Europe Quinoa Market

Market Size in USD Million

CAGR :

%

USD

300.09 Million

USD

555.05 Million

2024

2032

USD

300.09 Million

USD

555.05 Million

2024

2032

| 2025 –2032 | |

| USD 300.09 Million | |

| USD 555.05 Million | |

|

|

|

|

Quinoa Market Size

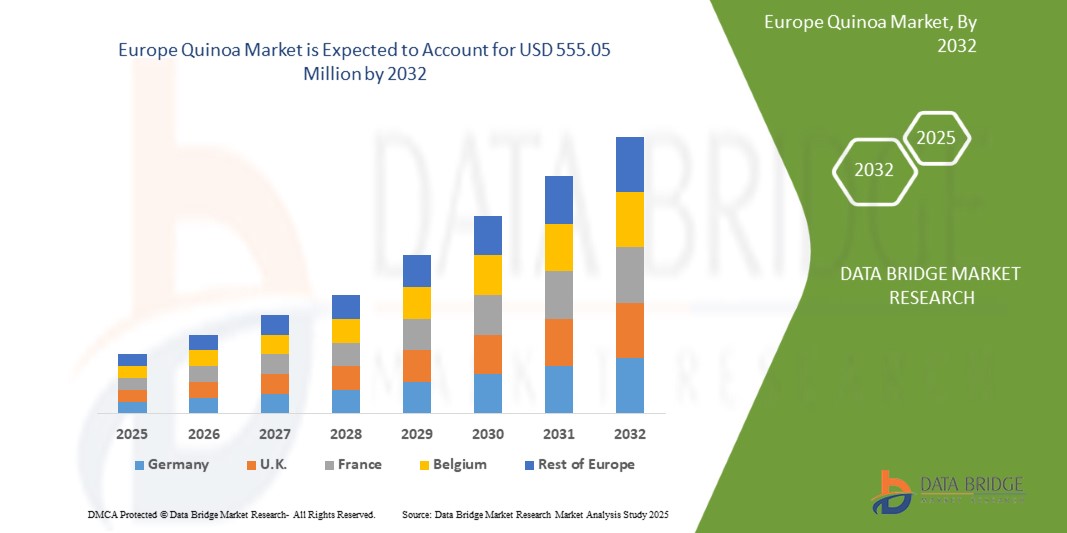

- The Global Quinoa market was valued at USD 300.09 million in 2024 and is expected to reach USD 555.05 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.1%, primarily driven by the rising popularity of locally sourced and organic quinoa varieties, fuelled by consumer demand for clean-label, sustainable, and traceable superfoods.

- This growth is driven by factors such as growing shift toward plant-based and gluten-free diets across the region.

Quinoa Market Analysis

- The Europe quinoa market is witnessing consistent growth, driven by the rising adoption of plant-based and gluten-free diets, particularly among health-conscious and environmentally aware consumers. Quinoa’s reputation as a complete protein, rich in fiber, essential amino acids, and micronutrients, makes it a sought-after alternative to traditional grains. Countries such as Germany, France, and the U.K. are at the forefront of this shift, with strong retail availability and product innovation in categories such as breakfast cereals, functional snacks, and ready-to-eat meals enhancing market visibility and consumption

- Quinoa is being widely incorporated across various segments including seeds, flour, flakes, and puffs, offering versatility for both household and industrial food applications. Its functional benefits—such as low glycemic index, satiety support, and digestive health—are driving its use in bakery, baby food, sports nutrition, and dietary supplements. European food manufacturers are capitalizing on its nutritional profile and clean-label appeal to target flexitarian, vegan, and allergen-sensitive consumer bases

- The market is evolving alongside rising demand for organic and fair-trade quinoa, with increasing interest in locally grown European varieties to reduce reliance on imports from South America. Efforts to scale sustainable cultivation in countries like Spain, France, and Italy are gaining momentum, supported by agri-tech investments and EU-backed rural development programs. Additionally, branding around ancient grains, superfoods, and ethical sourcing is reinforcing quinoa’s premium positioning in the European food ecosystem, suggesting sustained market expansion anchored in wellness and sustainability trends.

Report Scope and Quinoa Market Segmentation

|

Attributes |

Quinoa Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Quinoa Market Trends

“GROWING CONSUMER SHIFT TOWARD GLUTEN-FREE AND PLANT-BASED NUTRITION”

- As consumer dietary habits shift toward gluten-free and plant-based options, quinoa is gaining popularity as a naturally gluten-free pseudocereal rich in complete protein, appealing to individuals with gluten intolerance, vegetarians, vegans, and flexitarians seeking nutritionally balanced alternatives.

