Europe Self Adhesive Vinyl Films Market

Market Size in USD Billion

CAGR :

%

USD

77.59 Billion

USD

108.83 Billion

2024

2032

USD

77.59 Billion

USD

108.83 Billion

2024

2032

| 2025 –2032 | |

| USD 77.59 Billion | |

| USD 108.83 Billion | |

|

|

|

|

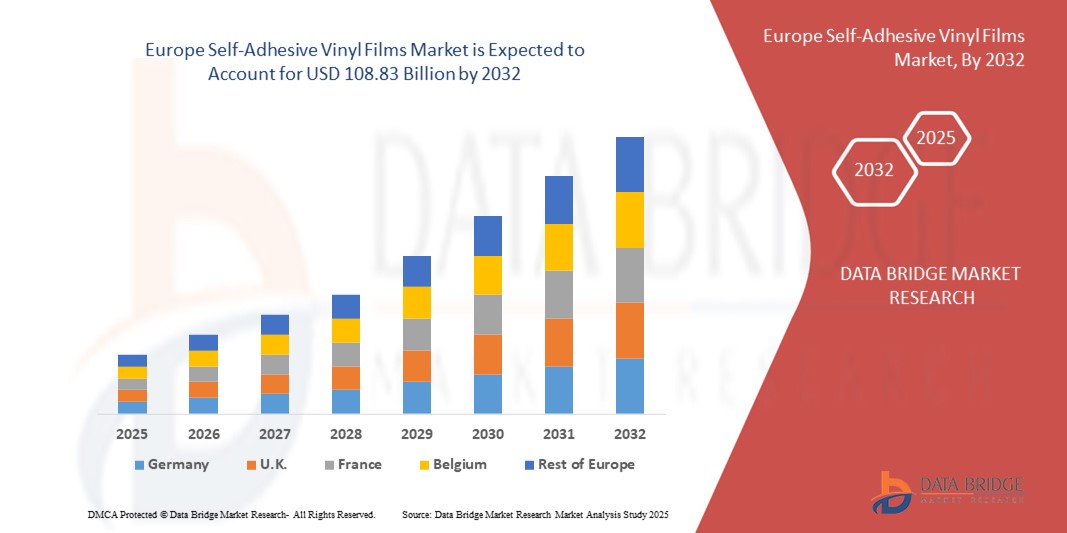

Europe Self-Adhesive Vinyl Films Market Size

- The Europe self-adhesive vinyl films market size was valued at USD 77.59 billion in 2024 and is projected to reach USD 108.83 billion by 2032, growing at a CAGR of 4.32% during the forecast period of 2025 to 2032

- Market growth in the region is primarily driven by increasing demand across industries such as advertising, automotive, and construction, where vinyl films are widely used for signage, vehicle wraps, and interior décor. Technological advancements in digital printing and pressure-sensitive adhesives are also enhancing product performance and application versatility

- In addition, growing emphasis on sustainability and environmentally friendly materials is influencing product innovation, as manufacturers respond to stringent EU environmental regulations. This, combined with the rising trend of customized branding and decor in both commercial and residential spaces, is fueling the expansion of the self-adhesive vinyl films industry across Europe

Europe Self-Adhesive Vinyl Films Market Analysis

- Self-adhesive vinyl films, used widely for advertising, décor, signage, and vehicle wraps, are gaining significant traction in Europe due to their ease of application, durability, and versatility across commercial and residential sectors, as well as increasing demand for cost-effective, customizable, and removable graphic solutions

- The growing market demand is largely driven by expanding digital printing technologies, the surge in branding and promotional activities, and rising interest in interior decoration and renovation projects

- U.K. dominated the self-adhesive vinyl films market with the largest revenue share of 46.37% in 2024, driven by strong demand across advertising, automotive, and interior décor sectors, as well as heightened emphasis on sustainability and design innovation

- The Germany self-adhesive vinyl films market is projected to grow at a fastest CAGR of 10.12% during the forecast period, supported by the country’s strong industrial base and emphasis on high-quality materials

- The opaque segment dominated the market with the largest revenue share of 54.6% in 2024, driven by its widespread use in outdoor advertising, billboards, vehicle wraps, and signage where high visibility and durability are essential

