Europe Sleep Disorder Treatment Market

Market Size in USD Billion

CAGR :

%

USD

2.28 Billion

USD

4.09 Billion

2025

2033

USD

2.28 Billion

USD

4.09 Billion

2025

2033

| 2026 –2033 | |

| USD 2.28 Billion | |

| USD 4.09 Billion | |

|

|

|

|

Europe Sleep Disorder Treatment Market Size

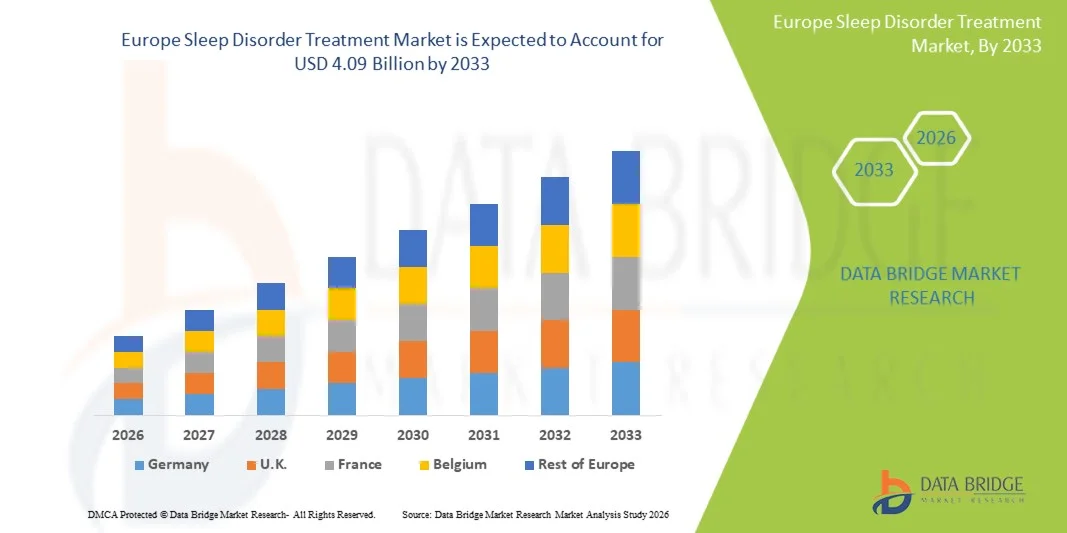

- The Europe Sleep Disorder Treatment Market size was valued at USD 2.28 billion in 2025 and is expected to reach USD 4.09 billion by 2033, at a CAGR of 7.60% during the forecast period

- The market growth is largely fueled by the increasing prevalence of sleep disorders, rising awareness of the importance of sleep health, and growing adoption of advanced diagnostic and therapeutic technologies in both home and clinical settings

- Furthermore, rising consumer demand for personalized, effective, and non-invasive solutions for sleep management is driving the uptake of Sleep Disorder Treatment solutions, thereby significantly boosting the industry's growth

Europe Sleep Disorder Treatment Market Analysis

- Smart sleep disorder devices and therapeutic solutions, offering diagnostic and treatment support for various sleep disorders such as insomnia, sleep apnea, and narcolepsy, are increasingly vital components of modern healthcare and home care systems due to their convenience, remote monitoring capabilities, and integration with digital health ecosystems

- The escalating demand for sleep disorder treatment solutions is primarily fueled by rising prevalence of sleep-related health issues, growing consumer awareness about sleep health, and an increasing preference for personalized and non-invasive therapies

- The U.K. dominated the Europe Sleep Disorder Treatment Market with the largest revenue share of approximately 39.8% in 2025, supported by a well-established healthcare infrastructure, high adoption of advanced diagnostic and therapeutic devices, strong presence of key market players, and growing public awareness regarding sleep health. The country is witnessing substantial growth in sleep disorder treatment adoption across hospitals, clinics, and home healthcare settings

- Germany is expected to be the fastest-growing country in the Europe Sleep Disorder Treatment Market during the forecast period, registering an estimated CAGR of around 8.9%, driven by rising investments in healthcare infrastructure, increasing prevalence of sleep disorders, adoption of digital and home-based sleep monitoring solutions, and expanding availability of specialized sleep therapy services across hospitals and clinics

- The Adult segment accounted for the largest market revenue share of 72.5% in 2025, due to high prevalence of sleep apnea, insomnia, and RLS in adult populations