- Quinoa’s high fiber content, essential vitamins, minerals, and antioxidants align well with growing global health awareness and demand for transparent, clean-label foods, positioning it as a go-to ingredient for wellness-driven consumers.

- The increasing use of quinoa in plant-based product innovation—such as meat substitutes, dairy alternatives, and functional snacks—has boosted its mainstream acceptance and market penetration across health food and specialty categories.

- Food manufacturers and retailers are actively introducing quinoa-enriched offerings to tap into rising demand from niche consumer groups focused on allergen-free and nutrient-dense diets, thereby expanding quinoa's application across multiple product lines.

- Supported by favorable regulatory reforms and endorsements from health organizations, quinoa is solidifying its role as a strategic ingredient in the evolving global food ecosystem focused on sustainability, allergen-conscious consumption, and nutritional excellence.

Quinoa Market Dynamics

Driver

“RISING HEALTH CONSCIOUSNESS AMONG URBAN POPULATIONS”

- Growing health awareness among global urban consumers is playing a pivotal role in driving demand for quinoa, as individuals increasingly seek nutrient-rich, whole-food options to manage or prevent chronic conditions like obesity, diabetes, and cardiovascular diseases.

- Quinoa’s high concentration of complete proteins, fiber, vitamins, and essential minerals makes it particularly attractive to health-conscious populations in urban areas, where sedentary lifestyles and processed food consumption are common.

- The grain’s low glycemic index, cholesterol-free nature, and digestive health benefits position it as a functional food for those aiming to improve metabolic health, manage weight, and pursue long-term wellness goals.

- Consumer interest in superfoods, clean-label ingredients, and plant-based nutrition continues to grow in cities, and quinoa’s versatility in salads, bowls, snacks, and beverages supports its widespread adoption across both household kitchens and foodservice menus.

- Influences from health advocacy campaigns, social media, and nutrition education are further solidifying quinoa’s reputation as a premium health food, making it a staple among urban consumers who prioritize balanced, preventive nutrition.

Restraint/Challenge

“ELEVATED PRODUCTION COSTS HINDER COMMERCIAL SCALABILITY”

- The quinoa market faces a significant restraint in the form of high production costs, which limit the feasibility of large-scale commercialization. Cultivation is labor-intensive and demands careful attention at every stage—from sowing to harvesting and post-harvest handling—to maintain grain quality and nutritional value.

- In traditional producing countries like Peru and Bolivia, low levels of mechanization contribute to inefficiencies, while manual labor requirements increase operational expenses. These structural limitations reduce cost competitiveness in global markets.

- Quinoa’s sensitivity to environmental conditions, such as temperature, soil quality, and salinity, further necessitates precision farming techniques and supplementary inputs like irrigation and pest control, all of which escalate production costs.

- For non-native growing regions attempting to scale up quinoa farming, challenges such as inadequate seed varieties, limited agronomic expertise, and underdeveloped supply chain infrastructure add to resource intensity and constrain yield potential.

- Despite its growing international demand and nutritional advantages, persistent price volatility, export restrictions, and high processing costs continue to hinder quinoa’s mainstream adoption—particularly in developing economies and among cost-sensitive consumers and food manufacturers.

Quinoa Market Scope

The market is segmented on the basis of type, product, packaging type, and distribution channel

- By Type

The quinoa market is segmented into Single and Tricolor varieties. In 2025, the Single type is expected to dominate the market owing to its greater availability, cost efficiency, and broad consumer acceptance. It is widely used in both retail and foodservice applications. The Tricolor segment is anticipated to grow at the fastest CAGR from 2025 to 2032, supported by rising consumer interest in premium and visually distinct products that offer a balanced nutritional profile.

- By Product

On the basis of product, the market is categorized into Seeds, Flour, Flakes, and Puffs. Seeds held the largest share in 2024, driven by their versatility in salads, grain bowls, and side dishes. The Flour segment is projected to grow at the fastest rate, fueled by increasing demand for gluten-free baking ingredients and protein-rich alternatives in breads, pastas, and snacks.