Report Scope and Market Segmentation

|

Attributes |

Self-Adhesive Vinyl Films Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Self-Adhesive Vinyl Films Market Trends

Sustainability and Customization Driving Market Evolution

- A major and accelerating trend in the Europe self-adhesive vinyl films market is the rising demand for eco-friendly and customizable solutions, spurred by tightening environmental regulations and evolving consumer preferences. These developments are significantly influencing product innovation and usage across key industries such as advertising, automotive, and interior décor

- For instance, leading manufacturers such as Hexis and Orafol have introduced PVC-free self-adhesive vinyl films that meet stringent EU environmental standards while maintaining high durability and print performance. These eco-conscious products are increasingly favored in indoor applications, such as retail graphics and home interiors, where low-emission materials are a priority

- In addition, the market is witnessing growing adoption of printable vinyl films with enhanced customization capabilities, enabling businesses and consumers to achieve high-resolution, personalized graphics. This is particularly notable in vehicle wrapping and promotional signage, where flexible and easy-to-apply vinyl films such as Avery Dennison's MPI range are widely used for creative branding solutions

- The expansion of digital printing technologies is also complementing this trend, as self-adhesive vinyl films now offer improved ink compatibility and faster turnaround times. This allows for cost-effective short runs and rapid prototyping, meeting the needs of small businesses and niche applications across Europe

- This shift toward sustainable, adaptable, and visually impactful vinyl solutions is reshaping how brands and individuals communicate visually in both temporary and long-term settings. Consequently, companies are investing in recyclable materials and solvent-free adhesives to align with circular economy goals and consumer sustainability demands

- With increased emphasis on environmental compliance, design flexibility, and user-friendly application, the European market for self-adhesive vinyl films is poised for continued growth, particularly in sectors such as retail, transportation, and interior design where visual appeal and sustainability converge

Europe Self-Adhesive Vinyl Films Market Dynamics

Driver

Rising Demand Across Advertising and Interior Décor Sectors

- The growing use of self-adhesive vinyl films in advertising, automotive wrapping, and interior décor is a key driver propelling the European market. The versatility, durability, and ease of application of these films make them highly attractive for both commercial and personal use across a wide range of industries

- For instance, in February 2024, Orafol Europe GmbH expanded its range of digitally printable films with new eco-friendly variants targeted at the interior design market. Such innovations are enabling brands and designers to offer visually impactful and customizable solutions while meeting environmental standards

- In the advertising industry, self-adhesive vinyl films are widely used for retail signage, promotional displays, and vehicle graphics, offering high-resolution printing and long-term outdoor durability. This has increased demand from businesses aiming to enhance brand visibility cost-effectively

- Simultaneously, the interior décor sector is adopting self-adhesive vinyl for applications such as wall murals, furniture wraps, and window films, driven by consumer demand for easy-to-install and removable design solutions. These films allow for frequent design updates without permanent alterations, which is ideal for rental spaces and commercial interiors

- The surge in demand for digitally printable, customizable films and the rise of short-run printing solutions are supporting broader adoption across various end-user segments. In addition, technological advancements in adhesives and film formulations are improving ease of use and performance, further driving market growth

Restraint/Challenge

Environmental Regulations and Raw Material Volatility

- Stringent environmental regulations across Europe regarding the use of PVC and solvent-based adhesives present a significant challenge for the self-adhesive vinyl films market. These materials, while widely used, are facing increasing scrutiny due to their ecological impact during production and disposal

- For instance, EU directives and national legislation targeting plastic waste reduction are compelling manufacturers to shift towards more sustainable alternatives, which can require substantial investment in R&D and production changes. This transition may temporarily impact product availability and increase costs for manufacturers and end-users asuch as

- In addition, fluctuations in raw material prices particularly for petrochemical-derived inputs such as PVC and acrylic adhesives can lead to unpredictable manufacturing costs, squeezing margins and potentially limiting product affordability in the price-sensitive segments of the market

- While some companies are developing PVC-free and water-based adhesive solutions to align with environmental goals, the performance of these alternatives must match traditional materials to ensure widespread adoption. Brands such as Avery Dennison and Hexis are actively investing in greener technologies, but scaling these innovations while maintaining competitive pricing remains a key challenge

- Navigating evolving regulations, ensuring product performance, and managing raw material costs will be critical for the long-term sustainability and competitiveness of the European self-adhesive vinyl films market

Europe Self-Adhesive Vinyl Films Market Scope

The market is segmented on the basis of type, category, width, manufacturing process, adhesive type, substrate, thickness, and application.