Report Scope and Europe Sleep Disorder Treatment Market Segmentation

|

Attributes |

Europe Sleep Disorder Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Sleep Disorder Treatment Market Trends

“Rising Adoption of Advanced and Non-Invasive Therapies”

- A significant trend in the Europe Sleep Disorder Treatment Market is the increasing adoption of advanced therapeutic interventions and non-invasive treatment options, including continuous positive airway pressure (CPAP) devices, oral appliances, and digital therapeutics

- These approaches are gaining traction as patients and healthcare providers seek effective solutions with improved compliance, comfort, and convenience

- For instance, in 2024, several sleep clinics in the United States and Canada reported higher patient preference for wearable sleep monitoring devices and home-based sleep testing kits, reflecting a broader move toward personalized and accessible sleep disorder management

- Continuous technological improvements, such as smart CPAP machines with adherence tracking, remote monitoring, and data-driven therapy optimization, are enhancing treatment efficacy and patient satisfaction

- Moreover, growing public awareness regarding the health risks associated with untreated sleep disorders, including cardiovascular complications, metabolic disorders, and mental health issues, is fueling the adoption of non-invasive and patient-friendly treatment modalities across the region

Europe Sleep Disorder Treatment Market Dynamics

Driver

“Rising Prevalence of Sleep Disorders and Growing Healthcare Investments”

- The Europe Sleep Disorder Treatment Market is primarily driven by the rising prevalence of conditions such as obstructive sleep apnea (OSA), insomnia, restless leg syndrome, and narcolepsy

- Increasing awareness of the link between sleep disorders and overall health has prompted patients to actively seek medical interventions

- In addition, the expansion of healthcare infrastructure and higher investments in sleep medicine clinics, research, and digital therapeutics are supporting market growth

- For instance, hospitals and specialized sleep centers across the U.S. and Canada are incorporating comprehensive diagnostic tools and therapy management systems, enabling early detection and personalized treatment plans

- Furthermore, the aging population and lifestyle factors such as obesity, stress, and urbanization are contributing to higher demand for effective sleep disorder treatments, driving consistent growth across both clinical and home-care settings

- Enhanced insurance coverage and reimbursement policies for sleep diagnostics and therapy are also encouraging more patients to pursue treatment, bolstering the overall market adoption in North America

Restraint/Challenge

“High Treatment Costs and Patient Compliance Issues”

- Despite the growing demand, the market faces challenges related to high costs of advanced therapies and patient adherence

- Devices such as CPAP machines, oral appliances, and continuous monitoring solutions often require significant upfront investment, limiting accessibility for price-sensitive patients

- In addition, patient compliance remains a critical issue, as discomfort, lack of education, or complexity of treatment regimens can lead to inconsistent therapy usage, reducing treatment efficacy

- Variations in healthcare policies, insurance coverage, and reimbursement across states can also create barriers to widespread adoption, particularly for non-invasive or newer therapeutic technologies

- For instance, a 2023 report by the American Sleep Apnea Association highlighted that nearly 30% of patients prescribed CPAP therapy discontinued usage within the first six months due to discomfort or inconvenience, demonstrating the impact of adherence challenges on market growth

- Addressing these challenges through patient education, affordable treatment options, and improved adherence monitoring is essential to drive sustained growth in the Europe Sleep Disorder Treatment Market

Europe Sleep Disorder Treatment Market Scope

The market is segmented on the basis of type, treatment, route of administration, drugs type, population type, end user, and distribution channel.

• By Type

On the basis of type, the Europe Sleep Disorder Treatment Market is segmented into Insomnia, Sleep Apnea, Restless Legs Syndrome (RLS), Narcolepsy, and Others. The Sleep Apnea segment dominated the largest market revenue share of around 42.7% in 2025, driven by the high prevalence of obstructive sleep apnea globally. Continuous Positive Airway Pressure (CPAP) therapy adoption, increasing awareness about associated cardiovascular risks, and advancements in monitoring devices fuel the dominance. Growing geriatric population and rising obesity rates contribute significantly. Insurance coverage and hospital support increase patient accessibility. Integration with smart devices enhances patient adherence. Research initiatives for early diagnosis strengthen uptake. Increasing homecare adoption expands reach. Regional healthcare infrastructure improvements reinforce market leadership. Government programs and public awareness campaigns support sustained growth.

