Europe Soil Health Market

Market Size in USD Billion

CAGR :

%

USD

3.83 Billion

USD

7.39 Billion

2025

2033

USD

3.83 Billion

USD

7.39 Billion

2025

2033

| 2026 –2033 | |

| USD 3.83 Billion | |

| USD 7.39 Billion | |

|

|

|

|

Europe Soil Health Market Size

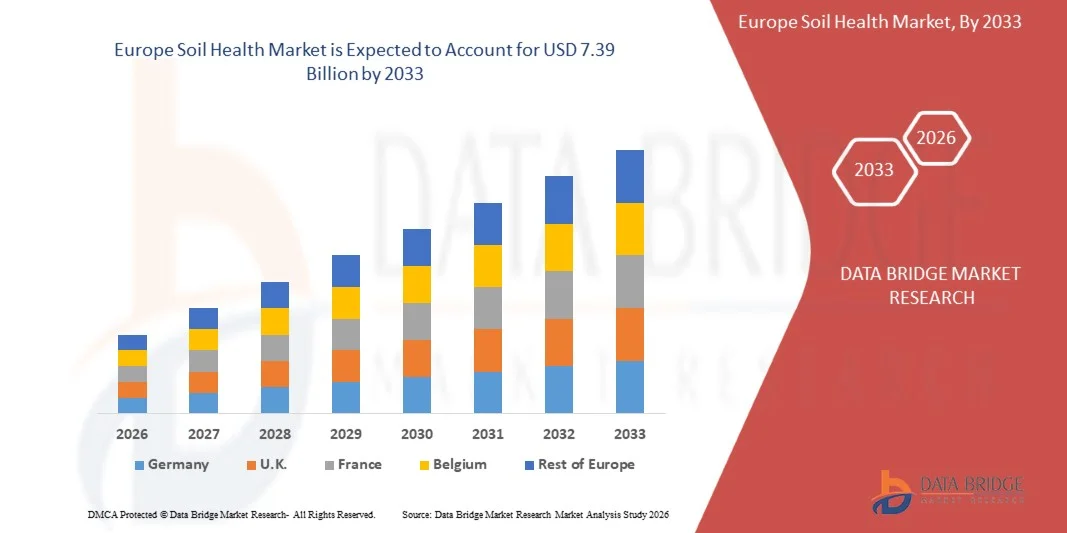

- The Europe Soil Health Market is expected to reach USD 7.39 Billion by 2033 from USD 3.83 Billion in 2025 growing with a CAGR of 8.6% in the forecast period of 2026 to 2033.

- The Europe Soil Health Market is experiencing consistent growth, driven by the increasing utilization of soil health solutions across sectors such as agriculture, horticulture, landscaping, and forestry. These solutions are valued for their ability to enhance soil fertility, improve nutrient retention, and support sustainable land management practices.

- Continuous advancements in soil amendment technologies, formulation techniques, and product efficacy, alongside improved quality standards, are facilitating wider adoption of innovative soil health products in high-performance applications, including crop productivity enhancement, soil remediation, and precision agriculture. This is contributing to improved soil quality, crop yields, and long-term environmental sustainability.

Europe Soil Health Market Analysis

- The Europe Soil Health Market serves a wide range of industries, including textiles, paper, resins, pharmaceuticals, cosmetics, and water treatment. Demand is primarily driven by its robust crosslinking capabilities and its role as a critical intermediate in specialty and high-performance chemical formulations.

- The Europe Soil Health Market caters to similar sectors, including textiles, paper, resins, pharmaceuticals, cosmetics, and water treatment. Its adoption is fueled by strong functional properties and its importance as an intermediate in specialty and performance chemical applications.

- In 2025, the Soil Enhancement Products segment is projected to dominate the Europe Soil Health Market with an 89.02% share, owing to its extensive use in producing resins, adhesives, and paper treatment chemicals. The segment benefits from substantial demand in large-scale industrial operations and cost-efficiency in bulk production, making it a preferred choice over other grades.

- Germany held the largest market share in 2025, capturing 18.06% due to its stringent environmental regulations under the EU Green Deal and Common Agricultural Policy, which prioritize sustainable farming and reduced chemical use.

- Germany is growing at a CAGR of 9.9% in the Europe Soil Health Market due to its pioneering role in Europe's Green Deal initiatives, which enforce strict sustainability standards and subsidize regenerative agriculture practices like cover cropping and reduced tillage.

- Rising adoption of advanced technologies, such as AI-enabled soil monitoring systems, automated irrigation, and real-time nutrient analytics, is enhancing operational efficiency and supporting market growth across commercial and industrial agricultural applications.

- Favorable government policies, infrastructure development, and investments in sustainable agriculture initiatives are further driving market growth, encouraging adoption of advanced soil health solutions, and reinforcing the industry’s long-term growth prospects.

Report Scope and Europe Soil Health Market Segmentation

|

Attributes |

Europe Soil Health Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Europe Soil Health Market Trends

“Integration with Smart Agriculture, Soil Management, and Precision Farming Ecosystems”

- Soil health solutions are increasingly integrated into smart agriculture environments, supporting crop productivity, nutrient optimization, and sustainable land management. These solutions enable consistent soil monitoring, precision application of amendments, and data-driven decision-making aligned with Industry 4.0 principles in agriculture.

- In soil processing and storage facilities, soil amendments and conditioners aid in moisture retention, nutrient stabilization, and soil structure improvement, enhancing handling efficiency, storage durability, and downstream application reliability.

- The growing adoption of soil health products in precision farming equipment, controlled irrigation systems, and automated field monitoring platforms supports large-scale agricultural efficiency by improving nutrient delivery, reducing wastage, and promoting long-term soil sustainability across farming operations.

For Instance,

- In January 2025, advanced soil amendment technologies were increasingly integrated into automated irrigation and field monitoring systems. These systems, combined with real-time soil nutrient sensors and digital analytics platforms, improved operational efficiency, consistency, and sustainability across agricultural operations, highlighting soil health solutions’ role in next-generation farming ecosystems.

- Recent industry developments indicate rising adoption of specialty soil conditioners, microbial inoculants, and humic-based products in high-performance farming and precision agriculture applications. Expanding mechanization, data-driven farming practices, and sustainability requirements reinforce the growing importance of soil health solutions beyond traditional agricultural applications.

Europe Soil Health Market Dynamics

Driver

“Rising Agricultural Modernization and Performance-Driven Soil Solution Requirements”

- The global agricultural sector is witnessing accelerated adoption of advanced soil health solutions driven by increasingly complex performance requirements across crop production, horticulture, landscaping, and forestry applications. Farmers and agribusinesses are prioritizing these solutions for their ability to enhance soil structure, nutrient retention, water-holding capacity, and long-term fertility. As agricultural processes evolve toward higher efficiency, yield consistency, and sustainability, demand is growing for soil amendments that support optimized nutrient delivery, improved crop performance, and environmentally responsible practices.

- The expanding role of soil health products within agricultural modernization initiatives has created a dynamic environment for innovation, leading to advancements in product formulation, application versatility, and compatibility with precision farming equipment. In response to this demand-driven shift, manufacturers are investing in the development of customized soil solutions tailored for specific crop types, soil conditions, and climate zones, including humic-based amendments, bio-stimulants, and performance-enhancing fertilizers.

- These innovations are largely driven by the operational needs of modern agriculture, which requires adaptable soil solutions capable of performing reliably under diverse field conditions and regulatory requirements. As farms and agribusinesses continue to integrate advanced soil health products into irrigation, fertilization, and land management workflows, this momentum not only influences supplier investment strategies but also reinforces soil health solutions’ role as a critical enabler of sustainable, high-yield, and quality-focused agricultural production.

