Europe Roll Forming Body In White Market

Market Size in USD Billion

CAGR :

%

USD

1.99 Billion

USD

3.11 Billion

2024

2032

USD

1.99 Billion

USD

3.11 Billion

2024

2032

| 2025 –2032 | |

| USD 1.99 Billion | |

| USD 3.11 Billion | |

|

|

|

|

Europe Roll Forming Body in White Market Size

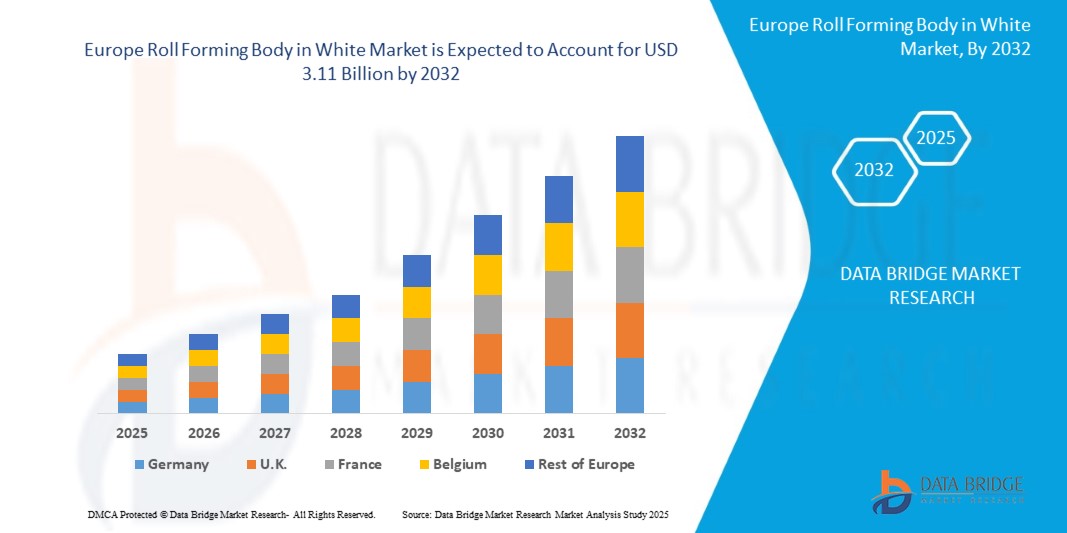

- The Europe roll forming body in white market size was valued at USD 1.99 billion in 2024 and is expected to reach USD 3.11 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is largely fuelled by the increasing adoption of lightweight and high-strength components in automotive body structures, driven by stringent emission norms and demand for improved vehicle fuel efficiency

Europe Roll Forming Body in White Market Analysis

- Growing electric vehicle (EV) production and government-led sustainability initiatives are accelerating the adoption of advanced manufacturing processes such as roll forming, which supports the development of structurally sound yet lightweight vehicle bodies

- The market is also benefiting from continuous innovation in high-strength steel and aluminum alloys, enabling OEMs to adopt roll forming for complex structural parts while maintaining rigidity and crashworthiness

- Germany roll forming body in white market dominated the regional landscape in 2024, driven by its strong automotive industry presence, emphasis on vehicle lightweighting, and technological advancements in high-strength material

- U.K. is expected to witness the highest compound annual growth rate (CAGR) in the Europe roll forming body in white market due to its growing focus on electric vehicle production, rising investments in automotive research and development, and supportive government policies aimed at reducing carbon emissions

- The exterior segment held the largest market revenue share in 2024 due to high utilization in forming parts such as side sills, door frames, roof rails, and bumper beams. Automakers in Europe increasingly rely on roll formed exterior parts to achieve precise dimensions, superior strength, and better aerodynamic properties in lightweight designs. The growing trend toward EVs and emission reduction further amplifies the need for optimized exterior structural components that enhance vehicle performance

Report Scope and Europe Roll Forming Body in White Market Segmentation

|

Attributes |

Europe Roll Forming Body in White Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Europe Roll Forming Body in White Market Trends

“Integration of Advanced High-Strength Steels (AHSS) in Roll Forming Processes”

- Automakers are increasingly integrating advanced high-strength steels into roll forming applications to achieve lightweight designs without compromising structural safety as these materials offer superior strength-to-weight ratio and crash resistance which are essential for modern vehicle platforms across Europe

- The ability of roll forming to shape AHSS into complex, thin-walled components enables manufacturers to meet strict EU emission and safety regulations while maintaining cost-effectiveness in production through minimal waste and high material efficiency