The Narcolepsy segment is anticipated to witness the fastest CAGR of 15.4% from 2026 to 2033, driven by rising diagnostic capabilities and increased recognition of rare sleep disorders. Biopharmaceutical companies are investing in novel therapeutics and gene-targeted interventions. Increased clinical trials and research funding fuel new treatment development. Physician awareness programs enhance diagnosis and therapy adoption. Collaboration with specialty clinics promotes patient access. Expanding patient education initiatives improve compliance. Launches of innovative treatments for daytime sleepiness drive market growth. Online pharmacy availability supports rapid access. Pediatric patient recognition drives additional adoption. Technological integration in monitoring enhances treatment efficiency.

• By Treatment

On the basis of treatment, the market is segmented into Pharmacological Therapy, Mechanical Therapy, Mandibular Advancement Devices, Hypoglossal Nerve Stimulator, Surgery, and Others. The Pharmacological Therapy segment held the largest market revenue share of around 46.5% in 2025, driven by widespread use of sleep-inducing medications, sedatives, and wakefulness-promoting drugs for insomnia, narcolepsy, and RLS. Easy accessibility of branded and generic drugs, physician preference, and established treatment protocols contribute to dominance. Insurance coverage and patient adherence initiatives boost revenue. Global research pipelines ensure continuous innovation. Regulatory approvals for newer pharmacological agents enhance market penetration. Integration with telemedicine facilitates patient monitoring. Rising awareness about sleep hygiene supports therapy adoption. Partnerships between pharma and clinics improve distribution. Population aging increases demand for chronic sleep disorder treatment.

The Hypoglossal Nerve Stimulator segment is projected to witness the fastest CAGR of 16.2% from 2026 to 2033, driven by adoption of minimally invasive interventions for obstructive sleep apnea. Technological advancements in implantable devices improve efficacy and comfort. FDA approvals and CE marking expand global availability. Specialist physician training increases procedural uptake. Rising awareness of surgical alternatives to CPAP fuels growth. Expanding reimbursement policies in developed markets support adoption. Positive clinical trial outcomes enhance confidence. Hospitals and specialty centers actively promote implantation. Collaborations with device manufacturers accelerate commercialization. Device monitoring through connected technologies improves outcomes.

• By Route of Administration

On the basis of route of administration, the market is segmented into Oral, Parenteral, and Others. The Oral segment dominated with a revenue share of 51.3% in 2025, owing to convenience, patient compliance, and the predominance of oral pharmacotherapy for insomnia and narcolepsy. Easy self-administration at home and the wide availability of oral formulations reinforce market leadership. Physician familiarity with dosing and standardized protocols improves prescription rates. Regulatory approvals for newer oral agents expand options. Integration with telehealth facilitates adherence monitoring. Generic availability reduces cost barriers. Patient preference for non-invasive therapy strengthens adoption. Public health awareness campaigns increase uptake. Chronic sleep disorder treatment needs support long-term usage. Distribution networks enhance access across regions.

The Parenteral segment is expected to grow at the fastest CAGR of 14.8% from 2026 to 2033, fueled by specialized injectable therapies for narcolepsy and RLS. Increasing clinical trials of biologics and targeted therapies enhance adoption. Hospital administration ensures controlled treatment. Innovations in delivery devices improve patient comfort. Reimbursement coverage supports therapy uptake. Specialty clinics focus on injectable administration for high-efficacy drugs. Regulatory approvals expand indications. Pediatric and geriatric patient adoption increases. Integration with monitoring devices supports adherence. Rising awareness among physicians drives adoption.

• By Drugs Type

On the basis of drugs type, the market is segmented into Branded and Generics. The Branded segment dominated with a market revenue share of 57.1% in 2025, driven by high adoption of patented therapies for sleep apnea, insomnia, and narcolepsy, backed by clinical evidence. Global pharmaceutical companies actively promote their brands. Insurance coverage supports affordability. Physician preference and marketing initiatives strengthen dominance. Launch of next-generation drugs improves efficacy. Telemedicine integration improves adherence. Regulatory approvals ensure safety and trust. Patient education supports compliance. R&D pipelines maintain product differentiation. Market exclusivity encourages investment.

The Generics segment is anticipated to witness the fastest CAGR of 13.9% from 2026 to 2033, driven by patent expirations and rising cost-conscious adoption in emerging markets. Government initiatives and favorable reimbursement promote generics uptake. Hospitals and pharmacies increasingly stock generic alternatives. Rising patient awareness reduces dependency on branded drugs. Retail and online distribution expands reach. Cost-efficient therapy boosts compliance. Collaborative programs between governments and clinics enhance access. Expansion of e-pharmacies accelerates growth.