For Instance,

- In September 2023, agricultural reports highlighted increased adoption of humic and microbial soil amendments in advanced horticultural and field crop operations aimed at improving soil structure, nutrient availability, and water retention while meeting stricter environmental standards.

- As of February 2024, regional insights indicated that farms across Europe intensified the use of bio-stimulants and nutrient-rich soil conditioners to support sustainable production practices and reduce dependency on conventional chemical fertilizers with higher environmental impact.

- The growing adoption of advanced soil health solutions across the global agricultural sector underscores their increasing importance as multifunctional products aligned with evolving performance, efficiency, and sustainability requirements. As agriculture continues to advance toward higher-quality outputs, controlled nutrient delivery, and optimized soil management, these solutions’ functional capabilities position them as critical enablers of improved crop yields, soil fertility, and long-term land productivity.

Restraint/Challenge

“Lack of Harmonized Global Regulatory Frameworks for Soil Health Solutions”

- The absence of harmonized global regulations governing soil amendment manufacturing, application, and handling presents a notable challenge for the Europe Soil Health Market, as regulatory requirements differ significantly across countries and regions.

- Regulatory authorities apply varying standards related to product composition, permissible active ingredient limits, environmental compliance, labeling, transportation, and waste management. This regulatory fragmentation compels soil health solution manufacturers and downstream agricultural users to modify formulations, documentation, safety protocols, and compliance strategies for each market, increasing operational complexity, compliance costs, and time to adoption.

- As a result, companies face constraints in scaling soil health product manufacturing and distribution globally, particularly for cross-border trade and multinational supply chains serving agriculture, horticulture, landscaping, and forestry applications.

For instance,

- In late 2025, regional environmental authorities in Asia and Europe introduced differing compliance requirements for soil conditioners, humic-based amendments, and microbial inoculants, with variations in allowable active components and reporting obligations, illustrating regulatory inconsistencies that complicate standardized production and export strategies.

- In May 2025, national and local regulatory bodies in emerging markets enforced stricter handling, storage, and transportation restrictions beyond existing central guidelines, creating temporary operational disruptions for soil health solution manufacturers and distributors, who were required to obtain additional approvals and modify logistics workflows during the enforcement period.

- The lack of harmonized global regulatory frameworks continues to pose a structural challenge for the Europe Soil Health Market, limiting the ease of standardized production, distribution, and cross-border trade, and increasing the need for region-specific compliance strategies.

Europe Soil Health Market Scope

The Europe Soil Health Market is segmented into six segments based on type, soil type, technology, application, end-user, and distribution channel.

By Type

On the basis of type, the market is segmented into soil enhancement products and testing & monitoring products.

In 2026, the Soil Enhancement Products segment is expected to dominate the Europe Soil Health Market, accounting for the highest share of 89.05%, reflecting its deep integration across a wide range of agricultural and horticultural applications. This dominance is primarily driven by the extensive use of industrial-grade soil amendments, humic-based products, and bio-stimulants in crop production, precision farming, landscaping, and land rehabilitation, where large-scale, continuous application is essential to maintain soil fertility, nutrient balance, and crop performance. Their ability to deliver reliable nutrient retention, water-holding capacity, and soil conditioning properties at field scale makes them a preferred choice for farmers and agribusinesses managing high-throughput agricultural operations.

Furthermore, the strong market position of the Testing & Monitoring Products segment is reinforced by its cost efficiency and availability in bulk volumes, which aligns well with the procurement strategies of large agricultural users seeking to optimize operational costs without compromising soil productivity and crop outcomes. As agricultural and horticultural sectors continue to expand rapidly across both developed and emerging economies, demand for standardized, high-volume soil health solutions is expected to remain robust. This sustained demand, combined with the versatility and compatibility of soil enhancement products with diverse soil types, crop cycles, and climate conditions, positions the industrial-grade segment as the primary revenue contributor to the Europe Soil Health Market in 2026.

By Soil Type

On the basis of Soil type, the market is segmented into Alluvial Soils, Red Soils, Loams, Black Soils, Arid Soils, Sandy Soils, Silt Soils, Clay Soils, Yellow Soils, Laterite Soils, Saline/Alkaline Soils, Peat Soils, Chalky Soils, and Others.

In 2026, the Alluvial Soils segment is expected to dominate the Europe Soil Health Market, accounting for the highest share of 16.17%, driven by its superior performance characteristics and enhanced functional reliability across advanced agricultural and land management applications. Soil health solutions tailored for alluvial soils offer improved nutrient retention, water-holding capacity, and soil structure stabilization, making them particularly suitable for applications where precise soil conditioning and consistent crop outcomes are critical. These properties significantly enhance adoption in precision agriculture, high-value horticulture, specialty crop production, and land rehabilitation projects, where optimized soil performance directly translates into improved crop yields, sustainability, and resource efficiency.

In addition, the strong market position of the Alluvial Soils segment is reinforced by its consistent quality and alignment with stringent regulatory and agronomic standards. Farmers and agribusinesses increasingly prefer tailored soil solutions for alluvial soils to meet evolving requirements related to soil safety, environmental stewardship, and process transparency. As agricultural practices continue to shift toward performance-driven, high-value cultivation, demand for high-quality soil health solutions for alluvial soils is expected to remain robust, solidifying this segment’s dominance within the Europe Soil Health Market in 2026.

By Technology

On the basis of Technology, the market is segmented into Conventional Soil Management, Integrated Soil Fertility Management (ISFM), Precision Soil Health Management, Regenerative Agriculture Practices, and Others.

In 2026, the Conventional Soil Management segment is expected to dominate the Europe Soil Health Market, accounting for the highest share of 31.36%, driven by its superior operational efficiency and strong alignment with modern agricultural and land management requirements. This management approach enables better nutrient delivery, consistent soil conditioning, and predictable crop outcomes, making it particularly well-suited for applications that demand reliable and standardized soil enhancement solutions. Compared to traditional or ad-hoc soil practices, structured conventional management techniques provide a controlled framework for soil treatment, supporting stable, large-scale cultivation with reduced variability and optimized field performance.

In addition, the strong market position of the Regenerative Agriculture Practices segment is reinforced by its enhanced operational safety, cost efficiency, and adherence to environmental and sustainability standards, which have become increasingly critical for soil solution providers. This approach reduces reliance on hazardous chemical inputs, supports lower environmental impact, and enables compliance with stringent regional regulations. As global demand for soil health solutions continues to grow across crop production, horticulture, landscaping, and precision agriculture applications, farmers and agribusinesses are increasingly adopting this scalable and sustainable method, solidifying its leading position in the market in 2026.

By Application

On the basis of Application, the market is segmented into Crop Soil and Non-Crop Soil. The Crop Soil is further sub-segmented by application into Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Commercial Crops, Plantation Crops, and Others.

In 2026, the Crop Soil segment is expected to dominate the market, accounting for the highest share of 70.21%, driven by its versatility and practical advantages across a wide range of agricultural and land management applications. Crop soil solutions are widely preferred due to their ease of handling, safe storage characteristics, and suitability for precise application, making them particularly well aligned with the requirements of crop production, horticulture, and high-value specialty crops, where controlled usage and contamination prevention are critical.

