Europe Pulse Protein Market

Market Size in USD Billion

CAGR :

%

USD

4.50 Billion

USD

7.67 Billion

2025

2033

USD

4.50 Billion

USD

7.67 Billion

2025

2033

| 2026 –2033 | |

| USD 4.50 Billion | |

| USD 7.67 Billion | |

|

|

|

|

Europe Pulse Protein Market Size

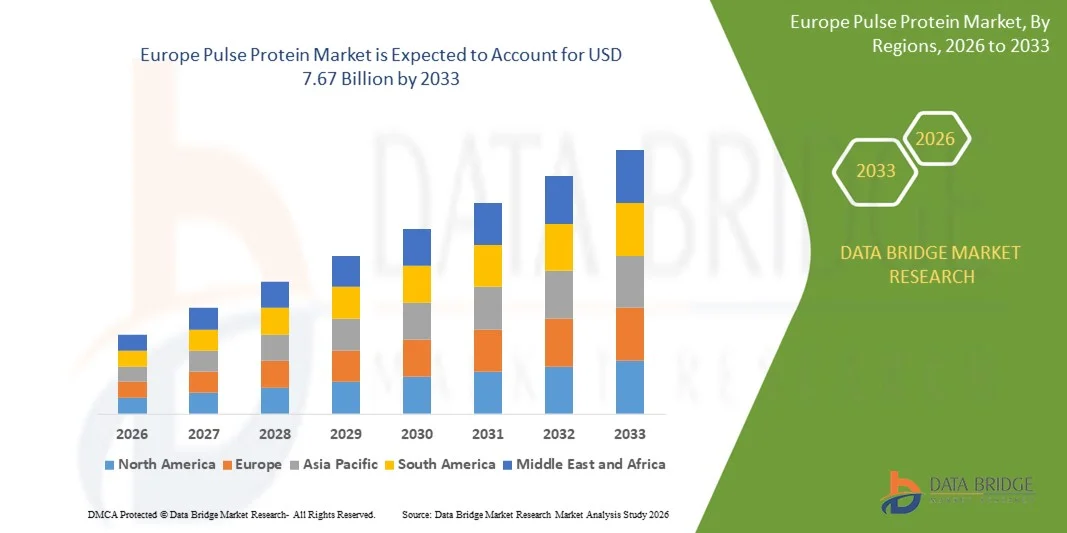

- The Europe pulse protein market size was valued at USD 4.50 billion in 2025 and is expected to reach USD 7.67 billion by 2033, at a CAGR of 6.9% during the forecast period

- The market growth is largely fueled by the rising consumer preference for plant-based and high-protein diets, driven by health awareness, increasing adoption of vegan and flexitarian lifestyles, and growing demand for functional and clean-label food products

- Furthermore, expanding applications of pulse protein in bakery, beverages, snacks, and meat alternatives are creating new revenue opportunities for food manufacturers. These converging trends are accelerating the adoption of pulse proteins, thereby significantly boosting the industry’s growth

Europe Pulse Protein Market Analysis

- Pulse protein is a plant-based ingredient extracted from pulses such as peas, chickpeas, lentils, and beans, and is used to enhance the protein content, texture, and functionality of food and beverage products. It serves as a sustainable and allergen-free alternative to animal-based proteins in various applications

- The escalating demand for pulse protein is primarily fueled by the increasing need for nutritious, plant-based, and sustainable food solutions, the expansion of the health and wellness sector, and the rising incorporation of proteins in functional and fortified foods across both developed and emerging markets

- Germany dominated the pulse protein market in 2025, due to its strong food processing industry, high consumer awareness of health and wellness, and established plant-based product innovation ecosystem

- U.K. is expected to be the fastest growing country in the pulse protein market during the forecast period due to rising emphasis on health-conscious consumption, sustainability, and regulatory compliance across the food sector

- Peas segment dominated the market with a market share of 39.4% in 2024, due to their abundant availability, high protein yield, and neutral taste that makes them suitable for multiple food applications. Pea protein is widely used in meat substitutes, sports nutrition, and dairy-free alternatives. Its lower allergenicity compared to soy and its superior functional properties, such as solubility and emulsification, make it a preferred choice among food processors. Strong adoption in beverages and plant-based meat further supports its dominance