- By Type

On the basis of type, the self-adhesive vinyl films market is segmented into opaque, transparent, and translucent. The opaque segment dominated the market with the largest revenue share of 54.6% in 2024, driven by its widespread use in outdoor advertising, billboards, vehicle wraps, and signage where high visibility and durability are essential. Opaque films are valued for their strong color representation, weather resistance, and ability to cover underlying surfaces effectively, making them the first choice for both indoor and outdoor branding. Their cost-effectiveness and compatibility with large-format printers further fuel their adoption among printing service providers.

The transparent segment is expected to witness the fastest CAGR of 17.8% from 2025 to 2032, fueled by growing demand for window graphics, glass decorations, and promotional displays. Transparent films provide aesthetic flexibility, allowing creative see-through designs while maintaining durability, making them highly attractive for retail and corporate branding applications.

- By Category

On the basis of category, the self-adhesive vinyl films market is segmented into printable and non-printable. The printable segment held the largest market share of 62.1% in 2024, supported by the increasing use of digital and wide-format printers for advertising, signage, and vehicle graphics. Printable vinyl films are popular due to their compatibility with UV, solvent, latex, and eco-solvent inks, offering high-resolution output for detailed branding and creative designs. Their widespread adoption by print shops, advertising agencies, and retail companies continues to fuel market growth.

The non-printable segment is projected to register the fastest CAGR of 16.5% from 2025 to 2032, driven by their rising use in interior decoration, protective layering, and automotive applications where direct printing is not required. Non-printable films are preferred for their cost efficiency, easy application, and versatility, making them increasingly popular in industrial and decorative purposes.

- By Width

On the basis of width, the market is segmented into middle size width (approx. 137 cm), big size width (152–160 cm), and small size width (below 110 cm). The middle size width segment dominated the market with the largest revenue share of 48.3% in 2024, as it is the most commonly used dimension for signage, banners, and retail advertising applications. Its widespread compatibility with standard printing equipment makes it highly preferred by commercial printers and ad agencies. The middle size option offers the right balance between usability, efficiency, and material cost, ensuring strong adoption across multiple industries.

The big size width segment is expected to grow at the fastest CAGR of 18.2% from 2025 to 2032, driven by its growing use in large-scale advertising, fleet graphics, and building wraps. Big size vinyl films are increasingly adopted by enterprises aiming for maximum visibility and impactful branding in outdoor campaigns.

- By Manufacturing Process

On the basis of manufacturing process, the market is segmented into calendered films and cast films. The calendered films segment dominated with the largest share of 57.5% in 2024, due to their cost-effectiveness, durability, and suitability for medium-term applications such as retail graphics, floor signage, and indoor advertising. Calendered films are widely preferred in emerging economies where budget-conscious customers seek reliable yet affordable vinyl solutions. Their production efficiency and large-scale availability make them the go-to option for volume-based applications.

The cast films segment is projected to record the fastest CAGR of 19.1% from 2025 to 2032, owing to their superior flexibility, longevity, and performance in demanding applications such as vehicle wrapping and outdoor advertising. Cast films maintain dimensional stability, conform easily to complex surfaces, and withstand extreme environmental conditions, making them a premium choice for high-end branding projects.

- By Adhesive Type

On the basis of adhesive type, the market is segmented into removable self-adhesive vinyl film and permanent self-adhesive vinyl film. The permanent segment held the largest share of 60.4% in 2024, owing to its durability and extensive application in outdoor signage, fleet graphics, and long-term branding solutions. Permanent adhesives provide strong bonding to surfaces such as metal, glass, and plastics, ensuring reliability in harsh weather conditions. Their use in infrastructure branding and automotive wrapping contributes significantly to market dominance.

