Europe Research Antibodies Reagents Market

Market Size in USD Billion

CAGR :

%

USD

2.75 Billion

USD

4.19 Billion

2024

2032

USD

2.75 Billion

USD

4.19 Billion

2024

2032

| 2025 –2032 | |

| USD 2.75 Billion | |

| USD 4.19 Billion | |

|

|

|

Europe Research Antibodies Reagents Market Analysis

The Europe research antibodies reagents market is a rapidly growing segment within the life sciences and biotechnology industries. Antibodies reagents are crucial tools in research applications, including diagnostics, drug development, disease understanding, and biomarker discovery. The market has witnessed significant growth due to the increasing demand for personalized medicine, advancements in genomics and proteomics, and the rising prevalence of chronic diseases like cancer, diabetes, and autoimmune disorders.

Europe Research Antibodies Reagents Market Size

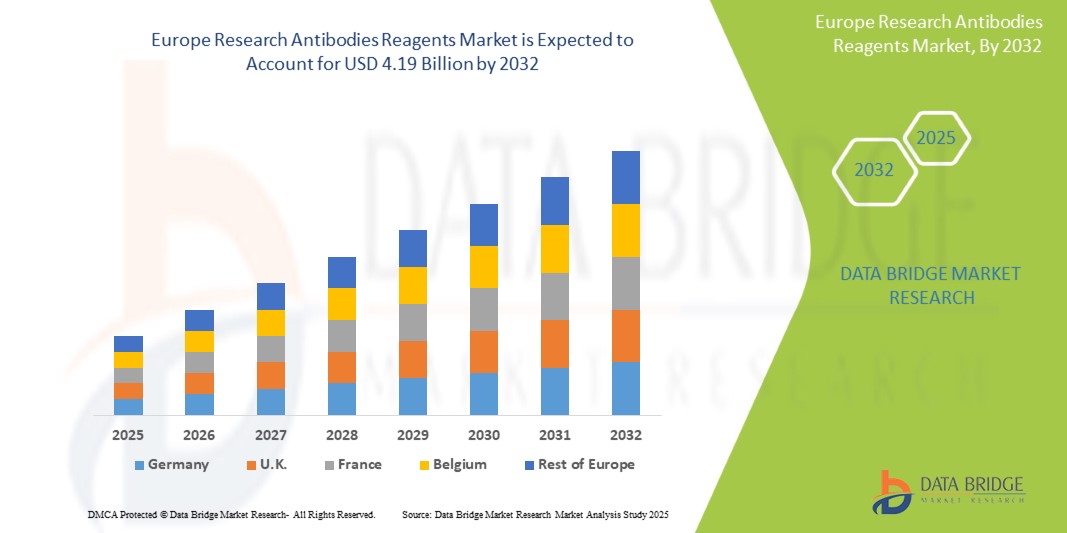

Europe research antibodies reagents market size was valued at USD 2.75 billion in 2024 and is projected to reach USD 4.19 billion by 2032, growing with a CAGR of 5.7% during the forecast period of 2025 to 2032.

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Europe Research Antibodies Reagents Market Trends

“Increasing Demand for Personalized Medicine and Targeted Therapies”

One significant trend in the Europe Research Antibodies Reagents Market is the increasing demand for personalized medicine and targeted therapies, which is driving innovation in antibody development. As researchers and pharmaceutical companies focus on developing customized treatments based on individual patient profiles, there is a rising need for high-specificity and affinity antibodies that can accurately target specific biomarkers associated with various diseases. This trend is further fueled by advancements in technologies such as monoclonal antibody production, recombinant DNA technology, and CRISPR, leading to the introduction of novel antibody reagents that enhance the effectiveness of diagnostic and therapeutic applications. Additionally, the growth of biobanks and precision research initiatives contributes to a broader array of available reagents, supporting the evolution of the market toward more specialized and effective research tools.