• By Population Type

On the basis of population type, the market is segmented into Children and Adults. The Adult segment accounted for the largest market revenue share of 72.5% in 2025, due to high prevalence of sleep apnea, insomnia, and RLS in adult populations. Increased obesity rates, lifestyle factors, and aging demographics drive dominance. Hospital and clinic-based treatments are largely adult-focused. Adoption of CPAP, mandibular advancement devices, and pharmacological therapy is widespread. Awareness campaigns target adult populations. Insurance coverage supports chronic treatment. Telemedicine monitoring improves adherence. Geriatric populations require long-term care interventions. Corporate wellness programs boost demand.

The Children segment is projected to grow at the fastest CAGR of 12.7% from 2026 to 2033, fueled by increased recognition of pediatric sleep disorders and specialized interventions. Pediatric clinics and hospitals adopt age-appropriate therapies. Parents’ awareness and proactive screening improve diagnosis rates. Regulatory approvals for pediatric medications and devices support adoption. School and community health initiatives enhance awareness. Pediatric CPAP adoption grows steadily. Specialized homecare solutions for children are increasingly used. Telehealth facilitates monitoring. Collaborations between pharma and pediatric centers accelerate access.

• By End User

On the basis of end user, the market is segmented into Hospitals, Specialty Clinics, Home Healthcare, Ambulatory Surgical Center, and Others. The Hospitals segment dominated with 48.6% revenue share in 2025, driven by availability of multidisciplinary sleep centers, diagnostic labs, and therapy administration facilities. Hospitals offer access to a broad range of interventions and treatments. Insurance coverage and reimbursement policies reinforce hospital usage. Integration with telemedicine improves patient follow-up. Research initiatives in hospital settings expand treatment portfolios. Training of medical personnel supports procedural adoption. Hospitals provide both adult and pediatric services. Partnerships with device manufacturers strengthen capability. High patient volume sustains market leadership.

The Home Healthcare segment is expected to witness the fastest CAGR of 15.8% from 2026 to 2033, driven by rising preference for home-based CPAP therapy and telemonitoring devices. Increasing patient convenience, cost efficiency, and adherence monitoring support adoption. Insurance coverage for home therapies improves accessibility. Home healthcare providers offer training and support. Telemedicine integration ensures continuous monitoring. Aging populations and chronic patients drive homecare demand. Online pharmacies and direct-to-patient device delivery enhance reach. Collaborations with medical device companies improve service offerings. Pandemic-driven shift toward home-based care accelerates growth.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct Tender, Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, and Others. The Hospital Pharmacy segment dominated with 54.2% revenue share in 2025, due to controlled supply of prescription therapies and integration with hospital-based sleep centers. Direct physician prescription ensures appropriate use. Reimbursement and insurance facilitate hospital pharmacy preference. Access to specialized medications supports dominance. Integration with hospital records ensures patient compliance. Supply chain efficiency enhances adoption. Physician familiarity reinforces usage. Multichannel hospital networks expand reach. Hospital pharmacies maintain stock for chronic therapy. Regulatory oversight ensures safety.

The Online Pharmacy segment is expected to grow at the fastest CAGR of 16.3% from 2026 to 2033, driven by increased digital adoption, telemedicine integration, and home delivery of sleep disorder therapies. Patient preference for convenience fuels online purchases. E-pharmacy platforms expand geographic reach. Digital prescriptions and automated delivery improve adherence. Awareness campaigns support online therapy uptake. Cost advantages attract patients. Rapid expansion in emerging markets accelerates adoption. Technological integration enhances patient monitoring. Collaborations with hospitals support credibility. Online channels improve access to both branded and generic drugs.

Europe Sleep Disorder Treatment Market Regional Analysis

- The U.K. Europe Sleep Disorder Treatment Market dominated Europe with the largest revenue share of approximately 39.8% in 2025, supported by a robust healthcare system, high adoption of advanced diagnostic and therapeutic devices, strong presence of key market players, and increasing public awareness of sleep health.

- Hospitals, specialized sleep clinics, and home healthcare providers are witnessing substantial growth in the adoption of sleep disorder treatments, driven by innovative technologies and preventive healthcare initiatives.