- By Packaging Type

The market is segmented into Bags, Pouches, Box, Jar, and Others. Bags accounted for the highest revenue share in 2024 due to consumer preference for resealable and portable packaging solutions. The Jar segment is projected to expand rapidly through 2032, attributed to premium positioning and rising popularity of sustainable and reusable packaging formats.

- By Distribution Channel

The market is divided into Offline and Online channels. Offline distribution, including supermarkets, hypermarkets, and health food stores, dominated the market in 2024 due to high consumer trust and established supply chains. However, the Online segment is expected to grow at the fastest CAGR through 2032, driven by increasing e-commerce penetration, convenience, and rising demand for organic and specialty quinoa products via digital platforms.

Quinoa Market Regional Analysis

- Europe holds a significant revenue share of 27.63% in 2024, driven by rising health consciousness, growing preference for plant-based diets, and increasing demand for gluten-free and high-protein food products. Countries such as Germany, France, the U.K., and the Netherlands are at the forefront of quinoa adoption, supported by expanding health food retail chains, dietary diversification, and supportive food labeling regulations across the EU.

- The region benefits from heightened consumer awareness around superfoods and functional nutrition, encouraging the incorporation of quinoa into a variety of food applications, including bakery products, cereals, snacks, and ready-to-eat meals. Additionally, the European food processing industry is actively investing in product innovation using quinoa flour, flakes, and puffs to cater to clean-label and allergen-free trends.

- Local production in countries such as Spain, Italy, and the U.K. has also gained momentum, aimed at reducing dependence on South American imports and enhancing supply chain sustainability. EU-funded agricultural programs and research initiatives are supporting agronomic adaptation of quinoa to European climates, helping expand cultivation in non-traditional areas. Overall, Europe’s commitment to nutritional wellness, sustainable sourcing, and functional food innovation continues to drive quinoa market growth across the region.

Europe Quinoa Market Insight

The Europe quinoa market is positioned for stable and long-term growth, driven by rising consumer awareness around plant-based nutrition, increasing demand for gluten-free superfoods, and alignment with the EU’s sustainability and health-focused food regulations. The market benefits from expanding vegan and flexitarian populations, along with a robust demand for clean-label, high-protein alternatives across categories such as breakfast cereals, snacks, and ready-to-eat meals. European food manufacturers are actively incorporating quinoa in both traditional and innovative product lines, further elevating its presence in the mainstream food landscape.

- France Quinoa Market Insight

The France quinoa market plays a vital role in Europe’s plant-based food shift, supported by increasing health consciousness, Mediterranean diet diversification, and growing demand for organic and nutrient-dense grains. Italian consumers are showing strong preference for locally sourced or regionally adapted quinoa varieties, while artisanal bakeries and health food brands are using quinoa flour and flakes in gluten-free breads, pasta, and gourmet snacks. Moreover, Italy’s culinary culture and agri-food innovation ecosystem are accelerating the integration of quinoa into fusion cuisine, premium offerings, and wellness-targeted food segments.

Germany Quinoa Market Insight

The Germany quinoa market is projected to grow consistently, underpinned by high consumer trust in sustainable and functional food products. German retailers are expanding their quinoa product ranges in both organic and conventional categories, with applications across muesli, protein bars, baby food, and dietary supplements. The country’s strong preference for allergen-free, fiber-rich, and high-protein ingredients aligns well with quinoa’s profile, while regulatory backing for sustainable sourcing and transparent labeling further enhances its appeal. Additionally, investments in local quinoa cultivation and processing are strengthening Germany’s position in the European quinoa supply chain.

The Major Market Leaders Operating in the Market Are:

- QUINOA FOODS COMPANY SRL (Bolivia)

- NORTHERN QUINOA PRODUCTION CORPORATION (Canada)

- Quinoa Corporation (U.S)

- The British Quinoa Company (U.K)

- Nourish You (U.K)

- Organic Tattva (India)

- Adinath Agro Industries (India)

- SARCHIO SPA (Italy)

- AARY'S FOOD (India)

- ARDENT MILLS (U.S)

- Appkin Agro Private Limited (India)

- Elworld Organic (India)

- Apex International (India)

- SHANTILAL AND SONS HUF (India)

- Vedaliya Industries LLP. (India)

- Shiloh Farms (India)

- ROYAL NUT COMPANY (India)

- MAATITATVA AGRO INDUSTRIES PRIVATE LIMITED (India)

- Dev Agro Industries (India)

- pureproducts (U.K)

- Alter Eco Foods (U.S)

- Irupana (Bolivia)

Latest Developments in EUROPE QUINOA MARKET

- In May 2025, Mehrotra Consumer Products showcased its “Organic Quinoa” at the Saudi Food Show in Riyadh, highlighting its gluten-free, high-protein, antioxidant-rich superfood to international buyers.

