Europe Slimming Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.05 Billion

USD

2.13 Billion

2025

2033

USD

1.05 Billion

USD

2.13 Billion

2025

2033

| 2026 –2033 | |

| USD 1.05 Billion | |

| USD 2.13 Billion | |

|

|

|

|

Europe Slimming Devices Market Size

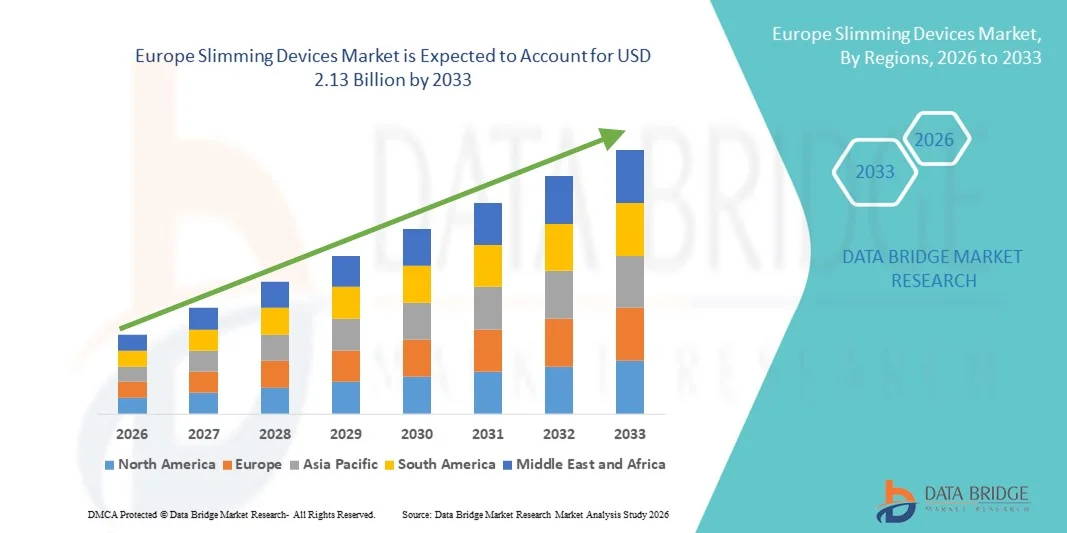

- The Europe slimming devices market size was valued at USD 1.05 billion in 2025 and is expected to reach USD 2.13 billion by 2033, at a CAGR of 9.25% during the forecast period

- The market growth is largely fueled by the increasing prevalence of obesity and lifestyle-related disorders, coupled with rising awareness about physical appearance and health management. Growing urbanization, sedentary lifestyles, and unhealthy dietary habits are significantly contributing to higher demand for non-invasive and minimally invasive slimming devices across both clinical and homecare settings

- Furthermore, the rising preference for aesthetic procedures with minimal downtime, along with continuous technological advancements such as laser lipolysis, cryolipolysis, radiofrequency, and ultrasound-based fat reduction systems, is strengthening product adoption. These converging factors are accelerating the uptake of Slimming Devices solutions, thereby substantially driving overall market expansion

Europe Slimming Devices Market Analysis

- Slimming devices, offering non-invasive and minimally invasive fat reduction and body contouring solutions, are becoming increasingly integral to modern aesthetic and wellness practices across both clinical and home-use settings due to their convenience, reduced recovery time, and growing preference for non-surgical cosmetic procedures

- The escalating demand for slimming devices is primarily fueled by the rising prevalence of obesity, increasing awareness regarding physical appearance and fitness, and a strong consumer shift toward technologically advanced, pain-free body contouring treatments

- The U.K. dominated the slimming devices market with the largest revenue share of 28.4% in 2025, characterized by high awareness of aesthetic treatments, strong spending on cosmetic procedures, advanced healthcare infrastructure, and the presence of well-established aesthetic clinics offering innovative fat reduction technologies

- Germany is expected to be the fastest growing country in the Slimming Devices market during the forecast period, driven by increasing demand for non-invasive cosmetic treatments, rising disposable income, growing medical tourism, and expanding adoption of advanced laser and energy-based body contouring systems

- The standalone segment accounted for the largest market revenue share of 57.8% in 2025, owing to its widespread usage in professional clinics and wellness centers

Report Scope and Slimming Devices Market Segmentation

|

Attributes |

Slimming Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Slimming Devices Market Trends