Report Scope and Europe Research Antibodies Reagents Market Segmentation

|

Attributes |

Europe Research Antibodies Reagents Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Germany, U.K., France, Netherlands, Spain, Switzerland, Belgium, Italy, Russia, Turkey, and Rest of Europe |

|

Key Market Players |

Thermo Fisher Scientific (U.S.), MilliporeSigma (U.S.), Santa Cruz Biotechnology (U.S.), Danaher (U.S.), Perkinelmer Inc (U.S.), F.Hoffmann La Roche Ltd.(Switzerland), Rockland Immunochemicals Inc (U.S.), Johnsons & Johnsons (U.S.), Agilent Technologies Inc. (U.S.), Eli Lily and Company (U.S.), BD (U.S.), Genscript Biotech Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Research Antibodies Reagents Market Definition

The Europe research antibodies reagents market refers to the commercial sector involving the production, distribution, and utilization of antibodies and related reagents used in research applications across various fields, including biotechnology, pharmaceuticals, and academic research. This market encompasses a wide range of products, including monoclonal and polyclonal antibodies, secondary antibodies, antibody fragments, and conjugated antibodies, which are essential tools for a variety of applications such as immunohistochemistry, Western blotting, enzyme-linked immunosorbent assays (ELISA), and flow cytometry. The market is driven by the growing need for innovative research tools to support drug discovery, disease diagnosis, and personalized medicine, as well as advancements in antibody technologies and increasing funding for research in life sciences.

Europe Research Antibodies Reagents Market Dynamics

Drivers

- Increase in Technological Advancements

Technological advancements play a crucial role in driving the Europe research antibodies reagents market by enabling the development of more specific, efficient, and diverse antibody products. Innovations such as monoclonal antibody production processes, phage display technology, and recombinant DNA technologies have significantly improved the ability to produce high-quality antibodies with enhanced specificity and affinity. These technologies allow researchers to create antibodies that are tailored to specific targets, which is essential in various applications, including drug development, diagnostics, and basic research. The continuous evolution of high-throughput screening techniques and the integration of bioinformatics tools further accelerate the discovery and validation of novel antibodies, leading to a broader range of reagents available on the market and meeting the diverse needs of the scientific community.

For instance,

- In November 2024, according to an article published in the National Library of Medicine, breakthroughs in genetic engineering have enabled the production of humanized antibodies and the advances in Fc engineering, thereby increasing therapeutic efficacy. The discovery of immune checkpoints and cytokines revolutionized the treatment of cancer and autoimmune diseases

- In February 2021, according to an article published in the National Library of Medicine, currently, more than 500 antibodies are in early stages of research, while more than 50 mAbs are in the final stages of clinical development, most of which are directed at combating cancer and autoimmune or inflammatory diseases such as melanoma, lupus, and rheumatoid arthritis

Increasing Prevalence of Neurodegenerative Diseases

The increasing prevalence of neurodegenerative diseases, such as Alzheimer's, Parkinson's, and amyotrophic lateral sclerosis (ALS), is significantly driving demand for research antibodies reagents in the Europe market. As the incidence of these diseases rises due to factors such as aging populations and lifestyle changes, there is an urgent need for ongoing research to uncover their underlying mechanisms, identify biomarkers for early diagnosis, and develop effective treatments. Antibodies play a critical role in this research, as they are essential tools for studying the pathological processes involved in neurodegenerative diseases. This growing focus on understanding and combating neurodegenerative conditions is fuelling investment in the development of specific antibodies to target proteins associated with these diseases, thus expanding the market for research antibodies reagents.

For instance,

- In February 2021, according to an article published in the National Library of Medicine, neurological disorders are the leading cause of physical and cognitive disability across the globe, currently affecting approximately 15% of the worldwide population. Absolute patient numbers have considerably climbed over the past 30 years. Moreover, the burden of chronic neurodegenerative conditions is expected to at least double over the next two decades

Moreover, the increased funding and resources being allocated to neuroscience research—both by government bodies and private organizations—create a conducive environment for the growth of the antibodies reagents market. As pharmaceutical and biotechnology companies ramp up their efforts to develop new therapies, including monoclonal antibodies and other biologics for treating neurodegenerative diseases, the demand for high-quality research antibodies and reagents to support preclinical and clinical studies is on a rise. This trend translates into opportunities for companies specializing in antibody production and related reagents, enabling them to enhance their product offerings and contribute to the advancement of treatments for neurodegenerative diseases, ultimately benefiting patients and healthcare systems.

