Europe Radiology Services Market

Market Size in USD Billion

CAGR :

%

USD

72.04 Billion

USD

192.88 Billion

2024

2032

USD

72.04 Billion

USD

192.88 Billion

2024

2032

| 2025 –2032 | |

| USD 72.04 Billion | |

| USD 192.88 Billion | |

|

|

|

|

Europe Radiology Services Market Size

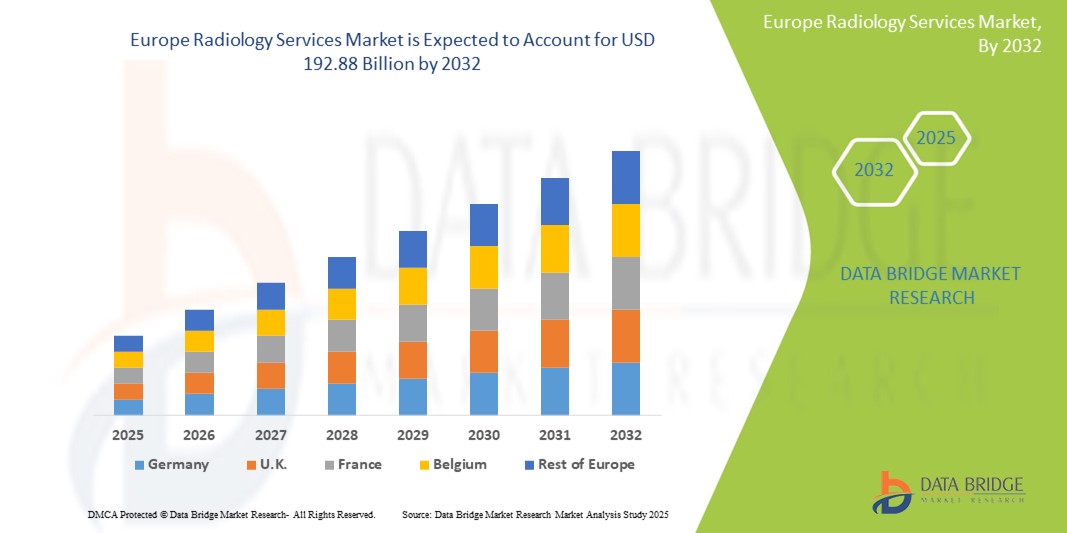

- The Europe radiology services market size was valued at USD 72.04 billion in 2024 and is expected to reach USD 192.88 billion by 2032, at a CAGR of 13.1% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic diseases such as cancer, cardiovascular conditions, and neurological disorders, along with an increasing geriatric population

- Furthermore, advancements in diagnostic imaging technologies, growing awareness regarding early diagnosis, and the integration of artificial intelligence (AI) and digital technologies are enhancing the efficiency and accuracy of radiological procedures, thereby significantly boosting the industry's growth

Europe Radiology Services Market Analysis

- Radiology services, encompassing diagnostic imaging such as X-rays, MRI, and CT scans, are critical for accurate and timely disease diagnosis and treatment planning within the European healthcare landscape. The market is increasingly driven by the rising prevalence of chronic diseases, a growing geriatric population, and continuous technological advancements

- The escalating demand for radiology services is primarily fueled by the increasing need for early disease detection, the integration of advanced imaging technologies such as AI and 3D imaging, and a rising awareness among patients and healthcare providers about the benefits of comprehensive diagnostic imaging

- Germany is expected to dominate the Europe radiology services market, driven by a strong demand for accurate diagnosis and treatment, coupled with a robust healthcare infrastructure and an increasing number of product launches by manufacturers

- U.K. is expected to witness the highest compound annual growth rate (CAGR) in the Europe radiology services market due to the increasing incidence of chronic diseases, technological advancements in imaging solutions, and a rising aging population

- MRI segment dominates the Europe radiology services market with a market share of 33.3% in 2024, driven by its superior soft tissue contrast, neurological and musculoskeletal imaging capabilities, and advancements in technology leading to wider clinical applications

Report Scope and Europe Radiology Services Market Segmentation

|

Attributes |

Europe Radiology Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Radiology Services Market Trends

“Enhanced Diagnostic Accuracy and Workflow Efficiency Through AI and Digital Integration”

- A significant and accelerating trend in the Europe radiology services market is the deepening integration of Artificial Intelligence (AI) and digital technologies. This fusion of technologies is significantly enhancing diagnostic accuracy, improving workflow efficiency, and streamlining operations across various imaging modalities

- For instance, AI algorithms are being extensively used to detect abnormalities in X-rays, CT scans, and MRIs, improving the accuracy of diagnoses for conditions such as lung nodules and breast cancer. AI also contributes to workflow optimization by automating repetitive tasks, prioritizing urgent cases, and reducing the time required for image interpretation and reporting

- AI integration in Europe's radiology services enables features such as predictive analytics for anticipating patient admission patterns, optimizing staff schedules, and providing real-time diagnostic feedback to clinicians. Voice AI systems are also transforming radiology by enabling faster and more accurate dictation of reports and facilitating swift access to relevant patient data from PACS and EHRs