Technological Advancements in Non-Invasive Body Contouring Solutions

- A significant and accelerating trend in the slimming devices market is the growing adoption of advanced non-invasive and minimally invasive body contouring technologies designed to reduce fat, tighten skin, and improve body aesthetics without surgical intervention

- This technological evolution is significantly enhancing treatment efficiency, safety, and patient comfort

- For instance, in March 2023, Allergan Aesthetics (AbbVie) expanded the availability of its CoolSculpting Elite system across key European markets, offering improved applicator designs and optimized cooling technology for enhanced fat reduction outcomes. Similarly, Cynosure introduced upgraded radiofrequency-based body contouring platforms in Europe to improve skin tightening and treatment precision

- Advancements in technologies such as cryolipolysis, laser lipolysis, ultrasound cavitation, and radiofrequency energy are enabling targeted fat reduction with minimal downtime. These innovations allow clinics to provide customized treatment plans based on individual body composition and aesthetic goals

- The increasing preference for outpatient cosmetic procedures and the shift toward non-surgical fat reduction are supporting widespread adoption among working professionals and younger demographics

- This trend toward safer, faster, and clinically proven body contouring solutions is reshaping consumer expectations in aesthetic treatments. Consequently, companies are focusing on device portability, improved energy delivery systems, and enhanced patient comfort features to strengthen their market presence

- The demand for advanced slimming devices is growing rapidly across aesthetic clinics, dermatology centers, and medical spas, as consumers increasingly prioritize minimally invasive cosmetic enhancement procedures

Europe Slimming Devices Market Dynamics

Driver

Rising Obesity Rates and Growing Demand for Aesthetic Procedures

- The increasing prevalence of obesity and lifestyle-related weight gain, coupled with rising awareness of aesthetic body contouring procedures, is a significant driver for the heightened demand for slimming devices across Europe

- For instance, in May 2024, data published by the World Health Organization (WHO) Europe indicated that nearly 60% of adults in the European region are overweight or obese, prompting increased demand for non-invasive fat reduction technologies in clinical settings. Such rising health and cosmetic concerns are expected to drive the Slimming Devices industry growth during the forecast period

- As individuals become more conscious of physical appearance and wellness, non-surgical body contouring treatments are emerging as preferred alternatives to traditional liposuction procedures

- Furthermore, increasing disposable income and the growing influence of social media trends promoting body aesthetics are encouraging consumers to seek professional slimming treatments

- The convenience of outpatient procedures, reduced recovery time, and visible results within a short duration are key factors propelling the adoption of slimming devices in both private clinics and hospital-based aesthetic departments. The expansion of specialized aesthetic centers and the availability of flexible financing options further contribute to market growth

Restraint/Challenge

High Treatment Costs and Regulatory Compliance Requirements

- The relatively high cost of advanced slimming device treatments, along with stringent regulatory requirements for medical aesthetic equipment, poses a significant challenge to broader market penetration. Since these devices involve energy-based technologies, they require strict clinical validation and certification, increasing operational costs for manufacturers and providers

- For instance, under the European Union Medical Device Regulation (EU MDR) implemented in 2021, manufacturers of aesthetic energy-based devices must comply with enhanced safety and clinical evidence requirements, leading to increased approval timelines and certification expenses

- In addition, the cost per treatment session can be relatively high for patients, limiting access among price-sensitive consumers and restricting repeat procedures

- The need for trained professionals to operate advanced slimming technologies further adds to clinic operating costs, impacting service pricing structures

- While awareness and demand are increasing, perceived premium pricing and limited reimbursement coverage for cosmetic procedures can still hinder widespread adoption

- Overcoming these challenges through cost-efficient device development, expanded practitioner training programs, and improved consumer education on treatment safety and effectiveness will be vital for sustaining long-term market growth

Europe Slimming Devices Market Scope

The market is segmented on the basis of product, technology, portability, body area, end user, and distribution channel.

- By Product

On the basis of product, the Slimming Devices market is segmented into electric pulse type, vibration type, pneumatic extrusion, and others. The electric pulse type segment dominated the largest market revenue share of 38.6% in 2025, driven by its increasing adoption for muscle stimulation and fat reduction treatments in both professional and home settings. These devices are widely preferred due to their non-invasive nature and ability to enhance muscle toning alongside fat metabolism. Growing consumer awareness regarding body contouring and rising demand for convenient aesthetic solutions further strengthen segment growth. Electric pulse devices are also supported by technological advancements that improve safety and treatment efficiency. Their affordability compared to surgical procedures makes them accessible to a broader population. Increasing partnerships between device manufacturers and wellness clinics further expand availability. Additionally, integration with digital monitoring features enhances user engagement. Strong marketing of EMS-based solutions and fitness trends also contribute to dominance. The segment benefits from continuous innovation and product upgrades, ensuring sustained leadership in 2025.

