Europe Rapid Diagnostic Tests Rdt Market

Market Size in USD Billion

CAGR :

%

USD

13.03 Billion

USD

24.49 Billion

2024

2032

USD

13.03 Billion

USD

24.49 Billion

2024

2032

| 2025 –2032 | |

| USD 13.03 Billion | |

| USD 24.49 Billion | |

|

|

|

|

Europe Rapid Diagnostic Tests (RDT) Market Size

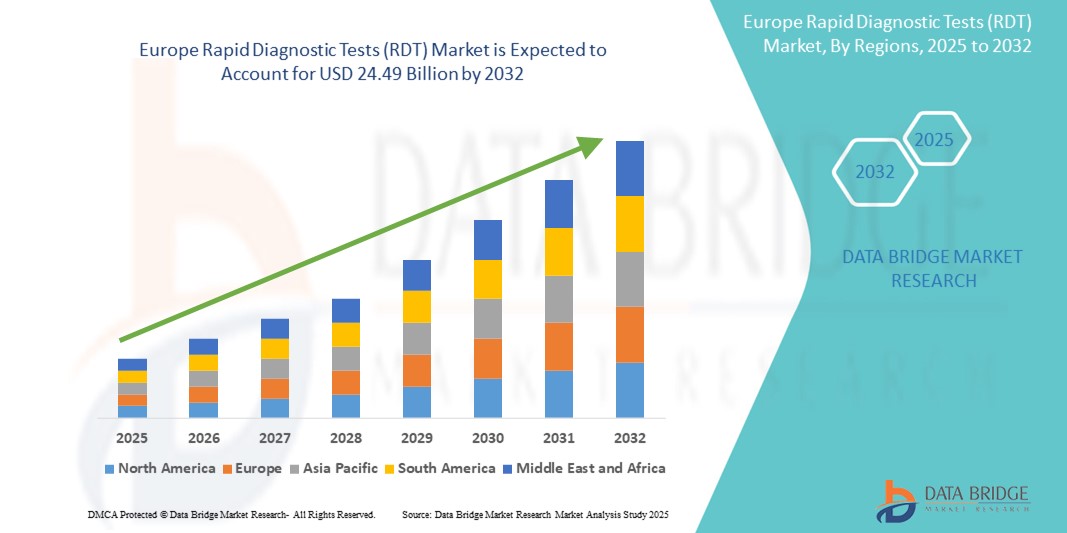

- The Europe rapid diagnostic tests (RDT) market size was valued at USD 13.03 billion in 2024 and is expected to reach USD 24.49 billion by 2032, at a CAGR of 8.20% during the forecast period

- The market growth is largely fueled by the widespread adoption of point‑of‑care and home‑based testing, enabled by rapid advances in diagnostic technologies such as lateral flow assays, microfluidics, and molecular RDTs. This enables faster disease detection and helps reduce the burden on conventional laboratory infrastructure across both urban and rural settings in Europe

- Furthermore, rising consumer demand for quick, accurate, and affordable diagnostic solutions—particularly for infectious diseases, chronic conditions, and antimicrobial resistance screening—is establishing RDTs as essential tools for early intervention, telehealth expansion, and public health surveillance. These converging factors are accelerating the uptake of rapid diagnostic solutions, thereby significantly boosting the Europe RDT market's growth

Europe Rapid Diagnostic Tests (RDT) Market Analysis

- Rapid Diagnostic Tests (RDTs), offering quick, point-of-care results without the need for complex laboratory infrastructure, are becoming essential tools in disease surveillance, outbreak response, and routine diagnostics across both hospital and homecare settings due to their speed, affordability, and ease of use

- The increasing demand for RDTs is primarily driven by the growing prevalence of infectious diseases, rising need for decentralized healthcare, and advancements in lateral flow and immunoassay technologies that have improved test accuracy and shelf life

- The U.K. dominated the Europe rapid diagnostic tests (RDT) market with the largest revenue share of 29.7% in 2024, supported by government initiatives promoting self-testing, a strong retail pharmacy network, and widespread use of RDTs in COVID-19, influenza, and STI testing. The expansion of e-commerce healthcare services further boosts home-based diagnostics in the country

- Germany is expected to be the fastest growing country in the Europe rapid diagnostic tests (RDT) market during the forecast period, driven by the rising incidence of chronic and infectious diseases, increasing healthcare expenditure, and strong uptake of innovative diagnostic technologies across hospital and ambulatory care settings

- The consumables and kits segment dominated the Europe rapid diagnostic tests (RDT) market with the largest revenue share of 64.3% in 2024, attributed to the high frequency of testing across healthcare settings and ease of availability

