Europe Specialty Food Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

54.00 Billion

USD

83.16 Billion

2025

2033

USD

54.00 Billion

USD

83.16 Billion

2025

2033

| 2026 –2033 | |

| USD 54.00 Billion | |

| USD 83.16 Billion | |

|

|

|

|

Europe Specialty Food Ingredients Market Size

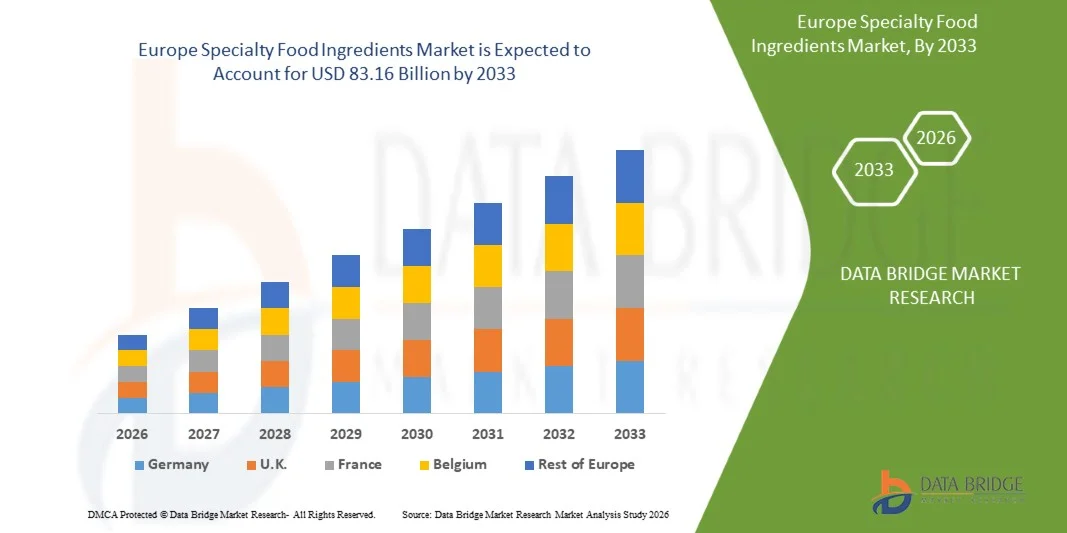

- The Europe Specialty Food Ingredients Market is expected to reach USD 83.16 Billion by 2033 from USD 54.00 Billion in 2025, growing with a substantial CAGR of 5.6% in the forecast period of 2026 to 2033

- The Europe Specialty Food Ingredients Market is experiencing steady and robust growth, driven by rising demand for processed and convenience foods, increasing consumption of functional and fortified products, and the expansion of the food & beverage manufacturing sector. Changing consumer preferences toward clean-label, natural, and health-oriented ingredients, along with growth in bakery, dairy, beverages, confectionery, and savory applications, are significantly supporting market expansion. Additionally, increasing urbanization, higher disposable incomes, and evolving dietary habits are accelerating demand for specialty food ingredients across the region.

- Market growth is further supported by stringent food safety and quality regulations, growing emphasis on product consistency and shelf-life extension, and rising adoption of specialty ingredients that enhance taste, texture, stability, and nutritional value. Advancements in ingredient formulation, increased use of plant-based and sustainable ingredients, and continuous investments in R&D and food processing technologies are improving product innovation and operational efficiency, thereby sustaining long-term growth of the Europe Specialty Food Ingredients Market.

Europe Specialty Food Ingredients Market Analysis

- Specialty food ingredients are becoming increasingly critical across the Europe food and beverage ecosystem, enabling manufacturers to enhance taste, texture, shelf life, stability, and nutritional value of food products. These ingredients play a vital role in improving product consistency and performance across key end-use sectors such as bakery, dairy, beverages, confectionery, processed foods, meat & protein products, and functional nutrition.

- Expanding food processing capacity, growing consumption of convenience and ready-to-eat foods, and increasing product innovation across the food & beverage industry are fueling strong demand for specialty food ingredients in Europe. Manufacturers are increasingly incorporating advanced ingredient solutions to improve sensory attributes, extend shelf life, and meet rising quality and safety expectations.