The vibration type segment is anticipated to witness the fastest growth rate of 22.4% CAGR from 2026 to 2033, fueled by rising consumer preference for portable and easy-to-use slimming equipment. Vibration devices are increasingly adopted in home fitness routines due to their affordability and compact design. Growing awareness about lymphatic drainage and cellulite reduction treatments supports segment expansion. The rise of social media fitness influencers promoting vibration-based body sculpting tools accelerates demand. These devices require minimal technical supervision, making them attractive for personal use. Manufacturers are focusing on ergonomic designs and multiple intensity settings to enhance customer appeal. Expansion of e-commerce platforms also contributes to accessibility and visibility. Increasing disposable income and interest in preventive healthcare further boost growth. As consumers seek non-surgical fat reduction methods, vibration type devices are positioned for rapid adoption across emerging markets.

- By Technology

On the basis of technology, the Slimming Devices market is segmented into cryolipolysis, low level laser therapy, focused ultrasound, and radiofrequency. The cryolipolysis segment held the largest market revenue share of 41.3% in 2025, driven by its proven effectiveness in targeted fat reduction without surgery. This technology is widely adopted in dermatology and aesthetic clinics due to clinically validated outcomes. Increasing demand for non-invasive body contouring procedures supports dominance. Cryolipolysis devices offer minimal downtime, which attracts working professionals. Continuous improvements in cooling applicator designs enhance treatment precision. Growing medical tourism for aesthetic procedures also strengthens the segment. High patient satisfaction rates and repeat treatments further drive revenue. Strong regulatory approvals and brand recognition among leading manufacturers sustain growth. The technology’s ability to treat stubborn fat pockets efficiently ensures its leading position in 2025.

The radiofrequency segment is expected to witness the fastest CAGR of 23.1% from 2026 to 2033, due to its dual benefits of fat reduction and skin tightening. Increasing consumer demand for combination treatments that address sagging skin and contouring drives rapid adoption. Radiofrequency devices are gaining popularity in wellness centers and cosmetic clinics for their versatility. Technological advancements enabling controlled heat delivery improve safety profiles. Rising awareness regarding anti-aging treatments further accelerates growth. Manufacturers are introducing portable RF devices for home use, expanding customer base. Growing investments in aesthetic infrastructure in developing countries support expansion. Social acceptance of cosmetic procedures also encourages uptake. As demand for non-invasive, multi-benefit treatments rises, radiofrequency technology is projected to grow at the fastest pace during the forecast period.

- By Portability

On the basis of portability, the Slimming Devices market is segmented into standalone and portable. The standalone segment accounted for the largest market revenue share of 57.8% in 2025, owing to its widespread usage in professional clinics and wellness centers. Standalone systems typically provide higher power output and advanced functionalities, delivering more effective results. These devices are preferred for clinical-grade procedures requiring precision and consistent performance. High investment capacity of aesthetic clinics supports procurement of advanced systems. Growing number of professional slimming centers globally contributes to segment dominance. Standalone devices often integrate multiple technologies in a single unit, enhancing versatility. Strong after-sales service support from manufacturers further drives adoption. Increasing patient trust in clinic-based treatments sustains market share. The segment continues to lead due to superior treatment outcomes and professional credibility.

The portable segment is projected to grow at the fastest CAGR of 24.5% from 2026 to 2033, driven by rising home-based treatment trends. Consumers increasingly prefer compact devices that offer flexibility and convenience. The surge in remote wellness solutions and self-care practices boosts demand. Portable devices are typically more affordable and accessible via online channels. Technological miniaturization has improved device performance while maintaining safety. Busy lifestyles and demand for time-efficient treatments further support growth. Manufacturers are launching rechargeable, user-friendly models to attract younger demographics. Increasing penetration in emerging markets accelerates adoption. As home aesthetics gain popularity, the portable segment is expected to expand rapidly during the forecast period.