In addition, the strong market position of the Crop Soil segment is reinforced by its widespread availability and cost-efficient production, which enable seamless distribution and procurement across both developed and emerging markets. Farmers and agribusinesses increasingly rely on standardized soil product formats that simplify storage, transportation, and regulatory compliance while ensuring product quality and performance. As the agricultural sector continues to demand convenient, reliable, and high-performing soil health solutions, the Crop Soil segment is expected to maintain its leading market position within the Europe Soil Health Market in 2026.

By End-User

On the basis of End-User, the market is segmented into Farmers & Growers, Agribusiness Companies, Landscaping & Forestry Companies, Government & Regulatory Bodies, Research Institutes, Universities, and Others.

In 2026, the Farmers & Growers segment is expected to dominate the market, accounting for the highest share of 53.44%, driven by its widespread application in improving soil fertility, crop productivity, and field performance. Advanced soil health solutions play a critical role in enhancing nutrient retention, water-holding capacity, and soil structure stability, making them essential across multiple agricultural and horticultural value chains.

In addition, the fastest-growing Agribusiness Companies segment is reinforced by the strong demand for specialty soil amendments, bio-stimulants, and humic-based products, particularly in precision agriculture, high-value crop production, and large-scale farming operations. These soil health solutions enhance soil performance while enabling efficient, cost-effective, and sustainable cultivation practices. As the agricultural sector continues to focus on yield optimization, soil sustainability, and operational reliability, this segment is expected to remain a key growth driver within the Europe Soil Health Market in 2026.

By Distribution Channel

On the basis of Distribution Channel, the market is segmented into Direct Sales and Aftermarket.

In 2026, the Direct Sales segment is expected to dominate the market, accounting for the highest share of 69.62%, supported by its broad utilization across crop production, horticulture, and soil conditioning applications. Soil health solutions in this segment play a critical role in enhancing soil fertility, nutrient retention, and crop resilience, making them a preferred choice in large-scale farming operations and high-throughput agricultural environments.

In addition, the fastest-growing Aftermarket segment is reinforced by the superior efficiency, stability, and compatibility of advanced soil amendments with existing farming practices and equipment, ensuring consistent performance under varied climatic and soil conditions. As demand continues to rise for reliable, high-performing, and sustainable soil health solutions across multiple agricultural sectors, this segment is expected to sustain robust adoption, maintaining its leading market share in 2026

Europe Soil Health Market Insight

Germany held the largest market share in 2025, capturing 18.06% due to its stringent environmental regulations under the EU Green Deal and Common Agricultural Policy, which prioritize sustainable farming and reduced chemical use.

Germany Europe Soil Health Market Insight

The Germany Europe Soil Health Market is witnessing steady growth, driven by strong agricultural infrastructure, technological innovation in soil management, and high adoption of performance-oriented soil solutions in crop production and specialty agriculture. Supportive environmental regulations and investment in sustainable farming practices position Germany as a key Europe Soil Health Market in Europe.

France Europe Soil Health Market Insight

The France Europe Soil Health Market is expanding, fueled by rising demand for soil conditioners, bio-stimulants, and humic-based products in agriculture, horticulture, and specialty crops. Government initiatives promoting sustainable farming, soil fertility improvement, and low-emission soil management solutions are supporting overall market development.

Europe Soil Health Market Share

The Soil Health is primarily led by well-established companies, including:

- BASF (Germany)

- Bayer AG (Germany)

- Corteva (U.S.)

- Mosaic India (India)

- UPL (India)

- FMC Corporation (U.S.)

- Syngenta Crop Protection AG (Switzerland)

- EarthOptics (U.S.)

- Miraterra Technologies Corporation (U.S.)

- Soil Scout Oy (Finland)

- Stevens Water Monitoring Systems Inc. (U.S.)

- METER (U.S.)

- Campbell Scientific, Inc. (U.S.)

- Sentek Technologies (Australia)

- Tecsoil, Inc. (U.S., estimate; verify)

- Nutrien Ag Solutions, Inc. (Canada)

- ICL (Israel)

- CropX Inc. (Israel)

- AgroCares (Netherlands)

- Soilwiz Ltd (UK/Europe)

- Growindigo / Indigo Ag (U.S.)

- Langley Fertilizers (U.K.)

- Humintech (Germany)

- Coromandel International Ltd. (India)

- Evonik (Germany)

- ADM (Archer Daniels Midland Company) (U.S.)

- HUMA GRO (U.S.)

- The Scotts Company LLC (U.S.)

Latest Developments in Europe Soil Health Market

- In October 2025, Multichem Specialities Private Limited was recognized among the Top 10 Specialty Chemical Distributors 2025 by Industry Outlook Magazine, highlighting its commitment to quality, innovation, and reliable service in the specialty chemicals sector. In July 2025, the company also organized a blood donation drive in collaboration with Breach Candy Hospital Trust, engaging employees and the community to support healthcare initiatives.

- In February 2024, Multichem Specialities Private Limited participated in Vitafoods India, strengthening its presence in the nutraceuticals and specialty ingredients segment while engaging with customers and partners to showcase its expanding portfolio of chemical solutions.

- In October 2024, Otto Chemie Pvt. Ltd. expanded its portfolio of high-purity laboratory chemicals and reagents, enhancing its presence in pharmaceutical, research, and industrial sectors. The company also strengthened its distribution network and supply chain capabilities to meet growing demand across India and international markets.

- In July 2024, Otto Chemie Pvt. Ltd. organized a blood donation and health awareness drive in collaboration with local hospitals, reflecting the company’s commitment to community welfare and corporate social responsibility initiatives.

- In March 2025, Oxford Lab Fine Chem LLP implemented eco-friendly packaging solutions and optimized waste management practices in its production and distribution processes, reinforcing the company’s commitment to sustainable and responsible chemical manufacturing.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS – MODERATE