Report Scope and Pulse Protein Market Segmentation

|

Attributes |

Pulse Protein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Pulse Protein Market Trends

Growing Demand for Plant-Based Proteins

- The pulse protein market is experiencing robust expansion as consumers shift to plant-based nutrition due to rising concerns regarding health, sustainability, and dietary ethics. Food manufacturers are leveraging pulse proteins such as pea, lentil, and chickpea to formulate meat alternatives, dairy substitutes, and protein-fortified snacks that appeal to a broad health-conscious audience

- For instance, major companies such as AGT Food and Ingredients and Ingredion have invested in developing versatile pulse protein isolates for use in plant-based burgers, protein bars, and non-dairy milk. Geographic hotspots such as Canada and Australia lead in production, supporting the global movement toward sustainable protein sourcing

- Innovations in extraction and processing are driving adoption, improving the solubility, texture, and taste of pulse proteins for use in a wide range of functional foods. Increasing vegetarian and vegan populations, as well as the flexitarian trend, are expanding the global customer base for plant-based protein applications

- Pulse proteins are promoted as being non-GMO, free from hormones and antibiotics, and environmentally friendly owing to lower resource use compared to animal proteins. Their application in nutraceuticals and specialized diet products is supporting new market entries and product launches worldwide

- The plant-based movement, together with heightened interest in clean labels and holistic nutrition, is expected to sustain the momentum of the pulse protein market. As regulatory standards around labeling and sustainability evolve, market leaders are focusing on innovation and consumer engagement to maintain growth

Europe Pulse Protein Market Dynamics

Driver

Increasing Health and Wellness Awareness Among Consumers

- Growing awareness of health and wellness among consumers is a primary driver for pulse protein demand. Pulse proteins are high in essential amino acids, fiber, vitamins, and minerals, while offering low-fat, allergen-free alternatives for individuals seeking to avoid animal products and common allergens such as dairy and soy

- For instance, Beyond Meat is promoting pea and lentil proteins in meal replacement shakes, snacks, and sports supplements to target fitness-conscious and weight-management segments in North America and Europe. Pulse protein’s heart-health and glycemic benefits are also emphasized in new product launches in Asian markets

- Nutritional research connecting pulse proteins to long-term benefits such as cholesterol reduction, diabetes prevention, and muscle recovery is expanding mainstream appeal. Clean-label marketing and the absence of additives or artificial ingredients further enhance consumer trust and drive repeat purchases

- The dietary supplement and functional food categories are witnessing rapid adoption of pulse proteins as core ingredients, supporting a broader healthy lifestyle narrative across all age groups. Increased focus on fortifying everyday foods with natural protein is accelerating market penetration

- A global pivot toward wellness-focused consumption, supported by policy initiatives, public education, and food industry reformulations, continues to reinforce the pulse protein market’s positive outlook. This ensures persistent growth prospects as more consumers integrate healthy, plant-based ingredients into daily diets

Restraint/Challenge

Fluctuating Supply Chains

- The pulse protein market faces challenges stemming from fluctuating supply chains, which impact raw material availability, input costs, and product consistency. Volatility in global pulse production, transportation disruptions, and changing trade policies exert unpredictable influences on producers and brands

- For instance, Cargill experienced input price instability and occasional shortages for processors and food manufacturers due to trade tensions and tariffs on split peas and other pulse commodities in key export markets such as North America, Europe, and Australia

- Weather-related crop failures and regional agricultural obstacles, particularly in India and Australia, contribute to uneven supplies and consequences for global market prices. Manufacturers are forced to diversify suppliers, invest in storage, or pass costs along to consumers, challenging affordability and reliability in finished products

- Quality variations and differences in processing technology can further disrupt supply chain uniformity, affecting product functionality and customer satisfaction. Ongoing sustainability and regulatory shifts, especially regarding labeling and food safety, require continued supplier adaptation

- In conclusion, fluctuating supply chains remain a critical challenge for the pulse protein sector. Continued investment in resilient sourcing strategies, supply chain transparency, and sustainable agricultural practices will be essential to ensuring future growth and market stability in this dynamic segment

Europe Pulse Protein Market Scope

The market is segmented on the basis of sources, category, extraction process, form, function, application, and end user.