Germany Europe Sleep Disorder Treatment Market Insight

Germany Europe Sleep Disorder Treatment Market is expected to be the fastest-growing country in the Europe Sleep Disorder Treatment Market during the forecast period, registering an estimated CAGR of around 8.9%. This growth is driven by rising investments in healthcare infrastructure, increasing prevalence of sleep disorders, adoption of digital and home-based sleep monitoring solutions, and expanding availability of specialized sleep therapy services across hospitals and clinics. The country’s focus on improving patient outcomes and promoting preventive healthcare continues to accelerate market adoption.

Europe Sleep Disorder Treatment Market Share

The Sleep Disorder Treatment industry is primarily led by well-established companies, including:

- Philips Respironics (Netherlands)

- Fisher & Paykel Healthcare (New Zealand)

- Invacare Corporation (U.S.)

- SomnoMed (Australia)

- Inspire Medical Systems (U.S.)

- Respicardia (U.S.)

- Itamar Medical (Israel)

- Zephyr Sleep Technologies (U.S.)

- Actelion Pharmaceuticals (Switzerland)

- Teva Pharmaceutical Industries (Israel)

- GlaxoSmithKline (U.K.)

- Novartis (Switzerland)

- Johnson & Johnson (U.S.)

- Koninklijke DSM (Netherlands)

- Sleep Number Corporation (U.S.)

- Apex Medical (Taiwan)

- Medtronic (U.S.)

- BMC Medical (China)

- SomniFix (U.S.)

Latest Developments in Europe Sleep Disorder Treatment Market

- In December 2024, the U.S. Food and Drug Administration (FDA) approved Zepbound (tirzepatide), a GLP‑1 receptor agonist developed by Eli Lilly, as the first medication specifically indicated for the treatment of moderate to severe obstructive sleep apnea (OSA) in adults with obesity, demonstrating significant reductions in apnea episodes alongside weight loss benefits. This approval marked a major expansion of pharmacological treatment options for OSA, historically dominated by device‑based therapy such as CPAP, and provided clinicians with a novel systemic therapy to address the underlying metabolic contributors to sleep apnea, particularly in obese populations

- In January 2024, ResMed launched the AirMini AutoSet Travel CPAP Machine, a compact, lightweight sleep apnea therapy device optimized for frequent travelers, representing a strategic move toward more portable and patient‑friendly sleep disorder technologies that support adherence outside traditional home environments. The AirMini’s introduction reflects industry trends toward miniaturization and user convenience in chronic sleep disorder management

- In June 2024, Philips announced a significant new CPAP platform with enhanced patient monitoring and cloud‑enabled data sharing capabilities, designed to streamline remote patient management and improve long‑term therapy adherence through integrated telehealth features, aligning device therapy with digital health trends. This launch highlighted how connectivity and data analytics are being embedded into sleep treatment infrastructure to support clinician oversight and patient engagement

- In September 2025, Airway Management received FDA clearance for Nylon flexTAP®, the first digitally printed single‑point midline oral appliance for mild to moderate obstructive sleep apnea, featuring patented Vertex Technology for improved comfort and therapeutic efficacy, broadening non‑CPAP treatment alternatives. This clearance expanded the oral appliance segment, offering patients additional non‑invasive therapies that compete with conventional devices

- In February 2025, Huxley Medical announced FDA clearance for its SANSA home sleep apnea test with cellular data upload capability, eliminating reliance on Bluetooth or smartphone apps to transmit diagnostic data, simplifying home sleep study procedures and improving accessibility for underserved patient populations. This innovation supports the trend toward decentralized, patient‑centric diagnostics in the sleep disorder market

- In March 2025, ResMed received FDA clearance for its new Adaptive Servo‑Ventilator device, a next‑generation sleep apnea therapy platform designed for patients with more complex respiratory needs, enhancing therapy precision and expanding treatment options for individuals who do not respond well to conventional CPAP or BiPAP devices. This device advancement underscores ongoing innovation in therapeutic hardware, addressing unmet needs in severe sleep disorder cases and reinforcing device‑based market expansion

- In January 2025, Medicare and Medicaid clarified coverage guidance allowing Zepbound to be included under Medicare Part D and potentially Medicaid plans for OSA treatment, significantly increasing patient access to this new pharmacological option for moderate‑to‑severe sleep apnea among older and low‑income populations. This development facilitated broader insurance reimbursement pathways, which are critical for real‑world adoption of novel sleep disorder therapies beyond traditional device usage, opening access for millions of beneficiaries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.