Europe Refractories Market

Market Size in USD Billion

CAGR :

%

USD

6.43 Billion

USD

9.57 Billion

2024

2032

USD

6.43 Billion

USD

9.57 Billion

2024

2032

| 2025 –2032 | |

| USD 6.43 Billion | |

| USD 9.57 Billion | |

|

|

|

|

Europe Refractories Market Size

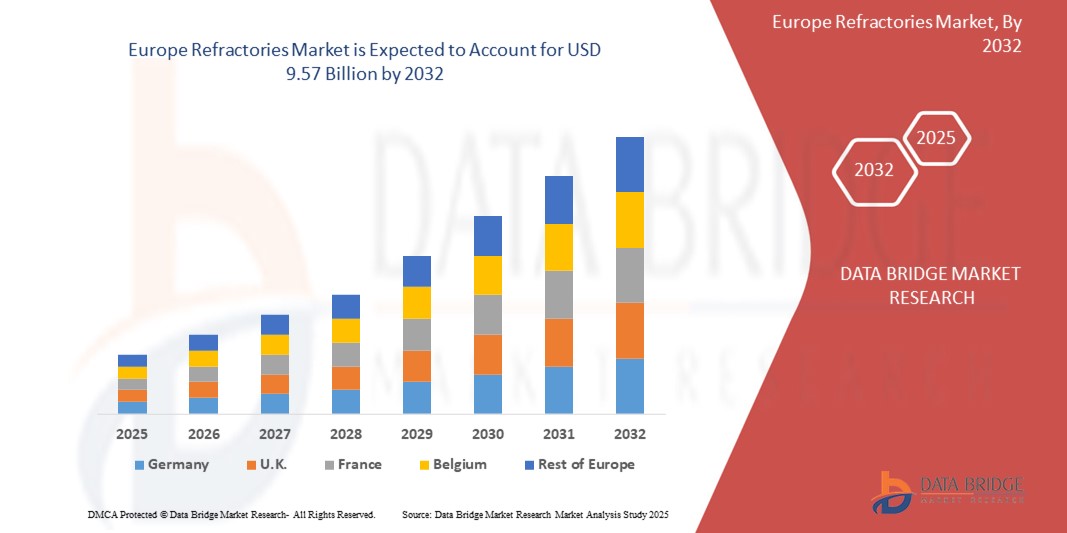

- The refractories market in Europe was valued at approximately USD 6.43 billion in 2024.It is expected to reach USD 9.57 billion by 2032, at a CAGR of 5.1% during the forecast period

- The market growth is largely fueled by the sustained growth and technological advancements within Europe's heavy industries, particularly iron and steel, cement, and glass, coupled with significant investments in infrastructure development

- Furthermore, rising demand for durable and heat-resistant materials in high-temperature industrial processes, driven by a focus on energy efficiency and sustainable practices, is establishing advanced refractories as critical components for modern industrial operations. These converging factors are accelerating the uptake of refractory solutions, thereby significantly boosting the industry's growth

Europe Refractories Market Analysis

- Refractories, offering high-temperature resistance and durability, are vital components in modern industrial processes, including steelmaking, glass manufacturing, and cement production, due to their crucial role in ensuring operational efficiency and prolonging equipment lifespan

- The escalating demand for refractories is primarily fueled by the sustained growth of heavy industries, increasing infrastructure development, and a rising focus on energy efficiency and sustainable manufacturing practices across Europe

- Europe holds a significant market share (approximately 14.2% in 2024). Within Europe, Germany traditionally holds the largest market share, characterized by its robust industrial base, while countries like the UK and Russia are experiencing substantial growth, driven by investments in modernization and infrastructure

- The Iron & Steel segment continues to dominate the refractories market in Europe with a significant market share of around 64.89% in 2024, driven by the extensive use of refractories in various steelmaking processes. The Glass & Ceramics segment is expected to be the fastest-growing during the forecast period due to increasing demand from these industries

Report Scope and Europe Refractories Market Segmentation

|

Attributes |

Smart Lock Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Refractories Market Trends

"Digitalization and Advanced Analytics for Optimized Performance"

- A significant and accelerating trend in the European refractories market is the deepening integration of digitalization, advanced analytics, and AI/Machine Learning (ML) throughout the entire refractory lifecycle. This fusion of technologies is significantly enhancing operational efficiency, extending refractory lifespan, and improving decision-making for end-users

- For instance, leading companies like RHI Magnesita are developing refractory management tools that combine production data with AI technology to predict refractory behavior in real-time, helping clients make fact-based decisions on when to replace linings. Similarly, advanced measurement systems like MINSCAN LSC are being integrated into Electric Arc Furnaces (EAFs) to provide real-time automated refractory maintenance, ensuring safer and more cost-effective operations