- Germany is currently the fastest-growing country in the Europe Specialty Food Ingredients Market, driven by expanding food processing industries, rising consumer awareness about health and nutrition, and increasing demand for functional and fortified food products. Strong urbanization, a growing middle-class population, and higher disposable incomes are encouraging consumers to shift toward value-added and health-oriented food choices, which in turn fuels demand for specialty ingredients. Additionally, supportive government initiatives, investments in food innovation, and the presence of both domestic and global ingredient manufacturers are accelerating market growth. Similar growth patterns are being observed across several other European countries, where evolving dietary preferences, modernization of retail channels, and increased focus on clean-label and nutritional products are collectively contributing to regional market expansion.

- Germany is projected to lead the Europe Specialty Food Ingredients Market in 2026, accounting for 15.36% of the regional market share. This dominance is supported by the country’s strong food and beverage manufacturing base, high consumption of processed and packaged foods, and well-developed food processing infrastructure. High adoption of advanced processing technologies, strong presence of ingredient manufacturers, and strict food safety and quality regulations further strengthen Germany’s leadership position. In addition, government initiatives promoting food innovation, nutritional security, and sustainable food production continue to reinforce the country’s role as a key contributor within the Europe’s market.

- The Sweeteners segment is dominating the Europe Specialty Food Ingredients Market with market share of 33.79% in 2025, driven by rising demand for low-calorie, reduced-sugar, and functional food products. Sweeteners are widely used across beverages, bakery, confectionery, dairy, and processed foods due to their versatility, cost efficiency, and ability to meet evolving consumer preferences for healthier and clean-label formulations.

Report Scope and Europe Specialty Food Ingredients Market Segmentation

|

Attributes |

Europe Specialty Food Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include Porter’s five forces analysis, Pestle analysis, Supply Chain Analysis by manufacturers, regulatory framework. |

Europe Specialty Food Ingredients Market Trends

“Rising Integration of Specialty Food Ingredients Across Processed and Functional Food Production”

- The steady expansion of food and beverage manufacturing activities across Europe is a major factor driving the increased adoption of specialty food ingredients. As demand for processed, convenience, and value-added food products continues to grow, manufacturers increasingly rely on specialty ingredients to enhance taste, texture, shelf life, nutritional value, and product consistency across complex and high-volume production environments.

- Specialty food ingredients play a critical role in ensuring product quality, safety, and formulation stability throughout food processing and distribution stages. By improving sensory performance, extending shelf life, and supporting nutritional fortification, these ingredients reduce formulation risks while enabling efficient, scalable, and compliant food production across manufacturing facilities and supply chains.

- The growing adoption of advanced food processing technologies, including automation, precision formulation, and clean-label product development, has increased demand for high-performance specialty ingredients. Innovations in sweeteners, enzymes, emulsifiers, preservatives, and functional additives enhance process efficiency, product differentiation, and compliance with evolving consumer and regulatory requirements.

- Industries across the food and beverage value chain are increasingly adopting specialty food ingredients to meet rising regulatory, quality, and consumer expectations. Strict food safety and labeling requirements, growing emphasis on clean-label and natural formulations, and increasing health and wellness awareness among consumers are encouraging manufacturers to integrate advanced and functional ingredient solutions that enhance product performance while ensuring compliance and transparency.

- Overall, the expanding scale of food production, consumption, and product innovation positions specialty food ingredients as an essential component of modern food industry strategy. These ingredients support product quality, operational efficiency, regulatory compliance, and sustainable growth across Europe’s evolving food and beverage landscape.

Europe Specialty Food Ingredients Market Dynamics

Driver

“Rising Consumer Demand for Nutrition and Functional Food Ingredients”

- Growing consumer awareness in Europe about nutrition, wellness, and disease prevention is driving demand for specialty food ingredients, supported by increased access to health information, campaigns, and digital media.

- Consumers are increasingly choosing foods enriched with probiotics, antioxidants, dietary fibers, plant-based proteins, and omega fatty acids to support immunity, digestive health, heart health, and overall well-being

- Food producers are reformulating products and launching innovative offerings that enhance nutritional value while maintaining taste, texture, and shelf life, with specialty ingredients improving functionality, stability, and bioavailability

- The rise in lifestyle-related conditions such as obesity and diabetes is accelerating demand for functional beverages, sports nutrition, and fortified foods, leading to higher investment and innovation in specialty food ingredients across the Europe market.

