Europe Smart Lighting Market

Market Size in USD Million

CAGR :

%

USD

6.75 Million

USD

26.96 Million

2024

2032

USD

6.75 Million

USD

26.96 Million

2024

2032

| 2025 –2032 | |

| USD 6.75 Million | |

| USD 26.96 Million | |

|

|

|

|

Smart Lighting Market Size

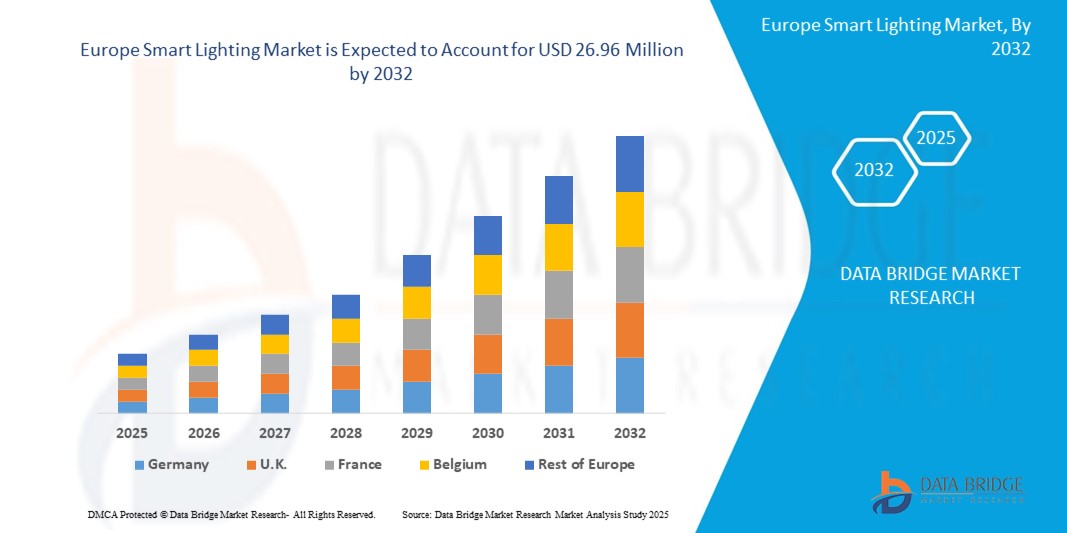

- The Europe Smart Lighting Market size was valued at USD 6.75 million in 2024 and is expected to reach USD 26.96 million by 2032, at a CAGR of 18.9% during the forecast period.

- This growth is driven by stringent EU regulations for energy efficiency, high adoption of smart city initiatives, and increasing demand for IoT-enabled and AI-driven lighting solutions.

- The market is further propelled by the replacement of traditional lighting with energy-efficient LED-based smart systems across residential, commercial, and public sectors

Smart Lighting Market Analysis

- Smart lighting systems in Europe leverage advanced technologies such as IoT, AI, and wireless connectivity (e.g., Zigbee, Wi-Fi, Bluetooth) to enhance energy efficiency, user control, and sustainability in indoor and outdoor applications.

- The market is driven by the European Union’s Ecodesign Directive and Green Deal, aiming for carbon neutrality by 2050, alongside widespread adoption of smart home and building automation systems.

- Germany holds a significant market share due to its leadership in industrial automation, smart factories, and presence of key players like Signify N.V. and Osram.

- The U.K. is expected to register the fastest growth, fueled by increasing adoption of smart home technologies and IoT-enabled lighting in residential and commercial spaces.

- The Hardware segment (LED bulbs, luminaires, sensors) is projected to account for a significant market share of approximately 55.21% in 2025, driven by the rapid adoption of energy-efficient LED technology.

Report Scope and Smart Lighting Market Segmentation

|

Attributes |

Smart Lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production cNAity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Lighting Market Trends

“Advancements in IoT, AI, and Human-Centric Lighting”

- IoT and AI are integrated into smart lighting systems to enable adaptive brightness, remote control, and occupancy-based lighting, enhancing energy efficiency and user experience.

- Human-centric lighting, which adjusts color temperature and brightness to align with circadian rhythms, is gaining traction in offices, hospitals, and schools to improve productivity and well-being.

- For instance, in January 2023, Signify N.V. launched a new range of Philips Hue smart bulbs with AI-driven adaptive lighting for residential and commercial applications.

- Governments are promoting energy-efficient lighting through incentives and regulations, such as the EU’s ban on fluorescent lighting by 2023, driving the adoption of LED-based smart lighting.

Smart Lighting Market Dynamics

Driver

“EU Regulations for Energy Efficiency and Smart City Development”

- The EU’s Green Deal and Ecodesign Directive, targeting carbon neutrality by 2050, drive demand for energy-efficient smart lighting solutions.

- Government initiatives, such as the Bulgarian government’s USD 34.08 million investment in energy-efficient street lighting in 2023, promote smart lighting adoption.

- For instance, a 2023 report highlighted that smart lighting systems reduced energy consumption by up to 15% in pilot cities like Amsterdam and Munich.

- The integration of smart lighting with 5G and IoT enhances connectivity and real-time control, addressing urban energy demands.