Opportunities

- Growing Demand for Personalized Medicine

The growing demand for personalized medicine presents a significant opportunity in the market. Personalized medicine, which tailors treatment based on an individual’s genetic makeup, lifestyle, and environment, has gained momentum due to its potential to improve patient outcomes and reduce adverse effects. This trend is fueling the need for advanced diagnostic tools and biomarker discovery, which rely heavily on antibodies and reagents.

Antibodies play a crucial role in personalized medicine, particularly in identifying and targeting specific biomarkers associated with diseases. Monoclonal and polyclonal antibodies are instrumental in developing precision therapies and companion diagnostics, which are integral to personalized treatment plans. For example, in cancer research, antibodies can target specific tumor antigens, allowing for the development of therapies that are more effective and less toxic than traditional treatments. Similarly, in autoimmune diseases, antibodies can be used to identify specific immune markers that guide treatment decisions.

As more research institutions and pharmaceutical companies focus on developing personalized therapies, there is an increasing demand for high-quality antibodies and reagents to aid in the discovery and validation of biomarkers. These tools are essential for creating diagnostic tests that determine the most appropriate treatments for individual patients, thereby improving therapeutic outcomes.

- Research Growth in Autoimmune and Infectious Diseases

With increasing advancements in biotechnology and the rising Europe burden of infectious diseases, there is a greater need for precise diagnostic tools and targeted therapies. The demand for antibodies and reagents is particularly high in this field due to their critical role in diagnosing and treating a variety of infectious diseases, such as COVID-19, tuberculosis, HIV, and emerging pathogens like Ebola and monkeypox.

In the case of infectious diseases, antibodies are vital for the development of rapid diagnostic tests that detect specific pathogens or their biomarkers. Monoclonal antibodies, in particular, are essential in developing tests and treatments for various infectious diseases by targeting antigens specific to the disease-causing microorganisms. Furthermore, antibodies play a key role in the development of vaccines, helping to identify and neutralize pathogens before they cause harm. With the increasing focus on pandemic preparedness, antibody-based reagents are critical for the rapid identification and isolation of infectious agents.

Research into autoimmune diseases, which occur when the immune system attacks the body’s own cells, is also gaining significant attention. Conditions such as rheumatoid arthritis, lupus, and multiple sclerosis are increasingly being studied using antibodies that specifically target immune cells involved in disease processes. These developments are crucial for developing more effective and less toxic therapies, offering new treatment options for patients. The growing interest in immunotherapy, which uses antibodies to modulate immune responses, is also expanding research in this area.

Restraints/Challenges

- Growing Use of Alternative Technologies

The growing use of alternative therapies poses significant challenges for the Europe research antibodies reagents market. As research shifts towards emerging therapeutic modalities, such as gene therapies, cell therapies, and RNA-based treatments, there may be a decreased reliance on traditional antibody-based approaches. This shift can lead to fluctuations in demand for conventional research antibodies, as funding and research priorities increasingly favour these innovative alternatives over established methodologies, potentially leading to market contraction for antibody reagent suppliers. Furthermore, the rapid development of alternative therapies may outpace the ability of antibody manufacturers to adapt, creating a gap between the needs of researchers and the available products.

For instance,

- In May 2024, according to the article, ‘Recent Advances in Gene Therapy for Haemophilia: Projecting the Perspectives’, gene therapy is considered to be the most promising method as it may overcome the problems associated with more traditional treatments

- In April 2020, according to U.S. Government Accountability Office, scientists are using CRISPR/ CAS9 technology to develop diagnostic tests that may rapidly identify diseases such as sickle cell anaemia and some types of cancer. They help in controlling certain diseases by altering the traits of insects or other organisms that can transmit disease

Additionally, the complexity and specificity associated with newer therapies can further challenge the antibodies market. As researchers explore novel approaches that require highly specialized or engineered antibodies, there may be difficulties in sourcing the appropriate reagents to meet these new demands. This creates pressure on manufacturers to invest in research and development for new types of antibodies and reagents that are tailored for these advanced therapies. Such investments may not yield immediate returns, leading to financial strain on companies that have traditionally relied on the sale of standard research antibodies. As a result, the growing demand for alternative therapies could compel antibody suppliers to either diversify their product offerings or face the risk of obsolescence in an evolving therapeutic landscape.