4.1.1.1 Capital Requirement – Moderate

4.1.1.2 Product Knowledge – Moderate to High

4.1.1.3 Technical Knowledge – High

4.1.1.4 Customer Relationship – High

4.1.1.5 Access to Application and Technology – Moderate

4.1.2 THREAT OF SUBSTITUTES – MODERATE

4.1.2.1 Cost – High

4.1.2.2 Performance – Moderate

4.1.2.3 Availability – High

4.1.2.4 Technical Knowledge – Low to Moderate

4.1.2.5 Durability – Low

4.1.3 BARGAINING POWER OF BUYERS – MODERATE TO HIGH

4.1.3.1 Number of Buyers Relative to Suppliers – High

4.1.3.2 Product Differentiation – Moderate

4.1.3.3 Threat of Forward Integration – Low

4.1.3.4 Buyer Volume – High

4.1.4 BARGAINING POWER OF SUPPLIERS – MODERATE

4.1.4.1 Supplier Concentration – Moderate to High

4.1.4.2 Buyer Switching Cost to Other Suppliers – Moderate

4.1.4.3 Threat of Backward Integration – Low to Moderate

4.1.5 COMPETITIVE RIVALRY WITHIN THE INDUSTRY – HIGH

4.1.5.1 Industry Concentration – Moderate

4.1.5.2 Industry Growth Rate – High

4.1.5.3 Product Differentiation – Moderate

4.1.6 STRATEGIC SUMMARY

4.2 BRAND OUTLOOK

4.3 CONSUMER BUYING BEHAVIOUR

4.3.1 GROUP 1: LARGE COMMERCIAL & CORPORATE FARMING OPERATIONS

4.3.2 GROUP 2: PROGRESSIVE MEDIUM-TO-LARGE FARMERS AND AGRIBUSINESS CLIENTS

4.3.3 GROUP 3: COST-CONSCIOUS COMMERCIAL FARMERS

4.3.4 GROUP 4: SMALLHOLDER AND TRADITIONAL FARMERS

4.3.5 GROUP 5: INPUT-DEPENDENT AND SUBSIDY-ORIENTED BUYERS

4.3.6 GROUP 6: SPECIALIZED, HIGH-VALUE CROP GROWERS AND INNOVATORS

4.3.7 STRATEGIC INSIGHT

4.4 COMPANY PRODUCTION CAPACITY ANALYSIS

4.5 PRICING ANALYSIS

4.5.1 PRICES OF NITROGEN-FIXING BACTERIA

4.5.2 PHOSPHATE-SOLUBILIZING MICROORGANISMS

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 OVERVIEW

4.6.2 LOGISTIC COST SCENARIO

4.6.2.1 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 VALUE CHAIN ANALYSIS – EUROPE SOIL HEALTH MARKET

4.7.1 RAW MATERIAL SOURCING & INPUT GENERATION

4.7.2 PROCESSING & FORMULATION

4.7.3 QUALITY CONTROL, CERTIFICATION & REGULATORY COMPLIANCE

4.7.4 DISTRIBUTION & SUPPLY CHAIN LOGISTICS

4.7.5 APPLICATION, TESTING & MONITORING (END USE)

4.7.6 FEEDBACK LOOP & VALUE REINFORCEMENT

4.7.7 VALUE CHAIN INSIGHT

4.8 SUPPLY CHAIN ANALYSIS – EUROPE SOIL HEALTH MARKET

4.8.1 CORE SUPPLY-CHAIN STAGES (FLOW + KEY ACTORS)

4.8.1.1 Raw-material sourcing

4.8.1.2 Processing & formulation

4.8.1.3 Quality control & compliance

4.8.1.4 Distribution & logistics

4.8.1.5 Retail & advisory

4.8.1.6 End use & monitoring

4.8.2 KEY CONSTRAINTS & BOTTLENECKS

4.8.2.1 Logistics & last-mile delivery

4.8.2.2 Cold-chain & shelf-life for biologicals

4.8.2.3 Raw-material seasonality & feedstock quality —

4.8.2.4 Regulatory fragmentation

4.8.2.5 Concentration & geopolitical exposure in mineral supply

4.8.3 OPERATIONAL & COMMERCIAL RISKS

4.8.4 ENABLERS

4.8.4.1 Public programmes & procurement

4.8.4.2 Digital platforms & logistics aggregation

4.8.4.3 Circular-economy feedstock integration

4.8.4.4 Harmonized standards & MRV

4.8.5 STRATEGIC OPPORTUNITIES

4.8.6 PRACTICAL RECOMMENDATIONS (FOR SUPPLIERS, INVESTORS, POLICY MAKERS)

4.9 RAW MATERIAL COVERAGE

4.9.1 ORGANIC AND BIOMASS-DERIVED RAW MATERIALS

4.9.1.1 Livestock Manure: Reactive Organic–Mineral Complexes

4.9.2 CROP RESIDUES AND GREEN BIOMASS

4.9.3 COMPOST FEEDSTOCKS AND STABILIZED ORGANIC MATTER

4.9.4 THERMOCHEMICAL CARBON MATERIALS

4.9.5 MINERAL AND GEOLOGICAL RAW MATERIALS

4.9.6 GYPSUM AND SULFUR MINERALS

4.9.7 PHOSPHATE ROCK AND SILICATE MINERALS

4.9.8 HUMIC SUBSTANCES AND CARBON EXTRACTS

4.9.8.1 Leonardite, Lignite, and Peat Resources

4.9.9 MICROBIAL AND BIOLOGICAL RAW MATERIALS

4.9.9.1 Microbial Biomass and Fermentation Inputs

4.9.10 CARRIER AND STABILIZATION MATERIALS

4.9.11 MARINE AND AQUATIC BIOMASS RESOURCES

4.9.11.1 Seaweed and Algal Feedstocks

4.9.12 RAW MATERIALS FOR SOIL TESTING AND DIGITAL MONITORING

4.9.12.1 Chemical and Biological Analytical Inputs

4.9.13 ELECTRONIC AND SENSOR MATERIALS

4.9.14 STRATEGIC IMPLICATIONS AND CONCLUSION

4.1 TECHNOLOGICAL ADVANCEMENTS

4.10.1 TECHNOLOGICAL ADVANCEMENTS IN RAW MATERIAL SOURCING AND CHARACTERIZATION

4.10.2 MANUFACTURING-CENTRIC TECHNOLOGICAL ADVANCEMENTS

4.10.3 MATERIAL ENGINEERING IN ORGANIC–MINERAL AND CARBON-BASED INPUTS

4.10.4 EXTRACTION AND REFINEMENT OF HUMIC SUBSTANCES

4.10.5 QUALITY CONTROL, AUTOMATION, AND DIGITAL MANUFACTURING INTEGRATION

4.10.6 PACKAGING, STABILITY, AND LOGISTICS TECHNOLOGIES

4.10.7 SMART LOGISTICS AND TRACEABILITY SYSTEMS

4.10.8 CUSTOMER DELIVERY, PRECISION APPLICATION, AND FEEDBACK LOOPS

4.10.9 DATA-ENABLED ADVISORY AND CONTINUOUS IMPROVEMENT

4.10.10 STRATEGIC IMPLICATIONS AND CONCLUSION

4.11 VENDOR SELECTION CRITERIA

4.11.1 RAW MATERIAL GOVERNANCE AS THE FIRST FILTER OF VENDOR CREDIBILITY

4.11.2 MANUFACTURING DEPTH AND PROCESS ENGINEERING CAPABILITY

4.11.3 SCIENTIFIC VALIDATION AS A MEASURE OF TECHNICAL INTEGRITY

4.11.4 REGULATORY READINESS AND STEWARDSHIP DISCIPLINE

4.11.5 SUPPLY CHAIN RESILIENCE AND SCALABILITY

4.11.6 DIGITAL CAPABILITY, DATA INTEGRITY, AND VALUE EXPANSION

4.11.7 FINANCIAL STRENGTH, UNIT ECONOMICS, AND CAPITAL EFFICIENCY

4.11.8 STRATEGIC ALIGNMENT AND LONG-TERM PARTNERSHIP VALUE

4.11.9 CONCLUSION: VENDOR SELECTION AS A LONG-TERM VALUE SAFEGUARD

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

5.1.1 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.1.2 VENDOR SELECTION CRITERIA DYNAMICS

5.1.3 IMPACT ON SUPPLY CHAIN

5.1.3.1 RAW MATERIAL PROCUREMENT

5.1.3.2 MANUFACTURING AND PRODUCTION

5.1.3.3 LOGISTICS AND DISTRIBUTION

5.1.3.4 PRICE PITCHING AND MARKET POSITIONING

5.1.4 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.1.4.1 SUPPLY CHAIN OPTIMIZATION

5.1.4.2 JOINT VENTURE ESTABLISHMENTS

5.1.5 MPACT ON PRICES

5.1.6 REGULATORY INCLINATION

5.1.7 GEOPOLITICAL SITUATION

5.1.8 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.1.8.1 FREE TRADE AGREEMENTS

5.1.9 ALLIANCES ESTABLISHMENTS

5.1.9.1 STATUS ACCREDITATION (INCLUDING MFTN)

5.1.9.2 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.1.9.3 SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 REGULATORY FRAMEWORK COVERAGE – MACRO & MICRO ANALYSIS

