propionate, calcium propionate, and propionic acid. The calcium propionate segment held the largest share in 2024 due to its widespread use as a mold inhibitor in bread, pastries, and animal feed. Its high efficacy, low toxicity, and regulatory acceptance make it an essential ingredient for manufacturers in the region.

The sodium propionate segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising applications in cheese preservation, pharmaceuticals, and food safety compliance. Its growing preference in processed meat and dairy further enhances its regional demand.

• By Form

Based on form, the Europe propionic acid and derivatives market is divided into dry and liquid. The dry form segment dominated the market in 2024, driven by its convenience in handling, storage stability, and compatibility with dry-mix food and feed applications. Dry forms are preferred by regional feed mills and food manufacturers for bulk processing and ease of transportation.

The liquid segment is expected to witness the fastest growth rate from 2025 to 2032, as demand rises for quick-acting, easy-to-blend formulations in industrial and agricultural uses. Liquid formulations offer superior solubility, making them ideal for direct spray or injection-based systems in modern farming operations.

• By Type

On the basis of type, the Europe propionic acid and derivatives market is segmented into encapsulated and non-encapsulated. The non-encapsulated segment accounted for the highest share in 2024, due to its direct and cost-effective use in feed and food applications. Its high efficacy and immediate release mechanism make it suitable for standard preservative functions in conventional setups.

The encapsulated segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption in specialized feed formulations where targeted release and stability are prioritized. Innovations in encapsulation technologies are further enhancing performance in extreme storage conditions.

• By Source

On the basis of source, the Europe propionic acid and derivatives market is segmented into natural and synthetic. The synthetic segment led the market in 2024 due to its established production infrastructure and consistent quality output, meeting the region's industrial and food-grade needs efficiently.

The natural segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer demand for clean-label products and growing interest in bio-based preservatives in food and personal care formulations.

• By Application

On the basis of application, the Europe propionic acid and derivatives market is segmented into food and beverage, feed, pharmaceuticals, cosmetics, home and personal care, agriculture, industrial, and others. The feed segment dominated in 2024 owing to rising livestock production and the growing need for safe, long-lasting feed ingredients.

The food and beverage segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increased consumption of packaged foods and the rising demand for effective preservatives in bakery, dairy, and meat applications.

• By Production Method

On the basis of production method, the Europe propionic acid and derivatives market is segmented into chemical synthesis and fermentation process. The chemical synthesis segment accounted for the largest market share in 2024 due to its cost-effectiveness, scalability, and widespread use across industrial applications.

The fermentation process segment is expected to witness the fastest growth rate from 2025 to 2032 owing to rising demand for sustainable and bio-based chemical production. Regulatory and consumer preference for naturally derived ingredients is further driving investments in fermentation technologies.

• By Distribution Channel

On the basis of distribution channel, the Europe propionic acid and derivatives market is segmented into direct sales, distributors, and online retail. The distributors segment held the largest share in 2024, reflecting the regional dependency on established chemical and feed ingredient supply chains across countries.

The online retail segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing digitalization, ease of procurement, and the rise of e-commerce platforms catering to specialty chemical and additive buyers.

Europe Propionic Acid and Derivatives Market Regional Analysis

- Germany dominated the Europe propionic acid and derivatives market, driven by its advanced food and feed manufacturing industries, strict regulatory compliance with EU food safety standards, and high adoption of preservatives in bakery, dairy, and animal nutrition sectors

- The country’s strong livestock farming base and well-developed infrastructure for chemical production contribute to the consistent demand for propionic acid and its derivatives

- In addition, Germany’s leadership in sustainable agriculture and innovations in food preservation technology further reinforce its position as the leading market in the region

U.K. Propionic Acid and Derivatives Market Insight

The U.K. is expected to witness the fastest growth rate from 2025 to 2032, due to rising demand for processed and ready-to-eat foods, increasing consumer preference for extended shelf-life products, and growing investments in domestic food security and animal health. The U.K.’s expanding food retail sector, coupled with its focus on reducing food waste and ensuring product quality during distribution, is accelerating the adoption of calcium and sodium propionate in both food and feed applications.

Europe Propionic Acid and Derivatives Market Share

The Europe Propionic Acid and Derivatives industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Perstorp (Sweden)

- Biomin (Austria)

- Niacet (Netherlands)

- Impextraco NV (Belgium)

- Addcon GmbH (Germany)

- Kemira (Finland)

- Macco Organiques (Czech Republic)

- Chr. Hansen (Denmark)

- Volac International Ltd (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Propionic Acid And Derivatives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Propionic Acid And Derivatives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Propionic Acid And Derivatives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.