Report Scope and Europe Rapid Diagnostic Tests (RDT) Market Segmentation

|

Attributes |

Europe Rapid Diagnostic Tests (RDT) Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Rapid Diagnostic Tests (RDT) Market Trends

“Improved Diagnostic Accuracy and Accessibility”

- A significant and accelerating trend in the Europe rapid diagnostic tests (RDT) market is the increasing integration of advanced technologies and decentralized testing models aimed at improving diagnostic speed and accessibility across clinical and non-clinical settings

- For instance, in May 2023, Roche announced the European launch of its cobas pulse system, a handheld device that combines digital health tools with rapid point-of-care testing. This innovation supports healthcare professionals in making quicker, more accurate diagnostic decisions at the bedside or in outpatient settings

- Emerging RDT platforms are now equipped with features that enable quicker detection of infectious diseases, chronic conditions, and biomarkers using compact, easy-to-use formats that do not require central laboratory infrastructure. These tools are especially useful in emergency settings, rural clinics, and home care, where timely results are crucial

- In addition, the growth in multiplex testing capabilities allows a single test to identify multiple pathogens or conditions at once. For instance, multiplex lateral flow assays can simultaneously screen for influenza, COVID-19, and RSV using a single nasal swab, saving time and resources while improving patient triage

- The seamless integration of RDTs into electronic medical records (EMRs) and clinical decision-support systems is further enhancing their clinical utility. Healthcare professionals can now access real-time results and integrate them directly into patient management workflows, thereby optimizing treatment initiation and follow-up care

- This trend toward more efficient, user-friendly, and interoperable diagnostic solutions is fundamentally reshaping expectations within healthcare systems. As a result, companies such as Abbott, Siemens Healthineers, and bioMérieux are expanding their RDT offerings to include both professional and over-the-counter solutions targeted at chronic disease monitoring and population-wide screening efforts

- The demand for rapid diagnostic tests that provide quick, accurate, and actionable results is growing rapidly across hospitals, home care, and decentralized medical environments, as public health agencies and private providers increasingly emphasize preventive care and early intervention

Europe Rapid Diagnostic Tests (RDT) Market Dynamics

Driver

“Growing Need Due to Rising Disease Burden and Demand for Quick Diagnosis”

- The rising prevalence of infectious diseases, including influenza, COVID-19, HIV, malaria, and respiratory syncytial virus (RSV), is a significant driver for the increasing demand for rapid diagnostic tests (RDTs) across Europe

- For instance, in January 2024, Roche Diagnostics launched a new dual antigen rapid test capable of detecting both COVID-19 and influenza A/B viruses, providing results in just 15 minutes. This aligns with the market's growing focus on early and accurate point-of-care diagnosis, which helps reduce transmission and improve patient outcomes

- Governments and healthcare systems in the region are also prioritizing decentralized and community-based diagnostics to reduce pressure on hospitals and improve disease surveillance. This trend is further fueled by initiatives from the European Centre for Disease Prevention and Control (ECDC) and public health agencies

- In addition, technological advancements in lateral flow assays, microfluidics, and biosensor integration have significantly improved the accuracy, speed, and usability of RDTs. These innovations are making RDTs a practical and reliable option for both professionals and consumers

- The convenience of at-home testing, especially for chronic conditions and infections requiring regular monitoring, is accelerating RDT adoption. Increased public awareness, driven by the pandemic, has also normalized self-testing, encouraging wider acceptance across age groups

Restraint/Challenge

“Concerns Regarding Test Accuracy and Regulatory Compliance”

- Despite their benefits, concerns about the sensitivity and specificity of some RDTs continue to challenge market expansion. False negatives or positives can lead to misdiagnosis or delayed treatment, reducing confidence among healthcare providers and patients

- For instance, studies during the early COVID-19 pandemic revealed that several over-the-counter antigen tests demonstrated lower sensitivity in asymptomatic individuals, prompting regulatory scrutiny and product recalls

- Stringent approval standards across European nations and evolving regulatory frameworks under the EU’s In Vitro Diagnostic Regulation (IVDR) pose additional hurdles for manufacturers aiming to commercialize new RDTs

- Moreover, disparities in reimbursement policies across countries such as Germany, Italy, and Spain hinder the equitable adoption of RDTs, particularly in public health and low-resource settings

- The high cost of next-generation rapid tests—such as those using molecular detection platforms—may also limit adoption in budget-constrained environments, despite offering higher sensitivity

- To overcome these restraints, stakeholders must focus on clinical validation, transparent performance data, and aligning with IVDR standards. Greater investment in local manufacturing, public-private partnerships, and cost-effective innovation will be essential for ensuring broader accessibility and sustainable market growth

Europe Rapid Diagnostic Tests (RDT) Market Scope

The market is segmented into product type, mode, technology, modality, age group, test type, approach, specimen, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the Europe rapid diagnostic tests (RDT) market is segmented into consumables and kits, instruments, and others. The consumables and kits segment dominated the market with the largest revenue share of 64.3% in 2024, attributed to the high frequency of testing across healthcare settings and ease of availability.