6.1.1 PRODUCT CODES – CLASSIFICATION LOGIC & COMPLIANCE CONSEQUENCES

6.1.2 CERTIFIED STANDARDS – MARKET ACCESS & QUALITY CONTROL

6.1.3 SAFETY STANDARDS – OPERATIONAL RISK MANAGEMENT

6.1.3.1 MATERIAL HANDLING & STORAGE – DETAILED ANALYSIS

6.1.3.2 TRANSPORT & PRECAUTIONS – REGULATORY DEPTH

6.1.3.3 HAZARD IDENTIFICATION – RISK DISCLOSURE & LIABILITY

6.1.4 REGULATORY ENFORCEMENT & MONITORING

6.1.5 REGULATORY IMPACT ON COST STRUCTURE

6.1.6 REGULATORY TRENDS & FUTURE OUTLOOK

6.1.7 STRATEGIC IMPLICATIONS FOR MARKET PARTICIPANTS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING ADOPTION OF REGENERATIVE AGRICULTURE AND SUSTAINABLE FARMING PRACTICES

7.1.2 INCREASING DEPLOYMENT OF PRECISION SOIL MONITORING AND DIGITAL AGRICULTURE TECHNOLOGIES

7.1.3 GOVERNMENT POLICIES AND CONSUMER DEMAND SUPPORTING SUSTAINABLE FOOD SYSTEMS

7.2 RESTRAINTS

7.2.1 HIGH COST AND LIMITED ACCESS TO COMPREHENSIVE SOIL TESTING AND MONITORING INFRASTRUCTURE

7.2.2 LIMITED FARMER AWARENESS AND TECHNICAL CAPACITY TO INTERPRET SOIL HEALTH DATA

7.3 OPPORTUNITIES

7.3.1 EMERGENCE OF SOIL CARBON AND CLIMATE FINANCE PROGRAMS CREATING NEW REVENUE STREAMS

7.3.2 GROWING NEED FOR MONITORING, REPORTING, AND VERIFICATION (MRV) SYSTEMS FOR SOIL HEALTH

7.3.3 EXPANSION OF BIO-BASED AND NATURE-BASED SOIL AMENDMENTS

7.4 CHALLENGES

7.4.1 LACK OF STANDARDIZATION AND REGULATORY CONSENSUS IN SOIL HEALTH AND SOIL CARBON MEASUREMENT

7.4.2 SCIENTIFIC VARIABILITY AND INCONSISTENT FIELD PERFORMANCE OF BIOLOGICAL SOIL SOLUTIONS

8 EUROPE SOIL HEALTH MARKET, BY TYPE

8.1 OVERVIEW

8.2 SOIL ENHANCEMENT PRODUCTS

8.3 TESTING & MONITORING PRODUCTS

8.4 EUROPE SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.4.1 SOIL AMENDMENTS

8.4.2 SOIL FERTILITY ENHANCERS

8.4.3 BIOLOGICALS / MICROBIAL SOLUTIONS

8.4.4 SOIL CONDITIONERS

8.4.5 PEAT

8.4.6 OTHERS

8.5 EUROPE SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

8.6 EUROPE SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 ORGANIC AMENDMENTS

8.6.2 INORGANIC AMENDMENTS

8.7 EUROPE ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.7.1 MANURE

8.7.2 COMPOST

8.7.3 GREEN MANURE

8.7.4 BIOCHAR

8.7.5 OTHERS

8.8 EUROPE INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.8.1 LIME

8.8.2 GYPSUM

8.8.3 MINERAL ADDITIVES

8.8.4 OTHERS

8.9 EUROPE SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.9.1 BIOFERTILIZERS

8.9.2 ORGANIC-MINERAL FERTILIZERS

8.1 EUROPE BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.10.1 NITROGEN-FIXING BACTERIA

8.10.2 PHOSPHATE-SOLUBILIZING MICROORGANISMS

8.10.3 POTASH-MOBILIZING MICROORGANISMS

8.11 EUROPE ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.11.1 NPK-ENRICHED ORGANIC FERTILIZERS

8.11.2 COMPOST-BASED MINERAL FORTIFIED PRODUCTS

8.11.3 HUMIC ACID AND NPK BLENDS

8.12 EUROPE NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.12.1 COMPOST + NPK BLENDS

8.12.2 BIO-ORGANIC NPK GRANULES / PELLETS

8.12.3 LIQUID ORGANIC + NPK FORMULATIONS

8.12.4 SLOW-RELEASE / CONTROLLED RELEASE ORGANIC-MINERAL NPKS

8.12.5 SPECIALTY / CROP-SPECIFIC ENRICHED ORGANIC NPKS

8.13 EUROPE COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.13.1 BIO-COMPOST + MINERAL BLENDS

8.13.2 GRANULATED COMPOST-BASED FERTILIZERS

8.13.3 VERMICOMPOST FORTIFIED WITH MINERALS

8.13.4 CO-COMPOSTED MINERAL + WASTE BLENDS

8.13.5 LIQUID COMPOST EXTRACTS FORTIFIED WITH NUTRIENTS

8.14 EUROPE HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.14.1 HUMIC + NPK SOLID BLENDS

8.14.2 LIQUID HUMIC + NPK FORMULATIONS

8.14.3 POTASSIUM HUMATE ENRICHED BLENDS

8.14.4 HIGH HUMIC FRACTION BLENDS

8.14.5 HUMIC + FULVIC + MINERAL BLENDS

8.15 EUROPE BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.15.1 TRICHODERMA

8.15.2 BACILLUS SPECIES

8.15.3 MYCORRHIZAL FUNGI

8.15.4 RHIZOBIA

8.15.5 OTHERS

8.16 EUROPE SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.16.1 HUMIC ACID

8.16.2 SEAWEED EXTRACTS

8.16.3 FULVIC ACID

8.16.4 POTASSIUM HUMATE ENRICHED BLENDS

8.16.5 HUMIC + FULVIC + MINERAL BLENDS

8.16.6 HIGH HUMIC FRACTION BLENDS

8.16.7 LIQUID HUMIC + NPK FORMULATIONS

8.17 EUROPE SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.17.1 ASIA-PACIFIC

8.17.2 NORTH AMERICA

8.17.3 EUROPE

8.17.4 SOUTH AMERICA

8.17.5 MIDDLE EAST & AFRICA

8.18 EUROPE SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (TONS)

8.19 EUROPE TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.19.1 SOIL TESTING KITS

8.19.2 LABORATORY ANALYTICAL SOLUTIONS (BIOLOGICAL ANALYSIS)

8.19.3 DIGITAL AND REMOTE MONITORING

8.2 EUROPE TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.21 EUROPE SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.21.1 PH KITS