- AI and ML integration in refractories enables features such as:

- Predictive Maintenance: Analyzing vast amounts of data (temperature, pressure, gas composition) from sensors embedded in kilns and furnaces to predict wear patterns and potential malfunctions, allowing for proactive maintenance and reducing unplanned downtime

- Process Optimization: AI algorithms can analyze historical data to determine optimal process parameters, significantly enhancing energy efficiency and reducing CO2 emissions

- Improved Quality Control: Data-driven insights and predictive tools can accelerate innovation in materials science, leading to the development of higher-performing refractories

- Enhanced Recycling: Advanced sorting equipment utilizing technologies like laser-induced breakdown spectroscopy and hyperspectral imaging cameras are being developed to improve the yield and quality of recycled refractory materials

- The seamless integration of digital tools and AI in refractory management facilitates centralized control over various aspects of industrial operations. Through a single interface, users can monitor refractory wear, manage maintenance schedules, and optimize energy usage alongside other plant operations, creating a unified and automated production environment

- This trend towards more intelligent, intuitive, and interconnected refractory systems is fundamentally reshaping industry expectations for industrial process management and sustainability. Consequently, companies are investing heavily in research and development to create "smart refractories" that offer enhanced performance and contribute to a more efficient and sustainable industrial landscape

- The demand for refractories that offer seamless digitalization and advanced analytical capabilities is growing rapidly across key industrial sectors, as producers increasingly prioritize operational efficiency, cost reduction, and environmental responsibility

Europe Refractories Market Dynamics

Driver

"Growing Need Due to Industrial Growth, Infrastructure Development, and Sustainability Focus"

- The increasing demand for durable and high-temperature-resistant materials from Europe's core industries, coupled with significant investments in infrastructure and a rising focus on sustainability, is a significant driver for the heightened demand for refractories

- For instance, the European Union's ambitious plans to double its freight rail capacity by 2030 and cut CO2 emissions will drive substantial demand for iron and steel, which are essential for constructing new rail systems. Refractories play a critical role in iron and steel production, lining furnaces to ensure durability and heat resistance during steelmaking processes. Such initiatives by governmental bodies and industrial trends are expected to drive the refractories industry growth in the forecast period

- As industries become more aware of the critical need for efficient high-temperature processes and seek enhanced operational longevity for their equipment, refractories offer advanced features such as improved thermal insulation, resistance to corrosive environments, and extended lifespan, providing a compelling advantage over less specialized materials

- Furthermore, the growing push for energy efficiency and reduced carbon emissions across European industries is making advanced refractories an integral component of sustainable manufacturing. Modern refractories are designed to minimize heat loss, optimize energy consumption, and support cleaner production processes

- The demand for higher-performance refractories that can withstand increasingly extreme conditions in modern industrial furnaces, coupled with the ability to contribute to energy savings and reduced environmental impact, are key factors propelling the adoption of advanced refractory solutions in various industrial sectors. The trend towards optimizing industrial processes for both economic and environmental benefits further contribute to market growth

Restraint/Challenge

"Raw Material Price Volatility, Environmental Regulations, and High Energy Costs"

- Concerns surrounding the volatility of raw material prices, stringent environmental regulations, and high energy costs pose significant challenges to the broader market penetration and profitability of the European refractories industry. As refractories rely heavily on specific minerals and energy-intensive production processes, they are susceptible to fluctuations in global commodity markets and the increasing cost of complying with environmental standards

- For instance, reports indicate that the prices of refractory raw materials like bauxite, magnesite, and graphite have experienced significant surges (over 25% in recent years) due to factors such as supply chain disruptions, geopolitical tensions, and export restrictions from key producing countries (e.g., China). This directly impacts production costs for European manufacturers. Additionally, the energy crisis in Europe has led to substantial increases in energy bills for refractory producers, with some reporting increases of up to 700%, pushing the industry to rethink energy consumption on-site

- Addressing these challenges through strategic sourcing, vertical integration, and investment in sustainable practices is crucial for building market resilience. Companies are exploring diversified supply chains and investing in recycling technologies to mitigate raw material price fluctuations. Furthermore, the European Union's stringent environmental regulations, such as the Carbon Border Adjustment Mechanism (CBAM), compel refractory manufacturers to invest in cleaner production methods and reduce emissions, adding to operational costs. While these regulations drive innovation towards greener refractories, the initial investment required for new technologies and compliance can be a barrier for some manufacturers