Opportunity

“Expansion of Smart Homes and Green Building Certifications”

- The adoption of smart home technologies, as seen in the U.K., where over 50% of households are projected to use smart lighting by 2027, offers significant growth potential.

- The push for green building certifications, such as LEED and BREEAM, encourages the integration of smart lighting in commercial and residential projects.

- For instance, in 2024, Germany announced plans to retrofit public buildings with IoT-enabled smart lighting to meet sustainability goals.

- Emerging markets like Turkey and Russia present opportunities due to increasing urbanization and smart city investments.

Restraint/Challenge

“High Initial Costs and Cybersecurity Risks”

- Deploying smart lighting systems, particularly those involving IoT and 5G infrastructure, involves high capital costs for hardware and integration, posing challenges for smaller municipalities.

- Cybersecurity risks associated with connected lighting systems, especially in public infrastructure, impact scalability and adoption.

- For instance, a 2024 industry report noted a 25% increase in cyberattacks targeting IoT-based smart lighting networks in Europe.

-

Regulatory complexities, such as varying energy efficiency standards across EU countries, complicate market expansion for smart lighting providers.

Smart Lighting Market Scope

The market is segmented based on offering, communication technology, installation type, light source, and application.

|

Segmentation |

Sub-Segmentation |

|

By Offering |

|

|

By Communication Technology |

|

|

By Installation Type |

|

|

By Light Source |

|

|

By Application |

|

In 2025, the Hardware segment is projected to dominate the Offering segment

The Hardware segment is expected to hold a market share of approximately 55.21% in 2025, driven by rapid urbanization and demand for LED-based smart lighting systems.

The Commercial application segment is expected to account for the largest share during the forecast period in the application market

In 2025, the Commercial application segment is projected to account for a market share of 41.79%, driven by increasing demand for energy-efficient lighting in offices, retail, and industrial settings.

“Germany Holds the Largest Share in the Smart Lighting Market”

-

Germany dominates the market due to its advanced industrial automation, smart factory initiatives, and presence of leading vendors like Osram and Signify N.V.

- The country benefits from significant investments in IoT infrastructure and smart city projects, supported by robust R&D ecosystems.

- Cities like Berlin and Munich lead in smart street lighting and green building initiatives.

“U.K. is Projected to Register the Highest CAGR in the Smart Lighting Market”

- The U.K.’s growth is driven by innovative smart home projects and strong government support for energy efficiency.

- The country is projected to exhibit the highest CAGR due to its leadership in IoT adoption and integrated smart lighting systems.

- The focus on residential smart lighting and public infrastructure retrofitting further accelerates market growth..

Smart Lighting Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production cNAities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Signify N.V. (Netherlands)

- Osram GmbH (Germany)

- Schneider Electric (France)

- Acuity Brands, Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Zumtobel Group AG (Austria)

- Eaton Corporation (Ireland)

- Lutron Electronics Co., Inc. (U.S.)

- Legrand S.A. (France)

- Cree, Inc. (U.S.)

- Wipro Lighting (India)

- Häfele GmbH & Co KG (Germany)

- Syska LED (India)

- LG Electronics (South Korea)

- Sengled Optoelectronics Co., Ltd. (China)

Latest Developments in Europe Smart Lighting Market

- In March 2022, Zumtobel Group AG (Austria) unveiled an advanced outdoor smart lighting solution at the Data Centre World 2022 exhibition in London, U.K. The system, designed for public infrastructure, integrates IoT sensors and wireless connectivity to enable real-time monitoring and adaptive brightness control. This innovation strengthens Zumtobel’s portfolio by addressing energy efficiency and sustainability needs in urban street lighting and public spaces, aligning with EU smart city goals.

- In January 2023, Signify N.V. (Netherlands) launched a new range of Philips Hue smart bulbs featuring AI-driven adaptive lighting technology. Targeting both residential and commercial markets, these bulbs automatically adjust color temperature and brightness based on occupancy, time of day, and user preferences. The launch enhances user comfort and energy savings, reinforcing Signify’s leadership in IoT-enabled lighting solutions across Europe.

- In August 2023, Osram GmbH (Germany) collaborated with a German smart city initiative in Munich to retrofit public street lighting with IoT-enabled LED systems. The project replaced over 5,000 traditional streetlights, achieving a 20% reduction in energy consumption and improving urban safety through dynamic lighting controls. This partnership underscores Osram’s commitment to sustainable urban development and scalable smart lighting solutions.

- In February 2024, Schneider Electric (France) introduced an innovative IoT-based lighting control system tailored for commercial buildings. The system seamlessly integrates with existing building management systems (BMS) to optimize energy use through real-time data analytics and automated lighting adjustments. Deployed in several European office complexes, it supports energy efficiency goals and enhances occupant comfort, strengthening Schneider’s position in smart building solutions.

- In September 2024, Honeywell International Inc. (U.S.) secured a multi-year contract to deploy smart lighting solutions at Frankfurt Airport, a major European hub. The project incorporates IoT-enabled LED lighting with advanced sensors to optimize energy use, improve operational efficiency, and enhance passenger experience through dynamic lighting in terminals. This initiative highlights Honeywell’s growing influence in Europe’s public infrastructure lighting market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Smart Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Smart Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Smart Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.