Europe Smart Transportation Market

Market Size in USD Million

CAGR :

%

USD

39.95 Million

USD

106.95 Million

2024

2032

USD

39.95 Million

USD

106.95 Million

2024

2032

| 2025 –2032 | |

| USD 39.95 Million | |

| USD 106.95 Million | |

|

|

|

|

Smart Transportation Market Size

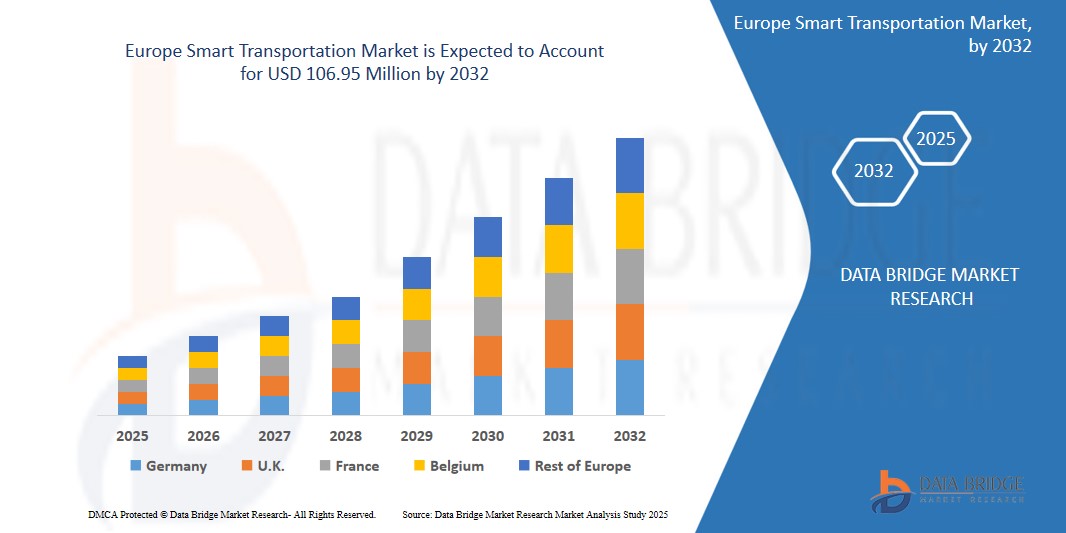

- The Europe Smart Transportation Market size was valued at USD 39.95 million in 2024 and is expected to reach USD 106.95 million by 2032, at a CAGR of 13.1% during the forecast period.

- This growth is driven by the countries are investing heavily in smart city infrastructure, including intelligent transport systems (ITS), real-time traffic management, and multimodal transport solutions.

Smart Transportation Market Analysis

- Smart transportation systems in Europe integrate advanced technologies such as IoT, AI, big data, and 5G to optimize roadways, railways, airways, and maritime transport, improving efficiency, safety, and sustainability.

- The market is propelled by the European Union’s focus on carbon-neutral transportation, advancements in autonomous vehicle technologies, and significant investments in smart infrastructure.

- Germany holds a significant market share due to its advanced automotive industry, high adoption of smart mobility solutions, and presence of key players like Siemens AG.

- The Netherlands is expected to register the fastest growth, fueled by innovative urban mobility projects, such as those in Amsterdam, and strong sustainability policies.

- The Traffic Management Solution segment is projected to account for a significant market share of approximately 42.77% in 2025, driven by demand for real-time, efficient transit systems in urban centers.

Report Scope and Smart Transportation Market Segmentation

|

Attributes |

Smart Transportation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production cNAity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Transportation Market Trends

“Advancements in AI, and Machine Learning (ML)”

- AI and ML are being integrated into transportation systems to enhance operational efficiency. These technologies enable predictive maintenance, optimize traffic management, and improve system reliability by analyzing vast datasets to identify patterns and predict congestion.

- The integration of smart grids with transportation systems allows for efficient energy distribution, especially for electric vehicles (EVs). Smart grids support bidirectional energy flow, enabling vehicles to not only consume but also supply energy back to the grid, enhancing overall energy efficiency.

- For instance, in March 2023, Alstom SA launched the Low Emission Access to Public Transport (LEAP) program in Bengaluru, deploying electric autorickshaws for last-mile connectivity to metro stations..

- Governments are promoting sustainable transportation, electric vehicles (EVs), and data-driven traffic management systems through funding, regulations, and partnerships with tech firms.

Smart Transportation Market Dynamics

Driver

“EU Policies for Carbon-Neutral Transport and Smart City Development”

- The EU’s Green Deal, aiming for carbon neutrality by 2050, drives demand for smart transportation solutions, particularly in EV infrastructure and public transit systems.

- Government initiatives, such as the European Commission’s USD 13 billion investment in transport infrastructure under the Connecting Europe Facility, promote smart mobility.

- For instance, a 2023 EU report highlighted that smart transportation systems reduced urban emissions by up to 12% in pilot cities like Copenhagen and Berlin.

- The integration of smart transportation with 5G and autonomous vehicles enhances connectivity, safety, and efficiency, addressing urban congestion.

