Europe Robot Assisted Pci Market

Market Size in USD Billion

CAGR :

%

USD

8.76 Billion

USD

25.16 Billion

2025

2033

USD

8.76 Billion

USD

25.16 Billion

2025

2033

| 2026 –2033 | |

| USD 8.76 Billion | |

| USD 25.16 Billion | |

|

|

|

|

Europe Robot Assisted Percutaneous Coronary Intervention (PCI) Market Size

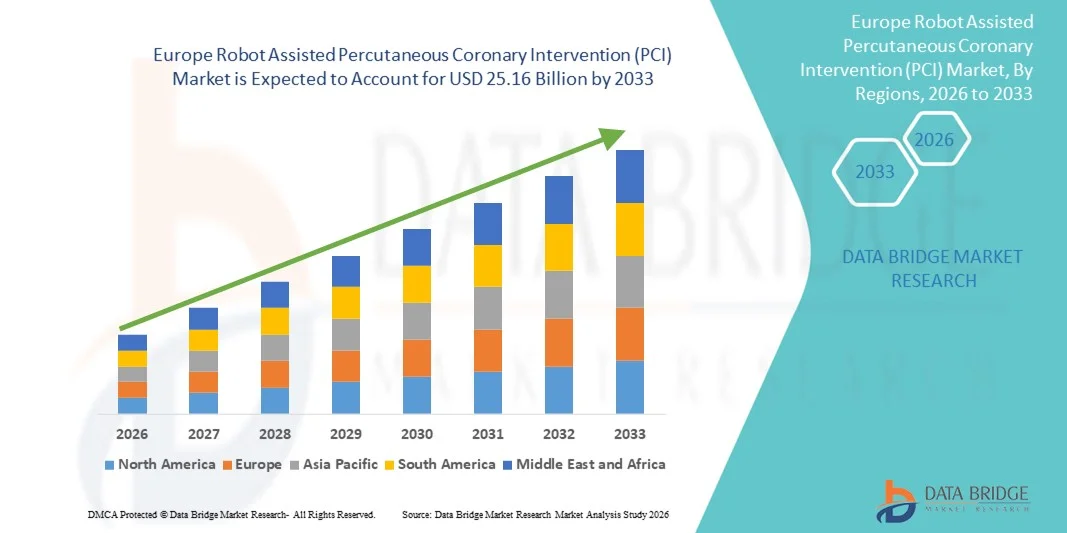

- The Europe robot assisted percutaneous coronary intervention (PCI) market size was valued at USD 8.76 billion in 2025 and is expected to reach USD 25.16 billion by 2033, at a CAGR of 14.10% during the forecast period

- The market growth is largely fueled by the growing prevalence of cardiovascular diseases, rising demand for minimally invasive procedures, and technological advancements in robotic catheterization and imaging systems, leading to increased adoption of robot-assisted PCI in hospitals and cardiac centers

- Furthermore, rising need for enhanced procedural accuracy, reduced radiation exposure, and improved patient outcomes is accelerating the uptake of Robot Assisted Percutaneous Coronary Intervention (PCI) solutions, thereby significantly boosting the industry's growth

Europe Robot Assisted Percutaneous Coronary Intervention (PCI) Market Analysis

- Robot-assisted PCI systems, offering advanced precision, reduced radiation exposure, and enhanced control during coronary interventions, are increasingly becoming vital components of modern interventional cardiology due to their ability to improve accuracy, optimize patient outcomes, and support minimally invasive procedure adoption across hospitals and cardiac centers

- The escalating demand for robot-assisted PCI is primarily fueled by the rising global burden of cardiovascular diseases, growing preference for minimally invasive procedures, technological advancements in robotic catheters and imaging systems, and increasing adoption of automation in catheterization labs to improve workflow efficiency and clinical consistency

- U.K. dominated the robot assisted percutaneous coronary intervention (PCI) market with the largest revenue share of 37.5% in 2025, supported by advanced healthcare infrastructure, high adoption of robotic-assisted procedures, strong government initiatives for cardiovascular care, and a robust presence of key medical device manufacturers