8.21.2 NUTRIENT TEST KITS

8.22 EUROPE DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.22.1 IOT SENSORS

8.22.2 REMOTE SENSING & DRONES

8.22.3 GIS & MAPPING TOOLS

8.23 EUROPE TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.23.1 ASIA-PACIFIC

8.23.2 NORTH AMERICA

8.23.3 EUROPE

8.23.4 SOUTH AMERICA

8.23.5 MIDDLE EAST & AFRICA

8.24 EUROPE TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

9 EUROPE SOIL HEALTH MARKET, BY SOIL TYPE

9.1 OVERVIEW

9.2 ALLUVIAL SOILS

9.3 RED SOILS

9.4 LOAMS

9.5 BLACK SOILS

9.6 ARID SOILS

9.7 SANDY SOILS

9.8 SILT SOILS

9.9 CLAY SOILS

9.1 YELLOW SOILS

9.11 LATERITE SOILS

9.12 SALINE/ALKALINE SOILS

9.13 PEAT SOILS

9.14 CHALKY SOILS

9.15 OTHERS

9.16 EUROPE ALLUVIAL SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.16.1 ASIA-PACIFIC

9.16.2 NORTH AMERICA

9.16.3 EUROPE

9.16.4 SOUTH AMERICA

9.16.5 MIDDLE EAST & AFRICA

9.17 EUROPE RED SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.17.1 ASIA-PACIFIC

9.17.2 NORTH AMERICA

9.17.3 EUROPE

9.17.4 SOUTH AMERICA

9.17.5 MIDDLE EAST & AFRICA

9.18 EUROPE LOAMS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.18.1 ASIA-PACIFIC

9.18.2 NORTH AMERICA

9.18.3 EUROPE

9.18.4 SOUTH AMERICA

9.18.5 MIDDLE EAST & AFRICA

9.19 EUROPE BLACK SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.19.1 ASIA-PACIFIC

9.19.2 NORTH AMERICA

9.19.3 EUROPE

9.19.4 SOUTH AMERICA

9.19.5 MIDDLE EAST & AFRICA

9.2 EUROPE ARID SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.20.1 ASIA-PACIFIC

9.20.2 NORTH AMERICA

9.20.3 EUROPE

9.20.4 SOUTH AMERICA

9.20.5 MIDDLE EAST & AFRICA

9.21 EUROPE SANDY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.21.1 ASIA-PACIFIC

9.21.2 NORTH AMERICA

9.21.3 EUROPE

9.21.4 SOUTH AMERICA

9.21.5 MIDDLE EAST & AFRICA

9.22 EUROPE SILT SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.22.1 ASIA-PACIFIC

9.22.2 NORTH AMERICA

9.22.3 EUROPE

9.22.4 SOUTH AMERICA

9.22.5 MIDDLE EAST & AFRICA

9.23 EUROPE CLAY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.23.1 ASIA-PACIFIC

9.23.2 NORTH AMERICA

9.23.3 EUROPE

9.23.4 SOUTH AMERICA

9.23.5 MIDDLE EAST & AFRICA

9.24 EUROPE YELLOW SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.24.1 ASIA-PACIFIC

9.24.2 NORTH AMERICA

9.24.3 EUROPE

9.24.4 SOUTH AMERICA

9.24.5 MIDDLE EAST & AFRICA

9.25 EUROPE LATERITE SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.25.1 ASIA-PACIFIC

9.25.2 NORTH AMERICA

9.25.3 EUROPE

9.25.4 SOUTH AMERICA

9.25.5 MIDDLE EAST & AFRICA

9.26 EUROPE SALINE/ALKALINE SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.26.1 ASIA-PACIFIC

9.26.2 NORTH AMERICA

9.26.3 EUROPE

9.26.4 SOUTH AMERICA

9.26.5 MIDDLE EAST & AFRICA

9.27 EUROPE PEAT SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.27.1 ASIA-PACIFIC

9.27.2 NORTH AMERICA

9.27.3 EUROPE

9.27.4 SOUTH AMERICA

9.27.5 MIDDLE EAST & AFRICA

9.28 EUROPE CHALKY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.28.1 ASIA-PACIFIC

9.28.2 NORTH AMERICA

9.28.3 EUROPE

9.28.4 SOUTH AMERICA

9.28.5 MIDDLE EAST & AFRICA

9.29 EUROPE OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.29.1 ASIA-PACIFIC

9.29.2 NORTH AMERICA

9.29.3 EUROPE

9.29.4 SOUTH AMERICA

9.29.5 MIDDLE EAST & AFRICA

10 EUROPE SOIL HEALTH MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 CONVENTIONAL SOIL MANAGEMENT

10.3 INTEGRATED SOIL FERTILITY MANAGEMENT (ISFM)

10.4 PRECISION SOIL HEALTH MANAGEMENT

10.5 REGENERATIVE AGRICULTURE PRACTICES

10.6 OTHERS

10.7 EUROPE CONVENTIONAL SOIL MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.7.1 ASIA-PACIFIC

10.7.2 NORTH AMERICA

10.7.3 EUROPE

10.7.4 SOUTH AMERICA

10.7.5 MIDDLE EAST & AFRICA

10.8 EUROPE INTEGRATED SOIL FERTILITY MANAGEMENT (ISFM) IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.8.1 ASIA-PACIFIC