- By Sources

On the basis of sources, the market is segmented into black lentils, green lentils, peas, navy beans, chickpeas, kaspa peas, black beans, kidney beans, lupins, faba bean, munga beans, and others. Peas accounted for the largest revenue share of 39.4% in 2024, owing to their abundant availability, high protein yield, and neutral taste that makes them suitable for multiple food applications. Pea protein is widely used in meat substitutes, sports nutrition, and dairy-free alternatives. Its lower allergenicity compared to soy and its superior functional properties, such as solubility and emulsification, make it a preferred choice among food processors. Strong adoption in beverages and plant-based meat further supports its dominance.

The chickpeas segment is expected to register the fastest CAGR from 2025 to 2032, driven by their rising popularity in protein-rich snacks, gluten-free bakery products, and dairy replacements. Chickpea proteins offer high nutritional value and also an appealing flavor profile, making them attractive for health-oriented consumers. Their integration in Mediterranean diets, combined with increasing use in protein blends and flour fortification, adds to market demand. Moreover, ongoing innovations in chickpea protein isolates and concentrates are expected to drive significant growth.

- By Category

On the basis of category, the market is segmented into organic and conventional. The conventional segment dominated the largest share in 2024, largely because of its widespread availability and cost-effectiveness, making it the primary choice for bulk food processing. Conventional pulse proteins are widely utilized in mainstream food and beverage applications such as bakery, snacks, and dairy alternatives. Their affordability makes them ideal for manufacturers looking to serve the mass market. With established supply chains and consistent quality, conventional proteins continue to dominate large-scale food applications globally.

The organic segment is projected to grow at the fastest rate from 2025 to 2032, as rising consumer awareness about health, sustainability, and natural nutrition drives preference for chemical-free proteins. Organic-certified pulse proteins are increasingly being adopted in premium health products, functional foods, and clean-label beverages. Consumers in developed markets are showing stronger willingness to pay more for organic plant proteins. Growing investments in organic farming and the expansion of organic product lines by global food brands will significantly support this segment’s growth.

- By Extraction Process

On the basis of extraction process, the market is divided into dry processing and wet processing. The dry processing segment held the dominant share in 2024, mainly due to its cost-effectiveness, eco-friendliness, and ability to preserve the natural fiber and starch content of pulses. This method is widely adopted in flour and bakery industries where functional purity is not the primary requirement. Lower energy usage and reduced water consumption also make dry processing favorable for sustainable production. It remains a preferred choice for large-scale applications requiring affordable protein ingredients.

The wet processing segment is forecast to witness the fastest growth from 2025 to 2032, as it produces high-purity protein isolates with improved solubility, digestibility, and functional versatility. Wet extraction allows proteins to be tailored for beverages, nutritional supplements, and infant formulas, where purity and quality are crucial. Increasing demand for protein isolates in sports nutrition and plant-based beverages is fueling growth. Moreover, innovations in wet processing technology are making it more efficient and scalable, further boosting adoption.

- By Form

On the basis of form, the market is categorized into isolates, concentrates, and hydrolysates. The concentrates segment dominated the largest share in 2024, as they offer a balanced protein profile along with fibers and starch, making them highly suitable for bakery, snacks, and feed applications. Pulse protein concentrates are cost-effective compared to isolates, ensuring wider use across both food and feed industries. Their ability to retain natural components makes them appealing for products targeting holistic nutrition. In addition, their versatility in extruded snacks and flour fortification ensures continued dominance.

The isolates segment is expected to record the fastest growth from 2025 to 2032, driven by the increasing demand for high-purity protein in plant-based beverages, sports nutrition, and functional foods. Isolates offer superior solubility and digestibility, making them ideal for ready-to-drink formulations and performance products. Consumers seeking high-protein diets are fueling demand for isolates in both developed and emerging markets. Growing innovations in plant-based dairy and nutritional supplements are expected to accelerate isolate adoption further.

- By Function

On the basis of function, the market is segmented into solubility, hydration, emulsification, foaming, and others. The emulsification segment dominated the market in 2024, as pulse proteins are widely used to stabilize oil and water mixtures in plant-based meat, dairy alternatives, sauces, and dressings. Their ability to improve texture, consistency, and mouthfeel makes them valuable in product formulations. Food manufacturers prefer pulse proteins for emulsification due to their clean-label appeal and allergen-free nature. Rising demand for natural stabilizers in food systems strongly supports segment dominance.