For Instance,

- In January 2022, according to the article published by NCBI, A global scoping review analyzing 75 empirical studies highlights that growing prevalence of chronic diseases has significantly increased societal interest in healthy and functional foods. The study identifies strong consumer acceptance driven by health awareness and nutrition-related factors, reinforcing demand for functional food ingredients, thereby acting as a key driver for the Europe Specialty Food Ingredients Market.

- In December 2024, as per the article published by Journal of Experimental Food Chemistry, growing consumption of fortified foods, probiotic and prebiotic products, and antioxidant-rich natural foods reflects rising consumer awareness of the link between diet and health. Increased preference for vitamin- and mineral-enriched milk, functional beverages, and fiber-rich foods drives higher usage of specialty ingredients, thereby acting as a strong driver for the Europe Specialty Food Ingredients Market.

- In December 2025, as published by Research on nutraceutical-fortified ready-to-eat foods shows a strong consumer preference for products enriched with bioactive ingredients such as probiotics, omega-3 fatty acids, and antioxidants. Improved nutritional value and sensory appeal drive acceptance of these functional RTE foods, increasing demand for specialty ingredients and thereby acting as a key driver for the Europe Specialty Food Ingredients Market.

- Rising consumer awareness and preference for health-promoting and functional foods are driving significant growth in the Europe Specialty Food Ingredients Market. Empirical studies and recent research highlight that increasing prevalence of chronic diseases, growing demand for fortified and bioactive-rich foods, and consumer inclination toward nutraceutical-fortified ready-to-eat products are boosting the adoption of specialty ingredients. This sustained demand encourages innovation, product development, and investment, firmly establishing nutrition and functional food ingredients as a key growth driver for the market.

Restraint/Challenge

“Limited Shelf Life & Stability of Some Ingredients”

- Limited shelf life and stability challenges associated with several natural and functional specialty food ingredients act as a key restraint for the Europe Specialty Food Ingredients Market. Ingredients such as natural colors, plant-based proteins, probiotics, enzymes, and bioactive compounds are highly sensitive to temperature, moisture, light, and oxygen exposure, leading to faster degradation during processing, transportation, and storage. This instability results in reduced functional performance, inconsistent quality, and changes in taste, texture, and appearance of finished food products. The need for careful handling, controlled storage conditions, and shorter usability periods limits formulation flexibility and product scalability, thereby restraining the growth of the Europe Specialty Food Ingredients Market.

For Instance,

- In February 2025, according to the article published by Research Gate, Probiotics illustrate the limited shelf life and stability challenges of natural specialty food ingredients, as they require minimum viable counts in final products to deliver health benefits. Maintaining viability during processing, storage, and consumption remains difficult due to environmental sensitivity and dosage variability. These stability limitations restrict consistent product performance, thereby acting as a restraint for the Europe Specialty Food Ingredients Market.

- In September 2025, as per the article published by NCBI, Natural food colorants exemplify shelf life and stability challenges in specialty food ingredients, as they are highly sensitive to light, heat, pH changes, and oxygen, leading to color degradation and inconsistency during processing and storage. Variability in source materials and limited color strength further affect performance. These stability constraints limit large-scale application, thereby restraining the Europe Specialty Food Ingredients Market.

- In October 2024, in accordance with the article published by NCBI, Field pea protein highlights shelf life and stability challenges in natural specialty food ingredients, as lipid oxidation during harvesting, storage, and processing leads to beany and off-flavours. These sensory changes reduce product acceptability, particularly in meat and dairy alternatives requiring neutral taste. Such stability-related limitations restrict broader application, thereby restraining the Europe Specialty Food Ingredients Market.

- Limited shelf life and stability issues across key natural and functional ingredients such as probiotics, natural food colorants, and plant-based proteins underscore a structural restraint within the Europe Specialty Food Ingredients Market. Sensitivity to environmental conditions, degradation during processing and storage, and resulting inconsistencies in functionality and sensory attributes hinder reliable performance in commercial food applications. These challenges constrain formulation reliability, scalability, and long-term product consistency, collectively restraining the sustained growth and broader adoption of specialty food ingredients at a global level.

Europe Specialty Food Ingredients Market Scope

The Europe Specialty Food Ingredients Market is segmented into four notable segments based on the type, nature, source, and application.