10.8.2 NORTH AMERICA

10.8.3 EUROPE

10.8.4 SOUTH AMERICA

10.8.5 MIDDLE EAST & AFRICA

10.9 EUROPE PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

10.9.1 REMOTE SENSING & DRONES

10.9.2 VARIABLE RATE TECHNOLOGY (VRT)

10.9.3 GPS & GIS MAPPING

10.1 EUROPE PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.10.1 ASIA-PACIFIC

10.10.2 NORTH AMERICA

10.10.3 EUROPE

10.10.4 SOUTH AMERICA

10.10.5 MIDDLE EAST & AFRICA

10.11 EUROPE REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

10.11.1 GPS & GIS MAPPING

10.11.2 VARIABLE RATE TECHNOLOGY (VRT)

10.11.3 REMOTE SENSING & DRONES

10.12 EUROPE PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA-PACIFIC

10.12.2 NORTH AMERICA

10.12.3 EUROPE

10.12.4 SOUTH AMERICA

10.12.5 MIDDLE EAST & AFRICA

10.13 EUROPE OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.13.1 ASIA-PACIFIC

10.13.2 NORTH AMERICA

10.13.3 EUROPE

10.13.4 SOUTH AMERICA

10.13.5 MIDDLE EAST & AFRICA

11 EUROPE SOIL HEALTH MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CROP SOIL

11.3 NON-CROP SOIL

11.4 EUROPE CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11.4.1 CEREALS & GRAINS

11.4.2 OILSEEDS & PULSES

11.4.3 FRUITS & VEGETABLES

11.4.4 COMMERCIAL CROPS

11.4.5 PLANTATION CROPS

11.4.6 OTHERS

11.5 EUROPE CEREALS & GRAINS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.5.1 CORN

11.5.2 WHEAT

11.5.3 RICE

11.5.4 BARLEY

11.5.5 OATS

11.5.6 OTHERS

11.6 EUROPE OILSEEDS & PULSES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.6.1 SOYBEAN

11.6.2 RAPESEED/CANOLA

11.6.3 SUNFLOWER

11.6.4 CHICKPEAS

11.6.5 GROUNDNUT

11.6.6 LENTILS

11.6.7 OTHERS

11.7 EUROPE FRUITS & VEGETABLES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.7.1 FRUIT CROPS

11.7.2 ROOT CROPS

11.7.3 LEAFY GREENS

11.7.4 NIGHTSHADES

11.7.5 CUCURBITS

11.7.6 OTHERS

11.8 EUROPE COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.8.1 SUGARCANE

11.8.2 COTTON

11.8.3 COFFEE

11.8.4 COCOA

11.8.5 TEA

11.8.6 TOBACCO

11.8.7 OTHERS

11.9 EUROPE PLANTATION CROPS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.9.1 PALM OIL

11.9.2 RUBBER

11.9.3 COCONUT

11.9.4 OTHERS

11.1 EUROPE CROP SOIL IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.10.1 ASIA-PACIFIC

11.10.2 NORTH AMERICA

11.10.3 EUROPE

11.10.4 SOUTH AMERICA

11.10.5 MIDDLE EAST & AFRICA

11.11 EUROPE NON-CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.11.1 TURF & LANDSCAPING

11.11.2 FORESTRY

11.11.3 SOIL RECLAMATION & RESTORATION

11.11.4 OTHERS

11.12 EUROPE NON-CROP SOIL IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.12.1 ASIA-PACIFIC

11.12.2 NORTH AMERICA

11.12.3 EUROPE

11.12.4 SOUTH AMERICA

11.12.5 MIDDLE EAST & AFRICA

12 EUROPE SOIL HEALTH MARKET, BY END-USER

12.1 OVERVIEW

12.2 FARMERS & GROWERS

12.3 AGRIBUSINESS COMPANIES

12.4 LANDSCAPING & FORESTRY COMPANIES

12.5 GOVERNMENT & REGULATORY BODIES

12.6 RESEARCH INSTITUTES

12.7 UNIVERSITIES

12.8 OTHERS

12.9 EUROPE FARMERS & GROWERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.9.1 SOIL AMENDMENTS

12.9.2 SOIL FERTILITY ENHANCERS

12.9.3 SOIL CONDITIONERS

12.9.4 BIOLOGICALS / MICROBIAL SOLUTIONS

12.9.5 TESTING & MONITORING PRODUCTS

12.9.6 PEAT

12.9.7 OTHERS

12.1 EUROPE FARMERS & GROWERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.10.1 ASIA-PACIFIC

12.10.2 NORTH AMERICA

12.10.3 EUROPE

12.10.4 SOUTH AMERICA

12.10.5 MIDDLE EAST & AFRICA

12.11 EUROPE AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.11.1 SOIL AMENDMENTS

12.11.2 SOIL FERTILITY ENHANCERS

12.11.3 BIOLOGICALS / MICROBIAL SOLUTIONS

12.11.4 SOIL CONDITIONERS

12.11.5 TESTING & MONITORING PRODUCTS

12.11.6 PEAT

12.11.7 OTHERS

12.12 EUROPE AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.12.1 ASIA-PACIFIC

12.12.2 NORTH AMERICA

12.12.3 EUROPE

12.12.4 SOUTH AMERICA

12.12.5 MIDDLE EAST & AFRICA

12.13 EUROPE LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.13.1 SOIL AMENDMENTS

12.13.2 SOIL CONDITIONERS

12.13.3 PEAT

12.13.4 BIOLOGICALS / MICROBIAL SOLUTIONS

12.13.5 SOIL FERTILITY ENHANCERS

12.13.6 TESTING & MONITORING PRODUCTS

12.13.7 OTHERS

12.14 EUROPE LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.14.1 ASIA-PACIFIC

12.14.2 NORTH AMERICA

12.14.3 EUROPE

12.14.4 SOUTH AMERICA

12.14.5 MIDDLE EAST & AFRICA

12.15 EUROPE GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.15.1 SOIL AMENDMENTS

12.15.2 TESTING & MONITORING PRODUCTS

12.15.3 SOIL CONDITIONERS

12.15.4 BIOLOGICALS / MICROBIAL SOLUTIONS

12.15.5 SOIL FERTILITY ENHANCERS

12.15.6 PEAT

12.15.7 OTHERS

12.16 EUROPE GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.16.1 ASIA-PACIFIC

12.16.2 NORTH AMERICA

12.16.3 EUROPE

12.16.4 SOUTH AMERICA

12.16.5 MIDDLE EAST & AFRICA

12.17 EUROPE RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.17.1 TESTING & MONITORING PRODUCTS

12.17.2 BIOLOGICALS / MICROBIAL SOLUTIONS

12.17.3 SOIL AMENDMENTS

12.17.4 SOIL FERTILITY ENHANCERS

12.17.5 SOIL CONDITIONERS

12.17.6 PEAT

12.17.7 OTHERS

12.18 EUROPE RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.18.1 ASIA-PACIFIC

12.18.2 NORTH AMERICA

12.18.3 EUROPE

12.18.4 SOUTH AMERICA

12.18.5 MIDDLE EAST & AFRICA

12.19 EUROPE UNIVERSITIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.19.1 TESTING & MONITORING PRODUCTS

12.19.2 SOIL AMENDMENTS

12.19.3 BIOLOGICALS / MICROBIAL SOLUTIONS

12.19.4 SOIL FERTILITY ENHANCERS

12.19.5 SOIL CONDITIONERS

12.19.6 PEAT

12.19.7 OTHERS

12.2 EUROPE UNIVERSITIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.20.1 ASIA-PACIFIC

12.20.2 NORTH AMERICA

12.20.3 EUROPE

12.20.4 SOUTH AMERICA

12.20.5 MIDDLE EAST & AFRICA

12.21 EUROPE OTHERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.21.1 TESTING & MONITORING PRODUCTS

12.21.2 BIOLOGICALS / MICROBIAL SOLUTIONS

12.21.3 SOIL AMENDMENTS

12.21.4 SOIL CONDITIONERS

12.21.5 SOIL FERTILITY ENHANCERS

12.21.6 PEAT

12.21.7 OTHERS

12.22 EUROPE OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.22.1 ASIA-PACIFIC

12.22.2 NORTH AMERICA

12.22.3 EUROPE

12.22.4 SOUTH AMERICA

12.22.5 MIDDLE EAST & AFRICA

13 EUROPE SOIL HEALTH MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT SALES

13.3 AFTERMARKET

13.4 EUROPE DIRECT SALES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.4.1 ASIA-PACIFIC

13.4.2 NORTH AMERICA

13.4.3 EUROPE

13.4.4 SOUTH AMERICA

13.4.5 MIDDLE EAST & AFRICA

13.5 EUROPE AFTERMARKET IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.5.1 ASIA-PACIFIC

13.5.2 NORTH AMERICA

13.5.3 EUROPE

13.5.4 SOUTH AMERICA

13.5.5 MIDDLE EAST & AFRICA

14 EUROPE SOIL HEALTH MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 FRANCE

14.1.3 U.K.

14.1.4 ITALY

14.1.5 SPAIN

14.1.6 NETHERLANDS

14.1.7 POLAND

14.1.8 BELGIUM

15 EUROPE SOIL HEALTH MARKET: COMPANY LANDSCAPE

15.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

16 MANUFACTURER COMPANY PROFILE

16.1 BASF

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 BAYER AG

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 CORTEVA

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 SYNGENTA

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 NUTRIEN AG SOLUTIONS, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ADM

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AGROCARES

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 CAMPBELL SCIENTIFIC, INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 COROMANDEL INTERNATIONAL LTD

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 CROPX INC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 EARTHOPTICS.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 EVONIK

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 FMC CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 INDIGO AG, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVEOPMENT

16.15 HUMA GRO

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 HUMINTECH

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 ICL

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 METER GROUP.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 MIRATERRA TECHNOLOGIES CORPORATION

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 MOSAIC INDIA

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 PLANTBIOTIX

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SENTEK TECHNOLOGIES.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SOIL SCOUT.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SOILWIZ LT

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 STEVENS WATER MONITORING SYSTEMS INC.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 SUNPALM AUSTRALIA

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 TECSOIL, INC.