The removable segment is forecasted to witness the fastest CAGR of 17.6% from 2025 to 2032, fueled by increasing demand for temporary promotions, seasonal advertising campaigns, and event-based displays. Businesses prefer removable adhesives for their easy installation and residue-free removal, offering flexibility for short-term yet impactful branding.

- By Substrate

On the basis of substrate, the self-adhesive vinyl films market is segmented into plastics, glass, floor, and others. The plastics segment dominated with a market share of 41.7% in 2024, driven by its extensive application in packaging, retail displays, and advertising panels. Plastic substrates are lightweight, versatile, and provide an excellent surface for vinyl adhesion, making them the most widely used across multiple industries.

The glass segment is anticipated to grow at the fastest CAGR of 18.9% from 2025 to 2032, supported by the rising trend of decorative window graphics, privacy films, and architectural glass designs. Increasing investments in corporate branding and retail window displays further fuel adoption of vinyl films on glass substrates.

- By Thickness

On the basis of thickness, the market is segmented into thin (2–3 mils) and thick (more than 3 mils). The thin segment dominated the market with 55.8% share in 2024, as these films are lightweight, flexible, and easy to handle, making them ideal for labeling, stickers, and advertising graphics. Their compatibility with both indoor and outdoor applications at a relatively lower cost enhances adoption.

The thick segment is projected to grow at the fastest CAGR of 16.8% from 2025 to 2032, owing to their increasing demand in heavy-duty applications such as floor graphics, furniture decoration, and industrial labeling. Their enhanced durability and wear resistance make them suitable for high-traffic environments and long-term branding.

- By Application

On the basis of application, the self-adhesive vinyl films market is segmented into fleet graphics, floor graphics, window graphics, car wrapping, labels & stickers, exhibition & stickers, outdoor advertising, furniture decoration, advertising & branding, wallcovering, and others. The outdoor advertising segment dominated with the largest revenue share of 34.9% in 2024, supported by growing investments in billboards, transit ads, and large-format marketing campaigns. Vinyl’s weather resistance and print versatility make it the preferred medium for impactful outdoor promotions.

The car wrapping segment is expected to witness the fastest CAGR of 20.4% from 2025 to 2032, fueled by rising demand for automotive personalization, corporate fleet branding, and cost-effective vehicle protection. Increasing adoption by SMEs and large enterprises asuch as highlights car wrapping as a major driver of future market expansion.

Europe Self-Adhesive Vinyl Films Market Regional Analysis

- U.K. dominated the self-adhesive vinyl films market with the largest revenue share of 46.37% in 2024, driven by strong demand across advertising, automotive, and interior décor sectors, as well as heightened emphasis on sustainability and design innovation

- Countries such as Germany, France, and the UK are leading adopters, benefiting from well-established print industries, high consumer expectations for quality finishes, and early adoption of eco-friendly materials such as PVC-free vinyl films

- The region’s mature infrastructure, stringent environmental regulations, and focus on premium branding applications continue to support widespread usage in both commercial and residential settings, positioning self-adhesive vinyl films as a preferred material for modern, customizable visual solutions

Germany Self-Adhesive Vinyl Films Market Insight

The Germany self-adhesive vinyl films market is projected to grow at a fastest CAGR of 10.12% during the forecast period, supported by the country’s strong industrial base and emphasis on high-quality materials. Demand is particularly high in automotive and construction sectors, where durable, weather-resistant films are used for surface protection, branding, and decorative applications. In addition, Germany's strict environmental regulations are pushing manufacturers toward sustainable product innovations, including recyclable films and solvent-free adhesives. The country's focus on energy-efficient buildings and modern aesthetics also promotes interior applications of vinyl films.

France Self-Adhesive Vinyl Films Market Insight

The France self-adhesive vinyl films market is expanding steadily, fueled by the rising use of digital printing in advertising and the growing popularity of personalized home décor. The retail and exhibition sectors are key contributors, leveraging vinyl films for window displays, signage, and event branding. French consumers are increasingly drawn to easy-to-install, repositionable solutions for residential interiors. Moreover, government incentives promoting eco-friendly materials are encouraging a shift toward low-emission vinyl products, aligning with the national sustainability agenda and influencing purchasing decisions.