- By Body Area

On the basis of body area, the Slimming Devices market is segmented into abdominal, hip, thighs, and others. The abdominal segment dominated the market with a revenue share of 46.9% in 2025, driven by high consumer focus on reducing belly fat. Abdominal fat is commonly associated with lifestyle diseases, prompting demand for targeted treatments. Aesthetic concerns and fitness trends emphasizing core toning further strengthen dominance. Clinics frequently offer abdominal contouring packages, supporting segment revenue. Increasing obesity prevalence globally fuels demand. Technological advancements enabling precise abdominal fat targeting enhance effectiveness. Marketing campaigns highlighting visible abdominal results also boost uptake. Repeat procedures for stubborn belly fat contribute to revenue stability. The segment remains dominant due to high treatment demand and proven outcomes.

The thighs segment is anticipated to witness the fastest CAGR of 21.9% from 2026 to 2033, driven by rising demand for lower body contouring. Consumers increasingly seek solutions for cellulite reduction and thigh toning. Growing popularity of body sculpting among younger demographics supports expansion. Fitness and fashion trends emphasizing lower body aesthetics boost interest. Advancements in applicator designs tailored for thigh areas enhance treatment precision. Wellness centers are promoting package-based treatments including thigh contouring. Rising disposable incomes in urban populations further drive growth. Increased awareness of non-invasive options encourages adoption. As demand for comprehensive body reshaping increases, thigh-focused treatments are expected to grow rapidly.

- By End User

On the basis of end user, the Slimming Devices market is segmented into gyms and fitness centers, wellness centers, home, and others. The wellness centers segment held the largest market revenue share of 39.4% in 2025, driven by professional expertise and availability of advanced equipment. Consumers often prefer supervised procedures for safety and better results. Wellness centers offer integrated slimming programs combining devices with dietary guidance. Increasing number of aesthetic clinics globally supports dominance. High consumer trust in certified practitioners further drives revenue. Technological upgrades in clinics enhance treatment effectiveness. Rising urbanization and lifestyle changes promote demand for structured slimming solutions. The segment continues to lead due to professional credibility and comprehensive service offerings.

The home segment is projected to register the fastest CAGR of 25.2% from 2026 to 2033, fueled by increasing demand for convenient and cost-effective treatments. Consumers prefer privacy and flexibility associated with home-based devices. Growing e-commerce penetration enhances product accessibility. Social media marketing and influencer endorsements accelerate adoption. Technological innovations have improved safety features in home devices. Busy lifestyles drive demand for time-saving solutions. Rising awareness of self-care trends further supports growth. Affordable pricing strategies by manufacturers attract a wider customer base. As personalized wellness becomes mainstream, the home segment is expected to expand at the highest growth rate.

- By Distribution Channel

On the basis of distribution channel, the Slimming Devices market is segmented into direct tenders and over the counter, retail. The direct tenders segment accounted for the largest market revenue share of 52.6% in 2025, driven by bulk procurement by hospitals, clinics, and wellness centers. Institutional purchases ensure steady revenue streams for manufacturers. Large-scale contracts often include maintenance and service agreements. Growing investments in aesthetic infrastructure support dominance. Direct procurement ensures access to advanced clinical-grade devices. Manufacturers benefit from long-term partnerships with healthcare providers. Rising demand for professional slimming services further boosts segment share. The structured procurement process strengthens market presence.

The over the counter, retail segment is expected to witness the fastest CAGR of 23.8% from 2026 to 2033, driven by increasing consumer inclination toward home-use slimming devices. Expansion of retail pharmacies and online platforms enhances accessibility. Competitive pricing and promotional offers attract individual buyers. Growing awareness regarding non-invasive fat reduction supports retail demand. Manufacturers are focusing on attractive packaging and marketing campaigns. Rising digital payments and doorstep delivery services further boost growth. Consumers increasingly prefer self-managed wellness solutions. As home-based aesthetics continue to rise, the retail distribution channel is projected to grow at a significant pace during the forecast period.

Europe Slimming Devices Market Regional Analysis

- The Europe slimming devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising prevalence of obesity, increasing awareness of aesthetic body contouring procedures, and growing preference for non-invasive fat reduction treatments

- The increase in urbanization, changing lifestyle patterns, and higher disposable income levels are fostering the adoption of advanced slimming technologies across the region. European consumers are increasingly drawn to minimally invasive cosmetic solutions that offer reduced downtime and visible results without surgical intervention

- The region is experiencing significant growth across aesthetic clinics, dermatology centers, and medical spas, with slimming devices being incorporated into both specialized cosmetic facilities and hospital-based aesthetic departments. Continuous technological advancements in laser, cryolipolysis, ultrasound, and radiofrequency-based systems are further strengthening market expansion