- Need for Expertise Associated with the Handling of Antibodies Reagents

The need for specialized expertise in the handling of antibody reagents presents a significant challenge for the Europe research antibodies reagents market. Antibodies are complex molecules that require meticulous handling, storage, and application to maintain their stability and functionality. Researchers must be well-versed in various protocols, including dilution, labelling, and conjugation techniques, to ensure that they achieve reliable and reproducible results in their experiments. This necessity for expertise can create barriers for organizations, particularly smaller labs or those in developing regions, which may lack access to adequately trained personnel or resources. As a consequence, the effective utilization of antibody reagents may be compromised, leading to suboptimal research outcomes and potential wastage of costly materials, ultimately challenging the overall growth of the market.

For instance,

- In August 2024, according to an article published by MBL International Corporation, Proper storage and handling of antibody reagents are crucial for maintaining their effectiveness over time. Antibodies degrade or lose activity if not stored under optimal conditions

- In May 2024, according to an article published by AByntek Biopharma S.L., The development of a successful diagnostic test or assay requires a secure supply chain of high-quality reagents. Recombinant antibody technology enables the production of highly reliable antibodies adapted to your specific assay, providing superior performance throughout the lifespan of your diagnosis

Moreover, the evolving landscape of antibody technologies, including advancements in humanization, engineering, and validation, necessitates continuous education and training for researchers. Moreover, as regulatory standards become increasingly stringent for antibody-based diagnostics and therapeutics, researchers must ensure compliance, which adds another layer of complexity in both research and applications. This reliance on expertise may limit the scalability of the market, as it could result in unequal access to advanced antibody reagents, stifling innovation and collaborations among various research institutions and industries. Consequently, the need for specialized knowledge in handling antibody reagents and constrains market growth and restricts the potential for new discoveries in biomedical research.

Europe Research Antibodies Reagents Market Scope

The market is segmented on the basis of type, application, research area, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Type

- Antibodies

- Antibodies, By Products

- Primary Antibodies

- Secondary Antibodies

- Antibodies, By Source

- Mouse

- Rabbit

- Goat

- Rat

- Others

- Antibodies, Based on Origin

- Monoclonal Antibodies

- Polyclonal Antibodies

- Recombinant Antibodies

- Antibodies, By Products

- Reagents

- Reagents, By Type

- Buffers & Solution

- Chemiluminescent Reagents

- Buffers & Solution, By Type

- PBS (Phosphate Buffered Saline)

- Blocking Buffers

- Dilution Buffers

- Wash Buffers

- Reagents, By Type

By Application

- Enzyme-Linked Immunosorbent Assay

- Western Blotting

- Immunohistochemistry

- Flow Cytometry

- Polymerase Chain Reaction

- Others

By Research Area

- Immunology

- Cell & Molecular Biology

- Neuroscience

- Genomics & Proteomics

- Biotechnology & Drug Discovery

- Microbiology

- Others

By End User

- Pharmaceutical and Biopharmaceutical Manufacturers

- Academic And Research Institutes

- Contract Research Organizations (CROs)

- Hospitals & Diagnostic Laboratories

- Others

By Distribution Channel

- Direct Sales

- Third Party Sales

- Others

Europe Research Antibodies Reagents Market Regional Analysis

The market is segmented on the basis of type, application, research area, end user, and distribution channel.

The countries covered in the market are Germany, U.K., France, Netherlands, Spain, Switzerland, Belgium, Italy, Russia, Turkey, and rest of Europe.

Germany is expected to dominate and fastest growing country in the market due to advanced research infrastructure, high funding for biotechnology and pharmaceuticals, increasing prevalence of diseases, and strong demand for innovative antibody reagents in diagnostics and drug development.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Europe Research Antibodies Reagents Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Europe Research Antibodies Reagents Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific (U.S.)