The solubility function is projected to grow at the fastest rate from 2025 to 2032, with increasing use in protein shakes, smoothies, and clinical nutrition beverages. High solubility ensures even dispersion and better consumer experience in liquid-based applications. As demand rises for fortified beverages and high-protein drinks, soluble pulse proteins are becoming highly attractive to food formulators. Moreover, advancements in processing technologies are enhancing the solubility of isolates, further boosting this segment’s growth potential.

- By Application

On the basis of application, the market is segmented into food and beverage, feed and pharmaceuticals, and cosmetics. The food and beverage segment dominated in 2024, as pulse proteins are increasingly incorporated into bakery products, dairy alternatives, beverages, and meat substitutes. Rising vegan and flexitarian populations worldwide are driving food manufacturers to include plant proteins in mainstream offerings. Strong growth in functional foods and health drinks also fuels adoption. Wide applicability across different food categories reinforces the segment’s leadership position.

The cosmetics segment is expected to witness the fastest growth from 2025 to 2032, due to the rising demand for plant-based and natural personal care ingredients. Pulse proteins are gaining popularity in skincare and haircare formulations for their moisturizing, conditioning, and film-forming properties. They are increasingly used in anti-aging and restorative products where clean-label ingredients are preferred. As consumers shift toward sustainable beauty products, pulse proteins are likely to see accelerated adoption in the cosmetics industry.

- By End User

On the basis of end user, the market is segmented into home use, snack food industry, flour industry, and others. The snack food industry segment held the largest share in 2024, supported by growing consumer demand for protein-rich, healthier snacking options. Pulse proteins are widely used in energy bars, extruded snacks, and baked chips, appealing to fitness-focused and busy consumers. Their high nutritional value and versatility allow manufacturers to innovate across multiple snack categories. Increasing popularity of on-the-go nutrition strongly contributes to the segment’s dominance.

The flour industry segment is anticipated to grow at the fastest pace from 2025 to 2032, as pulse proteins are being increasingly blended into traditional flours to enhance protein content and nutritional value. Growing demand for fortified flours in bakery, functional foods, and household cooking is driving adoption. This trend is further fueled by rising awareness of protein deficiency in developing regions. Flour manufacturers are expanding their use of pulse proteins to meet consumer demand for healthier everyday staples.

Europe Pulse Protein Market Regional Analysis

- Germany dominated the pulse protein market with the largest revenue share in 2025, driven by its strong food processing industry, high consumer awareness of health and wellness, and established plant-based product innovation ecosystem

- The country’s well-developed supply chain infrastructure, advanced R&D in functional foods, and stringent food safety regulations continue to support widespread adoption of pulse proteins across dietary supplements, meal replacements, and fortified food products

- Growing focus on plant-based nutrition, strong demand for protein-rich and allergen-free alternatives, increasing investments by leading food brands, and the presence of companies such as Rügenwalder Mühle reinforce Germany’s leading position. Continuous innovation in pulse protein formulations, alignment with EU nutrition and labeling directives, and strategic partnerships with downstream manufacturers ensure Germany’s dominance in Europe’s pulse protein market

U.K. Pulse Protein Market Insight

The U.K. is projected to record the fastest CAGR in the Europe pulse protein market from 2026 to 2033, supported by rising emphasis on health-conscious consumption, sustainability, and regulatory compliance across the food sector. For instance, U.K.-based brands such as Marigold Health Foods are increasingly incorporating pea and lentil proteins in functional foods, snacks, and beverages, boosting consumer adoption. Growing focus on clean-label, allergen-free products, expansion of sports nutrition and meal replacement offerings, and increasing awareness of plant-based diets are accelerating market growth. Strong regulatory oversight, investments in innovative plant-based formulations, and alignment with evolving EU and domestic nutrition guidelines further strengthen the U.K.’s position as the fastest-growing market in the region.