- Germany is expected to be the fastest-growing region in the robot assisted percutaneous coronary intervention (PCI) market during the forecast period, projected to record a CAGR of 11.8% from 2026 to 2033, driven by increasing prevalence of cardiovascular diseases, expanding catheterization laboratories, rising investments in advanced robotic systems, and growing awareness among patients and healthcare providers

- The Robotic Systems segment dominated the largest market revenue share of 67.5% in 2025, driven by the rapid technological advancements supporting precision navigation, reduced radiation exposure, and improved patient outcomes during PCI procedures

Report Scope and Robot Assisted Percutaneous Coronary Intervention (PCI) Market Segmentation

|

Attributes |

Robot Assisted Percutaneous Coronary Intervention (PCI) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

• Intuitive Surgical (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Robot Assisted Percutaneous Coronary Intervention (PCI) Market Trends

Growing Shift Toward High-Precision Robotic Navigation and Imaging Integration

- A significant and accelerating trend in the robot-assisted percutaneous coronary intervention (PCI) market is the deepening integration of high-precision robotic navigation systems with advanced intravascular imaging technologies such as IVUS, OCT, and FFR. This convergence is enhancing procedural accuracy, operator safety, and workflow efficiency across the region’s leading cardiovascular centers

- For instance, next-generation PCI robotic systems deployed across Japan, South Korea, Singapore, and China now incorporate real-time imaging synchronization, automated catheter manipulation, and enhanced lesion visualization, enabling operators to perform complex coronary interventions with greater consistency and reduced physical strain. Several hospitals in Asia-Pacific have already documented improvements in stent placement accuracy following robotic–imaging integration

- The increasing adoption of remote operation capabilities, allowing cardiologists to navigate guidewires and deploy stents from a radiation-protected workstation, is rapidly transforming the region’s interventional cardiology landscape. This not only reduces occupational hazards associated with prolonged X-ray exposure but also enhances ergonomics for cardiologists performing high-volume procedures

- The seamless connection of robotic PCI systems with digital cath lab ecosystems, including procedural workflow software, EHRs, and imaging consoles, allows operators to control multiple procedural elements through a unified interface. This integration supports smoother data flow, improved decision-making, and more standardized outcomes across complex interventions

- This trend toward highly automated, precision-driven robotic systems is reshaping clinical expectations in Asia-Pacific, driving hospitals to adopt platforms that enhance patient safety, reduce variability across procedures, and support minimally invasive cardiovascular care. Major manufacturers are responding by introducing systems with refined haptic feedback, improved catheter stability, and faster device exchange mechanisms

- The rising demand for robotic PCI systems is further supported by growing investments in specialized cardiac centers, regional clinical trials, and government-backed programs aimed at strengthening cardiovascular care infrastructure, particularly in China, India, Japan, and South Korea

Europe Robot Assisted Percutaneous Coronary Intervention (PCI) Market Dynamics

Driver

Growing Need Due to Rising Cardiovascular Disease Burden and Adoption of Minimally Invasive Technologies

- The increasing prevalence of coronary artery disease (CAD) across Asia-Pacific, coupled with the rising demand for minimally invasive cardiovascular procedures, is a significant driver for the accelerating adoption of robotic PCI technologies in the region

- For instance, in April 2025, several leading cardiovascular centers in Asia-Pacific announced expansions of robotic-assisted interventional cardiology programs, integrating next-generation robotic systems equipped with improved imaging and AI-guided navigation to enhance procedural efficiency. Such strategic advancements in the region’s interventional cardiology infrastructure are expected to drive robust market growth

- As clinicians face more complex lesions and increasing procedural volume, robotic PCI systems offer benefits such as reduced radiation exposure, enhanced precision in stent placement, improved operator ergonomics, and greater control during challenging anatomies, providing a compelling upgrade over traditional manual PCI

- Furthermore, the growing adoption of advanced cath lab technologies—including IVUS, OCT, and fractional flow reserve (FFR) systems—supports the integration of robotic platforms that can seamlessly coordinate with these modalities for optimized procedural outcomes

- The ability of robotic PCI systems to provide remote operation capabilities, enable precise device manipulation, and improve standardization in complex interventions is accelerating demand across high-volume hospitals and cardiac specialty centers. In addition, the increasing availability of training programs and user-friendly robotic interfaces further contributes to market expansion