- MilliporeSigma (U.S.)

- Santa Cruz Biotechnology (U.S.)

- Danaher (U.S.)

- Perkinelmer Inc (U.S.)

- F.Hoffmann La Roche Ltd. (Switzerland)

- Rockland Immunochemicals Inc (U.S.)

- Johnsons & Johnsons (U.S.)

- Agilent Technologies Inc. (U.S.)

- Eli Lily and Company (U.S.)

- BD (U.S.)

- Genscript Biotech Corporation (U.S.)

Latest Developments in Europe Research Antibodies Reagents Market

- In November 2024, Sigma-Aldrich has announced the winners of its Emerging Biotech Grant Program, which supports innovative biotech startups and researchers. The program aims to foster the development of groundbreaking technologies in life sciences. Winners receive funding, resources, and mentorship to accelerate their research and product development, contributing to advancements in biotechnology

- In September 2024, Sigma-Aldrich has introduced the **Mobius™ ADC** (antibody-drug conjugate) platform, designed to streamline the development and manufacturing of biologics. This advanced platform offers a comprehensive solution for the efficient production of ADCs, enabling faster, more scalable, and cost-effective creation of targeted therapies, enhancing the development of innovative cancer treatments

- In December 2024, Thermo Fisher Scientific has launched CTS Detachable Dynabeads CD4 and CTS Detachable Dynabeads CD8 to support cell therapy development and production. These innovative tools enhance T cell isolation and expansion processes, improving the efficiency and scalability of cell therapies, offering new opportunities for advanced immunotherapies and personalized treatments

- In October 2024, Thermo Fisher Scientific highlighted its expanded biopharma services at CPhI Milan 2024, showcasing innovations designed to support the development and production of complex biologics and cell therapies. These advancements focus on improving the scalability, efficiency, and speed of biopharmaceutical manufacturing, underscoring Thermo Fisher's commitment to accelerating biopharma solutions

- In November 2024, Eli Lilly and Company announced the election of Jon Moeller to its board of directors. Karen Walker resigned from the board, , but will collaborate on digital commercial activities in 2025

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE RESEARCH ANTIBODIES REAGENTS MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN TECHNOLOGICAL ADVANCEMENTS

6.1.2 INCREASING PREVALENCE OF NEURODEGENERATIVE DISEASES

6.1.3 GOVERNMENT FUNDING AND INITIATIVES

6.1.4 INCREASING USAGE OF DIAGNOSTICS

6.2 RESTRAINTS

6.2.1 GROWING USE OF ALTERNATIVE TECHNOLOGIES

6.2.2 NEED FOR EXPERTISE ASSOCIATED WITH THE HANDLING OF ANTIBODIES REAGENTS

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR PERSONALIZED MEDICINE

6.3.2 RESEARCH GROWTH IN AUTOIMMUNE AND INFECTIOUS DISEASES

6.3.3 EXPANSION OF HEALTHCARE SECTORS WORLDWIDE

6.4 CHALLENGES

6.4.1 HIGH COST OF ANTIBODIES LIMITS MARKET ACCESSIBILITY

6.4.2 REGULATORY CHALLENGES HINDER PRODUCT APPROVALS AND DELAY MARKET ENTRY

7 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE

7.1 OVERVIEW

7.2 ANTIBODIES

7.2.1 PRIMARY ANTIBODIES

7.2.2 SECONDARY ANTIBODIES

7.2.2.1 MOUSE

7.2.2.2 RABBIT

7.2.2.3 GOAT

7.2.2.4 RAT

7.2.2.5 OTHERS

7.2.3 MONOCLONAL ANTIBODIES

7.2.4 POLYCLONAL ANTIBODIES

7.2.5 RECOMBINANT ANTIBODIES

7.3 REAGENTS

7.3.1 BUFFERS & SOLUTION

7.3.2 CHEMILUMINESCENT REAGENTS

8 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ENZYME-LINKED IMMUNOSORBENT ASSAY