The instruments segment is expected to witness the fastest CAGR of 10.8% from 2025 to 2032, driven by the increasing demand for point-of-care diagnostic equipment in clinics and remote settings.

- By Mode

On the basis of mode, the Europe rapid diagnostic tests (RDT) market is segmented into professional and over-the-counter (OTC). The professional segment held the largest market share of 71.5% in 2024 due to widespread use in hospitals and diagnostic laboratories.

The OTC segment is anticipated to register the fastest growth at a CAGR of 12.4% from 2025 to 2032, driven by increased self-testing trends and product availability in retail pharmacies.

- By Technology

On the basis of technology, the Europe rapid diagnostic tests (RDT) market is segmented into PCR-Based, flow-through assays, lateral flow immunochromatographic assays, agglutination assay, microfluidics, substrate technology, and others. Lateral flow immunochromatographic assays held the highest share of 38.9% in 2024 due to their simplicity and low cost.

The microfluidics segment is expected to grow at the highest CAGR of 13.1% from 2025 to 2032, driven by the rise of lab-on-chip technologies for rapid multiplex testing.

- By Modality

On the basis of modality, the Europe rapid diagnostic tests (RDT) market is segmented into laboratory based test and non-laboratory based test. The non-laboratory based test segment led the market with a share of 58.7% in 2024 owing to the ease of use and faster turnaround time.

Laboratory based tests is expected to witness the fastest CAGR from 2025 to 2032 as these tests deliver superior accuracy and reliable results—making them vital for early detection of infectious diseases and chronic conditions.

- By Age Group

On the basis of age group, the Europe rapid diagnostic tests (RDT) market is segmented into adult and pediatric. The adult segment captured the largest share of 76.4% in 2024, supported by a higher disease burden and demand for chronic disease monitoring.

The pediatric segment is expected to witness the fastest CAGR from 2025 to 2032, due to increased focus on early disease detection in children.

- By Test Type

On the basis of test type, the Europe rapid diagnostic tests (RDT) market is segmented into determining confirmation, serological testing, and viral sequencing. In 2024, the determining confirmation test type dominated the market due to its high accuracy, widespread use in infectious disease detection, and preference for confirmatory diagnostics such as RT-PCR.

Serological testing is expected to witness the fastest CAGR from 2025 to 2032, driven by infectious disease detection and immune response tracking.

- By Approach

On the basis of approach, the Europe rapid diagnostic tests (RDT) market is segmented into in-vitro diagnostic and molecular diagnostic. The in-vitro diagnostic segment held the dominant share due to affordability and compatibility with multiple analyte types.

The molecular diagnostic segment is expected to expand at a highest CAGR from 2025 to 2032, owing to precision and high sensitivity.

- By Specimen

On the basis of specimen, the Europe rapid diagnostic tests (RDT) market is segmented into swab, blood, urine, saliva, sputum, and others. The Swab segment held the largest share in 2024 due to its widespread use in infectious disease screening.

Blood specimens is expected to witness the fastest CAGR from 2025 to 2032, due to their high diagnostic accuracy and widespread use in detecting infectious and chronic diseases.

- By Application

On the basis of application, the Europe rapid diagnostic tests (RDT) market is segmented into infectious disease testing, glucose monitoring, cardiology testing, oncology testing, cardiometabolic testing, drugs-of-abuse testing, pregnancy & fertility testing, toxicology testing, and others. Infectious disease testing dominated the market in 2024 with 42.6% share, due to increasing pandemic preparedness and high diagnostic demand.

Cardiometabolic testing is expected to witness the fastest CAGR from 2025 to 2032, due to rising cardiovascular and metabolic disease prevalence coupled with advances in rapid biomarker-based diagnostics.

- By End User

On the basis of end user, the Europe rapid diagnostic tests (RDT) market is segmented into hospital & clinic, diagnostic laboratory, home care setting, research and academic institutes, and others. The hospital & clinic segment held the highest share of 46.2% in 2024 due to high testing volumes and institutional infrastructure.

The home care setting segment is projected to grow at the fastest CAGR of 11.5% from 2025 to 2032, driven by remote monitoring trends.