- In February 2024, investment firm Trek One Capital completed its acquisition of Alter Eco Foods, the premium organic brand known for quinoa, granola, chocolate, and truffles. The deal aims to accelerate growth in their premium snack range and expand distribution channels.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRICING ANALYSIS

4.2 COST ANALYSIS BREAKDOWN OF THE EUROPE QUINOA MARKET

4.3 FACTORS AFFECTING BUYING DECISION

4.3.1 PRICE

4.3.2 PRODUCT QUALITY

4.3.3 BRAND REPUTATION

4.3.4 ADVERTISEMENT AND PROMOTIONS

4.3.5 PRODUCT AVAILABILITY

4.3.6 FINANCIAL ACCESSIBILITY

4.3.7 PEER AND EXPERT RECOMMENDATIONS

4.4 IMPACT OF ECONOMIC SLOWDOWN ON EUROPE QUINOA MARKET

4.4.1 IMPACT OF PRICE

4.4.2 IMPACT ON SUPPLY CHAIN

4.4.3 IMPACT ON SHIPMENT

4.4.4 IMPACT ON DEMAND

4.4.5 IMPACT ON STRATEGIC DECISIONS

4.5 INDUSTRY ECO-SYSTEM ANALYSIS

4.5.1 PROMINENT COMPANIES

4.5.2 SMALL & MEDIUM SIZE COMPANIES

4.5.3 END USERS

4.6 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.6.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.6.1.1 JOINT VENTURES

4.6.1.2 MERGERS AND ACQUISITIONS

4.6.1.3 LICENSING AND PARTNERSHIP

4.6.1.4 TECHNOLOGY COLLABORATIONS

4.6.1.5 STRATEGIC DIVESTMENTS

4.6.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.6.3 STAGE OF DEVELOPMENT

4.6.4 TIMELINES AND MILESTONES

4.6.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.6.6 RISK ASSESSMENT AND MITIGATION

4.6.7 FUTURE OUTLOOK

4.7 PATENT QUALITY AND STRENGTH

4.8 PATENT FAMILIES

4.8.1 LICENSING AND COLLABORATIONS

4.8.1.1 COMPANY PATENT LANDSCAPE

4.8.1.2 REGION PATENT LANDSCAPE

4.8.1.3 IP STRATEGY AND MANAGEMENT

4.8.2 PATENT ANALYSIS

4.8.3 CONSUMER BUYING BEHAVIOUR

4.9 PRODUCT ADOPTION SCENARIO

4.9.1 CONSUMER SEGMENT PENETRATION

4.9.2 INDUSTRIAL AND FOOD SERVICE ADOPTION

4.9.3 GEOGRAPHICAL EXPANSION

4.9.4 BARRIERS TO ADOPTION

4.1 RAW MATERIAL SOURCING ANALYSIS

4.10.1 KEY RAW MATERIAL: QUINOA SEEDS

4.10.2 MAJOR QUINOA-PRODUCING COUNTRIES

4.10.3 SOURCING CHANNELS

4.10.4 CERTIFICATIONS & QUALITY STANDARDS

4.10.5 CHALLENGES IN RAW MATERIAL SOURCING

4.10.6 TRENDS IN SOURCING STRATEGY

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 LOGISTIC COST SCENARIO

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 TARIFFS AND THEIR IMPACT ON MARKET

5.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCE ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATION COVERAGE

7 MARKET OVERVIEW

7.1 DRIVER

7.1.1 RISING DEMAND FOR GLUTEN-FREE AND PLANT-BASED FOODS

7.1.2 INCREASING HEALTH AWARENESS AMONG EUROPE URBAN CONSUMERS

7.1.3 FAST EXPANDING VEGAN AND VEGETARIAN DIETARY LIFESTYLE TRENDS

7.1.4 GROWING APPLICATION OF QUINOA IN FUNCTIONAL AND FORTIFIED FOOD PRODUCTS

7.2 RESTRAINTS

7.2.1 HIGH PRODUCTION COSTS LIMIT LARGE-SCALE COMMERCIAL EXPANSION

7.2.2 EXPANSION OF SINGLE-CROP QUINOA LEADING TO SOIL DEGRADATION, BIODIVERSITY LOSS, AND SUSCEPTIBILITY TO CLIMATE STRESS