• By Type

On the basis of type, the Europe Specialty Food Ingredients Market is segmented into Sweeteners, Nutritional & Fortification Ingredients, Flavor & Sensory Ingredients, Fermentation & Dough Improvement Ingredients, Hydrocolloids & Structural Agents, Preservatives, pH Control Agents & Acidulants, Leavening Agents, Humectants, Color Additives, Emulsifiers, Firming Agents, Enzymes, Fat Replacers, and Anti-Caking Agents. In 2026, the Sweeteners segment is projected to dominate the Europe Specialty Food Ingredients Market with the largest market share of 33.80%, due to rising consumption of processed foods and beverages, increasing demand for sugar reduction and low-calorie formulations, and the widespread use of both natural and artificial sweeteners to improve taste, stability, and shelf life across food and beverage applications.

• By Nature

On the basis of nature, the Europe Specialty Food Ingredients Market is segmented into Organic and Conventional. In 2026, the Conventional segment is projected to dominate the Europe Specialty Food Ingredients Market with a market share of 71.94%, due to its cost-effectiveness, wide availability, established supply chains, consistent quality, and extensive use across large-scale food and beverage manufacturing operations, particularly in processed and packaged food products.

• By Source

On the basis of source, the Europe Specialty Food Ingredients Market is segmented into Plant-Based, Animal-Based, Chemical Synthesis and Microbial. In 2026, the Plant-Based segment is projected to dominate the Europe Specialty Food Ingredients Market with a market share of 42.39%, due to increasing consumer preference for clean-label, natural, vegan, and plant-derived ingredients, rising demand for sustainable food solutions, and the growing use of plant-based sources in functional foods, beverages, and nutritional formulations.

• By Application

On the basis of application, the Europe Specialty Food Ingredients Market is segmented into Beverages, Baked Goods & Grains, Confections & Sweet, Sauces, Dressings & Condiments, Oils, Margarines & Fats, Dairy & Dairy Products, Processed & Snack Foods, Meat & Protein Products and Others. In 2026, the Beverages segment is projected to dominate the Europe Specialty Food Ingredients Market with the largest market share of 20.33%, due to high consumption of functional and fortified drinks, increasing demand for flavor enhancement, sweeteners, stabilizers, and preservatives, and continuous product innovation in ready-to-drink, energy, and health-focused beverage categories.

Europe Specialty Food Ingredients Market Regional Analysis

- Germany dominates Europe specialty market with market share of 15.09% in 2025. Germany represents one of the most important markets for specialty food ingredients, supported by its advanced food processing industry, strong R&D capabilities, and high consumer demand for premium, fortified, and clean-label products. Continuous innovation in bakery, beverages, dairy, and processed foods, combined with strict food safety regulations and strong collaboration between ingredient suppliers and manufacturers, is driving steady adoption of functional, nutritional, and performance-enhancing ingredients across the country.

- The U.K. is witnessing growing demand for specialty food ingredients as evolving consumer lifestyles, convenience food consumption, and the rapid shift toward healthier and reduced-sugar formulations reshape product development strategies. Food manufacturers are increasingly focusing on reformulation, clean-label transparency, and functional enrichment, which is accelerating the use of sweeteners, emulsifiers, preservatives, and nutritional ingredients across multiple food categories.

- France continues to emerge as a key growth hub for specialty food ingredients, driven by strong culinary traditions, rising interest in natural and organic formulations, and expanding food and beverage production capacity. The country’s emphasis on product quality, sustainability, and innovation is encouraging manufacturers to adopt advanced ingredient solutions that enhance flavor, texture, stability, and nutritional value while aligning with evolving regulatory and consumer expectations.

Germany Europe Specialty Food Ingredients Market Insight

The Germany Europe Specialty Food Ingredients Market is gaining momentum as food producers increasingly focus on premium reformulations, product differentiation, and nutritional enhancement. Strong collaboration between food manufacturers, research institutes, and ingredient suppliers is accelerating development of advanced ingredient blends tailored for bakery, beverages, dairy, and functional nutrition categories. Growing demand for lactose-free, protein-enriched, fiber-fortified, and reduced-additive formulations is encouraging companies to integrate technically sophisticated specialty ingredients that deliver performance without compromising taste. At the same time, Germany’s rigorous quality standards and traceability requirements are driving investments in safer, more transparent ingredient sourcing and processing, reinforcing the country’s role as a high-value innovation hub within the regional market.