- By Distribution Channel

On the basis of distribution channel, the Europe rapid diagnostic tests (RDT) market is segmented into direct tender and retail sales. Direct Tender was the leading channel in 2024, particularly for institutional procurement and government contracts.

Retail Sales is expected to witness the fastest CAGR from 2025 to 2032, due to OTC test kit availability in pharmacies and online platforms.

Europe Rapid Diagnostic Tests (RDT) Market Regional Analysis

- Europe dominated the global rapid diagnostic tests (RDT) market with a substantial revenue share of 40.01% in 2024, driven by increased demand for point-of-care testing, growing infectious disease burden, and expanded government investments in public health infrastructure

- The region benefits from a robust healthcare system, high awareness among consumers and practitioners, and advanced diagnostic infrastructure, which support widespread adoption of RDTs

- Furthermore, initiatives by the European Centre for Disease Prevention and Control (ECDC) and alignment with the EU's In Vitro Diagnostic Regulation (IVDR) are strengthening the diagnostic landscape and ensuring product reliability and safety

U.K. Rapid Diagnostic Tests (RDT) Market Insight

The U.K. rapid diagnostic tests (RDT) market dominated the Europe market with the largest revenue share of 29.7% in 2024, driven by high adoption of home testing kits and strong public health initiatives. The National Health Service (NHS) plays a pivotal role in widespread distribution and subsidization of RDTs for conditions such as COVID-19, HIV, and influenza. In addition, the U.K.’s robust e-commerce infrastructure has enabled greater access to over-the-counter RDTs for chronic and infectious diseases. Government-led awareness programs and screening campaigns also continue to promote early detection and preventive care.

Germany Rapid Diagnostic Tests (RDT) Market Insight

The Germany rapid diagnostic tests (RDT) market is projected to be the fastest-growing country in the Europe market, expected to register a CAGR of 10.6% from 2025 to 2032, driven by technological innovation, rising demand for decentralized diagnostics, and increasing investments in digital health solutions. The country’s strong manufacturing base for medical devices and diagnostics is accelerating the domestic availability of RDTs. In addition, Germany’s emphasis on sustainability and data-driven diagnostics supports the integration of next-generation RDTs into healthcare practices, especially in outpatient and remote care settings.

France Rapid Diagnostic Tests (RDT) Market Insight

The France rapid diagnostic tests (RDT) market is experiencing steady growth, supported by favorable reimbursement policies and growing private-public partnerships for pandemic preparedness and disease surveillance. The country is also witnessing increased adoption of rapid tests for women's health, cardiovascular markers, and respiratory conditions in both urban and rural settings.

Italy Rapid Diagnostic Tests (RDT) Market Insight

The Italy rapid diagnostic tests (RDT) market is expanding due to an increased focus on preventive healthcare and the modernization of its diagnostic infrastructure post-COVID-19. Growing demand for at-home testing and pharmacy-based point-of-care diagnostics is reshaping the delivery of healthcare in both northern and southern Italy.

Europe Rapid Diagnostic Tests (RDT) Market Share

The rapid diagnostic tests (RDT) industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Danaher (U.S.)

- Cellex (U.S.)

- Fujirebio (Japan)

- AdvaCare Pharma (U.S.)

- ACCESS BIO (U.S.)

- Cardinal Health (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Cepheid (U.S.)

- BD (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- BIOMÉRIEUX (France)

- InBios International, Inc. (U.S.)

- Luminex Corporation (U.S.)

- Gnomegen LLC (U.S.)

- QIAGEN (Netherlands)

- Quidel Corporation (U.S.)

- Sysmex Corporation (Japan)

- Siemens Healthineers AG (Germany)

- MEGACOR Diagnostik GmbH (Austria)

- PerkinElmer (U.S.)

- Sekisui Diagnostics (U.S./Japan)

- PTS Diagnostics (U.S.)

- Werfen (Spain)

- Nova Biomedical (U.S.)

- Trinity Biotech (Ireland)

Latest Developments in Europe Rapid Diagnostic Tests (RDT) Market

- In May 2023, F. HOFFMANN-LA ROCHE LTD officially announced the acquisition of Stratos Genomics. This acquisition led to the development of DNA-based sequencing for diagnostics use. This enhanced the healthcare diagnosis segment of the company, thus leading to more revenue generation for the company

- In April 2023, In July, bioMérieux SA’s BIOFIRE Respiratory Panel 2.1 plus tests for 23 pathogens, including SARS-CoV-,2 infection, responsible for respiratory tract infections is commercially available for use around the world and helps in the early diagnosis of respiratory infections. This development assisted the company in generating more revenue

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.