France Pulse Protein Market Insight

France is expected to witness steady growth during 2026–2033, driven by rising consumer interest in healthy, plant-based foods and functional ingredients. Growing emphasis on nutritional quality, modernization of food processing techniques, and wider adoption of pulse proteins in bakery, dairy alternatives, and snack products support market expansion. Collaboration between French food manufacturers and global suppliers, along with preference for high-quality and sustainable protein sources, encourages consistent adoption. The country’s focus on wellness-oriented product innovation, circular economy initiatives in food production, and compliance with EU nutrition standards reinforces France’s stable growth within Europe’s pulse protein market.

Europe Pulse Protein Market Share

- Ingredion (U.S.)

- Cargill Incorporated (U.S.)

- AGT Food and Ingredients (Canada)

- ADM (U.S.)

- ET-Chem (China)

- Shandong Jianyuan group (China)

- Axiom Foods, Inc. (U.S.)

- Kerry Group plc. (Ireland)

- Vestkorn (Norway)

- Glanbia PLC (Ireland)

- Roquette Frères (France)

- The Scoular Company (U.S.)

- Nutriati, Inc. (U.S.)

- DuPont (U.S.)

- Prolupin GmbH (Germany)

- FENCHEM (China)

- PURIS (U.S.)

- Emsland Group (Germany)

- Burcon (Canada)

- SOTEXPRO (France)

- Yantai Shuangta Food Co. (China)

Latest Developments in Europe Pulse Protein Market

- In June 2025, Roquette launched NUTRALYS T Pea 700XC, a large-chunk textured pea protein with 70% protein content and high thermal resistance. This innovation addresses the growing demand for hearty, meat-like textures in plant-based ready meals, sauces, and traditional dishes, making it easier for food manufacturers to create appealing, high-protein alternatives. Its minimal hydration requirement and simplified formulation process enhance efficiency in production, while offering consumers improved sensory experience. By introducing this product, Roquette strengthened its portfolio in the pulse protein market, meeting the rising trend for sustainable and versatile plant-based ingredients

- In February 2024, Roquette expanded its NUTRALYS plant protein range with four multi-functional pea proteins designed to improve taste, texture, and functionality in plant-based foods and nutritional products. This expansion enables food manufacturers to innovate and diversify product offerings while meeting increasing consumer demand for high-protein, plant-based solutions. The move reinforces Roquette's leadership in the pulse protein market by providing versatile ingredients suitable for beverages, bakery, and protein-enriched snacks, addressing evolving consumer preferences for clean-label and sustainable protein options

- In October 2022, Roquette introduced a new line of organic pea ingredients, including organic pea starch and organic pea protein, produced at its Canadian plant. This launch catered to the rising consumer demand for organic and plant-based ingredients, providing manufacturers with high-quality, sustainable protein sources. By offering organic alternatives, Roquette strengthened its competitive position in the pulse protein market and supported the shift toward healthier, environmentally conscious food products. This move also allowed the company to target emerging markets where organic and clean-label ingredients are becoming increasingly important

- In June 2022, Roquette launched the NUTRALYS range, featuring organic textured proteins derived from peas and fava beans. This strategic introduction broadened Roquette’s customer base by offering clean-label, sustainable, and high-protein solutions for food manufacturers. The launch responded to increasing consumer interest in plant-based diets and functional foods, helping brands deliver protein-rich products with improved texture and nutritional value. By reinforcing its focus on plant-based innovation, Roquette consolidated its presence in the growing pulse protein market

- In June 2021, Roquette launched the textured pea protein P6511C at FI Europe, positioned as a sustainable alternative to meat. The product targeted the growing consumer preference for plant-based foods with robust nutritional profiles, enabling manufacturers to create innovative protein-rich products with improved texture and versatility. By entering this niche, Roquette strengthened its competitive edge in the pulse protein market and supported the industry’s transition toward sustainable and functional ingredients

- In July 2020, Ingredion Incorporated EMEA launched an organic instant functional native starch to meet industry demand for high-quality, versatile plant-based ingredients. This innovation provided food and beverage manufacturers with functional starches suitable for clean-label and health-focused products. The launch helped Ingredion anticipate increased sales and strengthen its presence in the pulse protein and plant-based ingredient market, supporting the broader trend toward sustainable, protein-enriched food solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Pulse Protein Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Pulse Protein Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Pulse Protein Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.