U.K. Slimming Devices Market Insight

The U.K. slimming devices market dominated the slimming devices market with the largest revenue share of 28.4% in 2025, characterized by high awareness of aesthetic treatments, strong spending on cosmetic procedures, advanced healthcare infrastructure, and the presence of well-established aesthetic clinics offering innovative fat reduction technologies. The country’s strong consumer inclination toward appearance enhancement and body contouring solutions is significantly contributing to market dominance. In addition, the availability of skilled practitioners and access to advanced non-invasive technologies such as cryolipolysis and laser lipolysis are supporting sustained adoption. Growing social media influence and rising acceptance of cosmetic procedures among both men and women are further driving demand. The U.K.’s developed private healthcare sector and easy access to aesthetic consultation services continue to strengthen its leading market position during the forecast period.

Germany Slimming Devices Market Insight

Germany slimming devices market is expected to be the fastest growing country in the Slimming Devices market during the forecast period, driven by increasing demand for non-invasive cosmetic treatments, rising disposable income, growing medical tourism, and expanding adoption of advanced laser and energy-based body contouring systems. The country’s well-developed healthcare infrastructure and emphasis on high-quality medical services support the rapid uptake of innovative slimming technologies. Increasing consumer awareness regarding safe and clinically approved aesthetic treatments is further accelerating growth. Germany’s expanding network of dermatology clinics and aesthetic centers, particularly in major metropolitan regions, is contributing to higher procedure volumes. In addition, the country’s reputation for medical excellence is attracting international patients seeking advanced body contouring treatments, reinforcing its position as the fastest-growing market within Europe.

Europe Slimming Devices Market Share

The Slimming Devices industry is primarily led by well-established companies, including:

- Cynosure, LLC (U.S.)

- Venus Concept Ltd. (Canada)

- Cutera, Inc. (U.S.)

- Alma Lasers (Israel)

- Lumenis Ltd. (Israel)

- BTL Industries (U.K.)

- Fotona d.o.o. (Slovenia)

- Syneron Candela (U.S.)

- Sciton, Inc. (U.S.)

- Allergan Aesthetics (U.S.)

- Solta Medical (U.S.)

- Hologic, Inc. (U.S.)

- Lutronic Corporation (South Korea)

- Zimmer MedizinSysteme GmbH (Germany)

- Beijing KES Biology Technology Co., Ltd. (China)

Latest Developments in Europe Slimming Devices Market

- In January 2021, Allergan Aesthetics introduced the FDA-approved CoolSculpting Elite procedure, designed to target and eliminate visible fat bulges across nine different areas of the body including thighs, abdomen, flanks, back, buttocks, upper arms, submental and submandibular regions. This expanded applicator range enhanced the versatility and effectiveness of the CoolSculpting line in non-invasive fat reduction treatments

- In March 2023, iCRYO, a U.S.-based health and wellness brand, partnered with BTL Industries to integrate advanced non-invasive body shaping technologies, including Emsculpt NEO, into its service offerings. This collaboration expanded iCRYO’s capabilities in muscle toning, fat reduction, and body contouring, providing a broader range of innovative aesthetic solutions

- In June 2023, ShanDong EXFU Lasers Technology Co. Ltd., a China-based beauty and wellness products company, launched the FIND S EMS Slimming Machine, featuring advanced electrical muscle stimulation (EMS) technology with adjustable intensity levels and a compact, portable design to enable targeted muscle activation and enhanced body sculpting at home

- In August 2024, Zimmer MedizinSystems launched the Z Wave Q acoustic shockwave slimming device, featuring a water-cooled handpiece that operates with significantly reduced noise compared to previous units, offering improved comfort and convenience during body contouring sessions

- In September 2024, Venus Concept received clearance from Australia’s Therapeutic Goods Administration (TGA) for its Venus Bliss MAX system, a 3-in-1 body shaping solution that integrates diode laser technology for fat reduction, (MP)² technology for skin tightening, and electrical muscle stimulation for muscle toning

- In December 2024, BTL Aesthetics announced the launch of the EMSCULPT NEO EDGE applicators, designed to more effectively target the entire lateral abdomen by combining synchronized radiofrequency (RF) and high-intensity focused electromagnetic (HIFEM) energies for simultaneous fat reduction and muscle strengthening

- In February 2025, Cutera introduced the next-generation truSculpt flex+ device, featuring a rapid 15-minute treatment mode capable of treating up to eight areas simultaneously using Multi-Directional Stimulation (MDS) technology to enhance muscle toning and firming performance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.