Opportunity

“Expansion of Autonomous Shuttles and Sustainable Mobility”

- The adoption of autonomous shuttles, as seen in EU projects like SHOW, AVENUE, and ULTIMO, offers enhanced safety, efficiency, and reduced emissions.

- The push for green mobility, including hydrogen-powered vehicles and low-emission transit systems, aligns with Europe’s environmental goals, creating market expansion opportunities.

- For instance, in November 2023, France announced plans to install seven million EV charging points by 2030, boosting smart transportation infrastructure.

- The rising demand for smart mobility in emerging markets, such as Turkey and Russia, presents significant growth prospects.

Restraint/Challenge

“High Implementation Costs and Cybersecurity Concerns”

- Deploying smart transportation systems, particularly those involving 5G and IoT infrastructure, involves high capital costs for equipment and integration, posing challenges for smaller municipalities.

- Cybersecurity risks associated with connected vehicles and IoT-based systems, especially in developing regions, impact scalability and adoption.

- For instance, a 2024 industry report noted a 20% increase in cyberattacks targeting smart transportation networks in , highlighting security challenges.

- Regulatory complexities, such as varying data privacy standards across the U.S., Canada, and Mexico, further complicate market expansion for smart transportation providers.

Smart Transportation Market Scope

The market is segmented based on type, component, Communication Technology, Connection, Sales Channel, and Application.

|

Segmentation |

Sub-Segmentation |

|

By Solution |

|

|

By Service |

|

|

By Transportation Mode |

|

|

By Applications |

|

In 2025, the Traffic Management Solution segment is projected to dominate the Solution segment

The Traffic Management Solution segment is expected to hold a market share of approximately 42.77% in 2025, driven Rapid Urbanization and Smart City Initiatives.

The Mobility as a Service application segment is expected to account for the largest share during the forecast period in the application market

In 2025, the Mobility as a Service application segment is projected to account for a market share of 27.9%, driven by Increasing Public Demand for Safe and Efficient Transport.

“Germany Holds the Largest Share in the Smart Transportation Market”

- Germany dominates the market due to its advanced automotive and tech industries, widespread adoption of smart mobility solutions, and presence of leading vendors like Siemens AG and SAP SE.

- The country benefits from significant investments in 5G infrastructure and autonomous vehicle testing, supported by robust R&D ecosystems.

- Cities like Hamburg and Berlin lead in dynamic traffic management and green mobility initiatives.

“Netherlands. is Projected to Register the Highest CAGR in the Smart Transportation Market”

- The Netherlands’ growth is driven by innovative smart city projects, such as Amsterdam’s mobility programs, and strong government support for sustainability.

- The country is projected to exhibit the highest CAGR due to its leadership in EV adoption and integrated public transit systems.

- The focus on cycling integration and off-peak delivery systems further accelerates market growth.

Smart Transportation Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production cNAities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Kapsch TrafficCom AG (Austria)

- Thales Group (France)

- Alstom (France)

- Schneider Electric (France)

- Siemens (Germany)

- MSR-Traffic GmbH (Germany)

- Cubic Corporation (U.S.)

- AtkinsEurope (U.K.)

- Cisco (U.S.)

- Accenture (Ireland)

- IBM India Pvt Ltd (India)

- LG CNS (South Korea)

- Indigo (India)

- Toshiba Corporation (Japan)

- Oracle (U.S.)

- SAP (Germany)

- Huawei Technologies Co., Ltd. (China)

- Intel Corporation (U.S.)

- Parsons Corporation (U.S.)

Latest Developments in Europe Smart Transportation Market

- In June 2023, Kapsch TrafficCom AG (Austria) implemented an advanced Intelligent Transportation System (ITS) for the New Hampshire Department of Transportation. The system introduced All-Electronic Tolling (AET) with free-flow tolling at multiple plazas, utilizing license plate reading cameras, sensors, and in-pavement treadles. This initiative enhances driver convenience, reduces travel times, and improves toll collection efficiency.

- In November 2023, Alstom (France) signed a contract with the Egyptian National Railways Authority (ENR) to modernize the 65-km Tanta–Zifta–Zagazig railway mainline, including nine stations. The project involves installing advanced signaling, power, telecom systems, and trackside equipment to migrate to ETCS Level 1, improving public transport capacity and efficiency in Egypt.

- In September 2024, Siemens (Germany) secured a major framework contract with Beacon for the supply of Vectron locomotives, strengthening rail transport capabilities across Europe. This collaboration enhances Siemens Mobility’s position in providing sustainable and efficient rail solutions, contributing to smarter and greener transportation networks.

- In October 2024, Thales Group (France) was selected by Avinor to deploy Norway’s next-generation nationwide air traffic management system. This initiative modernizes air traffic services, enhancing safety and operational efficiency in Norway’s airspace, aligning with smart transportation goals for aviation.

- In October 2024, Cubic Corporation (U.S.) delivered a smart ticketing solution for Tasmania’s public transport network. The system modernizes fare collection, improves accessibility, and enhances operational efficiency, supporting the region’s efforts to create a seamless public transit experience.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.