- The seamless integration of AI-powered tools with broader healthcare platforms facilitates centralized control over various aspects of the diagnostic process. Through a unified interface, radiologists can manage image analysis, reporting, and patient data, creating a more cohesive and efficient healthcare ecosystem

- This trend towards more intelligent, intuitive, and interconnected radiological systems is fundamentally reshaping expectations for diagnostic imaging. Consequently, companies are developing AI-enabled solutions with features such as automatic image segmentation, advanced reconstruction algorithms, and enhanced dose reduction techniques

- The demand for radiology services that offer seamless AI and digital integration is growing rapidly across European hospitals and diagnostic centers, as healthcare providers increasingly prioritize improved patient outcomes, reduced costs, and comprehensive operational efficiency

Europe Radiology Services Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of Chronic Diseases and Aging Population”

- The increasing prevalence of chronic diseases such as cancer, cardiovascular conditions, and neurological disorders, coupled with Europe's accelerating aging population, is a significant driver for the heightened demand for radiology services. These factors necessitate frequent and precise diagnostic imaging for early detection, monitoring, and treatment planning

- For instance, data from the European Commission indicates that a substantial percentage of European citizens report chronic health issues, directly translating to a greater need for radiological examinations. Similarly, as the geriatric population expands, there's a surge in age-related illnesses requiring diagnostic imaging

- As healthcare providers and patients become more aware of the importance of early diagnosis and preventive healthcare, radiology services offer essential non-invasive diagnostic solutions that aid in precise medical decision-making and improved patient outcomes

- Furthermore, the continuous advancements in diagnostic imaging technologies, including the integration of artificial intelligence (AI) and digital solutions, are making radiology services more efficient, accurate, and accessible, thereby propelling their adoption across the region

- The demand for minimally invasive procedures, many of which are image-guided, also contributes to market growth. These converging factors underscore the critical role of radiology in modern European healthcare, significantly boosting the industry's expansion

Restraint/Challenge

“Concerns Regarding High Costs, Workforce Shortages, and Data Security Risk”

- Concerns surrounding the high initial and operational costs of advanced diagnostic imaging modalities, alongside persistent workforce shortages and growing data security risks in medical imaging, pose significant challenges to broader market expansion in Europe

- For instance, modern imaging techniques such as MRI and CT scans require substantial capital investment in high-end equipment, in addition to significant recurring costs for staffing, maintenance, and power consumption. These expenses are often passed on to patients through higher medical bills, potentially making advanced scans unaffordable for some segments of the population or leading to long waiting lists in publicly funded healthcare systems

- Furthermore, Europe faces a critical shortage of skilled radiologists and radiographers. This deficit results in increased workloads, longer turnaround times for reports, and potential compromises in the quality of interpretation, undermining efficiency and delaying diagnoses. The UK, for instance, faces a significant shortfall of clinical radiology consultants

- As radiology services increasingly adopt digital technologies and AI, the vulnerability to cybersecurity threats, including unauthorized access and ransomware attacks, is a growing concern. Such breaches can erode patient trust, disrupt operations, and lead to regulatory penalties, thereby impeding the adoption of digital radiology solutions and increasing operational costs for cybersecurity measures

Europe Radiology Services Market Scope

The market is segmented on the basis of type, location, modality, procedure, patient age, radiation type, application, and end users.

- By Type

On the basis of type, the radiology services market is segmented into product and services. The services segment dominated the largest market revenue share in 2024, driven by the rising demand for diagnostic and interventional radiology services across hospitals and imaging centers. The growth is attributed to increasing chronic disease cases and the integration of AI in imaging analysis.

The product segment, is expected to witness highest CAGR during forecast period, due to rising equipment upgrades and adoption of advanced radiology software solutions

- By Location

On the basis of location, the market is segmented into inshore, offshore, and in-house. The in-house segment held the largest market revenue share in 2024, supported by large healthcare institutions preferring internal radiology units for better control and faster results.

The offshore segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by cost-effective teleradiology solutions, increased outsourcing by European providers, and enhanced global radiologist availability

- By Modality

On the basis of modality, the radiology services market is segmented into X-ray, CT, MRI, ultrasound, mammography, and PET-CT. MRI segment dominates the Europe radiology services market with a market share of 33.3% in 2024, driven by its superior soft tissue contrast, neurological and musculoskeletal imaging capabilities, and advancements in technology leading to wider clinical applications.

The MRI segment is also expected to witness the fastest CAGR from 2025 to 2032, driven by rising neurological and musculoskeletal imaging needs, along with technological advancements improving image clarity and speed.

- By Procedure

On the basis of procedure, the radiology services market is segmented into digital and conventional. The digital segment held the largest market revenue share in 2024, fueled by the transition from analog systems, faster image processing, and easier storage.

Digital procedures is also expected to witness the fastest growth due to better diagnostic accuracy and workflow efficiency, making them the preferred choice across most facilities. The conventional segment continues to decline as more providers adopt fully digital imaging platforms.

- By Patient Age

On the basis of patient age, the radiology services market is segmented into pediatric and adults. The adults segment held the largest market revenue share in 2024, driven by the high imaging demand for age-related illnesses including cancer, cardiovascular diseases, and orthopedic disorders.