7.3 OPPORTUNITIES

7.3.1 EXPANDING QUINOA FARMING IN ASIA, AFRICA, NORTH AMERICA, AND EUROPE COUNTRIES

7.3.2 GOVERNMENT SUPPORT & POLICY INCENTIVES PROMOTING FARMERS TO ADOPT QUINOA AS A CLIMATE-RESILIENT CROP

7.3.3 RISING POPULARITY OF ORGANIC AND SUSTAINABLE AGRICULTURE PRACTICES

7.4 CHALLENGES

7.4.1 REGULATORY & TRADE UNCERTAINTIES

7.4.2 QUALITY INCONSISTENCIES ACROSS INTERNATIONAL QUINOA SUPPLY CHAINS

8 EUROPE QUINOA MARKET, BY TYPE

8.1 OVERVIEW

8.2 SINGLE

8.3 TRICOLOR

9 EUROPE QUINOA MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 SEEDS

9.3 FLOUR

9.4 FLAKES

9.5 PUFFS

10 EUROPE QUINOA MARKET, BY PACKAGING TYPE

10.1 OVERVIEW

10.2 BAGS

10.3 POUCHES

10.4 BOX

10.5 JAR

10.6 OTHERS

11 EUROPE QUINOA MARKET, BY NATURE

11.1 OVERVIEW

11.2 CONVENTIONAL QUINOA

11.3 ORGANIC QUINOA

12 EUROPE QUINOA MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 OFFLINE

12.3 ONLINE

13 EUROPE QUINOA MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 FRANCE

13.1.3 U.K.

13.1.4 ITALY

13.1.5 SPAIN

13.1.6 NETHERLANDS

13.1.7 BELGIUM

13.1.8 RUSSIA

13.1.9 SWITZERLAND

13.1.10 POLAND

13.1.11 DENMARK

13.1.12 NORWAY

13.1.13 TURKEY

13.1.14 SWEDEN

13.1.15 REST OF EUROPE

14 EUROPE QUINOA MARKET COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ARDENT MILLS

16.1.1 COMPANY SNAPSHOT

16.1.2 COMPANY SHARE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 ADINATH AGRO INDUSTRIES

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 NOURISH YOU

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 APEX INTERNATIONAL

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 AARY'S FOOD

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ALTER ECO FOODS

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 APPKIN AGRO PRIVATE LIMITED

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 DEV AGRO INDUSTRIES

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ELWORLD ORGANIC

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 IRUPANA ANDEN ORGANIC FOOD S.A.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 MAATITATVA AGRO INDUSTRIES PRIVATE LIMITED

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 NORTHERN QUINOA PRODUCTION CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 ORGANIC TATTVA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT/NEWS

16.14 PURE PRODUCTS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 QUINOA CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 QUINOA FOODS COMPANY SRL

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 ROYAL NUT COMPANY.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 SARCHIO SPA

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 SHANTILAL & SONS HUF

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 SHILOH FARMS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 THE BRITISH QUINOA COMPANY

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 VEDALIYA INDUSTRIES LLP.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 EUROPE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 EUROPE QUINOA MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 4 EUROPE SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 EUROPE SINGLE IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 EUROPE TRICOLOR IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE SEEDS IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE FLOUR IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE FLAKES IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE PUFFS IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE BAGS IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE POUCHES IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE BOX IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE JAR IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE OTHERS IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE CONVENTIONAL QUINOA IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE ORGANIC QUINOA IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE OFFLINE IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE ONLINE IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE QUINOA MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 29 EUROPE SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 36 GERMANY QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 GERMANY QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 38 GERMANY SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 GERMANY QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 40 GERMANY QUINOA MARKET, BY PRODUCT 2018-2032 (USD THOUSAND)