8.3 WESTERN BLOTTING

8.4 IMMUNOHISTOCHEMISTRY

8.5 FLOW CYTOMETRY

8.6 POLYMERASE CHAIN REACTION

8.7 OTHERS

9 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY RESEARCH AREA

9.1 OVERVIEW

9.2 IMMUNOLOGY

9.3 CELL & MOLECULAR BIOLOGY

9.4 NEUROSCIENCE

9.5 GENOMICS & PROTEOMICS

9.6 BIOTECHNOLOGY & DRUG DISCOVERY

9.7 MICROBIOLOGY

9.8 OTHERS

10 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICAL AND BIOPHARMACEUTICAL MANUFACTURERS

10.3 ACADEMIC AND RESEARCH INSTITUTES

10.4 CONTRACT RESEARCH ORGANIZATIONS (CROS)

10.5 HOSPITALS & DIAGNOSTIC LABORATORIES

10.6 OTHERS

11 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT SALES

11.3 THIRD PARTY SALES

11.4 OTHERS

12 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 FRANCE

12.1.3 U.K

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 SWITZERLAND

12.1.7 RUSSIA

12.1.8 BELGIUM

12.1.9 NETHERLAND

12.1.10 TURKEY

12.1.11 REST OF EUROPE

13 EUROPE GUITAR MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 MERCK KGAA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 THERMO FISHER SCIENTIFIC, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 SANTA CRUZ BIOTECHNOLOGY INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 COMAPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 DANAHER

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 PERKINELMER INC

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMAPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 AGILENT TECHNOLOGIES, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 BIO-RAD LABORATORIES INC

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 BIO-TECHNE CORPORATION

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BD (BECTON, DICKINSON AND COMPANY)

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 BIOLEGEND INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 ELI LILY AND COMPANY

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 F. HOFFMANN-LA ROCHE LTD

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 GENSCRIPT

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 JOHNSON & JOHNSON SERVICES, INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 LONZA

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 ROCKLAND IMMUNOCHEMICALS, INC

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 TEVA PHARMACEUTICAL INDUSTRIES LIMITED

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 3 EUROPE ANTIBODIES IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 4 EUROPE ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 5 EUROPE ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 6 EUROPE ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY BASED ON ORIGIN, 2018-2032 (USD MILLION)

TABLE 7 EUROPE REAGENTS IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 8 EUROPE REAGENTS IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 9 EUROPE BUFFERS & SOLUTION IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 10 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 11 EUROPE ENZYME-LINKED IMMUNOSORBENT ASSAY IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 12 EUROPE WESTERN BLOTTING IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 13 EUROPE IMMUNOHISTOCHEMISTRY IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 14 EUROPE FLOW CYTOMTERY IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 15 EUROPE POLYMERASE CHAIN REACTION IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 16 EUROPE OTHERS IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY RESEARCH AREA, 2018-2032 (USD MILLION)

TABLE 18 EUROPE IMMUNOLOGY IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 19 EUROPE CELL & MOLECULAR BIOLOGY IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 20 EUROPE NEUROSCIENCE IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 21 EUROPE GENOMICS & PROTEOMICS IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 22 EUROPE BIOTECHNOLOGY & DRUG DISCOVERY IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 23 EUROPE MICROBIOLOGY IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 24 EUROPE OTHERS IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 25 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 26 EUROPE PHARMACEUTICAL AND BIOPHARMACEUTICAL MANUFACTURERS IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 27 EUROPE ACADEMIC AND RESEARCH INSTITUTES IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 28 EUROPE CONTRACT RESEARCH ORGANIZATIONS (CROS) IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 29 EUROPE HOSPITALS & DIAGNOSTIC LABORATORIES IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 30 EUROPE OTHERS IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 31 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 32 EUROPE DIRECT SALES IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032(USD MILLION)

TABLE 33 EUROPE THIRD PARTY SALES IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 34 EUROPE OTHERS IN RESEARCH ANTIBODIES REAGENT MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 35 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 36 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 37 EUROPE ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 38 EUROPE ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 39 EUROPE ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY BASED ON ORIGIN, 2018-2032 (USD MILLION)

TABLE 40 EUROPE REAGENTS IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 41 EUROPE BUFFERS & SOLUTION IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 42 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 43 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY RESEARCH AREA, 2018-2032 (USD MILLION)