The pediatric segment is expected to witness steady growth through 2032, supported by improvements in pediatric imaging safety, awareness in early diagnosis, and tailored protocols for children.

- By Radiation Type

On the basis of radiation type, the radiology services market is segmented into diagnostics and interventional radiology. The diagnostics segment held the largest market revenue share in 2024, driven by the growing demand for routine imaging and disease diagnosis across various medical specialties

Interventional radiology is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by rising demand for minimally invasive, image-guided procedures in cardiovascular and oncology care.

- By Application

On the basis of application, the radiology services market is segmented into dental, musculoskeletal, pelvic and abdominal, gynecology, cardiology, urology, neurology, oncology, and others. The oncology segment dominates the largest market revenue share in 2024 due to the essential role of imaging in cancer screening, diagnosis, and monitoring.

Neurology is expected to witness the fastest growth rate from 2025 to 2032, supported by a growing burden of neurological diseases and increased MRI and CT utilization.

- By End Users

On the basis of end users, the radiology services market is segmented into hospitals, ambulatory centers, diagnostic centers, and clinics. The hospitals segment held the largest market revenue share in 2024, driven by their comprehensive imaging capabilities, integrated care models, and high patient inflow.

The diagnostic centers segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the expansion of outpatient services, teleradiology adoption, and increased private investment.

Europe Radiology Services Market Regional Analysis

- Germany dominates the Europe radiology services market with the largest revenue share of in 2024, driven by a strong demand for accurate diagnosis and treatment, coupled with a robust healthcare infrastructure and an increasing number of product launches by manufacturers

- Countries such as Germany, the UK, and France lead the region in imaging service adoption due to high diagnostic accuracy needs, rapid digital transformation of healthcare systems, and favorable reimbursement policies

- This strong market presence is further supported by a high concentration of trained radiologists, widespread use of teleradiology solutions, and continuous innovation in imaging modalities, reinforcing radiology services as a critical component of patient care across both public and private healthcare sectors

U.K. Europe Radiology Services Market Insight

The U.K. market is anticipated to have the highest CAGR during the forecast period, driven by the increasing incidence of chronic diseases, technological advancements in imaging solutions, and a rising aging population. Public health campaigns emphasizing early detection and the adoption of advanced modalities such as PET scans and 3D imaging significantly contribute to market growth.

Germany Europe Radiology Services Market Insight

The Germany market is expected to expand at a considerable CAGR, fueled by increasing awareness of the importance of early diagnosis and prevention, and the demand for technologically advanced imaging methods such as MRI and CT scans. Germany's robust healthcare system and ongoing integration of AI and machine learning into imaging technologies further propel the market, especially with a focus on oncology and neurology applications

France Europe Radiology Services Market Insight

The France market is anticipated to grow at a considerable CAGR, driven by an aging population, increasing prevalence of chronic diseases, and a growing emphasis on early diagnosis. Technological advancements in imaging devices, government initiatives for healthcare capacity improvement, and the increasing adoption of teleradiology for emergencies and second opinions are key driver.

Europe Radiology Services Market Share

The Europe radiology services industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- GE HealthCare (U.S.)

- FUJIFILM Holdings Corporation (Japan)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Bracco Imaging S.p.A. (Italy)

- Agfa-Gevaert Group (Belgium)

- Esaote SPA (Italy)

- Hitachi High-Tech Corporation (Japan)

- Hologic, Inc. (U.S.)

- Shimadzu Corporation (Japan)

- Carestream Health, Inc. (U.S.)

- Medica Group Plc (U.K.)

- UNILABS (Switzerland)

- Affidea (Netherlands)

- Alliance Medical Limited (U.K.)

- InHealth Group (U.K.)

- Evidia (Germany)

- Oxipit.ai (Lithuania)

- Gleamer (France)

Latest Developments in Europe Radiology Services Market

- In April 2025, Siemens Healthineers introduced a new cloud-based teleradiology solution, featuring enhanced cybersecurity and real-time collaboration tools designed for use across hospital networks. This development aims to streamline workflows and improve remote diagnostics

- In February 2025, Fujifilm Healthcare Europe announced the upcoming availability of its 100% helium-free MRI system, ECHELON Smart ZeroHelium MRI. This innovation focuses on sustainability and operational flexibility

- In February 2025, Unilabs, a leading European diagnostic services provider, partnered with Oxipit to integrate AI-powered chest X-ray solutions across its European network, starting with Portugal. This aims to automate triage and reporting, optimizing radiology workflows

- In February 2025, Bracco and ESR expand partnership for sustainable radiology. Bracco and the European Society of Radiology (ESR) strengthened their partnership at ECR 2025 with a new campaign focused on advancing innovative and sustainable approaches in radiology. This includes initiatives such as a urine filtration system for contrast agents.

- In February 2025, Philips introduces new AI-enabled systems and cloud services at ECR.Philips introduced new AI-enabled diagnostic imaging systems, including its next-generation BlueSeal helium-free MRI system with integrated AI. They also announced accelerated availability of cloud services in Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.