- The perceived high initial cost of advanced, high-performance refractories, especially compared to lower-cost alternatives from other regions, can also be a barrier to adoption for price-sensitive industries. While European refractories are often lauded for their superior quality and longer lifespan, the upfront investment can deter some buyers

- Overcoming these challenges through collaborative research and development, government support for sustainable technologies, and a clear demonstration of long-term cost benefits of advanced and sustainable refractories will be vital for sustained market growth

Europe Refractories Market Scope

The market is segmented on the basis of alkalinity, form type, product type, fusion temperature, application, and technology

- By Alkalinity

On the basis of alkalinity, the refractories market is segmented into Acidic & Neutral Refractories and Basic Refractories (Carbon). The Basic Refractories (Carbon) segment is anticipated to hold a significant market share, driven by their superior performance and increasing adoption in high-temperature applications within the steel and cement industries where basic slag conditions prevail. The Acidic & Neutral Refractories segment, while mature, continues to see steady demand, especially for applications requiring specific chemical resistance and high thermal shock resistance

- By Form Type

On the basis of form type, the refractories market is segmented into Bricks, Monolithic, and Others. The Bricks (Shaped Refractories) segment currently dominates the largest market revenue share, driven by their established reputation for structural integrity, precise dimensions, and ease of installation in various industrial furnaces. Industrial users often prioritize brick refractories for their perceived robustness and long service life. The market also sees strong demand for brick types due to their wide range of applications and compatibility with various furnace designs. The Monolithic (Unshaped) Refractories segment is anticipated to witness the fastest growth rate, fueled by increasing adoption due to their flexibility, faster installation times, and ability to form seamless linings, making them suitable for complex and irregularly shaped furnace areas. Their ease of application and reduced labor costs also contribute to their growing popularity

- By Product Type

On the basis of product type, the refractories market is segmented into Clay and Non-Clay. The Non-Clay segment (which includes materials like magnesia, alumina, silica, zirconia, etc.) held the largest market revenue share in 2024, driven by their superior performance at extremely high temperatures and their resistance to various corrosive environments. Non-clay refractories are essential for critical applications in industries like steel and glass. The Clay segment is expected to witness steady growth, particularly for applications requiring good thermal insulation and cost-effectiveness, such as in certain kiln linings and insulating refractories

- By Fusion Temperature

On the basis of fusion temperature, the refractories market is segmented into Normal Refractory (1580-1780°C), High Refractory (1780-2000°C), and Super Refractory (>2000°C). The High Refractory (1780-2000°C) and Super Refractory (>2000°C) segments are expected to witness significant growth, driven by the increasing need for refractories that can withstand more extreme operating temperatures in modern industrial processes (e.g., advanced steelmaking, specialized ceramics). This trend is fueled by the pursuit of higher efficiency and increased output in these industries. The Normal Refractory (1580-1780°C) segment maintains a consistent demand for general industrial applications

- By Application

On the basis of application, the refractories market is segmented into Iron and Steel, Cement and Lime, Energy and Chemicals, Glass, Non-Ferrous Metals, and Others. The Iron and Steel segment accounted for the largest market revenue share in 2024 (approximately 64.89%), driven by the extensive and critical use of refractories in various stages of steel production, including blast furnaces, basic oxygen furnaces, and electric arc furnaces. The Glass and Non-Ferrous Metals segments are expected to witness the fastest CAGRs, driven by the increasing demand for high-quality glass products and the expansion of non-ferrous metal production, both requiring specialized and durable refractory linings

- By Technology

On the basis of technology, the refractories market is segmented into Isostatics and Slide Gates. The Slide Gates segment held a substantial market share, driven by their critical role in controlling the flow of molten metal from ladles and tundishes in steelmaking, offering precise control and enhanced safety. The Isostatics technology is expected to witness strong growth, particularly in the production of high-performance refractories with uniform density and strength, often used in continuous casting processes and specific industrial applications requiring superior material properties

Europe Refractories Market Regional Analysis

- Europe holds a significant share of the global refractories market (approximately 14.2% in 2024), driven by its well-established industrial base and a strong emphasis on technological advancement and sustainability

- Industries across the region highly value refractories for their crucial role in enhancing operational efficiency, extending equipment lifespan in high-temperature processes, and contributing to reduced energy consumption and emissions

- This widespread adoption is further supported by the presence of major industrial players, continuous investment in modernization, and a growing preference for high-performance and environmentally compliant refractory solutions, establishing refractories as essential components for sustainable industrial production