Italy Self-Adhesive Vinyl Films Market Insight

The Italy self-adhesive vinyl films market is anticipated to grow at a healthy CAGR through the forecast period, driven by the flourishing design and architecture industries. Vinyl films are widely used for interior décor, furniture resurfacing, and commercial branding, with high demand for creative and luxurious finishes. Italian manufacturers and designers are adopting self-adhesive films for both functional and aesthetic purposes, especially in modern retail environments and hospitality interiors. The trend toward DIY home improvements and rental-friendly design upgrades is further boosting adoption across residential segments.

Spain Self-Adhesive Vinyl Films Market Insight

The Spain self-adhesive vinyl films market is showing promising growth, supported by robust activity in the construction, tourism, and retail sectors. Vinyl films are extensively used for outdoor advertising, window graphics, and vehicle wraps in tourist-heavy regions. Growing investments in infrastructure and urban renewal projects are also opening opportunities for building wraps and architectural vinyl applications. In addition, increasing awareness of eco-conscious design is leading to a gradual shift toward sustainable vinyl film options, creating new demand across both public and private sectors.

Europe Self Adhesive Vinyl Films Market Share

Europe Self Adhesive Vinyl Films Market Leaders Operating in the Market Are:

- 3M (U.S.)

- Avery Dennison Corporation (U.S.)

- LX HAUSYS (South Korea)

- ORAFOL Europe GmbH. (Germany)

- Metamark (U.K.)

- DRYTAC (U.S.)

- Achilles USA Inc. (U.S.)

- Navratan LLP. (India)

- Shanghai Hanker Industrial Co., Ltd. (China)

- ATP adhesive systems AG (Switzerland)

- Eikon Ltd. a Spandex Group Company (U.K.)

- Grafityp (Belgium)

- General Formulations (U.S.)

- POLI-TAPE Holding GmbH (Germany)

- LINTEC Corporation (Japan)

- UPM (Finland)

- Fedrigoni S.P.A. (Italy)

- HEXIS S.A.S. (France)

- KPMF (Netherlands)

- Flexcon Company, Inc. (U.S.)

- Aquabond Ltd. (U.S.)

- Gardiner Graphics Supplies Europe (U.K.)

- A.P.A. S.p.A (Italy)

Recent Developments in Europe Self-Adhesive Vinyl Films Market

- In May 2023, Orafol Europe GmbH expanded its sustainable product portfolio by launching a new line of PVC-free self-adhesive vinyl films under the ORAJET Eco Series. Targeted at the signage and advertising industries, these environmentally friendly films meet stringent EU environmental standards and offer high print quality, flexibility, and durability. The launch reflects Orafol’s commitment to sustainability and responds to growing demand for eco-conscious materials across Europe.

- In April 2023, Avery Dennison Graphics Solutions announced the expansion of its production capabilities in Belgium, enhancing supply chain efficiency and reducing lead times for European customers. This development supports the growing demand for customizable, high-performance self-adhesive vinyl films in the automotive and architectural sectors. The investment also reinforces Avery Dennison's commitment to serving the European market with innovative and locally sourced solutions.

- In March 2023, Hexis S.A.S., a France-based manufacturer, introduced a new range of interior design vinyl films under the Skintac series at the FESPA Global Print Expo in Munich. These films are designed for furniture wrapping, wall décor, and surface renovation, offering a variety of textures and finishes. The collection responds to the rising trend of personalized interior design and DIY home improvements in Europe.

- In February 2023, Poli-Tape Group, a German producer of self-adhesive materials, launched a new reflective vinyl film line for safety and industrial applications. These films meet updated EU visibility and safety regulations and are engineered for high-performance use in transportation and hazardous work environments. The move highlights the company's focus on functionality, compliance, and quality in the European industrial segment.

- In January 2023, Drytac Europe announced a strategic collaboration with several European print service providers to promote its SpotOn and ViziPrint ranges of removable self-adhesive films. Aimed at retail and promotional graphics, these products offer easy application and residue-free removal, ideal for short-term campaigns. The initiative reflects increasing demand for temporary yet impactful visual solutions in Europe’s retail sector.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Self Adhesive Vinyl Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Self Adhesive Vinyl Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Self Adhesive Vinyl Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.