TABLE 44 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 45 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 46 GERMANY RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 47 GERMANY ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 48 GERMANY ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 49 GERMANY ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY BASED ON ORIGIN, 2018-2032 (USD MILLION)

TABLE 50 GERMANY REAGENTS IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 51 GERMANY BUFFERS & SOLUTION IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 52 GERMANY RESEARCH ANTIBODIES REAGENTS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 53 GERMANY RESEARCH ANTIBODIES REAGENTS MARKET, BY RESEARCH AREA, 2018-2032 (USD MILLION)

TABLE 54 GERMANY RESEARCH ANTIBODIES REAGENTS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 55 GERMANY RESEARCH ANTIBODIES REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 56 FRANCE RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 57 FRANCE ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 58 FRANCE ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 59 FRANCE ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY BASED ON ORIGIN, 2018-2032 (USD MILLION)

TABLE 60 FRANCE REAGENTS IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 61 FRANCE BUFFERS & SOLUTION IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 62 FRANCE RESEARCH ANTIBODIES REAGENTS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 63 FRANCE RESEARCH ANTIBODIES REAGENTS MARKET, BY RESEARCH AREA, 2018-2032 (USD MILLION)

TABLE 64 FRANCE RESEARCH ANTIBODIES REAGENTS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 65 FRANCE RESEARCH ANTIBODIES REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 66 U.K. RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 67 U.K. ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 68 U.K. ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 69 U.K. ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY BASED ON ORIGIN, 2018-2032 (USD MILLION)

TABLE 70 U.K. REAGENTS IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 71 U.K. BUFFERS & SOLUTION IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 72 U.K. RESEARCH ANTIBODIES REAGENTS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 73 U.K. RESEARCH ANTIBODIES REAGENTS MARKET, BY RESEARCH AREA, 2018-2032 (USD MILLION)

TABLE 74 U.K. RESEARCH ANTIBODIES REAGENTS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 75 U.K. RESEARCH ANTIBODIES REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 76 ITALY RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 77 ITALY ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 78 ITALY ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 79 ITALY ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY BASED ON ORIGIN, 2018-2032 (USD MILLION)

TABLE 80 ITALY REAGENTS IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 81 ITALY BUFFERS & SOLUTION IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 82 ITALY RESEARCH ANTIBODIES REAGENTS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 83 ITALY RESEARCH ANTIBODIES REAGENTS MARKET, BY RESEARCH AREA, 2018-2032 (USD MILLION)

TABLE 84 ITALY RESEARCH ANTIBODIES REAGENTS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 85 ITALY RESEARCH ANTIBODIES REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 86 SPAIN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 87 SPAIN ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 88 SPAIN ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 89 SPAIN ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY BASED ON ORIGIN, 2018-2032 (USD MILLION)

TABLE 90 SPAIN REAGENTS IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 91 SPAIN BUFFERS & SOLUTION IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 92 SPAIN RESEARCH ANTIBODIES REAGENTS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 93 SPAIN RESEARCH ANTIBODIES REAGENTS MARKET, BY RESEARCH AREA, 2018-2032 (USD MILLION)

TABLE 94 SPAIN RESEARCH ANTIBODIES REAGENTS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 95 SPAIN RESEARCH ANTIBODIES REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 96 SWITZERLAND RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 97 SWITZERLAND ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 98 SWITZERLAND ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 99 SWITZERLAND ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY BASED ON ORIGIN, 2018-2032 (USD MILLION)

TABLE 100 SWITZERLAND REAGENTS IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 101 SWITZERLAND BUFFERS & SOLUTION IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 102 SWITZERLAND RESEARCH ANTIBODIES REAGENTS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 103 SWITZERLAND RESEARCH ANTIBODIES REAGENTS MARKET, BY RESEARCH AREA, 2018-2032 (USD MILLION)

TABLE 104 SWITZERLAND RESEARCH ANTIBODIES REAGENTS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 105 SWITZERLAND RESEARCH ANTIBODIES REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 106 RUSSIA RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 107 RUSSIA ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 108 RUSSIA ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 109 RUSSIA ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY BASED ON ORIGIN, 2018-2032 (USD MILLION)