Restraint/Challenge

Concerns Regarding High Costs and Limited Technical Expertise

- Despite the rapid technological progress, concerns surrounding the high capital cost of robotic PCI systems and the associated maintenance expenses pose a significant challenge to broader adoption, especially among mid-sized healthcare facilities in emerging Asia-Pacific economies

- For instance, reports highlighting the limited penetration of high-cost robotic interventional systems in developing Asia-Pacific regions have slowed overall adoption, as many hospitals prioritize cost-effective alternatives before investing in advanced robotic platforms

- Addressing these challenges requires improving cost-efficiency, enhancing reimbursement support, and providing extensive training for interventional cardiologists. Vendors emphasize features such as workflow optimization, long-term cost reduction through fewer complications, and reduced radiation exposure to justify investment. In addition, limited availability of skilled personnel trained in robotic PCI can be a barrier in several Asia-Pacific markets

- While training programs and structured certification pathways are expanding, the perceived complexity of integrating robotic systems into existing cath lab workflows continues to hinder widespread adoption, especially among hospitals lacking advanced imaging infrastructure

- Overcoming these challenges through greater affordability, wider availability of training, and improved interoperability with existing cath lab technologies will be vital for long-term and sustained market growth

Europe Robot Assisted Percutaneous Coronary Intervention (PCI) Market Scope

The market is segmented on the basis of product type and end user.

- By Product Type

On the basis of product type, the Asia-Pacific Robot Assisted Percutaneous Coronary Intervention (PCI) market is segmented into Robotic Systems and Instruments & Accessories. The Robotic Systems segment dominated the largest market revenue share of 67.5% in 2025, driven by the rapid technological advancements supporting precision navigation, reduced radiation exposure, and improved patient outcomes during PCI procedures. Hospitals and cath labs across Japan, China, South Korea, and Australia increasingly prefer robotic systems due to their ability to facilitate complex interventions with higher accuracy and operator safety. The strong presence of AI-enabled workflow automation and integration with advanced imaging technologies reinforces system adoption. Growing prevalence of coronary artery disease, rising elderly populations, and the intensifying focus on minimally invasive procedures further contribute to segment leadership. Favorable government initiatives to upgrade cardiac care infrastructure also influence strong uptake. Improved surgeon ergonomics and reduced fatigue associated with robotic PCI In addition support broad usage across tertiary hospitals in the region.

The Instruments & Accessories segment is anticipated to witness the fastest CAGR of 15.8% from 2026 to 2033, fueled by the recurrent need for consumables required in every PCI procedure and the expanding installed base of robotic systems across Asia-Pacific. Increasing procedure volumes, rising physician adoption of catheter robotics, and heightened emphasis on precision tools drive strong demand for guide catheters, robotic wires, disposable cassettes, and catheter-control components. As hospitals increasingly shift toward advanced robotic workflows, the need for compatible accessories grows steadily. Product upgrades from OEMs, improved integration with imaging systems, and enhanced durability of disposable instruments also accelerate growth. In addition, rising investments from regional hospitals in consumables procurement programs and service contracts contribute to continued expansion. Growing training programs for robotic PCI across emerging markets further increase utilization of robotic accessories.

- By End User

On the basis of end user, the Asia-Pacific Robot Assisted Percutaneous Coronary Intervention (PCI) market is segmented into Hospitals, Cath Labs, and Others. The Hospitals segment accounted for the largest market revenue share of 54.1% in 2025, driven by the concentration of advanced cardiac care infrastructure, higher patient throughput, and the availability of skilled interventional cardiologists. Hospitals prefer robotic PCI systems for their ability to reduce variability in procedures, improve accuracy, and mitigate radiation exposure to staff and patients. Increasing hospital investments in catheterization laboratories and robotic platforms enhance adoption rates. Rising incidence of cardiovascular diseases and expanding insurance coverage across Asia-Pacific further strengthen demand for robotic PCI within hospital settings. Many hospitals are upgrading to hybrid OR and integrated imaging systems, pushing forward robotic PCI adoption. Government-supported modernization programs also contribute to dominance. Higher clinical success rates and shorter recovery times make robotic PCI attractive to hospital networks aiming to boost their cardiac care reputation.