- Leading European OEMs are collaborating with Tier 1 suppliers to adopt servo-driven roll forming systems that handle AHSS and ultra-high-strength steels with precision which improves product quality and reduces post-processing efforts

- For instance, BMW’s CLAR platform incorporates AHSS-based roll formed components to enhance rigidity and crash protection while minimizing vehicle weight to support better fuel economy and electric vehicle range

- This trend reinforces the shift towards sustainable automotive engineering where AHSS and roll forming play a crucial role in advancing safe lightweight vehicle design for electric and fuel-efficient cars

Europe Roll Forming Body in White Market Dynamics

Driver

“Growing Emphasis on Lightweight Vehicle Construction Across Europe”

- Europe’s stringent carbon emission norms and electrification goals are pushing automakers to prioritize vehicle lightweighting with roll forming becoming a preferred method to manufacture high-strength structural components with reduced mass

- Roll forming supports the production of lightweight crash-resistant body-in-white structures by enabling thinner gauges and longer profiles which helps in reducing overall vehicle weight while preserving performance and safety

- Automakers in Germany and France are heavily investing in flexible roll forming equipment to accommodate multiple lightweight materials such as AHSS and aluminum enabling platform standardization across EV and hybrid segments

- For instance, the Renault-Nissan-Mitsubishi Alliance has integrated roll formed roof bows and side rails in its EV models to reduce weight and increase battery efficiency demonstrating the strategic role of roll forming in lightweighting

- The push for fuel efficiency and lower emissions is solidifying roll forming’s position as a vital solution in the European automotive manufacturing ecosystem with its contributions spanning from efficiency gains to emission reduction

Restraint/Challenge

“High Initial Investment and Equipment Setup Costs”

- The high cost of procuring roll forming machinery and setting up advanced production lines remains a significant barrier for small and mid-sized automotive suppliers across Europe especially in regions with limited industrial subsidies

- Roll forming of AHSS or aluminum requires precision tooling automation systems and skilled labor all of which demand substantial upfront investment and time before manufacturers realize productivity or ROI benefits

- Frequent retooling and lack of flexibility in handling different part geometries make roll forming challenging for manufacturers who operate in low-volume or customized vehicle segments which limits its broader adoption

- For instance, several component makers in Poland and Hungary face difficulties in deploying roll forming for complex EV parts due to financial constraints and lack of technical integration capabilities

- Unless these capital and operational challenges are mitigated through industry partnerships and governmental support the full-scale deployment of roll forming in Europe’s automotive sector will face delays and uneven adoption across regions

Europe Roll Forming Body in White Market Scope

The market is segmented on the basis of components, material type, construction type, propulsion type, material joining technique, sales channel, and vehicle type.

• By Components

On the basis of components, the market is segmented into interior and exterior. The exterior segment held the largest market revenue share in 2024 due to high utilization in forming parts such as side sills, door frames, roof rails, and bumper beams. Automakers in Europe increasingly rely on roll formed exterior parts to achieve precise dimensions, superior strength, and better aerodynamic properties in lightweight designs. The growing trend toward EVs and emission reduction further amplifies the need for optimized exterior structural components that enhance vehicle performance.

The interior segment is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, driven by the demand for lightweight reinforcements in dashboards, seat structures, and floor assemblies. Roll forming supports thin-walled and high-strength steel profiles that offer safety and rigidity for interior modules, while supporting space-saving vehicle layouts.

• By Material Type

On the basis of material type, the market is segmented into steel, aluminium, magnesium, carbon fiber reinforced polymer (CFRP), and others. Steel dominated the segment in 2024 due to its cost-efficiency, high formability, and strength required for producing roll formed structural body parts across conventional and electric vehicles. The integration of advanced high-strength steel (AHSS) has further reinforced steel’s dominance in crash-resistant roll forming applications.

The CFRP segment is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, supported by Europe’s strong focus on lightweighting, particularly in electric vehicle platforms. CFRP’s high stiffness-to-weight ratio makes it ideal for premium vehicle structures, and increased investment in automated CFRP roll forming is expected to drive segment growth.

• By Construction Type

On the basis of construction type, the market is segmented into into monocoque and frame mounted. The monocoque segment accounted for the larger share in 2024, driven by its extensive use in passenger cars and EVs, where a single integrated frame offers enhanced strength and weight reduction. Roll forming enables efficient manufacturing of critical monocoque elements with consistent dimensional accuracy and minimal material waste.