Germany Refractories Market Insight

The Germany refractories market captured a substantial revenue share within Europe, and is expected to expand at a considerable CAGR during the forecast period. This growth is fueled by a strong manufacturing sector, particularly in the iron & steel and automotive industries, and increasing awareness of the benefits of advanced refractory materials. Germany’s well-developed industrial infrastructure, combined with its emphasis on innovation and high-quality engineering, promotes the adoption of sophisticated refractory solutions, particularly in demanding applications. The country's focus on technological leadership and sustainable production practices further drives demand for cutting-edge refractories

U.K. Refractories Market Insight

The U.K. refractories market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by ongoing infrastructure projects, renewed investment in key industrial sectors like steel and glass, and a desire for increased operational efficiency. Additionally, the U.K.'s evolving industrial landscape and its focus on adopting advanced manufacturing techniques are encouraging the use of high-performance refractories. The country's embrace of technological innovation and its commitment to reducing carbon emissions are expected to continue to stimulate market growth for sustainable refractory solutions

Russia Refractories Market Insight

The Russia refractories market is projected to be the fastest-growing region in Europe with a CAGR of 7.5% from 2025 to 2030, reaching USD 3,945.5 million by 2030. This growth is fueled by significant domestic demand from its large metallurgical and heavy industries, as well as ongoing modernization efforts in these sectors. Russia's strong resource base and its strategic focus on industrial development, including crude steel production where it ranks among the top globally, contribute significantly to the demand for refractories. The increasing need for durable and high-performance linings in furnaces and kilns across its industrial landscape is a key factor propelling the market in Russia

Europe Refractories Market Share

The Europe Refractories industry is primarily led by well-established companies, including:

- Almatis GmbH (Germany)

- Imerys (France)

- RHI Magnesita GmbH (Austria)

- Saint-Gobain Performance Ceramics & Refractories (PCR) (France)

- Refratechnik (Germany)

- Allied Mineral Products, Inc. (US)

- ALTEO (France)

- Coorstek (US)

- HARBISONWALKER INTERNATIONAL (US)

- IFGL Refractories Ltd. (India)

- Krosaki Harima Corporation (Japan)

- Lhoist (Belgium)

- Magnezit Group (Russia)

- Minerals Technologies Inc. (US)

- Morgan Advanced Materials (UK)

- Puyang Refractories Group Co., Ltd. (China)

- SHINAGAWA REFRACTORIES CO., LTD. (Japan)

- VENUS Safety & Health Pvt. Ltd (India)

- Vesuvius (UK)

- Wuxi Nanfang Refractories Co., Ltd. (China)

Latest Developments in Global Smart Lock Market

- In June 2024, MIRECO (a joint venture of RHI Magnesita and Horn & Co. Group) acquired Refrattari Trezzi, an Italian refractory recycling specialist. This acquisition expands MIRECO's production footprint into Italy and represents a significant step towards the decarbonization targets of the European refractories industry by increasing the use of secondary raw materials and promoting the circular economy

- In October 2024, Shinagawa Refractories Co., Ltd. acquired Gouda Refractories Group B.V., a Netherlands-based manufacturer of high-alumina refractories and provider of refractory services. This acquisition strengthens Shinagawa's presence in Europe, providing it with state-of-the-art manufacturing for premium white refractories and high-value service capabilities in the region

- In April 2023, RHI Magnesita, a global leader in refractories, announced the acquisition of the Europe, India, and US operations of Seven Refractories. This strategic move complements RHI Magnesita's existing non-basic refractories portfolio and aims to open new opportunities in the development of low CO2 emitting manufacturing technologies, supporting sustainability goals in key customer industries like steel and cement

- In October 2023, RHI Magnesita also acquired the refractory businesses of the Preiss-Daimler Group ("P-D Refractories") located in Germany, the Czech Republic, and Slovenia. This acquisition enhances RHI Magnesita's capabilities in alumina-based refractories and strengthens its presence in process industries, where the Group is currently under-represented

- In 2022, RHI Magnesita and the Horn & Co. Group combined their recycling activities in Europe to increase the production, use, and supply of secondary raw materials for the European refractory industry, targeting a substantial reduction of CO2 emissions. This initiative underscores the industry's commitment to sustainability and circular economy principles

- The ATHOR and CESAREF projects are ongoing collaborative and interdisciplinary initiatives in Europe, bringing together academic and industrial partners. These projects, funded by programs like Horizon Europe, focus on developing advanced thermomechanical modelling of refractory linings, optimizing the use of mineral resources, recycling, anticipating the use of hydrogen in steelmaking, and improving energy efficiency and durability of refractories. These collaborations aim to shape the future of refractory technology and contribute to the decarbonization of European energy-intensive industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Refractories Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Refractories Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Refractories Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.