The Cath Labs segment is expected to witness the fastest CAGR of 16.4% from 2026 to 2033, driven by the growing trend toward standalone catheterization laboratories and increased need for minimally invasive cardiovascular interventions. Cath labs, particularly in China and India, are expanding rapidly due to rising cardiovascular patient loads and continuous capacity additions. The specialization and high procedure frequency typical of cath labs make robotic PCI systems highly attractive for improving procedural consistency and reducing exposure to fluoroscopy. Growing private cardiology centers in urban regions are investing heavily in robotic solutions to differentiate service offerings. Enhanced affordability of mid-scale robotic platforms and improved integration with intravascular imaging tools accelerate segment growth. In addition, increased training availability for interventional cardiologists in robotic techniques bolsters adoption.

Europe Robot Assisted Percutaneous Coronary Intervention (PCI) Market Regional Analysis

- The Europe robot assisted percutaneous coronary intervention (PCI) market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing prevalence of cardiovascular diseases, rising adoption of minimally invasive procedures, and strong investments in healthcare infrastructure

- The region is witnessing notable advancements in robotic-assisted catheterization systems, improving procedural accuracy and patient outcomes

- Hospitals and specialized cardiac centers across Europe are increasingly integrating robotic PCI systems into their cardiac care programs, enhancing operational efficiency and reducing procedure times

U.K. Robot Assisted Percutaneous Coronary Intervention (PCI) Market Insight

The U.K. robot assisted percutaneous coronary intervention (PCI) market dominated the Robot Assisted Percutaneous Coronary Intervention (PCI) market with the largest revenue share of 37.5% in 2025, supported by advanced healthcare infrastructure, high adoption of robotic-assisted procedures, strong government initiatives for cardiovascular care, and a robust presence of key medical device manufacturers. The U.K. market benefits from well-established cardiac care networks, growing awareness of minimally invasive interventions, and significant funding for digital and robotic healthcare solutions.

Germany Robot Assisted Percutaneous Coronary Intervention (PCI) Market Insight

Germany robot assisted percutaneous coronary intervention (PCI) market is expected to be the fastest-growing region in the Robot Assisted Percutaneous Coronary Intervention (PCI) market during the forecast period, projected to record a CAGR of 11.8% from 2026 to 2033, driven by increasing prevalence of cardiovascular diseases, expanding catheterization laboratories, rising investments in advanced robotic systems, and growing awareness among patients and healthcare providers. The country’s emphasis on innovation, precision medicine, and technologically advanced hospital infrastructure is accelerating the adoption of robotic PCI procedures across both public and private healthcare facilities.

Europe Robot Assisted Percutaneous Coronary Intervention (PCI) Market Share

The Robot Assisted Percutaneous Coronary Intervention (PCI) industry is primarily led by well-established companies, including:

• Intuitive Surgical (U.S.)

• Robocath (France)

• Stereotaxis (U.S.)

• Catheter Precision (U.S.)

• Hansen Medical (U.S.)

• CARMAT (France)

• Siemens Healthineers (Germany)

• Abbott Laboratories (U.S.)

• Philips Healthcare (Netherlands)

• Terumo Corporation (Japan)

• Asahi Intecc (Japan)

• MicroPort Scientific (China)

• Shanghai MicroPort (China)

• Cardiobot (China)

• Remedics (U.S.)

Latest Developments in Europe Robot Assisted Percutaneous Coronary Intervention (PCI) Market

- In February 2021, Siemens Healthineers expanded the footprint of robotic vascular interventions by introducing the CorPath GRX system (from Corindus Vascular Robotics) in India — enabling robotic-assisted coronary and peripheral vascular interventions in a country with high cardiovascular disease burden

- In May 2022, Corindus showcased CorPath GRX at the major interventional cardiology congress EuroPCR — including live robotic-assisted PCI cases and presentation of initial post‑market data from the NAVIGATE study, underscoring growing clinical adoption and interest in robotic PCI worldwide

- In May 2025, a large-scale real-world analysis published at the conference TCT 2025 confirmed that robotic-assisted PCI is safe and effective: among 1,734 robotic PCI procedures, clinical success rates were high (~97 %), even with complex lesions — signaling maturity of robotic PCI technologies in routine practice

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.