TABLE 110 RUSSIA REAGENTS IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 111 RUSSIA BUFFERS & SOLUTION IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 112 RUSSIA RESEARCH ANTIBODIES REAGENTS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 113 RUSSIA RESEARCH ANTIBODIES REAGENTS MARKET, BY RESEARCH AREA, 2018-2032 (USD MILLION)

TABLE 114 RUSSIA RESEARCH ANTIBODIES REAGENTS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 115 RUSSIA RESEARCH ANTIBODIES REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 116 BELGIUM RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 117 BELGIUM ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 118 BELGIUM ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 119 BELGIUM ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY BASED ON ORIGIN, 2018-2032 (USD MILLION)

TABLE 120 BELGIUM REAGENTS IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 121 BELGIUM BUFFERS & SOLUTION IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 122 BELGIUM RESEARCH ANTIBODIES REAGENTS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 123 BELGIUM RESEARCH ANTIBODIES REAGENTS MARKET, BY RESEARCH AREA, 2018-2032 (USD MILLION)

TABLE 124 BELGIUM RESEARCH ANTIBODIES REAGENTS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 125 BELGIUM RESEARCH ANTIBODIES REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 126 NETHERLANDS RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 127 NETHERLANDS ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 128 NETHERLANDS ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 129 NETHERLANDS ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY BASED ON ORIGIN, 2018-2032 (USD MILLION)

TABLE 130 NETHERLANDS REAGENTS IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 131 NETHERLANDS BUFFERS & SOLUTION IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 132 NETHERLANDS RESEARCH ANTIBODIES REAGENTS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 133 NETHERLANDS RESEARCH ANTIBODIES REAGENTS MARKET, BY RESEARCH AREA, 2018-2032 (USD MILLION)

TABLE 134 NETHERLANDS RESEARCH ANTIBODIES REAGENTS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 135 NETHERLANDS RESEARCH ANTIBODIES REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 136 TURKEY RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 137 TURKEY ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 138 TURKEY ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 139 TURKEY ANTIBODIES IN RESEARCH ANTIBODIES REAGENTS MARKET, BY BASED ON ORIGIN, 2018-2032 (USD MILLION)

TABLE 140 TURKEY REAGENTS IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 141 TURKEY BUFFERS & SOLUTION IN RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 142 TURKEY RESEARCH ANTIBODIES REAGENTS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 143 TURKEY RESEARCH ANTIBODIES REAGENTS MARKET, BY RESEARCH AREA, 2018-2032 (USD MILLION)

TABLE 144 TURKEY RESEARCH ANTIBODIES REAGENTS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 145 TURKEY RESEARCH ANTIBODIES REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 146 REST OF EUROPE RESEARCH ANTIBODIES REAGENTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: SEGMENTATION

FIGURE 2 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: SEGMENTATION

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET

FIGURE 13 ANTIBODIES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE RESEARCH ANTIBODIES REAGENTS MARKET IN 2025 - 2032

FIGURE 14 DROC ANALYSIS

FIGURE 15 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY TYPE, 2024

FIGURE 16 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY TYPE, 2025-2032 (USD MILLION)

FIGURE 17 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 18 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 19 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY APPLICATION, 2024

FIGURE 20 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY APPLICATION, 2025-2032 (USD MILLION)

FIGURE 21 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 22 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 23 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY RESEARCH AREA, 2024

FIGURE 24 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY RESEARCH AREA, 2025-2032 (USD MILLION)

FIGURE 25 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY RESEARCH AREA, CAGR (2025-2032)

FIGURE 26 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY RESEARCH AREA, LIFELINE CURVE

FIGURE 27 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY END USER, 2024

FIGURE 28 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY END USER, 2025-2032 (USD MILLION)

FIGURE 29 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY END USER, CAGR (2025-2032)

FIGURE 30 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 32 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 33 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 34 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: SNAPSHOT (2024)

FIGURE 36 EUROPE RESEARCH ANTIBODIES REAGENTS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.