The frame mounted segment is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, particularly in light commercial vehicles and certain high-performance applications where separate frame integration offers enhanced load distribution and towing capability. Roll formed rails and cross-members remain integral to these setups for ensuring durability and crash resistance.

• By Propulsion Type

On the basis of propulsion type, the market is segmented into gasoline and electric vehicles. The electric vehicle segment accounted for the larger share in 2024, driven by the European Union’s stringent emissions targets and growing EV adoption. Lightweight roll formed structures support battery efficiency, extended range, and safety in EV design.

Gasoline vehicles is expected to witness the fastest growth rate during the forecast period from 2025 to 2032 owing to their high market penetration and the well-established application of roll forming in existing internal combustion vehicle platforms. However, regulatory shifts are steadily encouraging OEMs to transition to electrified body designs.

• By Material Joining Technique

On the basis of joining technique, the market is segmented into welding, riveting, clinching, laser brazing, bonding, and others. Welding dominated the market in 2024, primarily due to its compatibility with high-speed roll forming lines and its ability to offer strong joints in load-bearing areas. Advanced welding technologies such as laser welding are widely adopted in body-in-white manufacturing across European plants.

Bonding is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, supported by the need for mixed-material joining, particularly in EVs using both metal and composite roll formed components. Its advantages in noise reduction and corrosion resistance are being increasingly recognized.

• By Sales Channel

On the basis of sales channel, the market is segmented into original equipment manufacturers (OEM) and aftermarket. The OEM segment held the dominant share in 2024, driven by direct adoption of roll formed parts in vehicle platforms by major European automakers such as Volkswagen, BMW, and Renault. Integration of roll forming in OEM assembly lines supports mass production with high efficiency and lower tooling costs.

The aftermarket segment is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, due to the rising demand for replacement of structural body parts, particularly in collision repair services. However, its growth is constrained by the technical complexity and specialized machinery needed for roll formed part replication.

• By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars, light commercial vehicles (LCV), heavy commercial vehicles (HCV), and electric vehicles. The passenger cars segment led the market in 2024, fueled by strong demand for safety, performance, and lightweighting in mainstream and luxury models. Roll forming is heavily deployed in producing body sides, door reinforcements, and roof structures.

The electric vehicle segment is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, driven by rising EV production and the need for lightweight, crashworthy structures that enhance battery efficiency. Roll forming enables scalable manufacturing of EV-specific body designs optimized for both safety and energy consumption.

Europe Roll Forming Body in White Market Regional Analysis

- The Germany roll forming body in white market dominated the regional landscape in 2024, driven by its strong automotive industry presence, emphasis on vehicle lightweighting, and technological advancements in high-strength material

- German manufacturers are increasingly adopting aluminium and CFRP components in BIW structures to meet stringent emission standards and boost performance

- The country’s focus on precision engineering, coupled with a well-established OEM and tier-1 supplier network, continues to support large-scale integration of roll forming processes across passenger and commercial vehicle platforms

U.K. Roll Forming Body in White Market Insight

The U.K. roll forming body in white market is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, fuelled by expanding electric vehicle initiatives, rising demand for sustainable automotive solutions, and strategic government support for low-carbon mobility. British automakers are incorporating roll-formed structures in both monocoque and frame-mounted vehicles to reduce weight and enhance structural rigidity. In addition, the U.K.’s evolving supplier ecosystem and investments in advanced joining techniques are expected to accelerate roll forming technology adoption across domestic vehicle assembly lines.

Europe Roll Forming Body in White Market Share

The Europe Roll Forming Body in White industry is primarily led by well-established companies, including:

- Gestamp Automoción (Spain)

- Voestalpine AG (Austria)

- Thyssenkrupp AG (Germany)

- ArcelorMittal (Luxembourg)

- Tata Steel Europe (U.K.)

- Salzgitter AG (Germany)

- BENTELER Automotive (Germany)

- SSAB AB (Sweden)

- Outokumpu (Finland)

- Constellium (France)

Latest Developments in Europe Roll Forming Body in White Market

- In May 2021, Bradbury Co., Inc. completed the acquisition of MicroMetl as a client, marking a strategic partnership in roll forming solutions. Through this collaboration, Bradbury provided advanced roll forming equipment that enabled MicroMetl to significantly reduce scrap in knock-down curb production and cut down job completion time compared to traditional press brakes. This development is expected to improve production efficiency and cost-effectiveness for MicroMetl. The partnership enhances Bradbury’s value proposition and strengthens its customer base in the competitive roll forming body in white market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Roll Forming Body In White Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Roll Forming Body In White Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Roll Forming Body In White Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.