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 THE SCOTTS COMPANY LLC

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENT

16.29 UPL

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PRODUCT PORTFOLIO

16.29.4 RECENT DEVELOPMENT

16.3 UTKARSH AGROCHEM PVT LTD

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENT

17 DISTRIBUTOR COMPANY PROFILE

17.1 CALIFORNIA AG SOLUTIONS

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENT

17.2 ENLIGHTENED SOIL CORP

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENT

17.3 GETDISTRIBUTORS.COM

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 ORGANIC DISTRIBUTORS, INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 SEACOLE

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 BRAND OUTLOOK BY PRODUCT CATEGORY

TABLE 2 CONSUMER PREFERENCES BY DECISION PARAMETER

TABLE 3 ESTIMATED OUTPUT

TABLE 4 EFFECTIVE TARIFF BURDEN (NOT JUST NOMINAL)

TABLE 5 PRODUCT-LEVEL IMPORT DEPENDENCY

TABLE 6 WEIGHTED DECISION MATRIX (INDICATIVE)

TABLE 7 MANUFACTURING ECONOMICS

TABLE 8 PRICE SEGMENTATION

TABLE 9 COST STACK CONTRIBUTION

TABLE 10 EUROPE SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 EUROPE SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 12 EUROPE SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 13 EUROPE SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 EUROPE ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 EUROPE INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 EUROPE SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 17 EUROPE BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 EUROPE ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 EUROPE NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 EUROPE COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 EUROPE HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 EUROPE BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 EUROPE SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 EUROPE SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 25 EUROPE SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (TONS)

TABLE 26 EUROPE TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 EUROPE TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 28 EUROPE SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 EUROPE DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 EUROPE TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 EUROPE TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 32 EUROPE SOIL HEALTH MARKET, BY SOIL TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 EUROPE ALLUVIAL SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 EUROPE RED SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 EUROPE LOAMS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 EUROPE BLACK SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 EUROPE ARID SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 EUROPE SANDY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 EUROPE SILT SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 40 EUROPE CLAY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 EUROPE YELLOW SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 42 EUROPE LATERITE SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 EUROPE SALINE/ALKALINE SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 44 EUROPE PEAT SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 EUROPE CHALKY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 46 EUROPE OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 EUROPE SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 48 EUROPE CONVENTIONAL SOIL MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 EUROPE INTEGRATED SOIL FERTILITY MANAGEMENT (ISFM) IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 EUROPE PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 51 EUROPE PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 EUROPE REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 53 EUROPE PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 EUROPE OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 55 EUROPE SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 56 EUROPE CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 57 EUROPE CEREALS & GRAINS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 EUROPE OILSEEDS & PULSES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 EUROPE FRUITS & VEGETABLES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 60 EUROPE COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 EUROPE PLANTATION CROPS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 EUROPE CROP SOIL IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 63 EUROPE NON-CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 EUROPE NON-CROP SOIL IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 65 EUROPE SOIL HEALTH MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 66 EUROPE FARMERS & GROWERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 EUROPE FARMERS & GROWERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 68 EUROPE AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 EUROPE AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 70 EUROPE LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 EUROPE LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 72 EUROPE GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 EUROPE GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 74 EUROPE RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 EUROPE RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 76 EUROPE UNIVERSITIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 EUROPE UNIVERSITIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 78 EUROPE OTHERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 EUROPE OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 80 EUROPE SOIL HEALTH MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 81 EUROPE DIRECT SALES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 82 EUROPE AFTERMARKET IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 83 EUROPE SOIL HEALTH MARKET, 2018-2033

TABLE 84 EUROPE SOIL HEALTH MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 85 EUROPE SOIL HEALTH MARKET FOR SOIL ENHANCEMENT PRODUCTS, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 86 EUROPE SOIL HEALTH MARKET FOR TESTING & MONITORING PRODUCTS, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 87 EUROPE SOIL HEALTH MARKET, BY COUNTRY, 2018-2033 (TONS)

TABLE 88 EUROPE SOIL HEALTH MARKET FOR TESTING & MONITORING PRODUCTS, BY COUNTRY, 2018-2033 (THOUSAND UNITS)

TABLE 89 EUROPE

TABLE 90 EUROPE SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 EUROPE SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 EUROPE SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 93 EUROPE SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 EUROPE ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 EUROPE INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 EUROPE SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 EUROPE BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 EUROPE ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 EUROPE NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 EUROPE COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 EUROPE HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 EUROPE BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 EUROPE SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 EUROPE TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 EUROPE TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 106 EUROPE SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 EUROPE DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 EUROPE SOIL HEALTH MARKET, BY SOIL TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 EUROPE SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 110 EUROPE PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 111 EUROPE REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 112 EUROPE SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 113 EUROPE CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 114 EUROPE CEREALS & GRAINS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 EUROPE OILSEEDS & PULSES IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 116 EUROPE FRUITS & VEGETABLES IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 EUROPE COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 EUROPE PLANTATION CROPS SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 EUROPE NON-CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 EUROPE SOIL HEALTH MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 121 EUROPE FARMERS & GROWERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 EUROPE AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 EUROPE LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 EUROPE GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 EUROPE RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 EUROPE UNIVERSITIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 EUROPE OTHERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 EUROPE SOIL HEALTH MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 129 GERMANY SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 GERMANY SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 GERMANY SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 132 GERMANY SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 GERMANY ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 GERMANY INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 GERMANY SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 GERMANY BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 GERMANY ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 GERMANY NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 GERMANY COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 GERMANY HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 GERMANY BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 GERMANY SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 GERMANY TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 GERMANY TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 145 GERMANY SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 GERMANY DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 GERMANY SOIL HEALTH MARKET, BY SOIL TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 GERMANY SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 149 GERMANY PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 150 GERMANY REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 151 GERMANY SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 152 GERMANY CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 153 GERMANY CEREALS & GRAINS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 GERMANY OILSEEDS & PULSES IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 GERMANY FRUITS & VEGETABLES IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 GERMANY COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 GERMANY PLANTATION CROPS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 GERMANY NON-CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 GERMANY SOIL HEALTH MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 160 GERMANY FARMERS & GROWERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 GERMANY AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 GERMANY LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 GERMANY GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 GERMANY RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 GERMANY UNIVERSITIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 GERMANY OTHERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 GERMANY SOIL HEALTH MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 168 FRANCE SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 FRANCE SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 FRANCE SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 171 FRANCE SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 FRANCE ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 FRANCE INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 FRANCE SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 FRANCE BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 FRANCE ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 FRANCE NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 FRANCE COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 FRANCE HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 FRANCE BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 FRANCE SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 FRANCE TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 FRANCE TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 184 FRANCE SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 FRANCE DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 FRANCE SOIL HEALTH MARKET, BY SOIL TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 FRANCE SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 188 FRANCE PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 189 FRANCE REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 190 FRANCE SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 191 FRANCE CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 192 FRANCE CEREALS & GRAINS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 FRANCE OILSEEDS & PULSES IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 FRANCE FRUITS & VEGETABLES IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 195 FRANCE COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 FRANCE PLANTATION CROPS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 FRANCE NON-CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 FRANCE SOIL HEALTH MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 199 FRANCE FARMERS & GROWERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 FRANCE AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 FRANCE LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 FRANCE GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 FRANCE RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 FRANCE UNIVERSITIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 FRANCE OTHERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 FRANCE SOIL HEALTH MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 207 U.K. SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 U.K. SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 U.K. SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 210 U.K. SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 U.K. ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 U.K. INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 U.K. SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 214 U.K. BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 U.K. ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 U.K. NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 217 U.K. COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 U.K. HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 219 U.K. BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 220 U.K. SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 U.K. TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 222 U.K. TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 223 U.K. SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 224 U.K. DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 U.K. SOIL HEALTH MARKET, BY SOIL TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 U.K. SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 227 U.K. PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 228 U.K. REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 229 U.K. SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 230 U.K. CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 231 U.K. CEREALS & GRAINS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 U.K. OILSEEDS & PULSES IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 U.K. FRUITS & VEGETABLES IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 U.K. COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)