TABLE 41 GERMANY QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 GERMANY QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 43 GERMANY OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 44 GERMANY ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 45 FRANCE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 FRANCE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 47 FRANCE SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 FRANCE QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 49 FRANCE QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 50 FRANCE QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 FRANCE QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 52 FRANCE OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 53 FRANCE ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 54 U.K. QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 U.K. QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 56 U.K. SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 U.K. QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 58 U.K. QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 59 U.K. QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 U.K. QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 61 U.K. OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 62 U.K. ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 63 ITALY QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 ITALY QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 65 ITALY SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 ITALY QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 67 ITALY QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 68 ITALY QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 ITALY QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 70 ITALY OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 ITALY ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 72 SPAIN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 SPAIN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 74 SPAIN SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 SPAIN QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 76 SPAIN QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 77 SPAIN QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 SPAIN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 79 SPAIN OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 80 SPAIN ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 81 NETHERLANDS QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 NETHERLANDS QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 83 NETHERLANDS SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 NETHERLANDS QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 85 NETHERLANDS QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 86 NETHERLANDS QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 NETHERLANDS QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 88 NETHERLANDS OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 89 NETHERLANDS ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 90 BELGIUM QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 BELGIUM QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 92 BELGIUM SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 BELGIUM QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 94 BELGIUM QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 95 BELGIUM QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 BELGIUM QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 97 BELGIUM OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 98 BELGIUM ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 99 RUSSIA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 RUSSIA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 101 RUSSIA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 RUSSIA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 103 RUSSIA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 104 RUSSIA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 RUSSIA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 106 RUSSIA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 107 RUSSIA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 108 SWITZERLAND QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 SWITZERLAND QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 110 SWITZERLAND SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 SWITZERLAND QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 112 SWITZERLAND QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 113 SWITZERLAND QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 SWITZERLAND QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 115 SWITZERLAND OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 116 SWITZERLAND ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 117 POLAND QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 POLAND QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 119 POLAND SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 POLAND QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 121 POLAND QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 122 POLAND QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 POLAND QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 124 POLAND OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 125 POLAND ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 126 DENMARK QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 DENMARK QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 128 DENMARK SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 DENMARK QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 130 DENMARK QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 131 DENMARK QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 DENMARK QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 133 DENMARK OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 134 DENMARK ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 135 NORWAY QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 NORWAY QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 137 NORWAY SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 NORWAY QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 139 NORWAY QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 140 NORWAY QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 NORWAY QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 142 NORWAY OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 143 NORWAY ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 144 TURKEY QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 TURKEY QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 146 TURKEY SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 TURKEY QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 148 TURKEY QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 149 TURKEY QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 TURKEY QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 151 TURKEY OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 152 TURKEY ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 153 SWEDEN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SWEDEN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 155 SWEDEN SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 SWEDEN QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 157 SWEDEN QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 158 SWEDEN QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 SWEDEN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 160 SWEDEN OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 161 SWEDEN ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 162 REST OF EUROPE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 REST OF EUROPE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

List of Figure

FIGURE 1 EUROPE QUINOA MARKET

FIGURE 2 EUROPE QUINOA MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE QUINOA MARKET: DROC ANALYSIS

FIGURE 4 EUROPE QUINOA MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE QUINOA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE QUINOA MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE QUINOA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE QUINOA MARKET: DBMR MARKET POSITION GRID

FIGURE 9 VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE QUINOA MARKET: EXECUTIVE SUMMARY

FIGURE 11 EUROPE QUINOA MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE THE EUROPE QUINOA MARKET, BY TYPE

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING DEMAND FOR GLUTEN-FREE AND PLANT-BASED FOODS IS EXPECTED TO DRIVE THE EUROPE QUINOA MARKET IN THE FORECAST PERIOD

FIGURE 15 THE SINGLE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE QUINOA MARKET IN 2025 AND 2032

FIGURE 16 EUROPE LONG CHAIN POLYAMIDE MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 17 PATENT FAMILIES

FIGURE 18 NUMBER OF INTERNATIONAL PATENT FAMILIES BY PUBLICATION YEAR

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF INDONESIA ZEOLITE MARKET

FIGURE 20 EUROPE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

FIGURE 21 EUROPE QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

FIGURE 22 EUROPE QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

FIGURE 23 EUROPE QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

FIGURE 24 EUROPE QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

FIGURE 25 EUROPE QUINOA MARKET: SNAPSHOT (2023)

FIGURE 26 EUROPE QUINOA MARKET: COMPANY SHARE 2024 (%)

Europe Quinoa Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Quinoa Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Quinoa Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.