U.K. Europe Specialty Food Ingredients Market Insight

The U.K. Europe Specialty Food Ingredients Market continues to expand as food brands respond to shifting consumer preferences toward convenience, lifestyle-aligned, and diet-specific products. Rapid growth in private-label innovation, foodservice reformulation, and ready-to-eat categories is boosting demand for ingredients that improve stability, texture, and shelf life while supporting targeted nutrition claims. Rising interest in plant-forward diets, allergen-free options, and calorie-controlled offerings is encouraging broader use of speciality sweeteners, stabilizers, enzymes, and fortification ingredients. In parallel, increasing retailer pressure for transparent labeling and responsible sourcing is prompting manufacturers to adopt ingredients that balance functionality with sustainability credentials, supporting durable long-term growth in the U.K. market.

Europe Specialty Food Ingredients Market Share

The Specialty Food Ingredients industry is primarily led by well-established companies, including:

- DAESANG (South Korea)

- Roquette Frères (France)

- Kemin Industries, Inc. (U.S.)

- Hangzhou Think Chemical Co., Ltd. (China)

- Sichuan Tongsheng Amino Acid Co., Ltd. (China)

- Emsland Group (Germany)

- Juneng Golden Corn Co. Ltd. (China)

- Sabinsa (U.S.)

- Evonik Industries AG (Germany)

- ADM (U.S.)

- CJ CheilJedang Corp (South Korea)

- Cargill, Incorporated (U.S.)

- Ajinomoto Co., Inc. (Japan)

- Merck KGaA (Germany)

- DSM‑Firmenich (Netherlands)

- Nagase & Co., Ltd. (Japan)

- AMINO GmbH (Germany)

- International Flavors & Fragrances Inc (U.S.)

- Vidhi Specialty Food Ingredients Limited (India)

- Life Supplies (India)

- Givaudan (Switzerland)

- Kerry Group (Ireland)

- Chr. Olesen (Denmark)

- Denk Ingredients GmbH (Germany)

- Ingredion (U.S.)

Latest Developments in the Europe Specialty Food Ingredients Market

- In January 2022, Ajinomoto Co., Inc. announced the launch of a new specialized subsidiary, Ajinomoto Health & Nutrition North America (AHNNA), aimed at strengthening its focus on the food ingredients and solutions business in the North American market. This strategic move consolidates the company’s flavor, amino acids, nutrition, and functional ingredient capabilities under a dedicated regional entity designed to accelerate innovation and customer engagement across diverse end uses such as savory, bakery, beverages, and nutrition sectors.

- In August 2025, International Flavors & Fragrances (IFF) agreed to sell its soy crush, soy protein concentrates, and lecithin business to Bunge, a transaction that involved operations generating about $240 million in revenue in 2024. This divestiture reflects IFF’s strategic decision to refine and focus its Food Ingredients portfolio on higher‑value, innovation‑driven and differentiated products, such as specialized emulsifiers, textures, and other functional ingredients used by food manufacturers.

- In November, Croda International Plc announced a strategic supply partnership with AMINO GmbH, a German manufacturer of pharmaceutical‑grade amino acids. Under this collaboration, Croda will leverage its global reach and expertise in specialty ingredients together with AMINO’s capabilities in precision amino acid manufacturing to improve the global availability of high‑purity amino acids for pharmaceutical formulation and biomanufacturing, helping customers accelerate product development and improve process efficiency.

- In November 2025, Cargill Animal Nutrition & Health (ANH) announced the completion of a major expansion at its Engerwitzdorf, Austria facility, increasing annual micronutrition production capacity by 50% to 30,000 metric tons to meet growing global customer demand for advanced animal nutrition solutions.

- In September 2025, CJ Foods announced the completion and launch of its new mandu production facility in Kisarazu City, Chiba Prefecture, Japan, marking its first locally built manufacturing plant in Japan by a Korean food company with an investment of approximately 100 billion KRW (73 million USD). The state‑of‑the‑art facility spans roughly 8,200 square meters and will produce bibigo mandu for nationwide distribution, supporting CJ’s strategy to accelerate global K‑food expansion and localize production in key overseas markets.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Specialty Food Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Specialty Food Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Specialty Food Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.